Global Kids Sports Equipment and Accessories Market Size, Share, Growth Analysis By Product Type (Sports Equipment, Accessories), By Sport Type (Team Sports, Individual Sports, Adventure/Outdoor Activities, Fitness Activities, Others), By Age Group (Pre-teens, Early childhood, Toddlers), By Distribution Channel (Supermarkets/hypermarkets, Online, Sports retail stores, Departmental stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159530

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

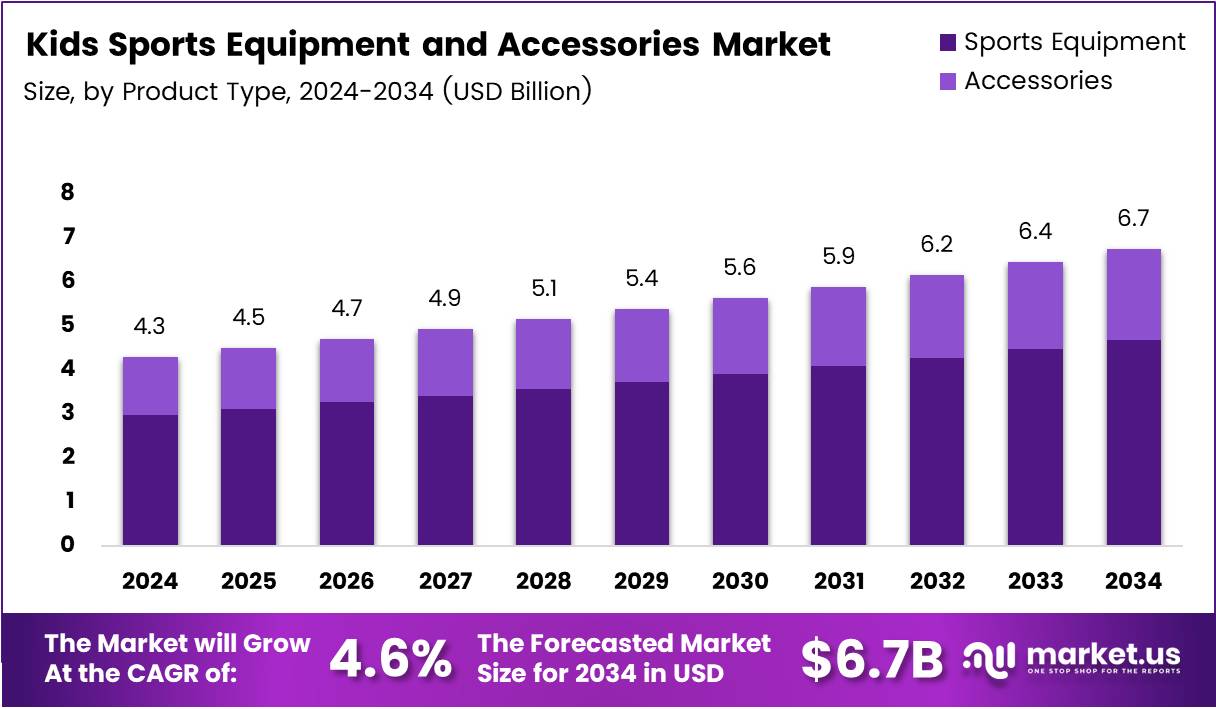

The Global Kids Sports Equipment and Accessories Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Kids Sports Equipment and Accessories Market has witnessed steady growth driven by increased interest in youth sports and fitness activities. As parents place a higher emphasis on physical health and extracurricular development, the demand for specialized equipment and accessories continues to rise. These products cater to a variety of sports, from soccer to tennis to basketball, offering both safety and performance-enhancing features.

Over the years, the market has expanded, partly due to innovations in equipment design and functionality. Lightweight, durable, and ergonomically designed products have become the standard. Additionally, as youth sports evolve, there has been a noticeable shift towards inclusive, multifunctional gear, making it easier for children to engage in various activities. Moreover, with the rise of fitness awareness, even non-competitive youth are being introduced to sports from an early age.

Government investments and initiatives further fuel the market’s growth by promoting sports participation among young individuals. Through grants, subsidies, and national programs, governments across various regions encourage healthier lifestyles, often allocating funds to improve sports facilities and introduce more community-based sports programs. These measures play a crucial role in making sports equipment more accessible to a broader demographic.

The growth of the market is also supported by the increasing expenditure on youth sports. According to industry reports, 46% of U.S. households with youth athletes spend $1,000 or more annually on their child’s primary sport, covering equipment, travel, and training. Furthermore, the average expenditure on youth sports per child in the U.S. rose to $1,016 in 2024, marking a 46% increase since 2019. This financial commitment reflects the growing importance of sports in children’s lives.

With a continually expanding customer base, the Kids Sports Equipment and Accessories Market presents significant opportunities for manufacturers and retailers to innovate. The sector’s future growth is supported by both rising disposable incomes and the growing recognition of the importance of physical fitness. Companies that can provide high-quality, affordable, and versatile products will likely succeed in tapping into this lucrative market.

Key Takeaways

- The Global Kids Sports Equipment and Accessories Market size is expected to reach USD 6.7 Billion by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

- Sports Equipment dominated the market in 2024, holding a 69.3% share in the By Product Type segment.

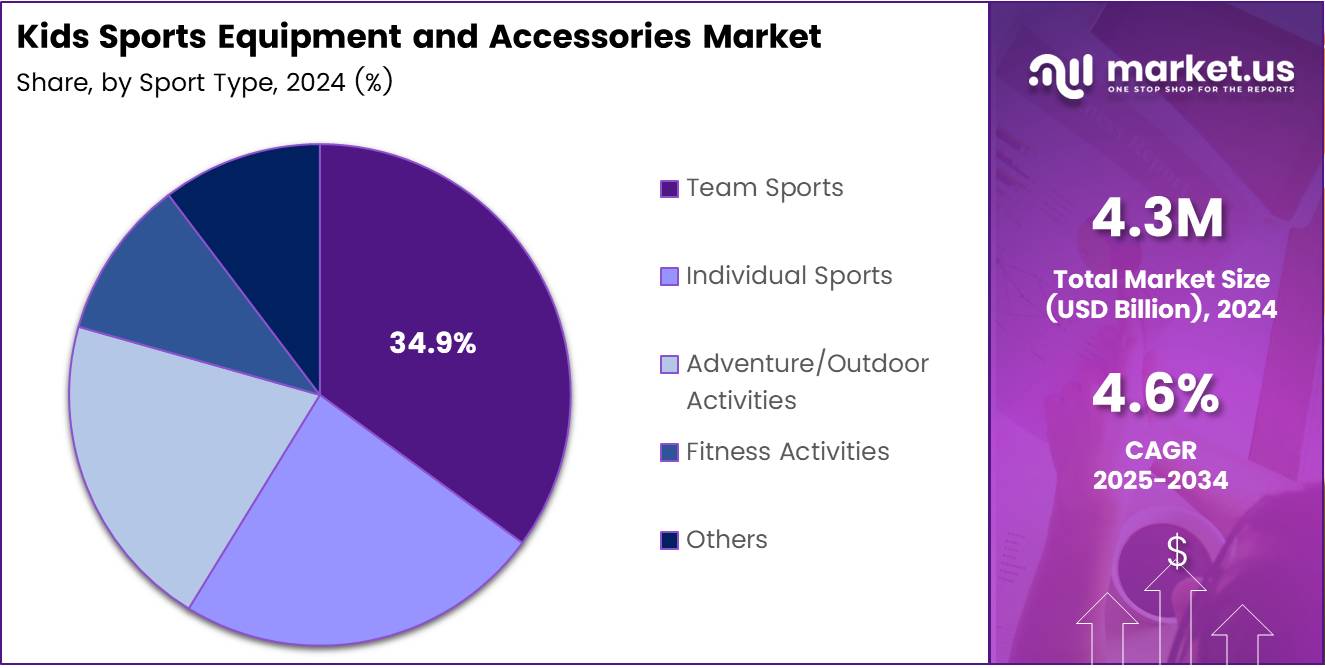

- Team Sports led the By Sport Type segment in 2024, with a 34.9% market share.

- Pre-teens (9-12 years) held the largest share of 45.4% in the By Age Group segment in 2024.

- Supermarkets/hypermarkets dominated the distribution channel segment in 2024, with a 46.8% market share.

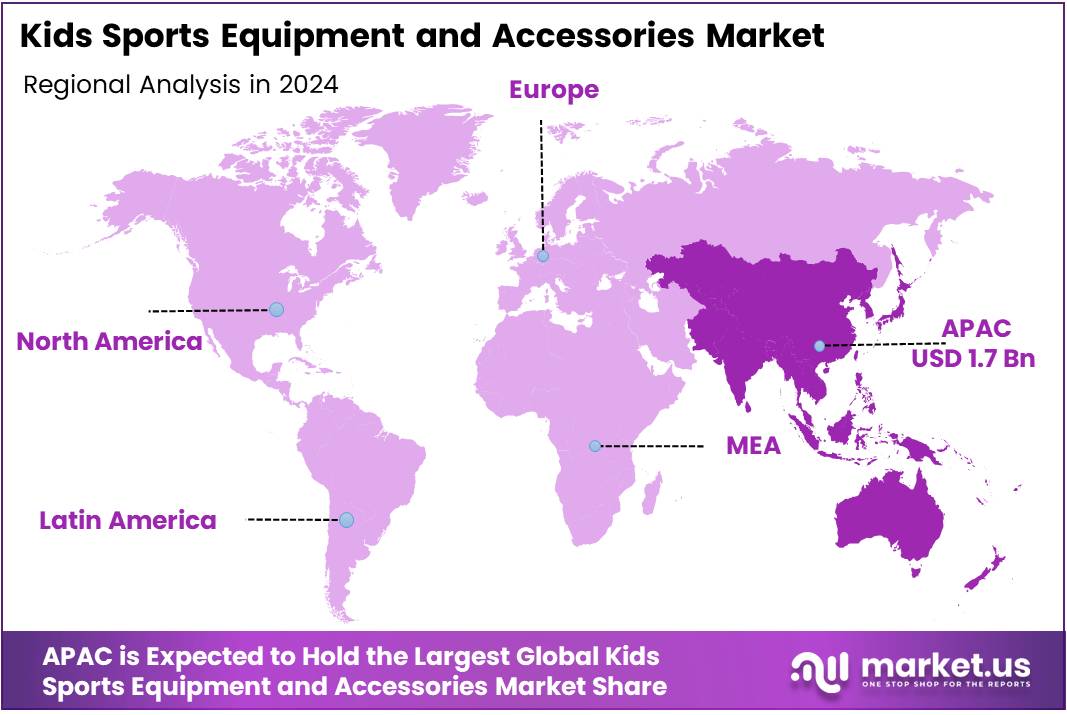

- Asia Pacific held the dominant market share of 41.6%, valued at USD 1.7 billion in 2024.

By Product Type Analysis

Sports Equipment dominates with 69.3% due to its high demand and essential role in youth sports.

In 2024, Sports Equipment held a dominant market position in the By Product Type segment of Kids Sports Equipment and Accessories Market, with a 69.3% share. This dominance is driven by the fundamental necessity of equipment such as balls, rackets, and protective gear. As youth participation in sports increases, the demand for equipment remains essential for practice and competition.

Accessories, while contributing to the market, hold a smaller share. In 2024, Accessories accounted for the remaining market share. These products, including bags, gloves, and water bottles, complement the sports equipment. Their role is significant but secondary, often linked to specific sports and the convenience they offer athletes.

By Sport Type Analysis

Team Sports dominates with 34.9% due to the popularity of sports like soccer, basketball, and baseball.

In 2024, Team Sports held a dominant market position in the By Sport Type segment of Kids Sports Equipment and Accessories Market, with a 34.9% share. The widespread appeal of team sports across schools and communities drives the demand for related equipment. This includes a range of gear necessary for soccer, basketball, and other team-based activities.

Individual Sports follow closely, offering a distinct market opportunity. With a strong focus on sports like tennis and gymnastics, individual sports gear is essential for practice and competition. However, it captures a smaller share compared to team sports, with growth expected as more children engage in personal athletic development.

Adventure/Outdoor Activities and Fitness Activities both show considerable potential. Adventure sports, such as hiking and climbing, appeal to older children and foster engagement with the outdoors. Fitness Activities, including yoga and personal exercise routines, are seeing increased participation, particularly in the wake of heightened health consciousness.

By Age Group Analysis

Pre-teens (9-12 years) dominate with 45.4% due to their active involvement in team and individual sports.

In 2024, Pre-teens (9-12 years) held a dominant market position in the By Age Group segment of Kids Sports Equipment and Accessories Market, with a 45.4% share. This age group is actively involved in a wide range of sports, from team activities to individual pursuits. Their growing physical development and energy make them a key consumer demographic for both equipment and accessories.

Early childhood (5-8 years) follows closely, driven by the increasing participation in early sports education and physical activities. Children in this age group use equipment suited for learning the basics of sports and motor skills development. While not as dominant, their participation in sports continues to grow year after year.

Toddlers (1-4 years) contribute the smallest share of the market. At this stage, children engage in basic play and movement activities. Products designed for this group are more oriented toward motor skill development, such as balance toys and soft sports items.

By Distribution Channel Analysis

Supermarkets/hypermarkets dominate with 46.8% due to their wide reach and convenience for parents.

In 2024, Supermarkets/hypermarkets held a dominant market position in the By Distribution Channel segment of Kids Sports Equipment and Accessories Market, with a 46.8% share. These retail channels offer convenience and competitive pricing for busy parents seeking a one-stop shop for their children’s sports needs. The wide availability of both equipment and accessories in these stores contributes to their dominance.

Online retail channels are rapidly growing, attracting more tech-savvy consumers who prefer the ease of online shopping. This segment is expected to experience strong growth, particularly among younger parents who value home delivery and the ability to browse a broad range of products.

Sports retail stores focus exclusively on sports-related products, which appeals to customers seeking specialized advice and expert knowledge. While this segment holds a smaller share, it remains important for niche products and higher-end equipment.

Departmental stores and other smaller retail outlets contribute to the market, but their share is relatively small compared to the larger retail channels mentioned above.

Key Market Segments

By Product Type

- Sports Equipment

- Protective Gears

- Nets & Goals

- Bats & Sticks

- Balls

- Others

- Accessories

- Gloves

- Bags & Backpacks

- Headbands & Wristbands

- Fitness Trackers & Wearables

- Others

By Sport Type

- Team Sports

- Individual Sports

- Adventure/Outdoor Activities

- Fitness Activities

- Others

By Age Group

- Pre-teens (9-12 years)

- Early childhood (5-8 years)

- Toddlers (1-4 years)

By Distribution Channel

- Supermarkets/hypermarkets

- Online

- Sports retail stores

- Departmental stores

- Others

Drivers

Growing Health Awareness and Sports Infrastructure Development Drives Market Growth

The kids sports equipment market is experiencing strong growth due to rising awareness about children’s physical fitness and the growing concern over childhood obesity rates. Parents and healthcare professionals are increasingly recognizing the importance of regular physical activity for children’s overall development and health.

There is a growing focus on encouraging outdoor activities and sports participation among children. Schools, communities, and parents are actively promoting sports as a way to keep kids active, build social skills, and develop healthy lifestyle habits from an early age.

Increased investments in school and community sports infrastructure are creating more opportunities for children to participate in various sports activities. New playgrounds, sports fields, and recreational facilities are being built, making sports more accessible to young people across different communities.

The expansion of e-commerce platforms has made sports equipment more convenient and accessible for parents. Online shopping allows families to easily compare products, read reviews, and find age-appropriate equipment without visiting multiple physical stores, driving market growth significantly.

Restraints

Safety Concerns and Market Fragmentation Limit Market Expansion

The risk of injuries during sports activities leads to reduced participation in certain contact sports and high-impact activities. Parents often hesitate to purchase equipment for sports they consider dangerous, which limits market growth in specific product categories.

There is a significant lack of awareness about quality sports equipment in rural and developing regions. Many families in these areas are not familiar with proper sports gear or may not understand the importance of using appropriate equipment for different activities.

Competition from low-quality, inexpensive alternatives poses a major challenge to established brands. Cheap imitation products flood the market, often compromising safety standards but attracting price-sensitive consumers who prioritize cost over quality and safety features.

Limited purchasing power in certain demographics restricts access to premium sports equipment. Many families cannot afford high-quality gear, forcing them to choose cheaper alternatives or avoid purchasing sports equipment altogether, which slows overall market development.

Growth Factors

Innovation and Sustainability Create New Market Opportunities

The introduction of eco-friendly and sustainable sports equipment presents significant growth opportunities. Environmentally conscious parents are increasingly seeking products made from recycled materials or sustainable sources, creating a new market segment for green sports equipment.

Customizable sports gear and accessories for kids are gaining popularity as parents look for personalized options. Custom colors, names, and designs allow children to express their individuality while using sports equipment, making the products more appealing and marketable.

Expanding partnerships between equipment manufacturers and sports organizations for youth development programs create new distribution channels. These collaborations help promote sports participation while providing direct access to target customers through organized sports programs and training camps.

Leveraging technology for enhanced product features and safety is opening new possibilities. Smart equipment with built-in sensors, GPS tracking, and safety monitoring systems appeal to tech-savvy parents who want to ensure their children’s safety while participating in sports activities.

Emerging Trends

Technology Integration and Design Innovation Shape Market Trends

The growing popularity of fitness tracking and wearable technology for kids is transforming the sports equipment market. Parents are increasingly interested in devices that can monitor their children’s activity levels, heart rate, and overall fitness progress during sports activities.

There is a rising emphasis on multi-sport equipment that offers versatile usage across different activities. Parents prefer purchasing gear that can be used for multiple sports rather than buying separate equipment for each activity, making versatile products more attractive in the market.

Digital platforms promoting sports-based fitness challenges are becoming increasingly popular among children and parents. These platforms encourage regular physical activity through gamification, creating demand for compatible sports equipment and accessories that work with these digital fitness programs.

Innovative designs and attractive colors are playing a crucial role in attracting the younger generation to sports equipment. Manufacturers are focusing on creating visually appealing products with bright colors, fun patterns, and child-friendly designs that make sports equipment more exciting for kids to use.

Regional Analysis

Asia Pacific Dominates the Kids Sports Equipment and Accessories Market with a Market Share of 41.6%, Valued at USD 1.7 Billion

Asia Pacific holds the dominant market share in the Kids Sports Equipment and Accessories Market, with 41.6% and a value of USD 1.7 billion. This region is experiencing rapid growth due to increasing disposable income and a growing emphasis on physical activity among children. Moreover, rising interest in sports across countries such as China, India, and Japan contributes to the market’s expansion.

North America Kids Sports Equipment and Accessories Market Trends

North America accounts for a significant portion of the market, driven by high consumer spending on youth sports and recreational activities. The U.S. market plays a pivotal role, with increasing demand for both equipment and accessories as parents seek to provide their children with opportunities to participate in organized sports. This trend is further fueled by extensive marketing efforts by sports brands.

Europe Kids Sports Equipment and Accessories Market Trends

Europe is another major market for kids’ sports equipment and accessories, with countries like the UK, Germany, and France leading the charge. A strong cultural focus on youth sports and physical education, coupled with the rising popularity of team sports, supports the demand for sports gear in the region. Additionally, increasing awareness of health and fitness among parents contributes to market growth.

Middle East and Africa Kids Sports Equipment and Accessories Market Trends

The Middle East and Africa market is expected to grow at a steady pace due to the increasing popularity of both traditional and emerging sports in countries like Saudi Arabia and South Africa. Investment in sports infrastructure and the growing adoption of sporting activities among children is creating opportunities for the market. However, limited market penetration in some areas remains a challenge.

Latin America Kids Sports Equipment and Accessories Market Trends

In Latin America, the market is seeing gradual growth, driven by increasing participation in sports among children. Countries such as Brazil and Mexico show strong demand for sports equipment, especially in football, which remains the region’s dominant sport. However, the region’s overall market share remains lower compared to other regions, due to economic constraints and limited sports infrastructure in certain areas.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids Sports Equipment and Accessories Company Insights

The global Kids Sports Equipment and Accessories Market in 2024 is highly competitive, with several key players significantly contributing to its growth.

Adidas has established itself as a dominant brand, leveraging its strong presence in sportswear and equipment. The company continues to innovate with new product lines focused on performance, durability, and style, appealing to both athletes and parents looking for quality and functionality.

Amer Sports remains a major player in the market, benefiting from its diverse portfolio of sports equipment and accessories. The company’s strategic acquisitions, such as Wilson and Salomon, have helped broaden its reach, especially in the youth sports segment, where they offer a wide range of products from tennis rackets to skiing gear.

Cabela’s, known for its outdoor equipment, holds a significant position in the market by offering a range of sports and recreational products for kids. With a focus on fishing, hunting, and outdoor sports, the brand has effectively captured the attention of families seeking versatile and durable equipment for various activities.

Epic Sports, catering primarily to team sports, has capitalized on its affordable pricing and wide selection of sporting goods. Its focus on bulk sales to schools, leagues, and organizations has positioned it as a key player in providing cost-effective solutions to youth sports programs.

These brands collectively shape the Kids Sports Equipment and Accessories Market by offering a mix of innovation, affordability, and specialization, contributing to the growing demand for sports-related products among children.

Top Key Players in the Market

- Adidas

- Amer sports

- Cabela’s

- Epic Sports

- Franklin Sports

- JD Sports

- Mizuno

- Nike

- Puma

- Under Armour

Recent Developments

- In May 2025, Unrivaled Sports secured a $120 million investment led by Dick’s Sporting Goods, enabling the company to accelerate its growth and expand its product offerings.

- In September 2025, DICK’S Sporting Goods completed a $2.4 billion acquisition of Foot Locker, further enhancing its retail footprint and market leadership in the sporting goods sector.

- In July 2024, KKR acquired Varsity Brands from Bain Capital for approximately $4.75 billion, marking a significant deal in the sports and school spirit product markets.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 6.7 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sports Equipment, Accessories), By Sport Type (Team Sports, Individual Sports, Adventure/Outdoor Activities, Fitness Activities, Others), By Age Group (Pre-teens, Early childhood, Toddlers), By Distribution Channel (Supermarkets/hypermarkets, Online, Sports retail stores, Departmental stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adidas, Amer sports, Cabela’s, Epic Sports, Franklin Sports, JD Sports, Mizuno, Nike, Puma, Under Armour Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Kids Sports Equipment and Accessories MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Kids Sports Equipment and Accessories MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adidas

- Amer sports

- Cabela's

- Epic Sports

- Franklin Sports

- JD Sports

- Mizuno

- Nike

- Puma

- Under Armour