Global Kids Smartwatch Market Size, Share, Growth Analysis By Connectivity (Cellular Networks, Wi-Fi, Bluetooth, and NFC), By Age Group (Preschool, Elementary School, and Teenagers), By Application (Fitness & Wellness, Entertainment, Communication, and Safety & Security), By Distribution Channel (Offline, and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2024

- Report ID: 59169

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

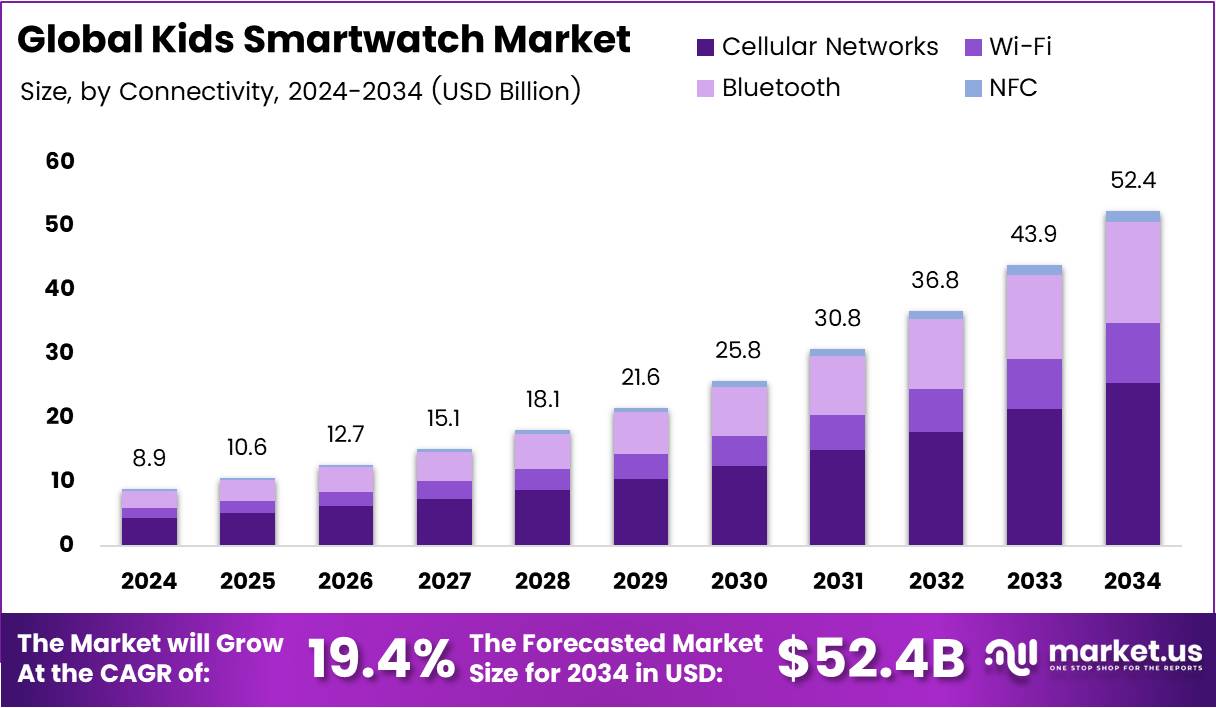

In 2024, the Global Kids Smartwatch Market was valued at US$8.9 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 19.4%, reaching about US$52.4 billion by 2034.

A smartwatch is a wearable, wrist-worn electronic device that functions like a mini-computer, offering features beyond telling time, such as health and fitness tracking, app integration, and communication capabilities.

In the consumer electronics industry, kids’ smartwatch represents an important sector due to their application in child safety. These smartwatches encompass features such as connection, GPS tracking, SOS button, geo-fencing capabilities, health trackers, and educational and entertainment tools.

As the number of working parents and parental concerns increases, kids’ smartwatches align with their interests, providing comprehensive solutions for their kids. Additionally, the market experiences steady growth due to the continuous technological advancements in the industry.

Similarly, the market is characterized by many players focusing on product innovations through strategic partnerships and collaborations. Kids’ smartwatches provide safety and convenience; however, the market faces challenges regarding data privacy and increased screen time of children due to the availability of entertainment on their wrists. The tech-savvy consumers in North America readily adopt the technology, and there are opportunities in the developing regions where consumer electronics are on the rise.

- A survey in the United States indicated that 18% of teenagers, aged between 13-17 years, and 7% of children, aged between 6-12 years, own a smartwatch.

Key Takeaways

- The global kids’ smartwatch market was valued at US$8.9 billion in 2024.

- The global kids’ smartwatch market is projected to grow at a CAGR of 19.4% and is estimated to reach US$52.4 billion by 2034.

- Based on connectivity, kids’ smartwatches that are connected to cellular networks dominated the market in 2024, comprising about 48.6% share of the total global market.

- Based on the age group of kids that used smartwatches, teenagers led the market with approximately 69% of the market share.

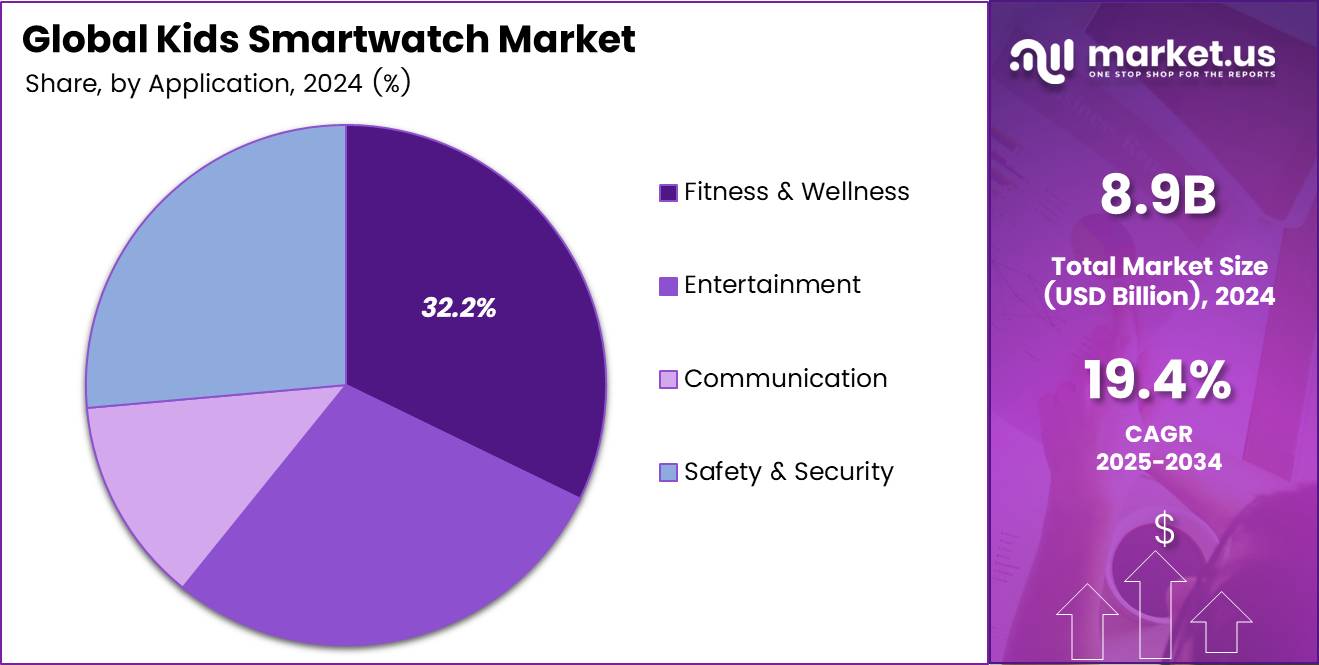

- Among the applications of the kids’ smartwatches, fitness & wellness applications dominated the market in 2024, accounting for around 32.2% of the market share.

- In 2024, most kids’ smartwatches were bought through offline distribution channels, with 73.3% of the market share.

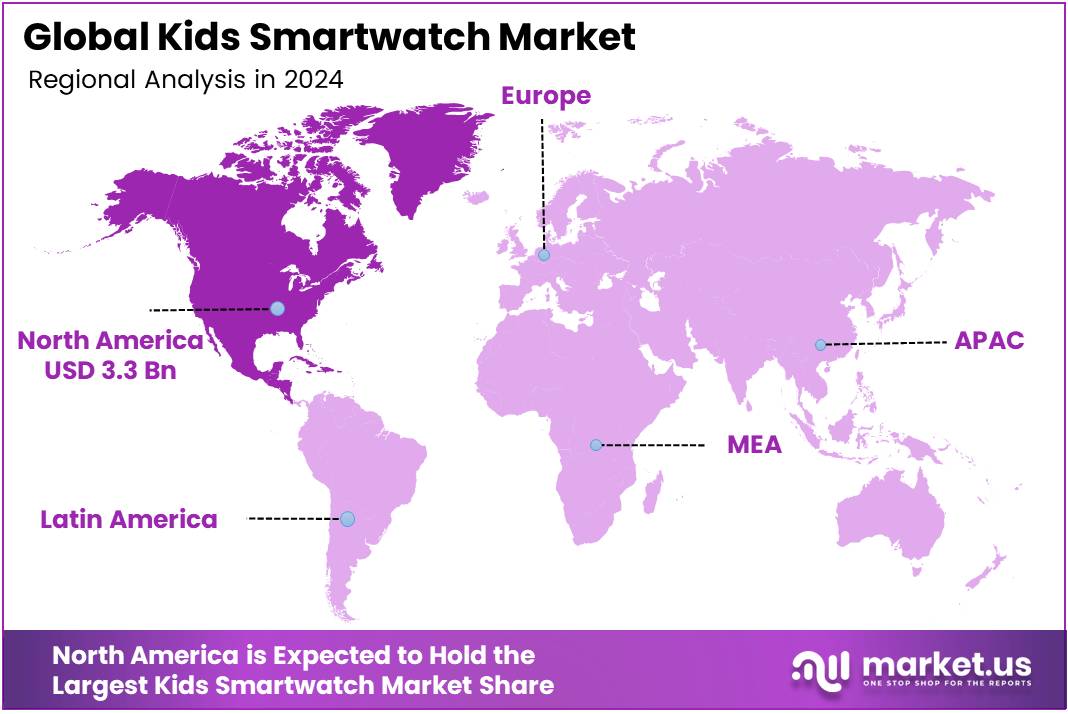

- North America was the largest market for kids’ smartwatches in 2024, comprising around 37.3% of the total global market share.

Connectivity Analysis

The Kids’ Smartwatches Connected to Cellular Networks Dominated the Market.

On the basis of the connectivity, the kids’ smartwatches market is divided into cellular networks, Wi-Fi, Bluetooth, and NFC. Kids’ smartwatches connected to the cellular networks dominated the market in 2024 with a market share of 48.6%.

A major driver of the popularity of the cellular network is the uninterrupted connectivity. Cellular networks provide constant, uninterrupted access to communication services, such as calls, texts, and GPS tracking, even when kids are outside the home, school, or any Wi-Fi zone. Wi-Fi, Bluetooth, and NFC have limited range and require specific infrastructure, which isn’t always available when a kid is out.

In addition, with a cellular connection, the smartwatch can make and receive calls or messages independently, without needing to be tethered to a smartphone via Bluetooth or near a Wi-Fi source. This is crucial in emergencies, where the child may not have access to a phone or trusted Wi-Fi.

Age Group Analysis

The Age Group That Used the Most Kids’ Smartwatches in 2024 was Teenagers.

On the basis of the age groups that use kids’ smartwatches, the market is divided into preschool, elementary school, and teenagers. In 2024, teenagers were the largest consumer segment of the kids’ smartwatches with approximately 69% of the market share. The device is mostly used by teenagers due to their greater need for communication and independence, and the capability of using the device effectively.

In contrast, younger children face practical limitations and school restrictions, making smartwatches less common in that age group. Teenagers often have more independence, such as walking to school alone, attending extracurricular activities, or going out with friends. Parents are more likely to provide smartwatches for communication, tracking, and safety as teens begin spending more time away from home.

Additionally, teenagers are more technologically literate and can easily navigate smartwatch interfaces. Preschool and early elementary children may struggle with complex functions, making the device less useful or engaging for them.

Application Analysis

In 2024, Fitness & Wellness Applications Dominated the Kids Smartwatch Market.

Based on the applications of the kids’ smartwatches, the market is segmented into fitness & wellness, entertainment, communication, and safety & security. Fitness & wellness applications of the smartwatches dominated the market in 2024 with a market share of 32.2%. The dominance of the segment is characterized by limited access to entertainment and communication. Safety & security features, such as GPS tracking, are passive and used mostly by parents rather than the kids themselves.

Communication features, such as calling or messaging, are often restricted to a few pre-approved contacts by guardians, reducing frequent use. Most kids’ smartwatches are intentionally designed with limited entertainment options to avoid distractions.

Furthermore, kids enjoy checking their steps, monitoring their sleep, or seeing how active they’ve been in a day, leading to the subjugation of the fitness and wellness applications.

Distribution Channel Analysis

The Offline Distribution Channels Dominated the Kids Smartwatch Market in 2024.

Based on the distribution channels through which kids’ smartwatches are sold, the market is segmented into offline and online channels. The offline channels led the kids’ smartwatches market in 2024 with 73.3% of the total market share. The dominance of the offline channels is led by customer preference to physically examine the goods bought specifically for kids to assess the size of the smartwatch and the comfort of the kids.

Additionally, the offline stores give customers greater confidence in product authenticity and warranty validation. Similarly, many stores offer in-store assistance and guidance regarding product features and troubleshoot initial issues.

Furthermore, security and payment concerns regarding potential scams and complicated return-refund processes if the products are unsatisfactory in online purchases may deter customers from buying smartwatches online.

Key Market Segments

By Connectivity

- Cellular Networks

- Wi-Fi

- Bluetooth

- NFC

By Age Group

- Preschool

- Elementary School

- Teenagers

By Application

- Fitness & Wellness

- Entertainment

- Communication

- Safety & Security

By Distribution Channel

- Offline

- Online

Drivers

Increasing Demand for Child Safety Propels the Kids’ Smartwatch Market the Most.

The increasing demand for child safety, which has led to the demand for various security solutions, is the key driver in the development of the kids’ smartwatch market. Smartwatches featuring connection, GPS tracking, SOS button, geo-fencing capabilities, health trackers, and educational tools give customers an all-in-one device.

GPS tracking allows customers to watch over their children in real time. Additionally, smartwatches feature connectivity that allows children to connect to their parents in case of an emergency, and health trackers give parents access to the children’s condition.

The need for security solutions for kids is majorly among working professionals, who are away from their kids for a prolonged time. According to U.S. Department of Labor statistics of 2024, in 66.5% of families with children less than 18-year-old, both parents are working. As this number continues to grow, the demand for child safety products such as kids’ smartwatches is on the rise.

Restraints

Increased Screen Time and Security Concerns Might Restrain the Market from Growing.

While kids’ smartwatches offer convenience, they also raise noteworthy privacy and data security concerns, mainly regarding children’s personal information. Many such devices gather sensitive data such as location, health metrics, and more, which can be vulnerable to hacking or misuse by third parties.

A study by the Norwegian Consumer Council found critical security flaws in several popular children’s smartwatches, allowing strangers to easily take over the devices and access stored data about the child’s whereabouts. Inadequate encryption, weak authentication methods, and insecure data transmission can all contribute to compromising a child’s privacy.

Moreover, some smartwatch apps may share personal information with third-party servers without proper safeguards, exposing children to potential privacy violations, which is a significant threat to the kids’ smartwatch industry, particularly in heavily guarded regions such as Europe. For instance, GDPR in the European Union requires organizations to implement appropriate technical and organizational measures to ensure data security.

Growth Factors

Technological Advancement in the Industry is Anticipated to Create More Opportunities for Emerging Players.

The market for kids’ smartwatches is witnessing significant growth, driven by technological advancements and product innovations in the market. For instance, in January 2025, CircuitMess introduced a product bundle with two projects, the Clockstar smartwatch and the CircuitPet virtual pet.

The Clockstar project is made for kids to learn about wearable technology by building and coding a fully functional smartwatch, which can be used to track time, set alarms, customize the display, and program new features. As consumer electronics are a highly concentrated market, players can find spaces in product innovation to gain a competitive edge in the market.

For instance, Tinitell developed a small phone watch for kids, which is secure and easy to use. The watch has a 2G mobile connection, so that kids can make a quick call back home if they ever need to reach out to a caretaker for any particular reason. The phone watch is voice-activated, and it’s as simple as pressing a button.

Emerging Trends

Shift Towards Strategic Partnerships for Product Innovations.

A significant trend influencing the kids’ smartwatch market is the focus of several players on strategic partnerships and collaborations for product innovations and market expansion.

For instance, in May 2025, COSMO Technologies, a leading innovator in family connection, and the Week Junior, the news magazine designed exclusively for kids, announced a partnership as creators of the first kids’ news application specifically for kids’ watches. With this initiative, the Week Junior’s content would be available digitally on a child’s wrist exclusively through COSMO’s JrTrack kids’ smartwatch.

Additionally, in August 2024, Xplora Technologies Inc., a leading player in the field of wearable technology for children, announced a collaboration with Viaero Wireless. The partnership was for the exclusive distribution of the X6Play Xplora smartwatch to consumers across Viaero’s extensive network.

Furthermore, in August 2024, Greenlight Financial Technology, Inc., the fintech company, announced a collaboration with Google to connect with the Fitbit Ace LTE, a first-of-its-kind smartwatch to help kids evolve financial smartness in kids to lead active and independent lives. Greenlight’s debit card can be seamlessly added to the Google Fitbit Ace LTE so kids can learn to spend wisely and safely tap to pay on the go with their smartwatch.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Kids Smartwatch Market.

Geopolitical tensions and trade disputes significantly disrupted the raw material supply chains of the consumer electronics industry, including kids’ smartwatches. Tariffs, trade barriers, and political instability in critical manufacturing regions hindered the supply chain activities of parts and materials.

For instance, the US-China trade war resulted in higher tariffs on consumer electronics and components, prompting manufacturers to reassess their supply chain strategies, shift manufacturing locations, and look for alternative suppliers, typically at increased costs.

Some companies, like Apple, shifted production away from China to mitigate the impact of tariffs on goods sold in the US. Countries like Vietnam, Thailand, and Mexico have seen increased export growth as companies seek alternative manufacturing locations.

Additionally, the trade war has impacted the availability of certain electronic components, particularly semiconductors for chips in smartwatches, and plastics and metals for bodies of the smartwatches, leading to price increases and potential shortages.

Similarly, as countries turn to developing their domestic consumer electronics industries, the demand for skilled workers in areas such as engineering, design, and manufacturing is increasing. However, there is a huge gap between this demand and the availability of professionals who are capable of performing the role.

Regional Analysis

North America was the Largest Market for Kids’ Smartwatches in 2024.

In 2024, North America dominated the global kids’ smartwatch market, holding about 37.3% of the total global market share, valued at approximately US$3.3 billion mainly due to strong consumer adoption, technological advancements, and robust distribution networks.

Parents in the region increasingly view kids’ smartwatches as essential safety and communication tools, offering GPS tracking, geofencing alerts, and emergency calling features that provide peace of mind. High levels of disposable income and willingness to invest in premium child safety solutions have further driven market growth.

Additionally, the region’s strong technological ecosystem, supported by leading smartwatch manufacturers and innovative startups, has ensured continuous product improvements such as improved battery life, interactive learning applications, and health monitoring features.

Additionally, the region includes robust retail channels for giants in the industry, which helps boost the market. Moreover, the abundance of industry players situated in the region makes the adoption and acceptance of the technology easier.

Similarly, the Asia Pacific was the fastest-growing market in the kids’ smartwatch industry in 2024, owing to the manufacturing industry in China, India, Japan, and South Korea, and the availability of tech giants such as Xiaomi and Huawei. Additionally, China is the biggest manufacturer of wearables and consumer electronics in the world.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids Smartwatch Company Insights

Apple, Xiaomi, and Huawei have maintained their position in the kids’ smartwatch market for several years due to their broad product portfolio and robust supply chain, gaining them an edge in the market.

Additionally, technological breakthroughs made by these companies and their early access to advancements in raw materials made by several companies serve as an advantage. Several companies in the market, such as Sekyo, Pebble, Starmax, Xplora, Pinwheel, Contixo, and Omate, also constitute a major part of the market share.

Additionally, companies such as Fitbit and Tinitell contribute the most to the advancements in the industry through their innovative products, such as the wrist-phone by Tinitell and fitness-focused smartwatches by Fitbit.

Top Key Players in the Market

- TickTalk Tech LLC

- Doki Technologies

- JOY FamilyTech, Inc.

- Garmin Ltd

- Omate Inc.

- KD Group

- Fitbit, Inc.

- Apple, Inc.

- Contixo Inc.

- Huawei Technologies

- Xplora Technologies Inc

- SRK Powertech Pvt Ltd (Pebble)

- Sekyo Innovations Private Limited

- Starmax Technology

- Tinitell

- Xiaomi Technologies

- Pinwheel

- Other Key Players

Recent Developments

- In June 2025, Pinwheel, the company known for its smartphones for children and teens, launched the children’s smartwatch offering age-appropriate, parent-monitored, and voice-activated AI chat. The watch provides parents with GPS tracking and management tools while enabling kids to text and make calls among parent-approved contacts. Furthermore, the watch offers unlimited access to a voice-activated and parent-monitored AI chat app, PinwheelGPT, that comes pre-loaded on every device.

- In March 2025, Xiaomi‘s Redmi launched its first smartwatch for children. The Redmi kids’ smartwatch features a large 1.68-inch display with a 360 x 390 resolution, a pixel density of 315 PPI, and a 5MP front camera.

Report Scope

Report Features Description Market Value (2024) USD 8.9 billion Forecast Revenue (2034) USD 52.4 billion CAGR (2025-2034) 19.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Connectivity (Cellular Networks, Wi-Fi, Bluetooth, and NFC), By Age Group (Preschool, Elementary School, and Teenagers), By Application (Fitness & Wellness, Entertainment, Communication, and Safety & Security), By Distribution Channel (Offline, and Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TickTalk Tech LLC, Doki Technologies, JOY FamilyTech, Inc., Garmin Ltd, Omate Inc., KD Group, Fitbit, Inc., Apple, Inc., Contixo Inc., Huawei Technologies, Xplora Technologies Inc, SRK Powertech Pvt Ltd (Pebble), Sekyo Innovations Private Limited, Starmax Technology, Tinitell, Xiaomi Technologies, Pinwheel, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LG Electronics

- Shenzhen Continental Wireless Co., Ltd

- TickTalk

- Doki Technologies

- JOY FamilyTech, Inc.

- SIBYL WORLD SDN BHD

- Garmin Ltd

- Franciscan Solutions Private Limited

- Omate Inc.

- VTech Holdings Limited

- KD Group

- Fitbit, Inc.

- Other Key Players