Global Kidnap & Ransom Insurance Market Size, Share, Growth Analysis By Component (Hardware, Software), By Feedback (Force, Tactile, Thermal), By Usage Type (Graspable, Touchable, Wearable), By Application (Consumer Electronics, Gaming, Automotive, Healthcare, Robotics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163006

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- AI Industry Adoption

- Analysts’ Viewpoint

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Coverage Type

- By End User

- By Distribution Channel

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

The global Kidnap & Ransom (K&R) Insurance Market was valued at USD 2.32 billion in 2024 and is projected to reach USD 4.7 billion by 2034, expanding at a CAGR of 7.3% during the forecast period. The market growth is primarily driven by increasing global security risks, political instability, and the rising number of high-net-worth individuals and expatriates operating in regions with elevated threat levels.

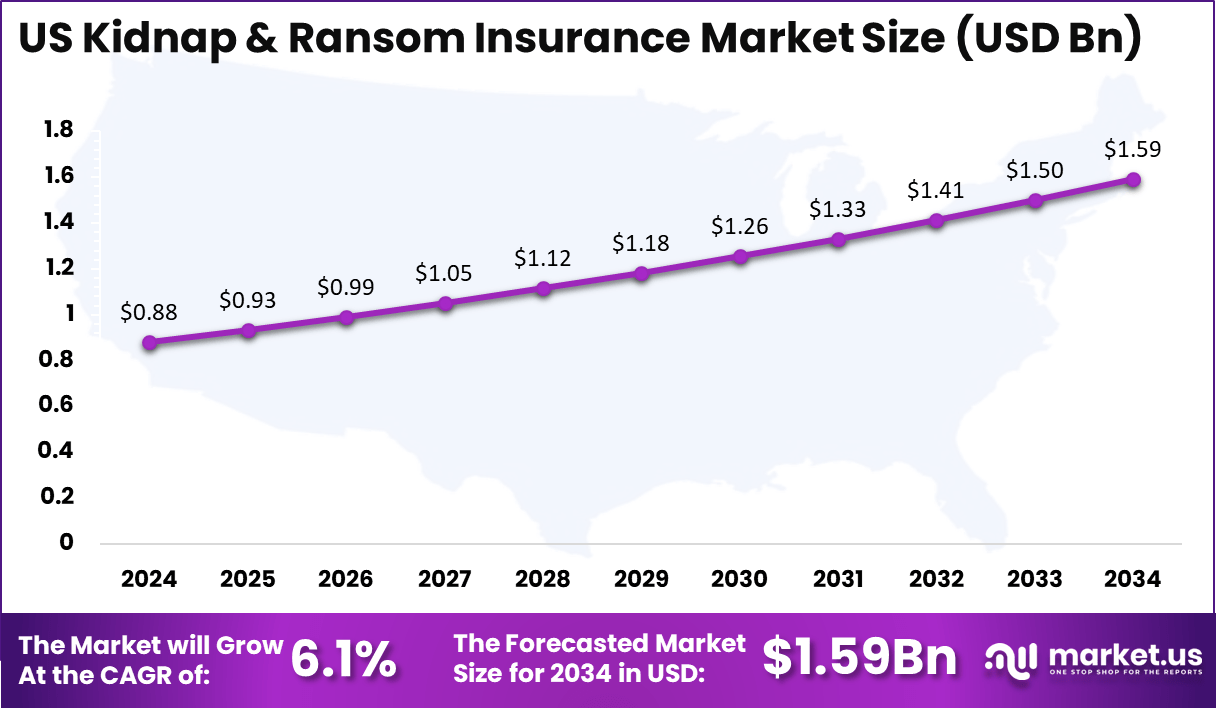

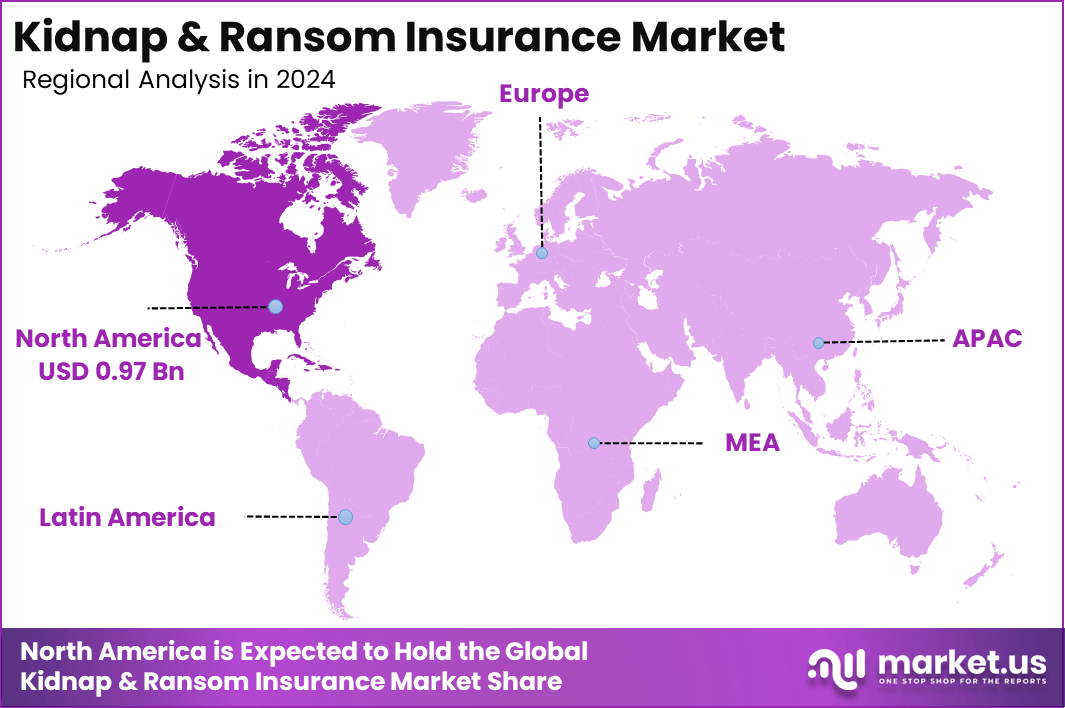

North America accounted for 42.2% of the global share in 2024, with a market size of USD 0.97 billion, driven by heightened awareness of corporate risk management and expanding coverage across multinational enterprises. The US market, valued at USD 0.88 billion in 2024, is expected to reach USD 1.59 billion by 2034, growing at a CAGR of 6.1%.

This growth is supported by increasing demand from the financial, energy, and travel sectors, as well as the inclusion of crisis response consultancy and digital extortion coverage in modern K&R policies. The market’s evolution reflects a shift toward holistic protection strategies combining insurance with proactive risk mitigation and intelligence support.

Kidnap and Ransom (K&R) insurance is a specialized risk management solution designed to protect individuals, families, and organizations against financial losses and liabilities arising from incidents such as kidnapping, extortion, wrongful detention, and hijacking.

It provides coverage not only for ransom payments but also for crisis management, negotiation services, and related expenses, including medical, legal, and security costs. This form of insurance has become increasingly important in today’s geopolitical climate, where global travel, business expansion, and operations in politically unstable or high-risk regions have heightened exposure to personal and corporate security threats.

The demand for K&R insurance is growing among multinational corporations, non-governmental organizations, media personnel, and high-net-worth individuals, reflecting an increasing emphasis on employee safety and duty of care obligations. Policies are often complemented by 24/7 access to professional crisis response consultants who specialize in negotiation and recovery, ensuring timely and strategic handling of incidents.

Furthermore, as digital threats such as cyber extortion and virtual kidnapping rise, insurers are broadening coverage to include these emerging risks. The evolution of K&R insurance highlights a shift from traditional indemnity-based protection toward comprehensive crisis response and preventive security planning, making it an integral component of global corporate risk management frameworks.

Recent developments in the Kidnap & Ransom (K&R) insurance industry in 2025 show a mix of strategic mergers, acquisitions, funding, and new product launches aimed at meeting the intensifying risks faced by multinational companies and high-net-worth individuals.

In 2025, there was a major acquisition when London-based insurer Hiscox finalized its purchase of a K&R specialty provider in Latin America, expanding their coverage to 20 new countries and increasing their global client portfolio by 17%. Meanwhile, AIG launched a new modular K&R insurance product targeting startups and NGOs in high-risk regions, boosting its total policy count in this segment by over 23% in the first nine months of the year.

Funding trends have also surged, with Lloyd’s syndicates investing an additional $75 million in digital underwriting platforms supporting faster K&R claims processing and better data analytics for client risk assessment. Industry statistics reveal that total premiums written for K&R insurance grew by 14% globally in 2025, driven by increased geopolitical tensions in Africa, Latin America, and South Asia.

Overall, insurers are actively expanding their offerings through targeted acquisitions and innovation, and the amount of capital flowing into technology-enabled K&R solutions continues to accelerate to meet client demand for flexible and rapid-response protection.

Key Takeaways

- The Kidnap & Ransom (K&R) Insurance Market is projected to expand at a CAGR of 7.3% from 2024 to 2034, driven by increasing global exposure to security threats, political instability, and corporate expansion into high-risk regions.

- North America held the largest regional share of 42.2% in 2024, valued at USD 0.97 billion, supported by strong demand from multinational companies and risk-sensitive industries.

- The US market, valued at USD 0.88 billion in 2024, is expected to reach USD 1.59 billion by 2034, growing at a CAGR of 6.1%, reflecting greater corporate emphasis on employee protection and crisis preparedness.

- By Coverage Type, Kidnap & Ransom Coverage dominated the market with 36.8%, driven by rising incidents of extortion, cyber-related kidnapping, and political abductions targeting global travelers and executives.

- By End User, Corporations accounted for 57.2%, as businesses increasingly adopt comprehensive employee safety frameworks and contractual risk coverage for overseas operations.

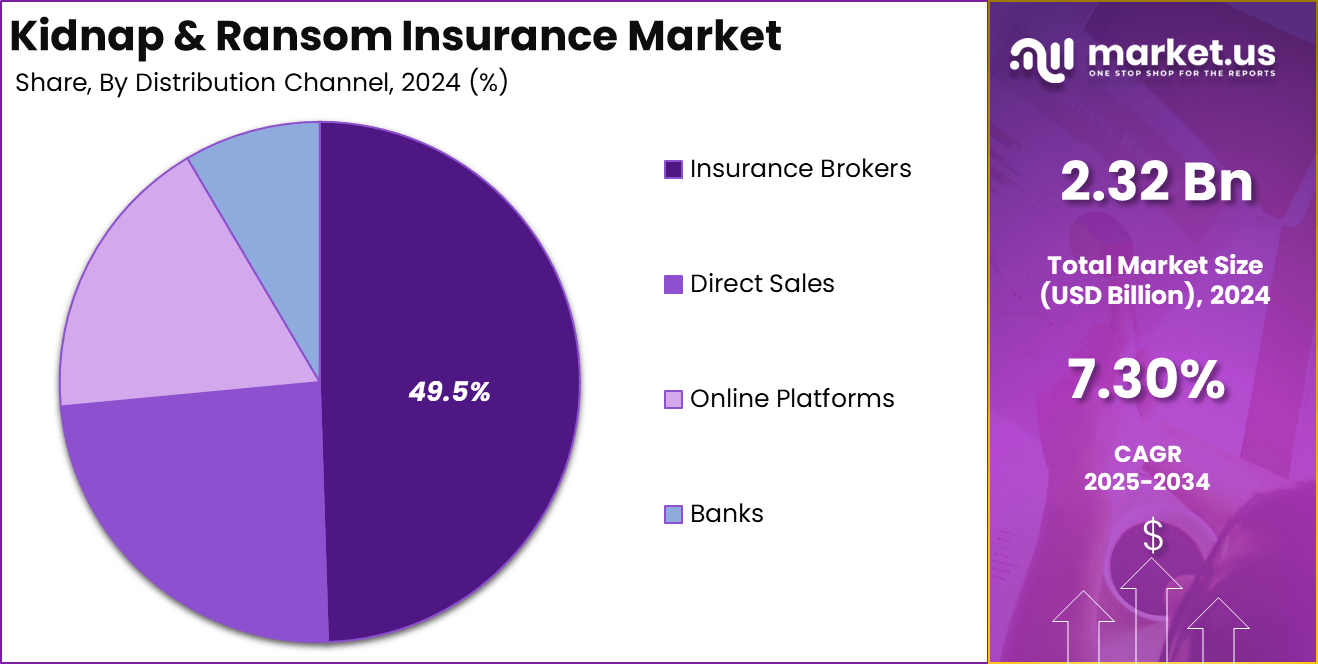

- By Distribution Channel, Insurance Brokers captured 49.5%, underscoring their vital role in providing customized coverage solutions, risk advisory services, and crisis management coordination for corporate and individual clients.

Role of AI

Artificial intelligence is increasingly shaping the evolution of the Kidnap and Ransom (K&R) insurance market by enhancing threat detection, risk assessment, and crisis response efficiency. AI-driven analytics help insurers monitor global geopolitical developments, crime trends, and social unrest in real time, allowing underwriters to dynamically assess exposure levels and price policies more accurately.

By analyzing large volumes of structured and unstructured data from government sources, news feeds, and social platforms, AI systems can identify potential hotspots and predict kidnapping or extortion risks before they escalate.

In operational contexts, AI tools support faster claims processing, fraud detection, and crisis event tracking, reducing response time during emergencies. Insurers are increasingly integrating AI with geospatial mapping and behavioral analytics to monitor employee movement and issue real-time alerts in high-risk zones. Additionally, machine learning models enhance the accuracy of ransom negotiation simulations, supporting crisis management teams with predictive insights based on historical case data.

As cyber extortion and virtual kidnapping become more common, AI plays a pivotal role in monitoring digital threats and identifying suspicious communication patterns. Overall, AI’s role in the K&R insurance ecosystem is transitioning from reactive assistance to proactive prevention, enabling smarter underwriting, faster response, and stronger client protection frameworks.

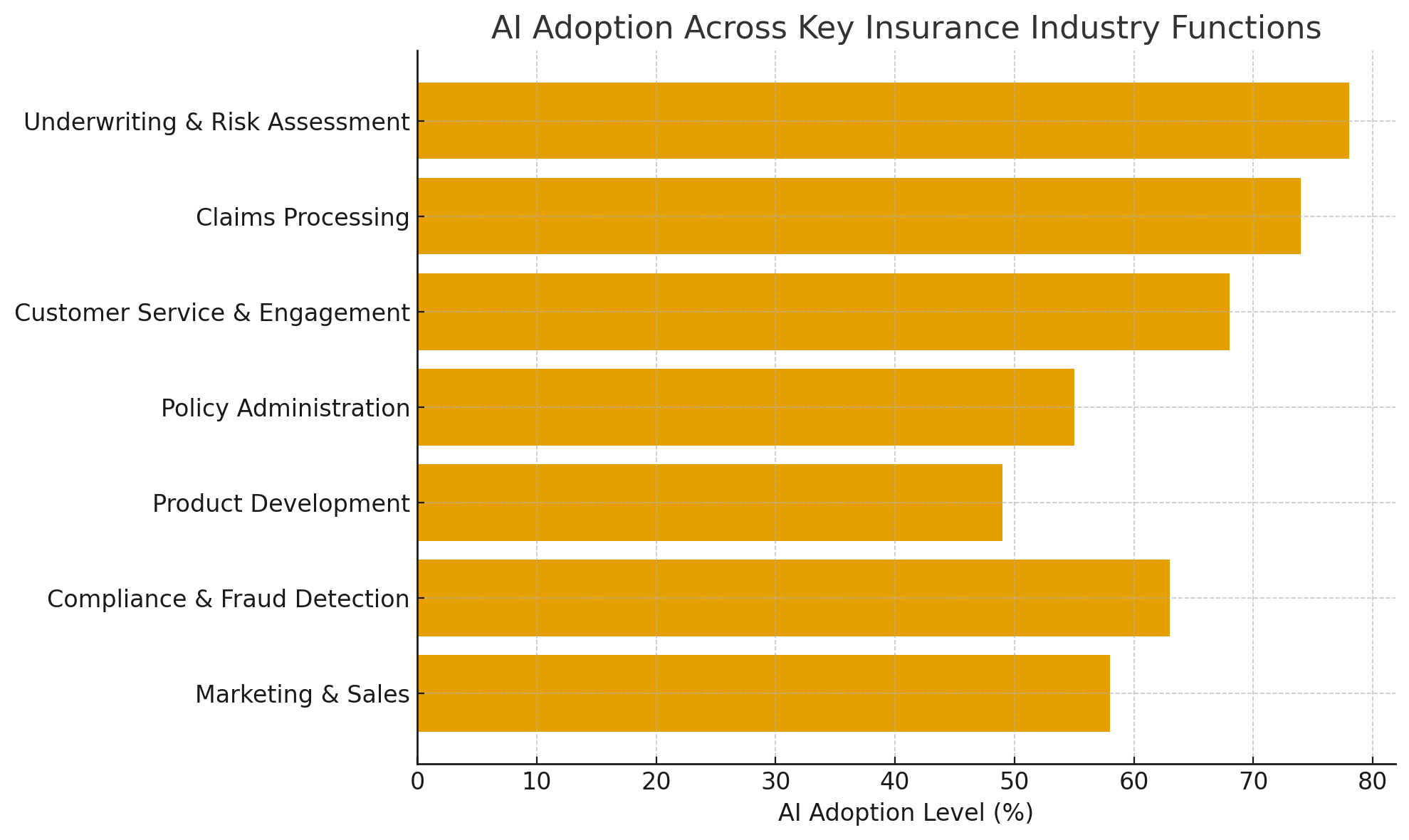

AI Industry Adoption

AI adoption in the insurance industry is gaining significant momentum, with insurers increasingly deploying artificial intelligence systems to enhance operational performance, risk management, and customer service. According to a 2024 survey, the insurance sector reached adoption levels nearly equal to those of leading technology industries, reflecting a shift from exploratory pilot projects toward production-scale implementations.

In underwriting and risk assessment, AI enables insurers to analyse large volumes of structured and unstructured data, identify patterns of potential loss, and refine pricing models with greater precision. Claims processing is another area of high adoption: natural-language processing, computer vision, and machine-learning algorithms automate document review, detect potential fraud, and speed adjudication of claims.

While adoption is strong, only a fraction of insurers report multiple AI applications running in full production, suggesting room for deeper integration and scaling. Overall, AI is transforming the insurance industry’s mindset from reactive cost management to proactive insight generation, positioning companies to deliver more agile, personalized, and efficient protection solutions.

Analysts’ Viewpoint

Analysts view the integration of AI within the insurance industry as both a significant opportunity and a complex strategic challenge. The sector is uniquely positioned to benefit from AI due to its deep reserves of historical data, strong analytic capabilities, and traditional reliance on quantitative decision-making.

However, despite early momentum in pilot projects and technology exploration, only a small fraction of insurers have moved through the scaling phase to full implementation — just 7% in some surveys.

To capture meaningful value from AI, analysts emphasise three key priorities: focusing on high-impact use cases rather than broad experimentation, ensuring alignment with near-term profitability objectives, and embedding AI across business, operational, and technology functions rather than isolating it within IT silos.

They warn that success hinges less on the sophistication of the algorithms than on data quality, governance frameworks, workforce readiness, and cross-functional collaboration — factors that under-investment often undermines.

On the regulatory front, authorities are increasingly scrutinising AI deployment in insurance, particularly regarding bias, transparency, and consumer protection.

Analysts expect that insurers capable of not only adopting AI but also doing so in a responsible, scalable, and integrated manner will gain a distinct competitive edge, while those treating AI as a one-off innovation risk will fall behind.

Emerging trends

Emerging trends in the insurance industry for AI adoption include the increasing use of generative AI to enhance both customer experience and operational productivity. Models trained on large datasets are now being used to support underwriting, claims processing, and customer service, enabling insurers to optimize product pricing, speed up adjudication, and deliver more personalized solutions.

Another key trend is real-time data integration and predictive risk modelling. Insurers are leveraging machine learning and advanced analytics to combine historical data with emerging signals such as IoT/telematics inputs and unstructured data from social media or news feeds. This enables more dynamic risk assessment and proactive loss prevention.

A further trend is the shift from isolated AI pilots towards embedded, enterprise-wide AI ecosystems. Carriers are increasingly standardizing data architecture, governance, and model-deployment pipelines to scale AI across functions rather than confining it to claims or underwriting alone.

Moreover, there is heightened focus on ethical, explainable, and regulated AI deployment. With regulators scrutinizing bias, transparency, and consumer protection, insurers are building controls around data, model fairness, and audit-readiness as AI becomes core to business operations.

US Market Size

The US market for kidnap & ransom (K&R) insurance is expected to grow at a CAGR of about 6.1%, rising from an estimated USD 0.88 billion in 2024 to approximately USD 1.59 billion by 2034. Growth is being driven by increased globalisation of business operations, higher volumes of international travel and work assignments, and elevated exposure to geopolitical risks, which collectively raise demand for K&R coverage among corporates and high-net-worth individuals.

The relatively mature state of the US insurance industry means that much of the expansion will come from product innovation and broader uptake rather than purely new market creation. Rising awareness of duty-of-care obligations, especially for multinational employers and organisations operating in volatile regions, is also contributing to heightened demand for comprehensive K&R coverages.

Premiums are being supported by the inclusion of added-value services such as crisis management, cyber extortion protection, and real-time intelligence support, enhancing policy attractiveness. However, the moderate growth rate signals that insurers must continue to differentiate through tailored offerings, efficient crisis-response capabilities, and robust underwriting infrastructure to capture value from this evolving market.

Investment and Business Benefit

Investment in the kidnap & ransom (K&R) insurance market offers compelling business benefits by addressing a critical—and often overlooked—risk exposure for companies operating globally. Organisations with employees or assets in politically unstable or high-threat regions gain strategic value by securing K&R coverage, as it not only reimburses ransom payments and related financial losses but also provides access to crisis-management teams and negotiation specialists that rapidly mobilise during an incident.

From a financial perspective, investing in K&R insurance enables firms to shift volatility from unexpected kidnappings, extortion demands, or wrongful detention events to a predictable annual premium. This converts a catastrophic one-off loss into a manageable line item within risk management budgets. Insurance carriers offering tailored K&R products often add value through pre-event training, travel-risk advisory services, and digital extortion support, enhancing overall protection while deepening client relationships.

For insurers and brokers, the increasing frequency of global business travel, remote work in volatile regions, and cyber-enabled kidnappings presents growth opportunities in underwriting and distribution. Firms that build strong crisis infrastructures, leverage data analytics for risk profiling, and develop value-added service capabilities are positioned to capture higher margins and client loyalty. In summary, K&R insurance delivers both defensive value for policyholders and strategic value-creation potential for providers in a world of evolving threats.

By Coverage Type

The Kidnap & Ransom (K&R) insurance segment, designated as Kidnap & Ransom Coverage, represented approximately 36.8% of the overall market share. This category primarily covers ransom payments demanded by kidnappers, as well as related costs such as delivery of the ransom, crisis-consultant fees, legal liability, and medical or trauma support.

Extortion Coverage, Disappearance Coverage, Detention Coverage, Hijacking Coverage, Hostage Crises Coverage, and other emerging formats fill the remainder of the segment, addressing broader risk scenarios such as wrongful detention, hijackings, cyber-extortion, and active-assailant events.

Demand for Kidnap & Ransom coverage remains strong because it provides the foundational indemnity and loss-recovery framework that organisations and high-net-worth individuals rely on when confronted with abduction or ransom incidents. At the same time, the growth of complex threats—such as express kidnappings, cyber-enabled extortion, and hostage situations tied to business operations—has led insurers to broaden policy wordings and extend coverage into adjacent peril domains.

As a result, market dynamics are shifting: while traditional Kidnap & Ransom coverage retains the largest share, the fastest-growing sub-segments are often those that combine indemnity with proactive services (crisis response, intelligence monitoring, digital extortion negotiation). This structural change is enabling insurers and clients alike to align protective coverage with evolving risk-exposure profiles in a globalised, high-risk operating environment.

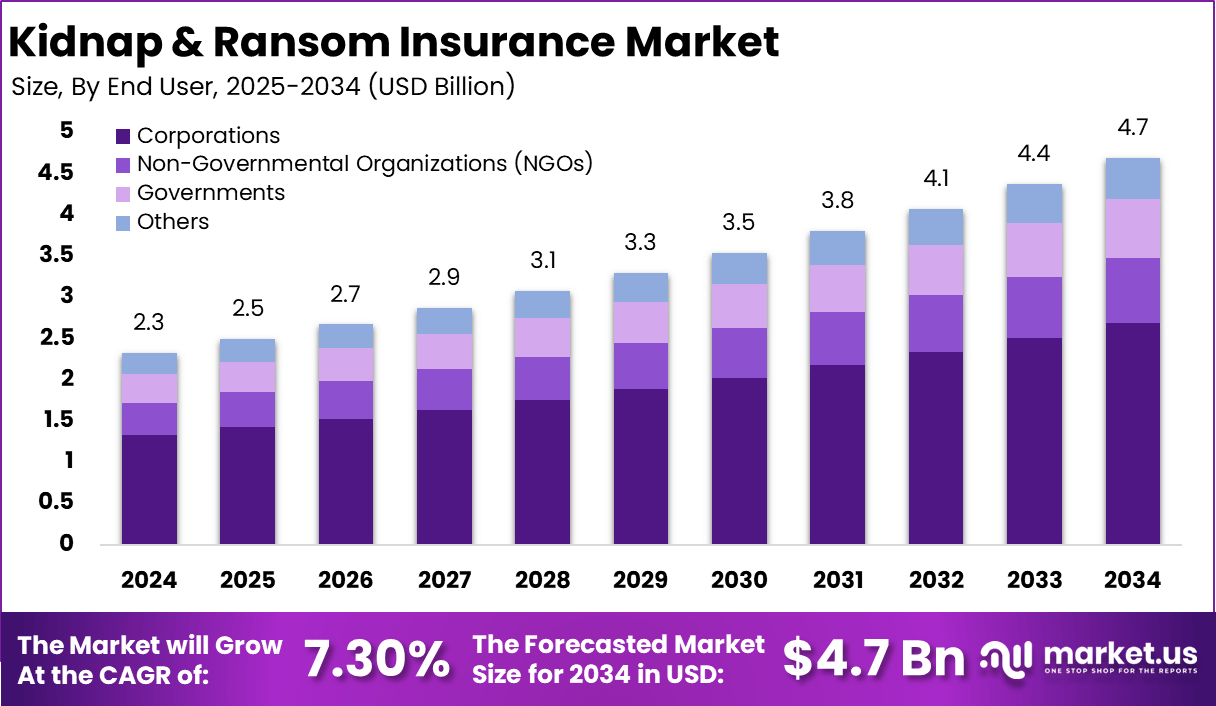

By End User

Corporations accounted for approximately 57.2% of the kidnap and ransom (K&R) insurance market, making them the leading end-user segment. The dominance of this segment is attributed to the increasing globalization of business operations, with multinational corporations deploying employees, contractors, and executives to regions with elevated political instability, civil unrest, or crime rates.

Organizations in sectors such as energy, construction, finance, and media have heightened exposure, prompting greater investment in comprehensive risk management and employee protection frameworks. Corporations are prioritizing K&R policies not only for ransom reimbursement but also for access to crisis management, negotiation support, and intelligence analysis to safeguard personnel and assets.

Non-Governmental Organizations (NGOs) form another key segment, as they often operate in conflict zones or regions prone to abductions and extortion, making coverage essential for staff safety and donor confidence. Government institutions use K&R insurance for diplomatic and defense personnel deployed abroad, while the “Others” category includes high-net-worth individuals, educational institutions, and travel agencies with international operations.

The corporate segment’s strong growth is further supported by the inclusion of cyber extortion and virtual kidnapping coverage, reflecting evolving risk landscapes. As global security challenges intensify, corporations are expected to remain the primary drivers of K&R insurance demand worldwide.

By Distribution Channel

Insurance brokers represented approximately 49.5 % of the distribution channel share in the kidnap & ransom (K&R) insurance market, making them the most dominant route to market. These brokers play a pivotal role in matching specialized K&R products with the nuanced risk profiles of multinational corporations, high-net-worth individuals, and organizations operating in unstable regions.

Their value proposition lies in offering tailored consultation, crisis-management linkage, risk-assessment services, and policy-structuring advice—services that are essential given the complexity and sensitivity of K&R insurance.

Direct sales remain a meaningful channel, primarily used by insurers with in-house sales teams targeting large corporate accounts or governmental clients. This channel enables insurers to establish direct relationships, offer integrated risk-mitigation services, and maintain full control of underwriting and claim-response capabilities.

Online platforms and digital distribution channels are emerging, albeit from a smaller base, providing standardized coverage for lower-exposure segments and enabling faster quote-to-bind cycles. Banking networks and affiliated distribution (bancassurance) form a niche channel, leveraging existing corporate and private-banking relationships to offer K&R solutions as part of broader risk-management portfolios.

Looking forward, brokers are expected to retain their lead due to their ability to deliver advisory-heavy services, crisis-response coordination, and custom policy design, while digital and bancassurance channels may grow faster as risk-awareness spreads and standard product offerings penetrate new customer segments.

Key Market Segments

By Coverage Type

- Kidnap & Ransom Coverage

- Extortion Coverage

- Disappearance Coverage

- Detention Coverage

- Hijackings Coverage

- Hostage Crises

- Others

By End User

- Corporations

- Non-Governmental Organizations (NGOs)

- Governments

- Others

By Distribution Channel

- Insurance Brokers

- Direct Sales

- Online Platforms

- Banks

Regional Analysis

The North American region accounted for approximately 42.2% of the global Kidnap & Ransom (K&R) insurance market in 2024, with a market size of about USD 0.97 billion. North America’s dominance is driven by a mature risk-management framework, high corporate awareness of duty of care obligations, and a substantial presence of multinational corporations operating in high-threat zones.

The United States, in particular, benefits from strong demand driven by sectors such as energy, mining, media, and travel, where employee exposure to abduction, extortion, or detention risks remains elevated.

Corporate policies in North America increasingly feature bundled services such as crisis-management teams, ransom negotiation support, and intelligence monitoring, reflecting a shift from indemnity-only coverage toward holistic protection. Insurance brokers and advisory specialists are well-established in the region, offering customised risk assessments and policy structuring that align with complex corporate deployments and global assignment programmes.

While the region is relatively mature, incremental growth is anticipated as coverage expands to include digital extortion threats, virtual kidnappings, and remote-worker exposures in volatile geographies. The well-developed regulatory environment, strong insurer infrastructure, and high-net-worth population underpin North America’s leadership; however, continued expansion may rely increasingly on the sophistication of service offerings and broader client education.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The increasing globalisation of business operations and travel to high-risk regions is a significant driver for growth in the kidnap & ransom (K&R) insurance market. Organisations deploying personnel in unstable geographies are more aware of kidnapping, extortion, wrongful detention, and hijacking threats, prompting demand for specialised cover and crisis-management services.

Heightened geopolitical volatility, growth in transnational organised crime, and the evolving nature of extortion (including digital threats) are further stimulating uptake of K&R insurance as part of comprehensive corporate risk frameworks.

Additionally, regulatory and governance pressures on duty-of-care for expatriates and employees operating overseas are forcing corporations to embed K&R cover into their travel and assignment policies.

Restraint Factors

The sensitive and clandestine nature of kidnappings and ransom demands introduces complexity and uncertainty into underwriting and claims management, which acts as a restraint to faster market growth.

Limited awareness and understanding of K&R products among smaller enterprises and individuals in many regions also constrain market penetration. The absence of standardised policy wordings and varying regulatory regimes across countries adds complexity for insurers and brokers operating globally.

Moreover, some critics argue that K&R insurance may contribute to moral hazard and ransom inflation, creating reputational and regulatory risk for insurers.

Growth Opportunities

The expansion of coverage into adjacent perils such as cyber-extortion, virtual kidnapping, and wrongful detention presents a high-growth opportunity for the K&R insurance market. As crime tactics evolve, insurers that offer bundled covers addressing both physical and digital threats are positioned to win new business.

Growth in emerging markets—with rising foreign direct investment, expatriate assignments, and media/NGO operations in high-threat geographies—offers untapped potential for K&R product adoption.

Strategic partnerships between insurers, crisis-response consultancies, and security-intelligence firms foster service-led differentiation and value-added offering development, enhancing client appeal and retention.

Challenging Factors

The K&R insurance market faces challenges in scaling sustainably: the rarity and high severity of events make loss-modelling difficult and limit standardisation of pricing. The sensitivity of the subject matter also means many potential buyers remain reluctant to discuss or disclose exposures, reducing transparency.

Regulatory scrutiny—particularly around ransom payments, sanctions, anti-money-laundering, and ethical risk—may inhibit growth or force greater cost for compliance. Additionally, as the coverage becomes more commoditised, insurers may face margin pressure unless they invest in crisis-management capabilities and differentiate beyond indemnity.

Competitive Analysis

The kidnap & ransom (K&R) insurance market is characterized by a mix of large multinational insurers and specialized providers offering crisis-management-backed coverage. The Travelers Indemnity Company provides tailored K&R products with comprehensive crisis consultancy and negotiation support designed for both corporate clients and individuals operating in volatile regions.

American International Group, Inc. (AIG) is a global leader with its CrisiSolution program, delivering multi-peril protection and 24/7 global response capabilities, setting a high standard for integrated coverage. Alliant Insurance Services Inc. and Starr Insurance Companies focus on delivering advisory-heavy, customized solutions for multinational clients exposed to geopolitical risks. W.R. Berkley Corporation, Arch Insurance, and Great America Insurance Group maintain strong underwriting portfolios, emphasizing financial stability and flexible policy customization.

Norwegian Hull Club and Tokio Marine HCC extend specialized K&R solutions for maritime and aviation risks, while Hiscox USA, AXA S.A., Chubb, and Beazley Plc cater to both corporate and private clients with expertise in emerging perils such as cyber extortion and virtual kidnapping.

The competitive edge increasingly lies in service integration, with leading players coupling traditional indemnity coverage with intelligence analysis, rapid crisis response, and pre-incident training. Insurers that combine global reach with responsive, data-driven crisis management are best positioned for sustained leadership.

Top Key Players in the Market

- The Travelers Indemnity Company

- American International Group, Inc.

- Alliant Insurance Services Inc.

- Starr Insurance Companies

- W. R. Berkley Corporation

- Arch Insurance

- Great America Insurance Group

- Norwegian Hull Club

- Tokio Marine HCC

- Hiscox USA

- AXA S.A.

- Chubb

- Beazley Plc

- Others

Major Developments

- June 12, 2025: Hiscox launched a new “Personnel Security Plus” endorsement for its kidnap & ransom product, expanding coverage to include extended services such as travel-risk intelligence and pre-incident security training.

- July 30, 2025: A surge in cryptocurrency-linked abductions pushed demand for kidnap & ransom and extortion insurance upward, with insurers reporting increased inquiries tied to virtual kidnappings and ransom demands in digital assets.

- May 12, 2025: Hiscox outlined its strategic development plan, elevating specialist K&R underwriting, emphasising global capability, family-member exposure coverage, and partnerships with crisis-consultancy firms to deepen service capability.

Report Scope

Report Features Description Market Value (2024) USD 2.32 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR(2025-2034) 7.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Coverage Type (Kidnap & Ransom Coverage, Extortion Coverage, Disappearance Coverage, Detention Coverage, Hijackings Coverage, Hostage Crises, Others), By End User (Corporations, Non-Governmental Organizations (NGOs), Governments, Others), By Distribution Channel (Insurance Brokers, Direct Sales, Online Platforms, Banks) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Travelers Indemnity Company, American International Group, Inc., Alliant Insurance Services Inc., Starr Insurance Companies, W. R. Berkley Corporation, Arch Insurance, Great America Insurance Group, Norwegian Hull Club, Tokio Marine HCC, Hiscox USA, AXA S.A., Chubb, Beazley Plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Kidnap & Ransom Insurance MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Kidnap & Ransom Insurance MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Travelers Indemnity Company

- American International Group, Inc.

- Alliant Insurance Services Inc.

- Starr Insurance Companies

- W. R. Berkley Corporation

- Arch Insurance

- Great America Insurance Group

- Norwegian Hull Club

- Tokio Marine HCC

- Hiscox USA

- AXA S.A.

- Chubb

- Beazley Plc

- Others