Global Indoor 5G Market Size, Share, Industry Analysis Report By Offering (Infrastructure (Distributed Antenna System (DAS), Small Cells), Services (Network Design, Integration & Deployment, Training, Support)), By Frequency Band (Sub-6 GHz, mmWave), By Business Model (Service Providers, Enterprises (Commercial Campuses, Government, Transportation & Logistics, Hospitality, Industrial & Manufacturing, Education, Healthcare, Entertainment & Sports Venue, Others), Neutral Host Operators), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 166169

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Statistics and Projections

- Increasing Adoption Technologies

- Investment and Business Benefits

- U.S Market Size

- By Offering Segment

- Frequency Band Segment

- Business Model Segment

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

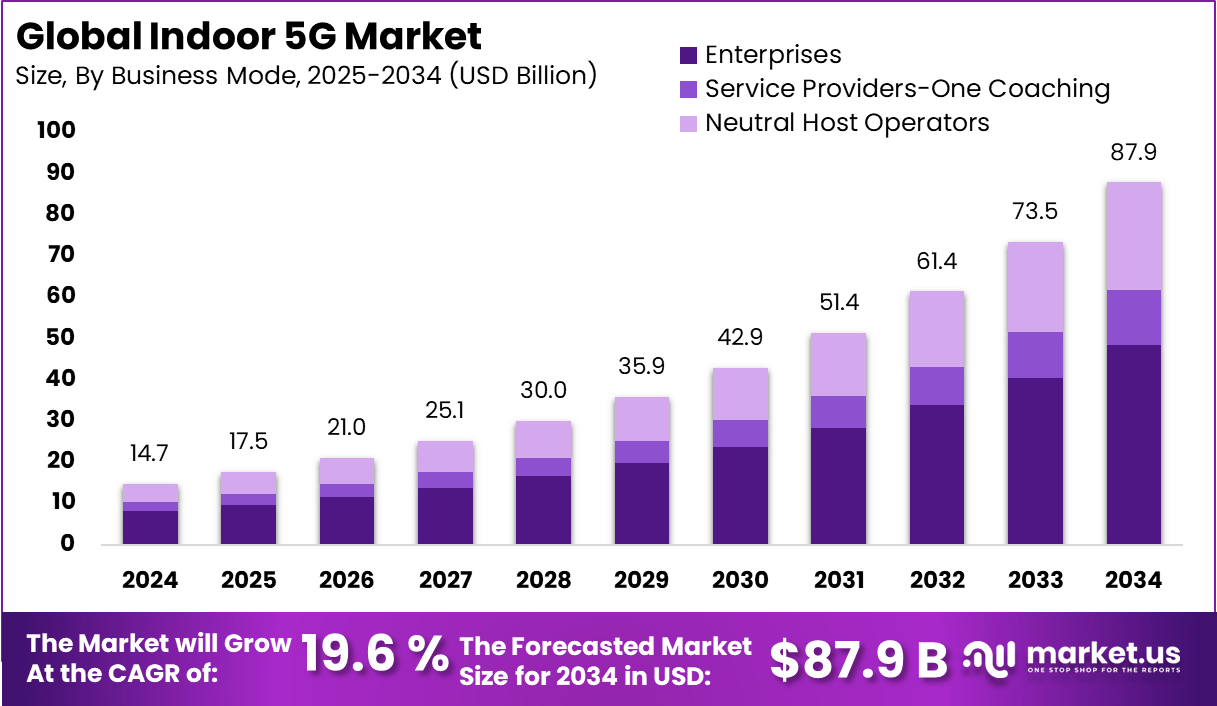

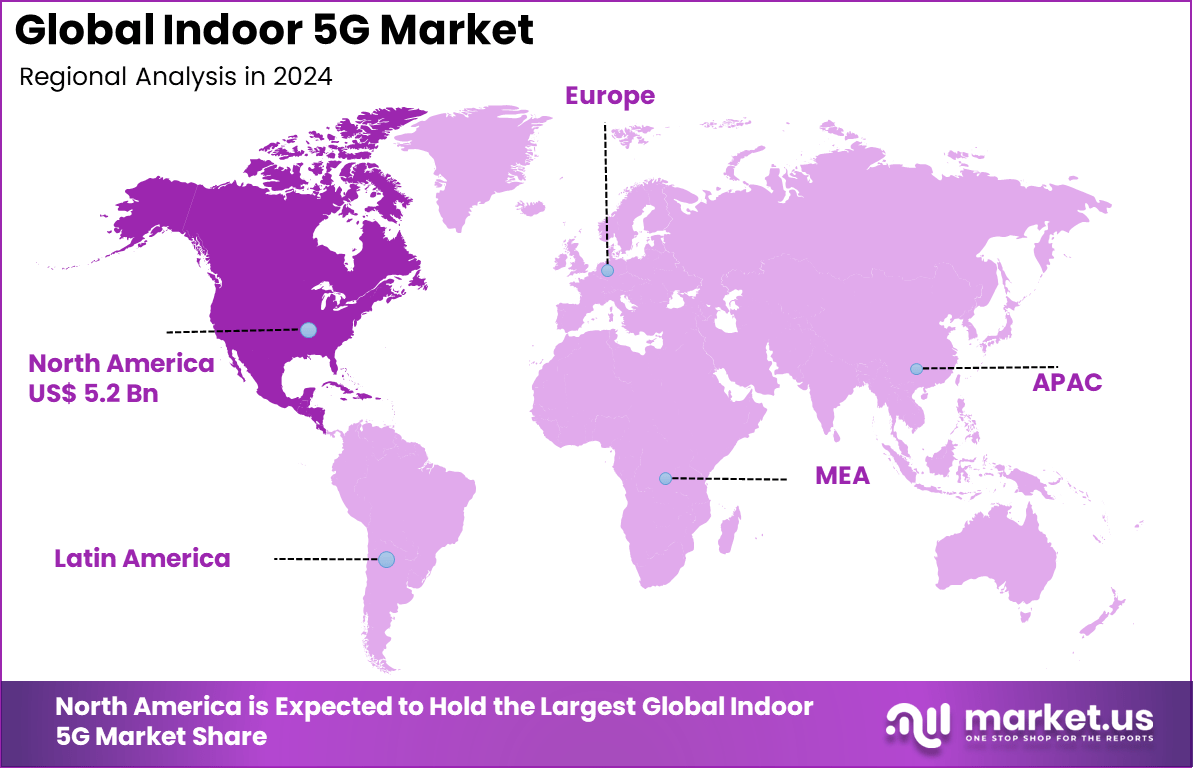

The Global Indoor 5G Market generated USD 14.67 Billion in 2024 and is predicted to register growth to about USD 87.9 Billion by 2034, recording a CAGR of 19.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.4% share, holding USD 5.2 Billion revenue.

The indoor 5G market focuses on delivering high speed and low latency 5G connectivity inside buildings such as offices, shopping malls, hospitals, factories, airports, and residential complexes. Traditional outdoor mobile networks often struggle to provide consistent indoor coverage due to walls, dense layouts, and signal interference. Indoor 5G solutions address this gap through small cells, distributed antenna systems, and private networks.

This market plays a critical role in ensuring reliable connectivity where most data consumption actually occurs, as studies show that over 80% of mobile data usage happens indoors. Indoor 5G plays a crucial role in enabling digital operations within smart buildings and enterprise environments. It supports real time applications such as video conferencing, automated manufacturing, connected healthcare systems, and immersive retail experiences.

Reliable indoor connectivity improves employee productivity, operational efficiency, and user satisfaction. In mission critical environments like hospitals and factories, indoor 5G enables stable communication for connected devices and automation systems where downtime is not acceptable. Growth is driven by rising indoor data traffic and the increasing number of connected devices per building.

Enterprises are adopting digital tools that require stable and high bandwidth connections. Expansion of smart offices, smart hospitals, and Industry 4.0 facilities has accelerated demand. Regulatory support for private 5G networks has also encouraged enterprise adoption. Industry reports indicate that indoor mobile traffic grows by more than 25% annually due to video streaming, cloud access, and collaboration tools.

Enterprises are seeking dedicated networks to avoid congestion and security risks associated with public networks. Demand is particularly strong in manufacturing, logistics, and healthcare, where reliable connectivity directly impacts operations. Large venues such as airports and stadiums are also investing heavily to support high user density. Surveys show that nearly 60% of enterprises consider indoor coverage a top priority in their 5G deployment plans.

Key Takeaways

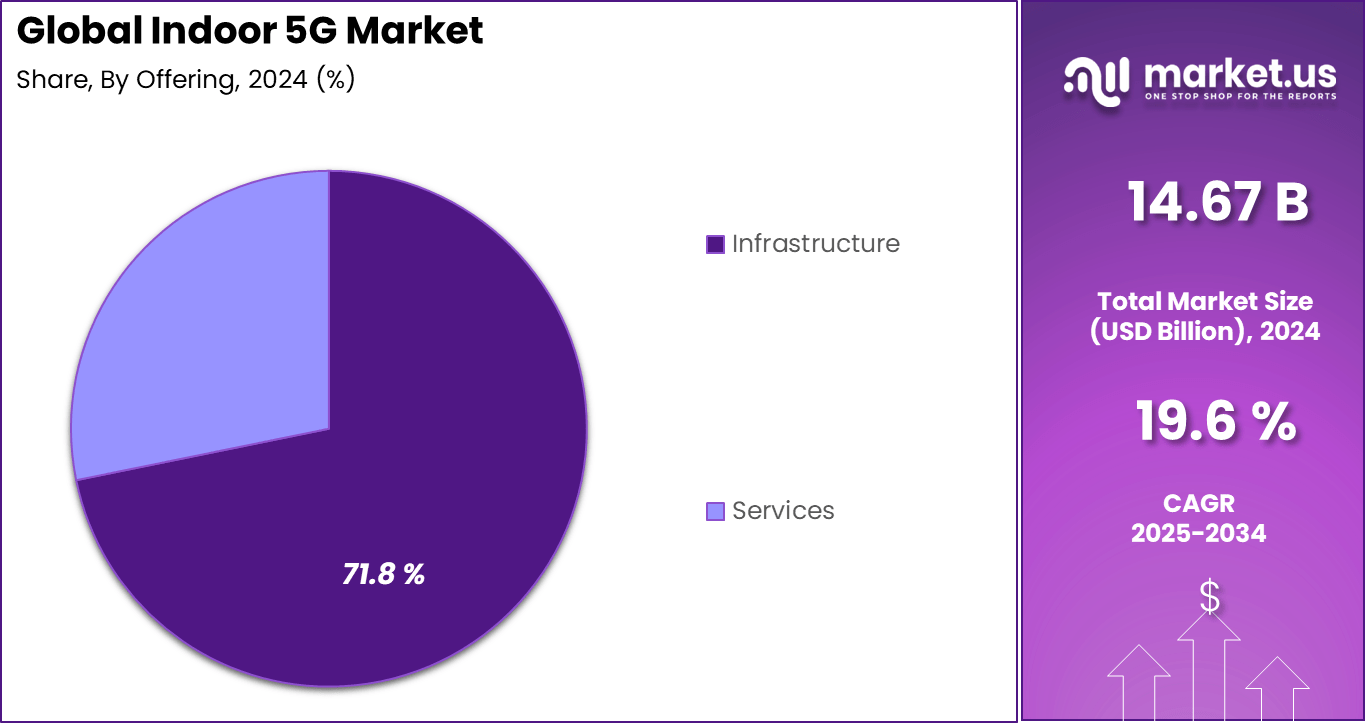

- The Indoor 5G market is driven by strong demand for advanced network Infrastructure, capturing 71.8% of the market by offering.

- The sub-6 GHz frequency band accounts for a substantial 90% of indoor 5G deployments.

- In terms of business models, enterprises represent the largest segment with a 55.2% share.

- Regionally, North America leads the indoor 5G market with a 35.4% share.

- The United States alone generates approximately USD 4.65 billion in revenue, supported by strong investments in telecom infrastructure and wide adoption of 5G in enterprise settings.

Statistics and Projections

- User Behavior: People spend approximately 90% of their time indoors, making reliable indoor connectivity crucial.

- Enterprise Adoption: Over 60% of enterprises adopting private 5G networks cite high-speed, low-latency connectivity as a key requirement.

- Infrastructure: The infrastructure segment (hardware like small cells and Distributed Antenna Systems) accounts for over 70% of the indoor 5G market share by offering.

- Frequency Bands: The sub-6 GHz frequency band currently dominates indoor 5G deployments with a 90% share due to its superior wall-penetrating capabilities, while mmWave is the fastest-growing segment.

- Capacity: 5G offers significantly more capacity than 4G, capable of supporting up to 1,000,000 devices per km² compared to 4G’s 2,000 devices per km².

Increasing Adoption Technologies

Key technologies supporting adoption include small cells, private 5G networks, network slicing, and edge computing. Small cells are widely used to improve coverage in complex indoor layouts. Private 5G networks allow enterprises to control performance and security. Edge computing is increasingly integrated to process data closer to devices, reducing latency for real time applications.

Industry adoption data suggests that more than 70% of early enterprise 5G deployments include indoor focused architectures. Enterprises adopt indoor 5G to gain higher network reliability, stronger security, and predictable performance. Unlike Wi Fi, 5G provides managed quality of service and better mobility support.

It enables seamless connectivity for moving devices such as robots and autonomous vehicles. Organizations also adopt indoor 5G to future proof infrastructure as device density increases. Enterprise IT surveys indicate that over 50% of companies view private indoor 5G as a long term replacement or complement to traditional wireless networks.

Investment and Business Benefits

Investment opportunities exist in indoor network design, small cell deployment, private network management, and edge enabled services. Managed indoor 5G services are gaining traction among enterprises that lack in house network expertise. Opportunities are also emerging in retrofitting older buildings with modern connectivity infrastructure.

As adoption expands beyond large enterprises to mid sized facilities, the addressable investment base continues to widen, with enterprise wireless spending growing at nearly 20% annually. Indoor 5G delivers strong business benefits by improving operational uptime, data security, and application performance.

Enterprises report better support for automation, real time analytics, and digital collaboration. Reduced network congestion leads to more stable operations and improved user experience. In industrial environments, productivity gains of up to 30% have been observed through reliable wireless automation and reduced downtime.

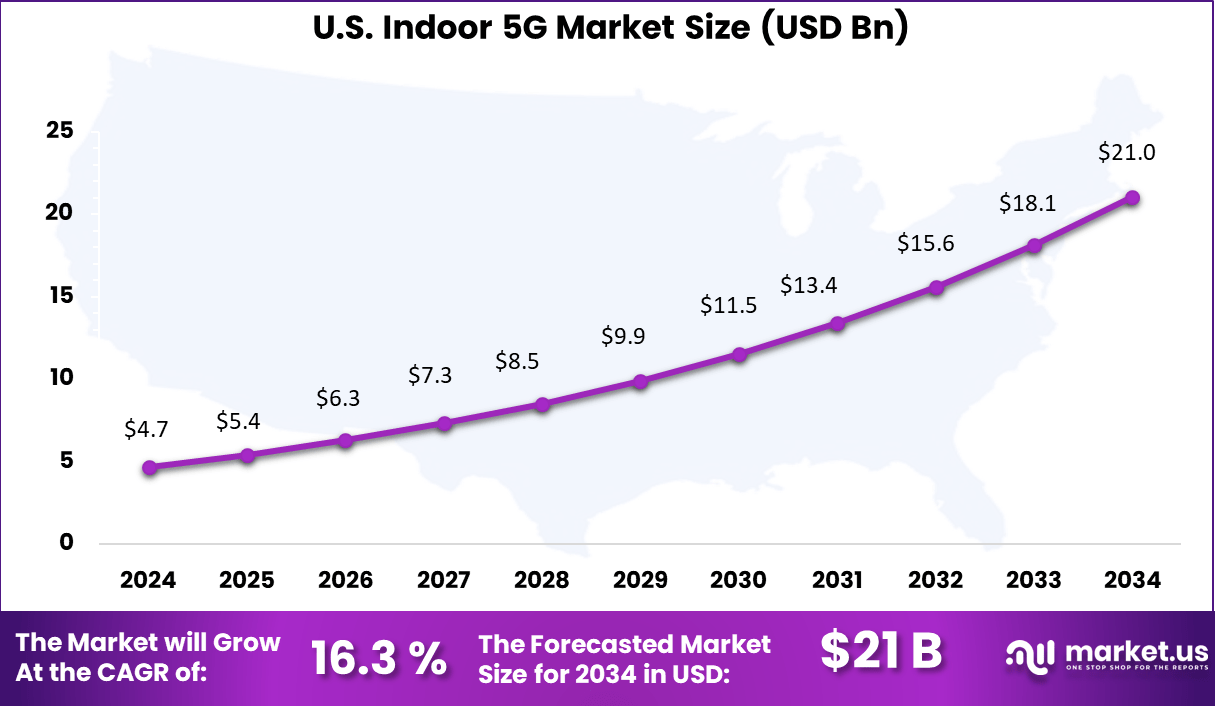

U.S Market Size

The United States, a key market within North America, recorded an Indoor 5G market size of approximately 4.65 billion USD. The US market is growing at a strong compound annual growth rate CAGR of 16.3%. This growth is propelled by high-scale adoption of private 5G networks in corporate offices, industrial premises, hospitals, and shopping centers.

Enterprises in the US are focused on deploying smart office solutions, industrial automation, and IoT-based applications which require resilient indoor 5G connectivity. Large investments in network infrastructure and an increasing shift towards network-as-a-service models also contribute to the dynamic expansion of indoor 5G across the country.

This analysis summarizes the critical segments shaping the Indoor 5G market landscape with emphasis on infrastructure, frequency band preferences, business use models, and regional highlights for North America and the U.S. Each segment points to the growing role of indoor 5G as a connectivity backbone for connected enterprises and advanced indoor environments.

North America is a leading region in the Indoor 5G market, capturing 35.4% of global market share. This strong position is driven by the region’s advanced telecommunications infrastructure, rapid technology adoption, and a high number of smart buildings and enterprises seeking reliable indoor connectivity.

Robust investments and government support further accelerate indoor 5G deployments across commercial, healthcare, and industrial facilities. The region’s mature wireless ecosystem also supports innovation and strong demand for private indoor 5G networks, fueling steady growth and network sophistication to meet the evolving needs of enterprises and public venues.

By Offering Segment

The infrastructure segment dominates the Indoor 5G market with a commanding share of 71.8%. This is primarily because infrastructure components such as small cells, distributed antenna systems, and routers provide the essential backbone for setting up reliable indoor 5G networks. Organizations deploying indoor 5G solutions invest heavily in these critical hardware elements to ensure high-quality coverage and performance inside buildings.

Infrastructure’s large share reflects the significant upfront costs and technical complexity in building indoor 5G networks. The demand for robust connectivity across commercial offices, industrial sites, and other enclosed spaces makes infrastructure the foundation of the indoor 5G ecosystem. This segment’s leadership points to the ongoing importance of hardware in driving network quality and reach.

Frequency Band Segment

Sub-6 GHz frequency band holds a dominant market share of 90% in the Indoor 5G space. This frequency range is favored for indoor environments due to its excellent coverage, ability to penetrate walls and obstacles, and cost-effective deployment. It is particularly well-suited to dense indoor environments like enterprise campuses and commercial buildings where consistent connectivity across multiple devices is critical.

While mmWave frequencies offer higher speeds, Sub-6 GHz’s reliability and broad area coverage make it the preferred choice for many indoor 5G implementations today. Its balance of performance and penetration aligns well with the connectivity needs of businesses aiming for seamless communication and IoT integration inside their facilities.

Business Model Segment

Enterprises lead as the largest business model segment for Indoor 5G, holding 55.2% of the market. Enterprises across various sectors such as IT, healthcare, finance, and retail are deploying private 5G networks to achieve higher connectivity, operational efficiency, and smart building capabilities. This large share reflects growing enterprise demand for dedicated indoor networks that support low latency and high throughput communication.

Enterprise adoption is fueled by needs for real-time analytics, secure data transmission, and enhanced collaboration within offices and campuses. The enterprise segment’s dominance underlines how indoor 5G is becoming critical for business digital transformation and infrastructure modernization efforts.

Key Market Segments

- By Offering

- Infrastructure

- Distributed Antenna System (DAS)

- Small Cells

- Services

- Network Design

- Integration & Deployment

- Training, Support

- Infrastructure

- By Frequency Band

- Sub-6 GHz

- mmWave

- By Business Model

- Service Providers

- Enterprises

- Commercial Campuses

- Government

- Transportation & Logistics

- Hospitality

- Industrial & Manufacturing

- Education

- Healthcare

- Entertainment & Sports Venue

- Others

- Neutral Host Operators

Driver Analysis

Growing Dependence on Strong Indoor Connectivity

A major driver is the increasing reliance on digital tools that must work smoothly indoors. Large offices, university buildings, airports, and healthcare centers handle thousands of devices at the same time. Older networks often slow down under this pressure. Indoor 5G offers higher capacity, faster response, and more stable performance, allowing all connected devices to operate efficiently during busy periods.

Another driving factor is the growth of automation and smart systems inside buildings. Factories use connected machines, malls use digital displays, and hospitals rely on real-time patient monitoring. All these activities require stable and continuous connectivity. Indoor 5G helps ensure uninterrupted performance, supporting advanced indoor applications that demand reliability.

Restraint Analysis

High Installation and Upgrade Costs

A major restraint for the market is the cost of building indoor 5G infrastructure. Installing small cells, antennas, cabling, and supportive backhaul systems requires skilled labor and careful planning. Older buildings may need additional electrical or structural updates before indoor 5G can be deployed. These expenses can discourage organizations with limited budgets.

Another cost-related restraint is the ongoing maintenance required to keep indoor 5G systems running efficiently. Businesses must update software, monitor network health, and occasionally replace equipment. These long-term costs can make some organizations hesitant to shift from existing Wi-Fi systems, especially when the benefits of indoor 5G are not yet fully understood.

Opportunity Analysis

Rising Demand for Private 5G in Enterprises

A strong opportunity exists in the adoption of private 5G networks inside industrial and commercial facilities. Manufacturers, logistics hubs, and research centers require secure and controlled communication networks for automation, real-time monitoring, and equipment coordination. Indoor 5G provides predictable performance, making it suitable for environments where precision and timing are critical.

There is also opportunity in sectors such as healthcare, retail, and hospitality. Hospitals can improve patient care through connected medical devices, while retail stores can enhance customer experience with smart displays and analytics. Hotels and event venues can provide stable indoor connectivity for large crowds. Indoor 5G providers can meet these needs by offering tailored solutions for different building types.

Challenge Analysis

Complex Integration in Diverse Indoor Environments

A major challenge is the difficulty of integrating indoor 5G systems into buildings with different layouts and materials. Thick concrete walls, metal structures, and reflective surfaces can weaken signals. Ensuring even coverage requires detailed planning, advanced testing tools, and careful placement of small cells. This makes installation more complex and time-consuming.

Another challenge comes from the need to manage network performance across many rooms, floors, and sections of a building. Indoor environments vary widely, and each part of the building may require different adjustments. This increases engineering effort and makes it harder to guarantee uniform connectivity. As a result, some organizations may delay adoption until installation methods become simpler and more standardized.

Key Players Analysis

Ericsson, Huawei, Nokia, Samsung, and ZTE lead the indoor 5G market with end to end solutions that improve coverage and capacity inside offices, factories, hospitals, airports, and large venues. Their portfolios include small cells, distributed antenna systems, and private 5G platforms. These companies focus on low latency, high reliability, and seamless integration with enterprise networks. Rising demand for high speed indoor connectivity continues to strengthen their market position.

CommScope, Corning, Comba Telecom, AT&T, Airspan, SOLiD, Dali Wireless, and Fujitsu strengthen the market with neutral host systems, fiber based infrastructure, and indoor radio solutions. Their technologies help enterprises and operators manage dense user environments and heavy data traffic. These providers emphasize flexible deployment, network scalability, and cost efficiency. Growing adoption of smart buildings and connected workplaces supports wider adoption.

BTI Wireless, Sercomm, PCTEL, Huber+Suhner, Nextivity, JMA Wireless, LitePoint, ExteNet Systems, Mavenir, Boingo Wireless, and other players expand the ecosystem with testing tools, signal boosting, and managed indoor 5G services. Their offerings support reliable performance across complex indoor layouts. Increasing use of IoT, automation, and immersive applications continues to drive steady growth in the indoor 5G market.

Top Key Players in the Market

- Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- CommScope Holding Company, Inc.

- Corning Incorporated

- Comba Telecom Systems Holdings Limited

- AT&T Inc.

- Airspan Networks Holdings Inc.

- SOLiD Inc.

- Dali Wireless, Inc.

- Fujitsu Limited

- BTI Wireless, Inc.

- Sercomm Corporation

- PCTEL, Inc.

- Huber+Suhner AG

- Nextivity, Inc.

- JMA Wireless

- Proptivity AB

- LitePoint Corporation

- ALCAN Systems GmbH

- ExteNet Systems, Inc.

- LITEON Technology Corporation

- Mavenir Systems, Inc.

- Maven Wireless AB

- Boingo Wireless, Inc.

- Others

Recent Developments

- In June 2025, Nokia partnered with Andorix to deploy private 5G and edge solutions across the North American real estate sector. Using Nokia’s Digital Automation Cloud platform, the collaboration supports smart building automation, IoT integration, and improved connectivity for commercial and residential properties.

- In April 2025, Bharti Airtel collaborated with Nokia to deploy core and fixed wireless access solutions for integrated 4G and 5G networks. The initiative supports the rollout of 5G Standalone while using automation and GenAI to improve service quality and reduce operating costs.

- Also in April 2025, Airspan acquired Corning’s wireless business, including its 6000 and 6200 DAS portfolio and SpiderCloud small cell assets for 4G and 5G. This acquisition strengthens Airspan’s indoor 5G capabilities and reinforces its position in enterprise and private network deployments.

Report Scope

Report Features Description Market Value (2024) USD 14.67 Bn Forecast Revenue (2034) USD 87.9 Bn CAGR(2025-2034) 19.60 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Infrastructure (Distributed Antenna System (DAS), Small Cells), Services (Network Design, Integration & Deployment, Training, Support)),

By Frequency Band (Sub-6 GHz, mmWave), By Business Model (Service Providers, Enterprises (Commercial Campuses, Government, Transportation & Logistics, Hospitality, Industrial & Manufacturing, Education, Healthcare, Entertainment & Sports Venue, Others), Neutral Host Operators)Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, Samsung Electronics Co. Ltd., ZTE Corporation, CommScope Holding Company Inc., Corning Incorporated, Comba Telecom Systems Holdings Limited, AT&T Inc., Airspan Networks Holdings Inc., SOLiD Inc., Dali Wireless Inc., Fujitsu Limited, BTI Wireless Inc., Sercomm Corporation, PCTEL Inc., Huber+Suhner AG, Nextivity Inc., JMA Wireless, Proptivity AB, LitePoint Corporation, ALCAN Systems GmbH, ExteNet Systems Inc., LITEON Technology Corporation, Mavenir Systems Inc., Maven Wireless AB, Boingo Wireless Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- CommScope Holding Company, Inc.

- Corning Incorporated

- Comba Telecom Systems Holdings Limited

- AT&T Inc.

- Airspan Networks Holdings Inc.

- SOLiD Inc.

- Dali Wireless, Inc.

- Fujitsu Limited

- BTI Wireless, Inc.

- Sercomm Corporation

- PCTEL, Inc.

- Huber+Suhner AG

- Nextivity, Inc.

- JMA Wireless

- Proptivity AB

- LitePoint Corporation

- ALCAN Systems GmbH

- ExteNet Systems, Inc.

- LITEON Technology Corporation

- Mavenir Systems, Inc.

- Maven Wireless AB

- Boingo Wireless, Inc.

- Others