Global Investment Banking Market By Service Type(Mergers and Acquisitions (M&A) Advisory, Debt Capital Markets, Equity Capital Markets, Syndicated Loans, Other Service Types), By End-User(Corporate Clients, Institutional Investors, Government and Public Sector, Individuals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128332

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

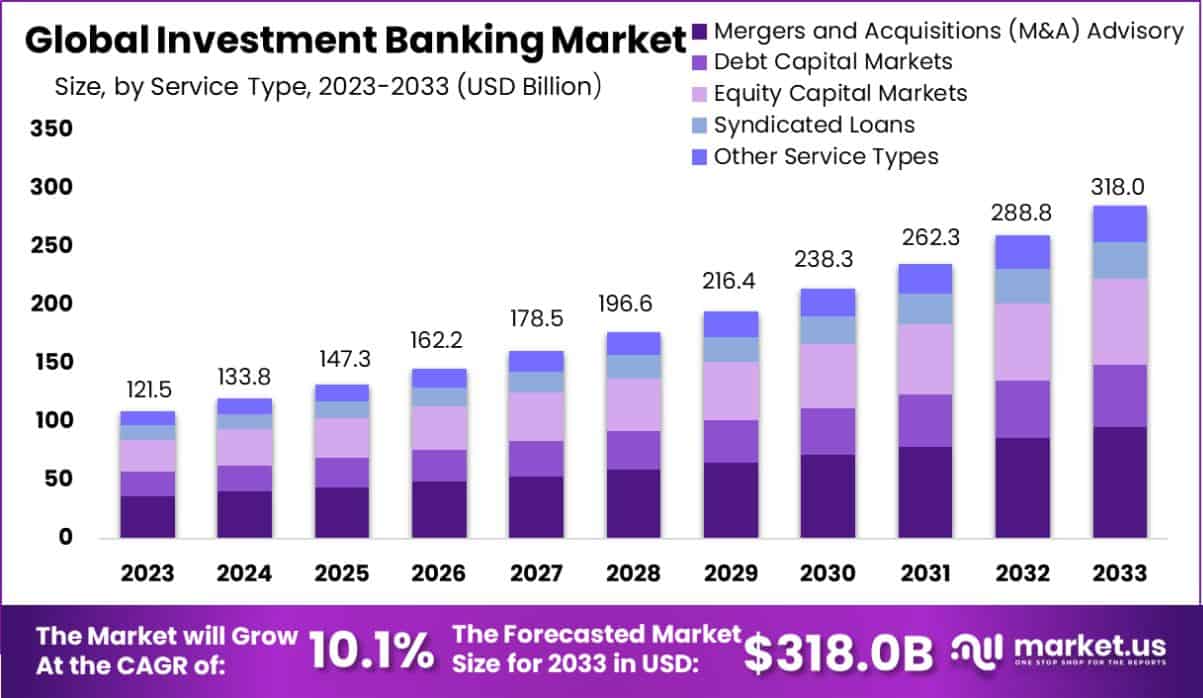

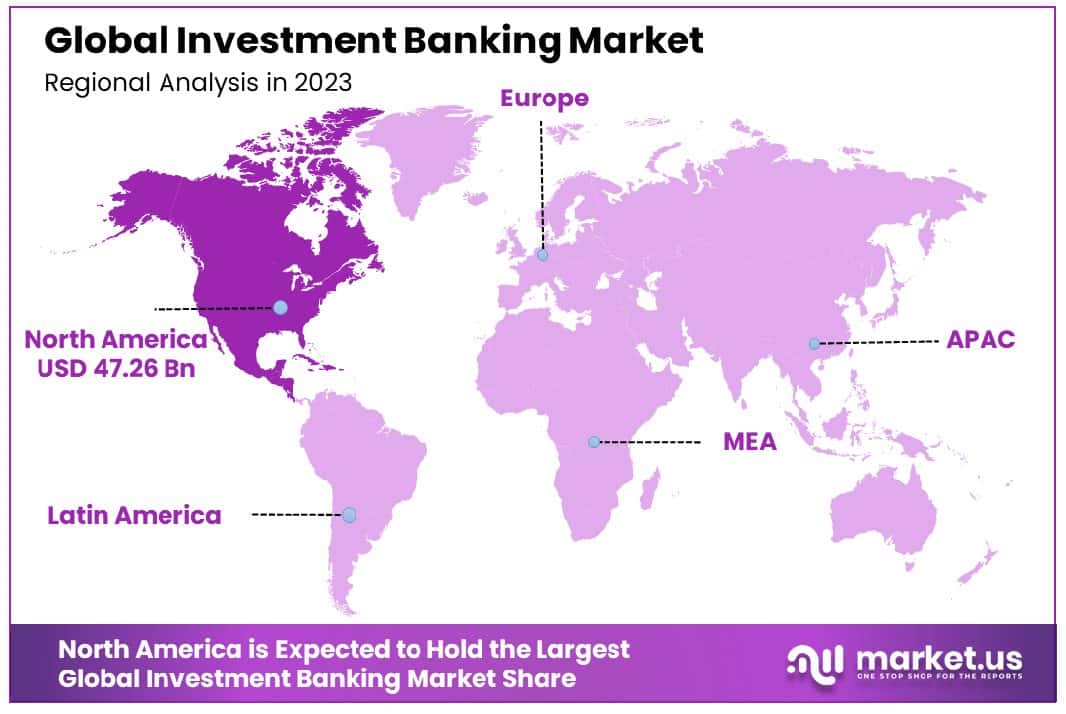

The Global Investment Banking Market size is expected to be worth around USD 318.0 Billion By 2033, from USD 121.5 Billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033. North America dominated the investment banking market, holding a 38.9% share and generating USD 47.26 billion in revenue.

Investment banking refers to a specific division of banking related to the creation of capital for other companies, governments, and other entities. Investment bankers assist in underwriting new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors. They also provide guidance to issuers regarding the issue and placement of stock.

The investment banking market is pivotal in facilitating economic growth by enabling access to capital markets. The sector is driven by factors such as global economic expansion, increasing regulatory reforms, and technological advancements in financial instruments. Notably, the market benefits from rising demand for expert financial advisory services amid complex corporate restructuring and expansive fiscal policies.

Top opportunities within the investment banking market include the expansion into emerging markets, increased focus on sustainable and green financing, and leveraging cutting-edge technology to enhance trading processes and improve customer experiences. These opportunities not only drive profitability but also foster innovation within the sector.

The investment banking sector continues to demonstrate robust growth and resilience, underscored by significant capital flows and strategic global investments. Notably, the United States hosts the largest bank by market capitalization, which stood at $491.76 billion as of January 2, 2024, with total assets amounting to $3.744 trillion. This exemplifies the substantial financial capacity and influence wielded by top-tier investment banks on a global scale.

Further reinforcing the sector’s pivotal role in economic development, the International Finance Corporation (IFC) committed a record $56 billion in fiscal year 2024 to private companies and financial institutions in developing regions. This investment is strategically aimed at catalyzing private sector initiatives to drive economic growth and alleviate poverty, marking a significant trend in leveraging finance for sustainable development.

Additionally, the World Bank’s recent approval of $1.5 billion in financing to support India’s low-carbon energy projects emphasizes the shifting focus towards sustainable and renewable energy solutions within the investment banking agenda. This move aligns with global environmental goals and showcases the sector’s adaptability to evolving market demands.

The Asian Development Bank (ADB) has also expanded its financial horizons, surpassing a capacity of $20 billion by 2020. The ongoing efforts to enhance lending practices to lower-income countries through innovative funding mechanisms illustrate the sector’s commitment to broader economic inclusivity and stability. These strategic financial commitments and capacities highlight the dynamic nature of the investment banking industry, poised to address both traditional financial services and emergent global challenges effectively.

Key Takeaways

- The Global Investment Banking Market size is expected to be worth around USD 318.0 Billion By 2033, from USD 121.5 Billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

- In 2023, Mergers and Acquisitions (M&A) Advisory held a dominant market position in the By Service Type segment of the Investment Banking Market, capturing more than a 40.5% share.

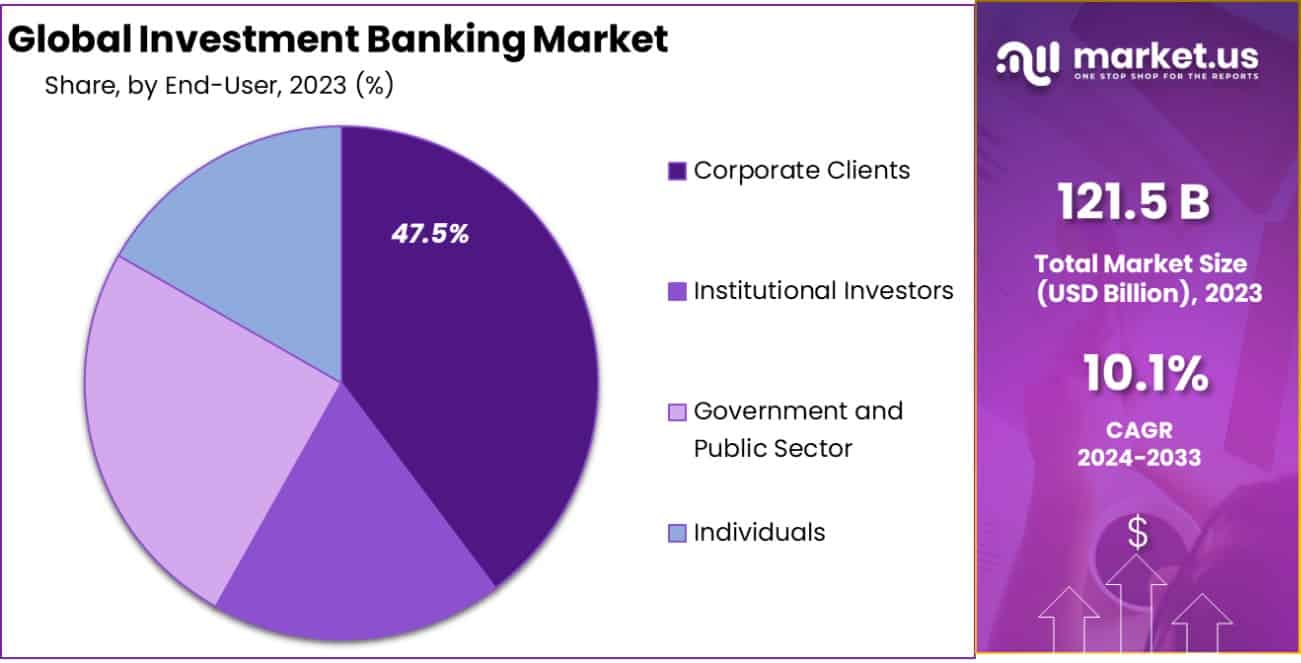

- In 2023, Corporate Clients held a dominant market position in the end-user segment of the Investment Banking Market, capturing more than a 47.5% share.

- North America dominated a 38.9% market share in 2023 and held USD 47.26 Billion in revenue from the Investment Banking Market.

By Service Type Analysis

In 2023, Mergers and Acquisitions (M&A) Advisory held a dominant market position in the “By Service Type” segment of the Investment Banking Market, capturing more than a 40.5% share. This significant market share underscores the critical role M&A Advisory services play in facilitating strategic acquisitions and mergers, which are pivotal for corporate restructuring and expansion strategies across various industries.

Following closely, Debt Capital Markets accounted for a substantial segment, reflecting the increasing reliance of companies on debt financing to leverage growth opportunities and manage capital structures effectively.

Equity Capital Markets also featured prominently, driven by a surge in initial public offerings and private equity investments, as businesses sought to capitalize on favorable market conditions to enhance liquidity. Syndicated Loan services were equally vital, providing tailored financing solutions to large-scale projects and transactions, demonstrating the banking sector’s adaptability in meeting diverse client needs.

Other Service Types, including financial advisory and restructuring services, although smaller in comparison, are essential for offering specialized financial strategies to niche markets, addressing specific client demands that are not covered by the mainstream categories. This segmentation highlights the dynamic nature of the Investment Banking Market, responding adeptly to evolving financial trends and client requirements.

By End-User Analysis

In 2023, Corporate Clients held a dominant market position in the “By End-User” segment of the Investment Banking Market, capturing more than a 47.5% share. This segment’s strong performance reflects the deep reliance of corporate entities on investment banking services for complex transactions like mergers, acquisitions, and capital-raising activities. These services are crucial in navigating the intricate landscape of global finance, particularly for corporations looking to expand or streamline their operations.

Institutional Investors also represent a significant portion of the market, as these entities, including pension funds, mutual funds, and insurance companies, increasingly rely on investment banks for asset management and advisory services. The need for sophisticated investment strategies and regulatory compliance support drives this demand.

The Government and Public Sector segment commands a pivotal role in the market, utilizing investment banking expertise for large-scale project funding and debt management strategies, which are vital for sustainable economic growth and infrastructure development.

Individuals, though holding a smaller market share, are an emerging segment, driven by high-net-worth individuals seeking investment advice and opportunities for wealth maximization. This trend is supported by the growing accessibility of investment banking services through digital platforms, broadening the reach to a more extensive client base. Together, these segments underscore the diversified client base that investment banks cater to, each with unique needs and contributions to the market’s dynamics.

Key Market Segments

By Service Type

- Mergers and Acquisitions (M&A) Advisory

- Debt Capital Markets

- Equity Capital Markets

- Syndicated Loans

- Other Service Types

By End-User

- Corporate Clients

- Institutional Investors

- Government and Public Sector

- Individuals

Drivers

Key Drivers in Investment Banking

The investment banking market is primarily driven by several key factors. Firstly, the surge in global economic activities encourages businesses to expand and merge, increasing the demand for investment banking services.

Technological advancements also play a significant role, enabling more efficient transaction processing and data analysis, thus attracting more clients. Additionally, the growing complexity of financial regulations worldwide necessitates expert advisory services, further boosting the market.

There is also a marked increase in the need for wealth management services among high-net-worth individuals, contributing to market growth. Lastly, the rising trend of digitalization and the adoption of blockchain and artificial intelligence in financial services are enhancing operational efficiencies, leading to new opportunities in investment banking. These drivers collectively foster the growth and transformation of the global investment banking landscape.

Restraint

Challenges Facing Investment Banking

The investment banking sector faces several restraints that could impede its growth. One of the most significant challenges is the stringent regulatory environment, which requires banks to maintain higher capital reserves and limits their risk-taking capabilities. This scenario can reduce profitability and deter aggressive market strategies.

Moreover, market volatility often leads to uncertain investment outcomes, affecting the stability and attractiveness of investment banking services. There is also increasing competition from non-traditional financial services providers, such as fintech companies, which offer innovative, customer-friendly solutions at lower costs.

Additionally, the ongoing global economic uncertainties, including geopolitical tensions and economic downturns, pose direct threats to investment banking activities. These factors collectively create a challenging landscape for investment banks, impacting their growth prospects and operational efficiencies.

Opportunities

Growth Opportunities in Investment Banking

The investment banking market is poised for growth, fueled by several promising opportunities. The increasing global inclination towards mergers and acquisitions provides a substantial revenue stream for investment banks, as companies seek expertise in navigating complex transactions.

Additionally, the rise in initial public offerings, particularly in emerging markets, opens new avenues for investment banking services. Technological advancements also present significant opportunities; by integrating technologies like artificial intelligence and blockchain, banks can enhance their efficiency, reduce operational costs, and offer superior client services.

Furthermore, the expansion into sustainable finance and ESG (Environmental, Social, and Governance) investments allows banks to tap into new, socially conscious investment pools. These opportunities, combined with a recovering global economy, suggest a robust pathway for expansion and innovation in the investment banking sector.

Challenges

Key Challenges in Investment Banking

Investment banking faces significant challenges that could impact its growth trajectory. Regulatory pressures continue to intensify, with stricter compliance demands and higher capital requirements, reducing profitability and operational flexibility.

Market volatility also remains a persistent concern, as fluctuations in global financial markets can lead to unpredictable investment outcomes, affecting client confidence and investment bank revenues. Technological disruption is another major hurdle, with fintech companies offering innovative, cost-effective alternatives that challenge traditional banking models.

Additionally, the reputation of investment banks is often vulnerable to public and media scrutiny, particularly following financial crises or scandals, which can erode trust and deter potential clients. These challenges require strategic adaptations and innovations by investment banks to maintain competitiveness and meet evolving market demands effectively.

Growth Factors

Drivers Fueling Investment Banking Growth

Investment banking is experiencing growth driven by several pivotal factors. The global economic expansion is a major catalyst, prompting companies to pursue mergers, acquisitions, and public offerings to capitalize on market opportunities.

Technological advancements are also crucial, as they enable banks to improve transaction efficiencies and client interactions through digital platforms. This tech integration helps in managing complex data and provides analytical tools that are essential in today’s data-driven market environment.

Furthermore, there is an increasing trend towards personal and corporate investment in emerging markets, which offers new territories for growth and investment. The rising interest in sustainable and green finance is another growth avenue, as more investors seek opportunities that comply with environmental, social, and governance (ESG) criteria. Collectively, these factors are broadening the scope and profitability of the investment banking sector.

Emerging Trends

Emerging Trends in Investment Banking

Emerging trends in the investment banking market are reshaping the industry. There is a noticeable shift towards digitalization, with banks leveraging advanced technologies such as artificial intelligence and blockchain to streamline operations and enhance security. This digital shift not only improves efficiency but also attracts a tech-savvy client base.

Another significant trend is the integration of sustainability into financial services, where there is a growing demand for green bonds and ESG-focused investment options. This reflects a broader societal shift towards environmental consciousness, which investment banks are capitalizing on to appeal to new generations of investors.

Additionally, the rise of fintech and alternative finance platforms is prompting traditional banks to innovate and adapt to maintain competitiveness. These trends underscore a dynamic period of transformation and opportunity within the investment banking sector, driven by technological advancements and changing investor priorities.

Regional Analysis

The global investment banking market is distinctly segmented across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America holds a commanding position, accounting for 38.9% of the market with a valuation of USD 47.26 billion. This dominance is primarily driven by the robust financial sectors in the United States and Canada, coupled with high levels of corporate activity, including mergers, acquisitions, and IPOs.

Europe follows, bolstered by its strong regulatory frameworks and the presence of significant financial hubs such as London and Frankfurt. The market here benefits from the diverse economic base and the steady demand for investment banking services related to cross-border transactions and corporate restructuring.

Asia Pacific is rapidly growing due to the economic rise of countries like China and India, increased entrepreneurial activities, and growing capital markets. This region shows a significant increase in infrastructure spending and corporate expansions, driving demand for investment banking services.

Meanwhile, the Middle East & Africa, and Latin America are emerging as promising regions due to increasing foreign investments and a rise in regional businesses seeking capital expansion through the financial markets. However, these regions still face challenges such as political instability and economic volatility, which can affect market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the performance of key players such as JPMorgan Chase & Co., Goldman Sachs Group, Inc., and Morgan Stanley significantly influenced the global investment banking market.

JPMorgan Chase & Co., with its extensive global network and diverse financial services, continued to lead in market share and revenue generation. The company’s robust approach to mergers and acquisitions, as well as its strategic investments in technology and sustainable finance, have positioned it as a top contender in the market.

Goldman Sachs Group, Inc., renowned for its strong advisory and wealth management services, has effectively capitalized on global corporate restructuring and IPO activities. Its focus on integrating advanced technologies like AI and data analytics has enhanced its operational efficiency and client service capabilities, further solidifying its market position.

Morgan Stanley has also made notable strides, particularly in wealth management and institutional securities. The firm’s commitment to expanding its digital services and its strategic initiatives in sustainable finance align with the evolving preferences of investors, thus driving its growth in the competitive investment banking landscape.

Together, these firms have set industry benchmarks, leveraging their comprehensive service offerings and innovative strategies to adapt to market dynamics and regulatory environments, underscoring their pivotal roles in the growth of the global investment banking market.

Top Key Players in the Market

- JPMorgan Chase & Co.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Bank of America Corporation

- HSBC Holdings plc

- Citigroup Inc.

- Credit Suisse Group

- Barclays PLC

- Deutsche Bank AG

- BNP Paribas

- Wells Fargo

- Nomura Holdings, Inc.

- UBS Group AG

- Other Key Players

Recent Developments

- In September 2023, Bank of America Corporation Announced a significant acquisition, boosting its asset management portfolio by 15%.

- In October 2023, HSBC Holdings plc, Launched a new digital investment platform aimed at expanding its customer base by 20% annually.

- In August 2023, Citigroup Inc., Secured $500 million in funding to enhance its technological capabilities in financial services.

Report Scope

Report Features Description Market Value (2023) USD 121.5 Billion Forecast Revenue (2033) USD 318.0 Billion CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type(Mergers and Acquisitions (M&A) Advisory, Debt Capital Markets, Equity Capital Markets, Syndicated Loans, Other Service Types), By End-User(Corporate Clients, Institutional Investors, Government and Public Sector, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape JPMorgan Chase & Co., Goldman Sachs Group, Inc., Morgan Stanley, Bank of America Corporation, HSBC Holdings plc, Citigroup Inc., Credit Suisse Group, Barclays PLC, Deutsche Bank AG, BNP Paribas, Wells Fargo, Nomura Holdings, Inc., UBS Group AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Investment Banking?Investment banking refers to a specific division of banking related to the creation of capital for other companies, governments, and other entities. Investment bankers assist in underwriting new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private investors. They also provide guidance to issuers regarding the issue and placement of stock.

How big is Investment Banking Market?The Global Investment Banking Market size is expected to be worth around USD 318.0 Billion By 2033, from USD 121.5 Billion in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Investment Banking Market?Global economic growth, technological advancements, complex regulations, and increasing wealth management needs, along with digitalization, drive the expansion and transformation of the investment banking market.

What are the emerging trends and advancements in the Investment Banking Market?Investment banking is embracing digitalization, sustainability, and fintech innovations to improve efficiency, attract modern clients, and stay competitive in a rapidly evolving market.

What are the major challenges and opportunities in the Investment Banking Market?Investment banking is set for growth with opportunities in M&As, IPOs, and sustainable finance, but faces challenges from regulations, market volatility, fintech competition, and reputational risks.

Who are the leading players in the Investment Banking Market?JPMorgan Chase & Co., Goldman Sachs Group, Inc., Morgan Stanley, Bank of America Corporation, HSBC Holdings plc, Citigroup Inc., Credit Suisse Group, Barclays PLC, Deutsche Bank AG, BNP Paribas, Wells Fargo, Nomura Holdings, Inc., UBS Group AG, Other Key Players

Investment Banking MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Investment Banking MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- JPMorgan Chase & Co.

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Bank of America Corporation

- HSBC Holdings plc

- Citigroup Inc.

- Credit Suisse Group

- Barclays PLC

- Deutsche Bank AG

- BNP Paribas

- Wells Fargo

- Nomura Holdings, Inc.

- UBS Group AG

- Other Key Players