Global Isobutanol Market By Type (Synthetic and Bio-based), By Purity (Up to 97%, 97% to 99%, and Above 99%), By Application (Paints and Coatings, Pharmaceuticals, Inks, Flavors and Fragrances, Fuel Additive, Chemicals, Textile, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 158937

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

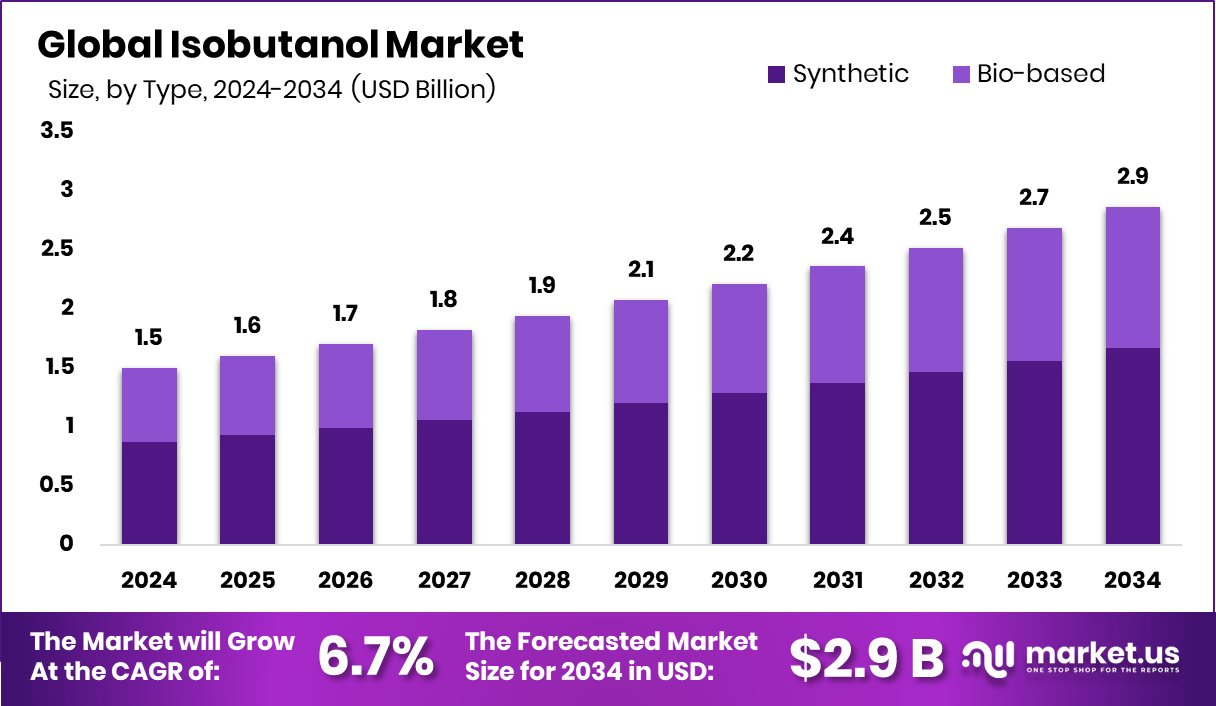

In 2024, the Global Isobutanol Market was valued at US$1.5 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 6.7%, reaching about US$2.9 billion by 2034.

Isobutanol, or 2-methylpropan-1-ol, is a colorless, flammable organic compound with a characteristic sweet, musty odor. It can be produced through chemical processes, such as the hydroformylation of allyl alcohol followed by hydrogenation, or the carbonylation of propylene. The chemical is primarily used as a solvent for varnishes and is a precursor for other esters. Its primary use is as a solvent in various industries, including coatings, flavors, fragrances, pharmaceuticals, and pesticides.

One of the major drivers of the isobutanol market is its application in the paints and coatings market. As there is a constant global demand for efficient fuels, the application of isobutanol in the fuel industry is gaining traction due to its high octane rating. Additionally, there is a shift towards sustainable products, which creates demand for bio-based isobutanol made from natural feedstock such as corn. Despite the advantages, the market faces challenges such as environmental concerns due to its toxic nature, particularly for the aquatic ecosystem.

Key Takeaways

- The global isobutanol market was valued at US$1.5 billion in 2024.

- The global isobutanol market is projected to grow at a CAGR of 6.7% and is estimated to reach US$2.9 billion by 2034.

- On the basis of the type of isobutanol, synthetic isobutanol dominated the market in 2024, comprising about 58.1% share of the total global market.

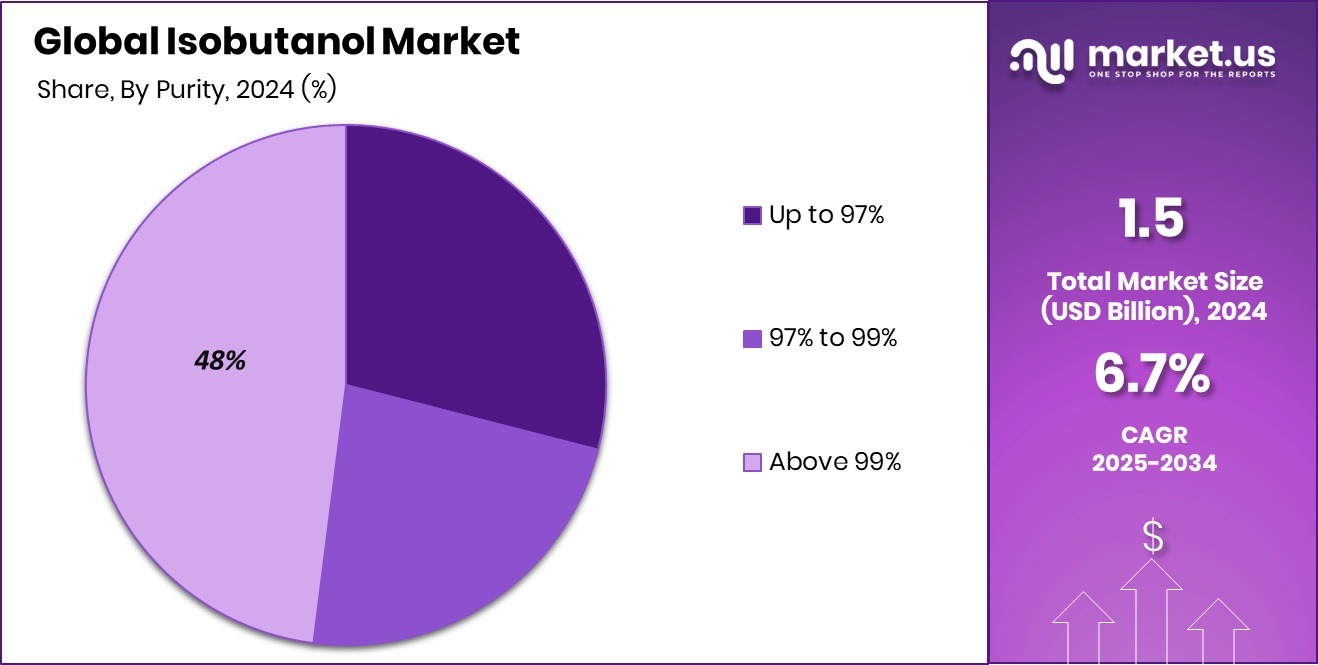

- Based on the purity, isobutanol, which is more than 99% pure, led the market, encompassing about 48.1% of the total global market.

- Among the applications of isobutanol, the paints & coatings industries held the majority of the share of the market.

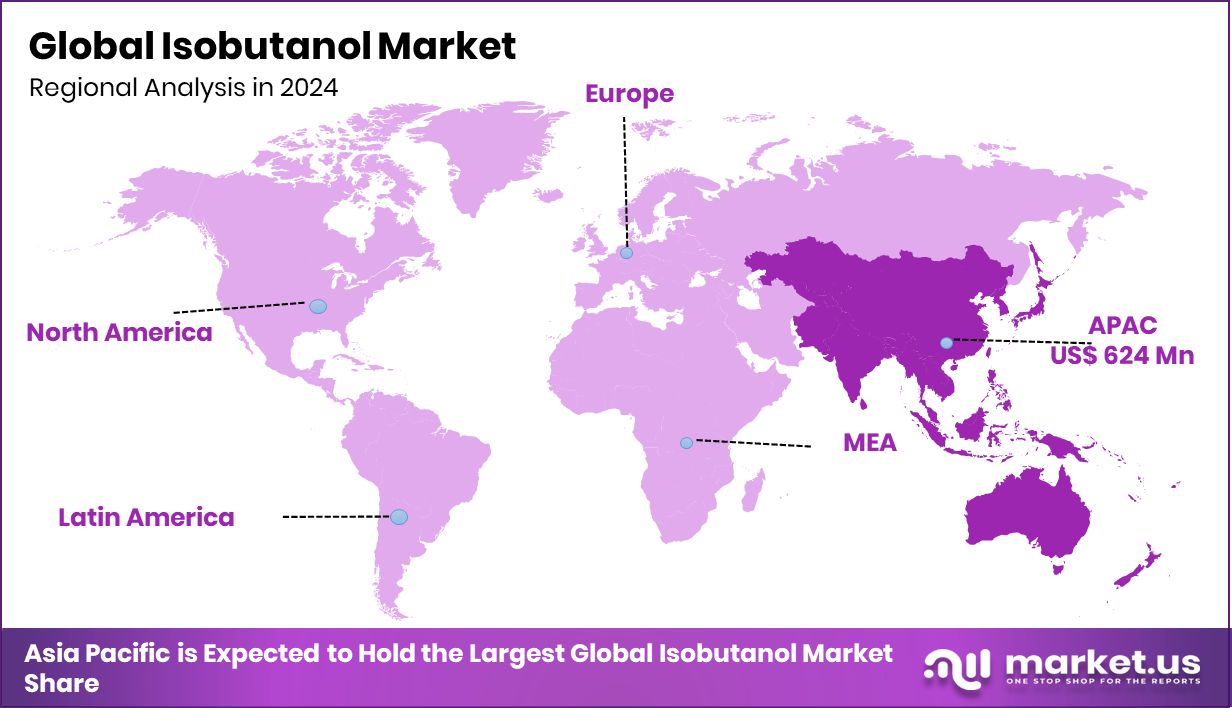

- Asia Pacific was at the forefront of isobutanol in 2024, comprising roughly 41.6% of the total global consumption.

Type Analysis

Synthetic Isobutanol Accounted for The Largest Share of the Market.

Based on types, the isobutanol market is segmented into synthetic and bio-based. Synthetic isobutanol dominated the market in 2024 with a market share of 58.1%. Synthetic isobutanol dominated over bio-based isobutanol primarily due to its cost-effectiveness, well-established production processes, and consistent supply. Derived from petrochemical feedstocks such as propylene, synthetic isobutanol benefits from mature infrastructure and economies of scale, making it more affordable and widely available for industrial use.

In contrast, bio-based isobutanol production involves complex fermentation processes and higher operational costs, which can limit scalability. Additionally, synthetic isobutanol offers reliable performance in applications such as solvents, coatings, and fuels, where price and supply stability are critical.

Purity Analysis

In 2024, Isobutanol with a Purity Exceeding 99% held the Dominant Position in the Market.

On the basis of purity, the isobutanol market is segmented into up to 97%, 97% to 99%, and above 99%. The isobutanol that is more than 99% pure dominated the market in 2024 with a market share of 48.1%. The dominance of the segment is because it ensures higher performance, consistency, and reduced impurities that could interfere with chemical processes.

High-purity isobutanol is especially important in sensitive applications, such as pharmaceuticals, coatings, and electronics, where even minor contaminants can affect product quality, reactivity, or safety. For instance, in paint formulations or resin synthesis, impurities in lower-purity isobutanol can alter drying times or compromise finish quality. Additionally, high-purity isobutanol improves efficiency in downstream processing and minimizes the risk of side reactions, making it the standard choice for manufacturers aiming for precision and high-quality output.

Application Analysis

One of the Major Applications of Isobutanol is in the Manufacturing of Paints & Coatings.

Based on the application of the isobutanol, the market is divided into paints & coatings, pharmaceuticals, inks, flavors and fragrances, fuel additives, chemicals, textiles, and others. The paintings & coatings sector dominated the Isobutanol market in 2024 with a market share of 43.2%.

Most isobutanol is used in the paints and coatings sector due to its excellent solvent properties, moderate evaporation rate, and compatibility with various resins and binders. It helps improve flow, leveling, and film formation, making it essential in producing high-quality coatings for automotive, industrial, and architectural applications. Additionally, coatings require large volumes of solvents, driving higher consumption. Its widespread utility, lower cost compared to specialty chemicals, and broad industrial demand make it dominant in this sector.

Key Market Segments

By Type

- Synthetic

- Bio-Based

By Purity

- Up to 97%

- 97% to 99%

- Above 99%

By Application

- Paints & Coatings

- Architectural

- Industrial

- Others

- Pharmaceuticals

- Inks

- Flavors Fragrances

- Fuel Additive

- Chemicals

- Textile

- Others

Drivers

Applications of Isobutanol in the Paints & Coatings Industry Drive the Market.

Isobutanol plays a crucial role in the paints and coatings industry due to its favorable chemical properties, such as low volatility, excellent solvency, and high compatibility with various resins. It is commonly used as a solvent in the formulation of paints, varnishes, and coatings, helping to improve flow, leveling, and drying time. Its moderate evaporation rate makes it ideal for applications requiring smooth finishes and extended workability. For instance, isobutanol is often used in automotive and industrial coatings to ensure consistent film formation and resistance to environmental degradation.

Additionally, isobutanol enhances the performance of waterborne coatings by stabilizing emulsions and improving pigment dispersion. As environmental regulations tighten around volatile organic compounds (VOCs), isobutanol’s relatively lower toxicity and better environmental profile compared to traditional solvents such as toluene or xylene make it a preferred alternative. With growing demand for high-performance and environmentally friendly coatings, the use of isobutanol in this sector is expected to remain significant.

Restraints

Aquatic Toxicity Might be a Significant Challenge for the Isobutanol Market.

Aquatic toxicity is a significant concern for the isobutanol market, particularly highlighted by incidents such as the chemical spill in Minnesota, where isobutanol leaked into nearby water bodies. Although isobutanol is considered less toxic than several industrial solvents, it can still pose risks to aquatic ecosystems at high concentrations. In such incidents, isobutanol can reduce dissolved oxygen levels in water, potentially harming fish and other aquatic organisms. For instance, high levels of isobutanol exposure can lead to behavioral changes, inhibited growth, and mortality in aquatic species.

The Minnesota incident raised public awareness and regulatory scrutiny regarding the storage, transportation, and handling of isobutanol. Spills or leaks during rail or truck transport, if not contained quickly, can lead to environmental damage and legal consequences. As environmental regulations tighten and awareness of chemical safety grows, the potential aquatic toxicity of isobutanol represents a considerable challenge for the industry.

Opportunity

Application of Isobutanol in the Fuel Industry Boosts the Market.

Isobutanol has emerged as a promising biofuel additive and alternative to traditional gasoline components, creating significant opportunities in the fuel industry. Isobutanol has a higher energy content than ethanol by volume, with values around 26.5 MJ/l compared to ethanol’s 21 MJ/l, approximately 21% more energy, making it more efficient for blending with gasoline. Additionally, its lower hygroscopicity, water absorption make it more compatible with existing fuel infrastructure, including pipelines and storage tanks, reducing the need for costly modifications. Similarly, in engine performance, isobutanol offers advantages such as improved combustion and reduced knocking due to its higher octane rating.

For instance, it can be blended up to 16% with gasoline without requiring engine modifications, which makes it an attractive option for transportation fuels. Moreover, it produces fewer greenhouse gas emissions and less corrosion in engines compared to ethanol, aligning with global sustainability goals. These characteristics make isobutanol a valuable component in renewable and cleaner-burning fuel formulations, driving its adoption in the energy sector.

Trends

Rising Demand for Bio-based Isobutanol.

The rising demand for bio-based isobutanol is a key trend shaping the isobutanol market, driven by increasing environmental concerns and the global shift toward sustainable chemicals. Bio-based isobutanol is produced from renewable feedstocks such as corn, sugarcane, or agricultural waste through fermentation processes, making it a greener alternative to its petrochemical counterpart. It offers similar performance characteristics while significantly reducing carbon emissions. Industries such as fuels, coatings, and plastics are increasingly adopting bio-based isobutanol to meet regulatory standards and consumer demand for eco-friendly products.

For instance, in the biofuels sector, bio-isobutanol is used as a drop-in replacement or blendstock for gasoline, offering benefits such as higher energy content and lower volatility compared to ethanol. Companies such as Gevo and Butamax have been actively developing bio-based isobutanol production technologies to scale up supply. As sustainability becomes central to industrial operations, the preference for bio-based isobutanol continues to grow across multiple applications.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Isobutanol Market.

Geopolitical tensions can significantly impact the isobutanol market by disrupting supply chains, increasing raw material costs, and creating uncertainty in international trade. Isobutanol production often relies on petrochemical feedstocks or bio-based sources that are globally traded, such as corn or sugarcane. As the petrochemical industry is highly vulnerable to geopolitical tensions, these tensions can significantly affect the market by disrupting its supply chain.

Conflicts or trade disputes in regions that are key exporters of these chemicals, such as the Russia-Ukraine conflict or tensions in the Middle East, can lead to supply shortages or price volatility. For instance, the Russia-Ukraine war has strained the global energy supply, especially affecting the cost and availability of petrochemical feedstock. Due to the conflict, natural gas prices surged due to disrupted pipelines, directly influencing the chemical manufacturing sector.

For instance, in April 2024, Eastman increased the prices for n-butanol and isobutanol to USD 0.05/lb and USD 0.08/lb, respectively. Similarly, ongoing trade disputes between major economies such as the United States and China have led to tariffs on chemical imports and exports, making raw materials more expensive and harder to source. As synthetic isobutanol comprises more than half of the market, such tensions across the world can significantly affect the market.

Regional Analysis

Asia Pacific was at the Forefront in the Global Isobutanol Market in 2024.

Asia Pacific held the major share of the global Isobutanol market, valued at around US$624 million, commanding an estimated 41.6% of total revenue share. The region had been at the forefront of the market due to its strong industrial base, growing chemical manufacturing sector, and rising demand across end-use industries such as paints and coatings, automotive, and construction.

Countries such as China, India, South Korea, and Japan are major consumers and producers of isobutanol, driven by expanding infrastructure projects and increased production of solvents, adhesives, and plasticizers.

For instance, China’s rapidly growing automotive and construction sectors fuel the demand for coatings and resins, where isobutanol is used as a key solvent and intermediate. Additionally, India’s rising consumption of chemicals for paints and agrochemicals supports domestic isobutanol usage. The presence of large petrochemical complexes and cost-effective labor and production capabilities further boost regional output.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major participants in the isobutanol market are Mitsubishi Chemical, Eastman Chemical, KH Neochem, BASF SE, Gevo, SABIC, Tasnee, Dow, Grupa Azoty, Andhra Petrochemicals, Bharat Petroleum Corporation, Nan Ya Plastics Corporation, Sasol, and INEOS Group.

Mitsubishi Chemical, a subsidiary of MCGC, specializes in producing high-quality chemicals, including isobutanol. Their production aligns with the market’s growing interest in sustainable and bio-based isobutanol alternatives.

Eastman produces isobutanol, a product that serves as a key chemical. The company has periodically increased isobutanol prices due to elevated operating costs, such as raw material expenses.

BASF is a major competitor in the global isobutanol market, which sees companies employing various growth strategies.

KH Neochem is a Japanese chemical and materials manufacturer, including isobutanol. The company possesses unique technology for producing INA and 1,3 Butylene Glycol, placing KH Neochem among a small number of global manufacturers for these products.

Top Key Players in the Market

- Mitsubishi Chemical Group Corporation

- Eastman Chemical Company

- KH Neochem Co., Ltd.

- BASF SE

- Gevo Inc.

- SABIC

- Tasnee

- Dow Inc.

- Grupa Azoty S.A.

- The Andhra Petrochemicals Limited

- Bharat Petroleum Corporation Limited

- Nan Ya Plastics Corporation

- Sasol

- INEOS Group

- Other Key Players

Recent Developments

- In August 2024, BASF signed an MoU with UPC Technology Corporation to focus on the supply of plasticizer alcohols and catalysts for phthalic anhydride (PA) and maleic anhydride (MA), along with the development of sustainable solutions to reduce carbon emissions from operations and products. BASF would supply 2-Ethylhexanol (2-EH) and N-Butanol to the Oxo plant at the Zhanjiang Verbund site.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic and Bio-based), By Purity (Up to 97%, 97% to 99%, and Above 99%), By Application (Paints & Coatings, Pharmaceuticals, Inks, Flavors and Fragrances, Fuel Additive, Chemicals, Textile, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Chemical Group Corporation, Eastman Chemical Company, KH Neochem Co., Ltd., BASF SE, Gevo Inc., SABIC, Tasnee, Dow Inc., Grupa Azoty S.A., Andhra Petrochemicals Limited, Bharat Petroleum Corporation Limited, Nan Ya Plastics Corporation, Sasol, INEOS Group, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsubishi Chemical Group Corporation

- Eastman Chemical Company

- KH Neochem Co., Ltd.

- BASF SE

- Gevo Inc.

- SABIC

- Tasnee

- Dow Inc.

- Grupa Azoty S.A.

- The Andhra Petrochemicals Limited

- Bharat Petroleum Corporation Limited

- Nan Ya Plastics Corporation

- Sasol

- INEOS Group

- Other Key Players