Global Ingestible Sensors Market, By Sensor Type (Temperature Sensor, Pressure Sensor, pH Sensor, Image Sensor), By Component (Sensor, Wearable Patch/Data Recorder, Software), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 67302

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

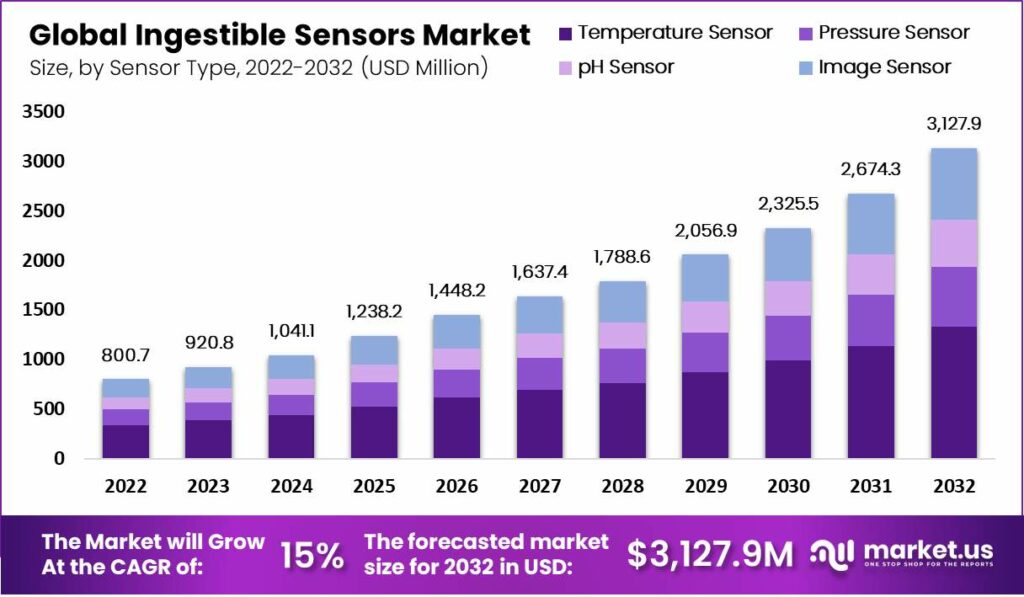

In 2023, the global ingestible sensors market was worth USD 920.8 million. It is expected to reach USD 3,127.9 million in 2032, growing at a CAGR of 15.0% between 2023-2032.

Ingestible sensors, also known as swallowable or smart pills, are small electronic devices designed to be swallowed and travel through the gastrointestinal (GI) tract to collect and transmit data about various aspects of the body’s functioning. These sensors are typically made up of biocompatible materials and can be equipped with various sensors, microchips, and wireless communication capabilities.

The primary purpose of ingestible sensors is to monitor specific physiological parameters or provide diagnostic information from within the body. They can measure factors such as temperature, pH levels, pressure, and chemical compositions in different parts of the GI tract.

Note: Actual Numbers Might Vary In The Final Report

These sensors can also be designed to track the presence or concentration of specific substances or drugs in the body. The development of ingestible sensors has the potential to revolutionize healthcare by providing non-invasive and real-time monitoring of various physiological parameters.

Rising technological advancements along with the increasing prevalence of chronic diseases like cardiovascular disease, cancer, diabetes, etc., are key factors driving the demand for ingestible sensors. Also, increasing healthcare awareness and new product launches are expected to contribute to the ingestible sensors market growth over the forecast period.

Key Takeaway

- Market Growth: The global ingestible sensors market was valued at USD 800.7 million in 2022 and is projected to reach USD 3,127.9 million by 2032, with a notable CAGR of 15.0% during the forecast period of 2023-2032.

- Driving Factors: The market’s growth is primarily driven by factors such as the rising geriatric population, increasing prevalence of chronic disorders like diabetes and cardiovascular diseases, and significant technological advancements in sensor miniaturization and wireless communication.

- Challenges: Challenges faced by the market include the limited functionality of ingestible sensors, regulatory hurdles, and the high cost involved, which may restrict market growth during the forecasted period.

- By Sensor Type Analysis: Temperature sensors dominate the ingestible sensors market with a revenue share of 42.5% in 2022.

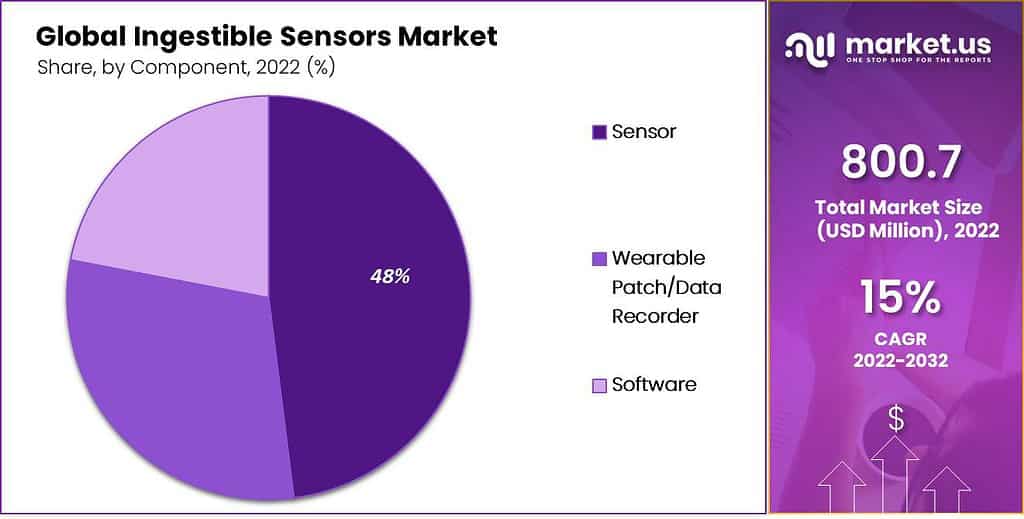

- By Component Analysis: The sensor component holds a significant share, accounting for 48% of the market in 2022.

- By End-User Analysis: The medical sector leads the ingestible sensors market, contributing to 58% of the revenue throughout the forecast period.

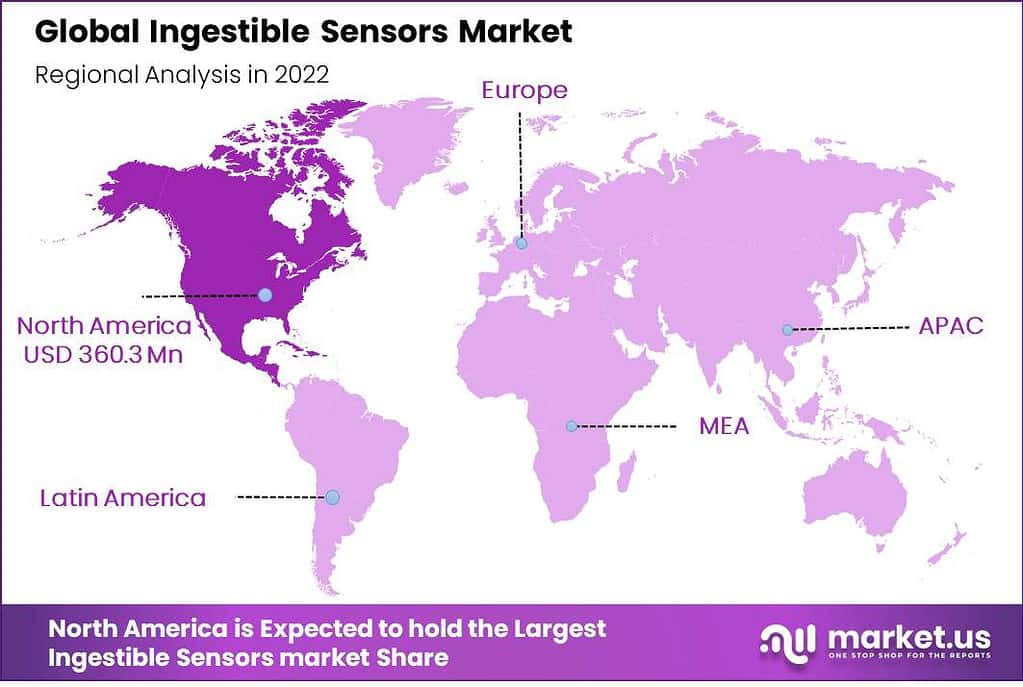

- Regional Analysis: North America leads the market, accounting for a major revenue share, followed by the Asia-Pacific region. Technological advancements, a robust healthcare system, an aging population, and increasing healthcare expenditure contribute to the high demand for ingestible sensors in these regions.

- Growth Opportunities: The expansion of remote patient monitoring and the growing adoption of telemedicine and digital health solutions present lucrative opportunities for the ingestible sensors market. These sensors can enable continuous, non-invasive data collection, enhancing remote tracking and management of patients’ conditions.

- Key Market Players: Major companies contributing to the market growth include Medtronic Plc., H.Q., Inc., Otsuka Holdings Co., Ltd., IntroMedic Co. Ltd, Olympus Corporation, JINSHAN Science & Technology, Proteus Digital Health, Inc., etectRx, Check-Cap, and MC10, among others.

Driving Factors

Rising geriatric population

Several nations around the globe are witnessing a significant increase in the elderly population. As per the 2022 Visual Capitalist estimates, about 10% of the world’s population will be over the age of 65 in 2022. The global population is aging, leading to an increased prevalence of chronic diseases and a greater need for remote patient monitoring.

Ingestible sensors can assist in managing the healthcare needs of the elderly by providing real-time data and alerts to caregivers or healthcare providers. They can enable proactive interventions and reduce the risk of complications, hospitalizations, and emergency situations. Therefore, the rising geriatric population is likely to drive the demand for ingestible sensors over the forecast period.

Increasing prevalence of chronic disorders

Many people in numerous countries around the world are suffering from various chronic diseases. Nearly 537 million persons worldwide had diabetes in 2021, according to the International Diabetes Federation (IDF). By 2030, it is anticipated that there will be 643 million people. Almost 11% of Americans suffer from a persistent intestinal illness. Ingestible sensors have the potential to revolutionize the management of chronic diseases like diabetes, hypertension, and gastrointestinal disorders.

These sensors can continuously monitor glucose levels, blood pressure, and digestive patterns, providing valuable insights for patients and their healthcare providers. By enabling more precise and personalized treatments, ingestible sensors can improve disease management and reduce healthcare costs. Thus, the increasing incidence of chronic diseases is expected to stimulate the demand for ingestible sensors during the projected time period.

Technological advancements

Advancements in sensor technology, miniaturization, and wireless communication have made ingestible sensors more feasible and accessible. These sensors are now smaller, more accurate, and capable of transmitting data wirelessly to external devices like smartphones or wearable devices.

The integration of artificial intelligence and machine learning algorithms further enhances the functionality and analytical capabilities of ingestible sensors, making them more attractive to both consumers and healthcare professionals. Such key technological advancements are anticipated to boost the demand for ingestible sensors during the estimated time period.

Restraining Factors

Limited functionality

Ingestible sensors, due to their small size, are limited in terms of the data they can collect. They primarily focus on physiological parameters like temperature, pH levels, or medication adherence. They may not be suitable for monitoring more complex health conditions or providing real-time diagnostic information. Thus, the limited functionality offered by ingestible sensors may limit the ingestible sensors market growth during the projected time period.

Regulatory challenges

The development and regulatory approval processes for ingestible sensors can be time-consuming and costly. These sensors must comply with strict regulatory standards to ensure safety and accuracy. Obtaining necessary approvals from regulatory bodies can delay their availability in the market. As a result, significant regulatory challenges involved in the approval of ingestible sensors are expected to have a negative impact on the growth of the ingestible sensors market over the forecasted time period.

High cost

Ingestible sensors can be expensive, especially when compared to traditional monitoring methods. The cost includes not only the sensor itself but also the associated technologies required for data processing and analysis. This can limit their accessibility and affordability for many individuals. Thus, the high cost involved in the case of ingestible sensors may restrain the ingestible sensors market growth during the projected time period.

By Sensor Type Analysis

Temperature sensors are experiencing the highest demand

The temperature sensors segment dominated the ingestible sensors market in 2022 with the largest revenue share of 42.5%. Ingestible temperature sensors provide a more comfortable and convenient method of temperature monitoring compared to traditional methods such as oral, rectal, or tympanic measurements.

They eliminate the need for invasive procedures or frequent measurement interruptions, improving the overall patient experience. Ingestible temperature sensors are easily swallowed, and they continuously monitor the temperature without requiring any patient effort. Thus, the enhanced comfort and convenience offered by temperature sensors are expected to stimulate segment growth during the projection period.

Also, the image sensors segment is expected to witness the fastest growth during the projection period. The demand for ingestible image sensors is driven by the need for non-invasive diagnostic imaging, improved patient experience, early detection and diagnosis, remote patient monitoring, technological advancements, screening and surveillance applications, and their role in research and development.

By Component Analysis

Sensor component dominates the ingestible sensors market

The sensor segment leads the component segment by accounting for a revenue share of 48% in 2022. Overall, the sensor component in ingestible sensors is responsible for capturing, processing, and transmitting data from within the body. It is a critical element that enables the monitoring of various physiological parameters and provides valuable insights into a person’s health and well-being. These factors are crucial in stimulating the overall segment growth during the projection period.

Furthermore, the wearable patch/data recorder segment is likely to witness high growth over the forecast period. Wearable patches and data recorders are valuable tools for managing chronic diseases. Patients with conditions like diabetes, cardiovascular diseases, or respiratory disorders can use these devices to monitor their health parameters regularly.

The continuous tracking of vital signs and other relevant data helps individuals and healthcare providers make informed decisions regarding medication adjustments, lifestyle modifications, and treatment plans. Thus, the growing prevalence of chronic diseases is likely to fuel the demand for wearable patches and data recorders during the forecast period.

Note: Actual Numbers Might Vary In The Final Report

By End-User Analysis

The medical sector is the major end-user

The medical sector is expected to dominate the ingestible sensors market with a revenue share of 58% throughout the forecast period. The combination of non-invasive monitoring, disease diagnosis and management, real-time data and remote monitoring, precision medicine, research applications, technological advancements, and the increasing aging population contributes to the high demand for ingestible sensors in the medical industry. As the technology continues to evolve and demonstrate its effectiveness, the demand for ingestible sensors is expected to increase further, driving advancements in personalized healthcare and patient monitoring.

Moreover, the sports and fitness segment is expected to witness growth at a high rate during the projection period. The growing demand for ingestible sensors in the sports and fitness industry is driven by the desire for performance monitoring, training optimization, injury prevention, hydration and nutrition management, recovery monitoring, personalized training and coaching, and the pursuit of a competitive edge.

Key Market Segments

Sensor Type

- Temperature Sensor

- Pressure Sensor

- pH Sensor

- Image Sensor

Component

- Sensor

- Wearable Patch/Data Recorder

- Software

End-User

- Medical

- Sports and Fitness

- Other End-Users

Growth Opportunity

Expansion of remote patient monitoring and growing adoption of telemedicine and digital health

The demand for remote patient monitoring is increasing, driven by factors such as the aging population, the prevalence of chronic diseases, and the need for personalized healthcare. Ingestible sensors can play a significant role in remote patient monitoring by providing continuous, non-invasive data collection.

There is an opportunity to expand the use of ingestible sensors in monitoring various health parameters, allowing healthcare providers to remotely track and manage patients’ conditions. Also, the increasing adoption of telemedicine and digital health solutions creates opportunities for ingestible sensors. These sensors can be integrated into telehealth platforms, enabling remote monitoring and enhancing the capabilities of virtual consultations.

Ingestible sensors can provide real-time data to healthcare providers, improving diagnosis, treatment decision-making, and patient engagement. Thus, the expansion of remote patient monitoring and the growing adoption of telemedicine and digital health solutions are anticipated to provide lucrative growth opportunities for the ingestible sensors market in the upcoming time period.

Latest Trends

Integration of ingestible sensors with artificial intelligence (AI) and machine learning

Ingestible sensors are being integrated with artificial intelligence algorithms and machine learning techniques for advanced data analysis and interpretation. AI can process large amounts of data collected by ingestible sensors, identify patterns, and provide valuable insights for diagnosis, treatment planning, and predictive analytics.

The integration of AI enhances the capabilities of ingestible sensors and enables more personalized and precise healthcare interventions. Thus, the integration of ingestible sensors with AI and machine learning can be considered a positive trend and is likely to boost market growth in the upcoming time period.

Regional Analysis

North America leads the market by holding a major revenue share in the account

The North American region is anticipated to witness the highest growth with a revenue share of 45% during the projected time period. The high demand for ingestible sensors in North America is driven by technological advancements, a robust healthcare system, the aging population, chronic disease burden, sports and fitness culture, research and development initiatives, and regulatory support. As the technology continues to evolve and demonstrate its benefits, the demand for ingestible sensors is expected to increase further in North America.

Moreover, the Asia-Pacific region is likely to grow at a high rate during the estimated time period. The Asia-Pacific region is witnessing significant growth in healthcare expenditure. Rising disposable incomes, expanding middle-class populations, and increased awareness of healthcare have led to increased spending on advanced medical technologies.

Note: Actual Numbers Might Vary In The Final Report

Ingestible sensors offer innovative solutions for monitoring and managing health conditions, aligning with the region’s growing healthcare expenditure. The Asia-Pacific region has been at the forefront of technological advancements, particularly in countries like Japan, South Korea, and China. These countries have strong research and development capabilities, fostering innovation in healthcare technologies.

Technological advancements in sensor miniaturization, wireless communication, and data analytics have accelerated the adoption of ingestible sensors in the region. Thus, increasing healthcare expenditure and key technological advancements are major factors driving regional growth during the projection period.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Ingestible Sensors market can be considered highly competitive, and key market players hold a prominent position in the market. The market is expected to grow at a high rate over the forecast period due to the high demand for ingestible sensors in the diagnosis and treatment of chronic disorders. Additionally, key partnerships and collaborations, investments in technology, launch of new products are likely to contribute to market growth in the upcoming years.

Top Key Players in Global Ingestible Sensors Market

- Medtronic Plc.

- H.Q., Inc.

- Otsuka Holdings Co., Ltd.

- IntroMedic Co. Ltd

- Olympus Corporation

- JINSHAN Science & Technology

- Proteus Digital Health, Inc.

- etectRx

- Check-Cap

- MC10

- Other Key Players

Recent Developments

- In February 2023, engineers at Caltech and MIT announced the demonstration of an ingestible sensor whose location can be tracked, through its movement along the digestive tract, a significant advancement that could enable doctors to successfully diagnose key gastrointestinal motility disorders such as gastroesophageal reflux disease, constipation, and gastroparesis, etc.

- In December 2022, engineers at UC San Diego created a pill-shaped, battery-free ingestible biosensing technology for continuous intestinal monitoring. It enables scientists to monitor gut metabolites in real-time, which was previously impossible. This technological breakthrough could lead to a better understanding of the makeup of intestinal metabolites, which has a substantial impact on human health overall.

Report Scope

Report Features Description Market Value (2023) USD 920.8 Mn Forecast Revenue (2032) USD 3,127.9 Mn CAGR (2023-2032) 15.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sensor Type- Temperature Sensor, Pressure Sensor, pH Sensor, Image Sensor, By Component- Sensor, Wearable Patch/Data Recorder, Software), By End-User- Medical, Sports and Fitness, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Medtronic Plc., H.Q., Inc., Otsuka Holdings Co., Ltd., IntroMedic Co. Ltd, Olympus Corporation, JINSHAN Science & Technology, Proteus Digital Health, Inc., etectRx, Check-Cap, MC10, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Ingestible Sensors Market?In 2022, the global Ingestible Sensors Market was valued at USD 800.7 million.

What will be the market size for Ingestible Sensors Market in 2032?In 2032, the Ingestible Sensors Market will reach USD 3,127.9 million.

What CAGR is projected for the Ingestible Sensors Market?The Ingestible Sensors Market is expected to grow at 15% CAGR (2023-2032).

List the segments encompassed in this report on the Ingestible Sensors Market?Market.US has segmented the Ingestible Sensors Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Sensor Type, market has been segmented into Temperature Sensor, Pressure Sensor, pH Sensor and Image Sensor. By Component, the market has been further divided into Sensor, Wearable Patch/Data Recorder and Software.

Which segment dominate the Ingestible Sensors industry?With respect to the Ingestible Sensors industry, vendors can expect to leverage greater prospective business opportunities through the Temperature sensors segment, as this dominate this industry.

Name the major industry players in the Ingestible Sensors Market.Medtronic Plc, H.Q. Inc., Otsuka Holdings Co. Ltd, IntroMedic Co. Ltd, Olympus Corporation and Other Key Players are the main vendors in this market.

-

-

- Medtronic Plc.

- H.Q., Inc.

- Otsuka Holdings Co., Ltd.

- IntroMedic Co. Ltd

- Olympus Corporation

- JINSHAN Science & Technology

- Proteus Digital Health, Inc.

- etectRx

- Check-Cap

- MC10

- Other Key Players