Global Industrial Valves Market By Type(Ball, Butterfly, Gate, Globe, Other Types), By Material(Steel, Cast Iron, Alloy based, Plastic, Other Materials), By Application(Chemical, Food and Beverage, Oil and Power, Water and wastewater, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 28590

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

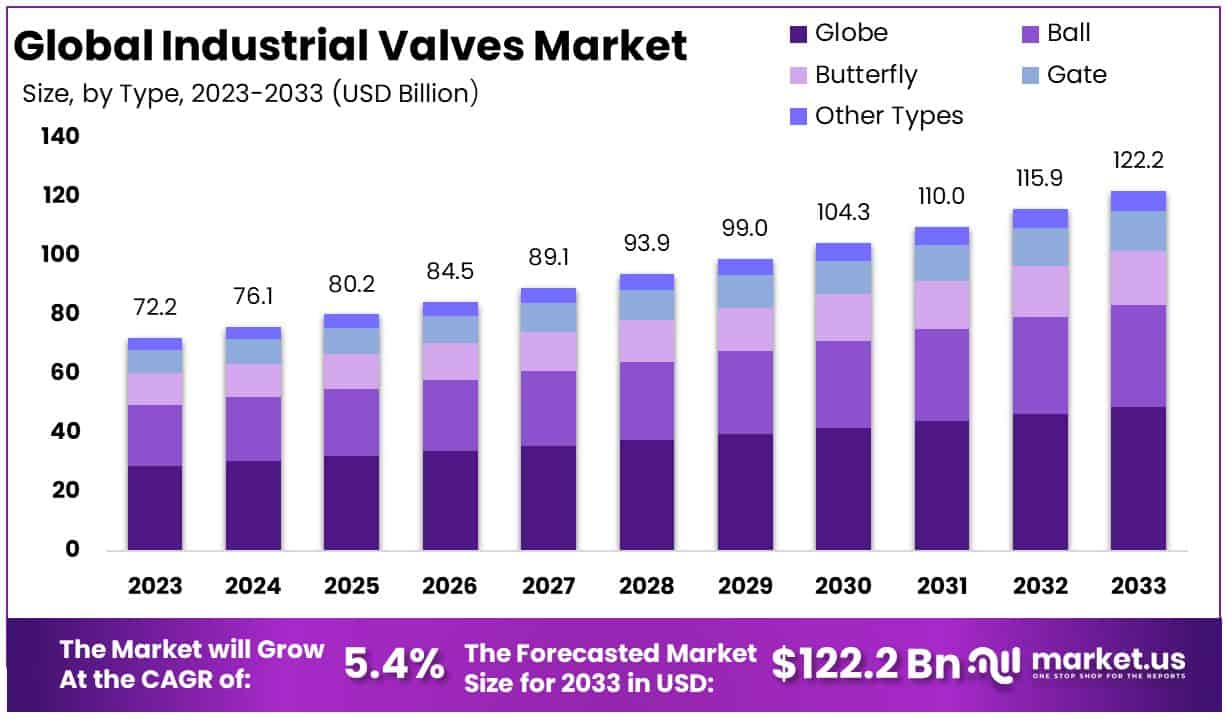

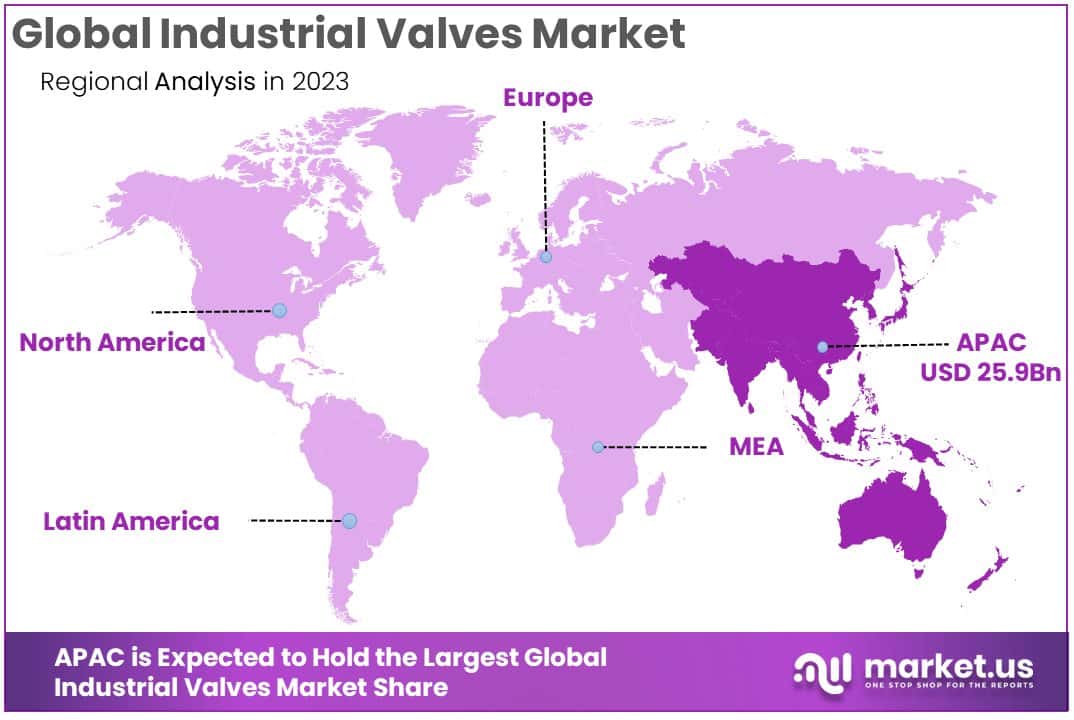

The Global Industrial Valves Market size is expected to be worth around USD 122.2 Billion by 2033, from USD 72.2 Billion in 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033. Asia Pacific dominated a 36% market share in 2023 and held USD 25.9 Billion revenue of the Industrial valves Market.

Industrial valves are mechanical devices that control the flow and pressure within a system or process. They are essential components in various industrial applications, including oil and gas, water and wastewater treatment chemicals, power generation, and manufacturing. These valves can regulate the flow of different types of fluids, gases, slurries, or powders through an opening and closing or partially obstructing passageways.

The industrial valves market is driven by several key factors. Increasing industrialization and urbanization in emerging economies necessitate expansive water and wastewater management systems, boosting demand for industrial valves.

Additionally, the energy sector’s continuous expansion, including traditional and renewable energy, requires robust valve solutions for efficient operations. Technological advancements in valve manufacturing, such as the development of smart valves equipped with smart sensors and real-time data analytics, present significant growth opportunities.

Growth in the industrial valves market is primarily fueled by the need for more sophisticated fluid handling solutions across various industries, including oil and gas, chemical, and water treatment. As these sectors expand, the requirement for durable and efficient valves increases, driving market growth.

Demand for industrial valves is surging due to rising infrastructure projects and upgrading of existing facilities, where modern, high-quality valves are essential for system integrity and regulatory compliance.

The market sees opportunities in the integration of IoT technologies with valve operations. This integration promises enhanced monitoring, predictive maintenance, and efficiency, providing substantial benefits to industries reliant on precise fluid control.

The industrial valves market is positioned for progressive growth, driven by strategic investments in energy efficiency and sustainable practices. The recent allocation of $46 million by the DOE for 29 projects across various states underscores a significant commitment to innovation within this sector.

These projects are anticipated to foster advancements in valve technologies, pivotal for optimizing energy usage and enhancing operational efficiencies. As industries continue to prioritize sustainability, the demand for advanced, energy-efficient industrial valves is expected to surge, marking a transformative phase in the market’s evolution.

This funding not only catalyzes technological enhancements but also supports the broader objective of integrating sustainability in industrial operations, positioning the industrial valves market at the forefront of eco-friendly industrial solutions.

Key Takeaways

- The Global Industrial Valves Market size is expected to be worth around USD 122.2 Billion by 2033, from USD 72.2 Billion in 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

- In 2023, Globe held a dominant market position in the By Type segment of the Industrial Valves Market, with a 40% share.

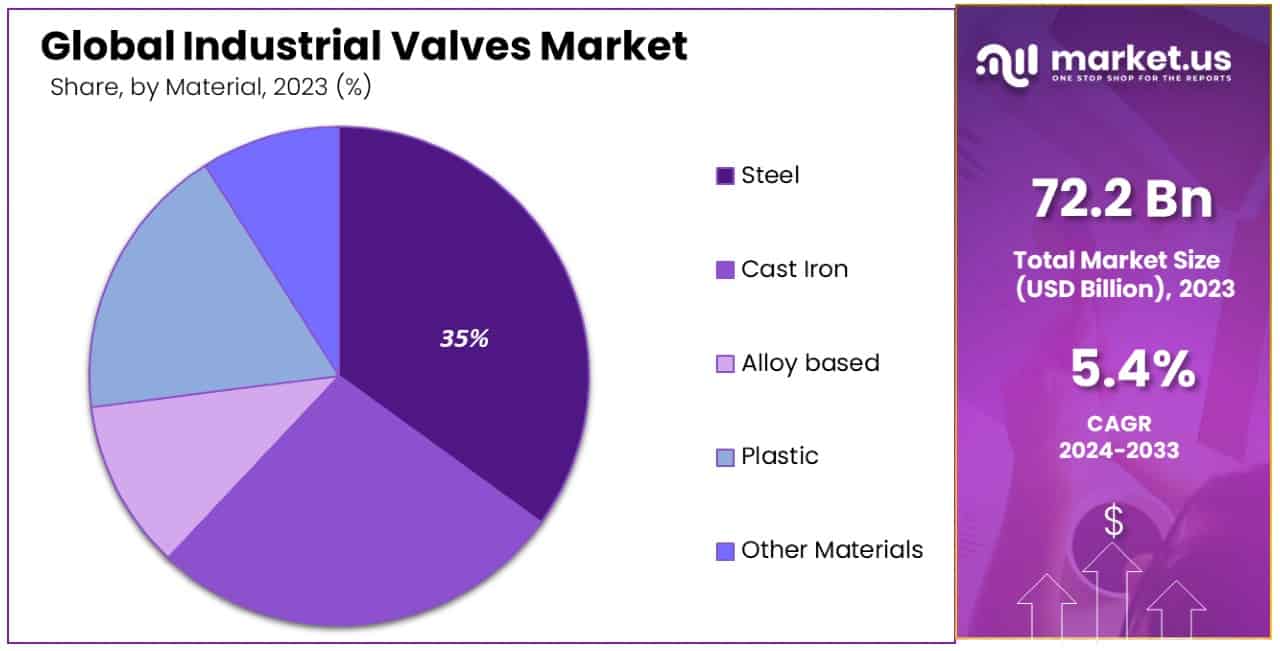

- In 2023, Steel held a dominant market position in the By Material segment of the Industrial valves Market, with a 35% share.

- In 2023, Oil and Power held a dominant market position in the By Application segment of the Industrial valves Market, with a 43% share.

- Asia Pacific dominated a 36% market share in 2023 and held USD 25.9 Billion revenue of the Industrial valves Market.

By Type Analysis

In 2023, Globe Valves held a dominant position in the By Type segment of the Industrial Valves Market, commanding a 40% market share. This segment outperformed other types such as Ball, Butterfly, Gate, and other specialized valves, underscoring its pivotal role in various industrial applications.

The substantial share held by Globe valves can be attributed to their superior ability to regulate flow and pressure, coupled with their versatility across diverse industries including oil and gas, water and wastewater treatment, and chemicals.

This market dominance is further reinforced by technological advancements and increasing investments in infrastructure projects globally. For instance, the $46 million funding by the DOE to enhance energy efficiency includes projects that potentially integrate advanced Globe valve technologies, promoting their adoption in energy-critical applications.

As industries increasingly focus on energy optimization and sustainable practices, the demand for Globe valves is expected to grow, leveraging their efficiency and adaptability to meet stringent environmental and operational requirements. This trend positions Globe valves as a key component in the future expansion and technological evolution of the Industrial Valves Market.

By Material Analysis

In 2023, Steel maintained a dominant market position in the By Material segment of the Industrial Valves Market, securing a 35% share. This segment led over others including Cast Iron, Alloy-based, Plastic, and Other Materials. Steel’s prominence is primarily due to its durability, corrosion resistance, and suitability for high-pressure environments, making it indispensable in critical sectors such as oil and gas, petrochemicals, and utilities.

The robust performance of steel valves is supported by ongoing innovations aimed at improving efficiency and sustainability in industrial operations. The significant allocation of $46 million by the DOE for enhancing energy-efficient technologies indicates a focus on advancements that could directly benefit the steel valve sector.

These funds are expected to drive the development of more durable and environmentally friendly steel valve solutions, thereby boosting their adoption across industries striving for operational excellence and reduced environmental impact.

As industries continue to evolve towards more sustainable practices, the demand for steel valves is projected to rise, further cementing their position as a fundamental component of the industrial valves landscape.

By Application Analysis

In 2023, the Oil and Power sectors held a dominant market position in the By Application segment of the Industrial Valves Market, with a 43% share. This segment outstripped other applications such as Chemical, Food and Beverage, Water and Wastewater, and Other Applications.

The robust position of Oil and Power is attributed to extensive investments in energy infrastructure and the critical nature of reliable valve performance in these industries.

The significant share held by Oil and Power is further bolstered by technological advancements and regulatory pressures aimed at enhancing efficiency and reducing environmental impact. The $46 million funding from the DOE, earmarked for projects that enhance energy efficiency, includes initiatives likely to incorporate cutting-edge valve technologies tailored for the energy sector.

This investment underscores a growing emphasis on sustainability and efficiency within the sector, driving the demand for advanced industrial valves. As the global energy landscape evolves with a sharper focus on renewable sources and energy conservation, the role of innovative valve solutions in the Oil and Power sectors becomes increasingly pivotal, ensuring their continued market dominance.

Key Market Segments

By Type

- Ball

- Butterfly

- Gate

- Globe

- Other Types

By Material

- Steel

- Cast Iron

- Alloy based

- Plastic

- Other Materials

By Application

- Chemical

- Food and Beverage

- Oil and Power

- Water and wastewater

- Other Applications

Drivers

Market Drivers for Industrial Valves

The Industrial Valves Market is experiencing significant growth driven by the increasing demand for energy efficiency and stringent environmental regulations. As industries across the globe strive to reduce their environmental footprint and optimize energy usage, the need for advanced valve technologies that can offer superior performance and sustainability is surging.

This trend is especially pronounced in critical sectors such as oil and gas, water treatment, and manufacturing, where the effective control of fluids is essential. Additionally, government initiatives like the DOE’s investment of $46 million into energy projects highlight the push towards enhancing industrial energy efficiency, further propelling the adoption of innovative valve solutions.

As a result, the market for industrial valves is set to expand, supported by both technological advancements and regulatory frameworks aimed at promoting sustainable industrial practices.

Restraint

Challenges in the Industrial Valves Market

The Industrial Valves Market faces notable challenges, primarily stemming from the stringent environmental regulations that govern the manufacturing and deployment of these components. Regulatory bodies worldwide have tightened standards to mitigate environmental impact, compelling valve manufacturers to invest significantly in research and development.

This necessity drives up the costs of production, potentially restraining market growth as companies struggle to align their offerings with these regulatory demands without passing excessive costs onto consumers.

Additionally, the increased scrutiny requires longer product development cycles, delaying market entry for new innovations and impacting the competitive dynamics within the industry. As a result, companies must navigate these regulatory hurdles carefully to maintain their market positions and ensure compliance without sacrificing profitability.

Opportunities

Growth Prospects in the Valve Market

The Industrial Valves Market is poised for growth, driven by the increasing demand for automation across various industries, including oil and gas, water treatment, and manufacturing. This trend towards automation is compelling companies to integrate smart valves that offer enhanced efficiency and precise control.

These technological advancements not only improve operational efficiency but also extend the lifespan of the equipment, reducing maintenance costs and downtime. Furthermore, the expanding infrastructure developments in emerging economies present a significant opportunity for market expansion.

Companies can capitalize on these trends by innovating and expanding their product lines to include smart, energy-efficient valve solutions, thereby positioning themselves advantageously in a competitive market and meeting the evolving needs of a diverse customer base.

Challenges

Key Challenges for the Valve Industry

The Industrial Valves Market confronts several challenges, with market saturation being a significant hurdle. As established markets in developed regions become increasingly saturated, companies face intense competition, which pressures pricing strategies and profit margins.

Additionally, the high cost of raw materials and the need for continuous innovation to meet changing technological and regulatory standards add layers of complexity and financial burden. These factors make it difficult for manufacturers to maintain profitability while investing in new product development and market expansion.

To navigate these challenges, companies must strategically enhance their operational efficiencies, focus on emerging markets for growth opportunities, and invest in research and development to stay ahead of technological advancements and regulatory demands, ensuring their offerings meet the latest industry standards and customer expectations.

Growth Factors

Driving Forces in the Valve Market

The Industrial Valves Market is experiencing significant growth driven by the global increase in industrial activities and infrastructural developments, particularly in emerging economies. As sectors such as oil and gas, water and wastewater management, and chemicals continue to expand, the demand for robust valve solutions to manage fluids effectively under various operating conditions also rises.

Additionally, technological advancements are fostering the adoption of smart valves equipped with automation and advanced monitoring capabilities, enhancing efficiency and operational reliability. The push for more environmentally friendly solutions is also prompting innovations in valve technology to ensure better regulatory compliance and reduced environmental impact.

These factors collectively contribute to the strong growth trajectory of the industrial valves market, providing ample opportunities for manufacturers to innovate and expand their market presence.

Emerging Trends

Trends Shaping Valve Industry

Emerging trends in the Industrial valve market are significantly influenced by the integration of IoT and digitalization, which are enhancing the functionality and operational efficiency of valve systems. Manufacturers are increasingly embedding sensors in valves to facilitate real-time data monitoring, predictive maintenance, and remote management capabilities.

This shift towards smart infrastructure is also supported by global trends towards sustainable and energy-efficient solutions, pushing the development of valves that minimize leaks and energy consumption. Additionally, the rising demand in sectors like healthcare and pharmaceuticals, where precision and hygiene are paramount, is prompting innovations in valve designs to meet stringent standards.

These trends are setting the stage for transformative changes in the market, enabling new business models and opportunities for growth as industries increasingly adopt advanced, interconnected valve technologies.

Regional Analysis

The Industrial Valves Market showcases distinct regional dynamics with Asia Pacific leading the way, commanding a substantial 36% market share and valued at USD 25.9 billion. This dominance is driven by rapid industrialization and infrastructure development, particularly in emerging economies such as China and India.

North America and Europe also hold significant positions in the market due to their advanced manufacturing sectors and stringent regulatory frameworks which demand high-quality standards and technological innovation in valve manufacturing.

The market in these regions is characterized by a high adoption rate of automated and smart valve technologies aimed at improving operational efficiency and reducing maintenance costs. Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth. The expansion in these regions is fueled by the oil and gas industry, which demands robust valve solutions for oil extraction and pipeline operations.

The strategic positioning of Asia Pacific as a manufacturing hub, combined with increasing investments in sectors like water & wastewater treatment and chemicals, continues to propel the region’s market dominance and growth trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Industrial Valves Market continues to be significantly shaped by the strategic maneuvers and technological advancements introduced by key players such as Crane, Emerson Electric Co., and Flowserve Corp. Each company contributes uniquely to the industry’s landscape, marked by innovation and competitive positioning.

Crane has strengthened its market position through a diversified portfolio that emphasizes reliability and efficiency in demanding industrial environments. The company’s focus on expanding its product offerings in automation and smart valve technologies has allowed it to capitalize on the growing demand for energy-efficient and integrated solutions, especially in sectors like water management and chemicals.

Emerson Electric Co. stands out with its cutting-edge solutions in process management and automation. Emerson’s commitment to innovation is evident in its development of smart, connected valve technologies, which are instrumental in driving operational efficiencies and predictive maintenance strategies.

The company’s strategic acquisitions and investments in research and development have bolstered its presence across various regions, enhancing its ability to meet the stringent regulatory and operational requirements of the global market.

Flowserve Corp continues to be a pivotal player with its extensive range of valve products and services that cater to high-growth industries such as oil and gas, power generation, and water resources. The company’s ongoing investment in developing high-performance and environmentally sustainable valve solutions aligns with global trends toward sustainability and regulatory compliance, further solidifying its role as a leader in the market.

Top Key Players in the Market

- AVK Holding

- Avcon Controls Pvt. Ltd

- Schlumberger Limited

- Crane

- Emerson Electric Co

- Flowserve Corp

- Forbes Marshall

- IMI Plc

- Metso Corporation

- The Weir Group Plc

Recent Developments

- In May 2023, IMI Plc completed a strategic acquisition of a valve manufacturing company specializing in high-pressure solutions, aiming to expand its footprint in the aerospace and defense sectors. This move is projected to increase IMI’s market capabilities by 20% in these specialized industries.

- In March 2023, Forbes Marshall introduced a smart valve monitoring system that leverages IoT technology to provide real-time data analytics. This innovation is expected to improve maintenance operations and reduce downtime by 25% for critical processing industries.

- In January 2023, Flowserve Corp announced the launch of its new series of energy-efficient valves aimed at reducing operational costs for industries by up to 30%. These valves are designed to enhance performance and sustainability in high-demand sectors such as oil and gas.

Report Scope

Report Features Description Market Value (2023) USD 72.2 Billion Forecast Revenue (2033) USD 122.2 Billion CAGR (2024-2033) 5.40% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Ball, Butterfly, Gate, Globe, Other Types), By Material(Steel, Cast Iron, Alloy based, Plastic, Other Materials), By Application(Chemical, Food and Beverage, Oil and Power, Water and wastewater, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape (AVK Holding, Avcon Controls Pvt. Ltd, Schlumberger Limited, Crane, Emerson Electric Co, Flowserve Corp, Forbes Marshall, IMI Plc, Metso Corporation, The Weir Group Plc) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Valves MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Valves MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AVK Holding

- Avcon Controls Pvt. Ltd

- Schlumberger Limited

- Crane

- Emerson Electric Co

- Flowserve Corp

- Forbes Marshall

- IMI Plc

- Metso Corporation

- The Weir Group Plc