Insulin Delivery Devices Market By Product Type (Insulin Delivery Devices (Insulin Pumps (Tubeless Pumps and Tubed Pumps), Pens (Disposable and Reusable), and Other Devices), and Consumables (Testing Strips, Pen Needles (Safety and Standard), Insulin Pumps Consumables, and Syringes)), By End-user (Hospitals & Clinics, Home Care, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 102734

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

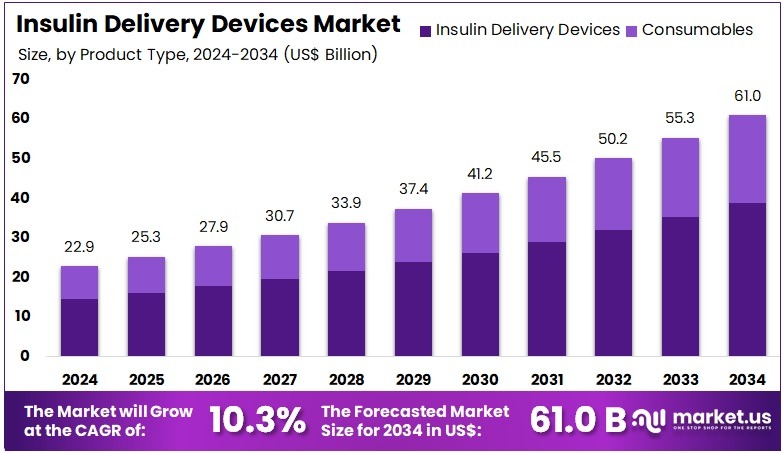

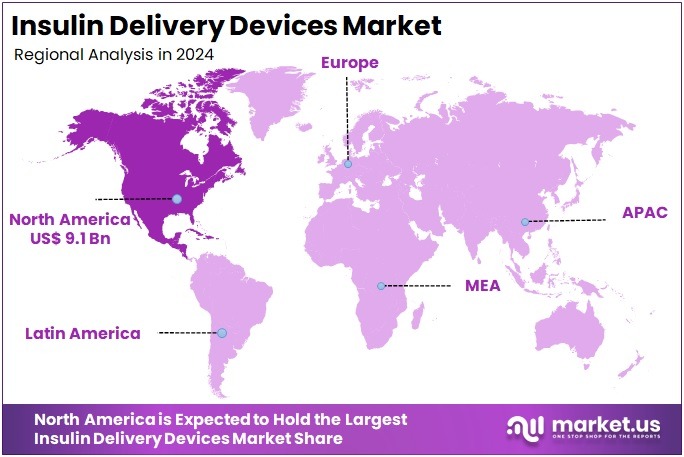

The Insulin Delivery Devices Market size is expected to be worth around US$ 61.0 billion by 2034 from US$ 22.9 billion in 2024, growing at a CAGR of 10.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.9% share and holds US$ 9.1 Billion market value for the year.

Increasing adoption of automated insulin delivery systems propels the Insulin Delivery Devices market, as patients and endocrinologists prioritize technologies that minimize glycemic variability and reduce daily decision burden. Manufacturers refine hybrid closed-loop platforms that combine continuous glucose monitoring with predictive algorithms for basal rate adjustments and automated correction boluses. These devices serve intensive insulin management in Type 1 diabetes, simplified regimens for Type 2 patients on basal-bolus therapy, pediatric populations requiring precise micro-dosing, and gestational diabetes needing tight control without hypoglycemia risk.

Advanced algorithm updates create opportunities to extend pump therapy to injection-reluctant adults previously managed with multiple daily injections. Tandem Diabetes Care delivered this exact expansion in March 2025 by launching its upgraded Control-IQ+ algorithm for the t:slim X2 and Mobi pumps, bringing sophisticated automated features to a broader Type 2 population and accelerating the shift toward algorithm-driven insulin delivery. This enhancement directly broadens clinical applicability and patient acceptance of pump technology.

Growing integration of pharmaceutical and device ecosystems accelerates the Insulin Delivery Devices market, as leading insulin producers acquire complementary capabilities to strengthen end-to-end diabetes management offerings. Strategic acquisitions position drug manufacturers to bundle next-generation molecules with smart delivery hardware and digital health tools.

Connected pens and dose-capture technologies support once-weekly insulin titration, combination therapy with GLP-1 agonists, concentration switching for cost optimization, and transition management from vials to prefilled devices. Drug-device convergence opens avenues for co-developed solutions that improve adherence and outcomes through unified data streams. Novo Nordisk advanced this strategy in August 2023 by acquiring Inversago Pharma, expanding its metabolic pipeline while reinforcing the strategic importance of connected pens and integrated platforms within its comprehensive diabetes portfolio. This move solidifies the trend toward seamless drug-device combinations in daily diabetes care.

Rising demand for digital titration and connectivity solutions invigorates the Insulin Delivery Devices market, as healthcare providers leverage apps and cloud platforms to guide safe, effective insulin dose optimization remotely. Technology partners develop interoperable systems that sync smart pens with continuous glucose monitors and electronic health records for real-time clinical oversight. These connected ecosystems facilitate basal insulin initiation in primary care, mealtime dose calculation using carbohydrate counting algorithms, correction dosing during illness or exercise, and population health management for large diabetes clinics.

Digital health integrations create opportunities for automated dose recommendations and proactive hypoglycemia alerts. Amalgam Rx and Novo Nordisk deepened this capability in December 2022 by expanding their partnership to commercialize the Dose Check titration app linked directly to insulin pens, CGMs, and medical records, markedly enhancing Type 2 insulin initiation and ongoing adjustment. This collaboration drives widespread adoption of data-driven, connected insulin delivery ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 22.9 billion, with a CAGR of 10.3%, and is expected to reach US$ 61.0 billion by the year 2034.

- The product type segment is divided into insulin delivery devices and consumables, with insulin delivery devices taking the lead in 2023 with a market share of 63.7%.

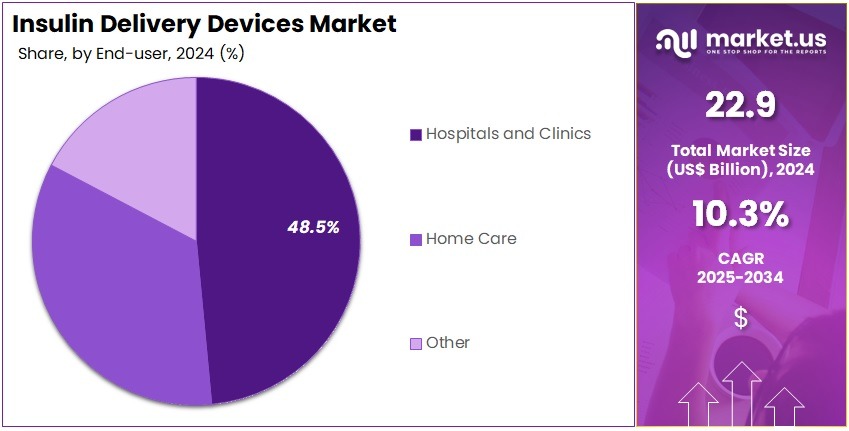

- Considering end-user, the market is divided into hospitals & clinics, home care, and other. Among these, hospitals & clinics held a significant share of 48.5%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Insulin delivery devices, holding 63.7% of the market, are expected to grow steadily as diabetes prevalence rises and users shift toward accurate, convenient, and connected administration methods. Strong adoption of pumps, smart pens, and wearable patches strengthens daily glucose control and simplifies treatment routines. Manufacturers introduce advanced algorithms, app-linked insights, and compact designs that encourage adoption in both developed and emerging regions.

Markets such as the United States, Germany, China, and Japan show strong preference for connected insulin ecosystems, and this preference is anticipated to support long-term revenue growth. Hybrid closed-loop systems are projected to expand as real-time feedback improves therapy precision. Pediatric users increasingly favor tubeless pumps for mobility, while seniors rely on smart reusable pens for simplified dosing.

Growing elderly populations expand device demand. Reimbursement improvements and national screening programs in Asia and Latin America support early insulin initiation. Manufacturer focus on comfort, safety, and digital support enhances satisfaction. Hospitals encourage connected devices during routine consultations. Continuous innovation and user-driven expectations keep this segment projected to remain the primary growth driver.

End-User Analysis

Hospitals and clinics, holding 48.5% of the end-user share, are anticipated to stay dominant because they initiate most transitions to pump and pen-based therapy. Physicians evaluate patient needs and recommend appropriate insulin delivery systems that align with treatment goals. Healthcare centers invest in structured diabetes programs and standardized glycemic-control pathways that strengthen device adoption. Patients trust hospital recommendations, and this trust accelerates the shift toward advanced delivery methods.

Major diabetes centers in the US, Europe, Japan, and South Korea increasingly use connected devices due to improved visibility and dosing accuracy. Rising hospital visits tied to uncontrolled diabetes increase reliance on guided therapy decisions. Hospitals conduct workshops, demonstrations, and counseling that improve confidence in modern devices.

Reimbursement assessments often begin in hospital settings, supporting higher uptake. Integration of digital insulin-management software reduces medication errors. Expansion of outpatient diabetes clinics in emerging regions improves awareness. Strong clinical oversight and continued patient engagement keep hospitals and clinics estimated to remain the most influential end-user category.

Key Market Segments

By Product Type

- Insulin delivery devices

- Insulin pumps

- Tubeless pumps

- Tubed pumps

- Pens

- Disposable

- Reusable

- Other devices

- Insulin pumps

- Consumables

- Testing strips

- Pen needles

- Safety

- Standard

- Insulin pumps consumables

- Syringes

By End-user

- Hospitals & Clinics

- Home care

- Other

Drivers

Increasing Prevalence of Diabetes is Driving the Market

The surge in diabetes cases globally has become a primary catalyst for the insulin delivery devices market, as escalating patient numbers demand reliable, user-friendly tools for daily glycemic management. This demographic shift, influenced by urbanization, dietary changes, and sedentary lifestyles, overwhelms traditional treatment paradigms, necessitating scalable delivery solutions like pens and pumps.

Healthcare policymakers are revising guidelines to incorporate advanced devices into standard care, ensuring integration with continuous glucose monitoring for comprehensive control. Manufacturers are ramping up production of compact, discreet systems to accommodate diverse age groups, from pediatrics to geriatrics. Public health campaigns emphasize device adoption to mitigate complications such as neuropathy and retinopathy, fostering preventive strategies.

Economic models project substantial savings from optimized insulin administration, justifying investments in accessible technologies. Collaborative efforts between endocrinologists and engineers refine ergonomics, enhancing adherence rates among newly diagnosed individuals. The prevalence not only boosts initial prescriptions but also sustains long-term consumable sales like reservoirs and cannulas.

International aid programs target high-burden regions, subsidizing device imports to bridge access gaps. This driver aligns with broader goals of chronic disease containment, spurring regulatory facilitations for expedited approvals. Global diabetes prevalence in adults reached 14% in 2022, up from 7% in 1990, as per WHO’s recent reports. Consequently, the market benefits from a structurally expanding user base, underpinning resilient growth trajectories.

Restraints

High Cost of Devices is Restraining the Market

The elevated pricing of insulin delivery devices remains a significant impediment to market penetration, particularly in low- and middle-income settings where affordability thresholds limit widespread adoption. Sophisticated features like bolus calculators and connectivity inflate manufacturing expenses, translating to prohibitive retail costs for uninsured patients.

Reimbursement frameworks vary regionally, with gaps in coverage leading to out-of-pocket burdens that deter proactive device transitions from syringes. This financial strain exacerbates health disparities, as patients delay upgrades to advanced systems, risking suboptimal control and higher complication rates. Providers face inventory challenges, balancing stock for premium versus basic models amid fluctuating payer negotiations.

Supply chain volatilities further compound costs, with raw material shortages driving up component prices unpredictably. Educational barriers compound the issue, as cost-conscious individuals undervalue long-term benefits over immediate expenses. Policy interventions aim to introduce generics, yet intellectual property protections prolong monopolistic pricing dynamics.

The restraint fosters innovation in cost-optimized designs, but incremental progress tempers overall expansion. Global health organizations advocate for tiered pricing, yet enforcement remains inconsistent across borders. Under Medicare, cost-sharing for insulin pumps and supplies ranged from $79 to $158 per month in 2023, depending on device age. These economics underscore the necessity for subsidized models to unlock latent demand.

Opportunities

Technological Advancements in Automated Systems are Creating Growth Opportunities

Innovations in automated insulin delivery systems are unveiling vast potential for market expansion, enabling closed-loop functionalities that mimic pancreatic responses for superior glycemic outcomes. These hybrid setups, pairing pumps with algorithms for predictive dosing, attract tech-savvy demographics seeking minimized manual interventions. Developers are exploring modular architectures, allowing seamless upgrades without full replacements, thus extending device lifespans.

Regulatory pathways for these advancements expedite market entries, with validations emphasizing cybersecurity in connected ecosystems. Partnerships between software firms and device makers accelerate interoperability with mobile apps, enhancing data-driven decisions. This opportunity extends to emerging markets, where solar-powered variants address electricity constraints in rural clinics. Clinical evidence of reduced hypoglycemic events bolsters payer endorsements, facilitating broader reimbursements.

Customization for pediatric use, including smaller reservoirs, taps into family-oriented segments. The convergence with biosensors promises fully integrated platforms, diversifying beyond standalone pumps. Longitudinally, these technologies position the market for subscription-based services, recurring through software updates. Medtronic’s diabetes segment reported $2.488 billion in revenue for fiscal 2024, a 10.0% increase from $2.262 billion in fiscal 2023. Such performance metrics signal robust avenues for sustained innovation.

Impact of Macroeconomic / Geopolitical Factors

Escalating interest rates and volatile raw material prices erode affordability for insulin delivery devices, compelling distributors to streamline inventories and delay expansions in emerging markets. Surging diabetes diagnoses and corporate wellness incentives, however, propel healthcare providers to stock advanced pens and pumps, capturing volume from proactive patient segments.

Geopolitical flare-ups in mineral-rich regions like the Congo Basin interrupt cobalt supplies critical for battery-powered devices, prolonging production cycles and amplifying costs for global assemblers. These frictions, nevertheless, galvanize manufacturers to explore recycled components and regional mining pacts that bolster ethical sourcing and innovation velocity.

U.S. Section 301 tariffs at 25% on Chinese-sourced infusion pumps and related equipment, effective October 2025, hike import bills for American pharmacies and challenge pricing strategies for volume sellers. Suppliers deftly reroute via Mexico under USMCA provisions and invest in U.S. molding facilities to dodge duties and secure exemptions.

Latest Trends

FDA Approval of Integrated CGM Sensors is a Recent Trend

The U.S. Food and Drug Administration’s endorsement of continuous glucose monitoring sensors integrated with insulin delivery systems has emerged as a defining trend in 2025, streamlining real-time data fusion for proactive adjustments. This evolution prioritizes disposable, factory-calibrated sensors that eliminate fingerstick verifications, appealing to active lifestyles. Manufacturers are embedding haptic feedback in pumps for discreet alerts, refining user interactions during daily routines.

The trend coincides with interoperability standards, enabling cross-device compatibility for personalized ecosystems. Validation studies affirm accuracy across ethnicities, addressing prior calibration biases. Adoption surges in ambulatory settings, where simplified pairings reduce training durations for novices. Competitive dynamics spur enhancements in sensor longevity, targeting 14-day wear periods without compromises. Global alignments with this model facilitate exports, harmonizing with European Medicines Agency specifications.

Patient registries track outcomes, informing iterative firmware releases for refined algorithms. The focus on inclusivity incorporates voice-guided setups for visually impaired users. On April 18, 2025, the FDA approved the Simplera Sync sensor for the MiniMed 780G System, enhancing automated insulin delivery integration. This milestone exemplifies the trend’s trajectory toward seamless, intelligent therapeutics.

Regional Analysis

North America is leading the Insulin Delivery Devices Market

The Insulin Delivery Devices market in North America captured 39.9% of the global share in 2024, propelled by escalating adoption of connected smart pens and closed-loop systems amid a surge in type 1 and type 2 diabetes diagnoses driven by lifestyle factors and genetic predispositions. Medical device firms including Medtronic and Tandem Diabetes Care unveiled hybrid models integrating continuous glucose monitoring with predictive algorithms, enabling personalized basal-bolus adjustments to minimize hypoglycemic episodes in ambulatory settings.

The Centers for Disease Control and Prevention amplified awareness campaigns through the National Diabetes Prevention Program, emphasizing device education to empower self-management among newly insured populations under expanded Medicaid provisions. Healthcare payers negotiated tiered formularies favoring high-adherence injectors, reducing copayments and fostering uptake in primary care clinics across Midwestern states.

Innovations in microneedle patch technologies addressed injection phobia, with pilot programs in Veterans Affairs hospitals demonstrating 25% improvements in compliance rates for elderly veterans. Federal initiatives via the Bipartisan Infrastructure Law funded telemedicine integrations, allowing remote fine-tuning of pump parameters to bridge urban-rural disparities in device access.

Collaborative trials at institutions like the Joslin Diabetes Center validated interoperability standards, streamlining data sharing between apps and electronic health records for optimized therapeutic outcomes. Supply chain fortification post-global disruptions ensured consistent availability of disposable reservoirs and infusion sets, mitigating shortages during peak seasonal demands.

Policy advancements under the Inflation Reduction Act capped out-of-pocket costs for insulin analogs, indirectly boosting compatible delivery hardware utilization. The U.S. Food and Drug Administration had approved six insulin pumps operable in automated insulin delivery mode as of September 2024, reflecting accelerated regulatory support for advanced glycemic control technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Forecasters project the glucose management hardware sector in Asia Pacific to burgeon during the forecast period, as burgeoning middle-class demographics necessitate scalable solutions for escalating metabolic syndromes. China spearheads mass procurement via its Healthy China 2030 blueprint, outfitting community health stations with affordable pen injectors tailored for urban migrants grappling with gestational diabetes.

Japan pioneers next-generation implantable reservoirs through its Agency for Medical Research and Development subsidies, targeting precision dosing for adolescent cohorts in high-density prefectures. India galvanizes its National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke by distributing subsidized smart caps for vials, enhancing tracking in rural outreach vans.

South Korea channels Korea Health Industry Development Institute allocations toward wearable prototypes fusing haptic feedback with dose reminders, catering to tech-savvy professionals in Seoul’s corporate enclaves. Authorities expedite conformity assessments under the ASEAN Medical Device Directive, facilitating seamless imports of bolus calculators from European collaborators. Incubation hubs in Taiwan nurture biosimilar-compatible adapters, slashing dependency on multinational supply lines while spurring local engineering talent.

Multilateral pacts via the Asia-Pacific Economic Cooperation forum harmonize reimbursement criteria, incentivizing private insurers to cover hybrid configurations for expatriate workforces. Pharmaceutical conglomerates forge alliances with device assemblers in Vietnam, embedding NFC chips for counterfeit prevention amid counterfeit proliferation concerns. The International Diabetes Federation estimates 215 million adults aged 20-79 years lived with diabetes in the Western Pacific region in 2022, underscoring the expansive patient base fueling demand for innovative administration tools.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent architects in the automated insulin administration sector catalyze expansion by pioneering hybrid closed-loop algorithms that synchronize continuous glucose monitors with variable-rate infusions, thereby commanding premium adoption among tech-savvy type 1 cohorts and fortifying reimbursement negotiations with sophisticated insurers. They execute opportunistic acquisitions of sensor fusion startups to embed predictive bolus calculators into compact, app-controlled reservoirs, streamlining daily adherence and capturing share from legacy syringe users.

Visionaries deploy targeted marketing coalitions with endocrinology influencers to embed experiential demos in virtual clinics, accelerating prescriptions in underserved suburban demographics. Firms channel executive oversight toward fortified supply ecosystems in Southeast Asia, customizing ergonomic grips for diverse hand sizes while aligning with local pharmacovigilance mandates. Leaders orchestrate co-innovation pacts with software giants to layer voice-activated adjustments atop Bluetooth ecosystems, differentiating amid commoditized pens and elevating lifetime value through subscription analytics. These synergistic thrusts not only amplify procedural efficiencies but also synchronize with the demographic tide of precision self-management.

Tandem Diabetes Care, Inc., a San Diego-headquartered vanguard founded in 2006, engineers integrated insulin delivery ecosystems that empower individuals with diabetes through its flagship t:slim X2 platform, a touchscreen-enabled pump that interfaces seamlessly with third-party sensors for automated basal adjustments and remote monitoring. The enterprise structures its operations around user-centric R&D, blending hardware durability with cloud-based data insights to support both type 1 and type 2 management paradigms across global markets.

Tandem amplifies its footprint via strategic alliances that extend compatibility to emerging wearables, while maintaining rigorous cybersecurity protocols to safeguard sensitive glucose trends. Under CEO Leah Loiseleur, the firm prioritizes agile firmware updates that incorporate clinician feedback, ensuring sustained relevance in evolving therapeutic guidelines. Tandem Diabetes Care sustains its competitive edge through dedicated infusion set innovations that minimize occlusions and enhance comfort, positioning itself as the linchpin for interoperable, future-proof diabetes orchestration worldwide.

Top Key Players in the Insulin Delivery Devices Market

- Julphar

- Insulet Corporation

- Haselmeier

- Gan & Lee Pharmaceuticals

- Hoffmann-La Roche Ltd.

- Eli Lilly & Company

- Dongbao Pharmaceutical

- Debiotech S.A.

- Biocon

- Becton, Dickinson and Company

Recent Developments

- In September 2025: Medtronic secured FDA clearance allowing the MiniMed 780G system to be used by individuals with Type 2 diabetes and enabling integration with Abbott’s Instinct Sensor. This expansion dramatically increases the eligible user base for hybrid closed-loop systems, pushing insulin pumps deeper into mainstream diabetes care and accelerating adoption of integrated sensor-pump platforms across primary and specialty clinics.

- In March 2023: Diabeloop partnered with Novo Nordisk to integrate its DBL-4pen algorithm with the connected NovoPen 6 and NovoPen Echo Plus for patients on multiple daily injections. By bringing adaptive, self-learning decision support to reusable pens, this collaboration transforms traditional injection therapy into a semi-automated system, expanding demand for smart insulin delivery tools among millions of MDI users.

Report Scope

Report Features Description Market Value (2024) US$ 22.9 billion Forecast Revenue (2034) US$ 61.0 billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Insulin Delivery Devices (Insulin Pumps (Tubeless Pumps and Tubed Pumps), Pens (Disposable and Reusable), and Other Devices), and Consumables (Testing Strips, Pen Needles (Safety and Standard), Insulin Pumps Consumables, and Syringes)), By End-user (Hospitals & Clinics, Home Care, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Julphar, Insulet Corporation, Haselmeier, Gan & Lee Pharmaceuticals, F. Hoffmann-La Roche Ltd., Eli Lilly & Company, Dongbao Pharmaceutical, Debiotech S.A., Biocon, Becton, Dickinson and Company. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insulin Delivery Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Insulin Delivery Devices MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Julphar

- Insulet Corporation

- Haselmeier

- Gan & Lee Pharmaceuticals

- Hoffmann-La Roche Ltd.

- Eli Lilly & Company

- Dongbao Pharmaceutical

- Debiotech S.A.

- Biocon

- Becton, Dickinson and Company