Global Infrared Thermal Imaging Drones Market By Product Type (Fixed-Wing Thermal Drones, Rotary-Wing Thermal Drones), By Resolution of Thermal Sensor (Medium Resolution (160*120-336*256 Pixels), High Resolution (>336*256 Pixels)), By Application (Construction & Infrastructure (Building Diagnostics (heat loss, moisture intrusion), Progress Monitoring, Roof Inspection, Agriculture (Crop Health Monitoring (stress, irrigation leaks), Livestock Monitoring (counting, detecting illness), Others), Utilities & Energy (Solar Farm Inspection (detecting faulty panels), Power Line and Substation inspection,others), Public Safety & Security (Search and Rescue (SAR) Operations, Firefighting (hotspot detection, situational awareness), Law Enforcement others), Industrial Inspection, Others (Mining, Defense & Homeland Security, etc.), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165947

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

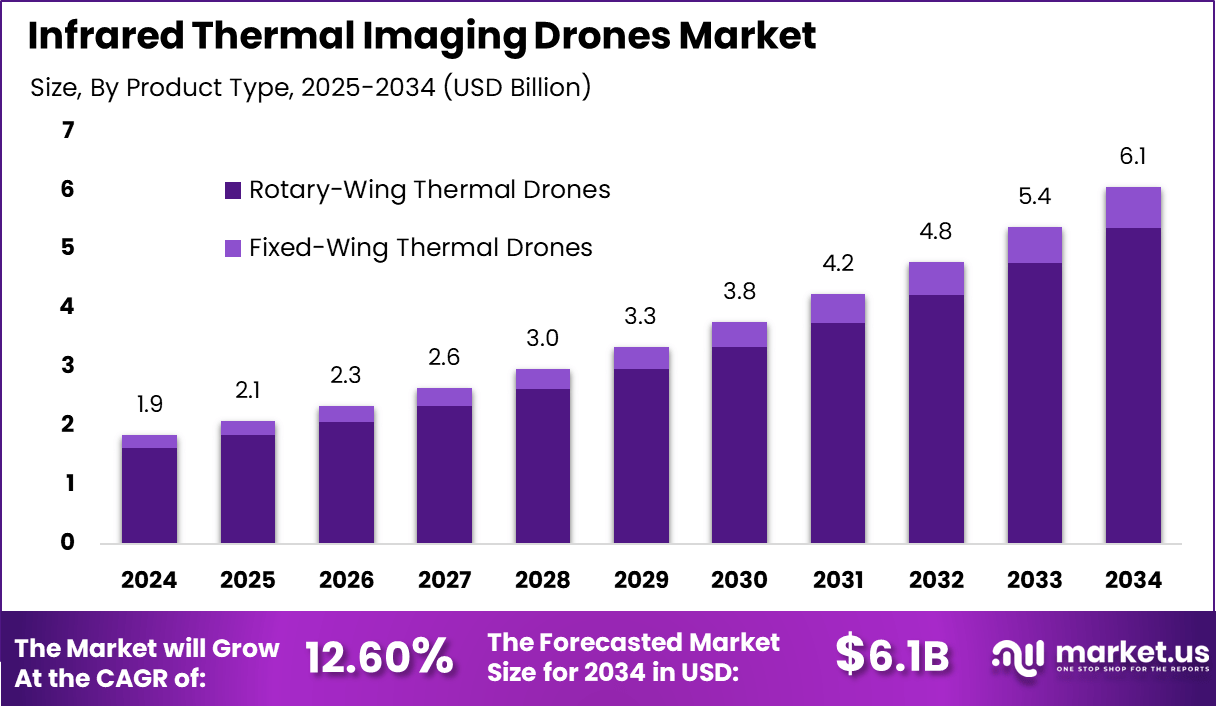

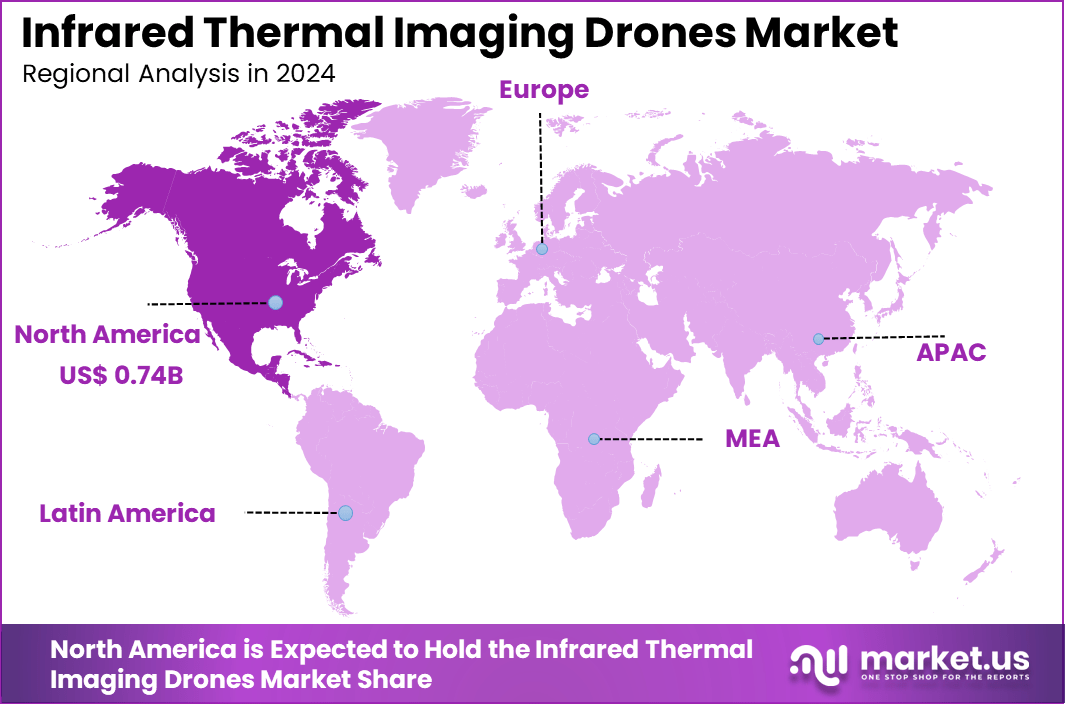

The Global Infrared Thermal Imaging Drones Market generated USD 1.9 billion in 2024 and is predicted to register growth from USD 2.1 billion in 2025 to about USD 6.1 billion by 2034, recording a CAGR of 12.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.2% share, holding USD 0.74 Billion revenue.

The infrared thermal imaging drones market has grown steadily as industries adopt aerial thermal cameras for inspection, monitoring and emergency response. These drones provide temperature based imaging that cannot be captured by standard visual sensors, making them valuable for safety, maintenance and precision surveillance. Growth reflects the broader shift toward advanced drone based sensing solutions across commercial, industrial and public sector operations.

The growth of the market can be attributed to rising demand for aerial inspection tools that improve safety and reduce on site risk. Sectors such as energy, construction and environmental services rely on thermal drones to identify heat anomalies, power line faults, water leaks and structural weaknesses. Public safety agencies use them for search and rescue, wildfire detection and disaster assessment.

Enhanced camera resolution, improved battery performance and better flight stability have further accelerated adoption. Industrial operators use thermal drones to monitor pipelines, solar farms and electrical grids. Construction firms deploy them for insulation inspections and quality verification. Emergency services benefit from their ability to locate missing persons, assess fire spread and map hazardous zones.

Top Market Takeaways

- By product type, rotary-wing thermal drones dominate with an 88.5% share due to their superior maneuverability and ability to hover, which is essential for close-range inspections and emergency response situations.

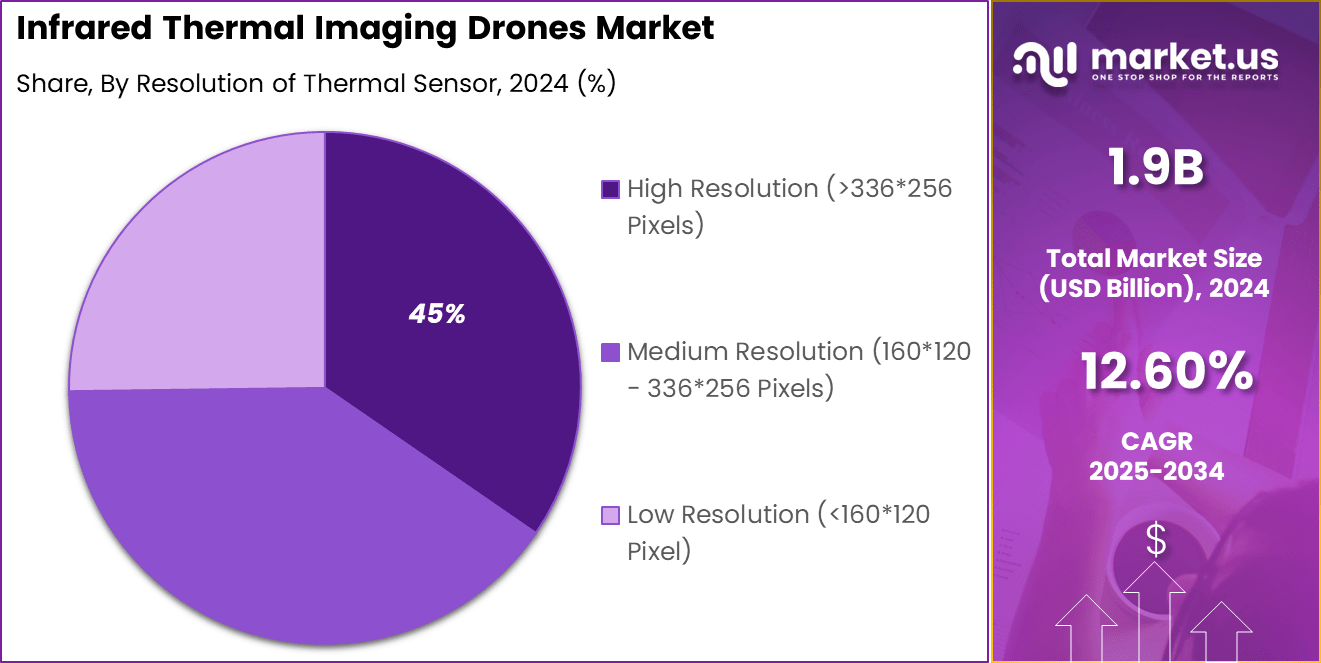

- By resolution of thermal sensors, high-resolution sensors (greater than 336×256 pixels, e.g., 640×512) make up 45.3% of the market, driven by demand for precise thermal imaging in detailed inspections and monitoring.

- By application, utilities and energy lead with a 25.6% share, reflecting widespread use for power line inspection, substation monitoring, and energy asset management to detect faults and prevent outages.

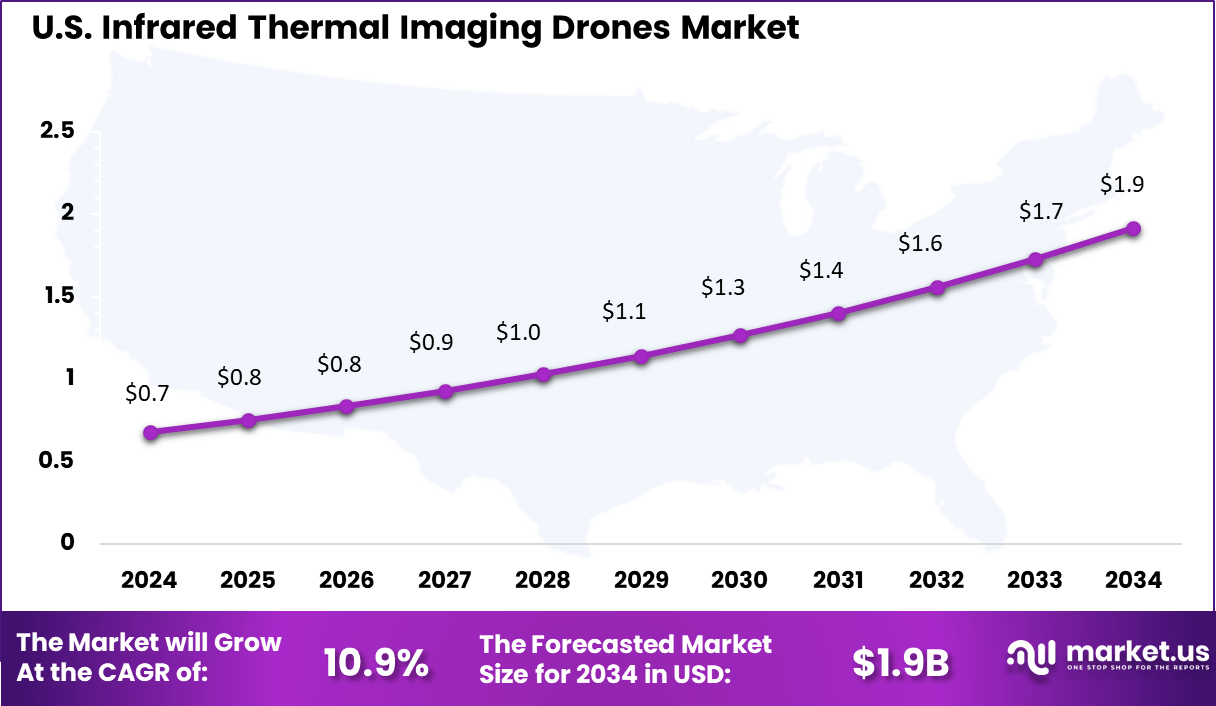

- North America holds a significant 40.2% market share with the U.S. market size estimated at approximately USD 0.68 billion in 2025.

- The market is growing at a CAGR of 10.9%, fueled by increasing investment in energy infrastructure, public safety, and advances in drone and thermal imaging technology enabling better data collection and real-time analytics.

- Key trends include integration with AI for automated fault detection, enhanced battery life for extended flight times, and strict regulatory frameworks supporting commercial drone operations.

By Product Type

In 2024, Rotary-wing thermal drones dominate the market with an impressive 88.5% share. These drones are favored because their vertical takeoff and landing capabilities allow for precise hovering, which is essential in thermal inspection missions.

Their agility and ability to operate in confined spaces make them ideal for tasks like fire surveillance, search and rescue, and industrial inspections. Rotary-wing drones provide stability during flight, crucial for high-quality thermal imaging and data accuracy.

The continued development of more efficient motors, lightweight frames, and better thermal cameras has further cemented rotary-wing drones as the go-to choice for companies and agencies focusing on thermal imaging applications.

By Resolution of Thermal Sensor

In 2024, Thermal drones equipped with high-resolution sensors (>336×256 pixels) hold 45% market share. High-resolution thermal sensors deliver sharper and more detailed thermal images, enabling better detection of temperature variations and anomalies. This precision is vital for applications ranging from infrastructure monitoring to firefighting, where early detection can prevent costly damages or loss of life.

Advances in sensor technology have led to increased sensitivity, enabling thermal drones to function effectively in diverse environmental conditions, enhancing their value to industrial, energy, and public safety sectors.

By Application

In 2024, The utilities and energy sector accounts for 25.6% of the infrared thermal imaging drone market. These drones are widely used to inspect power lines, substations, wind turbines, and solar panels. Thermal imaging helps detect faults such as overheating components, electrical resistance, or insulation failures without physical contact.

This non-invasive inspection technique improves maintenance efficiency, reduces downtime, and prevents major failures. Energy companies increasingly rely on thermal drones to maintain infrastructure health, boost safety, and comply with growing regulatory standards. The ability to cover large areas quickly with precise thermal data makes these drones an invaluable asset in modern power and utility operations.

Emerging Trends

Key Trends Description Integration of AI and machine learning AI improves thermal image analysis, enabling real-time anomaly detection and decision-making. Miniaturization of thermal sensors Smaller, lighter sensors improve drone maneuverability and flight duration. Multi-sensor payload systems Combining thermal with visual/light sensors for richer data and comprehensive analysis. Cloud-based data processing platforms Enables efficient data sharing, remote access, and collaborative analysis. Expansion in diverse applications Growth in sectors like agriculture, search & rescue, infrastructure inspection, and security. Growth Factors

Key Factors Description Increasing demand for surveillance Rising security concerns boost use across military, law enforcement, and public safety. Technology advancements Improved sensor resolution, thermal sensitivity, and better battery life lower costs. Expanding industrial & agricultural use Thermal imaging supports predictive maintenance, crop health monitoring, and inspections. Favorable UAV regulations Simplified drone use policies in regions like North America and Asia-Pacific enhance adoption. Government and private sector funding Increased investments and grants fuel innovation and market growth globally. Key Market Segments

By Product Type

- Fixed-Wing Thermal Drones

- Rotary-Wing Thermal Drones

By Resolution of Thermal Sensor

- Low Resolution (<160*120 Pixel)

- Medium Resolution (160120 – 336256 Pixels)

- High Resolution (>336*256 Pixels)

By Application

- Construction & Infrastructure

- Building Diagnostics (heat loss, moisture intrusion)

- Progress Monitoring

- Roof Inspection

- Energy Auditing

- Others

By Agriculture

- Crop Health Monitoring (stress, irrigation leaks)

- Livestock Monitoring (counting, detecting illness)

- Yield Prediction

- Others

By Utilities & Energy

- Solar Farm Inspection (detecting faulty panels)

- Power Line and Substation Inspection

- Oil & Gas Pipeline Monitoring

- Others

By Public Safety & Security

- Search and Rescue (SAR) Operations

- Firefighting (hotspot detection, situational awareness)

- Law Enforcement (surveillance, suspect tracking)

- Disaster Response

- Others

By Industrial Inspection

- Inspecting Industrial Facilities

- Chimneys

- Boilers, and Refractory Walls

- Others

- Others (Mining, Defense & Homeland Security, etc.)

Regional Analysis

North America solidified its leadership in the infrared thermal imaging drones market, commanding a substantial 40.2% share of the global revenue. The region’s growth is primarily driven by expansive adoption across defense, law enforcement, and industrial sectors, fueled by the need for enhanced surveillance, environmental monitoring, and safety inspections.

Technological advancements in sensor resolution, AI-powered analytics, and real-time imaging capabilities have significantly improved the effectiveness and operational range of infrared thermal drones. North America benefits from a strong base of OEMs, continuous R&D investments, and supportive regulatory frameworks that encourage drone integration in critical applications such as firefighting, energy infrastructure inspection, and border security.

The U.S., the market is valued at approximately USD 0.68 billion in 2024, exhibiting a healthy CAGR of 10.9%. The U.S. spurs growth through robust government and private sector investments focused on modernizing surveillance and emergency response capabilities using infrared thermal drones.

Major players like Teledyne FLIR LLC lead with innovative product portfolios that combine thermal imaging with UAV technologies to meet evolving demand in the military, industrial, and public safety domains. Enhanced adoption is also seen in agricultural and environmental monitoring, where these drones enable precise, non-invasive data collection.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Enhanced Surveillance and Safety

The infrared thermal imaging drones market is driven by the increasing need for enhanced surveillance and safety across industries such as defense, firefighting, and infrastructure inspection. These drones provide the ability to detect heat signatures in low-light and obscured environments, enabling early identification of hazards like fires, electrical faults, or unauthorized intrusions.

This capability significantly improves operational safety and response times. Technological advancements, including miniaturized thermal sensors and improved drone flight times, have made these drones more accessible and efficient. Growing governmental support and funding for public safety initiatives further accelerate adoption, expanding their use in emergency services and security monitoring.

Restraint

High Cost and Technical Expertise Requirement

Despite their advantages, the market faces restraints due to the high costs of thermal imaging cameras and drone systems combined. Advanced sensors and software integration demand significant capital investment, which limits adoption by smaller enterprises and budget-constrained organizations. Additionally, operating thermal imaging drones requires specialized skills in piloting and interpreting thermal data.

The complexity of integrating infrared imaging hardware with UAV platforms and processing large thermal datasets poses steep learning curves. This technical expertise requirement and cost barrier slow broader market penetration, particularly in developing regions.

Opportunity

Integration with AI and Expansion into New Applications

Opportunities are emerging as infrared thermal imaging drones increasingly integrate artificial intelligence and machine learning algorithms. AI enhances thermal image analysis for automated detection, anomaly identification, and real-time decision-making, providing actionable insights for industries such as agriculture, energy, and search and rescue.

Rising demand for non-destructive inspection, precision agriculture, and environmental monitoring drives broader application development. The adoption of drones-as-a-service (DaaS) models further expands accessibility for smaller users, enabling cost-effective deployment across various verticals.

Challenge

Regulatory Constraints and Battery Life Limitations

The infrared thermal imaging drones market faces challenges from evolving regulatory frameworks governing drone operations, especially concerning privacy, airspace, and data protection. These regulations can delay deployments and limit flight paths, reducing operational flexibility.

Additionally, limited battery life restricts flight duration and coverage area, particularly when combined with the high power consumption of thermal sensors. Balancing payload weight, power efficiency, and performance necessitates continuous innovation to enhance usability and meeting varied mission requirements remains technically demanding.

Competitive Analysis

The commercial drone market is highly dynamic and competitive, featuring prominent players such as DJI, Teledyne FLIR, Autel Robotics, AeroVironment, Parrot, Insitu, Yuneec International, Seek Thermal, Workswell, AgEagle, HGH Infrared Systems, Leonardo DRS, and Sierra-Olympic Technologies.

These companies differentiate themselves through technological innovation, product portfolio diversity, and application specialization, catering to various sectors such as agriculture, construction, defense, security, surveying, and infrastructure inspection. DJI remains the market leader, known for its broad product range and innovative features like AI-powered autonomy and advanced imaging.

Market growth is driven by increasing adoption of drones for precision agriculture, infrastructure monitoring, environmental conservation, and public safety. Competitors compete on factors like payload capacity, flight endurance, sensor integration (thermal, LiDAR, multispectral), and software capabilities for data analytics and mission planning.

Strategic collaborations, geographic expansion, and regulatory compliance also shape the competitive landscape. Companies leverage R&D investments to improve drone reliability, extend operational range, and optimize performance, positioning themselves in a rapidly evolving market with growing demand for commercial drone solutions.

Top Key Players in the Market

- DJI (Da-Jiang Innovations)

- Teledyne FLIR

- Autel Robotics

- AeroVironment

- Parrot

- Insitu

- Yuneec International

- Seek Thermal

- Workswell

- AgEagle

- HGH Infrared Systems

- Leonardo DRS

- Sierra-Olympic Technologies

- Others

Recent Developments

- November, 2025, DJI launched the Zenmuse L3, its first long-range, high-accuracy aerial LiDAR system, enhancing mapping and surveying capabilities. Earlier in August 2025, DJI released the Mini 5 Pro with upgraded camera and LiDAR sensors for obstacle avoidance, larger motors, and improved flight time. The company has a strong product pipeline including new consumer and enterprise drones and autonomous operation infrastructure.

- March, 2025, Autel Robotics updated its Dragonfish series for industrial and professional use, introducing enhanced stable takeoff/landing on moving platforms, improved battery management, and advanced AI flight features for autonomous operations such as maritime surveillance.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 6.1 Bn CAGR(2025-2034) 12.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Fixed-Wing Thermal Drones, Rotary-Wing Thermal Drones), By Resolution of Thermal Sensor (Low Resolution (<160120 Pixel), Medium Resolution (160120 – 336256 Pixels), High Resolution (>336256 Pixels)), By Application (Construction & Infrastructure (Building Diagnostics (heat loss, moisture intrusion), Progress Monitoring, Roof Inspection, Agriculture (Crop Health Monitoring (stress, irrigation leaks), Livestock Monitoring (counting, detecting illness), Others), Utilities & Energy (Solar Farm Inspection (detecting faulty panels), Power Line and Substation inspection,others), Public Safety & Security (Search and Rescue (SAR) Operations, Firefighting (hotspot detection, situational awareness), Law Enforcement others), Industrial Inspection, Others (Mining, Defense & Homeland Security, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DJI (Da-Jiang Innovations), Teledyne FLIR, Autel Robotics, AeroVironment, Parrot, Insitu, Yuneec International, Seek Thermal, Workswell, AgEagle, HGH Infrared Systems, Leonardo DRS, Sierra-Olympic Technologies, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infrared Thermal Imaging Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Infrared Thermal Imaging Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DJI (Da-Jiang Innovations)

- Teledyne FLIR

- Autel Robotics

- AeroVironment

- Parrot

- Insitu

- Yuneec International

- Seek Thermal

- Workswell

- AgEagle

- HGH Infrared Systems

- Leonardo DRS

- Sierra-Olympic Technologies

- Others