Global Intralogistics Market Market Size, Share, Growth Analysis By Component (Hardware, Software, Services), By Automation Level (Manual, Semi-automatic, Fully automatic), By End Use (Food & Beverage, Automotive, Manufacturing, Pharmaceuticals, Electronics, Healthcare, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167554

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

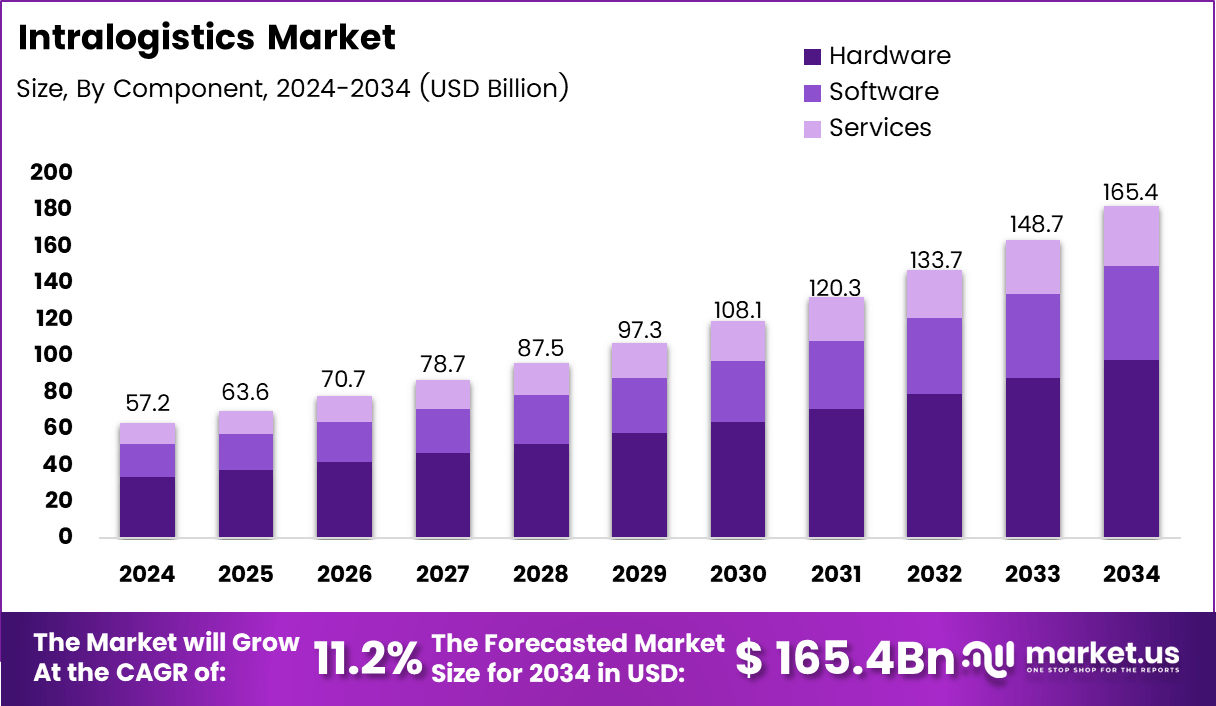

The Global Intralogistics Market size is expected to be worth around USD 165.4 Billion by 2034, from USD 57.2 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

The intralogistics market represents integrated material-flow systems that streamline storage, movement, and coordination within manufacturing and distribution facilities. It includes warehouse automation, conveyors, robotics, digital inventory control, and smart handling solutions that enhance operational continuity. It enables companies to reduce errors, accelerate throughput, and maintain real-time visibility across high-volume supply environments.

The market continues expanding as enterprises modernize logistics infrastructure and shift from manual handling toward advanced warehouse automation. Moreover, rising e-commerce penetration drives demand for high-speed order-processing systems that maintain accuracy under peak loads. Companies upgrade to intelligent intralogistics platforms to lower inefficiencies, optimize workforce utilization, and sustain fulfillment performance during volatile demand cycles.

Growth prospects remain strong because manufacturers increasingly adopt robotics, IoT tracking, and AI-based orchestration systems to enhance material-flow efficiency. Additionally, governments invest in logistics modernization programs that widen opportunities for technology-driven solutions. Policy support for industrial corridors, multimodal transport, and digital warehousing continues to accelerate technology adoption across regional manufacturing clusters.

Furthermore, regulatory emphasis on workplace safety, traceability, and energy-efficient operations strengthens the adoption of structured intralogistics ecosystems. Companies integrate automated systems to comply with safety standards, minimize occupational risks, and maintain operational continuity. As industries transition toward sustainable operations, energy-optimized storage and automated material-handling gain strategic importance for long-term efficiency plans.

Toward a statistical view, national and regional cost gaps highlight the urgency for intralogistics upgrades. According to the Government of India, logistics costs account for more than 14% of the GDP, whereas Europe and Japan operate at 10–11%. This wide gap encourages investments in warehouse automation and intralogistics optimization across domestic industries.

Additionally, Smart warehousing expansion demonstrates strong adoption momentum. According to the survey, the number of warehousing and storage businesses increased from 15,152 in 2010 to 19,190 in 2020. This consistent rise reinforces the long-term opportunity for intralogistics systems, especially as companies scale distribution footprints, expand storage capacity, and modernize fulfillment processes.

Key Takeaways

- The Global Intralogistics Market is projected to reach USD 165.4 Billion by 2034, rising from USD 57.2 Billion in 2024 at a strong 11.2% CAGR.

- Hardware remains the leading component with a dominant share of 59.3% supported by growing automation infrastructure.

- Semi-automatic systems account for the highest automation adoption with a 49.9% share in 2024.

- Food & Beverage emerges as the largest end-use segment with a commanding 27.4% share.

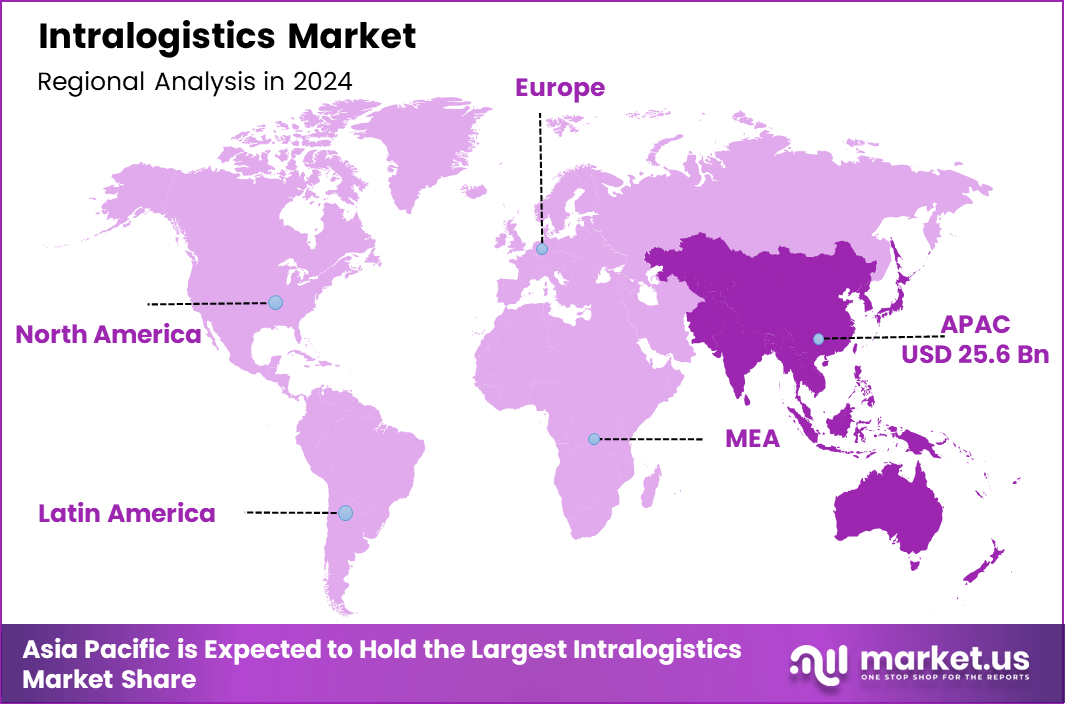

- APAC leads the global market with a substantial 44.8% share valued at USD 25.6 Billion.

By Component Analysis

Hardware dominates with 59.3% due to its high usage in automated storage, conveyors, and robotics.

In 2024, Hardware held a dominant market position in the By Component segment of the Intralogistics Market, with a 59.3% share. Increasing warehouse automation and the need for reliable material-handling equipment continue to strengthen hardware demand. Companies invest heavily in sensors, conveyors, and robotic modules to enhance operational speed.

Software adoption grows steadily as organizations transition to digital warehouse ecosystems. Additionally, integrated WMS, AI-based flow optimization, and real-time tracking platforms support accuracy and reduce manual errors. Industries increasingly favor data-driven decisions, boosting software deployment across mid-sized and large logistics environments.

Services expand as enterprises adopt maintenance, installation, and system-integration support for complex intralogistics setups. Furthermore, rising equipment sophistication pushes companies to depend on specialized service providers. Consulting, system upgrades, and lifecycle management remain essential to maximizing automation performance across multichannel distribution networks.

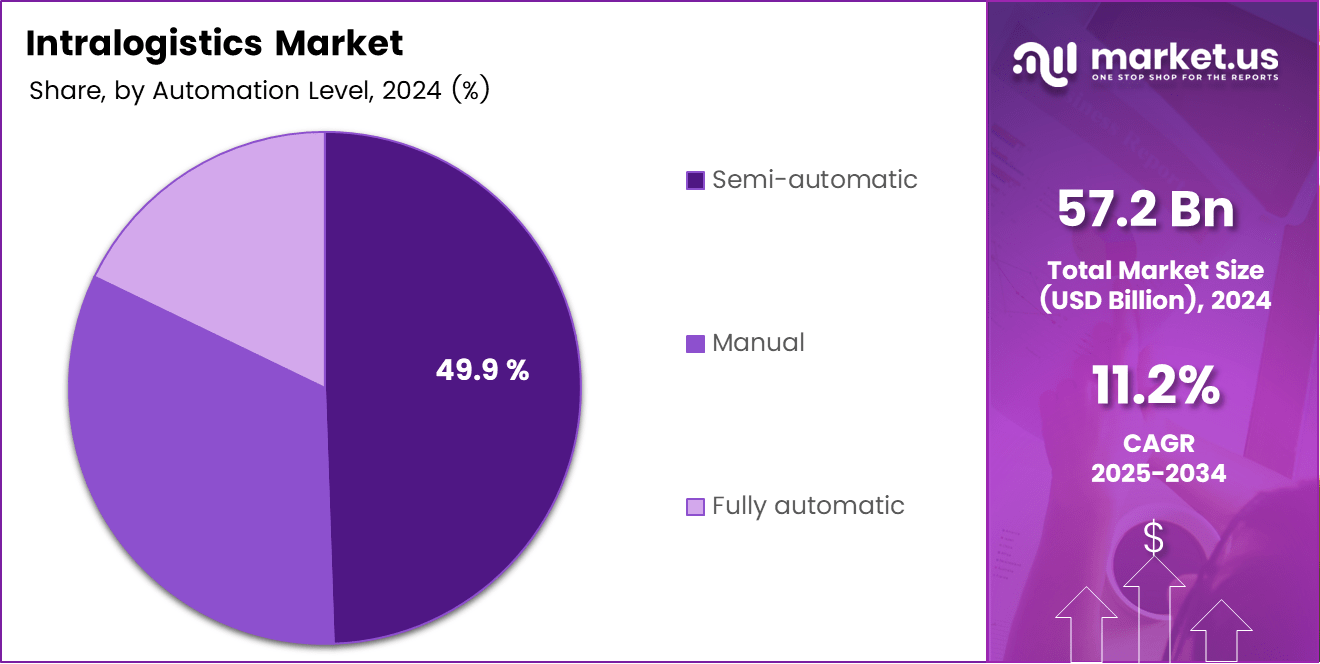

By Automation Level Analysis

Semi-automatic systems dominate with 49.9% due to balanced cost and automation efficiency.

In 2024, Semi-automatic systems held a dominant market position in the By Automation Level segment of the Intralogistics market, with a 49.9% share. Industries choose these systems for flexible operation, moderate investment, and smooth integration. They support faster throughput while retaining human oversight during complex material-flow tasks.

Manual systems remain relevant in small warehouses and low-volume production sites. They offer lower upfront costs and flexible handling for diverse product categories. However, industries gradually transition toward structured intralogistics frameworks as manual workflows restrict speed and increase operational inconsistencies.

Fully automatic systems continue gaining traction across large distribution centers. Companies invest in robotics, autonomous vehicles, and advanced sorting technologies to reach higher accuracy and 24/7 operations. Adoption increases where labor shortages and rising throughput demand strengthen the business case for complete automation.

By End Use Analysis

Food & Beverage dominates with 27.4% due to high-volume, time-sensitive supply chains.

In 2024, Food & Beverage held a dominant market position in the By End Use segment of the Intralogistics Market, with a 27.4% share. This sector depends on automated systems to maintain product freshness, accelerate order cycles, and ensure strict regulatory compliance across temperature-controlled environments.

Automotive operations increasingly adopt intralogistics solutions to manage complex parts flow. High model variability and just-in-time production cycles push manufacturers to integrate automated storage, robotic handling, and synchronized line-feeding systems for better workflow precision.

Manufacturing facilities expand intralogistics adoption to boost assembly efficiency and reduce downtime. Digital inventory control, automated retrieval, and streamlined movement processes help maintain stable production output. These technologies support scalable operations across diverse industrial environments.

Pharmaceuticals use structured intralogistics frameworks to maintain traceability, protect sensitive products, and ensure regulatory compliance. Electronics, Healthcare, Consumer Goods, and Others follow similar adoption patterns as companies seek faster fulfillment, reduced errors, and enhanced operational transparency.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Automation Level

- Manual

- Semi-automatic

- Fully automatic

By End Use

- Food & Beverage

- Automotive

- Manufacturing

- Pharmaceuticals

- Electronics

- Healthcare

- Consumer Goods

- Others

Drivers

Surge in Warehouse Automation Adoption Across E-commerce and Retail Fulfillment Drives Market Growth

The intralogistics market grows rapidly as companies accelerate warehouse automation to handle rising e-commerce volumes. Businesses want faster picking, smoother order flow, and fewer manual errors. As online retail expands globally, organizations invest in automated systems to stabilize operations during fluctuating demand cycles and high seasonal order peaks.

Real-time inventory visibility further strengthens market growth because companies now require synchronized data to improve decision-making. Accurate stock tracking reduces delays, prevents overstocking, and supports higher fulfillment accuracy. With increasing customer expectations for quick delivery, integrated digital tools become essential for responsive and connected warehouse operations.

Global manufacturing expansion also fuels the need for optimized material flow. Firms building new plants prefer structured intralogistics systems to manage parts movement, maintain continuity, and reduce floor inefficiencies. Automated storage and transport tools help improve production flow and support large-scale industrial growth across developing regions.

Additionally, the integration of robotics reshapes high-speed picking and pallet-handling operations. Robots help reduce human fatigue, improve workplace safety, and maintain consistent throughput. Industries that manage repetitive or weight-heavy tasks increasingly adopt robotic systems to strengthen workflow efficiency and ensure long-term operational stability.

Restraints

High Upfront Capital Investment for AS/RS, Conveyors, and Autonomous Fleets

High upfront investment for AS/RS, conveyors, and autonomous fleets acts as a major restraint in the Container Depot Services Market. Many depot operators work on fixed budgets, and the cost of automating storage, retrieval, and yard-handling functions is expected to remain high. This slows adoption, especially for small and medium depots that cannot allocate large capital budgets at once.

Limited availability of skilled technicians to manage advanced intralogistics systems further restricts growth. Modern depots need trained personnel who understand automated equipment, remote monitoring tools, and software-driven workflows. The shortage of such specialists increases operational dependence on external service providers and raises maintenance costs.

Integration challenges with legacy IT, WMS, and ERP infrastructures create additional restraints for depot automation. Many existing systems are outdated or incompatible with new digital tools. Upgrading them requires time, coordination, and investment. These gaps create delays in workflow optimization and slow down digital transformation across depot networks.

Downtime risks and operational disruptions during automation upgrades also limit market progress. Container depots handle continuous cargo flow, and any technology installation that stops operations can cause financial loss. As a result, many operators postpone automation phases to avoid disruption, slowing adoption of advanced container handling and storage systems.

Growth Factors

Increasing Deployment of AI-Enabled AMRs Creates Strong Growth Opportunities

AI-enabled autonomous mobile robots create significant opportunities as more mid-sized warehouses shift to compact automation. These robots improve navigation, reduce manual transport tasks, and optimize picking cycles. Their flexible deployment model helps businesses automate gradually without redesigning the entire warehouse layout, making them attractive for growth-oriented facilities.

Digital twins also offer new value by allowing companies to simulate layouts and optimize throughput before investing. This reduces design errors and helps predict bottlenecks. Manufacturers use these simulations to plan high-demand periods, improve layout accuracy, and support long-term intralogistics modernization strategies.

Energy-efficient intralogistics systems further expand opportunities. Smart power-management tools reduce operational energy use, support sustainability targets, and lower equipment running costs. Companies adopt energy-optimized conveyors, motors, and automated storage systems as part of their environmental goals and cost-control strategies.

Flexible and modular automation systems open additional potential across industries. These plug-and-play solutions allow companies to scale automation in stages, adjust workflows quickly, and support diverse product categories. This versatility drives adoption across food, automotive, pharmaceutical, and consumer-goods industries.

Emerging Trends

Rise of 5G-Enabled Connected Logistics Accelerates Market Trends

The rise of 5G-enabled connected logistics significantly shapes intralogistics trends. Faster connectivity improves machine communication, supports real-time analytics, and enhances sensor-based decision-making. Smart warehouses use 5G networks to streamline mobile robots, automated vehicles, and GPS tracking devices, enabling more responsive and accurate material-movement processes.

Human-robot collaboration is another key trend driving transformation. Workers and robots increasingly share tasks to improve safety and efficiency. Collaborative systems reduce physical strain on workers, minimize error rates, and enhance operational continuity. This blended workflow supports a more sustainable model for future warehouse operations.

Sensor-rich environments continue gaining momentum as companies adopt IoT-enabled monitoring tools. These environments help improve accuracy in picking, packing, and quality control. Advanced sensors ensure stronger tracking and reduce losses caused by misplaced inventory or damaged goods, improving overall warehouse performance.

These trends collectively reflect the industry’s move toward more intelligent, connected, and worker-friendly material-handling systems. The combination of automation, connectivity, and human-robot workflows sets a strong foundation for the next phase of intralogistics modernization.

Regional Analysis

APAC Dominates the Intralogistics Market with a Market Share of 44.8%, Valued at USD 25.6 Billion

The Asia Pacific region leads the intralogistics market due to rapid industrial expansion, strong e-commerce adoption, and rising warehouse automation investments. The region benefits from large manufacturing clusters that rely on automated material flow for operational stability. With a dominant 44.8% share and a valuation of USD 25.6 billion, APAC continues to accelerate modernization across fulfillment networks.

North America Intralogistics Market Trends

North America observes strong adoption of robotics and high-end warehouse automation driven by the advanced retail and logistics sectors. Industries prioritize real-time visibility and data-driven operations across large distribution hubs. Growing emphasis on labor productivity and connected logistics ecosystems further supports intralogistics expansion across the United States and Canada.

Europe Intralogistics Market Trends

Europe progresses steadily as businesses integrate sustainable automation, energy-efficient systems, and digital warehousing solutions. The region benefits from regulatory support for safe material handling and increased funding for smart manufacturing. High adoption of AGVs, AS/RS, and IoT-enabled logistics infrastructure strengthens Europe’s position in the global intralogistics space.

Middle East & Africa Intralogistics Market Trends

The Middle East and Africa region experiences rising modernization as governments invest in logistics infrastructure, free trade zones, and industrial diversification. Automation uptake grows among new warehouses designed for temperature-controlled, high-volume operations. Emerging digital transformation programs gradually encourage structured intralogistics adoption.

Latin America Intralogistics Market Trends

Latin America continues improving intralogistics adoption as regional manufacturers upgrade facilities to handle increasing production loads. Growing e-commerce penetration accelerates the need for faster picking, sorting, and fulfillment systems. Governments supporting industrial expansion and warehousing development contribute to gradual automation growth across the region.

United States Intralogistics Market Trends

The United States demonstrates strong momentum as companies deploy robotics, autonomous systems, and advanced warehouse management platforms. Expanding distribution hubs, large retail networks, and high consumer demand drive ongoing investments. The country also benefits from mature digital infrastructure supporting real-time data synchronization and connected supply-chain operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Intralogistics Market Company Insights

The global Intralogistics Market in 2024 is shaped by the strategic advancements and operational strengths of major industry participants. Daifuku Co., Ltd. remains an influential force, supported by its deep expertise in large-scale automation deployments. The company continues to help modernize global warehousing by providing highly scalable material-handling systems that align with rising e-commerce and high-throughput environments.

Dematic strengthens the market landscape by offering integrated software-driven automation solutions that enhance speed, accuracy, and order-flow efficiency. Its focus on intelligent robotics, real-time monitoring, and modular system design allows enterprises to adapt quickly to operational variability and peak-volume challenges.

SSI SCHÄFER drives innovation through its strong portfolio of storage, retrieval, and logistics software platforms. The company’s emphasis on sustainable intralogistics, ergonomic handling, and end-to-end system integration contributes to the growing demand for smart, energy-efficient warehouses across multiple industries.

Swisslog Holding AG plays a key role by advancing robotic automation and data-driven warehouse technologies. The company delivers flexible, high-performance intralogistics systems that support faster picking cycles and robust inventory visibility, enabling facilities to achieve greater efficiency within evolving fulfillment networks.

BEUMER Group adds value through its engineering expertise and resilient material-handling infrastructure suited for high-volume, mission-critical environments. Jungheinrich AG enhances the adoption of electric handling equipment and automated storage solutions, supporting the industry’s shift toward optimized warehouse mobility.

KION GROUP AG advances automated forklift and AGV integration, reinforcing safe material flow. Godrej Enterprises contributes to emerging-market automation growth. HÖRMANN supports industrial logistics modernization through integrated systems, while DLL facilitates equipment financing that enables broader automation adoption.

Top Key Players in the Market

- Daifuku Co., Ltd.

- Dematic

- SSI SCHÄFER

- Swisslog Holding AG

- BEUMER Group

- Jungheinrich AG

- KION GROUP AG

- Godrej Enterprises

- HÖRMANN

- DLL

Recent Developments

- In March 2025, Daifuku announced the acquisition of Swisslog’s European automation assets to extend its market presence. This step enabled Daifuku to strengthen its intralogistics portfolio and scale operations across key European distribution hubs.

- In October 2024, Nimble Robotics secured USD 106 million in Series C funding led by FedEx to deploy autonomous warehouse solutions. The investment supported the wider rollout of AI-powered robotic fulfillment systems across global distribution networks.

Report Scope

Report Features Description Market Value (2024) USD 57.2 Billion Forecast Revenue (2034) USD 165.4 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Automation Level (Manual, Semi-automatic, Fully automatic), By End Use (Food & Beverage, Automotive, Manufacturing, Pharmaceuticals, Electronics, Healthcare, Consumer Goods, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Daifuku Co., Ltd., Dematic, SSI SCHÄFER, Swisslog Holding AG, BEUMER Group, Jungheinrich AG, KION GROUP AG, Godrej Enterprises, HÖRMANN, DLL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daifuku Co., Ltd.

- Dematic

- SSI SCHÄFER

- Swisslog Holding AG

- BEUMER Group

- Jungheinrich AG

- KION GROUP AG

- Godrej Enterprises

- HÖRMANN

- DLL