Global Intraocular Lens Market By Type (Monofocal Intraocular Lens, Multifocal Intraocular Lens, Toric Intraocular Lens, Accomodative Intraocular Lens) By Material (Polymethylmethacrylate, Silicone, Hydrophobic and Hydrophilic Acrylic Materials, and Other Materials) By End-Users (Hospitals, Opthalmology Clinics, Eye Research Institutes, Ambulatory Surgery Centers, and Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 16555

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

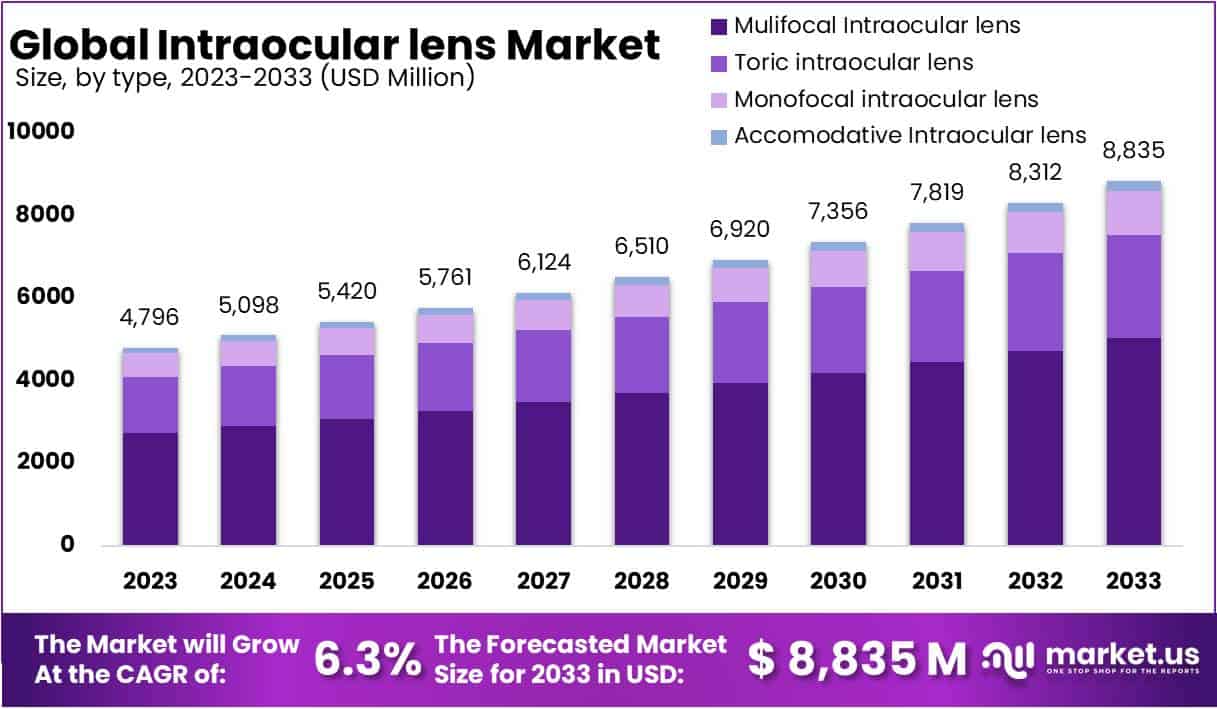

The Global Intraocular Lens Market size is expected to be worth around USD 8835 Million by 2033, from USD 4796 Million in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

An intraocular lens (IOL), is an artificial lens that is implanted into the eye after cataract or glaucoma surgery. These procedures have seen a rise in demand due to the increasing prevalence of cataracts. This is accompanied by new product launches that are contributing to market growth.

More patients are undergoing cataract surgery due to rising government support and favorable reimbursement policies. These factors have fueled the popularity of these products. Market growth is expected to be driven by rising initiatives to reduce the backlog in cataract surgeries and an increase in eye care awareness among the general population during the forecast period.

Key Takeaways

- Market Growth Projection: The Global Intraocular Lens Market is forecasted to reach USD 8,835 Million by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

- Type Dominance: In 2023, Multifocal Intraocular Lenses secured a leading market share at 56.9%, addressing complex retinal issues effectively.

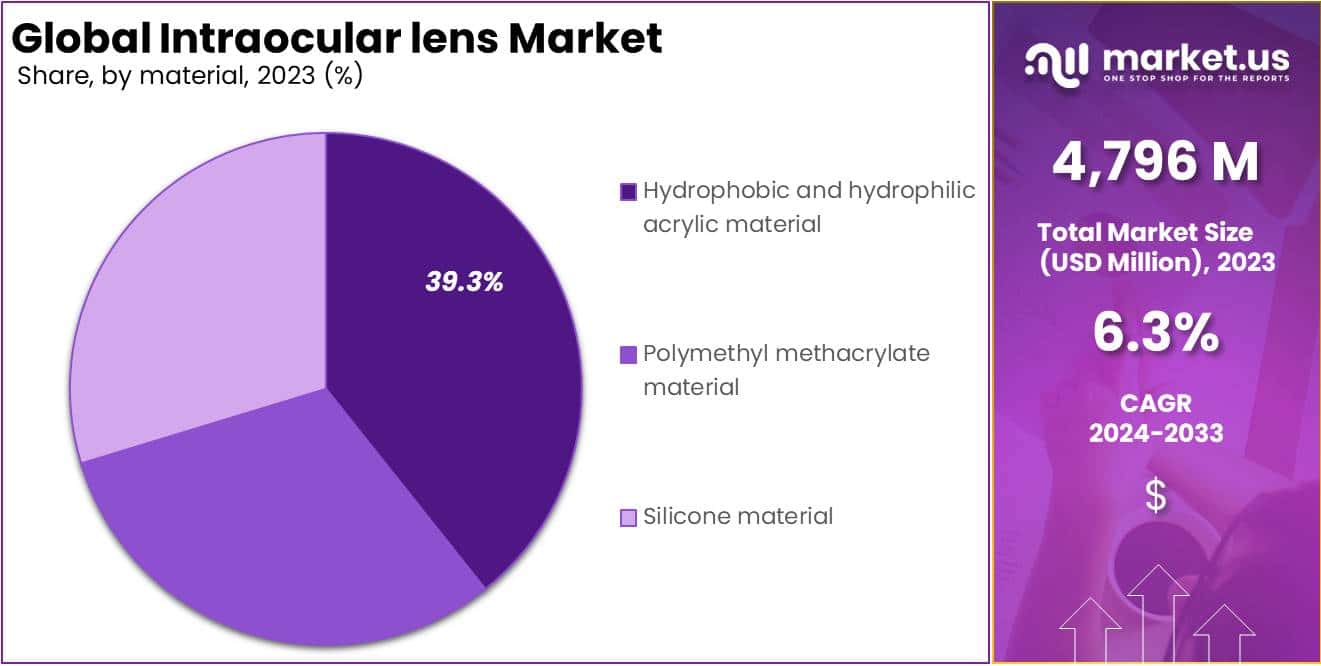

- Material Preference: Hydrophobic intraocular lens material captured 39.3% market share in 2023, favored for its high refractive index and ease of insertion.

- End-User Leadership: Hospitals dominated the market in 2023 with a 55.7% share, driven by a high volume of vision and cataract surgeries.

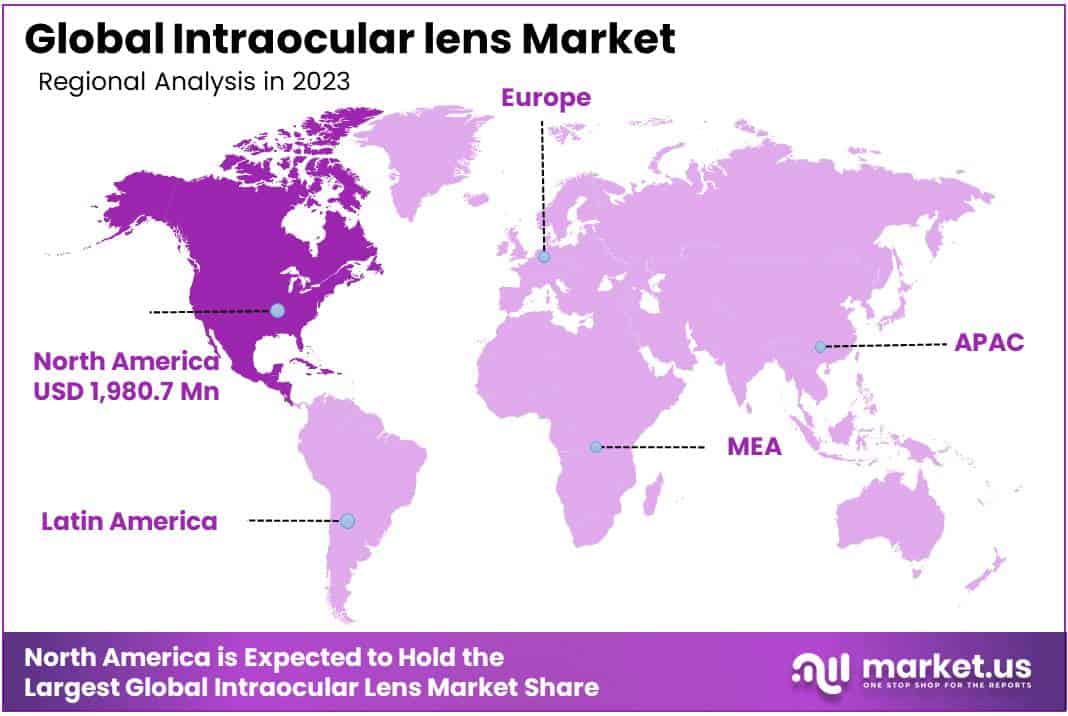

- North American Market Dominance: In 2023, North America held a market share of 41.3%, leading due to high demand for innovative products and favorable insurance policies.

Type Analysis

In 2023, Multifocal Intraocular Lens segment held a dominant market position, capturing more than a 56.9% share.

Based on lens type, the market is segmented into mono-focal intraocular lens, multifocal intraocular lens, toric intraocular lens, and accommodative intraocular lens. Multifocal intraocular lens proves to be effective in treating complex retinal problems and patients with multiple retinal issues. The vision zones present in this lens allow patients to see at different distances, with higher precision and better accuracy than traditional mono-focal lenses.

The toric intraocular lenses segment was the second largest segment. It is expected to grow rapidly over the forecast period because it is particularly beneficial for patients with moderate or high astigmatism. Astigmatic patients may have hypermetropia, myopia, or both. These patients can be treated with toric intraocular lenses that are specifically designed for them. Toric IOLs can also be used to treat astigmatism by eliminating the need for incision implants, which is why they are becoming more popular.

Material Analysis

In 2023, Hydrophobic segment held a dominant market position, capturing more than a 39.3% share.

Based on Material, the Global intraocular lens market is segmented into polymethylmethacrylate, silicone, hydrophobic and hydrophilic acrylic materials, and other materials. Because of its high refractive index, low water content, and preference, the hydrophobic segment holds the majority of the intraocular lens market share. The products made of foldable material are easier to insert and can be used more frequently in cataract surgery. IntechOpen published a research article that stated that hydrophobic acrylic products were the most popular intraocular lenses.

These factors were key to the growth of this segment. During the forecast period, it is anticipated that the polymethylmethacrylate (PMMA) segment will hold the second-largest market share. The first material that was used to make intraocular lenses was PMMA. It has a significant cost advantage over acrylic products, which is why it is used extensively all over the world, including in Europe. PMMA’s cost-effectiveness is expected to stimulate segment growth during the forecast period.

End-User Analysis

In 2023, Hospitals segment held a dominant market position, capturing more than a 55.7% share.

Based on end-user, the market is segmented into hospitals, ophthalmology clinics, eye research institutes, ambulatory surgery centers, and other end-users. With a market share of more than 50.0%, the hospital segment was the dominant segment in the market. This is due to the large number of vision and cataract surgeries performed in hospitals. Individual ophthalmic clinics are increasing in developing countries. These clinics do not have any affiliation with hospitals. The competition between service providers will increase due to the rise in eye care professionals and clinics.

These clinics are expected to offer services at affordable prices, which will fuel the growth of the segment. Research in the ophthalmic field has been a focus of both government and non-government agencies in recent years. This is done with the goal of developing technologically advanced products such as intraocular lenses that can better serve the needs and wants of patients. The rising investment in intraocular lens research and development is expected to increase the demand for intraocular lens research in academic and research institutes.

Key Market Segments

Based on Type

- Monofocal Intraocular Lens

- Multifocal Intraocular Lens

- Toric Intraocular Lens

- Accommodative Intraocular Lens

By Material

- Polymethylmethacrylate

- Silicone

- Hydrophobic and Hydrophilic Acrylic Materials

- Other Materials

By End-Users

- Hospitals

- Ophthalmology Clinics

- Eye Research Institutes

- Ambulatory Surgery Centers

- Other End-Users

Drivers

Increase in the Number of Cataract Surgeries to Drive Market Growth in the Forecast Period

Cataract surgery is one of the most popular ophthalmic procedures. Cataract surgery is becoming more popular due to the increasing prevalence of cataracts worldwide and associated visual impairments. According to Cataract Refractive Surgery Today, (CRST), more than 20.0 million cataract procedures were performed worldwide.

Over the forecast period, the number of cataract surgeries is expected to rise. The increasing prevalence of blindness and cataracts also drives market growth. Association for Research in Vision and Ophthalmology estimates that 15.2 million people over the age of 50 were going blind and another 78.8 million had cataracts. This is expected to boost the market’s growth over the forecast period.

Launch of Several Government Initiatives for Cataract Elimination to Surge Product Demand

In many countries, the rising incidence of cataracts is a major healthcare and economic burden. This has led to several government initiatives for eliminating cataracts. Vision 2020, a global initiative by the International Agency for the Prevention of Blindness, is designed to eradicate the most serious causes of blindness in the world. Vision 2020 requires the active participation of 53 countries in order to achieve the Vision 2020 target through favorable reimbursement policies, eye check camps, and other measures. These initiatives will be a strong driver of global market growth over the forecast period.

Restraints

Lack of Reimbursement Policies for Premium Products in Various Countries Hinder Growth Prospects

Globally, there is still a great need for cataract procedures. However, a major hindrance to market growth is the absence of reimbursement policies for premium products, particularly in emerging countries. These premium products can be used for conditions such as astigmatism, nearsightedness or farsightedness, cloudy vision, age-related vision loss, and nearsightedness. Despite many benefits, this market is limited by the inability to reimburse for these products.

In addition, there are numerous inadequate reimbursement policies, and a significant amount of the population, both in developed and developing nations, is unaware of these premium product options. In 2022, an article published by the Byrd & Wyandotte Eye Clinic in the United States stated that multifocal and toric lenses are regarded as premium IOLs and may not be covered by insurance. These things make it harder for people to use these products, which slows down the growth of the market.

Opportunity

A new era in cataract surgery has been established thanks to the untapped market and advances in intraocular lens technology and phacoemulsification. For example, in November 2017, the US Food and Drug Administration (USFDA) approved RxSight Inc. This light-adjustable lens and light delivery device are suitable for patients who have pre-existing astigmatism greater than 0.75 diopters and are undergoing cataract surgery. It also allows post-operative adjustment to correct uncorrected visual acuity.

Trends

New Product Approvals for Extended Depth of Focus Products to Propel Market Growth

The global market has seen many technologically advanced products in recent years. These products are in high demand due to the increasing prevalence of cataracts. In July 2016, the FDA approved the extended depth of focus products for the first time. Many players are constantly working to expand their product range to meet global patient demand. Alcon Inc. and J&J, for example, launched expanded depths of focus products in 2020.

Numerous advanced studies are also being conducted to examine the potential benefits of these new technologies. According to a continuing study published by ClinicalTrails.gov (U.S. National Library of Medicine), SightMD, a U.S.-based company, sponsored a study to assess the effects of a novel extended focus IOL on lifestyle and visual enhancement. These key trends will be a significant contributor to the growth of the global intraocular lens market.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 41.3% share and holding USD 1980.7 Million market value for the year.

Over the forecast period, it is anticipated that the North American region will dominate the global market. The high demand for innovative products like custom-made cataract lenses, their rapid adoption, and favorable insurance policies are the reasons for the region’s market dominance. Regulators also approve these innovative products, which helps the region’s growth prospects in the future.

The European market will be the second largest. This is because the use of femtosecond lasers to cut through both hydrophilic and hydrophobic acrylic lenses during cataract surgery is on the rise. Toric lenses have also become increasingly popular. The European population over the age of 70 is thought to have a 64.0% prevalence of cataracts, according to the National Institutes of Health (NIH).

This rate rises with age, with Germany’s rate being higher than Italy’s. The expanding number of patients is contributing to the flourishing global market. During the forecast period, it is anticipated that the intraocular lens market insights in Asia-Pacific will expand significantly. Since older people are more likely to develop cataracts, the region’s growing geriatric population is a common factor in the overall prevalence of cataracts.

Furthermore, the growing public awareness of cataracts and glaucoma surgery bodes well for the market in Latin America. Due to a lack of public awareness and reimbursement policies in the developing countries of these regions, it is anticipated that the Middle East and Africa will grow at a slower rate.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several Intraocular lens market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the bio-based disinfectants market are developing new products and portfolio expansion strategies through investments and mergers, and acquisitions. In addition, several key players are now focusing on different marketing strategies, such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Market Key Players

With the presence of many local and regional players, the intraocular lens market is fragmented. The market is likely to witness high growth due to the rise in the number of cataract surgeries. However, partnerships and product launches are expected to contribute to the market growth.

- Appasamy Associates

- Aurolab

- Care Group Sight Solution Pvt. Ltd.

- Carl Zeiss Meditec AG

- Dahlgren India

- Global Ophthalmic Pvt. Ltd.

- Johnson and Johnson Vision Care, Inc.

- NanoVision

- Omni Lens Pvt Ltd

- Truviz Ophthalmic

- Bausch & Lomb Incorporated

- Alcon, Inc.

- EyeKon Medical, Inc.

- Lenstec, Inc.

- HumanOptics AG

- STAAR Surgical Company

- HOYA CORPORATION

- Other Key Players

Recent Developments

- In December 2023, HOYA CORPORATION made strides by announcing a collaborative effort with the Indian Institute of Technology Delhi. This partnership aims to develop novel materials and technologies for intraocular lenses (IOLs), showcasing a commitment to advancing eye care solutions.

- In November 2023, Johnson & Johnson Vision Care, Inc. introduced the Tecnis Symfony IOL, a cutting-edge presbyopia-correcting intraocular lens (IOL) featuring “NaturalVue” technology. This innovation aims to enhance image quality and minimize halos for an improved visual experience.

- In October 2023, Alcon, Inc. achieved a milestone by securing FDA approval for the AcrySof IQ Vivity IOL. This presbyopia-correcting IOL is specifically designed to offer patients clear vision at near, intermediate, and distance ranges without the need for glasses.

Report Scope

Report Features Description Market Value (2023) US$ 4,796 Mn Forecast Revenue (2033) US$ 8,835 Mn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Monofocal Intraocular Lens, Multifocal Intraocular Lens, Toric Intraocular Lens, Accomodative Intraocular Lens; By Material- Polymethylmethacrylate, Silicone, Hydrophobic and Hydrophilic Acrylic Materials, and Other Materials; By End-Users- Hospitals, Opthalmology Clinics, Eye Research Institutes, Ambulatory Surgery Centers, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Appasamy Associates, Aurolab, Care Group Sight Solution Pvt. Ltd., Carl Zeiss Meditec AG, Dahlgren India, Global Ophthalmic Pvt. Ltd., Johnson and Johnson Vision Care Inc., NanoVision, Omni Lens Pvt Ltd, Truviz Ophthalmic, Bausch & Lomb Incorporated, Alcon Inc., EyeKon Medical Inc., Lenstec Inc., HumanOptics AG, STAAR Surgical Company, HOYA CORPORATION, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Appasamy Associates

- Aurolab

- Care Group Sight Solution Pvt. Ltd.

- Carl Zeiss Meditec AG

- Dahlgren India

- Global Ophthalmic Pvt. Ltd.

- Johnson and Johnson Vision Care, Inc.

- NanoVision

- Omni Lens Pvt Ltd

- Truviz Ophthalmic

- Bausch & Lomb Incorporated

- Alcon, Inc.

- EyeKon Medical, Inc.

- Lenstec, Inc.

- HumanOptics AG

- STAAR Surgical Company

- HOYA CORPORATION

- Other Key Players