Global Joint Replacement Market By Product (Extremities, Lower, Upper, Knees and Hips) By Fixation Type (Cementless, Cemented, Hybrid and Reverse Hybrid) By Procedure Type (Total Joint Replacement, Revision Joint Replacement and Partial Joint Replacement) By End-Use (Orthopedic Clinics, Hospitals and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 35264

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

The Global Joint Replacement Market size is expected to be worth around USD 26.5 Billion by 2032, from USD 18.4 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The joint replacement market is experiencing significant growth due to several key factors. Firstly, the rising number of osteoarthritis cases and orthopedic injuries, along with the growing elderly population, are major contributors to this expansion. The increasing incidence of conditions such as bone injuries, diabetes, and obesity further supports market growth.

Total knee arthroplasty (TKA), commonly known as knee replacement, is a prominent orthopedic surgery, particularly beneficial for obese patients. In the United States alone, over 600,000 knee replacement surgeries are performed annually, with obesity being a leading cause for these procedures.

Globally, over 350 million people suffer from arthritis, indicating a strong demand for joint replacement. The aging population is a significant factor, as older individuals are more susceptible to orthopedic disorders. By 2030, one in six people worldwide will be over 60, with this demographic expected to double by 2050.

Market growth is also driven by strategic actions like partnerships, mergers, acquisitions, and product launches by key players. For instance, Stryker’s launch of Mako Total Knee 2.0 in March 2023 and Symbios’s introduction of the ORIGIN CR Total Knee System in January 2022 are notable developments.

Additionally, the increasing prevalence of orthopedic disorders, osteoporosis, and rheumatoid arthritis, which affect joint health, further heightens the demand for joint replacement surgeries. The Arthritis Foundation estimates that by 2040, over 78 million adults in the U.S. will be diagnosed with arthritis, underscoring the growing need for these surgical interventions. This trend is expected to continue, propelling the joint replacement market forward.

Key Takeaways

- The Global Joint Replacement Market is projected to reach approximately USD 26.5 Billion by the year 2032, up from USD 18.4 Billion in 2023.

- The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.3% from 2023 to 2033.

- Total knee arthroplasty (TKA), also known as knee replacement, accounts for over 600,000 surgeries performed annually in the United States.

- Globally, more than 350 million people suffer from arthritis, highlighting the substantial demand for joint replacement procedures.

- By 2030, it is estimated that one in six people worldwide will be over the age of 60, further boosting the need for joint replacement surgeries.

- Strategic actions such as partnerships, mergers, acquisitions, and product launches by key players are driving market growth.

- The Arthritis Foundation predicts that by 2040, over 78 million adults in the U.S. will be diagnosed with arthritis, emphasizing the demand for joint replacement.

- In 2023, knees accounted for over 44.3% of the joint replacement market share due to the high prevalence of knee-related ailments.

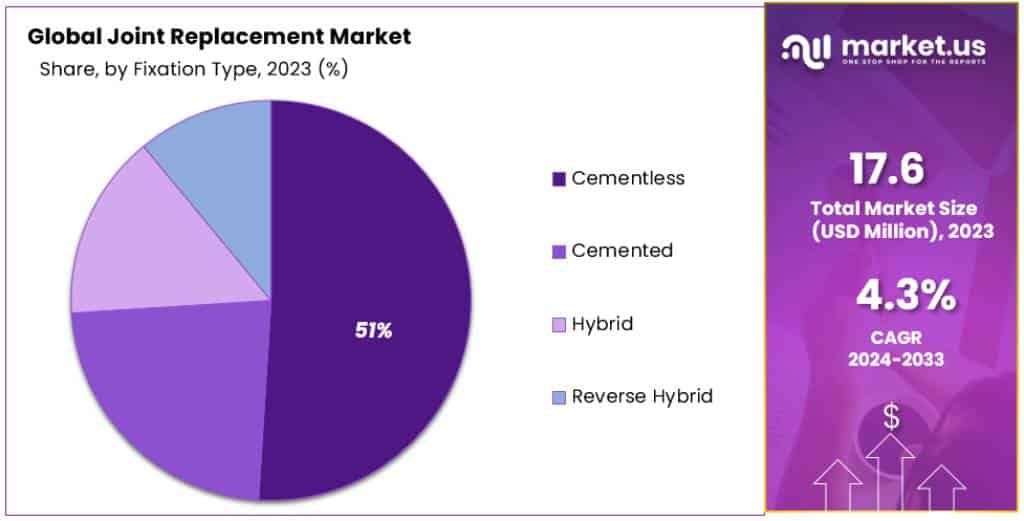

- The Cemented fixation type held a dominant market share of more than 51% in 2023, known for its reliability in joint replacement surgeries.

- Total Joint Replacement procedures make up over 65% of the market share in 2023, offering comprehensive solutions for advanced joint disorders.

- Hospitals hold a dominant market share of over 49% in the End-Use segment due to their advanced facilities and expertise.

- North America leads the Joint Replacement Market with a commanding 44% share, driven by a high incidence of osteoarthritis and comprehensive insurance coverage.

Product Analysis

Under the product segment in the joint replacement market, distinct trends are evident across various categories. In 2023, knees held a dominant market position, capturing more than a 44.3% share. This dominance is attributed to the high prevalence of knee-related ailments, particularly osteoarthritis, and the increasing number of knee replacement surgeries globally.

Turning to hips, this segment also represents a significant portion of the market. The demand for hip replacements is driven by similar factors as knees, including the aging population and the rising incidence of orthopedic conditions affecting the hip joint.

The market for extremities, encompassing joint replacements in areas such as shoulders, elbows, and ankles, is also notable. While smaller compared to knees and hips, this segment is growing due to technological advancements and an increasing awareness of treatment options for joint issues in these areas.

The lower extremities segment, covering areas below the hip, is primarily driven by the need for ankle and foot replacements. The growth in this segment is fueled by sports injuries, diabetes-related complications, and advancements in prosthetic technology.

Finally, the upper extremities segment, which includes shoulders, elbows, and wrists, is experiencing growth, though it remains a smaller part of the overall market. This growth is largely due to improved surgical techniques and prosthetic designs that enhance mobility and reduce pain for patients.

Overall, each segment within the joint replacement market is influenced by unique factors, including disease prevalence, demographic shifts, and technological advancements, shaping their respective market dynamics.

Fixation Type Analysis

In the joint replacement market, the Fixation Type segment reveals diverse trends across its categories. In 2023, the Cemented segment held a dominant market position, capturing more than a 51% share. This method, which uses bone cement to secure the implant, is popular due to its long history of effective results and reliability in joint replacement surgeries.

The Cementless segment, on the other hand, is gaining traction. This approach relies on bone growth into the implant for stability and is increasingly preferred for its potential for longer-lasting results, especially in younger patients. Its market share is rising as advancements in implant materials and design improve its effectiveness.

The Hybrid fixation segment, combining cemented and cementless techniques, represents a middle ground. It is chosen for specific cases where one part of the implant is fixed with cement, while the other part is cementless. This method offers a balance of immediate stability and long-term fixation, making it a preferred choice in certain scenarios.

Lastly, the Reverse Hybrid segment, although smaller in market share, is noteworthy. It involves a reverse of the hybrid approach, where different components of the implant are fixed differently. This method is particularly useful in complex cases where customized fixation is required.

Each of these fixation types caters to different patient needs and surgical requirements, contributing to the diverse dynamics within the joint replacement market. Their adoption varies based on factors like patient age, bone quality, and specific joint conditions, influencing their respective market shares.

Procedure Type Analysis

In the joint replacement market, examining the Procedure Type segment uncovers key trends. In 2023, Total Joint Replacement emerged as the leading segment, securing over a 65% market share. This dominance is driven by its widespread application in treating severe joint damage, particularly in knees and hips, offering comprehensive solutions for patients with advanced joint disorders.

Revision Joint Replacement, while a smaller segment, plays a crucial role in the market. This procedure involves replacing old or failed implants, catering to patients who have already undergone joint replacement surgery. The demand for this type of surgery is increasing due to the aging population and the natural wear and tear of previously implanted prosthetics.

Partial Joint Replacement represents a specific niche in the market. This procedure is preferred for patients with localized joint damage, where only a part of the joint needs replacement. Its market presence is bolstered by its suitability for less invasive interventions and quicker recovery times compared to total joint replacements.

End-Use Analysis

In the joint replacement market, the End-Use segment shows distinct patterns. In 2023, Hospitals stood out as the predominant sector, holding over a 49% market share. This dominance is largely due to their comprehensive facilities and expertise for conducting complex joint replacement surgeries. Hospitals are typically equipped with advanced surgical tools and have the capacity to handle a high volume of patients, making them a primary choice for such procedures.

Orthopedic Clinics also play a significant role in the market. These specialized clinics offer targeted treatments and are often preferred for less complex joint replacement procedures. Their personalized care approach and specialized focus on musculoskeletal health contribute to their market presence.

The ‘Others’ category encompasses various other settings where joint replacements are performed, such as ambulatory surgical centers and specialized surgical units. This segment caters to patients seeking more cost-effective or quicker alternatives to hospital stays. While smaller in market share compared to hospitals and orthopedic clinics, this segment is gaining traction due to its convenience and efficiency.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Extremities

- Lower

- Upper

- Knees

- Hips

By Fixation Type

- Cementless

- Cemented

- Hybrid

- Reverse Hybrid

By Procedure Type

- Total Joint Replacement

- Revision Joint Replacement

- Partial Joint Replacement

By End-Use

- Orthopedic Clinics

- Hospitals

- Others

Drivers

- Increasing Incidence of Orthopedic Disorders: The rising cases of osteoarthritis and other joint-related diseases are key drivers. Over 350 million people globally suffer from arthritis. In the U.S., arthritis diagnoses are expected to reach over 78 million by 2040.

- Growing Geriatric Population: By 2030, 1 in 6 people globally will be over 60, with the population aged 60+ doubling to 1.4 billion by 2050. This demographic is more prone to orthopedic issues.

- Technological Advancements: Innovations like Stryker’s Mako Total Knee 2.0 and ConforMIS Inc.’s Imprint Knee System are enhancing surgical outcomes.

- 3D Printing and Robotics: Custom implants and robotic surgeries, like Smith+Nephew’s CORI system, are improving efficiency and precision in joint replacement procedures.

Restraints

- High Costs and Alternatives: The expense and availability of alternative treatments can limit market growth.

- Product Recalls and Legal Issues: From 2003 to 2019, over 13,000 knee replacement recalls were reported by the FDA, with Zimmer Biomet leading these recalls.

Opportunities

- Online Educational Tools: Increasing internet use for orthopedic information offers new market opportunities.

- Expansion in Emerging Markets: Regions like Asia Pacific, with growing healthcare infrastructure and medical tourism, present significant growth opportunities.

Challenges

- COVID-19 Impact: The pandemic led to significant revenue losses, with Stryker’s revenue down 9.1% and Zimmer Biomet’s dropping 11.8% in 2020.

- Surgical Restrictions: Non-emergency surgery halts during COVID-19, costing an estimated USD 22.3 billion in the U.S., posed major challenges.

Trends

- Customization and Patient-Specific Solutions: The trend towards custom implants and personalized surgery plans is growing.

- Advancements in Implant Design: Continuous innovation in implant designs and materials are shaping future market trends.

Regional Analysis

In the Joint Replacement Market, North America leads with a commanding 44% share, amounting to USD 7.7 billion in 2023. This dominance is primarily fueled by a high incidence of osteoarthritis, a substantial geriatric population, comprehensive insurance coverage, and frequent trauma and accident cases. The American Joint Replacement Registry reported approximately 1.5 million hip and knee arthroplasty surgeries in 2019, evidencing the region’s market strength.

In contrast, Asia Pacific is fast emerging as a dynamic market, projected to grow rapidly due to increased healthcare spending, rapidly developing healthcare infrastructure, and a rise in medical tourism. The Asian Federation of Osteoporosis Societies notes a significant rise in hip fractures, from 1.2 million in 2019 to an expected 2.6 million by 2050. Factors like an aging population, higher healthcare expenditure in developing Asian economies, and an overall increase in conditions like osteoarthritis, osteoporosis, and diabetes are driving this growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global joint replacement market is dominated by a few major players, including Stryker Corporation, Arthrex, Inc., Smith+Nephew, Zimmer Biomet, DJO, LLC, DePuy Synthes, MicroPort Orthopedics, Corin Group, Conformis, Exactech, Inc., and Johnson & Johnson Services, Inc. These companies hold a significant share of the market due to their strong brand reputations, wide product portfolios, and extensive distribution networks.

Stryker Corporation is the largest player in the market, with a market share of approximately 25%. The company is known for its innovative products and strong presence in both the primary and revision joint replacement markets.

Маrkеt Кеу Рlауеrѕ

- Stryker Corporation

- Arthrex, Inc.

- Smith+Nephew

- Zimmer Biomet

- DJO, LLC

- DePuy Synthes

- MicroPort Orthopedics

- Corin Group

- Conformis

- Exactech, Inc.

- Johnson & Johnson Services, Inc.

- Other Key Players

Recent Developments

- October 2023: Zimmer Biomet announces the launch of its new ROSA XL robot for total knee arthroplasty. The ROSA XL is designed to provide surgeons with greater precision and control during surgery, which can lead to improved patient outcomes.

- September 2023: Stryker receives FDA approval for its Mako Robotic-Arm Assisted System for total hip arthroplasty. The Mako system is designed to help surgeons plan and perform hip replacement surgery more accurately, which can lead to a faster recovery and a longer implant lifespan.

- August 2023: Johnson & Johnson announces the launch of its new Accolade FR® Acetabular Liner for total hip arthroplasty. The Accolade FR® Acetabular Liner is designed to reduce the risk of dislocation, which is a common complication of hip replacement surgery.

- July 2023: Smith & Nephew announces the launch of its new JOURNEY II® Knee System for total knee arthroplasty. The JOURNEY II® Knee System is designed to provide patients with a more natural-feeling knee joint.

- June 2023: Zimmer Biomet announces the launch of its new Persona® Revision Hip System. The Persona® Revision Hip System is designed to provide surgeons with a more versatile and durable option for patients who need revision hip surgery.

Report Scope

Report Features Description Market Value (2023) USD 18.4 Billion Forecast Revenue (2032) USD 26.5 Billion CAGR (2023-2032) 4.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Extremities, Lower, Upper, Knees and Hips) By Fixation Type (Cementless, Cemented, Hybrid and Reverse Hybrid) By Procedure Type (Total Joint Replacement, Revision Joint Replacement and Partial Joint Replacement) By End-Use (Orthopedic Clinics, Hospitals and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Stryker Corporation, Arthrex, Inc., Smith+Nephew, Zimmer Biomet, DJO, LLC, DePuy Synthes, MicroPort Orthopedics, Corin Group, Conformis, Exactech, Inc., Johnson & Johnson Services, Inc., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the joint replacement market in 2023?The Joint replacement market size is USD 18.4 Billion in 2023.

What is the projected CAGR at which the Joint replacement market is expected to grow at?The Joint replacement market is expected to grow at a CAGR of 4.3% (2023-2033).

List the segments encompassed in this report on the Joint replacement market?Market.US has segmented the Joint replacement market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product (Extremities, Lower, Upper, Knees and Hips) By Fixation Type (Cementless, Cemented, Hybrid and Reverse Hybrid) By Procedure Type (Total Joint Replacement, Revision Joint Replacement and Partial Joint Replacement) By End-Use (Orthopedic Clinics, Hospitals and Others) , the market has been further divided into Hospitals, Orthopedic Clinics, and Other End-Uses.

List the key industry players of the Joint replacement market?Stryker Corporation, Arthrex, Inc., Smith+Nephew, Zimmer Biomet, DJO, LLC, DePuy Synthes, MicroPort Orthopedics, Corin Group, Conformis, Exactech, Inc., Johnson & Johnson Services, Inc., Other Key Players.

-

-

- Stryker Corporation

- Arthrex, Inc.

- Smith+Nephew

- Zimmer Biomet

- DJO, LLC

- DePuy Synthes

- MicroPort Orthopedics

- Corin Group

- Conformis

- Exactech, Inc.

- Johnson & Johnson Services, Inc.

- Other Key Players