Global Insurance Fraud Detection Market Size, Share Analysis Report By Component (Solutions, Services), By Deployment (Cloud, On-Premise), Organization Size (SMB, Large Organization), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132368

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

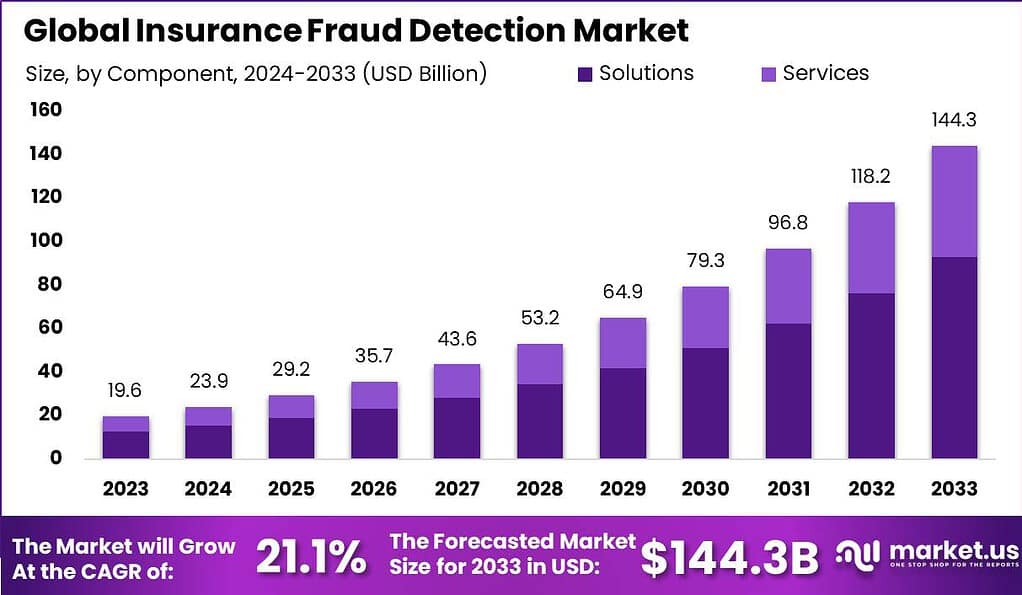

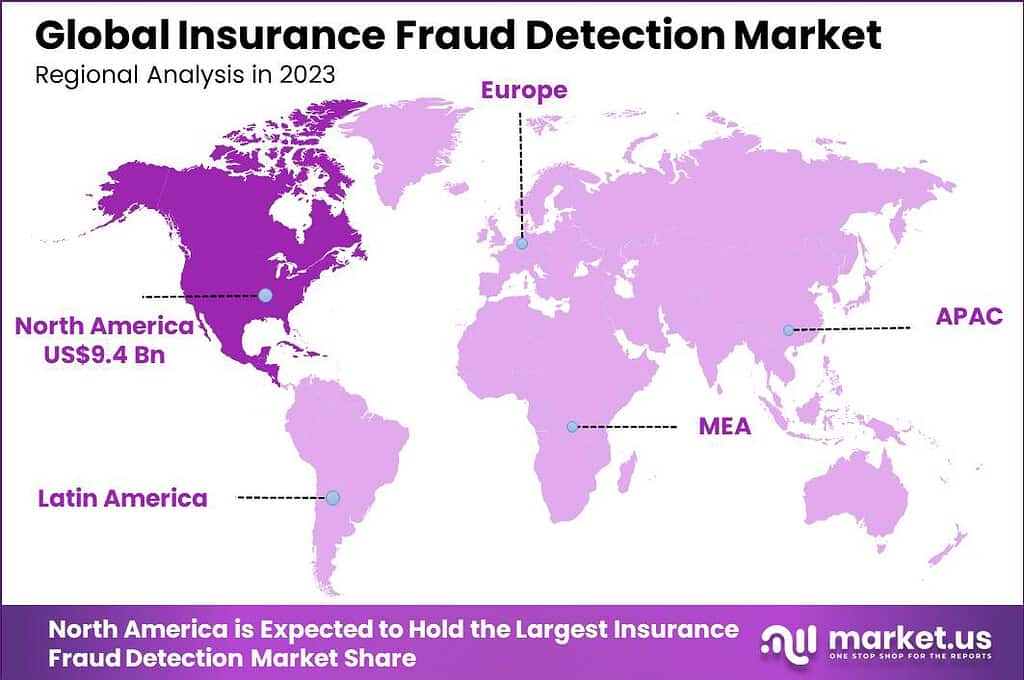

The Global Insurance Fraud Detection Market size is expected to be worth around USD 144.3 Billion By 2033, from USD 19.6 Billion in 2023, growing at a CAGR of 21.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 49.1% share, holding USD 9.4 Billion revenue.

Insurance fraud detection is an essential function within the insurance industry aimed at identifying and preventing fraudulent activities that can result in significant financial losses. This type of fraud can manifest in various forms, such as false claims, exaggerated damages, or fabricated incidents. The detection process often integrates advanced technologies such as artificial intelligence (AI) and machine learning to analyze patterns and flag suspicious cases.

The insurance fraud detection market is growing, driven by the increasing need for insurers to minimize losses associated with fraudulent claims, which in the U.S. alone cost insurers billions annually. As insurance processes become more digitized, the opportunities for fraud have also increased, making sophisticated fraud detection solutions more crucial. This market includes a range of solutions from simple anomaly detection systems to complex AI-driven platforms that analyze vast amounts of data to identify patterns indicative of fraudulent activity.

Several factors drive the demand for advanced fraud detection in insurance. The rising volume of insurance transactions and the growing complexity of fraud tactics require robust systems capable of identifying and reacting to potential threats swiftly. Additionally, regulatory requirements for better transparency and the need to maintain customer trust propel insurers to invest in these technologies. Insurers are adopting technologies like predictive analytics and machine learning to stay ahead of fraudsters.

Demand in the insurance fraud detection market is increasing as more insurers recognize the cost implications of fraud and the benefits of early detection systems. This demand is also spurred by the increasing prevalence of digital insurance services, which, while convenient, open new avenues for fraud. Insurers are keen on solutions that not only detect but also prevent fraud, thereby safeguarding their revenues and customer relationships.

According to Forbes, the annual loss due to insurance fraud in the U.S. is a staggering $308.6 billion, which breaks down to about $900 added to each consumer’s premium annually. A significant 78% of consumers express concern about the prevalence of insurance fraud, underlining its broad impact on public sentiment.

Health care insurance fraud tops the list as the most expensive, draining an estimated $105 billion from consumers each year. This is followed by life insurance and property and casualty frauds, which cost $74.7 billion and $45 billion respectively. These figures reflect a growing trend in fraudulent claims, which now constitute around 12% of total industry revenue – a number that has nearly doubled over the last thirty years.

On the international front, Indiaforensic Research highlights that insurance fraud costs India’s industry around INR 300 billion (approximately $6 billion) annually, making up about 8.5% of the industry’s total revenue. The life insurance sector feels the brunt of this impact, with 86% of all fraud cases.

In the health insurance sector, fraud accounts for between 3% to 10% of total health expenditures, and an alarming 15% of health insurance claims are suspected to be fraudulent, showcasing a crucial area for the advancement of fraud detection technologies.

Key Takeaways

- The Global Insurance Fraud Detection Market is set for impressive growth, expected to reach USD 144.3 billion by 2033, up from USD 19.6 billion in 2023, at a notable CAGR of 21.1% from 2024 to 2033.

- In 2023, North America dominated the market with over 49.1% market share, translating to USD 9.4 billion in revenue.

- The Solutions segment emerged as the most significant, capturing more than 64.5% of the market share in 2023.

- Regarding deployment, the on-premise segment held a dominant position in 2023.

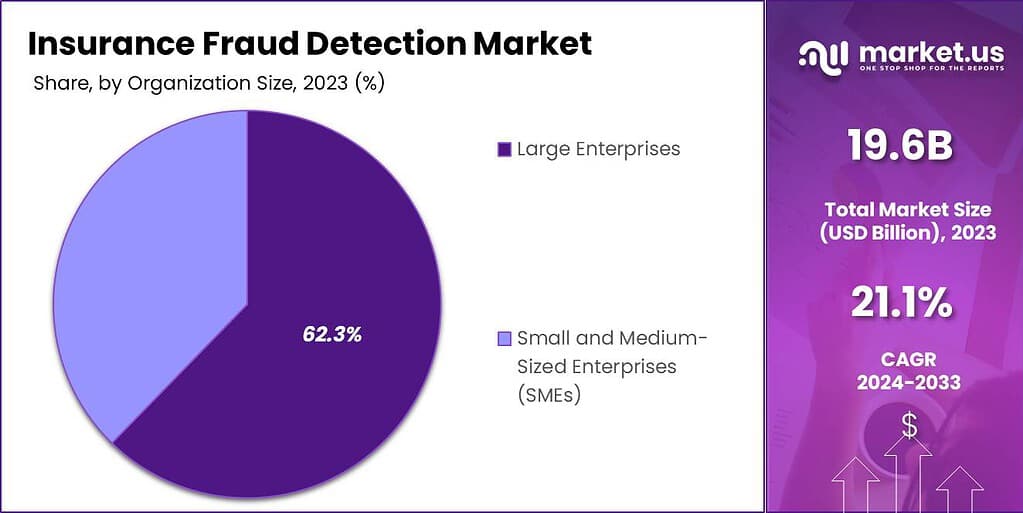

- Furthermore, large organizations led the market in 2023, holding a significant 62.3% share.

Component Analysis

In 2023, the Solutions segment held a dominant market position within the Insurance Fraud Detection market, capturing more than a 64.5% share. This dominance can be attributed to the increasing adoption of advanced technological solutions by insurance companies aiming to enhance their fraud detection capabilities.

As insurers face growing challenges from sophisticated fraud schemes, the demand for comprehensive solutions that can detect, analyze, and prevent fraudulent activities in real-time has surged. These solutions often integrate artificial intelligence, machine learning, and predictive analytics, providing insurers with powerful tools to identify unusual patterns and suspicious behaviors quickly and accurately.

The preference for the Solutions segment is also driven by the continuous development of new technologies and the integration of big data analytics into fraud detection systems. Insurance companies are increasingly investing in these technologies to stay ahead of fraudsters, reduce financial losses, and maintain compliance with regulatory standards.

By leveraging advanced analytics and modeling techniques, these solutions can sift through vast amounts of data to extract actionable insights, making them indispensable in the modern insurance landscape. Furthermore, the rise of digital transformation within the insurance industry has necessitated robust fraud detection solutions that can operate across digital platforms seamlessly.

As more customers interact with insurers via online channels, the potential for cyber fraud increases, thereby boosting the demand for solutions that can effectively manage and mitigate risks in a digital context. This trend is expected to continue as digital interactions become the norm, reinforcing the Solutions segment’s dominance in the market.

Overall, the Solutions segment’s commanding market share reflects its critical role in helping insurers protect against financial and reputational damage through effective and efficient fraud detection mechanisms. As the industry evolves, these solutions are likely to become even more sophisticated, incorporating newer technologies such as blockchain and IoT, which could offer additional layers of security and further drive segment growth.

Deployment Analysis

In 2023, the on-premise segment held a dominant market position in the Insurance Fraud Detection market, capturing a significant share. This continued preference for on-premise deployment stems primarily from the high-value concerns over data security and privacy.

Many insurance companies handle sensitive personal and financial information that requires stringent security measures, which on-premise solutions better guarantee by keeping data within the physical premises of the organization. This arrangement minimizes vulnerabilities associated with data breaches that are more common in cloud environments.

Additionally, on-premise deployment allows insurance firms to maintain full control over their IT infrastructure, which is crucial for integrating fraud detection solutions seamlessly with existing systems without the potential delays and compatibility issues associated with cloud deployments. It also provides the flexibility to customize solutions according to specific organizational needs and regulatory requirements, which can vary widely in different jurisdictions.

Moreover, despite the growing trend toward cloud-based solutions offering scalability and cost-effectiveness, the on-premise segment remains resilient due to its ability to offer better performance in terms of speed and reliability. These factors are critical when handling large volumes of claims data and executing complex fraud detection algorithms where real-time processing can significantly impact operational efficiency.

At the end, the dominance of the on-premise segment in the Insurance Fraud Detection market is supported by its superior capabilities in data security, system control, and performance. As the insurance industry continues to navigate the complexities of digital transformation, on-premise solutions are expected to remain a vital component of fraud prevention strategies, especially for firms prioritizing data security and system integration.

Organization Size Analysis

In 2023, the large organization segment held a dominant market position in the Insurance Fraud Detection market, capturing a significant share of 62.3%. This dominance can be attributed to several factors, primarily the scale of the financial and reputational risks associated with insurance fraud that large organizations face.

These entities typically handle vast numbers of transactions and claims, which increases their exposure to fraudulent activities and magnifies the potential impact of any single incident. As a result, large organizations invest heavily in comprehensive fraud detection systems to safeguard against substantial losses.

Moreover, large organizations have the financial capacity to implement advanced, resource-intensive fraud detection solutions that might be cost-prohibitive for smaller businesses. These solutions often involve integrating sophisticated technologies such as artificial intelligence, machine learning, and big data analytics, which are crucial for analyzing large datasets and identifying complex fraudulent patterns efficiently.

The ability to deploy such advanced systems supports the larger firms’ needs to maintain operational integrity and comply with strict regulatory requirements that govern their operations. Furthermore, the inherent complexity of large organizations – often operating across multiple regions with varied regulatory landscapes – necessitates robust fraud detection mechanisms that can be customized to specific operational and legal contexts.

This customization is easier to manage with the resources available to large organizations, allowing them to deploy tailored solutions that effectively address their unique challenges. In essence, the dominance of the large organization segment in the insurance fraud detection market is driven by their higher risk exposure, greater financial capabilities, and the complex, global nature of their operations, which demand the most comprehensive and advanced solutions available to prevent, detect, and manage fraud effectively.

Key Market Segments

By Component

- Solutions

- Services

By Deployment

- Cloud

- On-Premise

By Organization Size

- SMB

- Large Organization

Driver

Increasing Use of Advanced Technologies

The insurance fraud detection market is being driven significantly by the rising use of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies enhance the capabilities of insurance companies to detect and prevent fraud more effectively. AI and ML, for instance, enable the analysis of vast amounts of data to identify patterns that may indicate fraudulent activities.

This technological evolution helps insurers to manage the enormous volume of claims and customer interactions more efficiently, ensuring quicker response times and more accurate fraud detection. The increased adoption of these advanced analytical solutions is crucial as they proactively defend against sophisticated fraudulent schemes that could otherwise result in considerable financial losses.

Restraint

High Implementation Costs

One significant restraint in the insurance fraud detection market is the high cost associated with implementing advanced fraud detection systems. These systems often require substantial initial investment in terms of both technology and expertise.

Setting up AI and ML-powered systems, for instance, involves expenses related to acquiring the right tools, integrating them into existing systems, and training personnel to use them effectively. For many smaller insurance firms, these costs can be prohibitively expensive, limiting their ability to adopt the latest technologies. This financial barrier can slow down the market growth, as not all companies can afford to invest in such advanced detection mechanisms.

Opportunity

Integration with Emerging Technologies

The integration of emerging technologies like blockchain presents significant growth opportunities within the insurance fraud detection market. Blockchain technology offers enhanced security and transparency by creating immutable records of insurance transactions, which can significantly reduce the chances of fraud.

This technology also enables the verification of transactions and claims in real-time, which can help to streamline processes and reduce the administrative burden associated with claims processing. As more insurance companies recognize these benefits, the adoption of blockchain and other emerging technologies is likely to increase, thus expanding the market further.

Challenge

Complexity of Cyber Threats

A major challenge facing the insurance fraud detection market is the complexity and evolution of cyber threats. As insurance companies store large volumes of sensitive personal and financial information, they become prime targets for cyberattacks. The methods used by cybercriminals are becoming increasingly sophisticated, making it difficult for traditional fraud detection systems to keep up.

Insurance companies need to continuously update their fraud detection technologies to deal with these evolving threats, which can be both costly and technically challenging. This ongoing need for advanced security measures represents a significant hurdle for the industry.

Growth Factors

The insurance fraud detection market is experiencing substantial growth due to several pivotal factors. Foremost among these is the increasing integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics across the insurance industry.

These technologies are crucial in analyzing large datasets, identifying patterns, and predicting fraudulent activities, thereby enabling insurers to respond swiftly and effectively to potential threats. As the volume of digital transactions and data within the insurance sector continues to grow, so does the complexity of fraud, making these advanced analytical tools essential for modern fraud detection strategies. Moreover, regulatory pressures and compliance requirements are also significant growth drivers.

Insurers are mandated to implement stringent fraud detection measures to comply with global standards and regulations, which in turn fuels the adoption of sophisticated fraud detection solutions. This regulatory environment not only helps in maintaining market integrity but also assures customers of their protection against fraud, enhancing trust in insurance providers.

Additionally, the financial impact of insurance fraud, which incurs substantial losses to companies, compels the industry to invest in effective fraud detection and prevention solutions. The realization of the cost-effectiveness of preemptive fraud detection measures versus the expense of post-fraud settlements and payouts is pushing the market forward. As a result, there is a growing demand for insurance fraud detection solutions that can offer more precise risk assessment and robust fraud analytics capabilities.

Emerging Trends

Emerging trends within the insurance fraud detection market are primarily technology-driven. The adoption of blockchain technology is one such trend, enhancing the transparency and security of insurance transactions. Blockchain’s capability to provide immutable records and facilitate real-time transaction verification is becoming increasingly valued for fraud prevention in insurance.

The use of social media analytics for fraud detection is also on the rise. Insurers are leveraging these tools to analyze data from social media platforms to detect and prevent insurance fraud. This approach helps in understanding customer behavior patterns and identifying discrepancies that may indicate fraudulent activities.

Cloud-based fraud detection solutions are gaining traction due to their scalability, flexibility, and cost-efficiency. These solutions allow insurers to manage and analyze vast amounts of data more effectively and adapt to the rapidly changing dynamics of fraud risks. The shift towards cloud environments supports real-time data processing and enhances the overall efficiency of fraud detection operations.

Business Benefits

Implementing advanced fraud detection systems offers numerous business benefits to insurance companies. Firstly, it significantly reduces the financial losses associated with fraudulent claims. By identifying potential frauds early in the process, insurers can avoid hefty payouts and legal complications associated with fraudulent activities.

Enhanced customer trust and satisfaction is another crucial benefit. Customers feel more secure knowing that their insurance provider is actively protecting their policies from fraud. This trust translates into higher customer retention rates and attracts new customers looking for reliable and secure insurance options.

Operational efficiency is also improved through the automation of fraud detection processes. Advanced analytics and machine learning models can automate the screening and analysis of claims, reducing the workload on human adjusters and speeding up the claims process. This not only cuts operational costs but also enables insurers to allocate resources more effectively towards areas that require more strategic focus.

Regional Analysis

In 2023, North America held a dominant market position in the Insurance Fraud Detection market, capturing more than a 49.1% share with revenues amounting to USD 9.4 billion. This substantial market share can be attributed to several factors that reinforce the region’s leadership in the sector.

Firstly, the high adoption rate of advanced analytical technologies among North American insurance companies plays a crucial role. These entities leverage sophisticated AI and machine learning algorithms to analyze patterns and predict potential fraud scenarios, thereby mitigating risks and reducing losses.

Furthermore, stringent regulatory frameworks and substantial investments in fraud detection technologies drive the market forward. North American insurers are compelled to implement robust fraud detection systems to comply with government policies aimed at protecting consumer rights and ensuring market integrity. This regulatory pressure prompts continual upgrades in fraud detection capabilities, which in turn fuels market growth.

The presence of major technology providers and a competitive technological landscape in North America also contribute significantly. Companies based in the U.S. and Canada are at the forefront of developing innovative solutions that enhance the efficiency and effectiveness of fraud detection systems. These solutions include real-time processing and predictive analytics, which are integral to detecting and preventing insurance fraud.

Moreover, the high incidence of insurance fraud in the region necessitates ongoing advancements in fraud detection technologies, ensuring that North America remains a pivotal market in the global arena. In contrast, other regions such as Europe, APAC, Latin America, the Middle East, and Africa also develop their insurance fraud detection capabilities but at a slower pace compared to North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global insurance fraud detection market is characterized by the presence of several key players, each contributing unique solutions and services to combat fraudulent activities.

IBM Corporation offers advanced fraud detection solutions leveraging artificial intelligence (AI) and machine learning (ML) to identify and prevent fraudulent claims. Their Watson platform provides real-time analytics and insights, enhancing the efficiency of fraud detection processes.

SAS Institute Inc. provides comprehensive analytics solutions that enable insurers to detect, prevent, and manage fraud. Their fraud detection and investigation solutions utilize predictive analytics to identify suspicious activities and reduce false positives.

FICO (Fair Isaac Corporation) offers fraud detection and prevention solutions that utilize advanced analytics and decision management technology. Their Falcon Fraud Manager is widely used in the insurance industry to detect and prevent fraudulent activities.

Top Key Players in the Market

- IBM

- SAS Institute Inc.

- FICO

- LexisNexis Risk Solutions

- Oracle

- Capgemini

- DXC Technology Company

- FRISS

- BAE Systems

- Experian Information Solutions Inc.

Recent Developments

- October 2024: Experian agreed to acquire Brazilian cybersecurity firm ClearSale for $350 million. This acquisition aims to enhance Experian’s identity and fraud (ID&F) services by integrating ClearSale’s expertise in transaction fraud detection.

- In May 2024, Solutis, a Brazilian technology company, announced a strategic partnership with FICO. This collaboration is designed to support medium-sized banks and insurance companies by helping them reduce fraud risks and minimize financial losses. The initiative also promotes financial inclusion and aims to simplify critical business decisions for companies in the finance sector.

- In June 2024, ForMotiv, a leader in behavioral data science, teamed up with FRISS, well-known for trust automation solutions within the insurance industry. Together, they plan to deliver new insights into applicant behaviors and intentions, focusing on enhancing fraud detection and improving risk assessment capabilities.

Report Scope

Report Features Description Market Value (2023) USD 19.6 Bn Forecast Revenue (2033) USD 144 Bn CAGR (2024-2033) 21.1% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment (Cloud, On-Premise), Organization Size (SMB, Large Organization) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, SAS Institute Inc., FICO, LexisNexis Risk Solutions, Oracle, Capgemini, DXC Technology Company, FRISS, BAE Systems, Experian Information Solutions Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insurance Fraud Detection MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Insurance Fraud Detection MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- SAS Institute Inc.

- FICO

- LexisNexis Risk Solutions

- Oracle

- Capgemini

- DXC Technology Company

- FRISS

- BAE Systems

- Experian Information Solutions Inc.