Global Industrial Heaters Market By Product Type (Pipe Heaters, Immersion Heaters, Duct Heaters, Circulation Heaters, Cartridge Heaters), By Technology (Electric-based, Fuel-based, Hybrid-based, Steam-based), By End-Use Industry (Pharmaceuticals, Oil & Gas, Food & Beverages, Automotive, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 27566

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Industrial Heaters Market size is expected to be worth around USD 58.9 Billion by 2033, From USD 37.2 Billion by 2023, growing at a CAGR of 4.70% during the forecast period from 2024 to 2033.

Industrial heaters are devices used to heat various mediums or spaces in industrial applications. They are critical components in smart manufacturing, processing, and production across industries.

These heaters can vary in type, including immersion, band, cartridge, and infrared heaters, each tailored for specific temperature ranges and environments to improve process efficiency and safety.

The industrial heaters market comprises the sales and distribution of various heating devices used in industrial settings. This market is segmented based on heater type, application, and industry verticals such as oil and gas, chemicals, automotive, and food processing. The market is driven by the need for efficient thermal management and controlled processing environments in industrial operations.

The growth of the industrial heaters market can be attributed to the increasing demand for energy-efficient solutions and the expansion of manufacturing sectors globally. Enhanced focus on minimizing energy consumption and optimizing process performance has led to innovations in heater technologies, further propelling market growth.

Demand for industrial heaters is fueled by the ongoing industrialization in emerging economies and the retrofitting of existing facilities with advanced heating solutions in developed countries. The need for precise temperature control and reliability in critical applications also significantly contributes to the sustained demand.

Opportunities in the industrial heaters market are abundant with the rise of industries emphasizing sustainable and eco-friendly processes. Integrating IoT and smart technology for predictive maintenance and energy management in heaters presents new avenues for market expansion, alongside potential applications in green energy sectors.

In the context of a shifting global energy landscape, the industrial heaters market is poised for substantial growth, driven by increasing governmental support for energy-efficient technologies.

Notably, the UK government’s commitment of £530 million under the Public Sector Decarbonisation Scheme to upgrade heating systems in public buildings to low-carbon solutions underscores a significant shift towards sustainable energy practices.

This initiative, aimed at schools, hospitals, and other public facilities, is projected to yield annual savings of approximately £650 million by 2037 in energy costs, delineating a clear path for market expansion.

Additionally, the Industrial Energy Transformation Fund, with an allocation of £27.5 million, targets high-energy-consuming industries, facilitating reductions in both energy expenses and carbon emissions. This strategic investment not only fosters market growth but also supports the UK’s broader environmental targets.

In the United States, the emphasis on clean energy training programs, as reported by energy.gov, has prepared over 200,000 workers for roles in the clean energy sector, effectively marrying job creation with energy conservation initiatives.

Furthermore, the deployment of more than $545 million across 39 states through Recovery Act grants for clean energy projects, including enhancements to industrial heating systems, reflects a robust ecosystem conducive to technological advancements and market scalability.

This concerted push towards integrating sustainable practices within industrial operations presents lucrative opportunities for market players. The ongoing governmental incentives and training initiatives are not only enhancing workforce capabilities but are also setting a precedent for future investments in energy-efficient industrial heating solutions.

Key Takeaways

- The Global Industrial Heaters Market size is expected to be worth around USD 58.9 Billion by 2033, From USD 37.2 Billion by 2023, growing at a CAGR of 4.70% during the forecast period from 2024 to 2033.

- In 2023, Immersion Heaters held a dominant market position in the By Product Type segment of the Industrial Heaters Market, with a 39% share.

- In 2023, Electric-based held a dominant market position in the By Technology segment of the Industrial Heaters Market, with a 35% share.

- In 2023, Pharmaceuticals held a dominant market position in the By End-Use Industry segment of the Industrial Heaters Market, with a 41% share.

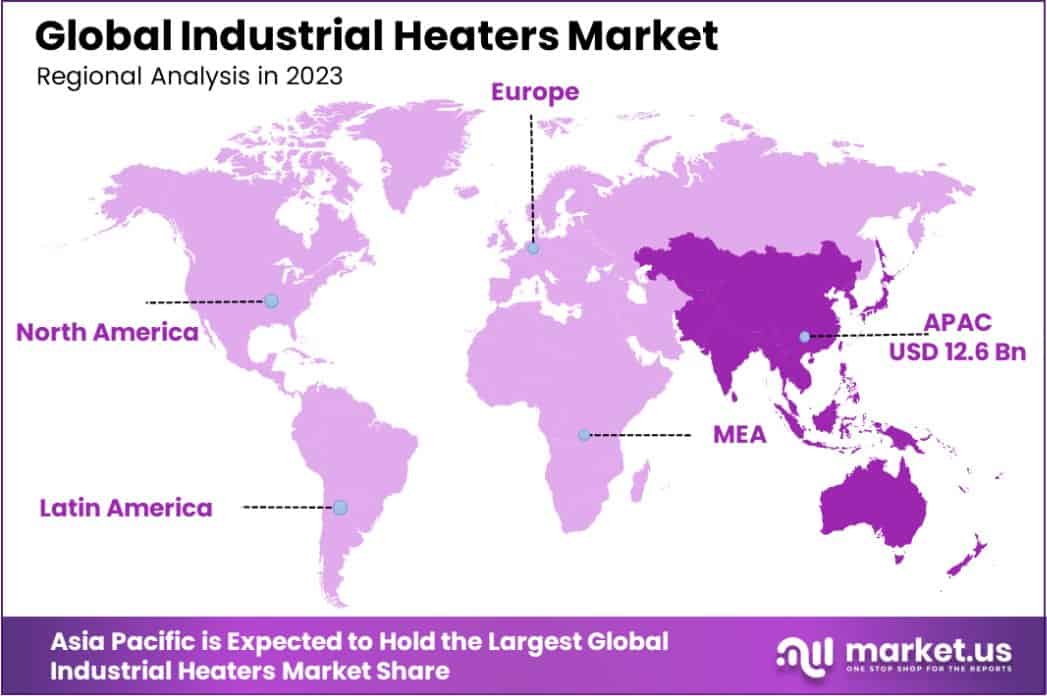

- Asia Pacific dominated a 34% market share in 2023 and held USD 12.6 Billion in revenue from the Industrial Heaters Market.

By Product Type Analysis

In 2023, the Industrial Heaters Market saw significant positioning across various product types, with Immersion Heaters leading with a 39% market share in the “By Product Type” segment. Following closely were Pipe Heaters, Duct Heaters, Circulation Heaters, and Cartridge Heaters. This distribution underscores the critical role of Immersion Heaters in diverse industrial applications due to their efficiency and adaptability in heating liquids in numerous sectors.

Immersion Heaters are preferred for their direct heating capability, which offers precise temperature control and rapid heat transfer. This efficiency is vital in industries where maintaining specific temperature conditions is crucial, such as in chemical processing and manufacturing sectors. The substantial market share of Immersion Heaters highlights their integral role in operations that require high energy efficiency and reliability.

Conversely, other heater types like Pipe Heaters and Duct Heaters cater to specialized needs, providing targeted heating solutions that complement the broader applications of Immersion Heaters. Circulation Heaters and Cartridge Heaters, although holding smaller shares, are pivotal in applications requiring space-efficient heating solutions and are anticipated to witness growth as technological advancements improve their performance and cost-effectiveness.

By Technology Analysis

In 2023, the “By Technology” segment of the Industrial Heaters Market was prominently led by Electric-based heaters, capturing a 35% market share. This segment was followed by Fuel-based, Hybrid-based, and Steam-based technologies. Electric-based heaters’ leading position is attributed to their efficiency, sustainability, and the increasing emphasis on reducing carbon emissions in industrial operations.

Electric heaters are favored in industries for their ability to provide clean and consistent heat without the byproducts associated with combustion processes. This characteristic is particularly advantageous in sectors such as pharmaceuticals and food processing, where contamination must be avoided. The preference for electric heaters is also bolstered by the push towards electrification of heating processes as part of broader industrial sustainability goals.

Meanwhile, Fuel-based heaters remain relevant in settings where high heat loads are necessary, and electricity costs or availability are prohibitive. Hybrid heaters, which combine electric and fuel-based technologies, offer versatility and are gradually gaining traction as companies seek more energy-efficient solutions without fully committing to electric-only systems.

Steam-based heaters, while holding a smaller share, are indispensable in applications requiring large-scale heating and where steam is readily available or produced as a byproduct. This diversity in heating technology preferences underscores the dynamic nature of the Industrial Heaters Market, adapting to evolving industrial demands and environmental considerations.

By End-Use Industry Analysis

In 2023, the Pharmaceuticals segment held a dominant market position in the “By End-Use Industry” segment of the Industrial Heaters Market, commanding a 41% share. This segment was followed by Oil & Gas, Food & Beverages, Automotive, and Other End-Use Industries.

The substantial market share held by Pharmaceuticals is a reflection of the stringent temperature control requirements essential for drug manufacturing and storage, which demand precise and reliable heating solutions.

Industrial heaters in the pharmaceutical sector are critical for processes such as maintaining active pharmaceutical ingredients (APIs) at specific temperatures and ensuring effective drug formulation and safety. The preference for high-quality and compliant heating solutions further drives the adoption of advanced heater technologies in this sector.

Following Pharmaceuticals, the Oil & Gas industry also relies heavily on industrial heaters for applications such as oil refining and natural gas processing, where precise temperature settings are crucial for efficiency and safety. The Food & Beverages industry integrates these heaters for pasteurization, sterilization, and other heat treatment processes that ensure product safety and quality.

Automotive and other industries, although representing smaller shares, utilize industrial heaters for various applications, including paint drying and parts manufacturing. The diverse application across industries underscores the pervasive necessity of industrial heaters in ensuring operational efficiency and compliance with industry standards.

Key Market Segments

By Product Type

- Pipe Heaters

- Immersion Heaters

- Duct Heaters

- Circulation Heaters

- Cartridge Heaters

By Technology

- Electric-based

- Fuel-based

- Hybrid-based

- Steam-based

By End-Use Industry

- Pharmaceuticals

- Oil & Gas

- Food & Beverages

- Automotive

- Other End-Use Industries

Drivers

Key Drivers of the Industrial Heaters Market

The Industrial Heaters Market is primarily driven by increasing demand across various sectors such as manufacturing, oil and gas, and chemicals due to their efficiency and capability to provide high-temperature heating.

Industries are adopting these heaters to enhance process efficiencies and reduce energy consumption, aligning with global initiatives for energy conservation and environmental sustainability.

Additionally, advancements in technology have led to the development of more compact, energy-efficient, and environmentally friendly heating solutions, catering to the stringent regulatory standards and operational requirements of modern industrial applications.

This trend is expected to propel market growth as industries continue to seek optimized thermal processing solutions.

Restraint

Challenges Facing the Industrial Heaters Market

A significant restraint in the Industrial Heaters Market is the stringent environmental regulations that govern emissions and energy consumption. These regulations compel companies to invest heavily in compliance, which can be cost-prohibitive, especially for small and medium enterprises (SMEs).

Additionally, the shift towards renewable energy sources and the increasing adoption of energy-efficient technologies challenge the demand for traditional industrial heating solutions. The market also faces technological disruptions, as newer, more efficient methods become available, potentially rendering existing heater technologies obsolete.

This dynamic requires continuous innovation and adaptation by manufacturers, adding to operational complexities and investment demands, which could slow market growth.

Opportunities

Growth Prospects in Industrial Heaters

The Industrial Heaters Market offers significant opportunities due to rising industrialization in emerging economies and the increasing need for energy-efficient heating solutions.

As industries like plastics, pharmaceuticals, and food processing expand, the demand for advanced heating technologies that offer precise temperature control and reduced energy consumption also grows.

Innovations such as IoT integration in heating equipment enable predictive maintenance and efficient energy management, attracting more industries to adopt these advanced systems. Moreover, the push towards environmental sustainability is driving the development of eco-friendly and energy-saving heating solutions, presenting a substantial market opportunity.

This trend is further supported by government incentives and subsidies promoting energy-efficient practices, creating a favorable environment for market expansion.

Challenges

Navigating Industrial Heaters Market Hurdles

The Industrial Heaters Market faces several challenges that could hinder its growth. The primary challenge is the high initial cost of advanced heating systems, which may deter smaller operations from upgrading their equipment. Additionally, the operational costs linked with the maintenance and repair of these systems can be significant, impacting the overall adoption rate.

There is also growing competition from alternative heating technologies, such as induction and infrared heaters, which are perceived as more energy-efficient and environmentally friendly. Regulatory compliance demands further complicate the landscape, as companies must continually adapt to new environmental standards that often require costly technology upgrades.

Lastly, global economic instability can affect industrial investments, leading to delayed or reduced spending on new heating technologies, which adds to the market’s uncertainties.

Growth Factors

Driving Growth in the Heater Market

The Industrial Heaters Market is set for growth, driven by the expanding manufacturing sectors worldwide that require consistent and efficient heating solutions. Increased investments in infrastructure projects, particularly in developing countries, further boost the demand for industrial heaters.

Technological advancements are also significant growth factors, as they improve heater efficiency and adaptability across various industrial applications. Moreover, the push towards sustainability is prompting industries to adopt eco-friendly heating technologies that align with environmental regulations.

This shift is supported by governmental incentives aimed at reducing carbon footprints, driving further integration of advanced heating solutions. Additionally, the rise of industries such as chemicals, petrochemicals, and oil and gas, where precise temperature control is critical, continues to propel the demand for high-performance industrial heaters.

Emerging Trends

New Trends in Heater Technology

Emerging trends in the Industrial Heaters Market are shaping its future growth trajectory. A notable trend is the integration of smart technologies, such as IoT (Internet of Things), which allows for real-time monitoring and control of heating systems, enhancing efficiency and reducing operational costs.

There’s also a growing shift towards the adoption of green technologies that minimize energy consumption and reduce emissions, appealing to environmentally conscious industries. Additionally, the development of ultra-efficient heat pumps and infrared heaters that offer faster heating times and lower energy usage is gaining traction.

These innovations meet the increasing demand for sustainable and cost-effective heating solutions. Moreover, customization of heaters to meet specific industrial requirements is becoming more common, providing tailored solutions that improve process efficiencies across diverse sectors.

Regional Analysis

The Industrial Heaters Market exhibits distinct regional dynamics, influenced by industrial activity, regulatory environments, and technological adoption. Asia-Pacific emerges as the dominant region, holding a 34% market share, with a valuation of USD 12.6 billion.

This growth is driven by rapid industrialization in countries such as China and India, extensive manufacturing activities, and escalating energy needs, which collectively propel the demand for efficient industrial heating solutions.

In North America, the market benefits from advanced manufacturing sectors and heightened investments in energy-efficient technologies, alongside strict environmental regulations that encourage the adoption of sustainable heating systems. Europe, while mature, continues to innovate in green technologies, maintaining steady growth with a strong focus on regulatory compliance and energy efficiency.

Conversely, the Middle East & Africa, with its expanding oil and gas sector, sees increasing demand for high-capacity industrial heaters. This region is exploring energy optimization in industrial processes to support economic diversification plans.

Latin America, though smaller in market size compared to Asia-Pacific and North America, is witnessing growth influenced by industrial expansion and modernization efforts across its manufacturing landscapes, which drives the adoption of advanced heating technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Industrial Heaters market, three key players—Dragon Power Electric Co. Ltd., Watlow Electric Manufacturing Company, and Wattco—stand out for their significant contributions and strategic initiatives.

Dragon Power Electric Co. Ltd. has carved a niche in Asia-Pacific, leveraging the region’s rapid industrial growth. The company focuses on producing a diverse range of industrial heating solutions that cater to local manufacturing needs, energy efficiency standards, and the shift towards sustainability.

Dragon Power’s strategy of localizing production and service has effectively minimized costs and improved service delivery, making it a formidable presence in the region.

Watlow Electric Manufacturing Company, based in the United States, is recognized for its innovation-driven approach. Watlow has consistently introduced technologically advanced products, such as heaters with integrated sensors and controls that optimize energy consumption and enhance performance.

Their commitment to R&D and custom solutions has strengthened their market position in North America and Europe, where high-efficiency and eco-friendly industrial applications are in great demand.

Wattco, a Canadian manufacturer, excels in the design and production of custom industrial heating equipment. Wattco’s flexibility in manufacturing tailored products allows them to serve a wide array of industries, from oil and gas to food processing.

Their ability to adapt to specific customer requirements and stringent industrial standards has enabled them to maintain a competitive edge, particularly in markets that value bespoke solutions.

These companies, each with their strategic focuses, drive the industrial heaters market forward through innovation, regional market penetration, and customized offerings, adapting to evolving industrial demands and environmental standards.

Top Key Players in the Market

- Dragon Power Electric Co. Ltd.

- Watlow Electric Manufacturing Company

- Wattco

- Elmatic Ltd.

- Chromalox

- Auzhan Electric Appliances Co.Ltd

- Thermal Flow Technologies

- Winterwarm

- Powrmatic Ltd.

- Other Key Players

Recent Developments

- In April 2024, Ontario launches Grid Innovation Fund with a $9.5 million investment to enhance electricity grid efficiency. Focus on transportation and heating/cooling sectors to manage demand.

- In April 2024, Tankless water heater industry trends focus on efficiency and sustainability. A. O. Smith develops high-efficiency condensing products; Bradford White introduces high-efficiency gas tankless with integrated recirculation; Chronomite anticipates 15% annual growth in electric heating.

Report Scope

Report Features Description Market Value (2023) USD 37.2 Billion Forecast Revenue (2033) USD 58.9 Billion CAGR (2024-2033) 4.70% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pipe Heaters, Immersion Heaters, Duct Heaters, Circulation Heaters, Cartridge Heaters), By Technology (Electric-based, Fuel-based, Hybrid-based, Steam-based), By End-Use Industry (Pharmaceuticals, Oil & Gas, Food & Beverages, Automotive, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dragon Power Electric Co. Ltd., Watlow Electric Manufacturing Company, Wattco, Elmatic Ltd., Chromalox, Auzhan Electric Appliances Co.Ltd, Thermal Flow Technologies, Winterwarm, Powrmatic Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Heaters MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Heaters MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Dragon Power Electric Co. Ltd.

- Watlow Electric Manufacturing Company

- Wattco

- Elmatic Ltd.

- Chromalox

- Auzhan Electric Appliances Co.Ltd

- Thermal Flow Technologies

- Winterwarm

- Powrmatic Ltd.

- Other Key Players