Global Industrial Absorbents Market Size, Share, And Business Benefits By Material Type (Natural Organic, Natural Inorganic, Synthetic), By Product (Pads, Rolls, Pillows, Granules, Booms and Socks, Sheets and Mats, Others), By Type (Universal, Oil-Only, HAZMAT/Chemical), By End-use (Oil and Gas, Chemical, Food Processing, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153575

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

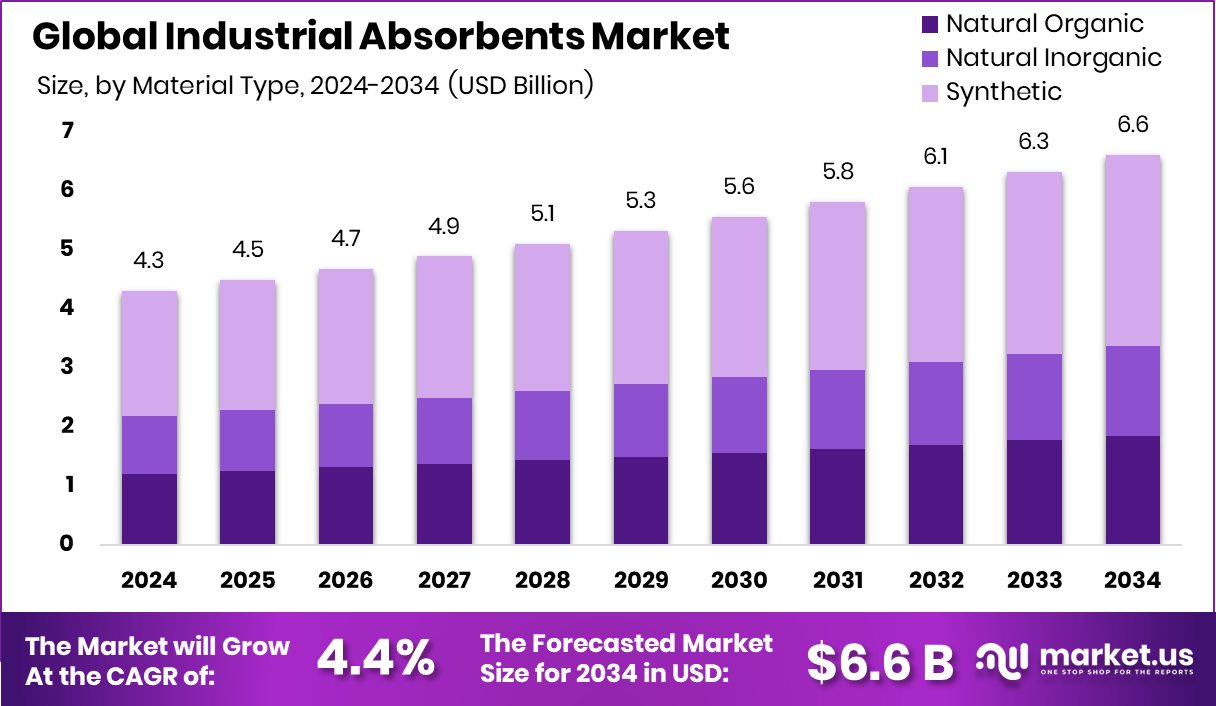

The Global Industrial Absorbents Market is expected to be worth around USD 6.6 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Strong industrial safety standards drive high absorbents demand across North America, 48.70%.

Industrial absorbents are specialized materials used to soak up or contain liquids such as oils, chemicals, solvents, and water in industrial environments. These materials are critical for managing spills, maintaining workplace safety, and complying with environmental regulations. They come in various forms like pads, rolls, granules, and socks, and are used across sectors such as manufacturing, transportation, oil & gas, and chemicals.

The industrial absorbents market refers to the global industry involved in the production, distribution, and application of absorbent materials used for spill control, leak management, and environmental protection. It supports industries that deal with hazardous liquids and strict safety norms. This market is influenced by industrial safety regulations, rising environmental awareness, and the growing demand for workplace risk management solutions.

Stringent environmental and safety regulations are driving consistent demand for industrial absorbents. Industries are under increasing pressure to minimize their environmental footprint and prevent hazardous spills. Regulatory frameworks from environmental agencies are mandating proper containment practices, making absorbents essential for compliance. This regulatory push is acting as a strong growth driver for the market.

The steady expansion of end-use sectors such as manufacturing, automotive, and energy is generating continuous demand for spill control products. As industrial operations scale up, so does the volume of fluids handled, thereby raising the need for efficient absorbent solutions. Additionally, frequent spills in maintenance and operational settings further drive routine demand across factories and workshops.

In line with growing interest in sustainable absorbent technologies, EF Polymer secured 1 billion yen in its Series B funding round to accelerate the development of its organic super absorbent polymer. Additionally, EF Polymer raised $6.6 million to further its efforts in advancing sustainable agriculture solutions, indicating increased investment in eco-friendly absorbent innovations.

Key Takeaways

- The Global Industrial Absorbents Market is expected to be worth around USD 6.6 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, synthetic materials led the Industrial Absorbents Market with a 48.4% usage share globally.

- Pads accounted for 31.8% of product demand in the Industrial Absorbents Market due to easy application.

- Oil-only absorbents dominated with 48.6% share, driven by rising spill control needs in industrial operations.

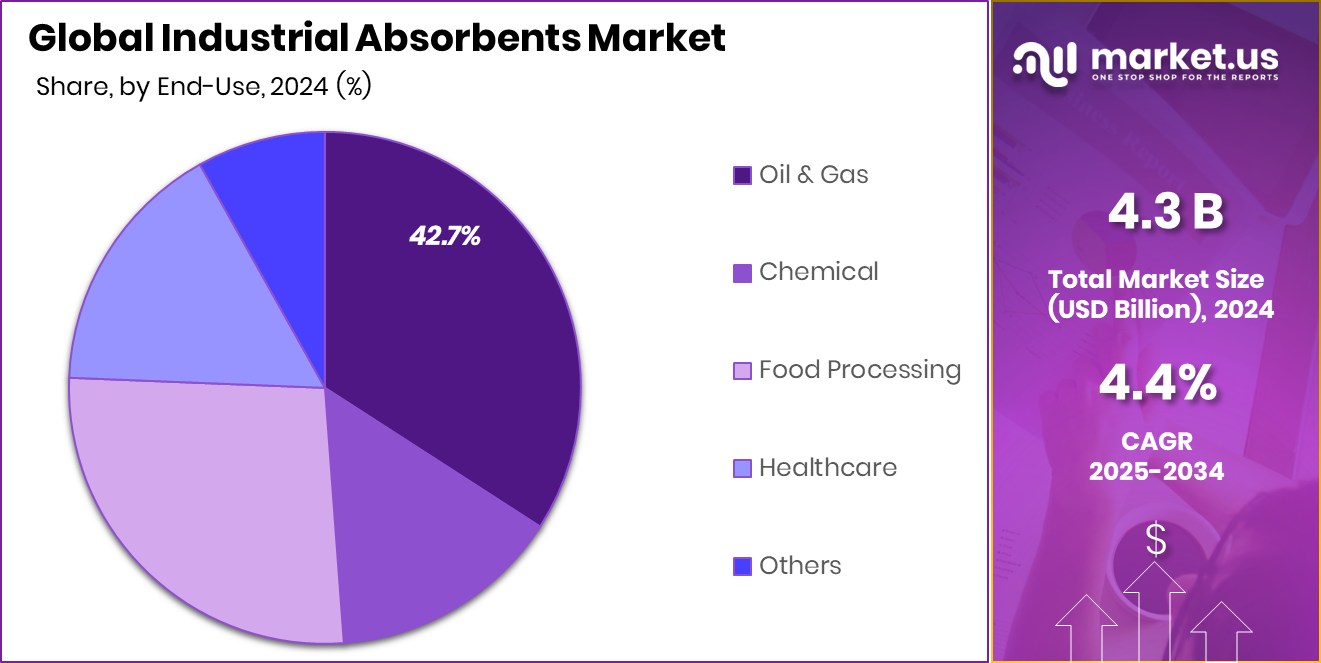

- The oil and gas sector led end-use demand in 2024, capturing a 42.7% share of the market.

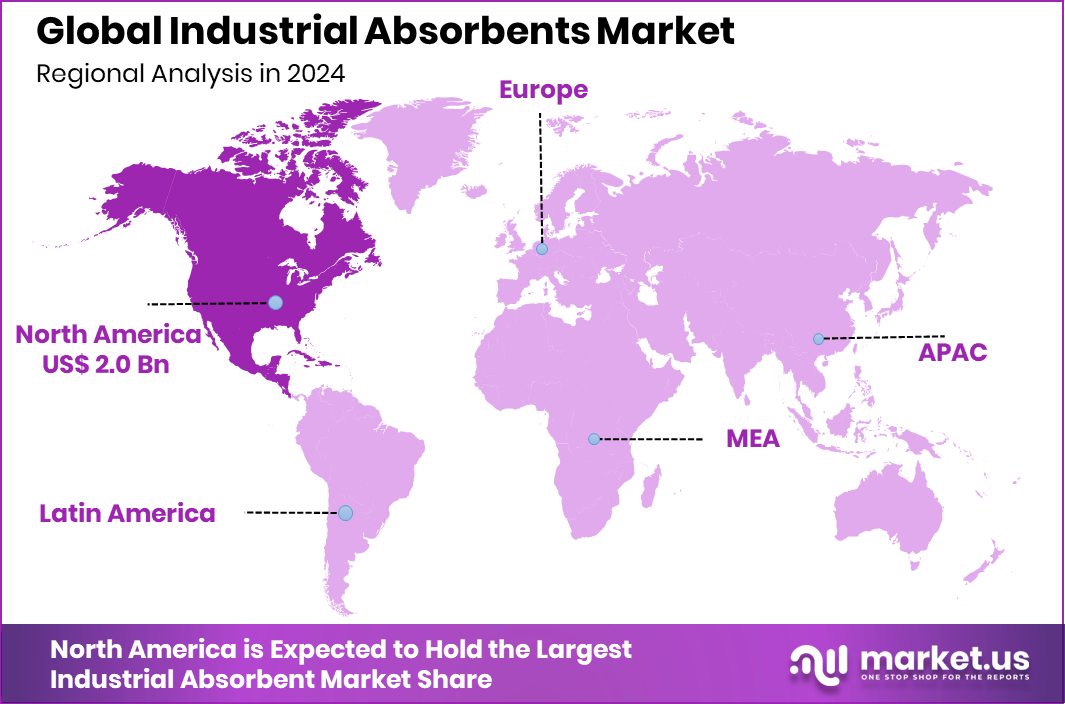

- North America reached a market value of USD 2.0 billion in 2024.

By Material Type Analysis

Synthetic materials dominate the Industrial Absorbents Market with 48.4%.

In 2024, Synthetic held a dominant market position in the By Material Type segment of the Industrial Absorbents Market, with a 48.4% share. This leadership can be attributed to the widespread usage of synthetic absorbents in industrial environments due to their high absorption capacity, durability, and chemical resistance. These materials, often made from polypropylene or similar polymers, are especially preferred in sectors that handle oil-based and hazardous chemical liquids, as they offer superior efficiency in spill response and control.

Synthetic absorbents are also favored for their lightweight nature and ability to be manufactured in various formats such as pads, booms, and rolls. Their consistency and performance in demanding conditions make them suitable for high-risk operations, particularly where rapid spill containment is critical. Furthermore, their longer shelf life and ease of storage contribute to reduced operational downtime, which is crucial for industries aiming to maintain continuous production flow.

The dominance of synthetic absorbents reflects a broader trend among industrial users toward reliable and standardized spill management solutions. As industries prioritize workplace safety and environmental compliance, the demand for robust absorbents such as synthetic materials remains strong, positioning this segment as a key contributor to the overall industrial absorbents market in 2024.

By Product Analysis

Pads lead in product usage, capturing a 31.8% share.

In 2024, Pads held a dominant market position in the By Product segment of the Industrial Absorbents Market, with a 31.8% share. This strong market presence is primarily driven by their convenience, high absorption efficiency, and ease of handling in various industrial settings. Pads are widely used for day-to-day maintenance tasks, routine clean-ups, and emergency spill response across workshops, factories, and warehouses. Their flat design allows for direct placement over spills, enabling rapid absorption and minimal waste generation.

The popularity of pads can also be attributed to their versatility. They are suitable for absorbing oils, coolants, solvents, and other industrial liquids, making them a go-to solution for general-purpose spill control. Their standardized sizing, disposable nature, and ease of storage further enhance operational efficiency, especially in environments where quick deployment is essential.

Moreover, the use of absorbent pads helps reduce cleanup time and maintain safer working conditions, aligning with industrial safety and hygiene practices. Their consistent performance and user-friendly format make them an essential component of industrial spill kits.

By Type Analysis

Oil-only absorbents hold the largest type share at 48.6%.

In 2024, Oil-Only held a dominant market position in the By Type segment of the Industrial Absorbents Market, with a 48.6% share. This dominance is largely due to the widespread use of oil-only absorbents in industries where oil spills are a frequent concern, such as marine, automotive, and heavy manufacturing. These absorbents are specifically designed to attract and retain hydrocarbons while repelling water, making them highly effective in both land-based and water-based spill scenarios.

Their ability to selectively absorb oil without becoming saturated with water gives them a critical advantage in outdoor environments, especially during rainy conditions or offshore applications. Oil-only absorbents come in various forms, including pads, booms, and pillows, and are often deployed as part of spill response kits where petroleum-based liquids are handled or stored.

The strong market share of this segment also reflects growing environmental compliance needs. Industries are increasingly focused on quick response and cleanup to minimize environmental damage and avoid regulatory penalties. The reliability, specificity, and efficiency of oil-only absorbents make them the preferred choice in such high-risk applications.

By End-use Analysis

Oil and gas sector drives demand with 42.7% dominance.

In 2024, Oil and Gas held a dominant market position in the By End-use segment of the Industrial Absorbents Market, with a 42.7% share. This significant share highlights the critical need for spill control and liquid containment in oil and gas operations, where handling of petroleum-based products is routine and large-scale. The segment’s dominance is strongly tied to the industry’s focus on safety, environmental protection, and regulatory compliance.

Oil and gas facilities, including drilling sites, refineries, and storage terminals, frequently encounter spills and leaks during extraction, transport, and processing activities. Industrial absorbents serve as a first-response tool in these settings, helping to contain and clean up hazardous substances quickly. Their role is especially crucial in offshore drilling and pipeline operations, where spill incidents can have severe ecological and financial consequences.

The high demand from the oil and gas sector is driven by the industry’s scale and the continuous handling of flammable and polluting fluids. The use of absorbents minimizes operational downtime, supports emergency preparedness, and helps companies meet strict environmental guidelines.

Key Market Segments

By Material Type

- Natural Organic

- Natural Inorganic

- Synthetic

By Product

- Pads

- Rolls

- Pillows

- Granules

- Booms and Socks

- Sheets and Mats

- Others

By Type

- Universal

- Oil-Only

- HAZMAT/Chemical

By End-use

- Oil and Gas

- Chemical

- Food Processing

- Healthcare

- Others

Driving Factors

Strict Safety Rules Boost Demand for Absorbents

One of the main driving factors for the industrial absorbents market is the strict safety and environmental rules set by governments and regulatory agencies. These rules require industries to manage spills quickly and safely to avoid harming the environment and workers. As a result, factories, oil facilities, and chemical plants are now using more absorbent materials to handle leaks and prevent accidents.

Companies are also investing in spill control products to meet compliance standards and avoid penalties. These rules apply not only to large industries but also to small workshops and warehouses. This ongoing pressure to follow regulations is leading to steady demand for absorbents and is helping the market grow across many industrial sectors.

Restraining Factors

High Disposal Costs Limit Absorbent Material Use

A major restraining factor for the industrial absorbents market is the high cost of disposal after use. Once absorbents are used to soak up oil, chemicals, or hazardous liquids, they are considered contaminated waste. This waste must be handled and disposed of according to strict environmental rules, which often involves expensive processes such as incineration or treatment at licensed facilities.

These costs can add up quickly, especially for companies that deal with frequent spills or large volumes of liquid waste. As a result, some industries may try to reduce their use of absorbents or seek alternative solutions. This cost burden acts as a barrier, especially for small and mid-sized companies with limited budgets.

Growth Opportunity

Growing Demand for Eco‑Friendly, Biodegradable Absorbents

An important growth opportunity in the industrial absorbents market lies in the development and adoption of eco‑friendly, biodegradable materials. As companies and regulators place increasing emphasis on environmental sustainability, there is a strong shift away from traditional synthetic or polypropylene absorbents toward greener alternatives.

These biodegradable options—often made from natural fibers like cotton, hemp, or recycled cellulose—offer the same absorption performance while reducing ecological impact and disposal costs. Industries are actively seeking products that align with their green initiatives and corporate social responsibility goals, presenting a clear pathway for manufacturers to innovate.

By introducing certified compostable or naturally derived absorbents, producers can meet the rising demand for sustainable solutions, differentiate their offerings, and capture new market segments focused on environmental stewardship.

Latest Trends

Smart Spill Kits with Advanced Absorbent Technology

A key trend emerging in the industrial absorbents market is the use of smart spill kits that feature advanced absorbent technology. These kits are being designed with materials that change color when saturated or in contact with certain hazardous substances, making it easier for workers to detect when a replacement is needed.

Some kits now include quick-seal packaging, leak-proof linings, and modular components for fast deployment. This trend is driven by the need for quicker spill response, improved safety, and reduced waste.

Industries are also looking for ready-to-use solutions that save time during emergencies. As workplaces become more safety-conscious and efficiency-focused, smart spill kits with intelligent absorbent features are becoming more common across various industrial operations.

Regional Analysis

North America led the industrial absorbents market with 48.70% share in 2024.

In 2024, North America emerged as the leading region in the global Industrial Absorbents Market, accounting for 48.70% of the total share, which translates to a market value of USD 2.0 billion. The region’s dominance is primarily supported by strict industrial safety regulations and high awareness regarding environmental compliance across sectors such as oil & gas, manufacturing, and chemicals. Facilities in the United States and Canada maintain rigorous protocols for spill prevention and response, contributing to consistent demand for industrial absorbents.

Other regions, including Europe, Asia Pacific, Latin America, and the Middle East & Africa, continue to show steady growth, driven by expanding industrial activities and the gradual enforcement of spill management norms.

While these regions contribute to the overall market development, none surpassed North America in terms of market share or value during the year. The maturity of infrastructure, combined with strong regulatory enforcement in North America, ensures that absorbent products remain a critical component of industrial safety practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M Company maintained its status as a market innovator through a broad portfolio of absorbent products tailored to diverse industrial applications. Its emphasis on research and development facilitated the introduction of specialized pads, rolls, and booms designed for high-efficiency liquid absorption and rapid spill control. 3M’s strong global presence ensured widespread distribution and accessibility, reinforcing its position among industrial users in regions with stringent safety regulations.

ANSELL LTD demonstrated a strategic focus on protection and personal safety integration. By combining absorbent technology within comprehensive safety kits and solutions, the company underscored the importance of addressing both human and environmental hazards. Its offerings often include gloves, mats, and absorbent pads designed to enhance overall workplace safety.

Brady Worldwide Inc. leveraged its expertise in industrial identification and compliance solutions to enrich its absorbent product line. Their spill control materials were frequently bundled with labeling systems, signage, and facility management services, providing customers with end-to-end solutions that support regulatory compliance. Brady’s ability to integrate absorbents into broader safety and operational frameworks helped clients streamline asset management and documentation—particularly useful in regulated sectors like oil & gas and pharmaceuticals.

Top Key Players in the Market

- 3M Company

- ANSELL LTD

- Brady Worldwide Inc.

- Johnson Matthey Inc

- Kimberly-Clark Worldwide Inc.

- Meltblown Technologies Inc.

- Monarch Green Inc.

- Tolsa SA

- DecorUS Europe Ltd.

- Asa Environmental Products Inc.

Recent Developments

- In May 2024, Tolsa SA confirmed plans for a drilling and trenching programme at the Pioche Sepiolite Project in Nevada, USA. The initiative is aimed at obtaining additional samples and evaluating the continuation of the sepiolite deposit, key to enhancing their industrial absorbent mineral portfolio.

- In April 2024, 3M completed the spin‑off of its Health Care business, creating a new company called Solventum Corporation. The spin‑off allowed 3M to concentrate on core businesses, including industrial absorbents, while Solventum pursued healthcare innovation. 3M retained a 19.9% stake in Solventum.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Natural Organic, Natural Inorganic, Synthetic), By Product (Pads, Rolls, Pillows, Granules, Booms and Socks, Sheets and Mats, Others), By Type (Universal, Oil-Only, HAZMAT/Chemical), By End-use (Oil and Gas, Chemical, Food Processing, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, ANSELL LTD, Brady Worldwide Inc., Johnson Matthey Inc, Kimberly-Clark Worldwide Inc., Meltblown Technologies Inc., Monarch Green Inc., Tolsa SA, DecorUS Europe Ltd., Asa Environmental Products Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Absorbents MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Absorbents MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- ANSELL LTD

- Brady Worldwide Inc.

- Johnson Matthey Inc

- Kimberly-Clark Worldwide Inc.

- Meltblown Technologies Inc.

- Monarch Green Inc.

- Tolsa SA

- DecorUS Europe Ltd.

- Asa Environmental Products Inc.