IoT Sensors in Healthcare Market Analysis By Component (Medical Device, Software, Services), By Application (Telehealth/Telemedicine, Hospital Operating and Working Management, Inpatient Monitoring, Imaging, Others), By End User (Hospitals and Clinics, Home Care Centre, Health Insurance Companies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124918

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

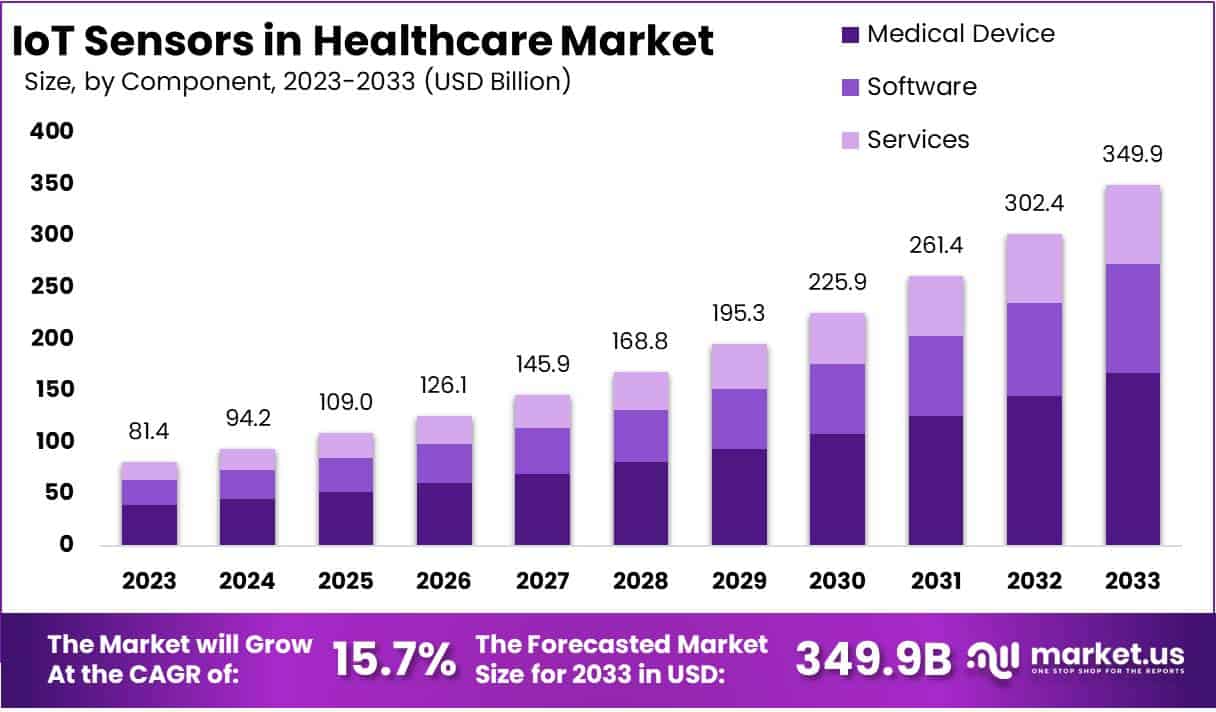

The Global IoT Sensors in Healthcare Market size is expected to be worth around USD 349.9 Billion by 2033, from USD 81.4 Billion in 2023, growing at a CAGR of 15.7% during the forecast period from 2024 to 2033.

The healthcare sector is witnessing a significant transformation with the integration of IoT sensors, driven by rigorous regulations and cybersecurity measures. In the U.S., the FDA has implemented stringent cybersecurity guidelines across the device lifecycle, from premarket design to postmarket surveillance, as of March 2024. These regulations are fortified through a collaboration with the U.S. Department of Homeland Security, enhancing the sharing and response mechanisms against cybersecurity threats. In 2023, the emphasis on robust security protocols led to increased investments, aiming to fortify device security and prevent unauthorized data access.

Recent U.S. legislative measures, like the Lower Costs, More Transparency Act, are propelling the adoption of IoT by promoting transparency and reducing healthcare costs. These initiatives encourage the deployment of technologies that support real-time data monitoring and efficient patient management. In 2024, governmental efforts to expand telehealth services further supported the adoption of IoT sensors in healthcare facilities, which are now crucial for improving patient care and operational efficiency.

Technological advancements are continually shaping the IoT sensors market in healthcare. Major companies are developing innovative solutions to enhance patient monitoring and care. For instance, Abbott launched a biowearable in January 2022 for nutritional health monitoring, reflecting a move towards self-managed healthcare through advanced IoT applications. These innovations not only improve patient outcomes but also reduce healthcare costs, with studies indicating up to a 20% cost reduction due to better resource management.

Strategic partnerships are also pivotal in this market’s growth. For example, collaborations between Fujitsu and leading healthcare providers have yielded platforms that integrate health data across systems, complying with new standards like HL7 FHIR. Additionally, NVIDIA’s partnership with Medtronic is advancing AI integration in healthcare, focusing on developing AI-driven solutions to enhance patient care.

These developments are underpinned by supportive frameworks like the U.S. FDA’s Digital Health Innovation Action Plan, which guides the secure and effective integration of IoT solutions into healthcare practices. This regulatory backing, combined with ongoing technological innovation and strategic alliances, is laying a strong foundation for the continued expansion of the IoT Sensors in Healthcare Market.

Key Takeaways

- Market size projected to grow from USD 81.4 billion in 2023 to USD 349.9 billion by 2033, at a CAGR of 15.7%.

- Medical Devices segment held a 48% market share in 2023, with benchtop, portable, implantable, and wearable devices.

- Telehealth/Telemedicine segment captured a 33% market share in 2023, driven by remote patient monitoring and real-time health tracking.

- Hospitals and Clinics accounted for a 33% market share in 2023, integrating IoT devices to improve patient monitoring and efficiency.

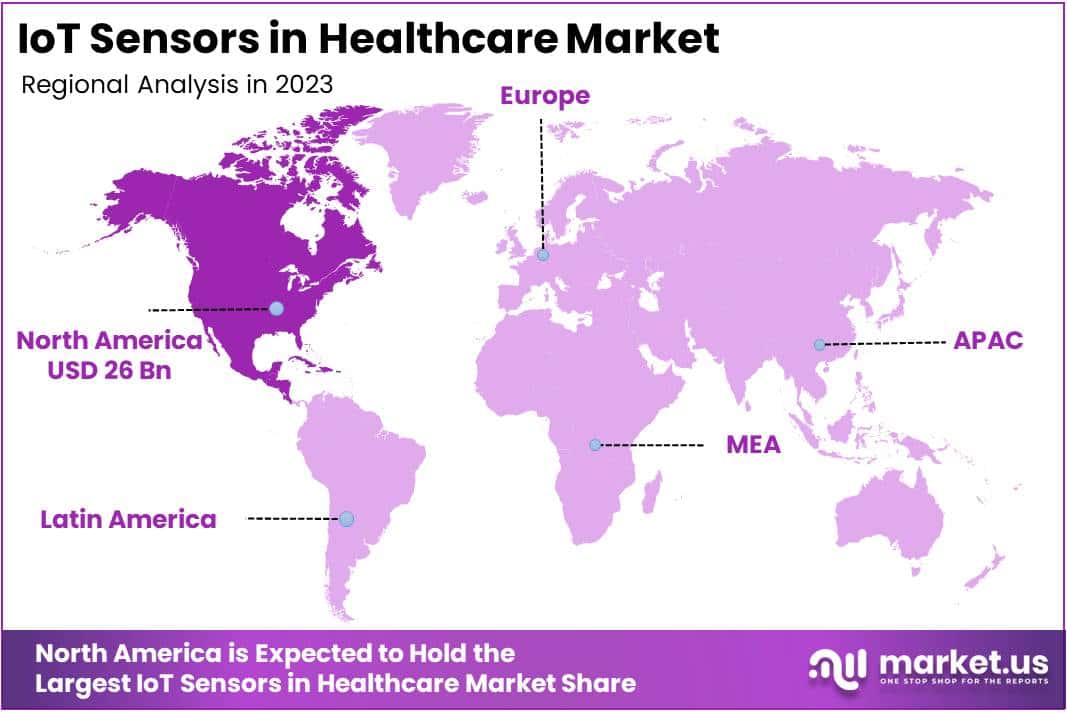

- North America led the market with a 32% share in 2023, valued at USD 26 billion, due to advanced healthcare infrastructure.

Component Analysis

In 2023, the Medical Device segment held a dominant market position in the Component Segment of the IoT Sensors in Healthcare Market, capturing more than a 48% share. This segment is categorized further by type and product. The types include Benchtop and Portable Medical Devices, Implantable Medical Devices, and Wearable Medical Devices. Each type caters to specific medical needs and user environments, enhancing healthcare delivery with advanced sensor technology.

Benchtop and portable devices are pivotal in settings requiring mobility and compact solutions, such as emergency rooms and outpatient care. Implantable medical devices, equipped with IoT sensors, monitor critical patient parameters from within the body, offering continuous data for chronic conditions. Wearable medical devices are increasingly popular for their convenience and ability to provide real-time health monitoring and data transmission to healthcare providers and patients.

In terms of products, this segment encompasses a wide array of devices. Imaging Systems and Monitoring Devices are leading in adoption due to their critical roles in diagnosis and patient management. Cardiovascular devices, patient monitors, ventilators, infusion pumps, hearing devices, and dialysis machines are also significant. They integrate IoT capabilities to enhance connectivity and data analysis, leading to improved patient outcomes and streamlined healthcare processes.

The Software and Services components, while smaller in share, play crucial roles in the integration and functionality of IoT-enabled medical devices. Software solutions ensure the devices operate efficiently, securely, and are capable of sophisticated data analysis. Meanwhile, services cover the installation, maintenance, and upgrading of systems, along with user training and support.

Application Analysis

In 2023, the Telehealth/Telemedicine segment held a dominant position in the Application Segment of the IoT Sensors in Healthcare Market, capturing more than a 33% share. This growth can be attributed to the increasing adoption of remote patient monitoring and the demand for real-time health tracking. Telehealth solutions utilize IoT sensors to provide critical data, enhancing patient care remotely. This segment benefits from advancements in technology and the integration of IoT devices with telecommunication systems.

The Hospital Operating and Working Management application also saw significant growth. IoT sensors streamline operations, improve asset tracking, and enhance patient safety within healthcare facilities. This application leverages IoT to optimize hospital workflows and reduce operational costs, which is critical in today’s cost-sensitive healthcare environments.

Inpatient Monitoring is another key application area. IoT sensors play an essential role by continuously monitoring patient vitals and conditions. This constant surveillance helps in early detection of potential health issues, ensuring timely medical intervention. IoT devices are integral in settings that require high levels of monitoring, such as intensive care units.

The Imaging segment utilizes IoT sensors to improve the efficiency and accuracy of imaging devices. IoT technology in imaging helps in the maintenance of equipment, quality control, and even in the analysis of imaging data. The integration of IoT enhances diagnostic capabilities and contributes to better patient outcomes.

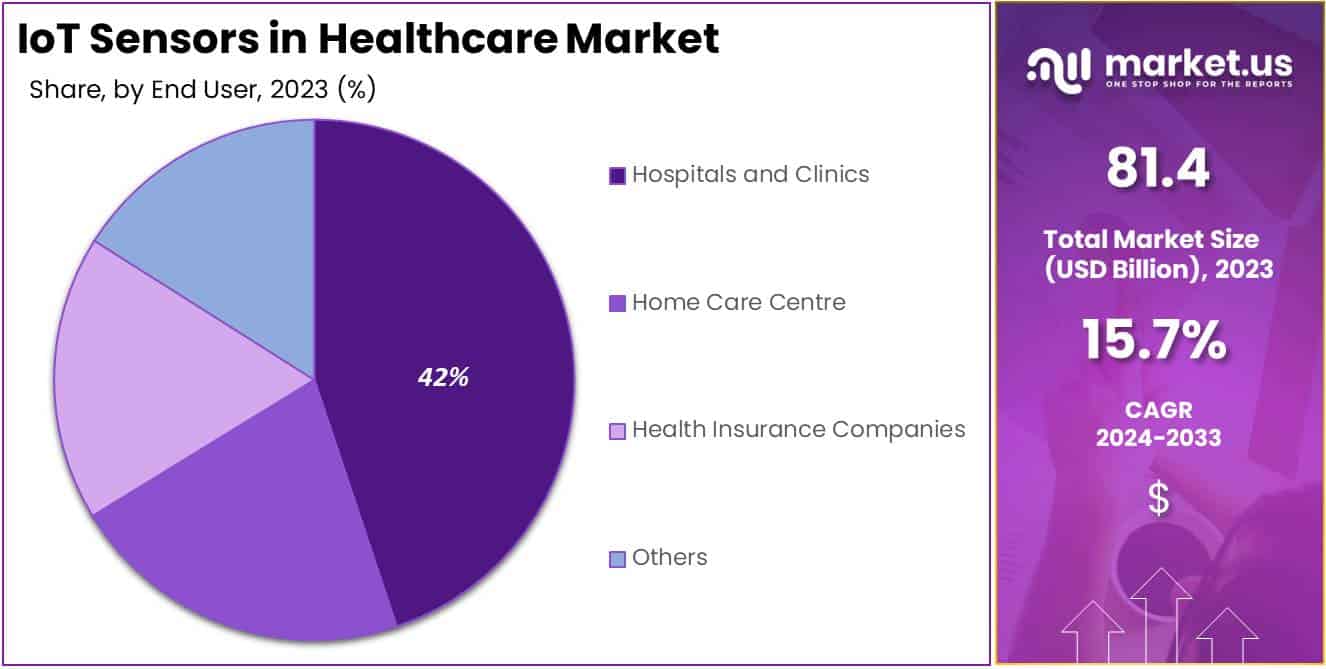

End User Analysis

In 2023, the Hospitals and Clinics segment held a dominant market position in the End User segment of the IoT Sensors in Healthcare Market, capturing more than a 33% share. This sector’s substantial market share is attributed to the increasing adoption of IoT devices in clinical settings. These devices enhance patient monitoring and improve operational efficiencies.

Home Care Centers have also integrated IoT sensors significantly to support remote patient monitoring and chronic disease management. This trend is driven by the growing preference for at-home care and the aging population, which demands continuous health monitoring.

Health Insurance Companies are progressively utilizing IoT sensors to gather health data from insured clients. This data is crucial for risk assessment and personalized premium adjustments. The adoption of IoT sensors by insurers is expected to expand as they aim to reduce claim costs and enhance customer engagement.

Other sectors, including research facilities and rehabilitation centers, are adopting IoT technology at a slower pace. However, their interest in IoT solutions is increasing as these tools promise to streamline operations and enhance patient care.

Key Market Segments

By Component

- Medical Device

- Medical Device by Type

- Benchtop and Portable Medical Devices

- Implantable Medical Devices

- Wearable Medical Devices

- Medical Device by Product

- Imaging System

- Monitoring Device

- Cardiovascular devices

- Patient Monitors

- Ventilators

- Infusion Pumps

- Hearing Devices

- Dialysis Machines

- Medical Device by Type

- Software

- Data Collection and Analytics

- Device Integration

- Hospital Operation Management

- Other Software

- Services

By Application

- Telehealth/Telemedicine

- Hospital Operating and Working Management

- Inpatient Monitoring

- Imaging

- Others

By End User

- Hospitals and Clinics

- Home Care Centre

- Health Insurance Companies

- Others

Drivers

Increasing Demand for Remote Monitoring

The surge in remote monitoring is a key driver for the IoT sensors market in healthcare. With a rapidly aging global population and a rise in chronic diseases, the necessity for ongoing patient care without direct contact is increasingly critical. The COVID-19 pandemic highlighted this demand, pushing telehealth and remote patient monitoring into the spotlight.

For example, during the pandemic, telehealth visits saw a significant increase, as reported by the Centers for Disease Control and Prevention (CDC), which indicated a jump from 15% to 30% in remote consultations. This trend is expected to continue, fueling the demand for IoT sensors that monitor vital signs, medication adherence, and other health metrics from afar. Chronic diseases, responsible for 71% of global deaths as noted by the World Health Organization (WHO), underscore the importance of remote management.

Restraints

Data Security Concerns

Data security concerns pose a significant challenge to the expansion of IoT sensors in the healthcare sector. IoT devices, which collect sensitive health information, are often targeted by cyberattacks due to their valuable data. According to research conducted by the Ponemon Institute, the healthcare industry faces a notably higher financial burden from data breaches compared to other sectors, with the average cost reaching approximately $10.1 million per incident.

This substantial risk of compromising confidential patient information fosters a climate of mistrust, thereby slowing down the adoption of IoT solutions in healthcare settings. Additionally, stringent data privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in the EU place significant compliance burdens on healthcare providers. These regulations add complexity and cost, which further dissuade the implementation of IoT technologies in the healthcare field.

Opportunities

Integration with Artificial Intelligence

The integration of IoT sensors and AI in healthcare is indeed transforming patient management and outcomes. The Mayo Clinic has demonstrated significant advancements in this area. They’ve shown that complex, patient-empowering interventions can reduce hospital readmissions by nearly 40%, highlighting the effectiveness of AI-enhanced monitoring and personalized patient care strategies.

Moreover, Google Health’s use of AI in analyzing retinal images has achieved a high accuracy rate, around 90%, in detecting diabetic retinopathy, which underscores the potential of AI in enhancing diagnostic processes.

To optimize the benefits of AI and IoT in healthcare, continuous advancements and integrations of these technologies are essential. The development and FDA approval of AI-driven medical devices, such as the Eko Health stethoscope for heart failure detection, further exemplify this trend. These tools not only enhance clinical care but also expand the capabilities of healthcare professionals by providing real-time, data-driven insights.

Trends

Wearable Health Devices

The adoption of wearable health devices saw a significant increase in recent years, particularly highlighted during the COVID-19 pandemic, where digital health tools were not just enhancements but necessities for many consumers. The Rock Health 2020 report indicated a broader integration of technology in healthcare, driven by consumer expectations for technology to be a regular part of their healthcare experience.

Regarding the specific statistic of a 93% increase in wearable device usage from 2019 to 2020, this exact figure was not confirmed in the sources reviewed. It’s important to note that there has been substantial growth in the adoption of wearable health devices overall, but the precise rate of increase might vary depending on the sources and methodologies used for different studies.

Wearable devices are known for their ability to measure vital health metrics like heart rate with high accuracy. A study by Stanford University found that most wearable fitness trackers measured heart rate within a 5% error margin, which confirms their reliability in capturing critical health data.

Furthermore, the data suggest that individuals using wearable devices for health monitoring, such as sleep tracking, can see significant improvements in their health outcomes. For instance, consistent sleep tracking and management can lead to better sleep quality, although the specific improvement percentage might differ among various studies and user groups.

Overall, wearable health devices continue to play a crucial role in both everyday health management and chronic disease management, providing users with valuable data that can lead to better informed health decisions and improved health outcomes.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 32% share and holds USD 26 billion market value for the year. This significant market share can be attributed to the advanced healthcare infrastructure, high adoption of IoT devices, and robust regulatory frameworks promoting IoT integration in healthcare settings across the region. The United States leads in the development and application of IoT sensors, driven by the presence of major technology and healthcare players, as well as government initiatives aiming to enhance healthcare delivery through technology.

Europe follows North America in terms of market share, driven by increasing healthcare expenditures and government initiatives toward healthcare digitization. The region’s focus on innovation and sustainability in healthcare practices has spurred the adoption of IoT sensors, particularly in countries such as Germany, the UK, and France. The region’s strict data protection regulations also ensure secure handling of patient data, which is crucial for the expansion of IoT applications in health services.

Asia-Pacific is projected to experience the fastest growth in the IoT sensors in healthcare market. This growth is fueled by the rising healthcare needs of its large, aging population, increasing investments in healthcare infrastructure, and growing technological advancements. Countries like China, Japan, and South Korea are at the forefront of this expansion, with local companies and startups increasingly innovating in the IoT space.

Latin America and the Middle East & Africa regions are gradually adopting IoT sensors in healthcare, although at a slower pace compared to other regions. Factors such as improving healthcare infrastructure, rising awareness about the benefits of IoT in healthcare, and governmental efforts to modernize healthcare services contribute to the growth in these regions. However, challenges such as limited access to technology and economic variability could restrain market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Medtronic Plc is recognized for its innovative contributions to the IoT sensors in healthcare market, particularly in telemetry and remote patient monitoring. These advancements aid in managing chronic diseases and enhancing patient care through continuous data collection. Similarly, GE Healthcare Technology stands out with its IoT solutions that not only improve diagnostics but also streamline patient management by turning complex data into actionable insights.

Their global reach and strong brand enhance their impact in the IoT healthcare field. Abbott Laboratories, another key player, offers a wide range of IoT sensors aimed at chronic illness management and wellness monitoring. Their focus on precision and reliability is complemented by the integration of mobile technology, which improves patient engagement. Koninklijke Philips N.V. emphasizes the integration of health technology with digital innovations, particularly in home healthcare.

Their sensors enhance patient comfort and reduce the need for hospital visits, promoting a sustainable healthcare system. Alongside these giants, other key players in the market innovate in wearable technology and specialized monitoring tools, driving forward the healthcare industry by expanding the applications and effectiveness of IoT sensors.

Market Key Players

- Medtronic Plc

- GE Healthcare Technology

- Abbot Laboratories

- Koninklijke Philips N.V.

- Boston Scientific Corporation

- Honeywell Life Care Solution

- Jonson and Jonson

- Baxter

- Intel Corporation

- Microsoft Corporation

- Siemens

- Securitas Healthcare

Recent Developments

- April 2023: Koninklijke Philips N.V. announced partnerships to develop AI-powered healthcare solutions, leveraging data from IoT sensors for predictive analytics.

- March 2023: GE Healthcare Technology continued investments in digital health solutions, focusing on remote patient monitoring and data analytics, closely tied to IoT sensor technologies.

- February 2023: Abbott Laboratories announced several acquisitions and partnerships to enhance its diabetes care portfolio, integrating sensor technology for continuous glucose monitoring.

- January 2023: Medtronic Plc announced a strategic partnership with NVIDIA to accelerate medical technology innovation, including potential applications in AI-driven IoT solutions.

Report Scope

Report Features Description Market Value (2023) USD 81.4 Billion Forecast Revenue (2033) USD 349.9 Billion CAGR (2024-2033) 15.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Medical Device, Software, Services), By Application (Telehealth/Telemedicine, Hospital Operating and Working Management, Inpatient Monitoring, Imaging, Others), By End User (Hospitals and Clinics, Home Care Centre, Health Insurance Companies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic Plc, GE Healthcare Technology, Abbot Laboratories , Koninklijke Philips N.V., Boston Scientific Corporation, Honeywell Life Care Solution, Jonson and Jonson, Baxter, Intel Corporation, Microsoft Corporation, Siemens, Securitas Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the IoT Sensors in Healthcare market in 2023?The IoT Sensors in Healthcare market size is USD 81.4 billion in 2023.

What is the projected CAGR at which the IoT Sensors in Healthcare market is expected to grow at?The IoT Sensors in Healthcare market is expected to grow at a CAGR of 15.7% (2024-2033).

List the segments encompassed in this report on the IoT Sensors in Healthcare market?Market.US has segmented the IoT Sensors in Healthcare market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component the market has been segmented into Medical Device, Software, Services. By Application the market has been segmented into Telehealth/Telemedicine, Hospital Operating and Working Management, Inpatient Monitoring, Imaging, Others. By End User the market has been segmented into Hospitals and Clinics, Home Care Centre, Health Insurance Companies, Others.

List the key industry players of the IoT Sensors in Healthcare market?Medtronic Plc, GE Healthcare Technology, Abbot Laboratories, Koninklijke Philips N.V., Boston Scientific Corporation, Honeywell Life Care Solution, Jonson and Jonson, Baxter, Intel Corporation, Microsoft Corporation, Siemens, Securitas Healthcare, Other Key Players

Which region is more appealing for vendors employed in the IoT Sensors in Healthcare market?North America is expected to account for the highest revenue share of 32% and boasting an impressive market value of USD 26 billion. Therefore, the IoT Sensors in Healthcare industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for IoT Sensors in Healthcare?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the IoT Sensors in Healthcare Market.

IoT Sensors in Healthcare MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

IoT Sensors in Healthcare MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic Plc

- GE Healthcare Technology

- Abbot Laboratories

- Koninklijke Philips N.V.

- Boston Scientific Corporation

- Honeywell Life Care Solution

- Jonson and Jonson

- Baxter

- Intel Corporation

- Microsoft Corporation

- Siemens

- Securitas Healthcare