Global Isobutyric Acid Market Size, Share Analysis Report By Grade (Reagent Grade, Industrial Grade), By Type (Synthetic, Renewable), By End-use (Animal Feed, Food and Flavor, Chemical Intermediate, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161264

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

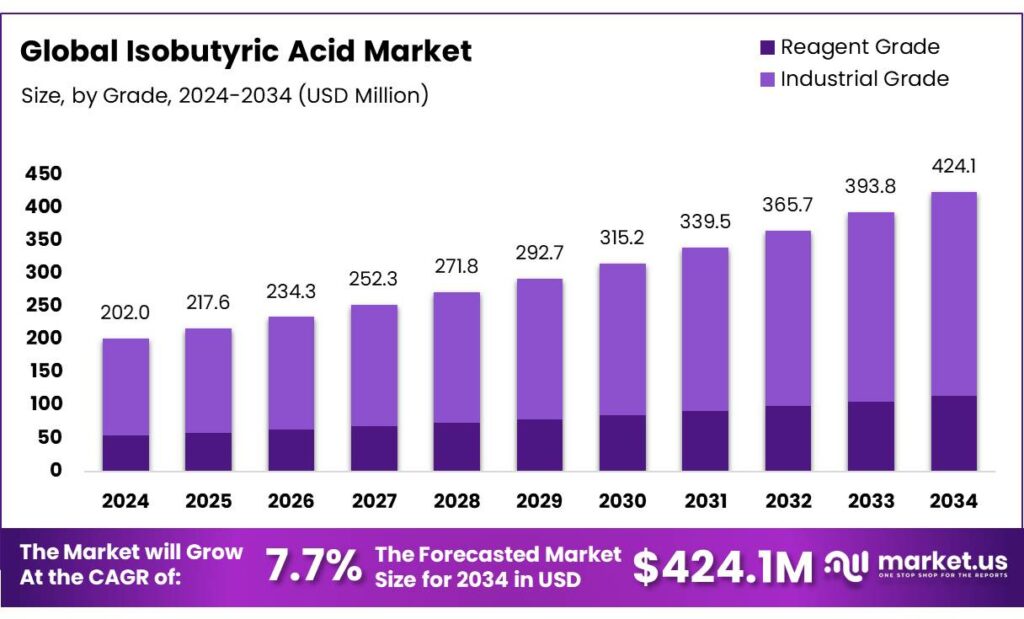

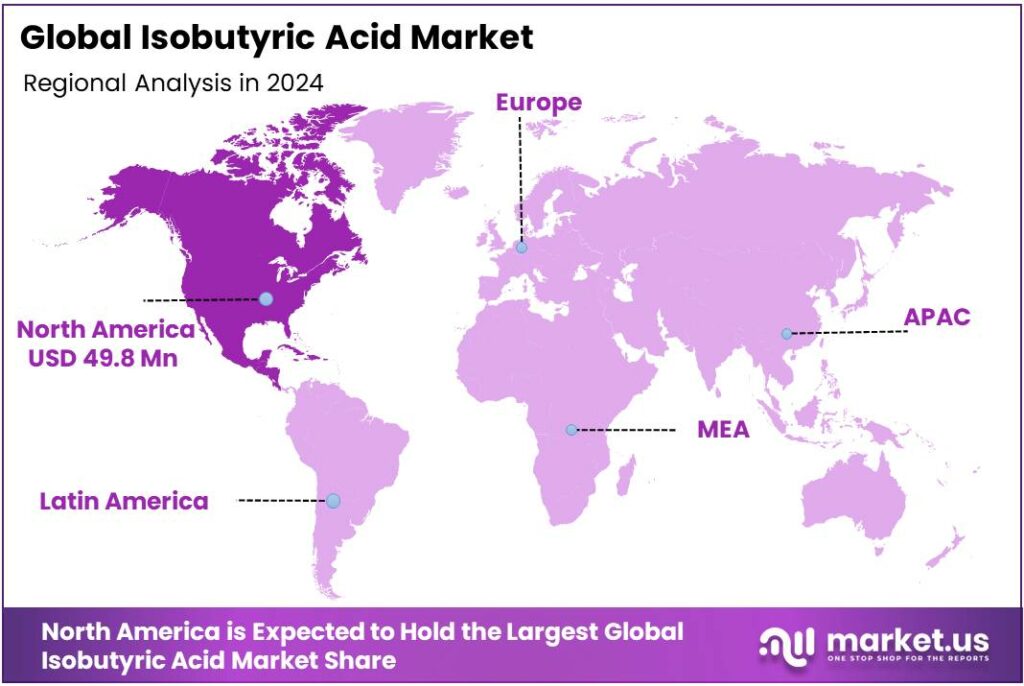

The Global Isobutyric Acid Market size is expected to be worth around USD 424.1 Million by 2034, from USD 202.0 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 24.70% share, holding USD 49.8 Million in revenue.

Isobutyric acid (2-methylpropionic acid) is a short-chain branched carboxylic acid that is deployed as a chemical intermediate for esters, solvents, plasticizers, flavor and fragrance components, pharmaceutical syntheses, and silage/feed additives. Its physicochemical profile (medium boiling liquid, MW 88.11 g·mol⁻¹) makes it well suited for esterification and for use where fruity/cheesy aroma profiles are required; accordingly, isobutyric acid is positioned as a versatile feedstock within fine chemicals and specialty intermediates manufacturing.

Industrial scenario Production and trade have been characterized by modest capacity concentrated among specialty chemical producers and integrated petrochemical suppliers; total global production volumes were reported at roughly 145,000 tonnes in 2022, indicating a commodity scale that is small relative to major commodity acids but substantial for specialty applications.

Driving factors Growth has been supported by expanding end-use demand in flavors & fragrances, pharmaceuticals and specialty polymers, where isobutyric-derived esters and intermediates confer targeted performance attributes. In addition, policy and public-sector funding to scale renewable and bio-based chemicals has been introduced in major markets and is anticipated to materially affect supply pathways.

The U.S. Department of Energy’s Bioenergy Technologies Office allocation of up to USD 23 million for renewable chemicals and fuels R&D (Jan 2025) and U.S. Department of Agriculture loan-guarantee programs that can underwrite biorefinery projects with federal participation up to USD 250 million. In Europe, the Circular Bio-based Europe Joint Undertaking and related funding streams have allocated multi-million euro awards (for example, a €20 million support item for a bio-based organic acids project) to accelerate commercial-scale processes for organic acids.

Policy and government initiatives are increasing the attractiveness of renewable and bio-based chemical routes relevant to isobutyric acid (particularly fermentation and biomass conversion pathways). The U.S. Department of Energy’s Bioenergy Technologies Office announced funding of up to USD 23 million to support R&D for renewable chemicals and fuels, reflecting explicit policy support for scale-up of biobased intermediates.

Key Takeaways

- Isobutyric Acid Market size is expected to be worth around USD 424.1 Million by 2034, from USD 202.0 Million in 2024, growing at a CAGR of 7.7%.

- Industrial Grade held a dominant market position, capturing more than a 73.7% share.

- Synthetic held a dominant market position, capturing more than an 86.4% share of the global isobutyric acid market.

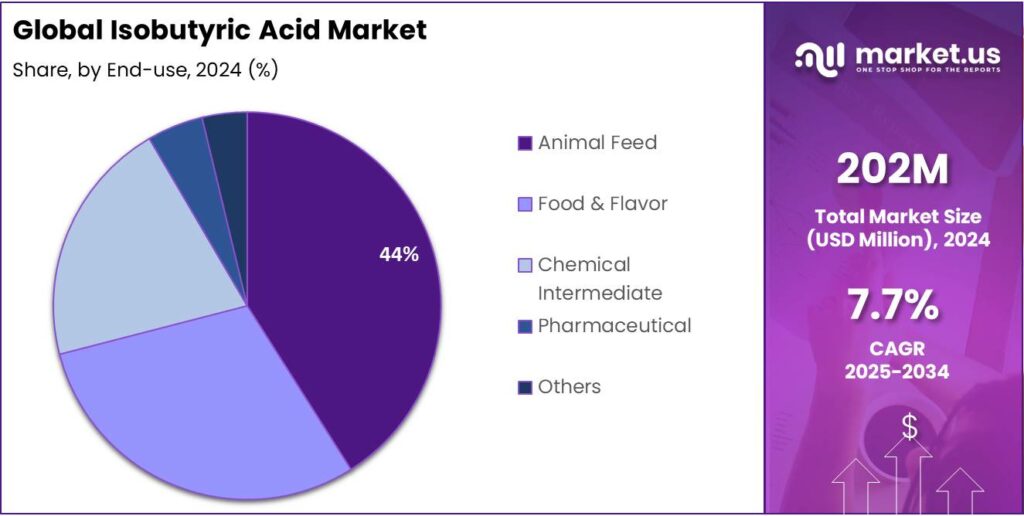

- Animal Feed held a dominant market position, capturing more than a 43.8% share of the global isobutyric acid market.

- North America accounted for approximately 24.70% of the isobutyric acid market, corresponding to a value of about USD 49.8 million.

By Grade Analysis

Industrial Grade dominates with 73.7% in 2024 owing to its broad industrial applications.

In 2024, Industrial Grade held a dominant market position, capturing more than a 73.7% share. The predominance of this grade can be attributed to its widespread adoption in large-volume industrial applications such as solvent formulations, plasticizer intermediates, and certain agrochemical processes, where specifications are less stringent but supply continuity and cost-efficiency are prioritized. Production and distribution networks have been configured to favor Industrial Grade, allowing economies of scale to be realized and inventory turns to be optimized; as a result, manufacturing capacity has been aligned with demand centres and logistics corridors.

In 2025, this grade continued to command market preference, supported by its fit-for-purpose attributes and the ongoing need for cost-effective feedstocks in bulk chemical production. Opportunities for marginal share growth are likely to be realized where producers invest in supply-chain integration, but the current structure suggests Industrial Grade will remain the principal segment in the near term.

By Type Analysis

Synthetic Type dominates with 86.4% share in 2024 driven by its stable production processes and consistent quality.

In 2024, Synthetic held a dominant market position, capturing more than an 86.4% share of the global isobutyric acid market. The strong dominance of the synthetic segment is primarily due to its established production technology, reliable feedstock availability, and cost-effective large-scale manufacturing routes. Synthetic isobutyric acid is typically derived from petrochemical processes involving oxidation of isobutyraldehyde, ensuring a steady supply and uniform purity levels that meet industrial standards. The chemical’s consistency and controlled quality make it the preferred choice in applications such as coatings, plastics, and solvents where precision in formulation is critical.

In 2025, the synthetic segment continued to lead the market as industries favored its proven supply chain resilience and stable pricing, especially amid fluctuations in bio-based feedstock costs. While interest in bio-based alternatives has grown, synthetic isobutyric acid remains the mainstay of industrial consumption owing to its scalability and compatibility with existing processing systems. The segment’s dominance is expected to persist over the next few years as producers continue to optimize yields and reduce emissions from synthetic pathways, ensuring compliance with tightening environmental norms without compromising production efficiency.

By End-use Analysis

Animal Feed dominates with 43.8% share in 2024 owing to its vital role in livestock nutrition and health improvement.

In 2024, Animal Feed held a dominant market position, capturing more than a 43.8% share of the global isobutyric acid market. The segment’s strong position can be attributed to the increasing use of isobutyric acid as a feed additive that enhances gut health, boosts nutrient absorption, and supports growth performance in poultry, swine, and cattle. Rising awareness about livestock productivity and the growing global demand for meat and dairy products have encouraged feed manufacturers to integrate organic acids like isobutyric acid for improved feed efficiency and pathogen control.

In 2025, the animal feed segment continued to expand, supported by government initiatives promoting sustainable livestock farming and food safety standards. The shift toward high-quality feed ingredients in Asia-Pacific and Europe further reinforced demand, as producers focused on achieving higher yield per animal. With increasing global meat consumption and the expanding commercial livestock industry, the use of isobutyric acid in feed applications is expected to sustain steady growth, ensuring that the animal feed segment remains the leading end-use category in the coming years.

Key Market Segments

By Grade

- Reagent Grade

- Industrial Grade

By Type

- Synthetic

- Renewable

By End-use

- Animal Feed

- Food & Flavor

- Chemical Intermediate

- Pharmaceutical

- Others

Emerging Trends

Microbial Electrosynthesis for Sustainable Isobutyric Acid Production

A notable recent development in isobutyric acid production is the application of microbial electrosynthesis (MES), a bioelectrochemical process that utilizes microorganisms to convert carbon dioxide (CO₂) and hydrogen (H₂) into valuable chemicals, including isobutyric acid. This method offers a sustainable alternative to traditional chemical synthesis by reducing greenhouse gas emissions and utilizing renewable energy sources.

In 2024, researchers at Ghent University and Universidade de Santiago de Compostela identified Clostridium luticellarii, an acetogen capable of producing both butyric and isobutyric acid from H₂ and CO₂. The study found that maintaining a mildly acidic pH (≤5.5) significantly enhanced the production of these acids, achieving a combined selectivity of 53 ± 3% for butyric and isobutyric acids. This discovery underscores the potential of MES in producing high-value chemicals from renewable resources.

Furthermore, advancements in electrode materials have improved the efficiency of MES processes. For instance, the development of non-precious metal cathodes, such as cobalt-phosphide (CoP), molybdenum-disulfide (MoS₂), and nickel-molybdenum (NiMo) alloys, has facilitated the electrochemical reduction of CO₂ to various organic acids, including isobutyric acid. These materials offer durability and high catalytic activity, making MES a more viable option for industrial applications.

The integration of MES with renewable energy sources, such as solar or wind power, further enhances its sustainability. By coupling MES with renewable electricity, the process becomes carbon-neutral, contributing to the reduction of global CO₂ emissions. This aligns with global efforts to transition towards a circular bioeconomy, where waste products are converted into valuable resources.

Drivers

Demand for Natural Flavoring Agents in the Food Industry

One of the primary drivers behind the growing demand for isobutyric acid is its role as a natural flavoring agent in the food industry. Isobutyric acid imparts a distinctive flavor profile to various food products, enhancing their taste and aroma. This characteristic makes it a valuable component in the production of cheeses, butter, and other dairy products, where it contributes to their characteristic flavors. Additionally, isobutyric acid is utilized in flavor blends for savory snacks and seasonings, further expanding its application in the food sector.

The increasing consumer preference for natural and clean-label ingredients has significantly influenced the food industry’s sourcing decisions. Manufacturers are increasingly seeking natural alternatives to synthetic additives, aligning with the growing trend towards transparency and health-conscious choices among consumers. Isobutyric acid, being naturally occurring and recognized for its safety as a food additive, meets these consumer demands effectively. The FAO/WHO Expert Committee on Food Additives has reviewed the safety of isobutyric acid and concluded that there are no concerns at the likely levels of intake.

Moreover, isobutyric acid’s versatility extends beyond flavoring; it also serves as a preservative in food products. Its antimicrobial properties help inhibit the growth of spoilage microorganisms, thereby extending the shelf life of perishable items. This dual functionality as both a flavor enhancer and preservative makes isobutyric acid an attractive ingredient for food manufacturers aiming to improve product quality and longevity.

The demand for isobutyric acid in the food industry is further bolstered by the increasing production of processed and convenience foods. As lifestyles become busier, consumers are turning towards ready-to-eat meals and snacks, which often require additives like isobutyric acid to maintain flavor and freshness. This trend underscores the growing importance of isobutyric acid in modern food manufacturing.

Restraints

High Production Costs of Isobutyric Acid

A significant challenge in the widespread adoption of isobutyric acid is its high production cost, which affects its competitiveness in various applications. The primary raw materials for producing isobutyric acid are propylene and synthesis gas (syngas), both of which are derived from fossil fuels. The cost of these feedstocks is subject to market fluctuations, impacting the overall production expenses.

- For instance, in the United States, the price of isobutyric acid reached USD 1,573 per metric ton in the fourth quarter of 2024, influenced by disruptions in production and supply chains. In contrast, in China, prices were recorded at USD 1,360 per metric ton during the same period.

The production process itself is energy-intensive, involving complex chemical reactions that require significant energy input. This contributes to high operational expenses, further escalating the overall production cost. Additionally, the need for specialized equipment and adherence to stringent environmental regulations adds to the capital and operational expenditures.

These elevated production costs pose a barrier to the widespread use of isobutyric acid, particularly in price-sensitive applications such as food processing and animal feed. Manufacturers often opt for more cost-effective alternatives, limiting the market potential of isobutyric acid. For example, in India, the first quarter of 2025 experienced significant challenges due to an oversupply of isobutyric acid, as production levels increased without a corresponding rise in demand from key industries

Opportunity

Integration of Isobutyric Acid in Bioplastics Production

A significant growth opportunity for isobutyric acid lies in its application in the production of bioplastics. With the increasing global emphasis on sustainability and reducing plastic waste, bioplastics have emerged as a viable alternative to conventional plastics. Isobutyric acid, being a short-chain fatty acid, can serve as a monomer in the synthesis of biodegradable plastics, contributing to the development of eco-friendly materials.

In India, the government has recognized the potential of bioplastics and is actively promoting their development. The Department of Biotechnology (DBT), under the Ministry of Science and Technology, has been instrumental in advancing the biomanufacturing of bio-based chemicals, including bioplastics. Through initiatives like the BioE3 policy, the government aims to foster high-performance biomanufacturing and promote the use of renewable resources in industrial applications. This policy supports the establishment of bio-manufacturing hubs and biofoundries, which are crucial for scaling up the production of bioplastics and other bio-based products.

The global demand for bioplastics is on the rise, driven by consumer preference for sustainable products and regulatory pressures to reduce plastic waste.

- According to the European Bioplastics Association, the production capacity of bioplastics in Europe is expected to reach 2.42 million tonnes by 2025, indicating a robust growth trajectory. This trend presents a significant opportunity for isobutyric acid to be integrated into the production of bioplastics, catering to the growing demand for environmentally friendly alternatives.

Regional Insights

North America commands with 24.70% share (USD 49.8 Mn) driven by strong demand across key industries.

In 2024, North America accounted for approximately 24.70% of the isobutyric acid market, corresponding to a value of about USD 49.8 million. This regional dominance reflects the concentration of end-use industries—particularly pharmaceuticals, flavor & fragrance, and animal nutrition—that favor high-quality intermediates.

The United States serves as the core within this region, where stable regulatory frameworks, advanced R&D infrastructure, and mature chemical value chains facilitate demand continuity and supplier confidence. The presence of well-established chemical and biotech firms in North America further anchors the consumption of isobutyric acid in both synthetic and emerging bio-based routes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

OQ Chemicals GmbH, formerly known as Oxea, is a global leader in the production of oxo-intermediates, including isobutyric acid. The company operates a state-of-the-art facility in Oberhausen, Germany, where it manufactures a range of carboxylic acids. Their isobutyric acid is utilized in the production of esters for flavors, fragrances, and as a chemical intermediate in various industrial applications. OQ Chemicals emphasizes sustainable practices and innovation in its manufacturing processes.

Evonik Industries is a leading global specialty chemicals company known for its innovation and sustainability initiatives. The company has developed processes to produce 2-hydroxy isobutyric acid (2-HIBA) from syngas using biotechnology methods. 2-HIBA serves as a precursor for various applications, including the production of PLEXIGLAS®. Evonik’s commitment to sustainable chemistry and resource efficiency positions it as a key player in the isobutyric acid market.

Nanjing Chemical Material Corp. is a Chinese company engaged in the production and distribution of chemical products, including isobutyric acid. The company manufactures isobutyric acid for use in the synthesis of isobutyrate, preparation of edible flavors and essences, preservatives, and as a raw material in the pesticide industry. Nanjing Chemical Material Corp. serves various sectors, including food, pharmaceuticals, and agriculture, with a focus on quality and reliability in its product offerings.

Top Key Players Outlook

- OQ Chemicals GmbH

- Eastman Chemical Company

- Evonik

- AFYREN

- Nanjing Chemical Material Corp.

- Yufeng International Group Co., Ltd.

- Glentham Life Sciences Limited

- Central Drug House

- Others

Recent Industry Developments

In 2024 OQ Chemicals GmbH, continued to strengthen its position in the PVA market by producing high-quality Selvol PVOH polymers and copolymers at its ISO-certified manufacturing facilities in the United States and Spain.

In 2024, Evonik reported sales of €15.2 billion and an adjusted EBITDA of €2.065 billion, reflecting a 25% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 202.0 Mn Forecast Revenue (2034) USD 424.1 Mn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Reagent Grade, Industrial Grade), By Type (Synthetic, Renewable), By End-use (Animal Feed, Food and Flavor, Chemical Intermediate, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape OQ Chemicals GmbH, Eastman Chemical Company, Evonik, AFYREN, Nanjing Chemical Material Corp., Yufeng International Group Co., Ltd., Glentham Life Sciences Limited, Central Drug House, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OQ Chemicals GmbH

- Eastman Chemical Company

- Evonik

- AFYREN

- Nanjing Chemical Material Corp.

- Yufeng International Group Co., Ltd.

- Glentham Life Sciences Limited

- Central Drug House

- Others