Global IV Disinfecting Caps Market By Product Type (Single Cap and Double Cap), By Application (Blood Collection, Blood Transfusion, Infusion and Others), By End-User (Hospitals, Clinics, Diagnostic Centres, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169674

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

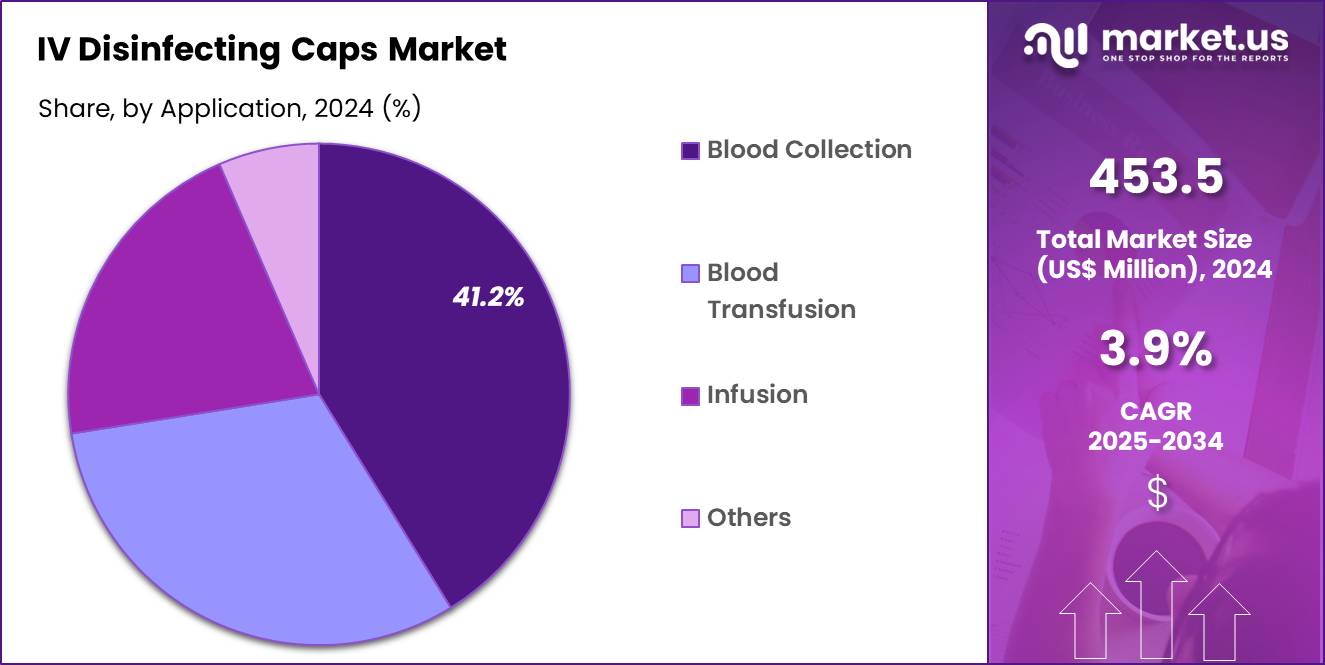

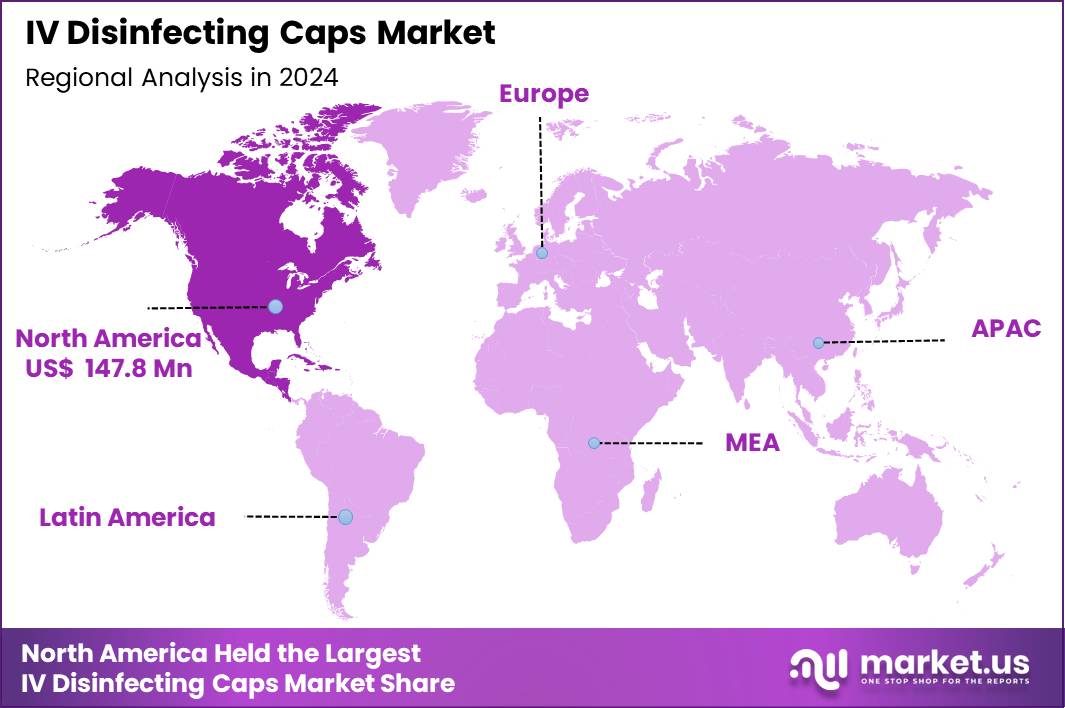

The Global IV Disinfecting Caps Market size is expected to be worth around US$ 588.6 Million by 2034 from US$ 401.5 Million in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.8% share with a revenue of US$ 147.8 Billion.

The IV Disinfecting Caps market plays a crucial role in maintaining sterile environments in medical settings by preventing infection from entering intravenous (IV) systems. As healthcare institutions emphasize patient safety and infection prevention, the adoption of IV disinfecting caps has risen significantly. These caps, which offer a simple yet effective method of disinfecting the access ports of IV devices, are in demand due to their role in reducing healthcare-associated infections (HAIs).

Growth stems from heightened awareness of antimicrobial resistance, government initiatives for hygiene protocols, and expanding healthcare infrastructure, particularly in Asia-Pacific regions like China and India. Single caps dominated with a 63.5% market share in 2025 due to their affordability, ease of use, and effectiveness in minimizing contamination risks. North America leads regionally, supported by advanced medical devices and high surgical volumes. High product costs, limited adoption in developing areas, and supply chain issues pose hurdles, though innovations like smart caps with real-time monitoring offer future opportunities.

As of early 2025, BD continues to list BD PureHub disinfecting caps as part of its Vascular Access Management portfolio. The caps use 70 % isopropyl alcohol (IPA), claim 99.99 % bacterial reduction within 1 minute of application, and maintain a contamination barrier for up to 7 days if not removed. BD states that PureHub is compatible with multiple needle‑free connectors (e.g., BD SmartSite, BD MaxZero, BD Q-Syte), aligning with major infusion‑therapy and infection‑control guidelines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 401.5 Million, with a CAGR of 3.9%, and is expected to reach US$ 588.6 Million by the year 2034.

- The Product Type segment is divided into Single Cap, and Double Cap, with Single Cap taking the lead in 2024 with a market share of 63.5%

- The Application segment is divided into Blood Collection, Blood Transfusion, Infusion, and Others, with Blood Collection taking the lead in 2024 with a market share of 41.2%

- The End-User segment is divided into Hospitals, Clinics, Diagnostic Centres, and Others, with Hospitals taking the lead in 2024 with a market share of 56.3%

- North America led the market by securing a market share of 36.8% in 2024.

Product Type Analysis

The Single Cap segment dominated the IV disinfecting caps market which accounted for 63.5% market share in 2024. This type is widely adopted in both hospital and clinic settings due to its cost-effectiveness and ease of use. Single caps are used for disinfecting the IV access ports between uses, ensuring that the risk of infection is minimized. This segment’s popularity is expected to continue growing as hospitals implement more infection prevention protocols and as disposable products become more favored due to hygiene concerns.

Double Caps are expected to see a gradual increase in adoption, primarily in high-risk settings such as surgical and intensive care units (ICUs). Double Cap designs offer an additional layer of protection, often with enhanced sealing mechanisms to prevent microbial ingress, making them ideal for more critical patient care situations. However, their higher cost may limit their broader use.

Application Analysis

Blood Collection contribute significantly to the market with 41.2% market share in 2024, as disinfecting caps are used to maintain the sterility of collection sites and transfusion lines. These applications are highly sensitive to contamination risks, especially when dealing with blood products, which increases the demand for disinfecting caps in these areas. Other applications, including general intravenous therapy and specific procedures requiring strict infection control, also contribute to the overall market demand.

The Infusion segment also holds major share the IV disinfecting caps market due to the widespread use of intravenous therapy in hospitals. Infusion therapy is commonly used for administering medications, fluids, and nutrients, especially in critical care scenarios. The importance of maintaining a sterile environment for infusions is driving the adoption of disinfecting caps, as they reduce the risk of infections during prolonged or frequent IV access.

End-User Analysis

Hospitals are the largest end-users of IV disinfecting caps, accounting for the majority of the market share of 56.3% in 2024. With the growing focus on patient safety and infection control, hospitals implement stringent measures to reduce healthcare-associated infections. IV disinfecting caps are an essential component of infection prevention protocols in hospitals, especially in emergency, surgical, and intensive care departments, where the risks of infections are high.

Clinics are also key end-users, particularly outpatient clinics that provide infusion and blood collection services. Diagnostic centers, although smaller in comparison to hospitals, still contribute a significant portion of market demand due to their role in diagnostic procedures that require sterile IV access. Other end-users, including research labs and home healthcare providers, also use IV disinfecting caps to ensure safe and hygienic intravenous access during clinical procedures.

Key Market Segments

By Product Type

- Single Cap

- Double Cap

By Application

- Blood Collection

- Blood Transfusion

- Infusion

- Others

By End-User

- Hospitals

- Clinics

- Diagnostic Centres

- Others

Drivers

Growing awareness of infection prevention in healthcare settings

The growing awareness of infection prevention in healthcare settings is a major driver of the IV disinfecting caps market. Use of disinfecting caps has been shown in multiple studies to significantly reduce rates of central line–associated bloodstream infections (CLABSIs) and catheter‑related bloodstream infections (CRBSIs), which remain a leading cause of morbidity in hospitalised patients. As hospitals and clinics increasingly adopt robust infection‑control protocols, reliance on simpler, passive interventions such as disinfecting caps becomes more common especially when standard “scrub the hub” methods are inconsistent or poorly adhered to.

Healthcare awareness campaigns, regulatory guidance and institutional infection‑control committees further push use of disinfecting caps as a standard part of catheter maintenance. The convenience and ease of use of disinfecting caps (pre‑sterilised, ready to apply, minimal training needed) make them an attractive option for busy wards, outpatient infusion centres and emergency settings.

Restraints

Cost sensitivity and budget constraints

Cost sensitivity and budget constraints in certain healthcare settings act as a restraint for the widespread adoption of disinfecting caps. While disinfecting caps reduce infection risk, their per‑unit cost is higher than traditional manual disinfection which may deter use in lower‑resource or underfunded clinics and diagnostic centres. In settings where infection‑control budgets are limited or where reuse of IV components is common, investment in single‑use caps may be deprioritised.

Variation in clinical practice and lack of strict enforcement of infection‑control guidelines may also limit adoption; in some facilities, standard manual cleaning remains the default method. Additionally, some clinicians may question necessity of caps for all IV lines, especially peripheral or short‑term lines, reducing demand in non‑critical care areas. Finally, in environments with inconsistent supply chains or procurement challenges, availability of disinfecting caps may be unreliable undermining their routine use even when infection‑control awareness is high.

Opportunities

Emerging markets and expanding healthcare systems

Emerging markets and expanding healthcare systems offer significant growth opportunity for the IV disinfecting caps market. As hospitals, clinics and diagnostic centres in developing countries upgrade their infrastructure and adopt international infection‑control standards, demand for passive infection‑prevention devices such as disinfecting caps is expected to rise.

Governments and public‑health initiatives promoting improved hygiene, patient safety and antimicrobial‑resistance containment further support this shift. For instance, national infection‑control guidelines encourage aseptic maintenance of intravenous lines creating a favourable environment for disinfecting cap adoption.

There is also opportunity in extending disinfecting‑cap use beyond central venous catheters to peripheral IV lines, blood‑collection and transfusion settings, outpatient infusion centres, and home‑care scenarios thereby broadening the addressable end‑user base. Advances in cap design such as improved antimicrobial formulations, better compatibility with variable connectors, and longer-lasting disinfection can further drive adoption.

Impact of Macroeconomic / Geopolitical Factors

The global medical‑device supply chain’s dependence on complex, international sourcing makes the IV Disinfecting Caps market vulnerable to economic volatility and geopolitical disruptions. Rising raw‑material and transportation costs, inflationary pressures, and currency fluctuations increase manufacturing costs for disinfecting caps and may lead to higher prices or supply delays. Economic downturns or austerity measures often lead to budget cuts in public health and hospital procurement, reducing expenditures on non‑critical disposable accessories this may lead to lower demand for IV disinfecting caps in under‑resourced healthcare settings.

Geopolitical tensions, trade wars, tariffs or sanctions affecting major exporter or raw material‑producing countries can disrupt supply chains. Such disruptions may result in shortages, longer lead times, and increased input costs for manufacturers making it challenging to ensure consistent global supply of sterilized caps.

In addition, regulatory divergence between regions and changing trade policies may complicate cross‑border distribution, making global sourcing riskier. On the other hand, these pressures could accelerate localisation or near‑shoring of manufacturing, which may benefit regions investing in domestic production infrastructure.

Latest Trends

Shift from manual “hub‑scrub” disinfection towards passive, single‑use antiseptic caps

A clear trend in the IV disinfecting caps market is the shift from manual “hub‑scrub” disinfection towards passive, single‑use antiseptic caps that provide consistent, reliable disinfection. Several major infection‑control organisations now recommend disinfecting caps as part of standard protocols when basic measures do not sufficiently reduce infection rates. The increasing use of needlefree connectors and central venous catheters for prolonged therapies including infusion, blood transfusion, and intensive‑care applications amplifies the need for reliable terminal‑site disinfection.

Healthcare institutions are increasingly embedding disinfecting caps into care bundles and catheter‑maintenance protocols, making their use routine, visible (caps often coloured for easy compliance monitoring), and accountable. The trend towards disposable, single‑use medical accessories—driven by hygiene, regulatory rigor, and patient‑safety priorities further supports long‑term growth of the disinfecting caps segment.

Regional Analysis

North America is leading the IV Disinfecting Caps Market

North America remains the largest region for the IV disinfecting caps market which accounted for 36.8% market share in 2024. Its leading position is underpinned by high volumes of surgical procedures and IV therapies in both hospital and outpatient care settings. The prevalence of vascular access procedures and increasing concerns about hospital‑acquired infections have driven heavy adoption of disinfecting caps.

North‑American healthcare providers often operate under stringent infection‑control standards and regulatory scrutiny, prompting routine use of sterile, single‑use caps to reduce risks of bloodstream infections. The presence of advanced healthcare infrastructure, well-established purchasing practices, and a large base of hospitals and clinics contribute to sustained demand. The dominance of major market players in this region and a mature supply chain further reinforce North America’s status as the largest regional market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is emerging as the fastest‑growing region for IV disinfecting caps. Rapid expansion of healthcare infrastructure in countries such as India, China, and other emerging economies is boosting demand. Rising incidences of infectious diseases and growing awareness around infection prevention have increased the uptake of IV caps in hospitals, clinics, and newly established medical centers.

Government initiatives aimed at improving patient safety and boosting healthcare standards are accelerating adoption of infection‑control measures. As private hospitals expand and regulatory expectations rise, demand for disposable, sterile disinfection solutions including IV disinfecting caps is climbing. The growing middle class, urbanisation, and increasing access to healthcare in APAC are contributing to accelerated growth compared with mature markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include 3M Company, Becton, Dickinson and Company (BD), ICU Medical, Inc., B. Braun Melsungen AG, Baxter International Inc., Merit Medical Systems, Inc., Teleflex Incorporated, Cardinal Health, Inc., Medline Industries, Inc., Vygon SA, Smiths Medical, Terumo Corporation.

3M Company — 3M’s Curos™ disinfecting caps use 70% IPA to disinfect IV needle‑free connectors or open female luers in ~1 minute, then provide a sterile barrier for up to 7 days. Their bright‑colored design aids easy compliance monitoring, and in vitro tests show a 99.99% reduction of common pathogens linked to bloodstream infections.

Becton, Dickinson and Company (BD) — BD’s PureHub™ disinfecting caps offer rapid disinfection (using 70% IPA) of needle‑free connectors, achieving >99.99% bacterial reduction in 1 minute and maintaining a barrier against contamination for up to 7 days. The caps are compatible with a range of BD needle‑free connectors, aligning with infection‑control guidelines to reduce catheter‑related complications.

ICU Medical, Inc. ICU Medical markets disinfecting caps under brands such as SwabCap™ and SwabTip™, intended for needle‑free connectors and male‑luer IV access points. These caps deliver alcohol‑based disinfection and serve as a sealed barrier between uses; usage of SwabCap has been shown to reduce catheter‑related bloodstream infections, especially in ICU, dialysis, and infusion therapy settings.

Top Key Players

- 3M Company

- Becton, Dickinson and Company (BD)

- ICU Medical, Inc.

- Braun Melsungen AG

- Baxter International Inc.

- Merit Medical Systems, Inc.

- Teleflex Incorporated

- Cardinal Health, Inc.

- Medline Industries, Inc.

- Vygon SA

- Smiths Medical

- Terumo Corporation

- Other key players

Recent Developments

- In September 2025, ICU Medical announced that its needle‑free IV connectors portfolio (Clave™ Needlefree IV Connectors) earned new regulatory clearance from the U.S. Food and Drug Administration (510(k)), with labeling claims based on peer‑reviewed data showing a 19% lower relative risk of central line‑associated bloodstream infection (CLABSI) in high‑volume hospitals using Clave connectors compared with non‑

- In May 2023, Intellego Technologies and HAI Solutions announced a strategic partnership aimed at enhancing the quality and safety of intravenous (IV) vascular access. This collaboration integrates Intellego’s patented ultraviolet-sensitive ink as an indicator in HAI Solutions’ QIKcap™ technology, providing visible and verifiable protection for IV ports and ensuring that the needle-free connector has been properly disinfected.

Report Scope

Report Features Description Market Value (2024) US$ 401.5 Million Forecast Revenue (2034) US$ 588.6 Million CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Cap and Double Cap), By Application (Blood Collection, Blood Transfusion, Infusion and Others), By End-User (Hospitals, Clinics, Diagnostic Centres, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Becton, Dickinson and Company (BD), ICU Medical, Inc., B. Braun Melsungen AG, Baxter International Inc., Merit Medical Systems, Inc., Teleflex Incorporated, Cardinal Health, Inc., Medline Industries, Inc., Vygon SA, Smiths Medical, Terumo Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IV Disinfecting Caps MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

IV Disinfecting Caps MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Becton, Dickinson and Company (BD)

- ICU Medical, Inc.

- Braun Melsungen AG

- Baxter International Inc.

- Merit Medical Systems, Inc.

- Teleflex Incorporated

- Cardinal Health, Inc.

- Medline Industries, Inc.

- Vygon SA

- Smiths Medical

- Terumo Corporation

- Other key players