Interventional Cardiology and Peripheral Vascular Devices Market Analysis By Product [Coronary Stents (Drug-eluting Stents, Bare Stents, Bioabsorbable Stents), Catheters (Angiography Catheters, Percutaneous Transluminal Coronary Angioplasty Guiding Catheters, Intravascular Ultrasound Catheters), Percutaneous Transluminal Coronary Angioplasty Guide Wires, Percutaneous Transluminal Coronary Angioplasty Balloons, Other Product Types], By Application (Congenital Heart Defect Correction, Angioplasty, Valvuloplasty, Percutaneous Valve Repair, Other Applications), By End-Use (Hospitals, Ambulatory Surgical Centers, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 33299

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

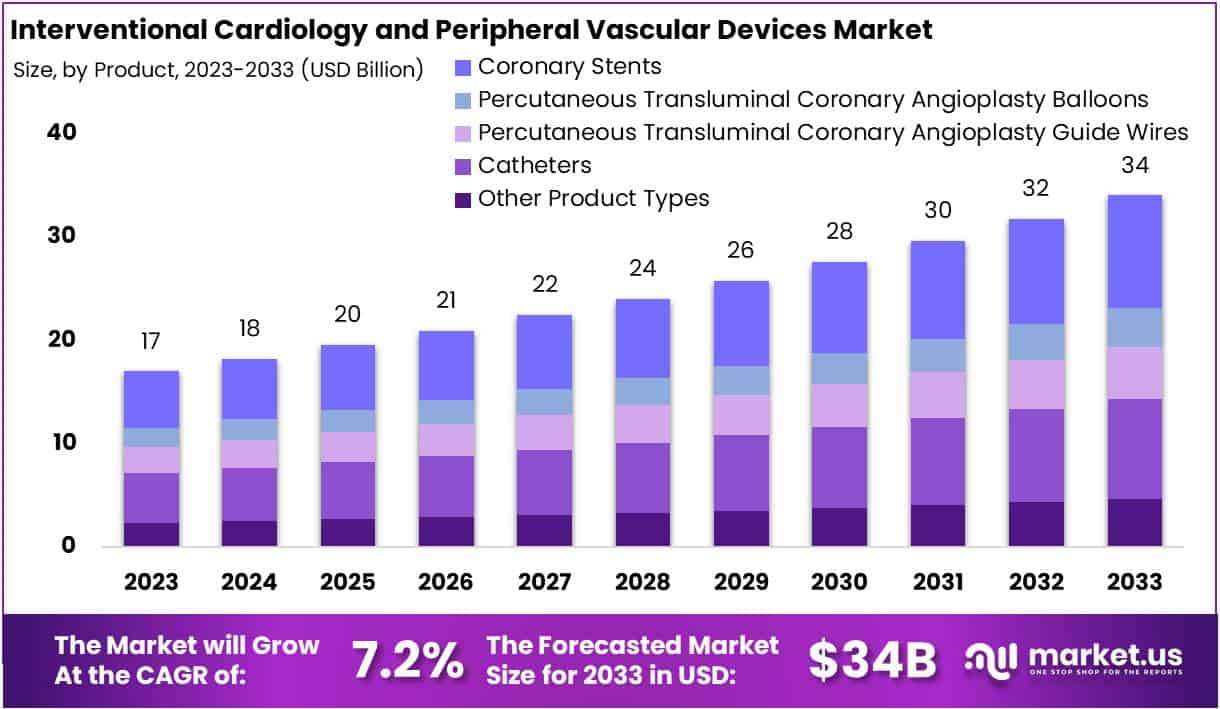

The Global Interventional Cardiology and Peripheral Vascular Devices Market size is expected to be worth around USD 34 Billion by 2033, from USD 17 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Interventional cardiology and peripheral vascular devices encompass an array of medical tools and procedures tailored to diagnose and manage cardiovascular conditions, focusing on the heart and the surrounding blood vessels. This specialized field integrates advanced medical devices with minimally invasive techniques, offering patients alternatives to traditional surgical interventions.

According to data from the World Health Organization, cardiovascular diseases are the leading cause of mortality worldwide, responsible for an estimated 17.9 million deaths annually. This alarming statistic underscores the urgency for effective treatment options and preventive measures.

The interventional cardiology and peripheral vascular devices market are experiencing significant growth, fueled by various factors. Demographic shifts, including aging populations, contribute to the rising incidence of cardiovascular diseases. For example, in the United States alone, the Centers for Disease Control and Prevention reported that approximately 18.2 million adults aged 20 and older have coronary artery disease.

Furthermore, lifestyle factors such as sedentary behaviors and poor dietary habits exacerbate the prevalence of these conditions, with studies showing that 1 in 3 adults worldwide have raised blood pressure, a major risk factor for heart disease.

Technological advancements are driving innovation within the market, with companies investing heavily in research and development. For instance, bioresorbable vascular scaffolds and transcatheter mitral valve replacement systems represent cutting-edge solutions aimed at enhancing patient outcomes and reducing procedural complexities.

Despite the market’s growth potential, regulatory challenges and reimbursement complexities pose significant barriers. Companies must navigate stringent regulatory frameworks and reimbursement policies to bring their products to market effectively. Additionally, competition among industry players intensifies as companies vie for market share and differentiation.

Key Takeaways

- Market size is projected at USD 34 billion by 2033, growing at 7.2% CAGR from 2024 to 2033.

- Coronary Stents dominate with 32% market share in 2023, crucial for treating cardiovascular conditions.

- Hospitals lead end-use, contributing over 42% market share in 2023, followed by Ambulatory Surgical Centers.

- Expanding geriatric population drives demand, as older adults are more susceptible to cardiovascular diseases.

- Stringent regulatory processes prolong product development, increasing costs and delaying market entry.

- Digital integration revolutionizes healthcare, with remote monitoring and AI algorithms enhancing patient care.

- North America holds 37% market share in 2023, driven by advanced healthcare infrastructure and favorable policies.

- Emerging markets offer growth opportunities, driven by economic progress and rising awareness of cardiovascular diseases.

- Congenital Heart Defect Correction leads application segments, showing increased demand for minimally invasive procedures.

- Innovations in interventional cardiology and peripheral vascular devices continue to improve patient outcomes and drive market growth.

Product Analysis

In 2023, the Interventional Cardiology and Peripheral Vascular Devices Market saw a significant dominance of the Coronary Stents segment, capturing over 32% of the market share. This underscores the crucial role these stents play in treating coronary artery disease by restoring blood flow and providing support to narrowed arteries. Within this segment, there are various types of coronary stents available to cater to specific patient needs, including Drug-eluting Stents, Bare Stents, and Bioabsorbable Stents.

Following closely behind is the Catheters category, which includes Angiography Catheters, PTCA Guiding Catheters, and IVUS Catheters. These catheters are essential for diagnostic imaging, guiding interventions, and delivering therapy during procedures, ensuring precise and effective treatments for cardiovascular conditions.

Additionally, PTCA Guide Wires and PTCA Balloons are significant segments within the market, aiding in navigating arterial pathways and dilating narrowed blood vessels, respectively. The market also encompasses various other product types aimed at addressing evolving clinical needs and advancing patient care in cardiovascular medicine.

As the market evolves due to technological advancements and demographic trends, stakeholders must stay abreast of emerging opportunities and challenges within each product segment to capitalize on growth prospects and deliver optimal patient outcomes.

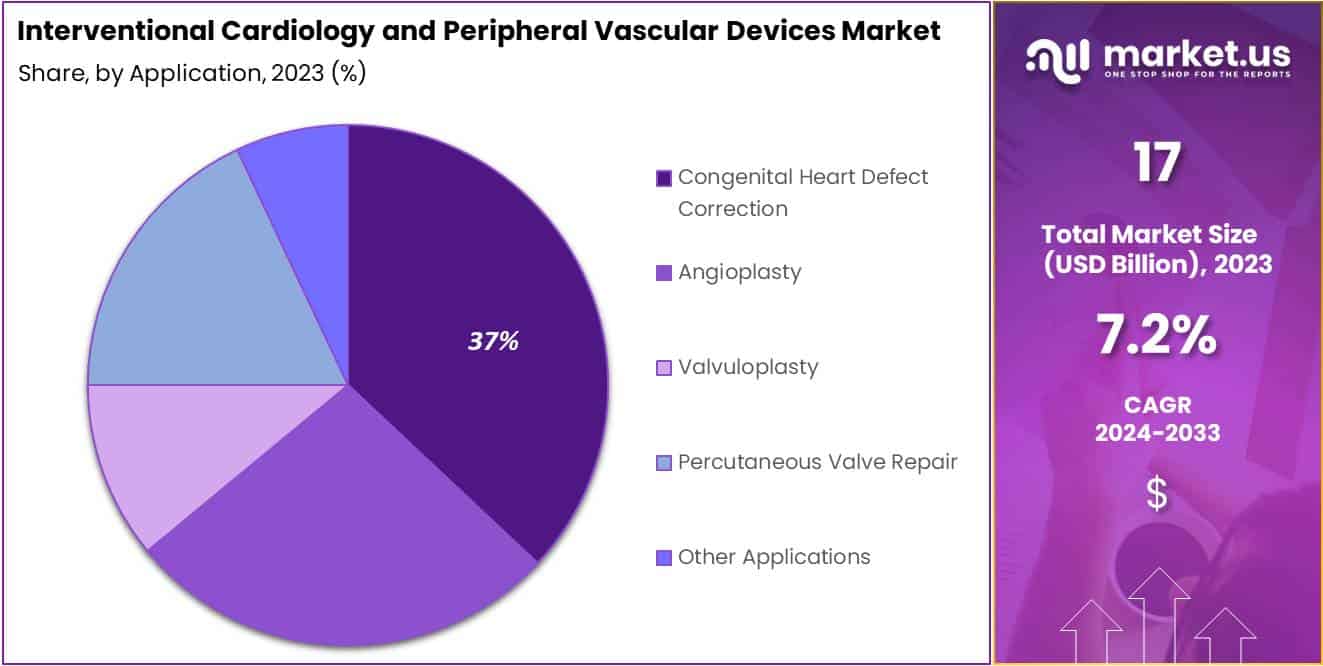

Application Analysis

In 2023, the Interventional Cardiology and Peripheral Vascular Devices Market saw significant growth, particularly in various application segments. One standout was the Congenital Heart Defect Correction segment, which dominated with over 37% market share. This was mainly due to the increasing prevalence of congenital heart diseases worldwide and the rising preference for minimally invasive correction procedures. Advancements in interventional cardiology techniques and devices further boosted the effectiveness and safety of these procedures, driving market growth.

Another noteworthy contributor was the Angioplasty segment, which experienced robust growth fueled by the rising incidence of cardiovascular diseases. Innovative devices and technologies facilitated minimally invasive treatments, attracting both patients and healthcare providers.

Similarly, the Valvuloplasty segment showed promise, thanks to the growing prevalence of valvular heart diseases, especially among the elderly population. Technological advancements in valvuloplasty devices and favorable reimbursement policies increased accessibility to these procedures.

The Percutaneous Valve Repair segment also emerged as a key segment, benefiting from the preference for minimally invasive valve repair procedures over traditional surgery. Adoption of transcatheter-based approaches and innovative devices improved patient outcomes and reduced procedural complexities.

Overall, the market saw dynamic growth across various applications, driven by evolving patient demographics and technological innovations. Continued investment in research and development, along with strategic collaborations, is expected to further drive market expansion and enhance patient outcomes in interventional cardiology and peripheral vascular interventions.

End-Use Analysis

In 2023, the Interventional Cardiology and Peripheral Vascular Devices Market saw the emergence of the Congenital Heart Defect Correction segment as the leader in the End-Use category, capturing over 42% of the market share. This indicates a significant demand for these devices within the healthcare sector, particularly for addressing congenital heart conditions.

Hospitals were the main drivers of demand for these devices, given their pivotal role in providing medical care. With their advanced infrastructure and technology, hospitals are crucial in delivering comprehensive healthcare services, thus fueling the demand for interventional cardiology and peripheral vascular devices.

Ambulatory Surgical Centers (ASCs) also contributed significantly to the market, offering specialized procedures and minimally invasive treatments for cardiovascular issues. Their popularity is attributed to factors like cost-effectiveness and patient preference for outpatient procedures.

Additionally, various other healthcare facilities, including specialty clinics and diagnostic centers, played a role in shaping niche markets for these devices, tailored to specific patient needs.

The market dynamics in each end-use segment are influenced by factors such as technological advancements, regulations, reimbursement policies, and evolving healthcare models. Understanding the unique needs of each segment is crucial for stakeholders to develop targeted strategies and seize opportunities in this dynamic market.

Key Market Segments

Product

- Coronary Stents

- Drug-eluting Stents

- Bare Stents

- Bioabsorbable Stents

- Catheters

- Angiography Catheters

- Percutaneous Transluminal Coronary Angioplasty Guiding Catheters

- Intravascular Ultrasound Catheters

- Percutaneous Transluminal Coronary Angioplasty Guide Wires

- Percutaneous Transluminal Coronary Angioplasty Balloons

- Other Product Types

Application

- Congenital Heart Defect Correction

- Angioplasty

- Valvuloplasty

- Percutaneous Valve Repair

- Other Applications

End-Use

- Hospitals

- Ambulatory Surgical Centers

- Other End-Uses

Drivers

Expanding Geriatric Population

The expanding geriatric population is a pivotal driver for the Global Interventional Cardiology and Peripheral Vascular Devices Market. According to the World Health Organization, the proportion of the world’s population over 60 years will nearly double from 12% to 22% between 2015 and 2050.

This demographic shift is critical because older adults are significantly more susceptible to cardiovascular diseases (CVDs), with risk factors such as hypertension, high cholesterol, and atherosclerosis becoming more prevalent with age. The aging process inherently increases the vulnerability to CVDs, necessitating increased cardiovascular interventions. As the elderly population grows, so does the demand for advanced interventional devices designed to address these complex medical needs efficiently.

This underscores the urgent need for innovative, minimally invasive devices that can offer older adults better treatment outcomes, driving sustained growth in the market for interventional cardiology and peripheral vascular devices. This demographic reality positions the expanding geriatric population not just as a statistical observation but as a catalyst for market expansion and technological innovation in the healthcare sector.

Restraints

Stringent Regulatory Approval Processes

The stringent regulatory approval processes for medical devices, particularly in the interventional cardiology and peripheral vascular devices market, impose a considerable restraint on industry growth. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate rigorous evaluation of medical devices to ensure patient safety and product efficacy.

This rigorous scrutiny requires extensive clinical trial data, which can significantly extend the product development cycle and increase costs. For example, a study by the Boston Consulting Group highlighted that the average cost to bring a medical device from concept to market approval in the U.S. can exceed $94 million, with regulatory processes accounting for a significant portion of this expenditure.

Furthermore, the timeline for regulatory approval can span several years, delaying market entry for new and innovative products. This environment not only heightens barriers to entry for new market players but also slows the pace at which new and potentially life-saving technologies become available to patients, thereby impeding the market’s overall expansion and innovation trajectory.

Opportunities

Emerging Markets

Emerging markets stand as a significant opportunity for the interventional cardiology and peripheral vascular devices market, underpinned by their swift economic progress and healthcare improvements. In Asia, Latin America, and Africa, there is notable enhancement in healthcare infrastructure and accessibility to medical services. Alongside, there’s a growing awareness of cardiovascular diseases (CVDs) and an imperative for advanced therapeutic interventions, setting the stage for market expansion.

According to a report by the Global Burden of Disease Study, over 75% of deaths attributable to CVDs occur in low- and middle-income countries, highlighting the urgent need for cardiovascular care in these regions. This demographic shift, combined with economic growth, presents a ripe environment for market penetration. Companies adept at navigating the distinct regulatory and market challenges can access a vast and expanding patient population, leveraging this opportunity to fuel growth in the global interventional cardiology and peripheral vascular devices market.

Trends

Integration of Digital Technologies

The interventional cardiology and peripheral vascular devices market represents a transformative trend, significantly impacting healthcare delivery and patient outcomes. Leveraging digital innovations like remote monitoring, artificial intelligence (AI) algorithms, and connected devices, this trend is set to redefine the standards of cardiovascular care.

According to a report by the American Heart Association, the use of digital health technologies in cardiology is anticipated to reduce hospital readmission rates by up to 25% over the next decade, highlighting the profound impact of digital integration on patient care efficiency and effectiveness. Furthermore, the adoption of AI in diagnostic procedures has shown potential to enhance the accuracy of cardiovascular disease diagnoses by up to 15%, as per industry analyses. These advancements facilitate a more personalized approach to patient care, improve the precision of treatments, and streamline clinical workflows, thereby driving the evolution of the market and setting new benchmarks for technological integration in healthcare.

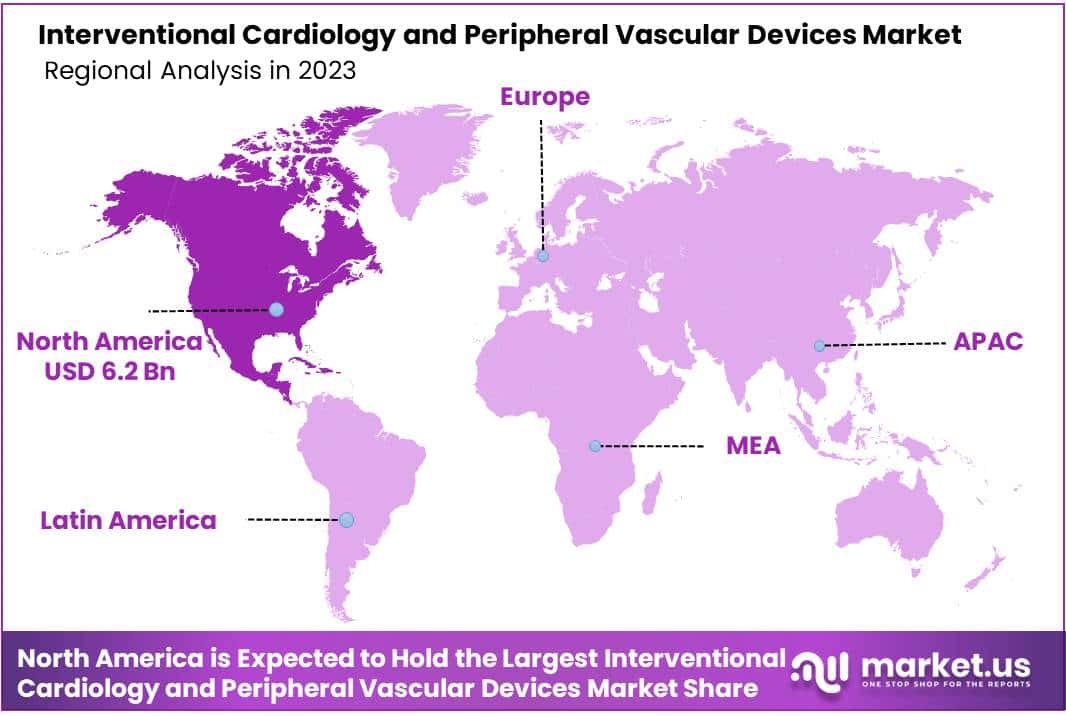

Regional Analysis

In 2023, North America held a dominant market position in the Interventional Cardiology and Peripheral Vascular Devices Market, capturing more than a 37% share and holding a market value of USD 6.2 billion for the year. This robust performance can be attributed to several key factors.

Firstly, North America boasts a sophisticated healthcare infrastructure coupled with high levels of awareness regarding cardiovascular diseases and their treatment options. The region is home to a significant patient pool requiring interventional cardiology and peripheral vascular procedures, thus driving demand for related devices and technologies.

Moreover, advancements in medical technology and the presence of leading healthcare institutions and research centers contribute to the continuous innovation and adoption of cutting-edge interventional cardiology and peripheral vascular devices across the region. This fosters a favorable environment for market growth and expansion.

Additionally, favorable reimbursement policies and government initiatives aimed at improving cardiovascular healthcare further stimulate market growth in North America. These initiatives often incentivize healthcare providers to invest in equipment and procedures, thus bolstering the demand for interventional cardiology and peripheral vascular devices.

Furthermore, strategic collaborations between healthcare organizations, medical device manufacturers, and research institutions facilitate the development of novel devices and treatment modalities, driving market growth and enhancing patient outcomes.

Moving forward, North America is expected to maintain its prominent position in the Interventional Cardiology and Peripheral Vascular Devices Market, driven by ongoing technological advancements, increasing prevalence of cardiovascular diseases, and continued investments in healthcare infrastructure and research. However, it’s essential for market players to remain vigilant of evolving regulatory landscapes and competitive dynamics to sustain growth and capitalize on emerging opportunities within the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Interventional Cardiology and Peripheral Vascular Devices Market features intense competition among leading players vying for market dominance through innovation and strategic collaborations. Abbott Laboratories leads with its diverse product lineup and robust distribution network, closely followed by Medtronic plc, known for its expansive global presence and cutting-edge technologies. B. Braun Melsungen AG commands a notable share with its high-quality offerings and reliable reputation, while Cardinal Health strengthens its position through a broad product portfolio and strategic acquisitions.

Other key players collectively contribute to market share with specialized products and services. Each company maintains strong financial performance and focuses on expanding into emerging markets and investing in research and development. While opportunities for growth abound, challenges such as regulatory hurdles and competitive pressures persist. Overall, these players drive market evolution, catering to the increasing demand for advanced interventional cardiology and peripheral vascular devices worldwide.

Market Key Players

- Abbott Laboratories

- B. Braun Melsungen AG

- Cardinal Health

- Medtronic plc

- Boston Scientific Corporation

- Cook Medical

- AngioDynamics

- C.R. Bard

- Gore & Associates Inc

- Teleflex Inc. W. L.

- Other Key Players

Recent Developments

- In January 2024, Abbott made headlines with its announcement of acquiring Tendyne, a company dedicated to developing minimally invasive mitral valve repair technology. This strategic move, valued at $4.2 billion, significantly broadens Abbott’s offerings in the realm of structural heart disease, positioning the company to be a strong contender in the rapidly expanding mitral valve repair market.

- In December 2023, Medtronic introduced the EnVision™ Cobalt Chrome Stent System, a cutting-edge stent engineered for enhanced durability and smoother delivery, particularly in challenging vascular anatomies. This innovative product aims to meet the demand for reliable stents in intricate peripheral vascular interventions.

- In November 2023, Boston Scientific forging a collaboration with Baylis Medical to jointly develop and bring to market the OcclusionSphere System. This novel device, designed for use during transcatheter aortic valve replacement (TAVR) procedures, represents a collaborative effort to enhance the safety and effectiveness of TAVR, drawing on the expertise of both companies.

- In October 2023, Gore & Associates made waves with the launch of the Viabahn Endoprosthesis featuring a Biocompatible Heparin Coating. This stent-graft is specifically crafted to mitigate the risk of blood clotting in peripheral artery interventions, addressing a significant concern in vascular procedures and potentially leading to improved patient outcomes.

Report Scope

Report Features Description Market Value (2023) USD 17 Bn Forecast Revenue (2033) USD 34 Bn CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Coronary Stents (Drug-eluting Stents, Bare Stents, Bioabsorbable Stents), Catheters (Angiography Catheters, Percutaneous Transluminal Coronary Angioplasty Guiding Catheters, Intravascular Ultrasound Catheters), Percutaneous Transluminal Coronary Angioplasty Guide Wires, Percutaneous Transluminal Coronary Angioplasty Balloons, Other Product Types], By Application (Congenital Heart Defect Correction, Angioplasty, Valvuloplasty, Percutaneous Valve Repair, Other Applications), By End-Use (Hospitals, Ambulatory Surgical Centers, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, B. Braun Melsungen AG, Cardinal Health, Medtronic plc, Boston Scientific Corporation, Cook Medical, AngioDynamics, C.R. Bard, Gore & Associates Inc, Teleflex Inc. W. L., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Interventional Cardiology and Peripheral Vascular Devices MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Interventional Cardiology and Peripheral Vascular Devices MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- B. Braun Melsungen AG

- Cardinal Health

- Medtronic plc

- Boston Scientific Corporation

- Cook Medical

- AngioDynamics

- C.R. Bard

- Gore & Associates Inc

- Teleflex Inc. W. L.

- Other Key Players