Global Interactive Display Market Size, Share, Growth Analysis By Product (Interactive Kiosks, Interactive Whiteboards, Interactive Tables, Interactive Video Walls, Interactive Monitors), By Panel Size (17-32 Inches, 32-65 Inches, Above 65 Inches), By Panel Type (Flat, Flexible, Transparent), By Technology (LCD, LED, OLED, Others), By Vertical (Retail & Hospitality, BFSI, Industrial, Healthcare, Corporate & Government, Transportation, Education, Sports & Entertainment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan. 2026

- Report ID: 162772

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- Analysts’ Viewpoint

- AI Industry Adoption

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Product

- By Panel Size

- By Panel Type

- By Technology

- By Vertical

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

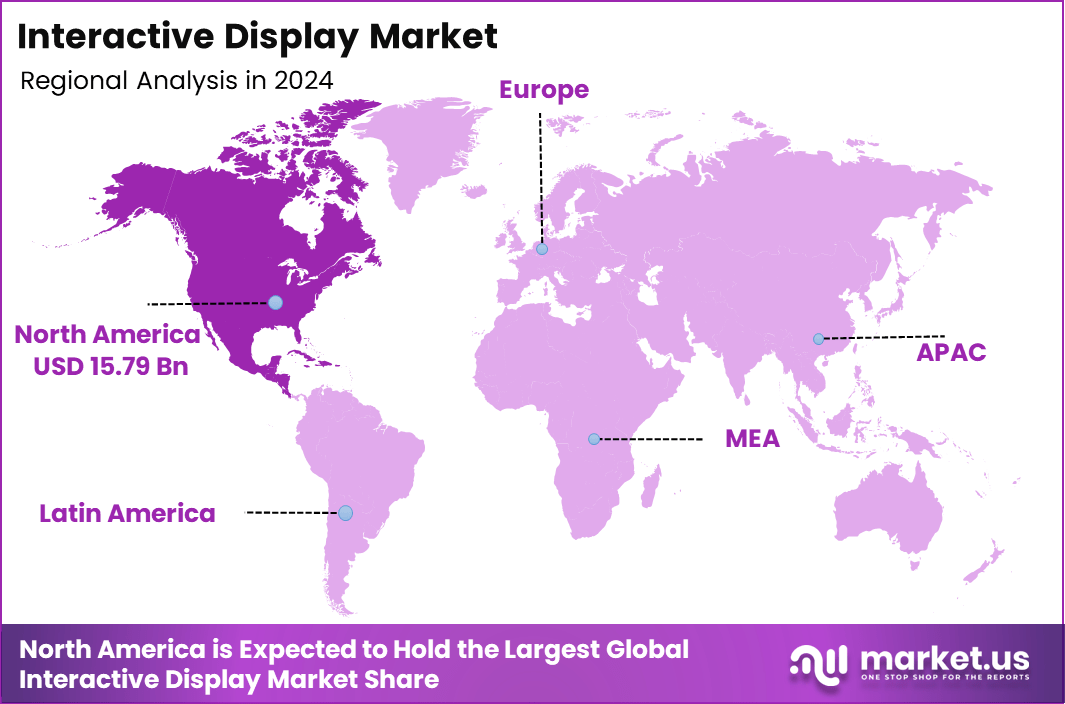

The Global Interactive Display Market size is expected to be worth around USD 91.28 Billion By 2034, from USD 45.2 billion in 2025, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. North America held a dominan Market position, capturing more than a 37.7% share, holding USD 15.7 Billion revenue.

The interactive display market refers to digital screens that enable user interaction through touch, gesture, stylus input, or connected devices. These displays are used in education, corporate meeting rooms, retail stores, healthcare facilities, and public spaces. Interactive displays support collaboration, visualization, and real-time content engagement. They include interactive flat panels, kiosks, whiteboards, and video walls. Adoption improves communication and participation across environments.

Funding rounds continue to support innovation, as seen with Aircards, which raised £3 million from Foresight in August 2025 to expand its interactive display and analytics platforms. New product launches included Mynd.ai’s Promethean brand unveiling the ActivPanel 10 and ActivSuite early in 2025, which allow flexible use across Chrome, Windows, and Android environments in schools and offices.

In manufacturing, Dixon Technologies sought approval for a major Indian display module venture in June 2025, aiming for “lighthouse factory” status. In Asia, Samsung committed $1.8 billion to an OLED plant in Vietnam focused on laptop and tablet displays, reflecting strong investment in next-generation display technologies. These developments point to strong demand from digital education, hybrid workspaces, and retail settings, with competitive innovation and increased funding driving growth and fresh product offerings.

Key Takeaways

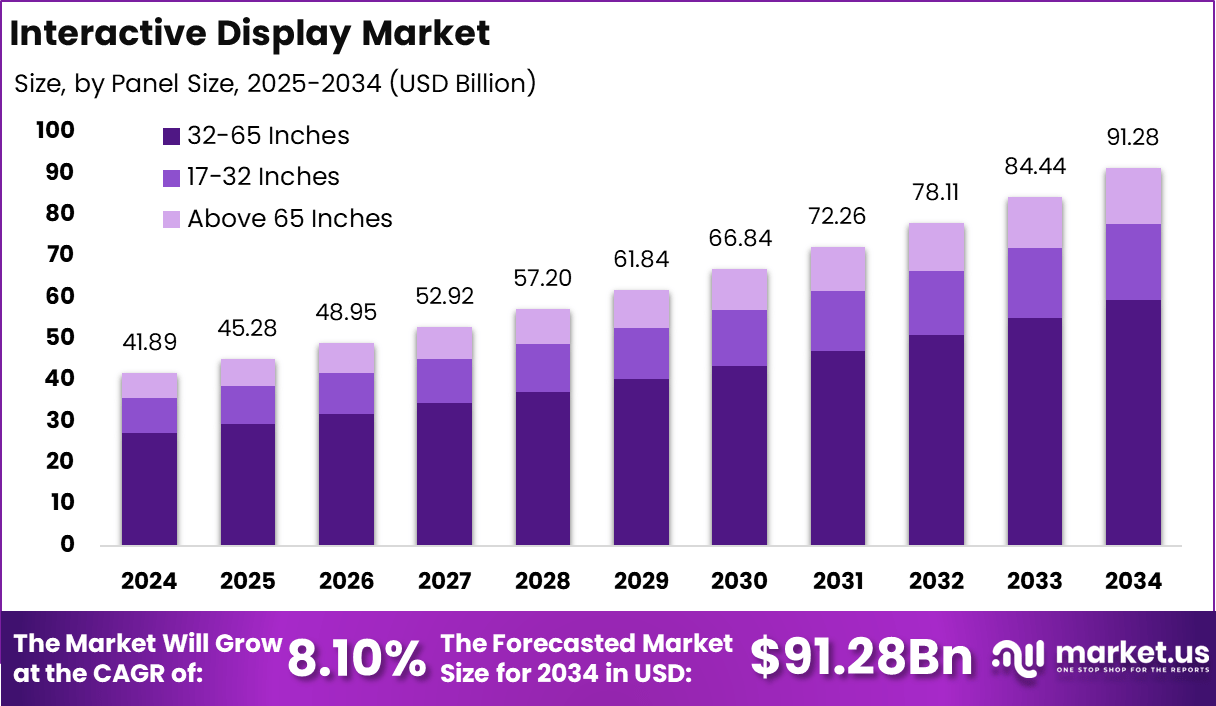

- The Global Interactive Display Market was valued at USD 41.89 billion in 2024 and is projected to reach USD 91.28 billion by 2034, expanding at a CAGR of 8.1% during the forecast period.

- North America accounted for 37.7% of the global market in 2024, valued at USD 15.79 billion, driven by widespread digital adoption across the education and corporate sectors.

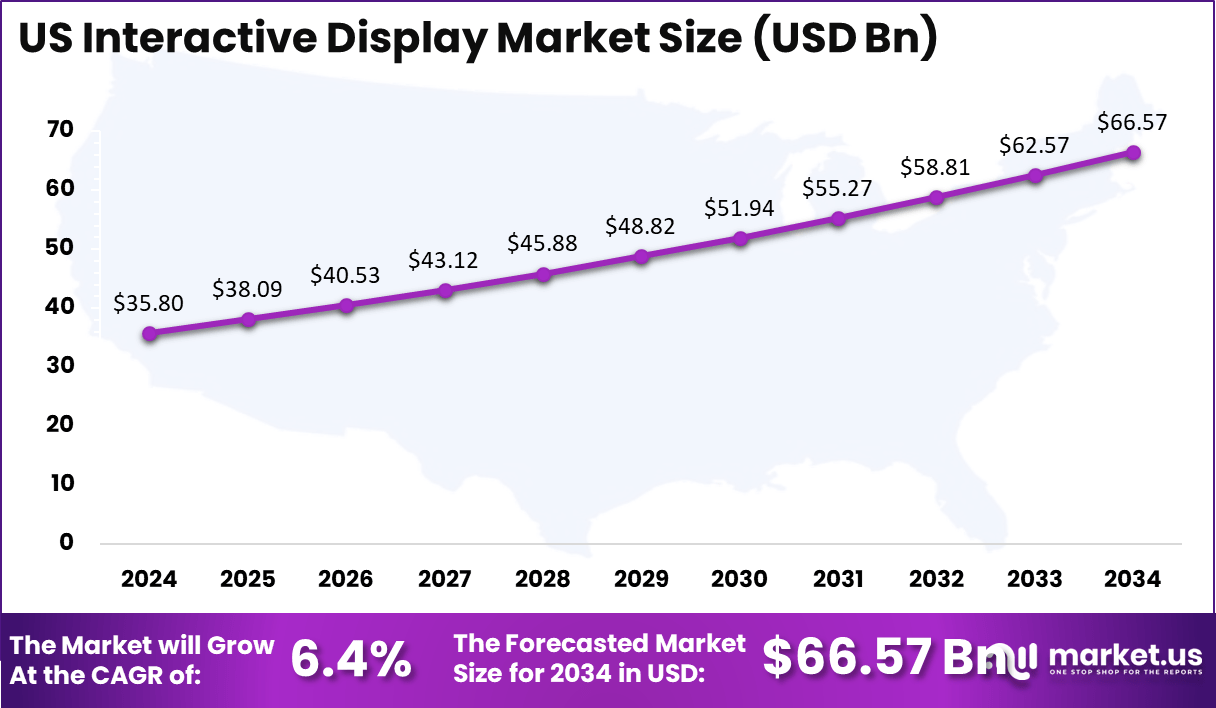

- The US market contributed USD 35.8 billion in 2024 and is expected to reach USD 66.57 billion by 2034, growing at a CAGR of 6.4%, fueled by advancements in smart learning and enterprise collaboration technologies.

- By Product, interactive whiteboards dominated with a 35.6% share, supported by increasing use in classrooms and training environments.

- By Panel Size, displays in the 32–65 inches range held the largest share at 65.2%, favored for their versatility in education and corporate applications.

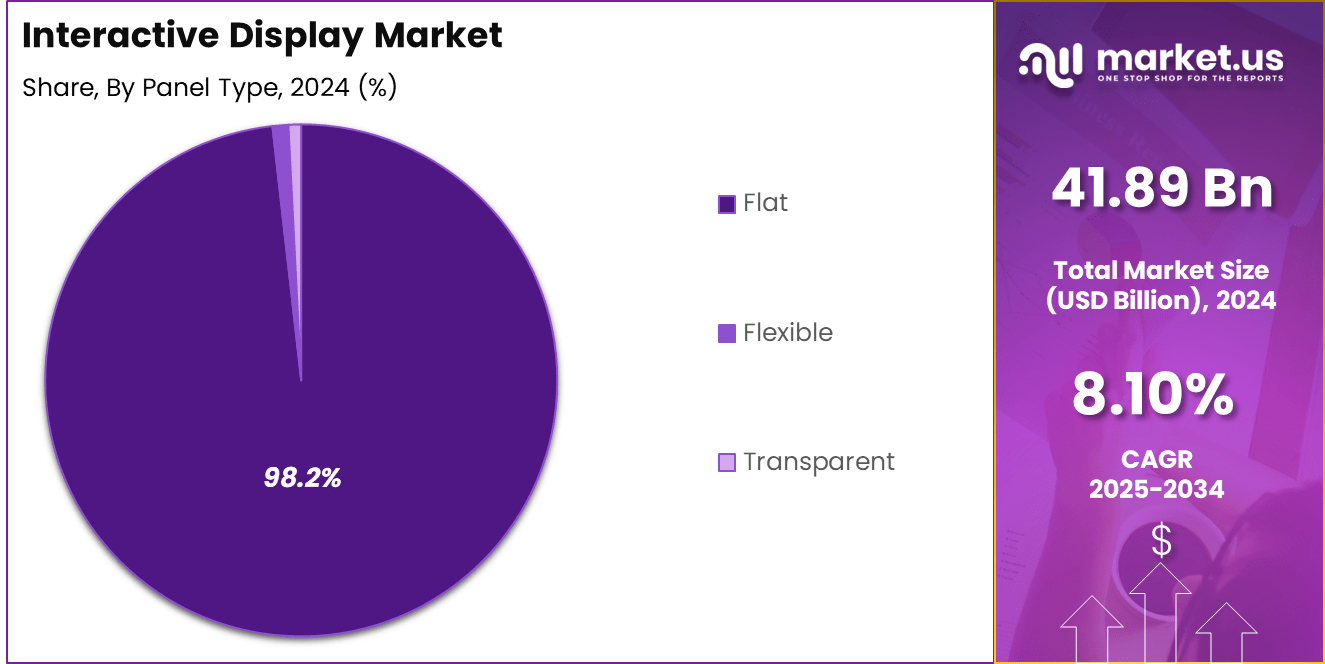

- By Panel Type, flat panels captured 98.2% of the market, driven by their slim design, energy efficiency, and superior display quality.

- By Technology, LED-based displays led with a 70.3% share, owing to their high brightness, durability, and lower power consumption.

- By Vertical, the education sector remained dominant with a 30.5% share, reflecting strong integration of interactive displays in digital classrooms and e-learning environments.

Role of AI

Artificial Intelligence is playing a transformative role in the Interactive Display Market by enhancing personalization, interactivity, and data-driven functionality. AI integration allows displays to recognize patterns, interpret gestures, and adapt to user behavior, creating smarter and more intuitive user experiences.

In educational settings, AI-powered interactive boards can assess student engagement, provide real-time feedback, and personalize content delivery based on learning progress. Similarly, in corporate environments, AI-enabled collaboration displays streamlined meetings by automatically transcribing discussions, summarizing key points, and suggesting actionable insights.

In retail and public spaces, AI-driven interactive signage is revolutionizing customer engagement through facial recognition, predictive analytics, and dynamic content recommendation. These displays adjust visuals and messages based on user demographics or behavior, improving marketing effectiveness. Additionally, AI enhances display maintenance through predictive diagnostics, reducing downtime and operational costs.

When integrated with voice assistants and natural language processing (NLP), interactive displays offer hands-free control, improving accessibility and convenience. As industries continue embracing automation and intelligent systems, AI’s role in transforming display technologies is expanding rapidly. Its ability to combine real-time analytics with adaptive learning makes interactive displays not just information tools, but intelligent interfaces bridging human interaction and digital intelligence.

Analysts’ Viewpoint

Analysts regard the interactive display market as poised for steady expansion, supported by increases in digital collaboration, smart-infrastructure investments, and learning-environment upgrades. Many foresee consistent growth in regions with mature adoption while identifying higher momentum in emergent markets.

In the education segment, analysts note that integration of interactive whiteboards and flat-panel displays is expected to deepen as institutions pursue more immersive and collaborative classroom environments. This adoption is enhanced by increasing budgets for ed-tech and government-driven digitisation programs. They project that corporate and enterprise applications, while large today, may face a slower CAGR as growth shifts to newer segments like flexible workspaces and hybrid meeting systems.

Analysts also highlight the importance of technology advances such as large-format panels, multi-touch interfaces, and cloud-managed services in differentiating vendors. Firms offering seamless user experience, software integration, and lifecycle services are viewed as better positioned. However, concerns are raised regarding supply-chain volatility, rising component cost (especially glass and semiconductors), and the need for sustainable business models as hardware-led competition intensifies.

Overall, the consensus among market watchers is that the interactive display market remains attractive, underpinned by digital transformation across education, enterprise, and public sectors, but success will depend on innovation, regional penetration, and partner ecosystems.

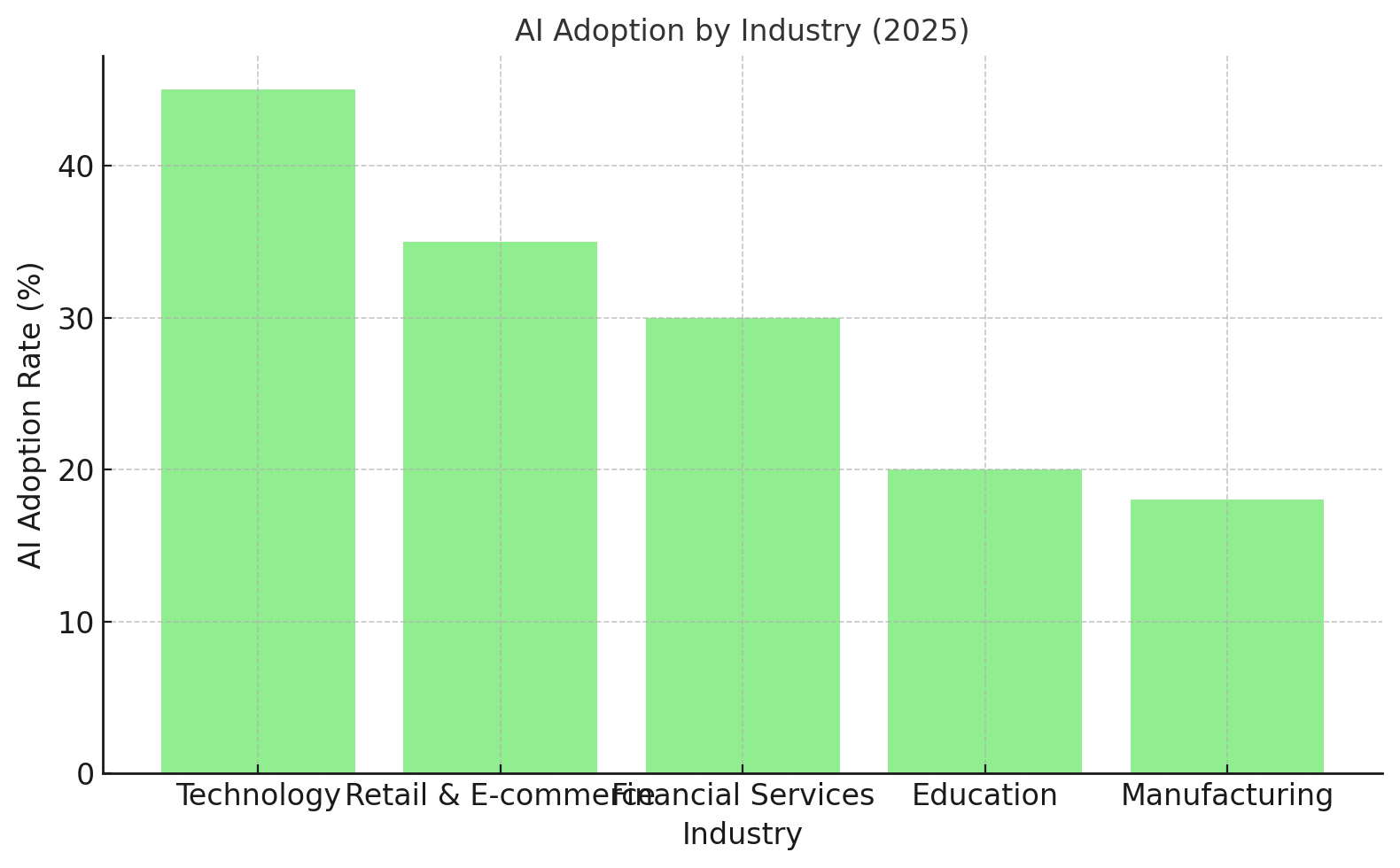

AI Industry Adoption

AI adoption in the interactive display industry is accelerating as organisations seek more engaging, intelligent, and responsive visual-interaction platforms. The integration of AI in interactive displays is enabling features such as gesture and voice recognition, facial analytics, real-time content adaptation, and predictive content scheduling.

In educational settings, AI-enabled interactive whiteboards and panels are increasingly deployed to personalise learning, track student engagement, and dynamically adjust content based on learner behaviour. This is driving adoption in the education vertical, where interactive displays are already prominent. The trend supports the broader move toward digital classrooms and smart teaching systems.

In retail, hospitality, and public-space applications, AI-driven interactive displays are leveraged for audience analytics, personalised digital signage, and touchless interfaces. These systems use computer vision and machine learning to detect user demographics and tailor content accordingly, improving customer engagement and operational effectiveness.

While AI integration in interactive displays is offering substantial value, the pace of uptake varies by region, infrastructure readiness, and demand for advanced features. Analysts expect the AI-interactive display segment to outgrow traditional displays thanks to these enhanced capabilities and the rising demand for smarter, connected solutions.

Emerging trends

- The integration of artificial intelligence (AI) and augmented reality (AR) is enhancing user experience by enabling interactive displays to deliver more immersive, context-aware content.

- Personalisation through analytics is becoming more prevalent: interactive displays are increasingly using real-time data to tailor content and interactions based on user behaviour, demographics, and environment.

- Growth of smart-city and public-space deployments: interactive displays are being embedded into urban infrastructure for wayfinding, digital signage, and citizen engagement, fuelling demand beyond traditional education and corporate use-cases.

- Advances in display hardware—such as higher resolution, improved touch technologies, thinner panels, and energy-efficient designs—are enabling broader adoption of flat panels in diverse settings from classrooms to retail.

- Hybrid and collaborative work-and-learning environments are driving demand: as organisations adopt flexible, remote or blended models, there is an increasing need for interactive displays that support multi-user collaboration, wireless connectivity, and cloud integration.

- These trends suggest the interactive display market is evolving from purely hardware-centric tools to intelligent interfaces that combine software, data, connectivity, and immersive experiences.

US Market Size

The US Interactive Display Market was valued at USD 35.8 billion in 2024 and is projected to reach USD 66.57 billion by 2034, expanding at a CAGR of 6.4% during the forecast period. The market growth is driven by the rapid adoption of digital learning systems, smart classrooms, and technologically advanced meeting environments.

The growing emphasis on collaboration and real-time communication in both education and corporate sectors has positioned interactive displays as essential tools for engagement and productivity. The presence of leading display manufacturers, software providers, and strong ICT infrastructure further supports market expansion.

In the education sector, interactive whiteboards and smart panels are being widely integrated to promote interactive teaching, hybrid learning, and visual collaboration. In the corporate segment, the shift toward hybrid work and remote collaboration is increasing demand for large-format interactive panels and cloud-based conferencing systems.

Retail, healthcare, and public service sectors are also deploying interactive kiosks and signage to enhance user interaction and service delivery. The continued investment in AI-powered displays, energy-efficient LED panels, and touchless interfaces is expected to strengthen the US position as a global innovation hub in the interactive display market over the next decade.

Investment and Business Benefit

Investments in the US interactive display market are increasingly directed towards modern, connected display systems that incorporate advanced hardware and software, enabling organisations to transform how they communicate and collaborate.

These investments are mainly allocated to cloud-enabled interactive panels, multi-touch displays, and AI-driven content management platforms that are designed to adapt, scale, and deliver real-time visual experiences. By upgrading legacy whiteboards and signage to interactive ecosystems, businesses and educational institutions are capturing greater value through enhanced productivity, engagement, and data insights.

From a business benefits standpoint, interactive display solutions offer significant returns by improving engagement among students in digital classrooms, reducing meeting inefficiencies in corporate environments, and enhancing customer interactions in retail or public spaces. Schools can leverage interactive displays to facilitate hybrid learning environments and personalise teaching, resulting in improved outcomes and cost-effectiveness in the long term.

Enterprises benefit from faster decision-making, better visualisation of complex information, and improved remote collaboration, while retail and hospitality sectors use these displays to increase foot-traffic engagement and brand impact. Overall, strategic investment in interactive display technology enables organisations to adopt more agile, interactive, and connected workflows, supporting innovation, operational efficiency, and competitive advantage in a digital-first environment.

By Product

Interactive whiteboards accounted for 35.6% of the Interactive Display Market in 2024, emerging as the leading product category due to their widespread use in education, corporate training, and government sectors. Their ability to transform static presentations into engaging, collaborative experiences has made them essential tools for classrooms and meeting environments.

In the education sector, these digital whiteboards are replacing traditional chalkboards, offering features such as real-time annotation, cloud connectivity, and multimedia integration that enhance learning outcomes and student participation. In corporate environments, interactive whiteboards facilitate brainstorming sessions, virtual meetings, and project management, allowing teams to visualize complex data and collaborate seamlessly, even remotely.

The growing emphasis on hybrid learning and work models has accelerated the adoption of networked and cloud-compatible whiteboards. Manufacturers are focusing on integrating AI, voice control, and wireless sharing to enhance usability and interactivity.

Meanwhile, other segments such as interactive kiosks, tables, and video walls are also witnessing demand growth in retail, hospitality, and entertainment. However, the dominance of interactive whiteboards remains strong, as their versatility and affordability continue to make them the preferred choice across multiple sectors. With advancements in touch technology and digital collaboration tools, this segment is expected to sustain its market leadership through 2034.

By Panel Size

Displays sized between 32 and 65 inches accounted for 65.2% of the Interactive Display Market in 2024, dominating the segment due to their balance between visibility, portability, and cost-effectiveness. This size range is widely preferred across education, corporate, and retail environments because it offers sufficient screen space for collaboration and interactivity without requiring excessive installation space.

Educational institutions favor 32–65-inch panels for smart classrooms, as they provide optimal viewing angles and support interactive learning for medium-sized classrooms. Similarly, enterprises use these displays in meeting and conference rooms to enhance presentation quality and facilitate digital collaboration.

Smaller displays ranging from 17 to 32 inches are primarily adopted in kiosks, point-of-sale systems, and personal learning setups, where compactness and user proximity are key. On the other hand, displays above 65 inches are increasingly being installed in auditoriums, large conference halls, and retail advertising, offering high-impact visual engagement.

However, their higher costs and space requirements limit mass adoption. The 32–65-inch category continues to strike the right balance between functionality and affordability, ensuring its strong position as the preferred size range for interactive applications across diverse industries, particularly in education and business collaboration environments.

By Panel Type

Flat panels accounted for 98.2% of the Interactive Display Market in 2024, making them the overwhelmingly dominant panel type due to their affordability, durability, and wide application range. Flat panel displays, typically based on LED and LCD technologies, are widely adopted in classrooms, offices, retail environments, and public spaces because of their high image clarity, energy efficiency, and compatibility with multi-touch functionality.

Their slim design, ease of wall mounting, and cost-effectiveness make them a practical choice for both small-scale and large-scale installations. The growing integration of 4K and 8K resolutions, along with anti-glare and eye-care technologies, has further improved user experience and driven adoption.

Flexible and transparent panels, though still in the early stages of commercialization, are gaining attention for their futuristic design and adaptability. Flexible displays are being explored for curved or foldable applications in advertising and automotive sectors, while transparent panels are used in luxury retail and high-tech showcases.

However, their higher production costs and limited large-scale manufacturing have restricted widespread deployment. As innovation in materials and manufacturing continues, these emerging technologies are expected to gain traction, but flat panels are projected to maintain dominance over the next decade due to their proven performance and economic viability.

By Technology

LED technology accounted for 70.3% of the Interactive Display Market in 2024, emerging as the dominant segment due to its superior brightness, energy efficiency, and long lifespan. LED displays are widely preferred across educational institutions, corporate offices, retail outlets, and public installations for their high-resolution visuals and low power consumption.

Their ability to deliver vivid colors and better contrast makes them ideal for both indoor and outdoor applications, including digital signage, interactive classrooms, and collaborative workspaces. The growing adoption of fine-pitch and micro-LED technologies has further enhanced display sharpness and interactivity, contributing to broader market penetration.

LCD technology continues to hold a notable share, especially in cost-sensitive markets where affordability and wide availability make it a suitable choice for schools and small businesses. However, OLED displays are gaining traction in premium and commercial applications due to their flexibility, thinner profile, and superior image quality.

The “Others” category, which includes emerging technologies such as quantum-dot and laser-based displays, is still at an early stage of development but shows promise for future innovation. Despite increasing competition, LED remains the preferred technology because of its durability, scalability, and ability to meet the growing demand for high-performance interactive display solutions globally.

By Vertical

The education segment accounted for 30.5% of the Interactive Display Market in 2024, representing the leading vertical due to the rapid digital transformation of classrooms and growing investments in smart learning environments. Educational institutions across primary, secondary, and higher education levels are increasingly adopting interactive whiteboards, flat panels, and smart displays to improve student engagement and facilitate collaborative learning.

The integration of AI, cloud connectivity, and touch-enabled technologies has made interactive displays essential tools for hybrid and remote learning models. Governments and private institutions are also funding large-scale digital education initiatives, driving the demand for connected and user-friendly classroom technologies.

The corporate and government sectors follow closely, using interactive displays to enhance communication, data visualization, and collaborative workflows in meeting spaces. Retail and hospitality are leveraging these systems for digital signage, customer engagement, and interactive service kiosks.

Healthcare institutions are adopting displays for telemedicine, patient education, and operational management, while the sports and entertainment industry uses them for real-time analytics and audience engagement. Transportation hubs are integrating interactive panels for navigation and passenger information systems. Although multiple sectors are expanding adoption, education remains the dominant vertical as interactive technologies continue to redefine modern teaching and learning experiences.

Key Market Segments

By Product

- Interactive Kiosks

- Interactive Whiteboards

- Interactive Tables

- Interactive Video Walls

- Interactive Monitors

By Panel Size

- 17-32 Inches

- 32-65 Inches

- Above 65 Inches

By Panel Type

- Flat

- Flexible

- Transparent

By Technology

- LCD

- LED

- OLED

- Others

By Vertical

- Retail & Hospitality

- BFSI

- Industrial

- Healthcare

- Corporate & Government

- Transportation

- Education

- Sports & Entertainment

- Others

Regional Analysis

The North American region is a key market for interactive displays, accounting for 37.7% of global revenue in 2024 with a market size of USD 15.79 billion. The region’s strong position is driven by high adoption in sectors such as education and enterprise, where institutions and businesses are rapidly replacing traditional whiteboards and displays with interactive solutions. Technologies like multi-touch panels, cloud connectivity, and AI-embedded displays are more widely accepted in North America than in many other regions.

Another factor supporting growth is the well-established infrastructure and high per-capita IT spending in the US and Canada, enabling rapid deployment of large-format interactive displays in classrooms, boardrooms, retail environments, and public venues.

Government initiatives to modernise schools and digitalise workplaces further accelerate uptake. According to one industry source, North America’s dominance is attributed to increasing demand for immersive and engaging technologies in the region as user behaviour evolves.

Going forward, the US market is projected to maintain its lead but is expected to grow at a more moderate pace compared to emerging markets. The region’s growth will rely increasingly on upgrading legacy installations, implementing hybrid-work solutions, and integrating smart display technologies into broader digital ecosystems.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The global interactive display market is experiencing robust growth, primarily propelled by the expanding adoption of interactive learning solutions and digital classrooms. The demand for such displays in educational institutions is rising as schools and universities upgrade from traditional whiteboards to advanced interactive panels that support hybrid learning models.

Technological advancements in touch-sensing, multi-user interaction, high-resolution panels, and cloud connectivity are further accelerating market uptake.

The retail, hospitality, and transportation sectors are also driving demand, with interactive kiosks, video walls, and digital signage becoming integral to customer engagement and service delivery.

Cost reductions and improved affordability of flat panel displays have made these solutions accessible to a broader range of end-users, supporting faster deployment.Restraint Factors

Despite the strong growth prospects, the interactive display market faces several restraints. High initial procurement cost and total cost of ownership remain a barrier for many small and medium-sized enterprises and educational institutions.

Supply chain disruptions and volatility in component costs—especially for panels, touch sensors, and LEDs—can increase lead times and pricing pressure.

Integration challenges with legacy systems and user training requirements impede adoption in certain segments. Additionally, concerns over security, data privacy, and system maintenance in public and multi-user interactive environments are slowing adoption in regulated sectors.

Growth Opportunities

The market presents significant opportunities for innovation and expansion. The rise of hybrid work and learning models is generating demand for displays that support remote collaboration, multi-touch input, and cloud-enabled connectivity.

Technological advancements like AI-driven analytics, gesture recognition, and voice interfaces open new value-added services around interactive displays. Expanding deployments in emerging economies—especially in education, retail, and smart infrastructure—offer large untapped markets as expenditure on digital transformation grows.

New product categories such as large-format interactive video walls and transparent or flexible panel displays provide pathways for differentiation and premium value creation.

Challenging Factors

Several challenges could impede the pace of adoption. Managing increasingly large and complex deployments across multiple locations adds operational complexity and resource demands. Vendor fragmentation and compatibility issues across software/hardware ecosystems may complicate procurement and integration decisions.

The rapid pace of technological change raises risks of obsolescence, prompting end-users to hesitate on large investments. In addition, achieving measurable ROI and justifying spend on interactive display versus more traditional display solutions remains a hurdle for many organisations.

Competitive Analysis

The interactive display market is characterised by the presence of several global and regional players vying for leadership. Notable vendors—such as Samsung Electronics Co., Ltd., LG Electronics Inc., NEC Corporation, Panasonic Corporation, and ViewSonic Corporation—have built strong product portfolios across hardware, software, and services.

Competitive differentiation is increasingly driven by capabilities such as AI-enabled interaction, seamless device ecosystem integration, and managed services for education/business environments. As the market shifts beyond hardware into software-centric value-added offerings, companies that invest in software, cloud platforms, and user experience will likely gain an advantage.

While incumbents have scale and brand strength, agile start-ups and niche players targeting vertical-specific applications (e.g., retail kiosks, transport way-finding) are emerging as potential disruptors. Product innovation, strategic partnerships, and global distribution reach are thus key success factors in this competitive landscape.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Panasonic Corporation

- Leyard Optoelectronic Co., Ltd.

- Sharp NEC Display Solutions, Ltd.

- ViewSonic Corporation

- Planar Systems, Inc.

- SMART Technologies ULC

- Promethean World Ltd.

- Newline Interactive, Inc.

- Elo Touch Solutions, Inc.

- BenQ Corporation

- Delta Electronics, Inc. (Vivitek)

- Christie Digital Systems USA, Inc.

- AU Optronics Corp.

- Advantech Co., Ltd.

- Boxlight Corporation

- Horizon Display, Inc.

- Baanto International Ltd.

- Intuiface (IntuiLab SAS)

- CLEVERTOUCH (Boxlight)

- Kiosk Information Systems

- GestureTek Systems, Inc.

- Others

Major Developments

- July 17, 2025: LG CreateBoard UltraWide (105-inch) was introduced by LG Electronics USA, featuring a 21:9 aspect ratio and 5 K UltraHD resolution (5120×2160 at 60 Hz). The display is positioned for corporate boardrooms and large classrooms, and incorporates a built-in microphone array, sub-woofer, and USB-C connectivity to enhance collaboration and device sharing.

- June 12, 2024: Samsung Electronics announced the development of its new Color E-Paper display and SmartThings Pro platform for business digital signage. The Color E-Paper technology claims ultra-low power consumption — even zero power when displaying a static image — making it especially suited for retail, hospitality, and public-space interactive displays.

Report Scope

Report Features Description Market Value (2024) USD 41.89 Billion Forecast Revenue (2034) USD 91.28 Billion CAGR(2025-2034) 8.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Product (Interactive Kiosks, Interactive Whiteboards, Interactive Tables, Interactive Video Walls, Interactive Monitors), By Panel Size (17-32 Inches, 32-65 Inches, Above 65 Inches), By Panel Type (Flat, Flexible, Transparent), By Technology (LCD, LED, OLED, Others), By Vertical (Retail & Hospitality, BFSI, Industrial, Healthcare, Corporate & Government, Transportation, Education, Sports & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Panasonic Corporation, Leyard Optoelectronic Co., Ltd., Sharp NEC Display Solutions, Ltd., ViewSonic Corporation, Planar Systems, Inc., SMART Technologies ULC, Promethean World Ltd., Newline Interactive, Inc., Elo Touch Solutions, Inc., BenQ Corporation, Delta Electronics, Inc. (Vivitek), Christie Digital Systems USA, Inc., AU Optronics Corp., Advantech Co., Ltd., Boxlight Corporation, Horizon Display, Inc., Baanto International Ltd., Intuiface (IntuiLab SAS), CLEVERTOUCH (Boxlight), Kiosk Information Systems, GestureTek Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Interactive Display MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Interactive Display MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Panasonic Corporation

- Leyard Optoelectronic Co., Ltd.

- Sharp NEC Display Solutions, Ltd.

- ViewSonic Corporation

- Planar Systems, Inc.

- SMART Technologies ULC

- Promethean World Ltd.

- Newline Interactive, Inc.

- Elo Touch Solutions, Inc.

- BenQ Corporation

- Delta Electronics, Inc. (Vivitek)

- Christie Digital Systems USA, Inc.

- AU Optronics Corp.

- Advantech Co., Ltd.

- Boxlight Corporation

- Horizon Display, Inc.

- Baanto International Ltd.

- Intuiface (IntuiLab SAS)

- CLEVERTOUCH (Boxlight)

- Kiosk Information Systems

- GestureTek Systems, Inc.

- Others