Global IP Camera Market By Component (Hardware and Services), By Product Type (Fixed, Pan-Tilt-Zoom (PTZ), Infrared), By Connection Type (Consolidated, Distributed), By End-use (Residential Use, Commercial Use, Industrial Use), Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 15250

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

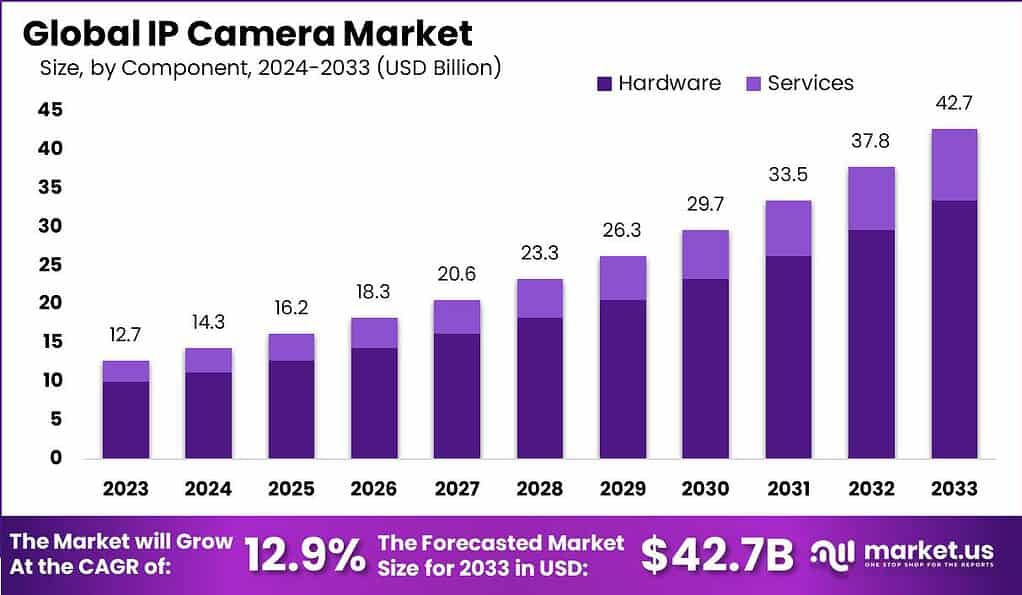

The Global IP Camera Market size is expected to be worth around USD 42.7 Billion by 2033, from USD 12.7 Billion in 2023, growing at a CAGR of 12.9% during the forecast period from 2024 to 2033.

IP cameras, also known as Internet Protocol cameras, have revolutionized the surveillance industry by providing advanced video monitoring capabilities. These cameras utilize digital technology to capture and transmit video data over an IP network, allowing users to access and view the footage remotely from anywhere with an internet connection. The IP camera market has witnessed significant growth in recent years, driven by various factors that highlight the advantages and applications of this technology.

The IP camera market has also benefited from the growing adoption of smart home and smart city initiatives. With the increasing focus on automation and connectivity, IP cameras play a crucial role in enabling remote monitoring and surveillance for residential and urban environments. The integration of IP cameras with other smart devices and systems, such as access control and alarm systems, further enhances security and offers comprehensive monitoring solutions.

Analyst Viewpoint

The IP camera market has been witnessing significant growth due to the increasing demand for safety and surveillance solutions across various sectors. The advancements in camera technology, coupled with the rising adoption of cloud-based services for video surveillance, have further propelled the market forward.

Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into IP cameras has enhanced their capabilities, enabling features such as facial recognition, motion detection, and anomaly detection. The market is also driven by the growing smart home trend, where IP cameras are integrated with other smart devices for enhanced home security.

Opportunities within the IP camera market are vast and varied. The burgeoning smart home industry presents a lucrative avenue for IP camera manufacturers, as homeowners increasingly seek integrated security solutions that offer both surveillance and connectivity to other smart devices. Additionally, the push towards smart city initiatives globally opens up avenues for the deployment of IP cameras in public infrastructure, enhancing public safety and city management.

Key Takeaways

- The IP camera market is likely to reach USD 42.7 billion by 2033. The market is further expected to surge at a CAGR of 12.9% during the forecast period 2024 to 2033.

- In 2023, the hardware segment held a dominant market position in the IP camera market, capturing more than a 78.4% share.

- In 2023, the fixed IP camera segment held a dominant market position in the IP camera market, capturing more than a 44.7% share.

- In 2023, the consolidated IP camera segment held a dominant market position in the IP camera market, capturing more than a 75.9% share.

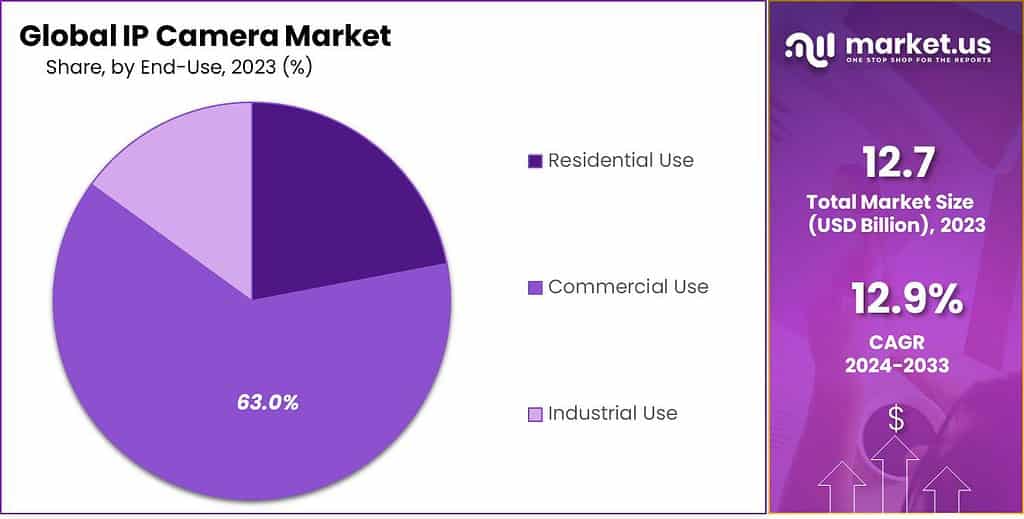

- In 2023, the commercial use segment held a dominant market position in the IP camera market, capturing more than a 63% share.

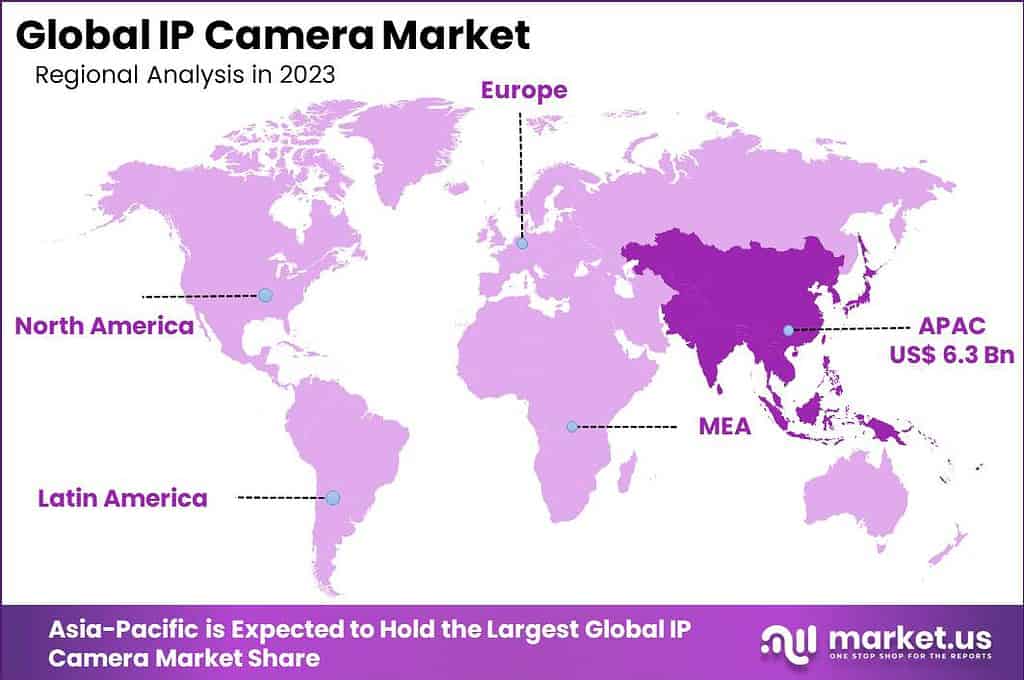

- In 2023, the Asia-Pacific (APAC) region held a dominant market position in the IP camera market, capturing more than a 48.9% share.

Component Analysis

In 2023, the hardware segment held a dominant market position in the IP camera market, capturing more than a 78.4% share. This significant market dominance can be attributed to several factors that highlight the importance and demand for IP camera hardware components.

The hardware segment comprises the physical components of IP cameras, including the camera units, lenses, sensors, enclosures, and other related accessories. These components are essential for capturing and transmitting video data over IP networks. The dominance of the hardware segment can be attributed to the widespread adoption of IP cameras across various industries and applications.

One of the key drivers for the hardware segment is the increasing need for video surveillance in the banking, financial services, and insurance (BFSI) sector. The BFSI industry deals with sensitive information and valuable assets, making security a top priority. IP cameras provide advanced surveillance capabilities that help banks, financial institutions, and insurance companies monitor their premises, protect against theft, fraud, and unauthorized access, and ensure the safety of employees and customers.

The high-resolution cameras, along with features such as facial recognition and video analytics, enable accurate identification of individuals, monitoring of transactions, and proactive threat detection. IP camera hardware components, such as high-quality lenses and sensors, ensure clear and detailed video footage, enhancing the effectiveness of surveillance systems in the BFSI sector. Furthermore, the scalability and flexibility of IP camera hardware allow for easy installation and integration with existing security infrastructure, making it a preferred choice for the BFSI industry.

Product Type Analysis

In 2023, the fixed IP camera segment held a dominant market position in the IP camera market, capturing more than a 44.7% share. This significant market dominance can be attributed to several factors that highlight the advantages and applications of fixed IP cameras.

Fixed IP cameras are designed to provide a fixed field of view, meaning that their lens and direction are set at a specific angle during installation. This type of camera is widely used in various surveillance applications, ranging from residential and commercial settings to public spaces and transportation systems. The dominance of the fixed IP camera segment can be attributed to its versatility, ease of installation, and cost-effectiveness.

One of the key drivers for the fixed IP camera segment is its suitability for general surveillance purposes. Fixed cameras are commonly used in areas where a specific view needs continuous monitoring, such as entrance gates, parking lots, and building perimeters. The fixed field of view allows for focused monitoring of specific areas without the need for manual adjustment or tracking, making it a reliable choice for continuous surveillance needs.

Furthermore, fixed IP cameras offer high-resolution video capture capabilities, enabling clear and detailed footage for identification and investigation purposes. These cameras are equipped with advanced features such as wide dynamic range (WDR) and low-light imaging, ensuring optimal performance in various lighting conditions. The simplicity of fixed IP cameras makes them easy to install and integrate into existing surveillance systems, reducing installation costs and complexity.

The dominance of the fixed IP camera segment can also be attributed to its cost-effectiveness. Fixed cameras are typically more affordable compared to other types, such as pan-tilt-zoom (PTZ) or infrared cameras. This cost advantage makes them an attractive option for budget-conscious businesses and organizations that require a reliable surveillance solution without the need for advanced functionalities like PTZ or specialized capabilities like infrared imaging.

Connection Type Analysis

In 2023, the consolidated IP camera segment held a dominant market position in the IP camera market, capturing more than a 75.9% share. This significant market dominance can be attributed to several factors that highlight the advantages and applications of consolidated IP camera systems.

Consolidated IP camera systems, also known as centralized systems, are characterized by a centralized approach to video management and storage. These systems typically consist of a central server or network video recorder (NVR) that collects and manages video feeds from multiple IP cameras. The dominance of the consolidated segment can be attributed to its scalability, ease of management, and cost-effectiveness.

One of the key drivers for the consolidated IP camera segment is its scalability. Consolidated systems allow for the integration and management of a large number of IP cameras, making them suitable for installations that require extensive coverage, such as large-scale enterprises, campuses, and city surveillance projects. The centralized approach simplifies the management of multiple cameras by providing a unified interface for configuration, monitoring, and retrieval of video data, thereby enhancing operational efficiency.

Furthermore, consolidated IP camera systems offer ease of management and maintenance. With a centralized server or NVR, administrators can easily monitor and control the entire surveillance system from a single location. This centralized control enables efficient configuration of camera settings, software updates, and firmware upgrades, reducing the complexity and time required for maintenance activities. Additionally, consolidated systems facilitate centralized storage, enabling easy retrieval and analysis of video footage for investigative purposes.

End-use Outlook

In 2023, the commercial use segment held a dominant market position in the IP camera market, capturing more than a 63% share. This significant market dominance can be attributed to several factors that highlight the advantages and applications of IP cameras in commercial settings.

Commercial use of IP cameras encompasses a wide range of applications across various industries, including retail, hospitality, healthcare, education, and offices. The dominance of the commercial use segment can be attributed to the increasing emphasis on security, safety, and operational efficiency in commercial environments.

One of the key drivers for the commercial use segment is the need for enhanced security and surveillance in retail establishments. IP cameras offer advanced features such as high-resolution video capture, facial recognition, and real-time monitoring, enabling retailers to deter theft, prevent shoplifting, and ensure the safety of employees and customers. Additionally, IP cameras integrated with analytics software can provide valuable insights into customer behavior, enabling retailers to optimize store layouts, product placements, and marketing strategies.

The dominance of the commercial use segment can also be attributed to IP cameras’ role in ensuring safety and security in hospitality and healthcare settings. Hotels, resorts, and healthcare facilities utilize IP cameras to monitor public areas, entrances, and parking lots, enhancing guest safety and deterring unauthorized access. IP cameras with features like night vision and motion detection are particularly beneficial in these environments, where round-the-clock surveillance is crucial.

Furthermore, IP cameras play a vital role in enhancing security and safety in educational institutions and office buildings. These cameras help monitor entrances, hallways, parking lots, and other areas, ensuring the safety of students, staff, and visitors. IP cameras integrated with access control systems enable efficient visitor management and help prevent unauthorized entry.

Driving Factors

- Security Concerns: The increasing concern for security across residential, commercial, and industrial sectors is a significant driver. IP cameras offer advanced surveillance features, enabling real-time monitoring and remote access, which enhances security measures.

- Technological Advancements: Ongoing technological innovations, such as high-definition imaging, night vision, and edge analytics, are driving market growth. These advancements improve the effectiveness of IP cameras and expand their range of applications.

- Integration with IoT: The integration of IP cameras with the Internet of Things (IoT) ecosystem is a key driving factor. IP cameras can now be seamlessly connected to other smart devices and systems, enabling comprehensive and automated security solutions.

- Cost-Efficiency: IP cameras are becoming more cost-effective, making them accessible to a broader range of consumers. Lower installation costs, scalability, and reduced maintenance expenses are boosting their adoption across various industries.

Restraining Factors

- Privacy Concerns: The widespread use of IP cameras has raised concerns about privacy invasion. Striking a balance between security and privacy remains a challenge, leading to regulatory hurdles and public apprehension.

- Bandwidth and Storage Requirements: High-resolution IP cameras generate vast amounts of data, requiring substantial bandwidth and storage. This poses challenges for organizations in terms of infrastructure and maintenance costs.

- Cybersecurity Risks: As IP cameras become more connected, they are vulnerable to cybersecurity threats. Unauthorized access, hacking, and data breaches can compromise the integrity of surveillance systems, necessitating robust cybersecurity measures.

- Installation and Maintenance Expertise: Setting up and maintaining IP camera systems can be complex, requiring skilled technicians. The shortage of qualified personnel can be a restraining factor for some businesses and homeowners.

Growth Opportunities

- AI and Video Analytics: The integration of artificial intelligence (AI) and video analytics presents significant growth opportunities. IP cameras with AI capabilities can automatically detect and respond to suspicious activities, making surveillance more intelligent and efficient.

- Smart Home and Smart Cities: The growing trend toward smart homes and smart cities creates opportunities for IP camera market expansion. These cameras are integral to creating safer and more efficient living environments.

- Healthcare and Telemedicine: IP cameras are finding applications in healthcare for remote patient monitoring and telemedicine. The healthcare sector offers substantial growth potential as the demand for telehealth services increases.

- Cloud-Based Solutions: The adoption of cloud-based IP camera solutions is on the rise. Cloud storage and remote access capabilities offer convenience and scalability, making them attractive to businesses and individuals.

Challenges

- Data Privacy Regulations: Adhering to evolving data privacy regulations, such as GDPR, poses challenges for IP camera manufacturers and users. Compliance with these regulations requires ongoing efforts and investments.

- Interoperability Issues: Ensuring compatibility and interoperability among various IP camera brands and models can be challenging. This can limit the flexibility of surveillance system deployments.

- Environmental Conditions: IP cameras are exposed to various environmental conditions, which can impact their durability and performance. Harsh weather, extreme temperatures, and physical damage are challenges to consider.

- Competition: The IP camera market is highly competitive, with numerous manufacturers vying for market share. Staying innovative and offering unique features is a constant challenge for companies in the industry.

Key Market Trends

- 4K and Ultra HD Cameras: The market is witnessing a trend toward 4K and ultra HD IP cameras, offering superior image quality. These cameras are becoming more affordable and popular for high-end surveillance applications.

- Edge Computing: IP cameras are increasingly incorporating edge computing capabilities, allowing them to process data locally. This reduces the load on central servers and enhances real-time analysis.

- Mobile Access: The ability to access IP camera feeds through mobile devices is a growing trend. Mobile apps and remote monitoring solutions are in high demand, providing users with greater flexibility.

- Environmental Sustainability: Sustainable and eco-friendly IP cameras are gaining traction. Manufacturers are focusing on energy-efficient designs and reducing the environmental impact of their products to align with green initiatives.

Key Market Segments

Component

- Hardware

- Services

Product Type

- Fixed

- Pan-Tilt-Zoom (PTZ)

- Infrared

Connection Type

- Consolidated

- Distributed

End-use Outlook

- Residential

- Commercial

- BFSI

- Education

- Healthcare

- Industrial

- Real estate

- Retail

- Transportation & logistics

- Industrial

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the IP camera market, capturing more than a 48.9% share. The demand for IP Camera in Asia-Pacific (APAC) reached US$ 6.3 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

This significant market dominance can be attributed to several factors that highlight the growth and demand for IP cameras in the APAC region. The APAC region encompasses countries such as China, Japan, India, South Korea, and several Southeast Asian nations, which are witnessing rapid economic growth, urbanization, and infrastructure development. These factors, coupled with the increasing adoption of advanced technologies, contribute to the dominance of the APAC region in the IP camera market.

One of the key drivers for the APAC region’s dominance is the rising need for enhanced security and surveillance across various sectors. Countries in this region are experiencing increasing concerns regarding public safety, crime prevention, and protection of critical infrastructure. Industries such as retail, banking, transportation, and government are actively investing in IP camera solutions to address these security challenges. Additionally, the growing urban population and the need for secure residential complexes also drive the demand for IP cameras in the residential sector.

The APAC region is also witnessing significant advancements in smart city initiatives and the Internet of Things (IoT) technologies. Governments and city planners are deploying IP cameras as a key component of their smart city infrastructure for traffic management, public safety, and efficient urban planning. This trend further propels the demand for IP cameras in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The key players in the Internet Protocol (IP) camera market are strategically oriented towards introducing new technologies and innovative products and services. This proactive approach is aimed at gaining a competitive edge, attracting more customers, and driving increased sales and revenue. These market leaders recognize the importance of staying at the forefront of technological advancements to meet evolving customer demands and to capitalize on the growing adoption of IP cameras.

Top Market Leaders

- Honeywell International Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- D-Link Systems, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Pelco Incorporated

- Sony Corporation

- Arecont Vision Costar, LLC

- Panasonic Corporation

- Johnson Controls International Plc

- GeoVision Inc.

- Other Key Players

Recent Developments

1. Honeywell International Inc.:

- March 2023: Announced the acquisition of Xtralis, a leading provider of life safety and security solutions, including video surveillance technology, expanding their IP camera portfolio and expertise.

- July 2023: Launched the “HomePro Wi-Fi 2 Indoor/Outdoor Camera,” a new smart home security camera offering high-resolution video, live streaming, and AI-powered person detection.

2. D-Link Systems, Inc.:

- February 2023: Launched the “DCS-8830 Wi-Fi 2K QHD Pan & Tilt Camera,” featuring enhanced resolution, wider field of view, and improved night vision capabilities.

- November 2023: Partnered with Amazon to integrate their IP cameras with Alexa smart home devices, enabling voice control and smart home automation features.

3. Robert Bosch GmbH:

- April 2023: Launched the “MIC IP starlight 8000i,” a high-performance IP camera with advanced low-light capabilities and intelligent video analytics for demanding security applications.

- September 2023: Partnered with Huawei to develop and offer edge computing solutions for IP cameras, enabling on-device video analysis and storage for improved privacy and security.

Report Scope

Report Features Description Market Value (2023) US$ 12.7 Bn Forecast Revenue (2033) US$ 42.7 Bn CAGR (2024-2033) 12.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware and Services), By Product Type (Fixed, Pan-Tilt-Zoom (PTZ), Infrared), By Connection Type (Consolidated, Distributed), By End-use (Residential Use, Commercial Use, Industrial Use) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Honeywell International Inc., Hangzhou Hikvision Digital Technology Co. Ltd., Axis Communications AB, D-Link Systems Inc., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Pelco Incorporated, Sony Corporation, Arecont Vision Costar LLC, Panasonic Corporation, Johnson Controls International Plc, GeoVision Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an IP Camera?An IP Camera, or Internet Protocol Camera, is a digital video camera that transmits and receives data over the internet. It is used for surveillance and security purposes, providing remote access and advanced features like motion detection and night vision.

How big is IP Camera Industry?The Global IP Camera Market size is expected to be worth around USD 42.7 Billion by 2033, from USD 12.7 Billion in 2023, growing at a CAGR of 12.9% during the forecast period from 2024 to 2033.

What are the typical applications of IP Cameras?IP Cameras find applications in various sectors, including residential, commercial, and industrial. They are commonly used for surveillance, security monitoring, and enhancing overall safety in different environments.

Who are the key players in IP camera market?Some key players operating in the IP camera market include Honeywell International Inc., Hangzhou Hikvision Digital Technology Co. Ltd., Axis Communications AB, D-Link Systems Inc., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Pelco Incorporated, Sony Corporation, Arecont Vision Costar LLC, Panasonic Corporation, Johnson Controls International Plc, GeoVision Inc., Other Key Players

Which region dominated the global IP camera market share?In 2023, the Asia-Pacific (APAC) region held a dominant market position in the IP camera market, capturing more than a 48.9% share.

-

-

- Honeywell International Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- D-Link Systems, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Pelco Incorporated

- Sony Corporation

- Arecont Vision Costar, LLC

- Panasonic Corporation

- Johnson Controls International Plc

- GeoVision Inc.

- Other Key Players