Global IVD Contract Manufacturing Market By Product Type (Products (Instruments, Reagents and Consumables & Disposables) and Software & Services (Assay Development, Manufacturing, Packaging & Labelling and Quality & Regulatory Support)), By Technology (Immunoassay, Molecular Diagnostics, Clinical Chemistry, Hematology, Microbiology and Coagulation & Hemostasis), By End-User (Medical Device & Biotechnology Companies and Academic & Research Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176145

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

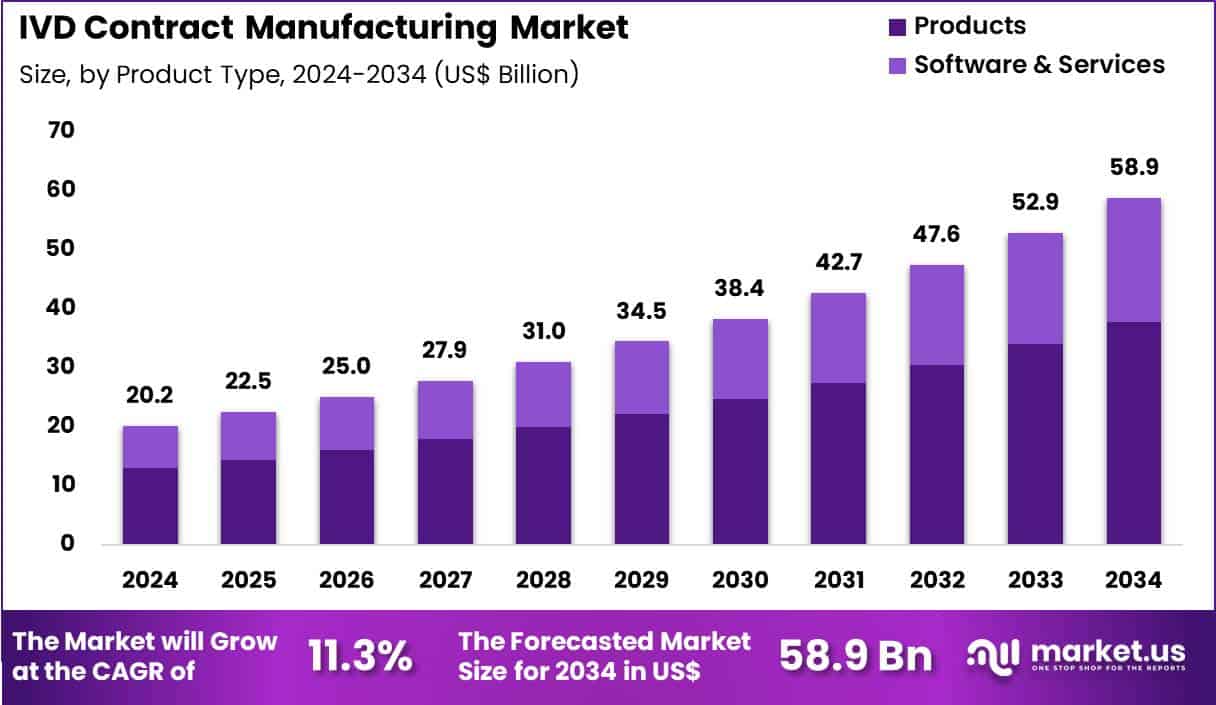

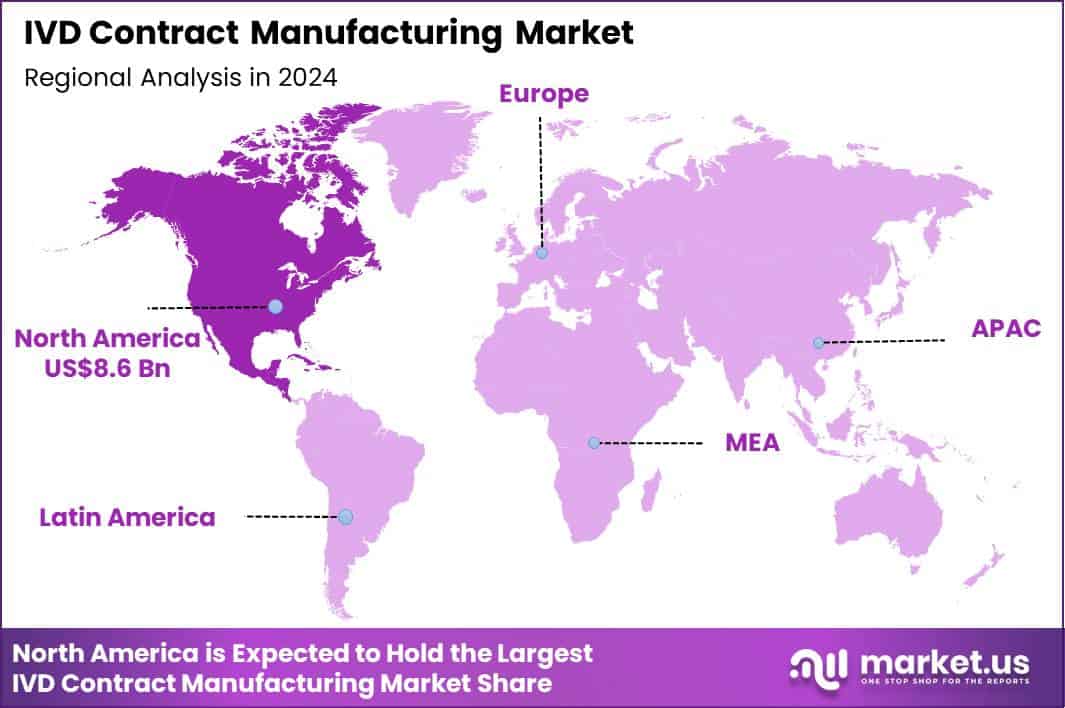

Global IVD Contract Manufacturing Market size is expected to be worth around US$ 58.9 Billion by 2034 from US$ 20.2 Billion in 2024, growing at a CAGR of 11.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 8.6 Billion.

Increasing complexity in in vitro diagnostic product development compels diagnostic companies to outsource manufacturing to contract organizations that offer specialized expertise, regulatory compliance, and scalable production capacity. IVD manufacturers increasingly partner with contract organizations to produce lateral flow assays for rapid point-of-care testing, enabling quick detection of infectious diseases and cardiac biomarkers in emergency and primary care settings.

These partners assemble microfluidic cartridges for molecular diagnostics, supporting high-sensitivity nucleic acid amplification tests that identify pathogens and genetic markers with minimal sample volumes. Contract manufacturers fabricate enzyme-linked immunosorbent assay kits for autoimmune and infectious disease serology, ensuring consistent reagent coating and plate assembly for reliable quantitative results.

They also produce multiplex bead-based assays that simultaneously measure multiple analytes, streamlining workflows in clinical chemistry and oncology companion diagnostics. In addition, contract organizations support development of continuous glucose monitoring sensors and electrochemical immunoassays, delivering precise analyte detection for diabetes management and therapeutic drug monitoring.

Contract manufacturing organizations seize opportunities to integrate advanced automation and digital quality systems that enhance reproducibility and traceability across reagent formulation, device assembly, and packaging. Providers advance capabilities in reagent lyophilization and stabilization, expanding applications for long-shelf-life point-of-care tests in resource-limited environments.

These services facilitate rapid scale-up for emergency-use diagnostics during public health crises, accelerating deployment of antigen and molecular assays. Opportunities emerge in supporting next-generation sequencing library preparation kits and digital PCR consumables, addressing demand for high-throughput genomic and liquid biopsy testing.

Companies invest in cleanroom expansions and ISO 13485-compliant processes that streamline technology transfer for innovative immunoassays and molecular diagnostics. Recent trends emphasize strategic alliances that combine contract manufacturing with regulatory consulting, enabling faster market entry for novel IVD platforms while maintaining rigorous quality standards.

Key Takeaways

- In 2024, the market generated a revenue of US$ 20.2 Billion, with a CAGR of 11.3%, and is expected to reach US$ 58.9 Billion by the year 2034.

- The product type segment is divided into products and software & services, with products taking the lead with a market share of 64.3%.

- Considering technology, the market is divided into immunoassay, molecular diagnostics, clinical chemistry, hematology, microbiology and coagulation & hemostasis. Among these, immunoassay held a significant share of 36.1%.

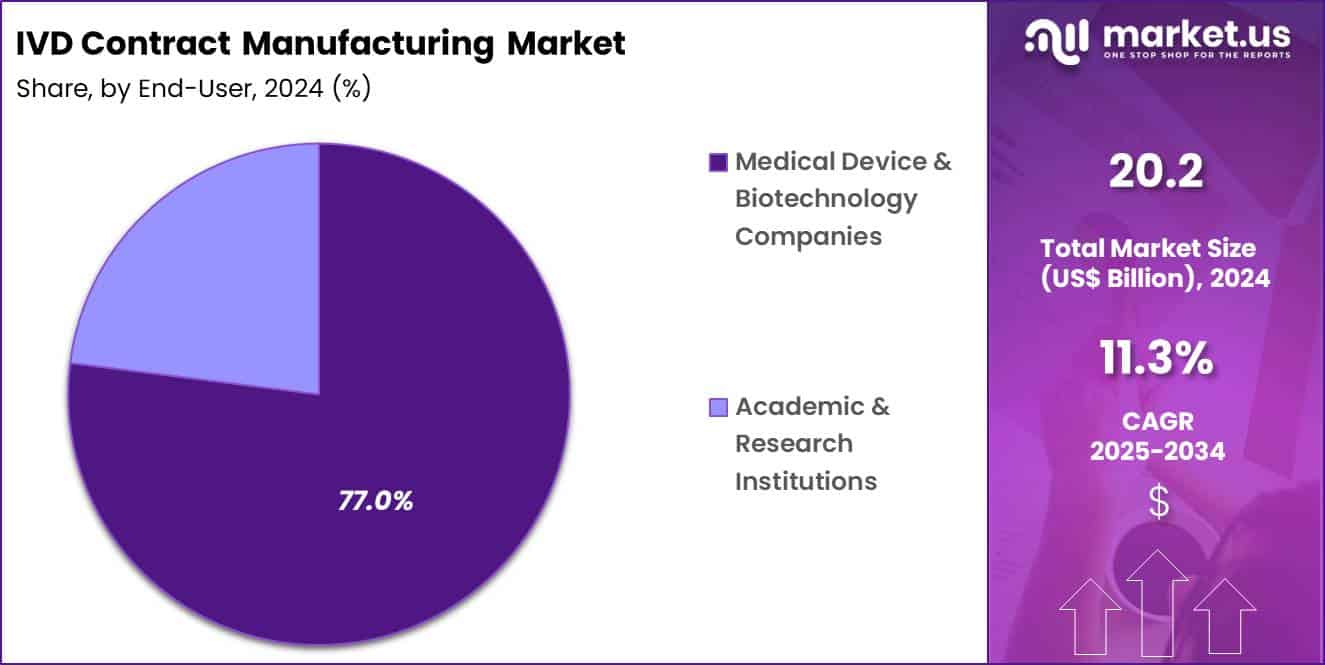

- Furthermore, concerning the end-user segment, the market is segregated into medical device & biotechnology companies and academic & research institutions. The medical device & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 77.0% in the market.

- North America led the market by securing a market share of 42.5%.

Product Type Analysis

Products contributed 64.3% of growth within product type and dominated the IVD contract manufacturing market due to sustained outsourcing of instruments, reagents, and consumables by diagnostic companies. IVD developers increasingly rely on contract manufacturers to scale production without expanding internal manufacturing footprints.

High testing volumes across routine diagnostics drive consistent demand for reagents and disposables, which strengthens recurring manufacturing contracts. Instrument OEMs also outsource sub-assemblies and full-system production to optimize cost structures and accelerate commercialization timelines.

Growth further strengthens as diagnostic portfolios diversify across infectious disease, chronic disease, and point-of-care testing. Contract manufacturers invest in automated lines and quality systems that support high-volume, regulated production.

Supply chain resilience remains a priority, pushing OEMs toward experienced manufacturing partners. Consumables benefit from repeat ordering cycles and shorter replacement intervals. The segment is projected to maintain dominance as IVD companies prioritize scalable production and operational efficiency.

Technology Analysis

Immunoassay accounted for 36.1% of growth within technology and led the IVD contract manufacturing market due to its broad clinical utility and high test volumes. Immunoassays remain central to diagnostics for infectious diseases, oncology markers, hormones, and autoimmune conditions.

Diagnostic companies expand immunoassay menus to address screening and monitoring needs, which increases outsourcing of assay production. Contract manufacturers support this growth through formulation expertise, bulk reagent production, and validated assembly processes.

The segment benefits from continuous assay innovation and demand for faster turnaround solutions. High-throughput laboratory testing sustains large-scale immunoassay consumption. Regulatory familiarity with immunoassay platforms reduces development risk and accelerates market entry. Contract partners provide flexibility across ELISA, CLIA, and rapid formats. Immunoassay manufacturing is anticipated to expand steadily as laboratories prioritize reliable, high-volume diagnostic solutions.

End-User Analysis

Medical device and biotechnology companies contributed 77.0% of growth within end-user and dominated the IVD contract manufacturing market due to their reliance on external partners for production scale-up. These companies focus internal resources on assay development, clinical validation, and commercialization strategy while outsourcing manufacturing execution.

Rapid pipeline expansion across diagnostics increases the need for flexible manufacturing capacity. Biotechnology firms also leverage contract manufacturers to navigate regulatory and quality requirements efficiently.

Growth accelerates as emerging diagnostic companies enter the market without in-house production capabilities. Established OEMs use contract manufacturing to manage cost pressures and global demand variability. Strategic partnerships support faster product launches and lifecycle management. Outsourcing also reduces capital expenditure and operational risk. The segment is expected to remain the primary growth engine as diagnostic innovation continues to outpace internal manufacturing expansion.

Key Market Segments

By Product Type

- Products

- Instruments

- Reagents

- Consumables & Disposables.

- Software & Services

- Assay Development

- Manufacturing

- Packaging & Labelling

- Quality & Regulatory Support.

By Technology

- Immunoassay

- Molecular Diagnostics

- Clinical Chemistry

- Hematology

- Microbiology

- Coagulation & Hemostasis

By End-User

- Medical Device & Biotechnology Companies

- Academic & Research Institutions

Drivers

Increasing demand for in vitro diagnostics is driving the market.

The expanding requirement for in vitro diagnostic tests worldwide has notably increased the reliance on contract manufacturing to fulfill production needs efficiently. Heightened focus on early disease detection and personalized medicine necessitates scalable manufacturing capabilities for IVD devices and reagents. Roche reported Diagnostics Division sales of CHF 14.324 billion in 2024, reflecting a 4% growth at constant exchange rates from the previous year.

This performance indicates robust market expansion driven by demand for immunoassay and molecular diagnostics. Contract manufacturers provide expertise in regulatory compliance and cost-effective production to support this growth. The linkage between rising healthcare expenditures and IVD utilization further stimulates outsourcing activities.

Public health organizations promote widespread testing for infectious diseases, enhancing the role of specialized manufacturing partners. Major firms are scaling operations to accommodate surging volumes in clinical chemistry and point-of-care segments. This driver encourages investments in advanced facilities equipped for high-throughput assembly. Ultimately, the IVD demand trend fortifies the contract manufacturing ecosystem globally.

Restraints

Regulatory complexities and compliance costs are restraining the market.

The stringent oversight by health authorities demands extensive documentation and validation, elevating operational expenses for IVD contract manufacturers. Navigating diverse international standards complicates supply chain management and product timelines. Smaller entities often face resource limitations in meeting FDA and EU MDR requirements, restricting market entry.

Certification processes for quality systems like ISO 13485 add financial strain on ongoing activities. In regions with evolving regulations, adaptation delays can impact contract fulfillment. Providers may hesitate to engage new clients due to potential audit risks and liability concerns. This restraint curtails flexibility in rapid prototyping and customization services.

Collaborative frameworks seek to standardize practices, yet implementation challenges persist. Despite technological benefits, compliance burdens limit competitive pricing strategies. Addressing these issues through specialized consulting is vital for alleviating market constraints.

Opportunities

Rising investments in biopharma infrastructure in Asia-Pacific is creating growth opportunities.

The swift augmentation of diagnostic facilities in Asia-Pacific nations offers prospects for IVD contract manufacturing in emerging production hubs. Governmental funding for health technology parks facilitates the deployment of outsourced services in regional markets. The area’s escalating participation in global diagnostic supply chains heightens the need for localized manufacturing expertise.

Alliances with indigenous companies enable adherence to local standards and efficient distribution. Capacity upgrades in densely populated countries tackle unmet demands in infectious disease testing. Thermo Fisher Scientific reported Asia-Pacific contributing to its overall revenue growth in 2024, underscoring regional momentum.

Professional development programs for staff foster uniform quality in IVD production. This opportunity permits multinational entities to broaden beyond traditional territories. Prominent organizations are founding Asian subsidiaries to exploit reduced expenses and proximity. Focused initiatives can establish considerable presence in these expanding healthcare arenas.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions shape the IVD contract manufacturing market through healthcare spending trends, funding cycles for diagnostics firms, and working capital discipline. Inflation and higher interest rates increase financing costs for customers, which delays outsourcing decisions and stretches order timelines. Geopolitical tensions disrupt supplies of reagents, plastics, electronics, and precision tooling, raising complexity across global production networks.

Current US tariffs on imported components and subassemblies add cost pressure for contract manufacturers and squeeze margins when long-term pricing agreements lock rates. These headwinds strain smaller programs and elevate execution risk.

On the positive side, tariffs and trade uncertainty accelerate nearshoring, capacity expansion in North America, and multi-sourcing strategies. Demand for scalable, compliant manufacturing remains strong as diagnostics companies seek speed, quality, and flexibility. With operational excellence, automation, and deeper partnerships, the market can turn volatility into sustained growth.

Latest Trends

Formation of CDMO collaborations for CLIA reagents is a recent trend in the market.

In 2024, partnerships between diagnostic firms and contract manufacturers have advanced the production of chemiluminescence immunoassay systems for clinical use. These alliances utilize specialized facilities to ensure compliance with stringent quality benchmarks.

Agappe Diagnostics Ltd. and Fujirebio Holdings, Inc. entered a CDMO agreement in January 2024 for cartridge-based CLIA reagents manufacturing. This initiative targets immunology equipment integration to enhance diagnostic accuracy. Contract partners are incorporating automated processes to streamline reagent assembly and testing. The trend prioritizes scalability for high-volume outputs in oncology and infectious disease panels.

Regulatory endorsements in 2024 for collaborative products have expedited market introductions. Sector synergies concentrate on optimizing formulations for minimal sample inputs. These evolutions tackle efficiency requirements in centralized laboratory environments. Such partnerships establish collaborative manufacturing as central to forthcoming IVD progress.

Regional Analysis

North America is leading the IVD Contract Manufacturing Market

North America commands a 42.5% share of the global IVD Contract Manufacturing market, showcasing significant growth in 2024 attributed to surging requirements for rapid diagnostic solutions in response to escalating infectious and chronic disease burdens.

Prominent entities like Danaher Corporation and Qiagen have enhanced their outsourcing capabilities by introducing scalable production platforms that support high-volume reagent and assay manufacturing, addressing needs in molecular testing and immunology. The area’s sophisticated supply chain networks and emphasis on quality assurance have enabled efficient scaling of operations for point-of-care devices and laboratory instruments.

Federal programs through agencies such as the Centers for Disease Control and Prevention have promoted collaborations that streamline regulatory compliance and accelerate product timelines. Rising emphasis on companion diagnostics for targeted therapies has amplified outsourcing demands, as manufacturers seek specialized expertise in customization. Joint ventures among biotech firms and contract organizations have spurred technological integrations, including automation for precision assembly.

Furthermore, expanded access to venture funding has empowered smaller innovators to leverage contract services for faster market entry. According to the National Institutes of Health, an estimated 3.3 billion in vitro diagnostic tests are performed in the U.S. every year, emphasizing the scale driving manufacturing expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts foresee considerable expansion in the diagnostic outsourcing industry across Asia Pacific over the forecast period, since regional leaders bolster incentives for foreign investments in healthcare production hubs. Entities in Singapore and Malaysia construct advanced facilities that specialize in reagent formulation and device assembly, meeting stringent international standards for export markets.

Healthcare providers in populous countries like Indonesia prioritize locally sourced tools to combat prevalent ailments, prompting firms to localize supply chains for efficiency. Regulators implement policies that expedite reviews for novel technologies, attracting partnerships with Western specialists in quality control. Entrepreneurs secure grants to innovate affordable kits for infectious disease detection, enhancing accessibility in rural zones.

Economic policies in Thailand foster clusters where suppliers collaborate on component sourcing, reducing costs and timelines. Trade agreements facilitate knowledge exchange, enabling upgrades in sterilization and packaging processes. The National Medical Products Administration in China approved 138 innovative medical devices since 2022, highlighting momentum in regional advancements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the IVD contract manufacturing market drive growth by expanding end-to-end capabilities, including reagent formulation, kit assembly, and regulatory support that help OEMs accelerate time to market. They invest in state-of-the-art facilities and quality systems to meet stringent global standards and attract large diagnostics partners seeking dependable scale.

Firms also deepen value propositions by offering customized development services that align with evolving biomarker trends and multiplex assay demand. Strategic collaborations with diagnostic innovators and regional distributors broaden their customer base and reinforce recurring revenue streams.

Charles River Laboratories stands out with its comprehensive biologics and diagnostics service portfolio, global footprint, and commitment to high-quality manufacturing excellence that supports complex assay production. The company advances its competitive agenda through targeted capacity investments, client-centric project management, and disciplined execution that meets both performance expectations and compliance benchmarks.

Top Key Players

- Thermo Fisher Scientific

- Avioq, Inc.

- Bio‑Techne

- Argonaut Manufacturing Services

- West Pharmaceutical Services, Inc.

- KMC Systems

- TCS Biosciences Ltd

- Randox Laboratories

- EKF Diagnostics

- Cenogenics Corporation

- Celestica Inc.

- Savyon Diagnostics

- Novo Biomedical

- Cone Bioproducts

- TE Connectivity

Recent Developments

- In 2025, Jabil Inc., a major player in the healthcare manufacturing space, reported a total net revenue of US$ 29.802 billion, showcasing its massive scale in providing outsourced manufacturing solutions for complex medical devices, including in-vitro diagnostic platforms. The company’s focus on the healthcare segment has been bolstered by its ability to integrate advanced automation and digital supply chain solutions, which are critical for the production of high-volume diagnostic consumables and sophisticated laboratory equipment used in clinical settings.

- In 2025, Plexus Corp. announced that its Healthcare and Life Sciences segment achieved an annual revenue of US$ 1.629 billion, emphasizing the critical role of contract manufacturing in the diagnostics sector. As per recent reports, the company has increasingly focused on specialized manufacturing for life sciences, including the development of molecular diagnostic tools and clinical chemistry analyzers. This revenue performance reflects the ongoing shift among diagnostic companies toward outsourcing complex assembly and engineering tasks to mitigate supply chain risks and leverage specialized technical expertise.

Report Scope

Report Features Description Market Value (2024) US$ 20.2 Billion Forecast Revenue (2034) US$ 58.9 Billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Products (Instruments, Reagents and Consumables & Disposables) and Software & Services (Assay Development, Manufacturing, Packaging & Labelling and Quality & Regulatory Support)), By Technology (Immunoassay, Molecular Diagnostics, Clinical Chemistry, Hematology, Microbiology and Coagulation & Hemostasis), By End-User (Medical Device & Biotechnology Companies and Academic & Research Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Avioq, Inc., Bio‑Techne, Argonaut Manufacturing Services, West Pharmaceutical Services, Inc., KMC Systems, TCS Biosciences Ltd, Randox Laboratories, EKF Diagnostics, Cenogenics Corporation, Celestica Inc., Savyon Diagnostics, Novo Biomedical, Cone Bioproducts, TE Connectivity. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IVD Contract Manufacturing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

IVD Contract Manufacturing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Avioq, Inc.

- Bio‑Techne

- Argonaut Manufacturing Services

- West Pharmaceutical Services, Inc.

- KMC Systems

- TCS Biosciences Ltd

- Randox Laboratories

- EKF Diagnostics

- Cenogenics Corporation

- Celestica Inc.

- Savyon Diagnostics

- Novo Biomedical

- Cone Bioproducts

- TE Connectivity