Global Inhalational Anaesthesia Drugs Market By Product Type (Sevoflurane, Desflurane, Isoflurane and Nitrous Oxide), By Application (Induction and Maintenance), By End-User (Hospitals, Ambulatory Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174092

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

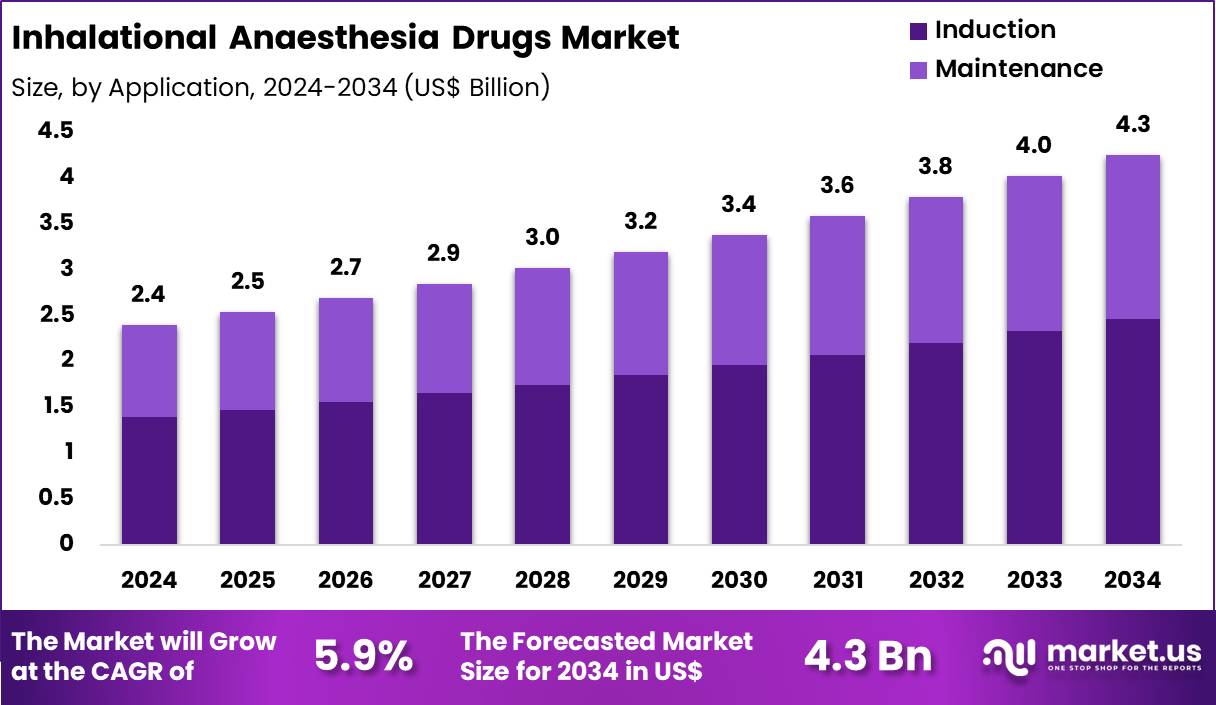

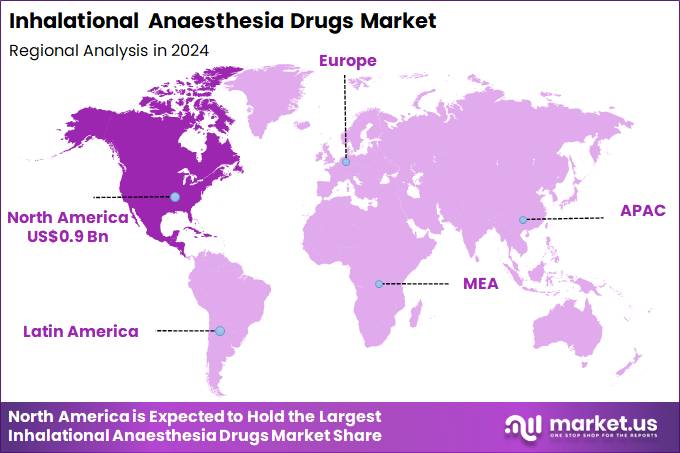

The Global Inhalational Anaesthesia Drugs Market size is expected to be worth around US$ 4.3 Billion by 2034 from US$ 2.4 Billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 0.9 Billion.

Rising demand for safe and controllable general anesthesia in surgical procedures drives the inhalational anaesthesia drugs market as anesthesiologists select volatile agents that provide rapid induction, precise depth control, and quick recovery. Clinicians administer sevoflurane for mask induction in pediatric patients, leveraging its non-pungent odor and minimal airway irritation to facilitate smooth transitions to maintenance anesthesia. These agents support balanced anesthesia in adult outpatient surgeries, allowing deep sedation with fast emergence and reduced postoperative nausea.

Anesthesiologists utilize desflurane in neurosurgical cases where rapid titration and minimal cerebral vasodilation prove essential for hemodynamic stability. These drugs enable maintenance of anesthesia during prolonged orthopedic and cardiothoracic operations, offering consistent muscle relaxation and amnesia throughout extended procedures.

In June 2023, Lunan Pharmaceutical Group obtained marketing authorization in the Netherlands for sevoflurane inhalation therapy for use in both adult and pediatric general anesthesia, with further European approvals anticipated. This regulatory milestone directly supports the inhalational anaesthesia drugs market by expanding geographic availability of a core volatile anesthetic. Broader European access strengthens supply competition, improves hospital procurement flexibility, and reinforces routine clinical adoption of sevoflurane across surgical and pediatric care settings.

Manufacturers pursue opportunities to develop low-flow delivery systems compatible with modern anesthesia workstations, optimizing the use of inhalational agents in environmentally conscious operating rooms. Developers advance formulations that minimize compound A production during sevoflurane administration, broadening safe applications in patients with renal impairment during long-duration surgeries.

These innovations facilitate low-concentration maintenance strategies that reduce environmental impact while preserving clinical efficacy in ambulatory procedures. Opportunities emerge in integrating inhalational agents with total intravenous anesthesia hybrids, creating flexible protocols for high-risk cardiac patients requiring precise hemodynamic management.

Companies invest in next-generation vaporizers that enhance accuracy of desflurane delivery, supporting its expanded use in minimally invasive and robotic-assisted surgeries. Firms explore enhanced recovery protocols that leverage rapid offset properties of these drugs to accelerate postoperative mobilization in elderly populations.

Industry specialists refine scavenging systems and low-flow techniques that decrease occupational exposure and atmospheric release of volatile anesthetics during routine use. Developers prioritize agents with favorable pharmacokinetic profiles that support same-day discharge in outpatient surgical centers performing orthopedic and urologic procedures.

Market participants advance educational initiatives that promote optimal dosing strategies, ensuring consistent depth of anesthesia across diverse patient demographics. Innovators explore combination approaches with adjunctive agents to minimize emergence delirium in pediatric populations receiving sevoflurane. Companies emphasize sustainability-focused innovations that align inhalational anesthesia with institutional green operating room goals. Ongoing advancements focus on precision monitoring technologies that guide titration, elevating safety and efficiency in both routine and complex surgical applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.4 Billion, with a CAGR of 5.9%, and is expected to reach US$ 4.3 billion by the year 2034.

- The product type segment is divided into sevoflurane, desflurane, isoflurane and nitrous oxide, with sevoflurane taking the lead in 2023 with a market share of 41.6%.

- Considering application, the market is divided into induction and maintenance. Among these, induction held a significant share of 57.9%.

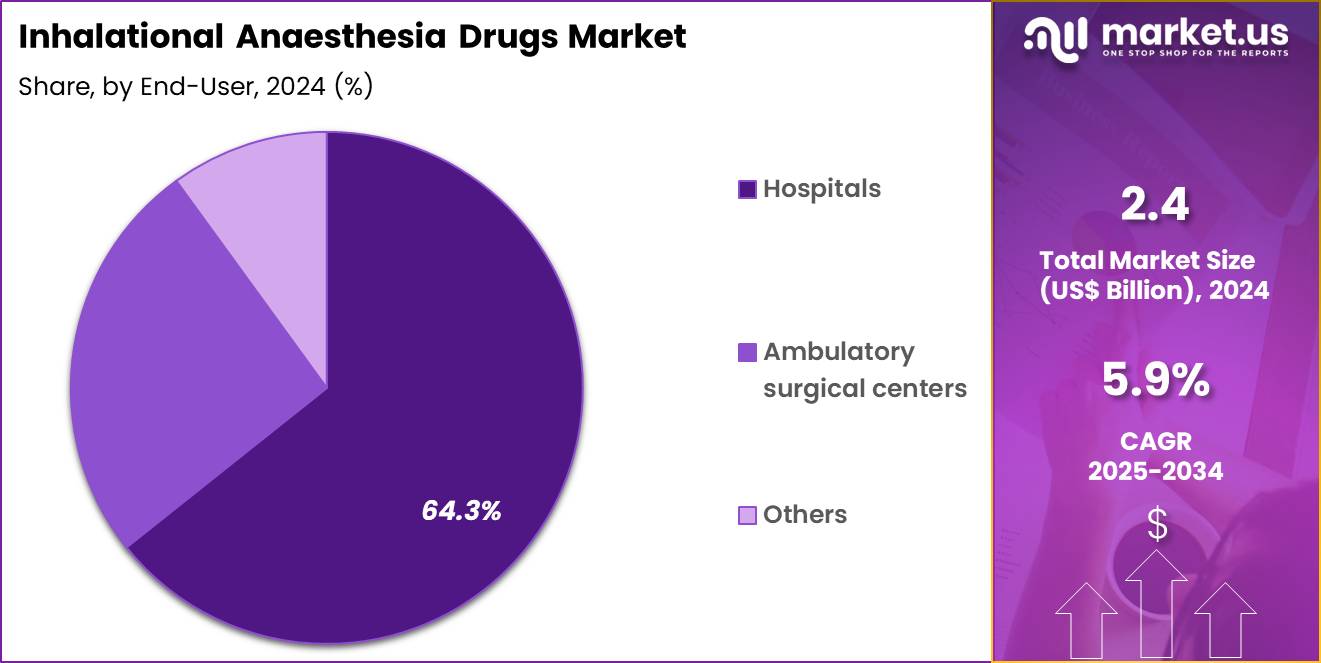

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 64.3% in the market.

- North America led the market by securing a market share of 38.8% in 2024.

Product Type Analysis

Sevoflurane accounted for 41.6% of growth within the product type category and represents the leading agent in the Inhalational Anaesthesia Drugs market. Anesthesiologists increasingly prefer sevoflurane due to its rapid onset and smooth induction profile. Low airway irritation supports use across adult and pediatric populations. Faster recovery times improve operating room efficiency. Sevoflurane demonstrates favorable hemodynamic stability during induction. Hospitals prioritize agents that support predictable depth of anesthesia.

Growing surgical volumes increase demand for fast-acting inhalational agents. Day-care and short-stay procedures benefit from rapid emergence characteristics. Clinicians value sevoflurane for mask induction in uncooperative patients. Reduced pungency enhances patient comfort. Compatibility with modern anesthesia workstations supports widespread adoption. Clinical guidelines frequently reference sevoflurane as a first-line agent.

Expanding pediatric and outpatient surgeries reinforce usage. Improved safety perception strengthens institutional formularies. Anesthesia training programs emphasize sevoflurane proficiency. Lower postoperative nausea rates improve patient outcomes. Procurement decisions favor agents with broad applicability. Pharmaceutical manufacturers ensure consistent supply chains. Sevoflurane maintains strong acceptance across specialties. The segment is projected to retain dominance due to versatility and clinical preference.

Application Analysis

Induction captured 57.9% of growth within the application category and stands as the primary driver of the Inhalational Anaesthesia Drugs market. Every surgical procedure requires an effective induction phase. Inhalational induction remains essential for patients without intravenous access. Pediatric surgeries significantly increase induction-related demand. Sevoflurane-based induction protocols support smooth transition to anesthesia. Clinicians prioritize rapid loss of consciousness during induction.

Shorter induction times improve operating room throughput. Induction phases demand higher anesthetic concentrations, increasing consumption volumes. Emergency surgeries frequently rely on inhalational induction. Reduced patient anxiety supports inhalational approaches. Induction techniques benefit from predictable anesthetic depth. Training standards emphasize safe induction practices. Hospitals invest in agents optimized for induction efficiency. Improved safety monitoring supports consistent use.

Induction remains critical across elective and emergency procedures. Growth in minimally invasive surgeries sustains induction demand. Patient comfort during induction improves satisfaction metrics. Induction protocols integrate well with multimodal anesthesia. Anesthesia workflows depend heavily on reliable induction agents. The segment is anticipated to maintain dominance due to universal procedural necessity.

End-User Analysis

Hospitals represented 64.3% of growth within the end-user category and dominate the Inhalational Anaesthesia Drugs market. Most major surgeries occur within hospital settings. Hospitals manage complex and high-risk surgical cases. Anesthesia departments maintain continuous demand for inhalational agents. Emergency and trauma surgeries concentrate anesthetic usage in hospitals. Hospitals support advanced anesthesia infrastructure and monitoring. Centralized procurement ensures steady supply availability. Teaching hospitals drive adoption through standardized protocols.

Multidisciplinary surgical teams increase procedure volumes. Hospitals handle pediatric, geriatric, and critical care surgeries. Inpatient surgical capacity supports higher anesthetic consumption. Regulatory oversight aligns closely with hospital anesthesia practices. Hospitals emphasize agents with strong safety records. Intensive care and postoperative monitoring reinforce hospital-based anesthesia use.

High surgical caseloads drive repeat utilization. Hospital formularies prioritize clinically proven anesthetics. Referral networks funnel patients to hospital surgical units. Expansion of tertiary care centers supports growth. Hospitals integrate anesthesia services across specialties. Institutional trust strengthens hospital dominance. The segment is expected to retain leadership due to procedural concentration and infrastructure strength.

Key Market Segments

By Product Type

- Sevoflurane

- Desflurane

- Isoflurane

- Nitrous Oxide

By Application

- Induction

- Maintenance

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Increasing number of ambulatory surgical procedures is driving the market

The inhalational anaesthesia drugs market is significantly driven by the increasing number of ambulatory surgical procedures, which require efficient and short-acting agents to facilitate rapid recovery and discharge. Healthcare providers prefer inhalational drugs for their controllable depth of anesthesia and quick onset, supporting the shift to outpatient settings for cost-effective care.

Regulatory bodies endorse these procedures to reduce hospital burdens, promoting the use of agents like sevoflurane and desflurane in ambulatory centers. Pharmaceutical companies expand production to meet the demands of rising procedural volumes in specialties such as ophthalmology and orthopedics. Clinical protocols integrate inhalational drugs to minimize postoperative nausea and enhance patient satisfaction in ambulatory environments.

Global health trends in minimally invasive surgery amplify the role of these drugs in procedural efficiency. Academic research validates their safety in outpatient use, driving industry innovation. Patient care improves with drugs enabling same-day discharge and reduced complications. Economic factors, including lower costs for ambulatory care, further justify market expansion. The Agency for Healthcare Research and Quality reported approximately 9.1 million ambulatory surgery encounters in the United States in 2022.

Restraints

Environmental concerns regarding greenhouse gas emissions are restraining the market

The inhalational anaesthesia drugs market is restrained by environmental concerns over greenhouse gas emissions, as volatile agents contribute to climate change and face regulatory scrutiny for their global warming potential. Healthcare facilities must implement low-flow techniques to minimize emissions, adding operational complexity and costs. Regulatory agencies are imposing restrictions on high-impact agents like desflurane, deterring their widespread use.

Pharmaceutical companies encounter challenges in reformulating drugs to reduce environmental footprint while maintaining efficacy. Clinical practices shift toward alternatives like intravenous anesthesia to comply with sustainability goals. Global health policies highlight the carbon footprint of healthcare, pressuring the adoption of eco-friendly options. Academic analyses underscore the need for emission reduction strategies in operating rooms.

Patient safety protocols intersect with environmental considerations, limiting agent selection. Economic implications include higher compliance costs for emission monitoring and disposal. In 2023, findings published in The Lancet Planetary Health indicated a substantial reduction in the environmental footprint of halogenated anaesthetic agents.

The total greenhouse gas emissions associated with these agents declined by 27% over the period from 2014 to 2023, falling from 2,754 kilotons to 2,005 kilotons of CO2 equivalent. This downward trend highlights the cumulative impact of clinical practice changes, increased awareness, and sustainability focused initiatives aimed at reducing the climate burden of inhalational anaesthesia.

Opportunities

Development of low-global warming potential formulations is creating growth opportunities

The inhalational anaesthesia drugs market offers growth opportunities through the development of low-global warming potential formulations, which address environmental regulations and attract investment in sustainable anesthesia solutions. Developers can innovate agents with reduced emissions to meet the needs of eco-conscious healthcare systems. Regulatory frameworks encourage approvals for greener formulations, facilitating market entry for modified sevoflurane or isoflurane variants.

Healthcare providers gain options for maintaining efficacy while complying with carbon reduction targets. Pharmaceutical partnerships focus on reformulating drugs to minimize atmospheric impact. Clinical research explores low-GWP agents in high-volume procedures for broader applications. Global adoption in emerging markets aligns with infrastructure development for sustainable care.

Academic collaborations refine formulations to ensure stability and safety in diverse climates. Patient therapies benefit from agents that balance environmental and clinical needs. Baxter’s annual report noted declines in inhaled anesthetics sales in 2024, offset by other growth, highlighting the need for sustainable innovations to counter restraints.

Impact of Macroeconomic / Geopolitical Factors

Global economic advancements allocate resources to surgical advancements, fueling the inhalational anaesthesia drugs market through expanded elective procedures in high-income nations. Organizations leverage stable monetary policies to innovate safer volatile agents, capturing growth in outpatient settings driven by healthcare reforms. Nonetheless, pervasive international inflation escalates solvent and container expenditures, hampering affordability for clinics in fluctuating currencies.

Intensified territorial disputes in oil-producing areas impede halogenated compound transports, delaying deliveries for essential suppliers worldwide. Strategists address these hurdles by adopting flexible routing protocols, which improves delivery predictability and encourages joint risk-sharing models. Current US tariffs, levying duties up to 25% on imported pharmaceutical goods from primary exporters, heighten acquisition burdens for overseas-dependent distributors.

Local manufacturers utilize this scenario to enhance production infrastructures, stimulating specialized R&D and regional economic boosts. Revolutionary refinements in low-flow anaesthesia techniques perpetually enhance the field’s prospects, delivering cost savings and superior clinical results across borders.

Latest Trends

Nationwide efforts to reduce anaesthetic gas emissions is a recent trend

In 2024, the inhalational anaesthesia drugs market has demonstrated a prominent trend toward nationwide efforts to reduce anaesthetic gas emissions, focusing on low-flow techniques and agent selection to lower the carbon footprint of surgical care. Manufacturers are adapting products to support these initiatives, emphasizing agents with lower global warming potential. Healthcare professionals are implementing emission reduction strategies in operating rooms to comply with sustainability goals.

Regulatory agencies are providing guidance on gas capture and reuse to minimize environmental impact. Clinical practices are shifting to alternatives like propofol to offset volatile agent use. Academic studies are evaluating the effectiveness of reduction approaches in real-world settings. Global networks are sharing best practices for emission control in anesthesia.

Patient care remains prioritized with efforts to maintain efficacy during transitions. Ethical protocols are ensuring equitable implementation across facilities. The British Journal of Anaesthesia reported that anaesthetic gases account for approximately 3% of the healthcare sector’s carbon footprint and up to 63% of emissions from surgical care in 2025.

Regional Analysis

North America is leading the Inhalational Anaesthesia Drugs Market

In 2024, North America held a 38.8% share of the global Inhalational Anaesthesia Drugs market, bolstered by the surge in ambulatory surgeries and elective procedures that favor volatile agents like sevoflurane and isoflurane for their rapid induction and recovery profiles, allowing for efficient patient throughput in resource-optimized healthcare facilities. Anesthesiologists expanded usage of these drugs in orthopedic and cardiovascular interventions, supported by protocol updates emphasizing low-flow techniques to reduce environmental impact and costs.

Innovations in vaporizer technology enhanced precision dosing, aligning with safety standards for pediatric and geriatric cohorts amid aging demographics. Rising obesity rates necessitated adjustable anesthesia plans with desflurane for better airway management, prompting integrated models in bariatric centers. Pharmaceutical refinements improved agent purity to minimize postoperative nausea, facilitating broader adoption in outpatient clinics.

Collaborative monitoring tracked adverse events, fostering confidence in long-duration cases. Supply adaptations ensured consistent availability of halogenated compounds, complying with biosecurity norms in high-volume operating rooms. U.S. surgical procedure volumes totaled over 92.3 million in 2024, reflecting the heightened reliance on inhalational agents for procedural efficiency.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts predict notable escalation in inhalational anaesthesia drugs across Asia Pacific during the forecast period, as surgical infrastructure upgrades confront escalating procedural demands from population growth and chronic disease burdens. Specialists incorporate low-solubility agents into anesthesia protocols for thoracic surgeries, optimizing recovery times in humid environments prone to respiratory complications. National authorities subsidize vaporizer procurements for public hospitals, equipping them to handle cardiac cases amid urbanization stresses.

Biotech developers customize nitrous oxide blends with enhanced stability, tailoring them to regional metabolic variations in obese patients. Cross-border consortia validate sevoflurane efficacy through trials, fostering safety for pediatric interventions in infection hotspots. Pharmaceutical manufacturers localize isoflurane production, ensuring affordability for rural facilities facing logistical hurdles.

Community programs train anesthesiologists on closed-circuit techniques, extending coverage to peripheral areas with limited resources. The global Surgical Procedures Market size was 312762.46 thousand units in 2024, with Asia Pacific contributing significantly to this volume through rapid healthcare expansions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Inhalational Anaesthesia Drugs market drive growth by improving agent purity, delivery efficiency, and safety margins to support predictable anesthesia control during complex surgical procedures. Companies expand adoption by aligning products with modern anesthesia machines and low-flow techniques that reduce environmental impact and operating-room costs.

Commercial strategies emphasize hospital formulary access, anesthesiologist education, and protocol integration across high-volume surgical centers. Innovation priorities focus on faster onset and recovery profiles that support outpatient surgery and shorter post-operative monitoring.

Market expansion targets regions increasing surgical capacity and investing in advanced perioperative care infrastructure. Baxter International operates as a prominent participant with a strong anesthesia portfolio, global manufacturing scale, and long-standing relationships with hospitals that support consistent supply and clinical trust.

Top Key Players

- AbbVie Inc.

- Baxter International Inc.

- Fresenius Kabi

- Piramal Enterprises Ltd.

- Hikma Pharmaceuticals PLC

- Sandoz International GmbH

- Halocarbon Life Sciences LLC

- Dechra Pharmaceuticals PLC

- Jiangsu Hengrui Medicine Co., Ltd.

- Lunan Pharmaceutical Group

Recent Developments

- In August 2024, Amneal Pharmaceuticals secured US FDA approval for its Propofol Injectable Emulsion across multiple vial strengths for use in hospital anesthesia and sedation. Although propofol is administered intravenously, the approval signals continued expansion in surgical procedure volumes and anesthesia utilization within hospitals. Higher operating room throughput typically translates into greater parallel use of inhalational agents such as sevoflurane and isoflurane for induction or maintenance, indirectly supporting steady growth in the inhalational anaesthesia drugs market.

- In July 2024, Fresenius Kabi introduced a smart infusion pump system in the US featuring integrated software and RFID based safety controls for intravenous anesthetic administration. This development reflects the broader shift toward digitally enabled anesthesia management. As hospitals invest in connected systems to improve accuracy, workflow efficiency, and patient safety, similar modernization trends extend to inhalational anesthesia delivery infrastructure, encouraging upgrades of vaporizers, monitoring platforms, and anesthetic gas usage across operating rooms.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 4.3 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sevoflurane, Desflurane, Isoflurane and Nitrous Oxide), By Application (Induction and Maintenance), By End-User (Hospitals, Ambulatory Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AbbVie Inc., Baxter International Inc., Fresenius Kabi, Piramal Enterprises Ltd., Hikma Pharmaceuticals PLC, Sandoz International GmbH, Halocarbon Life Sciences LLC, Dechra Pharmaceuticals PLC, Jiangsu Hengrui Medicine Co., Ltd., Lunan Pharmaceutical Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Inhalational Anaesthesia Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Inhalational Anaesthesia Drugs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AbbVie Inc.

- Baxter International Inc.

- Fresenius Kabi

- Piramal Enterprises Ltd.

- Hikma Pharmaceuticals PLC

- Sandoz International GmbH

- Halocarbon Life Sciences LLC

- Dechra Pharmaceuticals PLC

- Jiangsu Hengrui Medicine Co., Ltd.

- Lunan Pharmaceutical Group