Global Industrial V-Belt Market Size, Share, Growth Analysis By Belt Type (Classical V-Belts, Narrow V-Belts, Wedge V-Belt, Others), By Material (Rubber V-Belts, Polyurethane (PU) V-Belts, Fabric-Reinforced V-Belts, Others), By End-Use Industry (Automotive, Industrial Manufacturing, Oil & Gas, Construction, Agriculture, Mining, Energy & Utilities, Aerospace & Defence, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176801

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

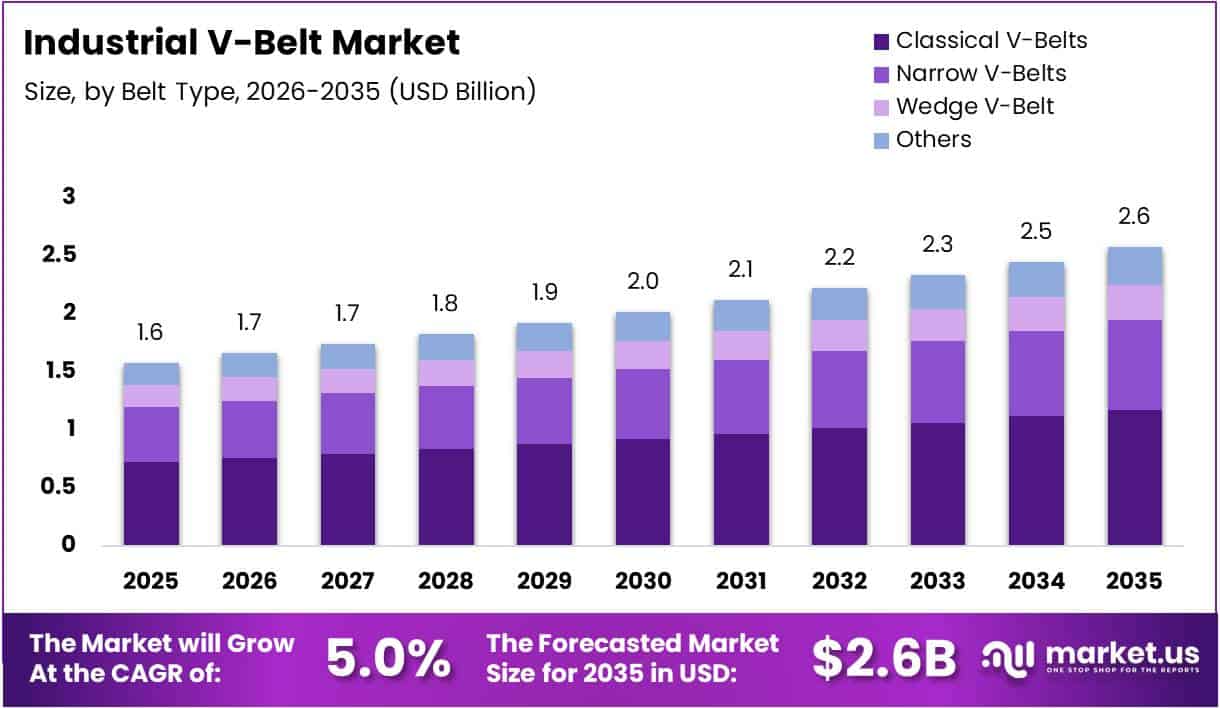

The Global Industrial V-Belt Market size is expected to be worth around USD 2.6 Billion by 2035 from USD 1.58 Billion in 2025, growing at a CAGR of 5.0% during the forecast period 2026 to 2035.

Industrial V-belts are flexible power transmission components used to transfer rotational force between pulleys in machinery. These belts feature a trapezoidal cross-section that wedges into matching grooves, providing reliable friction-based power delivery. They serve critical functions across manufacturing, automotive, mining, and agricultural equipment globally.

The market demonstrates steady expansion driven by continuous industrial automation and infrastructure development. Moreover, sustained demand for cost-effective maintenance solutions supports replacement cycles in existing machinery bases. Heavy industries require dependable transmission systems that balance performance with affordability, positioning V-belts as essential components.

Growth opportunities emerge from expanding industrial activities in developing economies where manufacturing capacity increases rapidly. Additionally, technological advancements enable production of high-performance belts with improved energy efficiency and durability. Customization capabilities allow manufacturers to address specific application requirements across diverse industrial sectors effectively.

Government initiatives promoting industrial modernization and infrastructure projects stimulate market demand substantially. Furthermore, regulatory frameworks emphasizing energy efficiency encourage adoption of advanced belt designs that minimize power loss. Investment in mining, construction, and metals processing sectors particularly strengthens market prospects across multiple regions.

According to Sihaibelt, standard V-belts can transfer power with 95-98% efficiency under ideal conditions. Upgrading to modern energy-saving V-belts can reduce power usage by approximately 12-18% compared with older belt designs, demonstrating significant operational improvements.

According to Sihaibelt, EPDM polymer-based V-belts improve heat dissipation by approximately 60% versus standard rubber compounds, contributing to reduced heat-related wear. Additionally, optimized V-belt designs have reduced slip rates by approximately 40% compared with legacy belts through advanced grooves and materials.

According to the U.S. Department of Energy, cogged belts typically operate approximately 2% more efficiently than standard V-belts due to reduced bending resistance. This efficiency gain translates into measurable energy savings across industrial applications, reinforcing the value proposition of modern belt technologies.

Key Takeaways

- The Global Industrial V-Belt Market is projected to reach USD 2.6 Billion by 2035 from USD 1.58 Billion in 2025, growing at 5.0% CAGR.

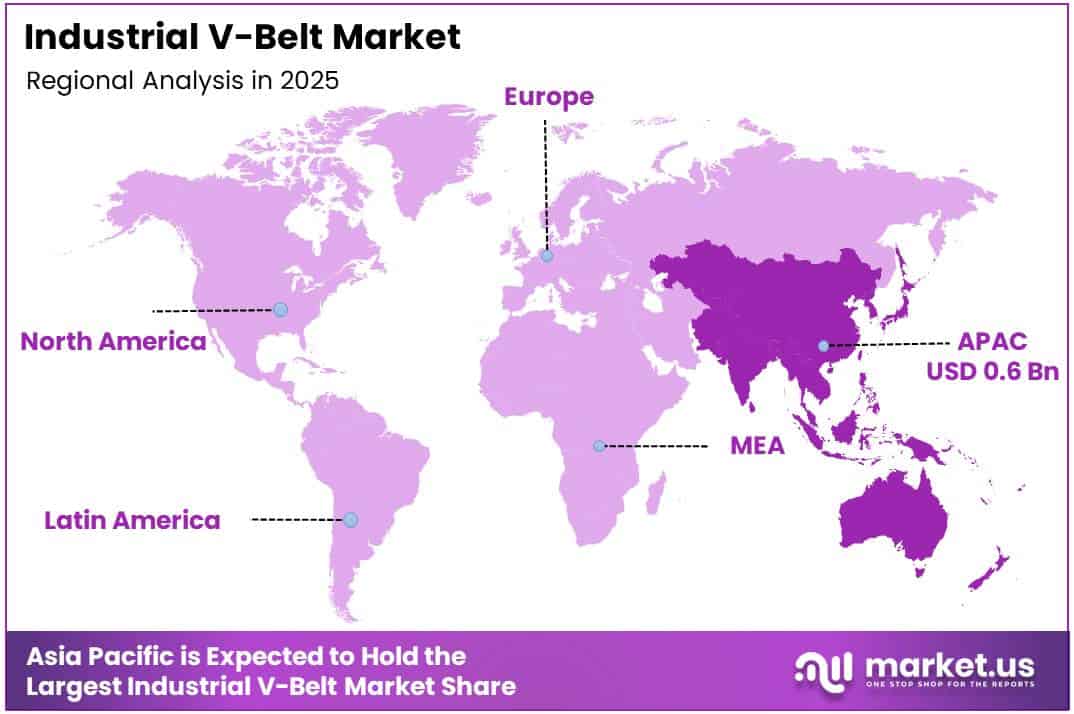

- Asia Pacific dominates the market with 41.1% share, valued at USD 0.6 Billion in 2025.

- Classical V-Belts segment leads by belt type with 45.5% market share in 2025.

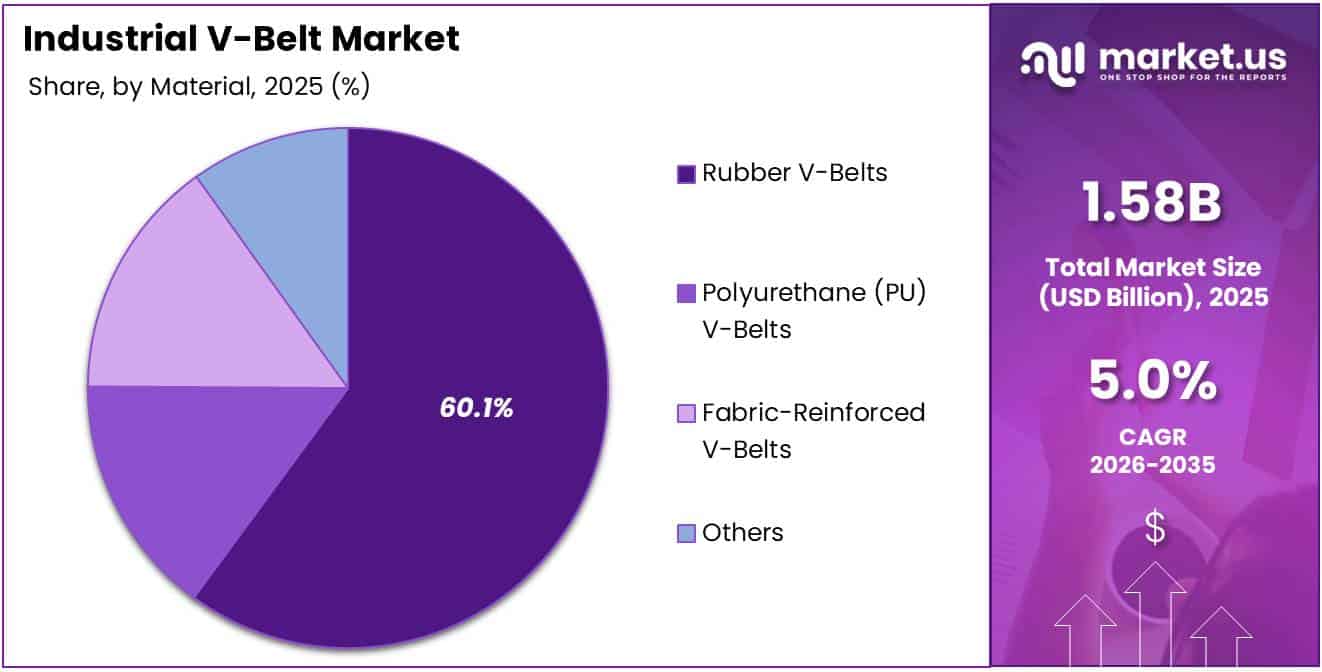

- Rubber V-Belts hold 60.1% share in the material segment during 2025.

- Automotive end-use industry accounts for 35.1% market share in 2025.

Belt Type Analysis

Classical V-Belts dominate with 45.5% due to widespread compatibility and proven reliability across traditional industrial machinery.

In 2025, Classical V-Belts held a dominant market position in the By Belt Type segment of Industrial V-Belt Market, with a 45.5% share. These belts maintain extensive adoption across legacy equipment and conventional machinery installations. Their standardized dimensions ensure broad compatibility with existing pulley systems. Consequently, replacement demand remains consistently strong across diverse industrial applications worldwide.

Narrow V-Belts gain traction through superior power transmission capacity within compact spaces. These belts deliver higher efficiency in modern machinery designs where space optimization is critical. Moreover, their enhanced grip characteristics reduce slippage under heavy loads. Industries transitioning toward compact equipment configurations increasingly prefer narrow belt solutions.

Wedge V-Belts serve specialized applications requiring exceptional torque transmission in demanding environments. Their unique geometry provides increased surface contact area, enhancing power delivery efficiency. Additionally, these belts demonstrate superior performance in high-speed and high-temperature conditions. Mining and heavy manufacturing sectors particularly value their robust operational characteristics.

Others include specialized belt variants such as double-sided V-belts, variable speed belts, and application-specific custom designs. These products address niche requirements where standard configurations prove inadequate for unique operational demands. Furthermore, technological innovations introduce new belt types optimized for emerging equipment designs. Consequently, specialized segments provide manufacturers with differentiation opportunities and premium positioning.

Material Analysis

Rubber V-Belts dominate with 60.1% due to cost-effectiveness, durability, and excellent performance across standard operating conditions.

In 2025, Rubber V-Belts held a dominant market position in the By Material segment of Industrial V-Belt Market, with a 60.1% share. These belts combine affordability with reliable performance in typical industrial environments. Their proven track record across decades establishes strong market confidence. Furthermore, continuous compound improvements enhance heat resistance and service life substantially.

Polyurethane (PU) V-Belts address applications requiring chemical resistance and reduced maintenance intervals. These belts exhibit superior resistance to oils, solvents, and aggressive industrial chemicals. Additionally, their lightweight construction minimizes inertial loads on drive systems. Food processing and pharmaceutical industries particularly favor PU belts for hygienic operational requirements.

Fabric-Reinforced V-Belts provide enhanced tensile strength for high-torque applications in heavy machinery. Their reinforced construction prevents elongation under sustained loading conditions. Moreover, these belts maintain dimensional stability across extended operational periods. Construction and mining equipment manufacturers specify fabric-reinforced variants for extreme-duty applications.

Others encompass advanced materials including aramid-reinforced belts, silicone-based compounds, and composite constructions addressing specialized requirements. These materials offer superior performance characteristics such as extreme temperature tolerance and enhanced chemical resistance. Additionally, innovative material formulations enable customization for unique industrial applications.

End-Use Industry Analysis

Automotive dominates with 35.1% due to extensive belt applications in engines, alternators, and ancillary systems across vehicle production.

In 2025, Automotive held a dominant market position in the By End-Use Industry segment of Industrial V-Belt Market, with a 35.1% share. Vehicle manufacturing requires numerous V-belts for power steering, air conditioning, and alternator drives. Aftermarket replacement demand further strengthens this segment continuously. Consequently, automotive applications represent the largest consumption category globally.

Industrial Manufacturing consumes substantial V-belt volumes across production machinery, conveyor systems, and processing equipment. This sector encompasses diverse applications from textiles to metalworking operations. Moreover, ongoing capacity expansions in emerging markets drive replacement and new installation demand. Manufacturers prioritize reliable transmission solutions that minimize production downtime effectively.

Oil & Gas operations deploy V-belts in drilling equipment, pumps, and extraction machinery operating under harsh conditions. These applications demand robust belts capable of sustained performance in extreme environments. Additionally, remote installation locations require extended service intervals and exceptional durability. Specialized belt formulations address sector-specific operational challenges comprehensively.

Construction equipment utilizes V-belts in excavators, concrete mixers, and material handling machinery across project sites. This sector requires belts that withstand dust, vibration, and variable loading conditions. Furthermore, equipment mobility necessitates reliable components with minimal maintenance requirements. Construction activity cycles directly influence replacement demand patterns regionally.

Agriculture machinery depends on V-belts for tractors, harvesters, irrigation systems, and crop processing equipment worldwide. These applications experience seasonal demand patterns aligned with planting and harvesting cycles. Moreover, agricultural equipment operates in dusty, outdoor environments requiring durable belt solutions. Therefore, agricultural sectors maintain consistent replacement demand across global farming operations.

Mining operations require heavy-duty V-belts for conveyor systems, crushers, and material handling equipment processing extracted minerals. These applications involve extreme loads, abrasive materials, and continuous operational demands. Additionally, mining equipment reliability directly impacts productivity and operational costs significantly. Consequently, mining sectors specify premium belt solutions ensuring maximum uptime.

Energy & Utilities facilities employ V-belts in power generation equipment, water treatment systems, and auxiliary machinery supporting infrastructure operations. These applications demand consistent performance maintaining critical utility services without interruption. Furthermore, regulatory compliance and safety standards influence component selection processes. Therefore, energy sectors prioritize certified and reliable transmission solutions.

Aerospace & Defence applications utilize specialized V-belts in ground support equipment, maintenance machinery, and auxiliary systems requiring precision performance. These sectors maintain stringent quality standards and certification requirements for all components. Moreover, defense equipment operates in diverse environments demanding exceptional reliability. Consequently, aerospace applications represent premium market segments with specialized requirements.

Others encompass diverse applications including pharmaceutical manufacturing, food processing machinery, packaging machinery, and specialized industrial equipment. These sectors require customized belt solutions addressing unique operational conditions and hygiene standards. Additionally, emerging industries create new application opportunities expanding market scope. Therefore, miscellaneous applications contribute meaningfully to overall market diversity and growth.

Key Market Segments

By Belt Type

- Classical V-Belts

- Narrow V-Belts

- Wedge V-Belt

- Others

By Material

- Rubber V-Belts

- Polyurethane (PU) V-Belts

- Fabric-Reinforced V-Belts

- Others

By End-Use Industry

- Automotive

- Industrial Manufacturing

- Oil & Gas

- Construction

- Agriculture

- Mining

- Energy & Utilities

- Aerospace & Defence

- Others

Drivers

Rising Deployment of Industrial Automation Drives Market Growth

Industrial automation expansion across manufacturing facilities necessitates reliable power transmission components for automated machinery systems. Modern production lines integrate numerous motor-driven equipment requiring efficient belt-based drives. Consequently, automation adoption directly correlates with increased V-belt consumption across factories. Moreover, automated systems demand consistent performance characteristics that traditional V-belts reliably deliver.

Heavy-duty machinery in processing, manufacturing, and extraction industries requires dependable power transmission under sustained operational loads. V-belts provide proven reliability in equipment operating continuously across extended periods. Additionally, their ability to absorb shock loads protects downstream components from damage. Therefore, industries prioritize V-belts for mission-critical applications where equipment failure causes significant production losses.

Mining, cement, and metals industries experience robust expansion driven by infrastructure development and construction activities globally. These sectors deploy heavy machinery requiring high-torque transmission systems for crushing, grinding, and material handling operations. Furthermore, V-belts offer cost-effective solutions compared to alternative drive technologies in large-scale industrial applications. Consequently, sectoral growth directly translates into sustained market demand.

Restraints

Adoption of Direct Drive Technologies Limits Market Growth

Direct drive and gearless transmission systems eliminate intermediate components, reducing maintenance requirements and improving overall efficiency. Modern motor designs increasingly incorporate integrated drive mechanisms that bypass traditional belt systems entirely. Moreover, industries seeking simplified equipment architectures favor direct connection between motors and driven components. Consequently, this technological shift gradually displaces V-belt applications in certain equipment categories.

V-belts demonstrate performance limitations when operating under extreme temperature fluctuations or sustained heavy loading conditions. High-temperature environments cause accelerated degradation of rubber compounds, reducing service life substantially. Additionally, excessive loads induce slippage and premature wear that compromises transmission efficiency. Therefore, specialized applications increasingly require alternative solutions such as chain drives or gear systems.

Operational challenges in extreme environments limit V-belt adoption where temperature ranges exceed material capabilities significantly. Industries operating in arctic conditions or high-heat processes experience frequent belt failures requiring costly replacements. Furthermore, chemical exposure in certain processing applications degrades standard belt materials rapidly. These limitations drive users toward more specialized transmission technologies.

Growth Factors

Industrial Infrastructure Investments Accelerate Market Expansion

Emerging economies invest heavily in manufacturing capacity expansion, creating substantial demand for industrial machinery and associated components. Government initiatives promoting domestic manufacturing stimulate factory construction and equipment installation projects continuously. Moreover, infrastructure development programs require construction and material processing equipment utilizing V-belt systems extensively. Consequently, regional industrialization trends significantly influence global market growth trajectories.

Modern equipment designs emphasize energy efficiency to reduce operational costs and meet environmental regulations increasingly. High-performance V-belts incorporating advanced materials minimize power loss through reduced friction and improved heat dissipation. Additionally, cogged belt designs decrease bending resistance, enhancing transmission efficiency measurably. Therefore, manufacturers develop innovative products addressing evolving efficiency requirements across industrial applications.

Diverse industrial sectors require specialized belt solutions tailored to unique operational conditions and performance specifications. Customization capabilities enable manufacturers to develop belts optimized for specific temperature ranges, chemical exposures, or load characteristics. Furthermore, application-specific designs improve equipment performance while extending service intervals significantly. This customization demand creates premium market segments with enhanced profitability potential.

Emerging Trends

Advanced Materials Transform V-Belt Performance Capabilities

Manufacturers develop advanced rubber compounds incorporating synthetic polymers that enhance heat resistance and durability substantially. EPDM and specialized elastomer formulations withstand higher operating temperatures while maintaining flexibility across wider temperature ranges. Moreover, reinforcement materials evolve from traditional fabrics to aramid fibers and advanced composites. Consequently, modern V-belts deliver superior performance compared to conventional designs across demanding applications.

Modern belt designs incorporate features minimizing operational noise and vibration transmission to surrounding equipment and structures. Precision manufacturing techniques ensure dimensional consistency that reduces pulley engagement irregularities causing noise generation. Additionally, optimized belt profiles decrease vibration amplitudes transmitted through drive systems. Therefore, industries prioritizing workplace comfort and equipment longevity increasingly specify low-noise belt variants.

Energy efficiency initiatives drive adoption of belt designs that minimize power loss through optimized friction characteristics and reduced flexing resistance. Manufacturers focus on developing products that maximize transmission efficiency while reducing heat generation during operation. Furthermore, regulatory pressures and cost reduction objectives encourage industries to upgrade legacy systems with efficient alternatives. Consequently, energy-efficient V-belts gain market share across environmentally conscious industrial sectors.

Regional Analysis

Asia Pacific Dominates the Industrial V-Belt Market with a Market Share of 41.1%, Valued at USD 0.6 Billion

Asia Pacific leads the global market driven by extensive manufacturing activities and ongoing industrialization across China, India, and Southeast Asian nations. The region hosts numerous automotive production facilities, heavy machinery manufacturers, and processing industries consuming substantial V-belt volumes. Moreover, infrastructure development projects and mining operations further strengthen regional demand. In 2025, Asia Pacific held 41.1% market share valued at USD 0.6 Billion, reflecting its dominant industrial base.

North America Industrial V-Belt Market Trends

North America maintains steady demand supported by mature industrial infrastructure requiring continuous maintenance and replacement components. The region emphasizes high-performance and energy-efficient belt solutions aligned with stringent operational standards. Additionally, automotive manufacturing and oil extraction activities sustain consistent market consumption. Advanced manufacturing technologies drive adoption of premium belt products across diverse applications.

Europe Industrial V-Belt Market Trends

Europe demonstrates strong preference for technologically advanced and environmentally compliant V-belt solutions across industrial sectors. Stringent energy efficiency regulations encourage adoption of high-performance belt designs minimizing power loss. Moreover, established automotive and manufacturing industries maintain substantial replacement demand continuously. Germany, France, and the UK represent key consumption markets within the region.

Middle East & Africa Industrial V-Belt Market Trends

Middle East and Africa experience growing demand driven by expanding construction, mining, and oil extraction activities across Gulf nations and South Africa. Infrastructure development projects require heavy machinery utilizing V-belt transmission systems extensively. Additionally, industrial diversification initiatives beyond petroleum sectors stimulate manufacturing equipment installations. However, market maturity remains lower compared to established regions.

Latin America Industrial V-Belt Market Trends

Latin America shows moderate growth influenced by mining operations, agricultural machinery, and manufacturing sector development across Brazil and Mexico. Economic fluctuations impact industrial investment cycles affecting equipment purchases and maintenance budgets periodically. Nevertheless, natural resource extraction activities maintain baseline demand for heavy-duty belt applications. Regional market expansion correlates closely with commodity price trends.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Gates Corporation maintains a leading position through comprehensive product portfolios spanning automotive and industrial power transmission solutions globally. The company leverages extensive distribution networks and strong brand recognition across diverse industrial sectors. Moreover, continuous innovation in belt materials and designs strengthens competitive positioning. Gates invests significantly in research facilities developing next-generation transmission technologies addressing evolving customer requirements effectively.

ContiTech Deutschland GmbH delivers advanced rubber and plastics technology solutions including high-performance V-belt systems for industrial applications. The company emphasizes engineering excellence and customization capabilities serving specialized industry needs. Additionally, ContiTech’s global manufacturing footprint ensures consistent product availability across major markets. Strong parent company support enables sustained investment in production capacity and technological advancement initiatives.

Mitsuboshi Belting Ltd. specializes in precision-engineered power transmission belts serving automotive, industrial, and agricultural equipment manufacturers. The company maintains strong presence across Asian markets while expanding international operations strategically. Furthermore, Mitsuboshi focuses on developing energy-efficient belt designs aligned with global sustainability trends. Advanced manufacturing processes ensure consistent quality standards across product lines.

Optibelt GmbH provides premium V-belt solutions emphasizing superior performance characteristics and extended service life across demanding applications. The company targets industries requiring reliable transmission systems with minimal maintenance requirements. Additionally, Optibelt invests in technical support services enhancing customer relationships and application expertise. Specialized product development addresses niche market segments with unique operational challenges.

Key Players

- Gates Corporation

- ContiTech Deutschland GmbH

- Mitsuboshi Belting Ltd.

- Optibelt GmbH / Arntz Optibelt Group

- Bando Chemical Industries Ltd.

- SKF Group

- Hutchinson / Hutchinson Belt Drive Systems

- PIX Transmissions Ltd.

- Timken Belts

- Zhejiang Sanlux Rubber Co. Ltd. / Sanlux Co., Ltd.

- PowerDrive LLC

- BEHA Innovation GmbH

- Dunlop Belting Products

- Goodyear Belts

- Other Key Players

Recent Developments

- December 2025 – Solve Industrial Motion Group acquires D&D Global, Inc., expanding its power transmission product portfolio and distribution capabilities across North American markets. This strategic acquisition strengthens the company’s position in industrial belt solutions and enhances customer service networks regionally.

- January 2025 – Belt Power acquires Sparks Belting Company, Inc., consolidating market presence in specialized belt distribution and technical support services. The acquisition enables expanded product offerings and improved supply chain efficiency for industrial customers requiring comprehensive transmission solutions.

Report Scope

Report Features Description Market Value (2025) USD 1.58 Billion Forecast Revenue (2035) USD 2.6 Billion CAGR (2026-2035) 5.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Belt Type (Classical V-Belts, Narrow V-Belts, Wedge V-Belt, Others), By Material (Rubber V-Belts, Polyurethane (PU) V-Belts, Fabric-Reinforced V-Belts, Others), By End-Use Industry (Automotive, Industrial Manufacturing, Oil & Gas, Construction, Agriculture, Mining, Energy & Utilities, Aerospace & Defence, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Gates Corporation, ContiTech Deutschland GmbH, Mitsuboshi Belting Ltd., Optibelt GmbH / Arntz Optibelt Group, Bando Chemical Industries Ltd., SKF Group, Hutchinson / Hutchinson Belt Drive Systems, PIX Transmissions Ltd., Timken Belts, Zhejiang Sanlux Rubber Co. Ltd. / Sanlux Co., Ltd., PowerDrive LLC, BEHA Innovation GmbH, Dunlop Belting Products, Goodyear Belts, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gates Corporation

- ContiTech Deutschland GmbH

- Mitsuboshi Belting Ltd.

- Optibelt GmbH / Arntz Optibelt Group

- Bando Chemical Industries Ltd.

- SKF Group

- Hutchinson / Hutchinson Belt Drive Systems

- PIX Transmissions Ltd.

- Timken Belts

- Zhejiang Sanlux Rubber Co. Ltd. / Sanlux Co., Ltd.

- PowerDrive LLC

- BEHA Innovation GmbH

- Dunlop Belting Products

- Goodyear Belts

- Other Key Players