Global Insurance Chatbot Market Report By Type (Customer Service Chatbots, Sales Chatbots, Claims Processing Chatbots, Underwriting Chatbots, Others), By User Interface (Text-based Interface, Voice-based Interface), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 127613

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

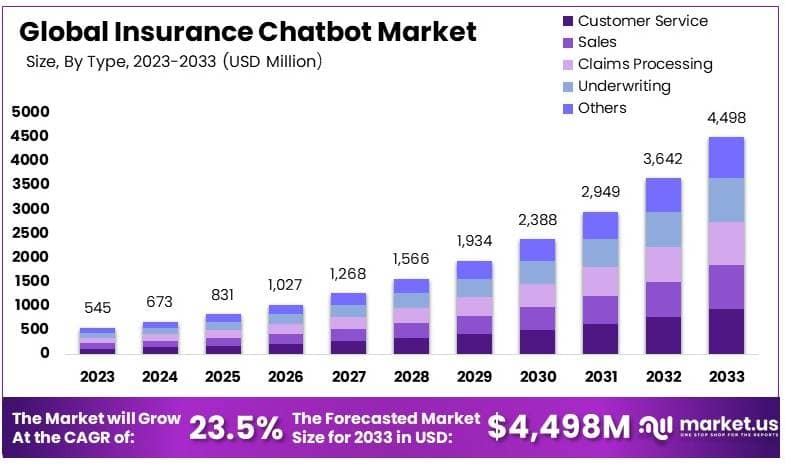

The Global Insurance Chatbot Market size is expected to be worth around USD 4,498 Million by 2033, from USD 545 Million in 2023, growing at a CAGR of 23.5% during the forecast period from 2024 to 2033.

An insurance chatbot is an automated software tool designed to simulate conversation with human users, specifically to assist with insurance-related queries and services. These chatbots utilize artificial intelligence (AI) and natural language processing (NLP) technologies to understand and respond to user inputs effectively. They can perform various functions such as providing policy details, assisting in claim processing, and answering FAQs.

Insurance companies deploy these chatbots on their websites, mobile apps, and through social media platforms to enhance customer service, streamline operations, and reduce operational costs by handling routine inquiries without human intervention. The insurance chatbot market is expanding as insurers increasingly adopt digital solutions to improve customer engagement and operational efficiency. This market’s growth is driven by the rising demand for automated customer support services, the need for seamless 24/7 customer service, and the ability to manage large volumes of customer interactions cost-effectively.

This evolution is supported by ongoing technological advancements in machine learning, AI, and computing power, which are making chatbots more reliable and capable of handling complex interactions. The market is further influenced by the digital transformation trends across the insurance industry, prompting companies to innovate and maintain competitive advantage.

The demand for insurance chatbots has surged due to the growing need for efficient customer service solutions in the insurance sector. Customers increasingly seek instant responses and 24/7 access to information regarding their insurance policies, claims, and other services. Insurance chatbots fulfill this need by providing real-time interactions and automating routine inquiries, which enhances customer experience and satisfaction.

The future opportunities for insurance chatbots are vast. As technology evolves, chatbots are expected to become more sophisticated, with enhanced natural language processing abilities to better understand and respond to complex customer queries. There is also potential for greater integration of chatbots into mobile platforms, social media, and even IoT devices, expanding the touchpoints through which insurers can engage customers.

The insurance chatbot market is gaining significant momentum as the industry adapts to evolving customer expectations and technological advancements. In 2023, the U.S. insurance industry demonstrated resilience, generating approximately $1.4 trillion in total revenue, with health insurance contributing over $1.1 trillion.

Chatbots are increasingly becoming a critical tool for insurance companies, enhancing customer engagement, streamlining operations, and reducing costs. Globally, approximately 1.5 billion people use chatbots, with the United States, India, Germany, the United Kingdom, and Brazil leading in adoption.

The number of chatbot users is expected to continue rising, and by 2027, chatbots are projected to become the primary customer service channel for 25% of businesses. This shift is largely driven by the demand for instant support, with 88% of web users having interacted with chatbots in the previous year. Notably, 7 out of 10 users reported a positive experience, highlighting the effectiveness of chatbots in meeting customer needs.

For the insurance industry, chatbots offer several advantages. They provide immediate responses to customer inquiries, handle routine tasks like policy information updates and claim status checks, and free up human agents to focus on more complex issues.

The concentration of market power within the top 25 insurance groups, which accounted for over $1 trillion in direct written premiums, underscores the competitive landscape. These large entities are likely to lead the charge in chatbot adoption, leveraging the technology to enhance their customer service offerings and gain a competitive edge.

The insurance chatbot market is poised for significant growth. As consumer expectations for fast and reliable service continue to rise, insurance companies that invest in chatbot technology will be better positioned to meet these demands, improve operational efficiency, and maintain their market position in an increasingly competitive environment.

Key Takeaways

- The Insurance Chatbot Market was valued at USD 545 million in 2023, and is expected to reach USD 4,498 million by 2033, with a CAGR of 23.5%.

- In 2023, Customer Service Chatbots dominated the type segment with 21.2% due to their role in enhancing customer interactions.

- In 2023, Text-based Interface led the user interface segment with 68.4%, favored for its simplicity and familiarity.

- In 2023, North America was the dominant region with 37.5% market share, driven by advanced adoption of AI technologies in insurance.

Type Analysis

Customer Service Chatbots dominate with 21.2% due to their ability to enhance customer interaction and service efficiency.

In the insurance chatbot market, Customer Service Chatbots have established themselves as the dominant sub-segment, holding a market share of 21.2%. This dominance is primarily driven by the increasing demand for efficient and real-time customer service solutions in the insurance industry.

Customer Service Chatbots streamline interactions, manage high volumes of queries, and provide instant responses, which are critical for maintaining customer satisfaction and loyalty in a competitive market.

While Customer Service Chatbots lead, other types such as Sales Chatbots, Claims Processing Chatbots, and Underwriting Chatbots also play significant roles. Sales Chatbots enhance the marketing aspect by engaging potential clients and generating leads.

Claims Processing Chatbots optimize the claims handling process, reducing the time and effort required by human agents. Underwriting Chatbots automate risk assessment tasks, increasing the speed and accuracy of policy issuance.

Despite the lower market share of these other types, their impact on operational efficiencies and cost reductions makes them vital to the growth and evolution of the insurance chatbot market. As technology advances, these segments are expected to gain traction, potentially altering market dynamics by offering specialized solutions tailored to different aspects of the insurance process.

User Interface Analysis

Text-based Interface dominates with 68.4% due to its simplicity and wide applicability.

The Text-based Interface holds the largest share in the user interface category for insurance chatbots, dominating the market with 68.4%. This predominance is largely due to the universal applicability and simplicity of text-based interactions, which do not require the user to possess advanced technical skills.

Most customers find text-based chatbots easy to use, making them a preferred choice for insurance companies aiming to implement an efficient, scalable, and cost-effective customer service solution.

On the other hand, Voice-based Interfaces, while growing in popularity, are yet to reach the widespread adoption seen with text-based systems. These interfaces represent a more natural form of communication and are increasingly seen as a way to enhance user experience, especially with the rise of voice-activated devices.

The dominance of text-based interfaces is expected to continue in the near future, supported by their ease of integration into existing platforms and lower operational costs. However, as advancements in AI and natural language processing improve the capability and accessibility of voice-based technologies, their adoption is likely to increase, potentially shifting the dynamics within the market segment.

Key Market Segments

By Type

- Customer Service Chatbots

- Sales Chatbots

- Claims Processing Chatbots

- Underwriting Chatbots

- Others

By User Interface

- Text-based Interface

- Voice-based Interface

Driver

Technological Advancements Drive Market Growth

Technological advancements have significantly driven the growth of the Insurance Chatbot Market. The integration of artificial intelligence (AI) and machine learning (ML) into chatbots enhances customer interaction by providing personalized experiences. This leads to higher customer satisfaction and retention, boosting market demand.

Additionally, the increasing adoption of digital transformation strategies by insurance companies has fueled the need for automated customer service tools. Chatbots reduce operational costs by automating routine inquiries, thereby improving efficiency.

Furthermore, the rise in mobile device usage has expanded the reach of chatbots, making them more accessible to a broader audience. This increased accessibility contributes to the market’s expansion.

Finally, regulatory support for digital solutions in the insurance sector has encouraged companies to implement chatbots to comply with industry standards, further propelling market growth. Collectively, these factors underscore how technological advancements and the broader adoption of digital tools are central to the market’s upward trajectory.

Restraint

Data Privacy and Compliance Restraints Market Growth

Data privacy and compliance issues significantly restrain market growth in the Insurance Chatbot Market. The increasing enforcement of data protection regulations, like GDPR, requires insurance companies to invest heavily in secure data management practices. This not only adds to operational costs but also slows down the deployment of chatbot solutions.

Moreover, the risk of data breaches and cyber-attacks raises concerns among insurers, making them cautious in adopting chatbot technologies. Ensuring robust cybersecurity measures to protect sensitive customer data becomes a critical requirement, further complicating implementation.

Additionally, customer skepticism about sharing personal information with chatbots due to privacy concerns can limit the effectiveness and reach of these tools. This lack of trust may hinder customer engagement, reducing the overall impact of chatbot integration.

Opportunity

Expanding Digital Adoption Provides Opportunities

Expanding digital adoption provides significant opportunities for players in the Insurance Chatbot Market. The rapid shift towards digital insurance platforms across industries opens avenues for chatbot integration in insurance services. As customers increasingly prefer digital communication, insurers have the chance to enhance customer engagement through chatbot solutions, driving higher interaction rates.

Moreover, the growing importance of personalized services creates an opportunity for companies to develop advanced chatbots that cater to individual customer needs. This personalization can lead to improved customer loyalty and competitive advantage in the market.

In addition, the surge in mobile AI usage presents an opportunity to reach a wider customer base. Insurers can capitalize on this trend by offering chatbot services on mobile platforms, ensuring accessibility and convenience for users.

Furthermore, regulatory support for digital innovations in the insurance sector offers an opportunity to align chatbot solutions with compliance requirements. This alignment not only ensures smoother operations but also strengthens the trust between insurers and customers, enhancing market growth potential.

Challenge

Technological Complexity Challenges Market Growth

Technological complexity presents significant challenges to the growth of the Insurance Chatbot Market. Integrating advanced chatbot solutions with existing legacy systems is often difficult, especially for insurance companies operating with outdated infrastructure. This can lead to operational inefficiencies and increased implementation costs.

Additionally, the rapid evolution of chatbot technology requires continuous updates and maintenance. Keeping up with these advancements demands significant resources, which can be a burden for smaller companies.

Furthermore, a lack of technical expertise within some insurance firms hinders the effective deployment and utilization of chatbots. Without proper knowledge, companies may struggle to maximize the benefits of chatbot technology.

The complexity of customizing chatbots to meet specific business needs adds another layer of difficulty. Tailoring these solutions to align with unique operational requirements can be time-consuming and costly.

Growth Factors

AI and Automation Are Growth Factors

AI and automation are significant growth factors driving the expansion of the Insurance Chatbot Market. The increasing integration of artificial intelligence (AI) in chatbots enhances their ability to provide personalized and efficient customer service. This personalization improves customer satisfaction, leading to higher retention rates and increased demand for chatbot solutions.

Furthermore, the automation of routine tasks, such as answering common inquiries and processing claims, reduces operational costs for insurance companies. This cost-effectiveness encourages more firms to adopt chatbot technology, further fueling market growth.

Additionally, the scalability of AI-driven chatbots allows insurance companies to handle a growing volume of customer interactions without compromising service quality. This capability is particularly important as the customer base expands, making chatbots a critical tool for managing customer relationships effectively.

Moreover, the continuous advancements in natural language processing (NLP) technology improve the accuracy and responsiveness of chatbots, enhancing their appeal to both insurers and customers. As chatbots become more sophisticated, their adoption is expected to rise, contributing to sustained market growth.

Emerging Trends

Personalization and Mobile Integration Are Latest Trending Factors

Personalization and mobile integration are the latest trending factors influencing the growth of the Insurance Chatbot Market. The growing demand for personalized customer experiences is pushing insurers to adopt chatbot solutions that can tailor interactions based on individual customer profiles. This trend not only enhances customer satisfaction but also strengthens brand loyalty, driving market expansion.

Moreover, the widespread use of mobile devices has led to the integration of chatbot services within mobile apps. This mobile integration ensures that customers have access to insurance services anytime, anywhere, significantly increasing the convenience and appeal of chatbots.

Additionally, the trend of omnichannel communication, where customers interact with companies across multiple platforms seamlessly, is gaining traction. Chatbots that can operate across various channels, including mobile, web, and social media, are becoming essential tools for insurers looking to provide a consistent customer experience. This adaptability contributes to the growing popularity and demand for chatbot solutions.

Regional Analysis

North America Dominates with 37.5% Market Share

North America leads the Insurance Chatbot market with a 37.5% share, valued at USD 204.38 million. This dominance is driven by the region’s advanced digital infrastructure, high adoption of AI and automation technologies, and a strong push towards enhancing customer service in the insurance sector.

The presence of major technology innovators and insurance companies in North America fosters a competitive environment that accelerates the deployment and refinement of chatbots. High consumer expectations for fast, personalized service and the widespread use of mobile and internet technologies also contribute to the widespread adoption of chatbots.

The future of North America’s market presence appears robust, with ongoing advancements in AI and machine learning expected to further refine and expand chatbot capabilities. As insurers continue to focus on improving customer engagement and operational efficiency, the demand for sophisticated chatbot solutions is likely to increase.

Regional Overview for Other Regions

- Europe: Europe is also a significant player in the Insurance Chatbot market, driven by stringent customer service standards and widespread digital transformation across industries. The region’s focus on data protection and user privacy aligns with the development of secure and compliant AI-driven chatbot solutions.

- Asia Pacific: Asia Pacific is experiencing rapid growth in this market due to increasing internet penetration and a shift towards digital channels for consumer services. Financial sectors in high-growth economies such as China and India are particularly keen on adopting chatbot technology to handle large customer bases.

- Middle East & Africa: In the Middle East & Africa, adoption is still emerging but promising, given the region’s strategic investments in digital infrastructure and a growing fintech sector. Chatbots are becoming an attractive solution for providing scalable customer service without extensive physical networks.

- Latin America: Latin America shows potential for growth in the Insurance Chatbot market. Factors like increasing mobile usage and a young, tech-savvy population drive the adoption of chatbots, with businesses looking to capitalize on cost-effective solutions to improve customer interaction and service delivery.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Insurance Chatbot Market is shaped by a few leading companies that play a crucial role in its growth and innovation. The top three key players in this market are IBM Corporation, Oracle, and Amazon.com, Inc.

IBM Corporation is a major player in the insurance chatbot market, leveraging its Watson AI platform to deliver advanced conversational AI solutions. IBM’s strong expertise in AI and machine learning enables insurers to offer personalized and efficient customer service. Its global reach and continuous innovation position IBM as a leader in this market.

Oracle is another key player, providing robust chatbot solutions integrated with its cloud and enterprise software platforms. Oracle’s chatbots are widely used in the insurance sector for automating customer interactions and streamlining operations. Oracle’s strong presence in the enterprise market and its focus on AI-driven solutions give it significant influence in the insurance chatbot space.

Amazon.com, Inc. also holds a strong position in this market with its AWS AI services, particularly through Amazon Lex. Amazon’s technology powers many insurance chatbots, offering scalable and reliable solutions. Amazon’s dominance in cloud computing and its continuous investment in AI research strengthen its strategic positioning and impact on the insurance chatbot market.

These companies lead the way in the insurance chatbot market, driving innovation and adoption. Their strategic positioning, technological advancements, and market influence make them the key players shaping the future of insurance chatbots.

Top Key Players in the Market

- Oracle

- IBM Corporation

- Nuance Communications, Inc.

- LivePerson

- AlphaChat

- Chatfuel

- Botsify

- Amazon.com, Inc.

- Verint Systems, Inc.

- Inbenta Holdings Inc.

- Baidu Inc.

- NVIDIA Corporation

Recent Developments

- LivePerson: LivePerson announced that its AI-driven chatbots could automate up to 74.2% of insurance industry conversations, reducing customer care costs and enhancing engagement by handling common queries related to policy management and claims processing.

- IBM: Nuance Communications, now part of IBM, launched the Dragon Ambient eXperience (DAX™) Express. This solution integrates conversational AI and GPT-4 to automate clinical documentation and is also adapted for insurance to streamline administrative tasks.

- Oracle: Oracle has focused on expanding its presence in the insurance sector by integrating AI and chatbot solutions into its Oracle Insurance suite, designed to enhance policyholder interactions, streamline claims processing, and improve underwriting efficiency.

- Verint Systems: Verint Systems, Inc. has seen significant growth in its chatbot and AI solutions for the insurance industry. The company’s products are widely adopted for customer support and claims processing, contributing to a more efficient customer experience.

Report Scope

Report Features Description Market Value (2023) USD 545 Million Forecast Revenue (2033) USD 4,498 Million CAGR (2024-2033) 23.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Customer Service Chatbots, Sales Chatbots, Claims Processing Chatbots, Underwriting Chatbots, Others), By User Interface (Text-based Interface, Voice-based Interface) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Oracle, IBM Corporation, Nuance Communications, Inc., LivePerson, AlphaChat, Chatfuel, Botsify, Amazon.com, Inc., Verint Systems, Inc., Inbenta Holdings Inc., Baidu Inc., NVIDIA Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Insurance Chatbot Market?The Insurance Chatbot Market focuses on AI-driven chatbots designed to assist with insurance-related tasks such as customer support, claims processing, and policy management.

How big is the Insurance Chatbot Market?The Insurance Chatbot Market was valued at USD 545 million and is projected to grow to USD 4,498 million, with a CAGR of 23.5% during the forecast period.

What are the key factors driving the growth of the Insurance Chatbot Market?The growth is driven by increasing demand for automated customer service, the need to improve operational efficiency, and advancements in AI technology that enhance chatbot capabilities.

What are the current trends and advancements in the Insurance Chatbot Market?Trends include the integration of advanced natural language processing (NLP) capabilities, personalized customer interactions, and the use of chatbots for a wide range of insurance services including claims and policy inquiries.

What are the major challenges and opportunities in the Insurance Chatbot Market?Challenges include ensuring accurate and secure handling of sensitive customer information. Opportunities lie in expanding chatbot functionalities and integrating them with other digital insurance services.

Who are the leading players in the Insurance Chatbot Market?Leading players include Oracle, IBM Corporation, Nuance Communications, Inc., LivePerson, AlphaChat, Chatfuel, Botsify, Amazon.com, Inc., Verint Systems, Inc., Inbenta Holdings Inc., Baidu Inc., and NVIDIA Corporation.

-

-

- Oracle

- IBM Corporation

- Nuance Communications, Inc.

- LivePerson

- AlphaChat

- Chatfuel

- Botsify

- Amazon.com, Inc.

- Verint Systems, Inc.

- Inbenta Holdings Inc.

- Baidu Inc.

- NVIDIA Corporation