Global Infertility Drugs Market, By Drug Class (Gonadotropins, Aromatase Inhibitors), By Distribution Channel (Hospital Pharmacy, Speciality & Retail Pharmacy, and Other Distribution Channels), By End-User (Men, and Women), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Apr 2024

- Report ID: 14089

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

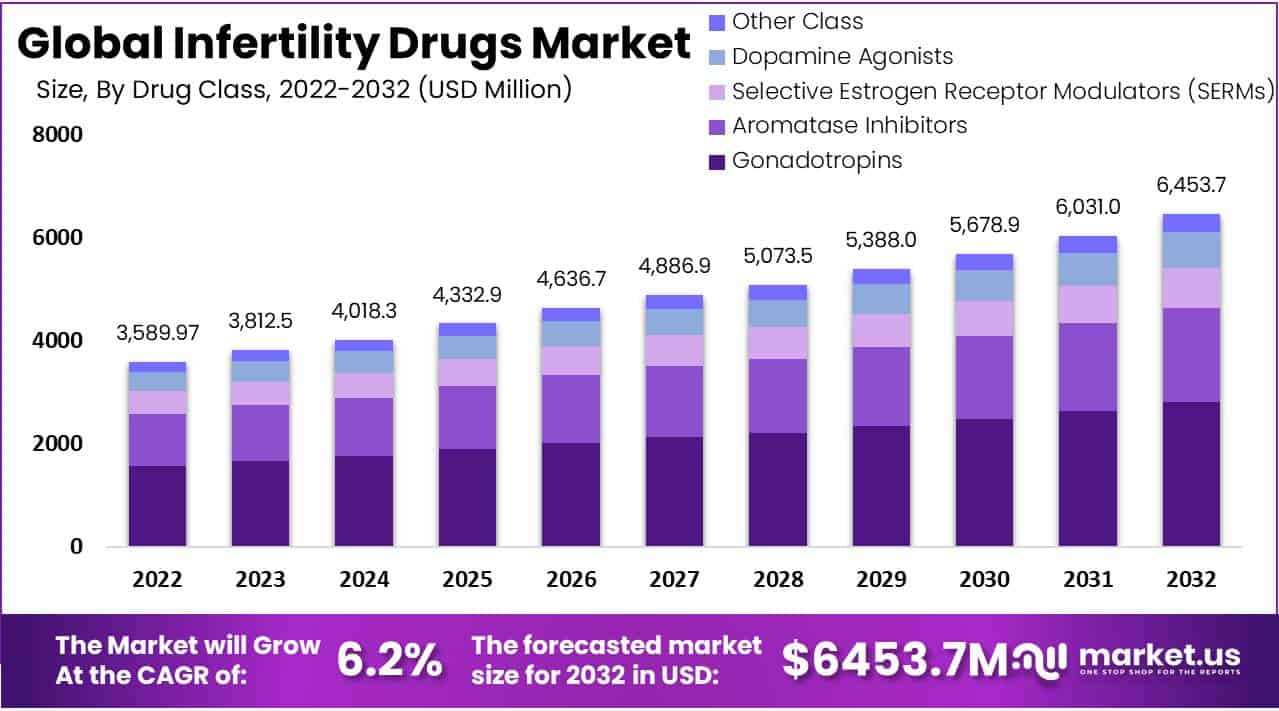

Global Infertility Drugs Market size is expected to be worth around USD 6453.7 Mn by 2032 from USD 3589.97 Mn in 2022, growing at a CAGR of 6.2% during the forecast period from 2022 to 2032.

Market players are actively working on developing innovative medicines for treating infertility. Key players, including Oxolife, are currently involved in developing the product OXO-001, a high-quality candidate that can improve embryo implantation by improving binding with an inner lining of the endometrium in the uterus. Such products can address an unmet medical need that affects women undergoing assisted reproduction around the world. Female infertility can be caused by factors like growing older, miscarriages, obesity, and polycystic ovarian syndrome, whereas male infertility can be caused by factors like erectile, low sperm count, abnormal sperm, and dysfunction.

Key Takeaways

- Market Growth: Infertility drugs market set to grow at a CAGR of 6.2%, reaching USD 6,453.7 million by 2032.

- Gonadotropins Dominance: Gonadotropins lead with an 8.2% projected CAGR, offering high effectiveness.

- Aromatase Inhibitors Rise: A 7.4% CAGR for aromatase inhibitors in 2022, due to high success rates.

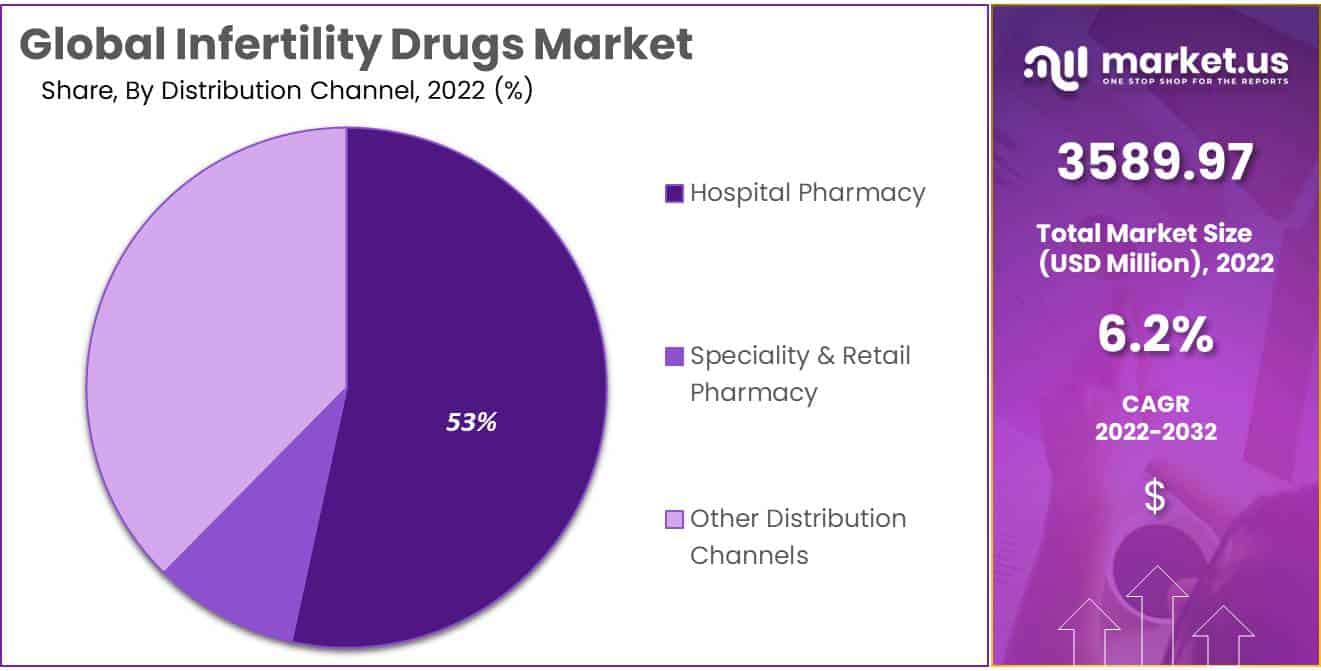

- Hospital Pharmacies Lead: Hospital pharmacies hold a 53.4% market share with an 8.9% CAGR.

- Online Pharmacies Growing: Other pharmacies see a 7.2% CAGR with a market share of 37.6%.

- Women’s Majority: Women account for 74.6% of the market with an 8.3% CAGR in 2022.

- Fastest Growing Segment: Women’s segment is projected as the fastest growing with a 2022-2031 CAGR.

- Infertility Prevalence: Infertility affects 48 million couples and 186 million individuals globally.

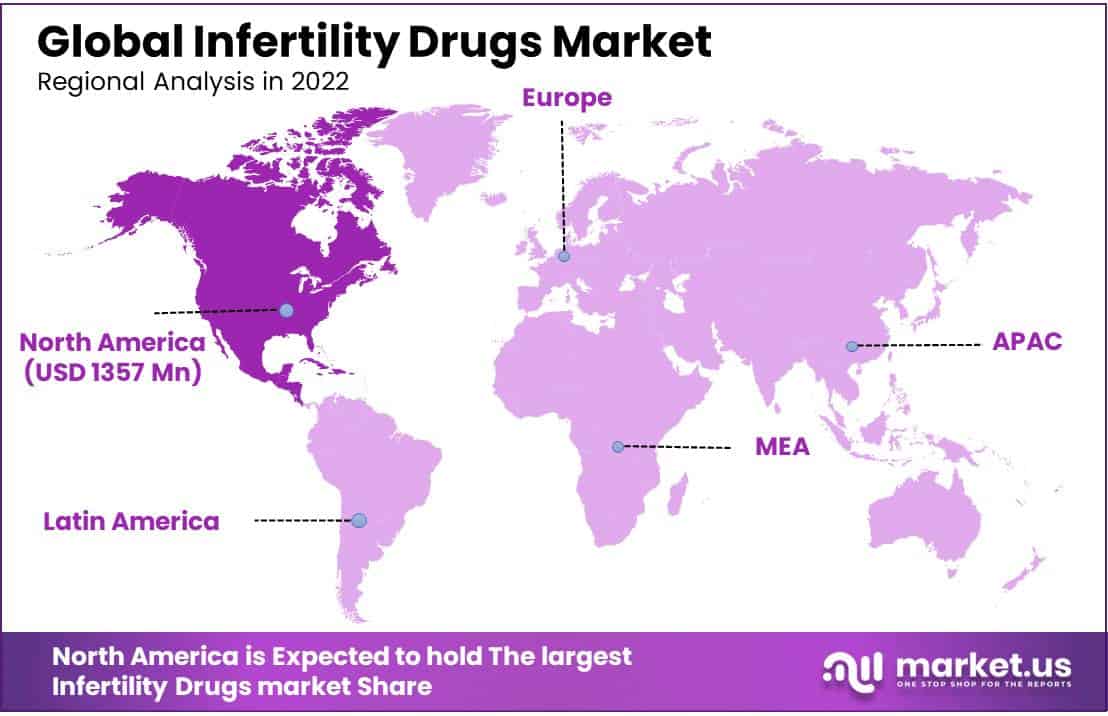

- North America Leading: North America dominates with a 37.8% market share and 7.2% CAGR.

- APAC Growth: Asia Pacific is the fastest-growing region with a 6.8% CAGR.

Drug Class Analysis

The Gonadotropins Segment is The Most Lucrative Segment in The Offering Segment in Infertility Drugs Market.

Based on drug class, the market for infertility drugs market is segmented into gonadotropins, aromatase inhibitors, selective estrogen receptor modulators, dopamine agonists, and other classes. Among these types, the gonadotropins segment is the most lucrative in the global Infertility Drugs market, with a projected CAGR of 8.2. Owing gonadotropins such as Gonal-F Follitism Menopur, Bravelle, and Menopur have a higher effectiveness but also come at a higher cost to patients. Due to these advantages, these hormones may attract new clients and boost revenue streams from existing customers.

The Aromatase Inhibitors Segment is Expected to Grow in the Projected Period in Infertility Drugs Market.

Followed by gonadotropins, aromatase inhibitors accounted for the fastest growing drug class segment in the infertility drugs market, and its estimated market share is 28.3% and a CAGR of 7.4% in 2022. Owing to the high success rate as it is very effective in helping women to ovulate & conceive, fewer side effects as compared to other fertility drugs, and improved pregnancy outcomes in women who uses aromatase inhibitors are more likely to have successful pregnancies. As in result, they are quickly becoming one of the fastest growing segments in the industry.

Distribution Channel Analysis

Hospital Pharmacy Holds the Significant Share in Distribution Channel Segment in Infertility Drugs Market.

Based on the distribution channel, the market is divided into hospital pharmacy, specialty & retail pharmacy, and other distribution channels. Among these, hospital pharmacies are dominant in the distribution channel segment in the infertility drugs market, with a market share of 53.4% and a CAGR of 8.9. This is due to recent data released by NCBI revealing that there were approximately 72,786 inpatient visits of women seeking treatment consultation in the U.S. Furthermore, data provided by the Centers for Drug Control and Prevention (CDC) shows nearly 489 clinics across America provide infertility treatments like consultations or assisted reproductive technology (ART).

Other Pharmacy Segment is Identified as Fastest Growing Distribution Channel Segment in Projected Period.

Other pharmacies are also important distribution channel segments in the infertility drugs market and it is expected to grow faster in the distribution channel segment in the infertility drugs market with a CAGR of 7.2% and a market value is 37.6.%. It is fastest growing due to online clinical chains, which offer scheduled delivery to patients and allow for patient choice due to stigmatization associated with fertility issues, which have fuelled this growth. Furthermore, this space may benefit from strategic alliances between online fertility clinics and major platforms.

End-User Analysis

The Women Segment Accounted for the Largest Revenue Share in Infertility Drugs Market in 2022.

Based on end-user, the market is segmented into men and women. Among these types, the women segment is expected to be the most lucrative segment in the global infertility drugs market, with the largest revenue share of 74.6% and a projected CAGR of 8.3% during the forecast period. Due to the widespread accessibility of infertility drugs for women, nearly 11% are affected by it when of reproductive age in America, compared to only 9% among men. Furthermore, the Fertility Society of Australia & New Zealand estimates that nearly 45% of the female population experience issues with infertility there as well. Thus, due to this rising prevalence worldwide demand for these medications has grown exponentially.

The Women Segment is Fastest Growing End-User Segment in Infertility Drugs Market.

The women segment is projected as the fastest growing end-user segment in the infertility drugs market from 2022 to 2031. Due to an increasing disease burden among reproductive-age women and the adoption of sedentary lifestyles that interfere with ovulation, thyroid disorders & breast cancer are now among the leading causes of infertility among women – leading to dramatic drops in fertility rates. Smoking & alcohol consumption is increasing as illnesses such as PCOS & Uterine fibroids become more prevalent.

Key Market Segments

Based on Drug Class

- Gonadotropins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Other Class

Based on Distribution Channel

- Hospital Pharmacy

- Speciality & Retail Pharmacy

- Other Distribution Channels

By End-User

- Men

- Women

Drivers

Effective Infertility Treatment, Government Initiatives Drive the Market Growth of Infertility Drugs Market.

According to the WHO, infertility affects millions of people worldwide who are of reproductive age. 48 million couples and 186 million individuals face this issue. Male, female, or a combination of both may be at fault for an infertility disorder; alternatively, it could go undetected. Environmental and lifestyle factors like smoking, drinking excessively, being overweight, and exposure to pollutants have all been linked to higher rates of infertility among both women and men.

This remains the primary cause behind the surge in demand for medications used in infertility treatments today. Fertility drugs help to prepare the body for treatment and increase the likelihood that eggs will be produced from the ovaries during infertility therapies and in-vitro fertilization procedures. As such, this field of infertility treatments could continue to expand. This is because of decreased fertility rates, an increase in fertility clinics globally, technological advances, and public-private partnerships. All these factors are expected to shape the infertility drugs market.

Many governments around the world have made efforts to provide insurance coverage for infertility patients’ treatments. For example, in the United Kingdom, the National Health Service pays for some infertility procedures. Furthermore, in Canada provincial health insurance programs cover assisted reproductive technologies for those who qualify. Most recently, a program launched by the Ministry of Health Labor and Welfare in March 2022 significantly increases access to therapy by reducing costs by 70% while increasing prescriptions.

Restraints

Ineffective Skin Types is the Restraint for Infertility Drugs Market.

Infertility drug market growth has been hindered by side effects such as headaches, abnormal bleeding or spotting, injection site pain, ovarian hyperstimulation syndrome, upper respiratory infection, and vomiting. According to a 2016 NCBI study, up to 10%-20% of women who take infertility drugs may experience mild OHSS symptoms that typically resolve on their own without treatment. About one percent of patients experienced severe cases.

There is also the potential that an increased adoption rate of effective alternatives to medications could negatively affect market growth. According to Reproductive Biomedicine’s research article, 2.5 million IVF procedures are performed annually worldwide. There is a high threat of substitutes during this forecast period since most European countries provide full funding for several IV procedures.

Opportunity

Personalized Medicine, Digital Health, Emerging Markets Create Opportunities in Infertility Drugs Market.

As genomics & molecular advances, personalized medicine has become an increasingly important area of research in fertility treatment. The development of drugs targeted to a specific patient’s genetic makeup could improve the effectiveness of infertility treatment and reduce adverse effects. Hormonal therapies have traditionally been the standard of care for infertility treatment, but now there is increasing interest in non-hormonal therapies also.

New non-hormonal therapies may offer fewer side effects & greater safety for patients. The use of digital health technologies like wearables, remote monitoring, and mobile apps is rapidly expanding in healthcare. These technologies can be used to monitor patients and optimize treatment plans, potentially leading to improved outcomes in infertility treatment. The infertility drugs market is expanding in emerging markets, where there is a growing demand for infertility treatment. This presents an opportunity for pharmaceutical companies in developing and market drugs specifically for these regions.

Trends

Growing Demand for Personalized Medicine, Growing Popularity of Natural and Alternative Therapies are Some Recent Trends in Infertility Drugs Market.

There are several recent trends in the infertility drugs market which include, the expiration of patents on biologic infertility drugs, which has led to the development of biosimilars, that have the potential to reduce the cost of infertility treatment and increase patient access to care. As genomics & molecular biology advance, personalized medicine is becoming an increasingly important area of research in infertility treatment. The development of drugs, targeted to a specific patient’s genetic makeup, could improve the effectiveness of infertility treatment and reduce adverse effects.

Patients are increasingly looking for non-invasive treatment options for infertility which has led to the development of new non-invasive therapies, like acupuncture and herbal medicine, which are gaining popularity in the infertility treatment market. There is increasing interest in natural & alternative therapies for infertility, like dairy supplements and herbal remedies. This has led to the development of new natural and alternative products which are gaining popularity in the infertility treatment market.

Regional Analysis

North America Accounted for the Largest Revenue Share in Infertility Drugs Market in 2022.

North America is estimated to be the most lucrative market in the global infertility drugs Market, with the largest market share of 37.8%, and is expected to register a CAGR of 7.2% during the forecast period. Due to the launch and rapid increase of various fertility medicines, research activities in this region related to infertility are expected to open new opportunities for business growth. For instance, Ferring B.V. and Igenomix entered into a four-year research collaboration in June 2020 for developing novel healing products for treating patients with pregnancy-related problems.

APAC is expected as Fastest Growing Region in Projected Period in Infertility Drugs Market.

Asia Pacific is expected as the fastest-growing region in the forecast period in the infertility drugs market with a CAGR of 6.8. Key market leaders have taken strategic steps to commercialize and develop new fertility medicines. The Ministry of Health, Labor and Welfare approved twelve additional infertility treatments, including Letrozole from Novartis AG and Cabaser by Pfizer. These drugs will be in high demand throughout the Asia Pacific due to the label expansion approval.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Merck KGaA is a leader in the infertility market, offering drugs such as Gonal-f and Menopur. Ferring Pharmaceuticals is another prominent player in reproductive medicine with treatments and diagnostic tools for infertility patients around the world. Vitrolife is a Swedish company that develops and distributes products for the in vitro fertilization (IVF) market. Cook Medical is a global medical device company that supplies an array of infertility products such as catheters, needles, and devices for assisted reproductive technology (ART). The Cooper Companies Inc. and Irvine Scientific are top providers of cell culture media and IVF supplies respectively; Genea Biomedx stands out among these providers with their selection of culture media, IVF workstations, and incubators.

Listed below are some of the most prominent infertility drugs market industry players.

Market Key Players

- Merck & Co., Inc.

- Ferring B.V.

- Organon Group of Companies

- Abbott Laboratories

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Mankind Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Other Key Players

Recent Developments

- In June 2022, Mankind Pharma launched an Indian generic Dydrogesterone tablet to treat patients with pregnancy-related problems in India. The drug was an identical version to Abbott Duphaston tablets. The launch of this drug was anticipated to increase the infertility treatments market.

- In March 2021, Evofem Biosciences announced that its contraceptive gel, Phexxi had been approved by the FDA for use as a contraceptive. While not specifically an infertility drug, Phexxi also can help in preventing unintended pregnancies which can contribute to infertility.

- In April 2021, Merck announced that it had received FDA approval for its fertility drug, pergoveris. Pergoveris is used of stimulating ovulation in women undergoing fertility treatment.

Report Scope

Report Features Description Market Value (2022) USD 3589.97 Mn Forecast Revenue (2032) USD 6453.7 Mn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Class (Gonadotropins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, and Other Classes),By Distribution Channel (Hospital Pharmacy, Speciality & Retail Pharmacy, Other Distribution Channels),By End-User (Manufacturing, Oil & Gas, Utilities, Transport, BFSI, IT & Telecomm, Healthcare, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck & Co., Inc., Ferring B.V., Organon Group of Companies, Abbott Laboratories, Novartis AG, Bayer AG, Pfizer Inc., Mankind Pharma Ltd., Teva Pharmaceutical Industries Ltd., Sanofi S.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Infertility Drugs Market worth?Global Infertility Drugs Market market size is Expected to Reach USD 6453.7 Bn by 2032.

What was the Market Segmentation of the Infertility Drugs Market?By Class (Gonadotropins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, and Other Classes),By Distribution Channel (Hospital Pharmacy, Speciality & Retail Pharmacy, Other Distribution Channels),By End-User (Manufacturing, Oil & Gas, Utilities, Transport, BFSI, IT & Telecomm, Healthcare, Other End-Users

What is the CAGR of Infertility Drugs Market?The Infertility Drugs Marketis growing at a CAGR of 6.2% during the forecast period 2022 to 2032.

Who are the major players operating in the Infertility Drugs Market?Merck & Co., Inc., Ferring B.V., Organon Group of Companies, Abbott Laboratories, Novartis AG, Bayer AG, Pfizer Inc., Mankind Pharma Ltd., Teva Pharmaceutical Industries Ltd., Sanofi S.A., Other Key Players

Which region will lead the Global Infertility Drugs Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Merck & Co., Inc.

- Ferring B.V.

- Organon Group of Companies

- Abbott Laboratories

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Mankind Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Other Key Players