Global Internet Auction Software Market Size, Share, Industry Analysis Report By Deployment Type (On-Premises, Cloud-Based), By Application (Automotive, Real Estate, Retail, Art and Collectibles, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (Auction Houses, E-commerce Platforms, Individual Sellers, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158726

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business benefits

- Role of Generative AI

- US Market Size

- By Deployment Type: On-Premises

- By Application: Automotive

- By Enterprise Size: Large Enterprises

- By End-User: Auction Houses

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

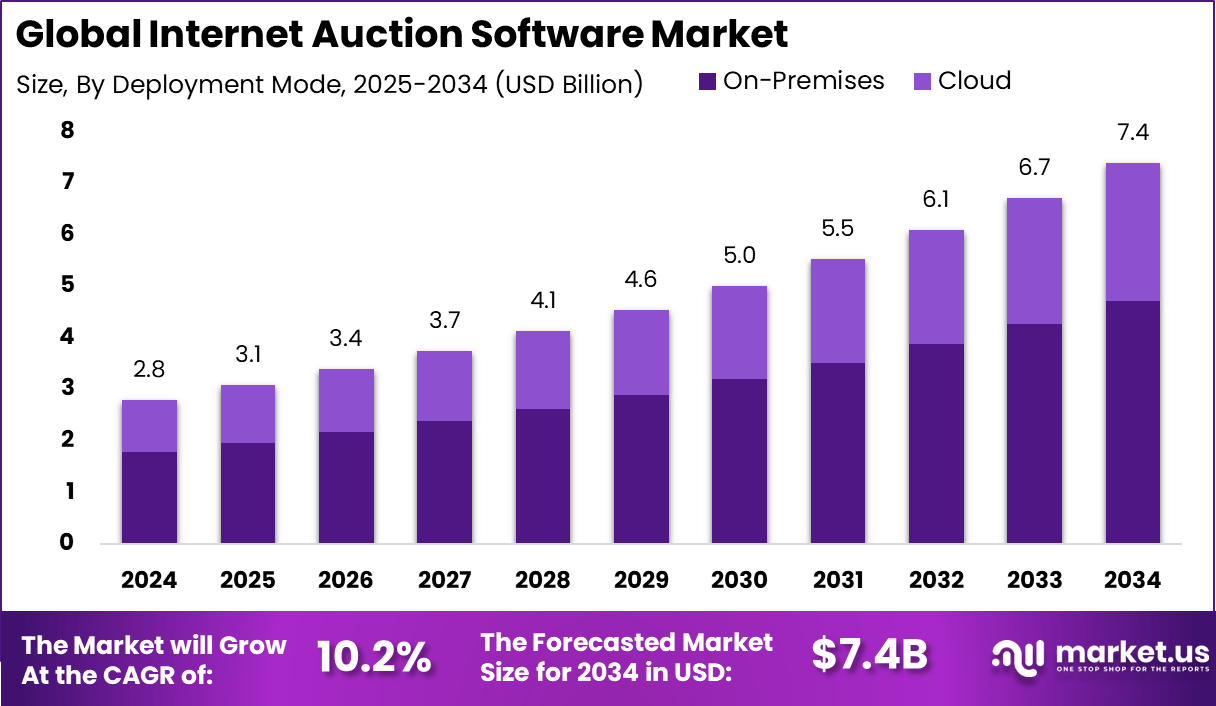

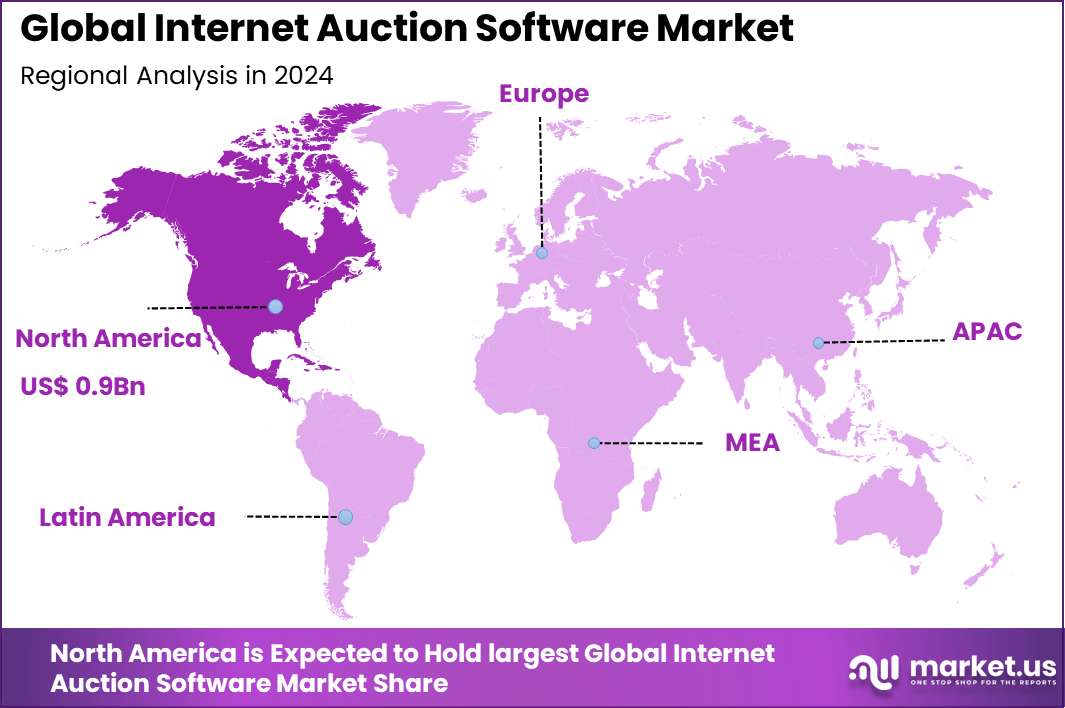

The Global Internet Auction Software Market size is expected to be worth around USD 7.4 Billion By 2034, from USD 2.8 billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35.2% share, holding USD 0.9 Billion revenue.

The Internet Auction Software Market refers to digital platforms that enable buyers and sellers to participate in auctions over the internet. These platforms provide a convenient and transparent way to conduct bidding for various goods and services, ranging from collectibles and real estate to industrial equipment. The software typically supports real-time bidding, mobile access, and secure payment systems, offering an alternative to traditional physical auctions.

The market is driven by the rising adoption of e-commerce and the growing preference for dynamic pricing models that auctions enable. Businesses are increasingly turning to internet auction software to liquidate surplus inventory, maximize returns on assets, and attract competitive buyers. Growth in online collectibles, art trading, and automotive resales is fueling adoption. The global shift toward digital-first commerce and rising internet penetration are further accelerating market expansion.

According to 9cv9.com, background checks are a standard part of the hiring process for most employers. Nearly 95% of employers conduct at least one form of background screening before hiring. Among these, 92% perform criminal background checks, making it the most common type of verification. Employment history and education are also key areas of focus.

Around 87% of employers verify previous employment records, while 72% check education qualifications to confirm candidate credentials. Additionally, 67% of employers conduct reference checks to assess character and past performance. For specific positions, especially those involving financial responsibility, 47% of employers run credit background checks.

Key Insight Summary

- By deployment type, the On-Premises segment led the market with a 63.7% share, reflecting continued reliance on in-house systems for data control and security.

- By application, the Automotive sector dominated with a 40.6% share, driven by rising demand for online vehicle auctions.

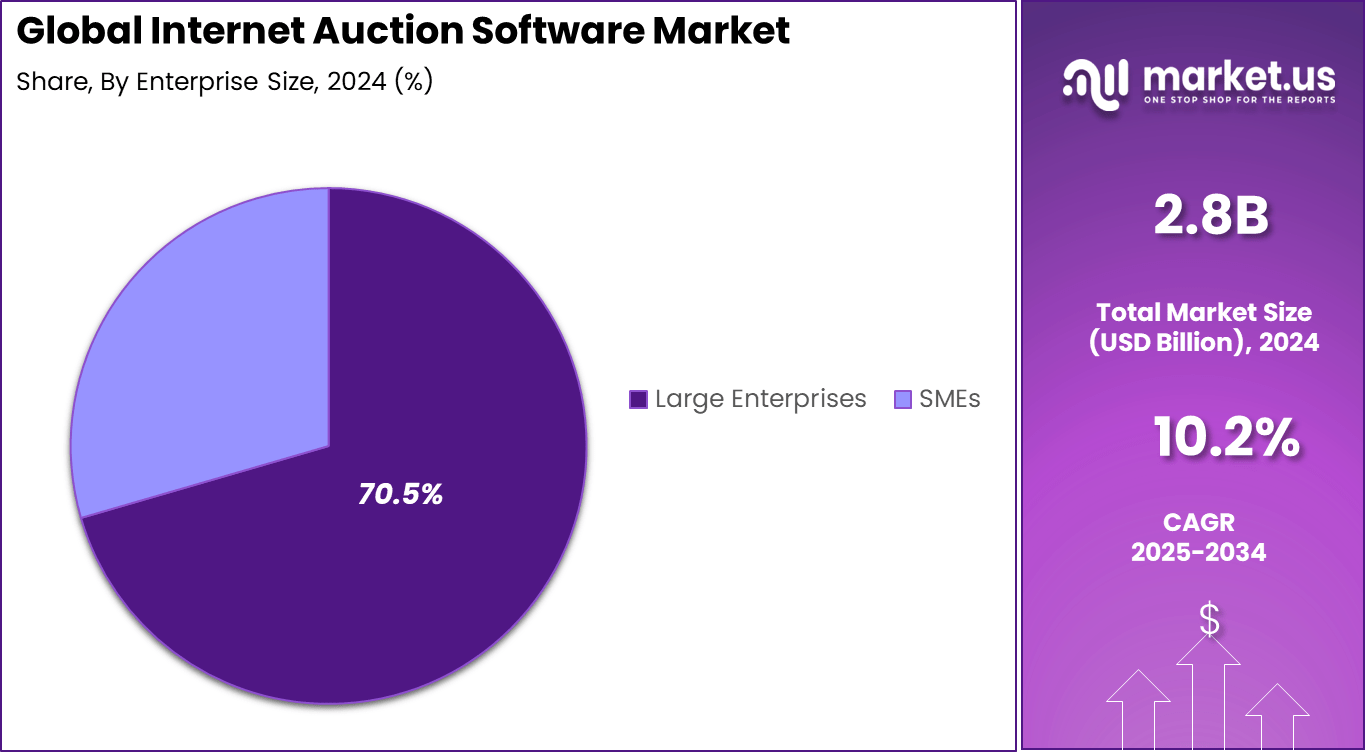

- By enterprise size, Large Enterprises captured a significant 70.5% share, highlighting their strong adoption of auction platforms for large-scale operations.

- By end-user, Auction Houses accounted for 38.9% share, making them the primary users of internet auction software solutions.

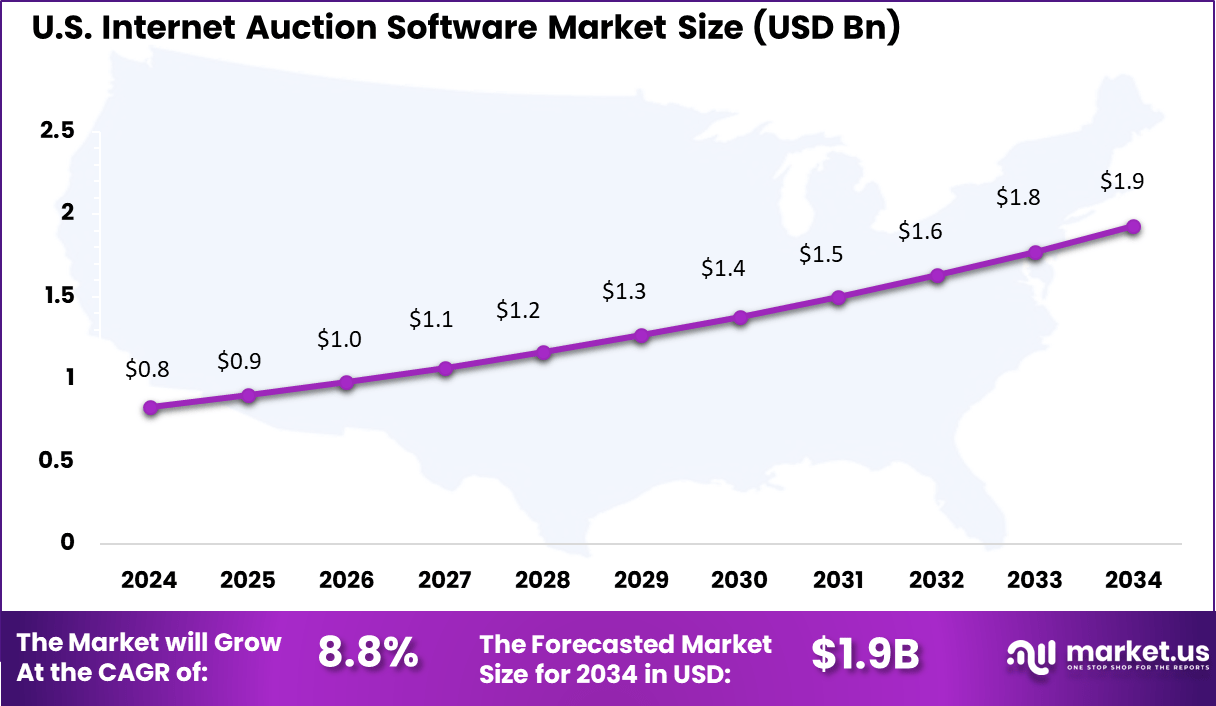

- Regionally, North America held 35.2% share, with the U.S. market valued at USD 0.83 Billion in 2024, expanding at a steady CAGR of 8.8%.

Analysts’ Viewpoint

Demand is strong in consumer-to-consumer and business-to-consumer e-commerce platforms, where auction systems help sellers reach broader audiences. Enterprises are adopting auction platforms to manage procurement through reverse auctions, reducing sourcing costs. The automotive sector is increasingly using online auctions for resale of used vehicles and fleet liquidation.

Increasing adoption of technologies like artificial intelligence, blockchain, and cloud computing is a significant trend. AI helps optimize bids and detect fraudulent activities, while blockchain enhances transaction security by creating tamper-proof records that build trust among participants. Cloud platforms increase the flexibility and scalability of auction software, allowing easier access and integration for businesses of all sizes.

Key reasons for adopting internet auction software include lowering operational costs by reducing the need for physical auction venues and staff. Businesses can reach a global audience, which increases participation and potential sale prices. Real-time analytics and data insights help companies understand bidder behavior and sales trends, improving marketing and pricing strategies.

Investment and Business benefits

Investment opportunities are expanding as small and medium enterprises increasingly use auction platforms to liquidate assets and enter new markets. The growth in niche auction sectors like luxury goods, collectibles, and real estate also opens new paths for specialized software development.

Emerging markets in regions such as Latin America, Asia-Pacific, and the Middle East show strong interest due to rising internet access and digital literacy. Investors can benefit from funding innovative features like mobile-first platforms, AI enhancements, and cybersecurity improvements.

Business benefits of using internet auction software are extensive. Companies gain access to wider markets and can engage customers with competitive, dynamic pricing models. Cost savings from digital auctions versus traditional formats can be significant.

Furthermore, the ability to analyze real-time auction data offers actionable insights that improve inventory management and customer targeting. These platforms also help businesses maintain compliance with financial transactions and consumer protection, adding reliability to their operations.

Role of Generative AI

Generative AI is playing an increasingly important role in internet auction software by enhancing user engagement and optimizing auction outcomes. It enables personalized recommendation systems that analyze past bidding behaviors and preferences to highlight items that closely match user interests, increasing satisfaction and participation.

AI-driven adaptive pricing strategies carefully adjust reserve prices, bid increments, and auction durations in real-time based on market conditions and bidder activity, aiming to maximize returns for sellers while maintaining fairness for buyers. Furthermore, AI facilitates the creation of lifelike virtual auction environments where bidders can explore items interactively, providing a richer, more immersive experience similar to physical auction houses.

These AI enhancements significantly improve auction efficiency, user experience, and security by detecting fraudulent bidding patterns promptly. Statistics show AI-enabled predictive bidding can improve bid placement accuracy by up to 87% and boost user engagement by 30%, underlining its growing impact on auction dynamics

US Market Size

The U.S. Internet Auction Software Market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 1.9 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2025 to 2034.

In 2024, North America holds a 35.2% share of the Internet Auction Software Market. The US leads the regional market with strong adoption driven by mature digital infrastructure and an established e-commerce ecosystem. The region benefits from widespread internet penetration and technological innovation in auction software, supporting diverse auction sectors from automotive to real estate.

Europe Market Trends

Europe’s Internet Auction Software Market is marked by steady growth due to increasing adoption of digital auction platforms in countries such as the UK, Germany, and France. Technological advancements in payment security and mobile bidding are notable drivers. The market benefits from supportive regulatory frameworks that promote e-commerce and online transactions.

Increasing demand comes from sectors like art, collectibles, and luxury goods auctions, where secure and transparent bidding is essential. European auction houses also emphasize user-friendly interfaces and multilingual support to cater to a diverse bidder base, supporting ongoing digital transformation.

Asia Pacific Market Trends

Asia Pacific is witnessing rapid digital transformation in its auction market, fueled by rising internet penetration, smartphone adoption, and cloud technology integration. There is a growing shift from traditional physical auctions to online platforms, enabling broader participation from urban and rural areas alike.

The region is also seeing innovations in AI-driven personalized bidding experiences and mobile auction applications. Countries like China and India lead growth, supported by expanding digital payment infrastructure and government initiatives encouraging e-commerce adoption across sectors including automotive and real estate.

By Deployment Type: On-Premises

On-premises deployment holds a significant share of 63.7% in the Internet Auction Software Market. This preference is driven by enterprises seeking control over data security and customized infrastructure. On-premises solutions allow organizations to tailor their software environment to specific operational needs while complying with internal policies or industry regulations.

However, while cloud solutions gain traction for flexibility and scalability, many auction houses and enterprises still rely on on-premises systems for critical auction operations. These organizations prioritize reliability and direct management of data over the convenience of cloud-based offerings, which sustains the strong demand for on-premises deployment.

By Application: Automotive

The automotive sector represents a dominant application segment with 40.6% share of the Internet Auction Software Market. This sector leverages online auction platforms extensively to facilitate vehicle liquidations, dealer-to-dealer sales, and end-consumer auctions. The nature of automotive auctions, with large inventories and high transaction volumes, fits well with robust software designed for efficiency and transparency.

Online auction software in automotive helps reduce costs related to physical auctions and expands the reach to a broader audience. The use of real-time bidding and secure payment integration contributes to smoother transactions, helping automotive businesses optimize inventory turnover and improve market pricing accuracy.

By Enterprise Size: Large Enterprises

Large enterprises hold a notable 70.5% share in this market. These organizations generally have more complex auction needs and often operate at larger scales, requiring more sophisticated software solutions. The capability to handle higher volumes of items, integrate with existing enterprise resource planning (ERP) systems, and ensure compliance governs their preference for advanced auction technologies.

Large enterprises also tend to invest more in customizing and securing their auction platforms, which often leads to higher adoption of on-premises deployment models. Their scale enables them to leverage the full suite of software capabilities, including enhanced analytics, automation, and multi-user management features.

By End-User: Auction Houses

Auction houses account for 38.9% of the user base for internet auction software. These specialist organizations rely heavily on tailored auction software to run live, timed, or silent auctions. The software’s ability to support various auction formats and provide transparent bidding histories is crucial for maintaining bidder trust and operational efficiency.

The market for auction houses is broadening as auctions expand beyond traditional categories, including real estate, collectibles, and industrial assets. Auction houses are increasingly adopting online platforms to reach global bidders, increase participation, and lower operational costs while improving the customer experience.

Emerging Trends

The internet auction software market is evolving with several notable trends shaping its future. Mobile-first platforms have become essential, allowing users to participate in auctions anytime and anywhere, with real-time bidding and instant notifications enhancing convenience.

Blockchain technology is increasingly incorporated to ensure transparency and secure provenance verification, especially for valuable items, reducing fraud risks. The adoption of virtual and augmented reality tools is rising, enabling bidders to inspect items in immersive 3D environments, which has contributed to about a 22% increase in final sale prices in experimental applications.

Cryptocurrency payment integration is another trend gaining ground, providing users with fast, cost-effective alternatives to traditional payments. These trends collectively contribute to broader user adoption and improved auction outcomes, reflecting a market moving toward higher technological sophistication and user-centric design.

Growth Factors

Several factors continue to drive growth in the internet auction software market. Increased digitization across industries, especially in retail and industrial sectors, is a key growth driver by expanding the reach and efficiency of auction transactions.

The rising demand for cost-effective procurement solutions, such as reverse auctions, motivates businesses to adopt online auction platforms to optimize spending. Small and medium enterprises contribute significantly to market growth by leveraging auction software to access wider audiences and liquidate inventory efficiently.

Additionally, technological advancements like AI and machine learning improve user experience and bidding outcomes through dynamic pricing and fraud detection, fostering trust and increasing platform usage. The continued preference shift toward online auctions for their convenience and accessibility fuels a sustained growth trajectory.

Key Market Segments

Deployment Type

- On-Premises

- Cloud-Based

Application

- Automotive

- Real Estate

- Retail

- Art and Collectibles

- Others

Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

End-User

- Auction Houses

- E-commerce Platforms

- Individual Sellers

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Digital and Mobile Auction Platforms

A key driver of the Internet auction software market is the increasing demand for digital and mobile auction platforms. As more individuals and businesses shift towards online and mobile channels for buying and selling, auction software provides a convenient way to participate in real-time auctions from anywhere.

For instance, the rise of smartphone usage and the availability of cloud-based auction solutions have made it easier for buyers and sellers to engage without geographical limits, enabling platforms to reach a broader audience. This expansion of access boosts the overall usage and adoption of auction software solutions.

Sectors such as automotive, real estate, and collectibles are increasingly leveraging online auctions to streamline sales processes and enhance market reach. This driver is supported by the broader growth of e-commerce and the continued digitization of commerce, which encourages both businesses and consumers to seek auction software to facilitate secure and efficient transactions.

Restraint Analysis

Concerns Over Security and Fraud

A major restraint limiting the widespread adoption of Internet auction software is the concern over security and fraud. Online auction platforms handle sensitive personal and financial data, making them attractive targets for cybercriminals.

For instance, data breaches and identity theft incidents have raised significant caution among users about sharing information and trusting digital auction environments. These concerns can slow down adoption rates, as buyers and sellers demand strong assurances of platform security.

Additionally, the challenge of maintaining compliance with various international and local regulations adds complexity and cost to operating auction platforms. For example, data privacy laws and financial transaction regulations differ widely across countries, creating barriers for platforms aiming to expand globally. These obstacles must be overcome to build trust and encourage users to fully embrace online auction software.

Opportunity Analysis

Emerging Markets and Blockchain Integration

One of the promising opportunities in the Internet auction software market lies in emerging markets and the integration of advanced technologies like blockchain. Emerging regions such as Asia-Pacific, Latin America, and the Middle East are experiencing rapid internet penetration and digital adoption, which is opening new audiences for online auctions.

For instance, as ecommerce grows in countries like India, there is a rising demand for reliable auction platforms that can cater to both consumer-to-consumer and business-to-consumer transactions. Blockchain presents another significant opportunity by enhancing transparency and security in auction transactions.

By using blockchain, auction platforms can provide immutable transaction records, reduce fraud, and increase trust among users. The adoption of cryptocurrency payments in auctions is also expanding, attracting tech-savvy bidders and providing alternative payment methods that can reduce transaction costs and delays.

Challenge Analysis

Intense Competition and Market Saturation

The Internet auction software market faces a notable challenge from intense competition and market saturation. Numerous players are entering the market, offering various feature sets tailored to different industries and user preferences.

For instance, this creates difficulty for companies to differentiate themselves and attract loyal customers amid a crowded landscape. To succeed, providers must continuously innovate and offer unique functionalities such as advanced analytics or AI-driven insights.

Additionally, high implementation and operational costs can be a barrier, especially for smaller entrants and niche auction platforms. For example, developing secure, scalable, and user-friendly auction solutions requires significant investment. This challenge forces many providers to focus on niche segments or specialized industries to stand out and maintain profitability in a growing but competitive market.

Competitive Analysis

In the internet auction software market, eBay Inc. remains the most influential player, supported by its massive global user base and advanced online bidding platform. Its scale and brand recognition give it a significant advantage, making it a key driver of digital auction adoption.

Other established firms such as Auction Software Inc., RainWorx Software, and Auction Flex also contribute with versatile platforms designed for both large enterprises and small auction houses, offering features like real-time bidding, payment integration, and inventory management.

Specialized providers including Proxibid, Bidpath, Wavebid, and Maxanet focus on business-to-business and enterprise-level auction solutions. These companies offer secure, customizable platforms that support complex auctions, from industrial equipment to real estate.

Niche and charity-focused platforms such as BiddingOwl, Auctria, BiddingForGood, Silent Auction Pro, Handbid, ClickBid, Charity Auctions Today, BidJS, Auction Mobility, and Bid Beacon expand the market with tailored solutions. These firms provide user-friendly tools optimized for fundraising events, nonprofit organizations, and mobile-first audiences.

Top Key Players in the Market

- eBay Inc.

- Auction Software Inc.

- BiddingOwl.com

- RainWorx Software

- PHP Pro Bid

- Auction Flex

- BidJS

- Live Auction Group

- Proxibid Inc.

- Bidpath

- Wavebid

- Maxanet

- Auctria

- BiddingForGood

- Silent Auction Pro

- Handbid

- ClickBid

- Charity Auctions Today

- Auction Mobility

- Bid Beacon

- Others

Recent Developments

- In March 2025, RainWorx Software released version 3.6 of AuctionWorx Enterprise and AuctionWorx: Events Edition, introducing new features and improvements to ease auction management and event planning for users.

- In April 2025, Auction Flex announced updated pricing plans and ongoing software enhancements to boost live auction and online bidding management capabilities. The company continues to integrate cloud data storage and offer technical support options to users.

- In February 2025, eBay Inc. completed the acquisition of Caramel, a platform streamlining online vehicle transactions with seamless digital workflows including paperwork and financing. This move aims to enhance buyer and seller confidence and expand secure, transparent transactions in the automotive auction segment.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Bn Forecast Revenue (2034) USD 7.4 Bn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Type (On-Premises, Cloud-Based), By Application (Automotive, Real Estate, Retail, Art and Collectibles, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (Auction Houses, E-commerce Platforms, Individual Sellers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape eBay Inc., Auction Software Inc., BiddingOwl.com, RainWorx Software, PHP Pro Bid, Auction Flex, BidJS, Live Auction Group, Proxibid Inc., Bidpath, Wavebid, Maxanet, Auctria, BiddingForGood, Silent Auction Pro, Handbid, ClickBid, Charity Auctions Today, Auction Mobility, Bid Beacon, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Internet Auction Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Internet Auction Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- eBay Inc.

- Auction Software Inc.

- BiddingOwl.com

- RainWorx Software

- PHP Pro Bid

- Auction Flex

- BidJS

- Live Auction Group

- Proxibid Inc.

- Bidpath

- Wavebid

- Maxanet

- Auctria

- BiddingForGood

- Silent Auction Pro

- Handbid

- ClickBid

- Charity Auctions Today

- Auction Mobility

- Bid Beacon

- Others