Global Industrial Engines Market By Power(50HP-500HP, 500HP-10,000HP, Above 10,000HP), By Fuel Type(Diesel, Gasoline), By Type(2 Stroke, 4 Stroke), By End-Use(Power Generation, General Manufacturing, Oil & Gas, Marine, Agriculture/Off-road vehicles, Construction, Mining & Metallurgy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 13286

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

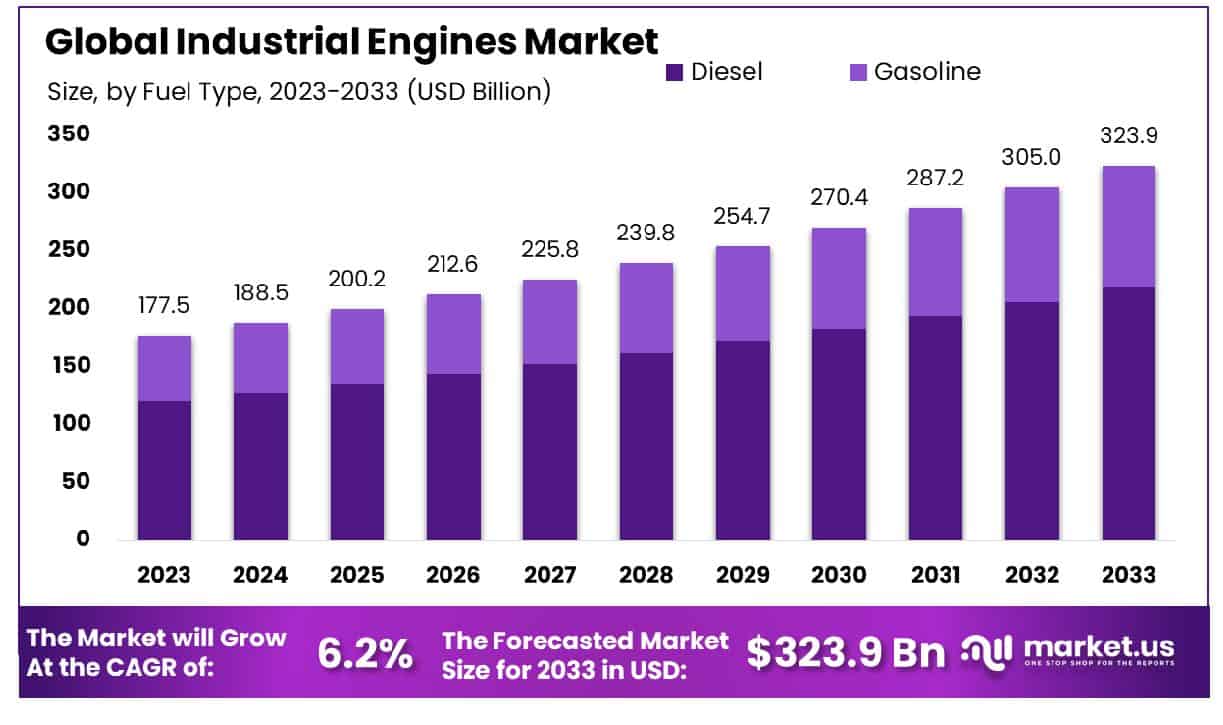

The Global Industrial Engines Market size is expected to be worth around USD 323.9 Billion by 2033, From USD 177.5 Billion by 2023, growing at a CAGR of 6.20% during the forecast period from 2024 to 2033.

The Industrial Engines Market encompasses the procurement, manufacturing, and utilization of engines tailored for heavy-duty applications across diverse industrial sectors. These engines, ranging from combustion to electric variants, power machinery vital to production, transportation, and energy generation. Key players in this market supply engines designed for durability, efficiency, and compliance with stringent regulatory standards.

Market trends indicate a shift towards sustainable solutions, with an emphasis on cleaner fuel alternatives and advanced hybrid technologies. As industrial processes evolve, stakeholders, including product managers, must navigate this dynamic landscape to optimize performance, reduce environmental impact, and capitalize on emerging opportunities.

The Industrial Engines Market continues to exhibit resilience and growth, bolstered by various macroeconomic factors and industry-specific dynamics. The market’s expansion is propelled by a confluence of factors, including increasing industrialization, infrastructure development, and a growing emphasis on energy efficiency and sustainability.

In 2022, the global industrial landscape witnessed significant shifts, particularly in the energy sector. The United States emerged as a key player, achieving record-breaking oil and natural gas production levels. With U.S. oil production reaching 12.1 million barrels per day (b/d) and natural gas production hitting 121.1 billion cubic feet per day (Bcf/d), the nation solidified its position as a leading contributor to the global energy market.

Furthermore, the increase in global crude oil production, marking a record 5.4% growth in 2022, underscores the sector’s robustness. Notably, regions such as the Middle East, North America, and Latin America spearheaded this growth trajectory, signaling widespread industry momentum.

Despite fluctuations in oil demand, attributed to various geopolitical and economic factors, the industry remains resilient. While oil demand in 2022 experienced a marginal decline of 0.7% compared to 2019 levels, the market’s adaptability and diversification mitigate potential downturns.

Moreover, the industrial landscape is witnessing a paradigm shift towards sustainability and clean energy initiatives. Investment in renewable power and electric vehicles (EVs) has surged, with low-emissions power projects expected to dominate electricity generation investments in the coming years.

Key Takeaways

- Market Growth: The Global Industrial Engines Market size is expected to be worth around USD 323.9 Billion by 2033, From USD 177.5 Billion by 2023, growing at a CAGR of 6.20% during the forecast period from 2024 to 2033.

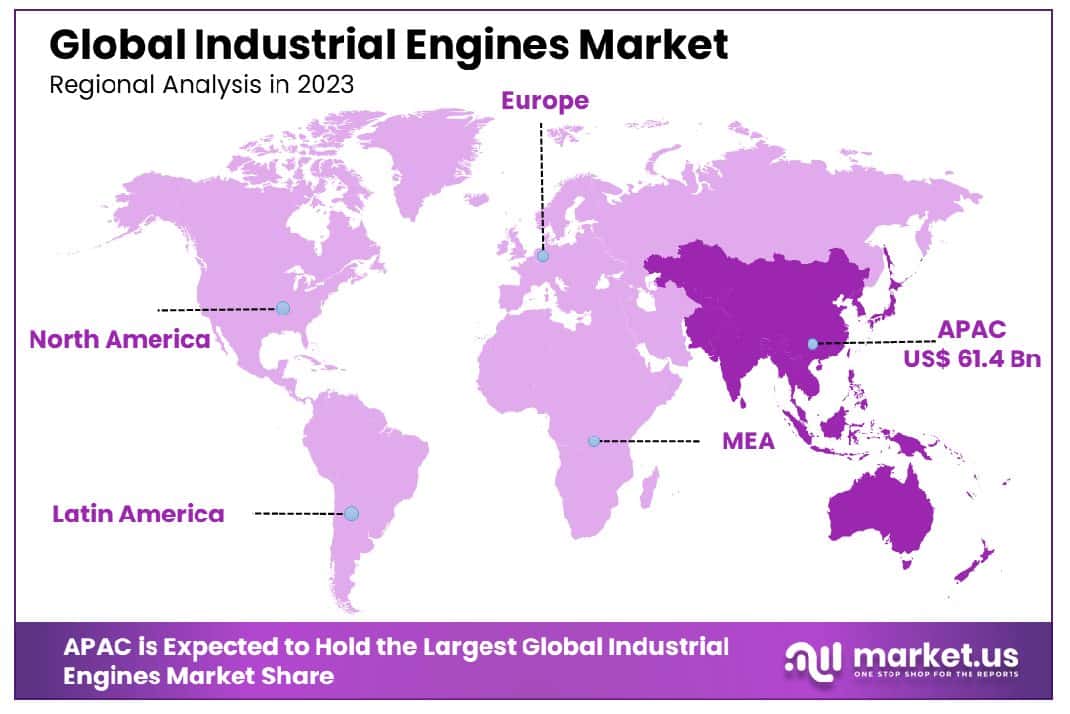

- Regional Dominance: In 2023, Asia-Pacific dominated the industrial engines market with a 34.6% share.

- Segmentation Insights:

- By Power: By power, engines ranging from 500HP to 10,000HP constitute 48.2% of the market.

- By Fuel Type: By fuel type, diesel engines dominate, accounting for 67.6% of the total.

- By Type: By type, four-stroke engines represent 62.3% of the market share.

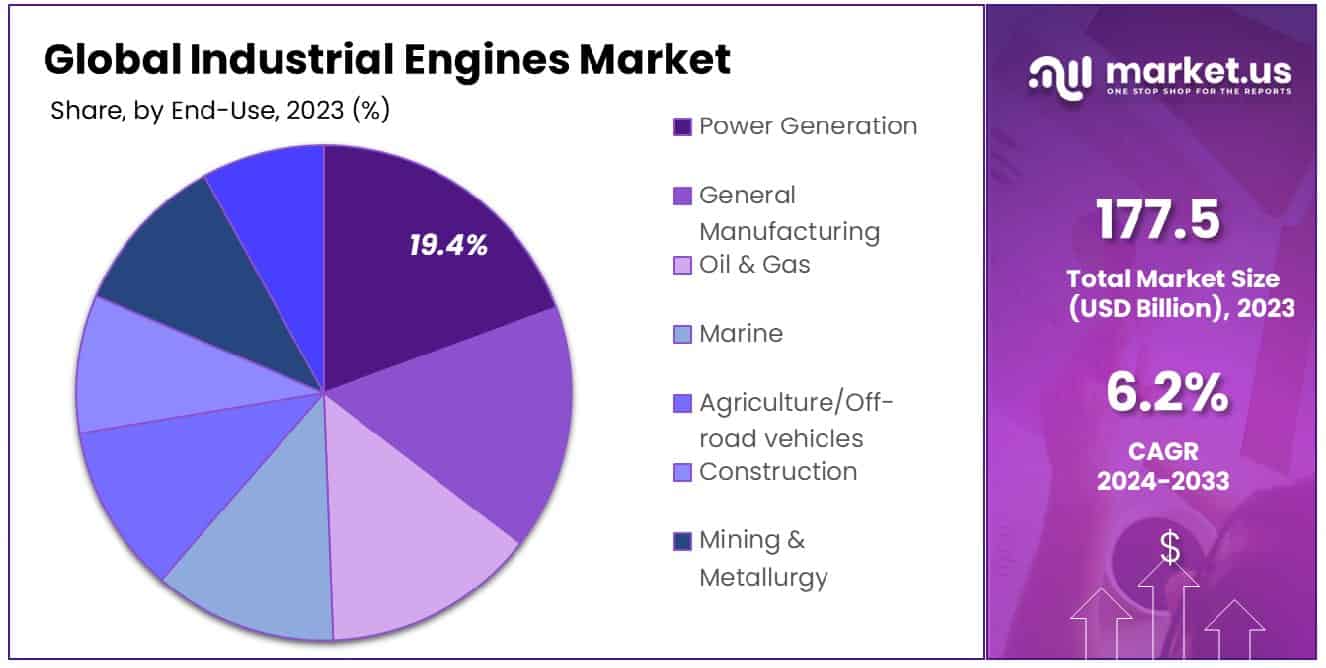

- By End-Use: By end-use, power generation’s market share stands at 19.4%.

- Growth Opportunities: In 2023, The global industrial engines market sees growth driven by government regulations favoring production and rising demand for eco-friendly engines, presenting ample opportunities for manufacturers and stakeholders.

Driving Factors

Diversified Industrial Applications Fueling Engine Demand

The growth of the Industrial Engines Market is significantly driven by the increasing demand across diverse sectors such as automotive, construction, smart agriculture, and marine industries. Each of these sectors requires robust engine solutions to power a variety of machinery and vehicles, contributing to heightened production and operational efficiencies.

For instance, in construction, the need for engines that can withstand heavy loads and long operational hours is crucial. As urbanization and infrastructural development accelerate, especially in emerging economies, the demand for such engines is expected to surge, thereby propelling the market forward. Additionally, the agricultural sector’s push towards mechanization to meet global food demand further amplifies this growth trajectory.

Technological Innovations Enhancing Engine Performance

Technological advancements in industrial engines are pivotal in shaping market dynamics. Modern engines are being developed to offer higher efficiency, reduced emissions, and greater reliability, aligning with global environmental regulations and cost-effectiveness.

Innovations such as turbocharging, direct fuel injection, and the integration of enterprise IoT for predictive maintenance not only extend the engine lifespan but also enhance performance metrics. These improvements are crucial for end-users, as they translate to lower operational costs and minimal downtime, making advanced engines more appealing and increasing their market penetration.

Energy and Power Requirements Boosting Engine Sales in Emerging Markets

The rising demand for energy and power generation equipment in emerging economies acts as a catalyst for the industrial engines market. With economic growth, the expansion of industrial activities, and the increased focus on infrastructure, there is a substantial need for power transformer generation, which in turn requires high-capacity industrial engines. This demand is particularly pronounced in regions that are currently expanding their energy infrastructure to support industrialization and urban development.

The market for industrial engines benefits as these regions invest in both renewable and conventional power generation, necessitating reliable and powerful engines to ensure continuous and efficient energy supply. This factor not only stimulates direct engine sales but also contributes to the aftermarket services and parts sector.

Restraining Factors

Environmental Regulations Shaping Engine Development

Strict environmental regulations are significantly influencing the industrial engines market by limiting the use of traditional diesel and gasoline engines, which are known for their high emissions. Governments worldwide are implementing stricter emission standards, such as the European Union’s Stage V and the U.S. Environmental Protection Agency’s Tier 4 regulations, which mandate significant reductions in pollutants like nitrogen oxides and particulate matter.

These regulations compel engine manufacturers to invest heavily in research and development to produce engines that are not only compliant with current laws but are also capable of meeting future standards. While this restricts the use of older, more polluting engine models, it also opens up opportunities for growth in sectors focused on hybrid and electric engine technologies, which could redefine market trajectories by aligning with global sustainability goals.

Cost Challenges for SMEs Impacting Market Accessibility

The high cost associated with advanced industrial engines poses a significant barrier to market entry, particularly for small and medium-sized enterprises (SMEs). Advanced engines that comply with new environmental standards tend to be more expensive due to the sophisticated technology and materials required for their production. For SMEs, this high cost can restrict access to the latest engine technologies, impacting their competitiveness and operational efficiency.

Furthermore, the financial burden of replacing or upgrading existing machinery to accommodate new engines can be substantial, affecting the overall adoption rates of newer, cleaner engine technologies within this market segment. Together, these factors can dampen market growth, as cost considerations take precedence over potential operational benefits among key consumer groups.

By Power Analysis

By power, engines ranging from 500HP to 10,000HP constitute 48.2% of the market segment.

In 2023, the “By Power” segment of the Industrial Engines Market was notably dominated by the 500HP-10,000HP range, capturing more than 48.2% of the market share. This segment’s commanding lead can be attributed to its broad applicability across various heavy industries, including manufacturing, mining, and power generation, where robust power output and reliability are paramount.

In comparison, the 50HP-500HP segment, while versatile, typically caters to lighter industrial applications, resulting in a smaller market share. These engines are commonly utilized in sectors that require moderate power but prioritize fuel efficiency and cost-effectiveness. On the other end of the spectrum, engines above 10,000HP are specialized units designed for very high-power applications such as large ships and heavy stationary plants. This segment, although critical, remains niche due to its specialized applications and higher operational costs.

The significant market share of the 500HP-10,000HP engines is further bolstered by advancements in engine technology that enhance efficiency and environmental compliance without sacrificing power. Manufacturers have focused on innovations that reduce emissions and increase fuel efficiency, aligning with global regulatory pressures and market demand for more sustainable industrial operations.

The strategic importance of the 500HP-10,000HP segment is underscored by its integration into key areas of industrial growth, such as renewable energy projects and infrastructure development, which require dependable and powerful engines. The continued evolution of industrial engine technology and shifting market needs will likely influence future dynamics in this segment, potentially increasing its market prevalence in response to industrial expansion and technological advancements.

By Fuel Type Analysis

By fuel type, diesel engines dominate with a significant 67.6% share of the market.

In 2023, Diesel maintained a dominant position in the “By Fuel Type” segment of the Industrial Engines Market, securing over 67.6% of the market share. This significant market share can be attributed to diesel engines’ widespread adoption across diverse industrial applications, owing to their superior efficiency, durability, and torque characteristics.

The Diesel segment’s supremacy is underscored by its versatility and reliability in powering various heavy-duty machinery and equipment, including generators, construction machinery, agricultural equipment, and marine vessels. Diesel engines are favored for their robust performance in demanding environments and their ability to operate efficiently under heavy loads, making them indispensable in industries where reliability and power output are critical factors.

In contrast, the Gasoline segment, while suitable for certain applications such as small-scale power generation and light machinery, commands a smaller market share due to limitations in power output and efficiency compared to diesel engines. Gasoline engines are typically preferred for their quieter operation and lower emissions, making them suitable for applications where noise and environmental concerns are paramount, but they are less prevalent in heavy industrial settings where diesel engines excel.

The dominance of the Diesel segment is further reinforced by ongoing technological advancements aimed at enhancing fuel efficiency, reducing emissions, and meeting stringent environmental regulations. Manufacturers continue to invest in research and development to improve diesel engine performance, making them more competitive and sustainable in the evolving industrial landscape.

Looking ahead, the Diesel segment is expected to maintain its leading position in the Industrial Engines Market, driven by ongoing industrialization efforts, infrastructure development projects, and the growing demand for reliable and efficient power solutions across various sectors.

By Type Analysis

Regarding engine type, 4-stroke engines lead, representing 62.3% of the industry.

In 2023, the “By Type” segment of the Industrial Engines Market witnessed 4 Stroke engines maintaining a dominant market position, securing over 62.3% of the market share. This substantial market share is indicative of the widespread preference for 4 Stroke engines across various industrial applications due to their superior efficiency, durability, and performance characteristics.

The dominance of 4 Stroke engines can be attributed to their inherent design advantages, which include a more efficient combustion process, better fuel economy, and lower emissions compared to their 2 Stroke counterparts. These engines are favored for their reliability and versatility in powering a wide range of industrial machinery and equipment, including generators, pumps, compressors, and construction machinery.

In contrast, the 2 Stroke segment commands a smaller market share due to limitations in efficiency and emissions control inherent in its design. While 2 Stroke engines offer advantages such as simpler design and higher power-to-weight ratio, they are generally less fuel-efficient and emit higher levels of pollutants compared to 4 Stroke engines. As a result, their usage is often limited to specific applications where their unique characteristics outweigh their drawbacks.

The dominance of the 4 Stroke segment is further reinforced by ongoing technological advancements aimed at improving engine efficiency, reducing emissions, and meeting stringent regulatory standards. Manufacturers continue to invest in research and development to enhance the performance and environmental sustainability of 4 Stroke engines, solidifying their position as the preferred choice for industrial applications.

By End-Use Analysis

In terms of end-use, power generation accounts for 19.4% of the engines utilized.

In 2023, the “By End-Use” segment of the Industrial Engines Market saw Power Generation asserting a dominant market position, securing over 19.4% of the market share. This substantial market share underscores the critical role of industrial engines in powering generators and backup power systems essential for ensuring uninterrupted electricity supply in various settings.

The dominance of the Power Generation segment is driven by the indispensable nature of reliable power generation solutions across industries, commercial establishments, and critical infrastructure. Industrial engines play a vital role in supporting power generation facilities, both as primary power sources and backup systems, ensuring operational continuity during grid outages or in remote areas where grid connectivity is limited.

Within the segment, General Manufacturing, Oil & Gas, Marine, Agriculture/Off-road vehicles, Construction, Mining & Metallurgy, and others utilize industrial engines for a diverse range of applications, including material handling, pumping, propulsion, and machinery operation. However, the Power Generation segment stands out due to its universal importance in providing essential electricity supply for commercial, residential, and industrial purposes.

In comparison, while other end-use segments such as General Manufacturing, Oil & Gas, and Construction also rely on industrial engines for powering machinery and equipment, they typically exhibit more varied market dynamics influenced by sector-specific factors such as economic conditions, regulatory policies, and technological advancements.

Looking ahead, the Power Generation segment is expected to maintain its dominant position in the Industrial Engines Market, driven by increasing demand for reliable and efficient power generation solutions, particularly in emerging economies and remote regions where electrification efforts are underway. Additionally, advancements in engine technology, including improvements in fuel efficiency and emissions control, will further bolster the segment’s growth prospects.

Key Market Segments

By Power

- 50HP-500HP

- 500HP-10,000HP

- Above 10,000HP

By Fuel Type

- Diesel

- Gasoline

By Type

- 2 Stroke

- 4 Stroke

By End-Use

- Power Generation

- General Manufacturing

- Oil & Gas

- Marine

- Agriculture/Off-road vehicles

- Construction

- Mining & Metallurgy

- Others

Growth Opportunities

Government Regulations and Incentives Fuel Growth in Industrial Engines Market

The global industrial engines market in 2023 presents a promising landscape, primarily fueled by government regulations and incentives aimed at promoting industrial engine production. Governments worldwide are increasingly prioritizing environmental sustainability and energy efficiency, driving the adoption of cleaner technologies across industries.

This has prompted significant investments in the development and manufacturing of industrial engines that comply with stringent emission standards. As a result, manufacturers operating in this space are witnessing a surge in demand for their products.

Rising Demand for Efficient and Environmentally Friendly Engines

In tandem with regulatory initiatives, the market is experiencing a notable uptick in demand for engines that offer enhanced efficiency and environmental sustainability. Industries are increasingly recognizing the long-term benefits of investing in engines that not only optimize performance but also minimize their carbon footprint.

This shift is driven by a growing awareness of the importance of environmental stewardship and the need to mitigate the adverse effects of industrial activities on the planet.

Latest Trends

R&D Advancements Drive Engine Performance and Emission Reduction

In 2023, the global industrial engines market witnesses a significant trend marked by heightened investment in research and development (R&D) aimed at enhancing engine performance while concurrently reducing emissions.

Manufacturers are increasingly prioritizing innovation to develop cutting-edge technologies that not only improve efficiency but also comply with stringent environmental regulations. This strategic focus on R&D reflects the industry’s commitment to sustainability and its acknowledgment of the imperative to mitigate environmental impact.

Embracing Electric and Hybrid Technologies for Sustainability

Another notable trend shaping the global industrial engines market is the accelerating shift towards electric and hybrid engine solutions. Fueled by mounting concerns about climate change and the urgent need for more sustainable energy alternatives, industries are actively transitioning from traditional combustion engines to electric and hybrid models.

These eco-friendly alternatives offer reduced emissions and lower carbon footprints, aligning with global efforts to combat climate change and foster a greener future. As a result, manufacturers are ramping up production of electric and hybrid industrial engines to meet the escalating demand from environmentally conscious consumers.

Regional Analysis

The Asia-Pacific region dominates the industrial engines market, accounting for a substantial 34.6% share.

In North America, the industrial engines market maintains a robust stance, driven primarily by the presence of established industrial sectors and ongoing infrastructure projects. According to recent data, North America accounted for approximately 28% of the global industrial engines market share in 2023, with a steady growth trajectory expected owing to increasing industrialization and technological advancements.

Europe, characterized by its strong manufacturing base and emphasis on environmental sustainability, holds a notable share in the industrial engines market. With stringent emissions regulations driving the demand for efficient and eco-friendly engine solutions, Europe accounted for approximately 22% of the global market share in 2023.

The Asia-Pacific region emerges as the dominating force in the global industrial engines market, commanding a significant share of approximately 34.6%. Rapid industrialization, infrastructure development initiatives, and expanding manufacturing activities in countries like China, India, and Japan propel the demand for industrial engines in this region. Additionally, favorable government policies and investments in key sectors further contribute to the region’s dominance in the market.

Middle East & Africa and Latin America regions exhibit promising growth prospects in the industrial engines market, supported by infrastructure development projects, growing construction activities, and increasing investments in the mining and oil & gas sectors. Despite facing challenges such as political instability and economic uncertainties, these regions contribute to the global market landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global industrial engines market witnessed a competitive landscape marked by the presence of key industry players, each contributing significantly to the market’s growth trajectory. Among these, Caterpillar Inc., Cummins Inc., Volvo Group, Deutz AG, Kubota Corporation, Wärtsilä Corporation, Yanmar Co., Ltd., MTU Friedrichshafen GmbH, Doosan Infracore, MAN SE, and John Deere emerged as prominent entities shaping the market dynamics.

Caterpillar Inc., a renowned name in the industrial machinery sector, continued to strengthen its market position through innovative product offerings and strategic collaborations. With a diverse portfolio of industrial engines catering to various applications, Caterpillar Inc. maintained its relevance across industries, driving growth through reliability, performance, and service excellence.

Cummins Inc., a global leader in power solutions, remained a key player in the industrial engines market, leveraging its extensive expertise in engine manufacturing and technological innovation. The company’s focus on sustainability and emissions reduction further bolstered its competitive edge, resonating with the market’s increasing demand for eco-friendly solutions.

Volvo Group, known for its comprehensive range of engines tailored for industrial applications, maintained a strong foothold in the market. Through continuous research and development initiatives, Volvo Group offered cutting-edge engine solutions, emphasizing fuel efficiency, durability, and operational versatility.

Deutz AG, Kubota Corporation, Wärtsilä Corporation, Yanmar Co., Ltd., MTU Friedrichshafen GmbH, Doosan Infracore, MAN SE, and John Deere also played pivotal roles in shaping the global industrial engines market landscape. With their diverse product portfolios, technological innovations, and strategic market initiatives, these key players contributed to the market’s growth and evolution, meeting the diverse needs of industries worldwide.

Market Key Players

- Caterpillar Inc.

- Cummins Inc.

- Volvo Group

- Deutz AG

- Kubota Corporation

- Wärtsilä Corporation

- Yanmar Co., Ltd.

- MTU Friedrichshafen GmbH

- Doosan Infracore

- MAN SE

- John Deere

Recent Development

- In April 2024, Achates Power, with support from the U.S. Department of Energy, develops hydrogen-fueled opposed-piston engines, advancing propulsion technology for cleaner, more efficient vehicles, backed by a $133 million investment.

- In March 2024, DLR’s LUMEN demonstrator, a liquid-fueled rocket engine, successfully tested for system-level and component validation, offering a cost-effective research platform for space propulsion technology development.

- In February 2024, China accelerates new productive forces development, focusing on high-tech and future industries like quantum technology. Investments surge, talent pool expands, propelling economic growth. Notable examples include Hefei’s focus on NEVs.

Report Scope

Report Features Description Market Value (2023) USD 177.5 Billion Forecast Revenue (2033) USD 323.9 Billion CAGR (2024-2033) 6.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power(50HP-500HP, 500HP-10,000HP, Above 10,000HP), By Fuel Type(Diesel, Gasoline), By Type(2 Stroke, 4 Stroke), By End-Use(Power Generation, General Manufacturing, Oil & Gas, Marine, Agriculture/Off-road vehicles, Construction, Mining & Metallurgy, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Caterpillar Inc., Cummins Inc., Volvo Group, Deutz AG, Kubota Corporation, Wärtsilä Corporation, Yanmar Co., Ltd., MTU Friedrichshafen GmbH, Doosan Infracore, MAN SE, John Deere Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Industrial Engines Market in 2023?The Global Industrial Engines Market size is USD 177.5 Billion in 2023.

What is the projected CAGR at which the Global Industrial Engines Market is expected to grow at?The Global Industrial Engines Market is expected to grow at a CAGR of 6.20% (2024-2033).

List the segments encompassed in this report on the Global Industrial Engines Market?Market.US has segmented the Global Industrial Engines Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Power(50HP-500HP, 500HP-10,000HP, Above 10,000HP), By Fuel Type(Diesel, Gasoline), By Type(2 Stroke, 4 Stroke), By End-Use(Power Generation, General Manufacturing, Oil & Gas, Marine, Agriculture/Off-road vehicles, Construction, Mining & Metallurgy, Others)

List the key industry players of the Global Industrial Engines Market ?Caterpillar Inc., Cummins Inc., Volvo Group, Deutz AG, Kubota Corporation, Wärtsilä Corporation, Yanmar Co., Ltd., MTU Friedrichshafen GmbH, Doosan Infracore, MAN SE, John Deere

Name the key areas of business for Global Industrial Engines Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Industrial Engines Market.

Industrial Engines MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Engines MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar Inc.

- Cummins Inc.

- Volvo Group

- Deutz AG

- Kubota Corporation

- Wärtsilä Corporation

- Yanmar Co., Ltd.

- MTU Friedrichshafen GmbH

- Doosan Infracore

- MAN SE

- John Deere