India Thyroid Function Test Market By Test Type (TSH (Thyroid Stimulating Hormone), T4 (Thyroxine), T3 (Tri-iodothyronine), FT4 (Free Thyroxine), and FT3 (Free Tri-iodothyronine)), By End-user (Diagnostic Laboratories, Clinics, Research Organizations, and Hospitals), and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162507

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

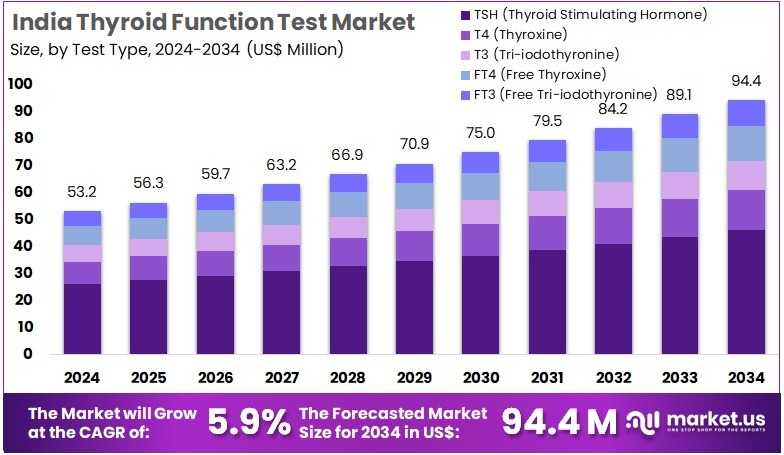

The India Thyroid Function Test Market Size is expected to be worth around US$ 94.4 million by 2034 from US$ 53.2 million in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034.

Increasing emphasis on non-communicable disease (NCD) screening drives the India Thyroid Function Test Market, as public health initiatives prioritize early detection of thyroid disorders. Clinicians utilize thyroid function tests (TFTs) to diagnose hypothyroidism and hyperthyroidism in routine health check-ups, enabling timely intervention for metabolic imbalances. These tests support prenatal care by assessing maternal thyroid health, reducing risks of complications like preeclampsia.

Advanced immunoassays enhance diagnostic precision in hospital labs, streamlining large-scale screening efforts. In February 2025, the Union Health Ministry rolled out an Intensified Special NCD Screening Drive targeting individuals aged 30 and above, incorporating TFTs to address prevalent NCDs. This initiative amplifies demand for thyroid diagnostics, fostering market growth through integrated health programs.

Growing integration of thyroid testing in occupational health programs fuels the India Thyroid Function Test Market, as employers prioritize workforce wellness. TFTs play a critical role in community health screenings, identifying subclinical thyroid conditions in at-risk populations like shift workers. Primary care facilities employ these tests for differential diagnosis of fatigue and weight changes, improving patient outcomes.

Point-of-care testing innovations enable rapid results in outreach camps, expanding access in underserved areas. In September 2024, the Bruhat Bengaluru Mahanagara Palike implemented an expanded health check-up program for sanitation workers, adding TFTs to standard screenings for comprehensive health monitoring. Such initiatives drive market expansion by embedding thyroid diagnostics in public health frameworks.

Rising focus on women’s health creates opportunities in the India Thyroid Function Test Market, as targeted campaigns enhance screening accessibility. TFTs support endocrine profiling in women with irregular menstrual cycles, aiding fertility management. Preventive care programs leverage these tests to detect thyroid dysfunction early, reducing risks of cardiovascular complications.

Automated diagnostic platforms improve throughput in private clinics, catering to rising consumer demand for wellness packages. In March 2025, Star Health Insurance launched the SheTARA campaign in Tamil Nadu, offering subsidized TFTs within preventive screenings for women. This effort boosts market growth by increasing awareness and uptake of thyroid testing in gender-specific health initiatives.

Key Takeaways

- In 2024, the market generated a revenue of US$ 53.2 million, with a CAGR of 5.9%, and is expected to reach US$ 94.4 million by the year 2034.

- The test type segment is divided into TSH (Thyroid Stimulating Hormone), T4 (Thyroxine), T3 (Tri-iodothyronine), FT4 (Free Thyroxine), and FT3 (Free Tri-iodothyronine), with TSH (Thyroid Stimulating Hormone) taking the lead in 2023 with a market share of 48.9%.

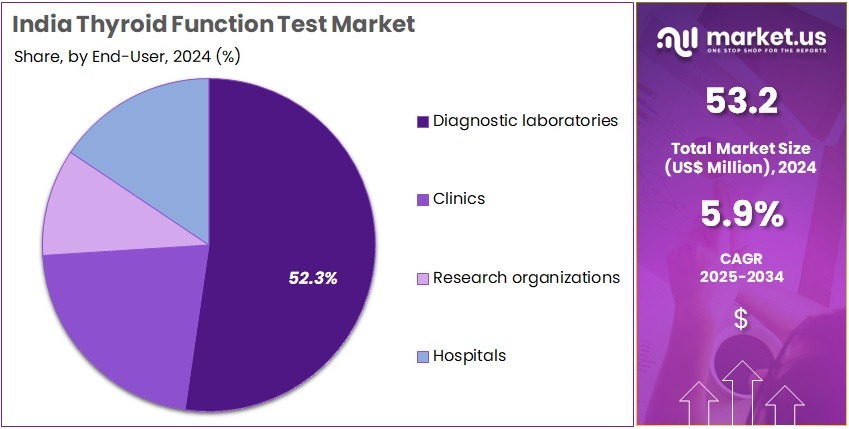

- Considering end-user, the market is divided into diagnostic laboratories, clinics, research organizations, and hospitals. Among these, diagnostic laboratories held a significant share of 52.3%.

Test Type Analysis

TSH tests hold 48.9% of the India Thyroid Function Test market and are projected to continue growing due to their pivotal role in diagnosing and monitoring thyroid disorders. TSH serves as the primary marker for hypothyroidism, hyperthyroidism, and subclinical thyroid dysfunction, making it the preferred test among clinicians. The rising prevalence of thyroid disorders, particularly in women and older adults, is likely to increase demand for TSH testing.

Advances in immunoassay technologies, including enhanced sensitivity and automated platforms, are anticipated to improve accuracy and throughput. Increased awareness of the importance of early detection and regular monitoring supports higher adoption rates. Diagnostic laboratories and hospitals increasingly integrate TSH testing into routine checkups and preventive health programs.

Government initiatives promoting thyroid screening in high-risk populations further bolster market growth. The affordability and simplicity of TSH assays compared to full thyroid panels enhance accessibility in both urban and semi-urban areas.

Growth is also supported by the rising number of outpatient and wellness centers offering thyroid function tests. Automation and digital reporting in laboratories improve turnaround times, enabling rapid clinical decision-making. The combination of accuracy, clinical relevance, and ease of use positions TSH testing as the leading segment in the Indian thyroid diagnostics market.

End-User Analysis

Diagnostic laboratories represent 52.3% of the end-user segment and are expected to remain the dominant consumers of thyroid function tests due to their infrastructure, technical expertise, and high patient throughput. Laboratories provide centralized testing solutions for TSH, T4, T3, FT4, and FT3 assays, ensuring consistent quality and accurate results.

The increasing number of thyroid disorder cases, coupled with growing awareness about early detection, drives volume demand in laboratories. Advanced automated analyzers and immunoassay platforms adopted by laboratories improve efficiency, reduce errors, and enable high-throughput testing. Diagnostic laboratories are increasingly partnering with hospitals, clinics, and wellness centers to expand accessibility and manage larger sample volumes.

The focus on preventive healthcare and regular screening programs reinforces their role as primary testing hubs. Laboratories also offer specialized panels and comprehensive thyroid assessments, supporting research, clinical diagnostics, and monitoring of therapy. Adoption of laboratory information systems enhances workflow, reporting, and integration with hospital electronic health records.

Regulatory approvals and accreditation of laboratory services provide trust and reliability, encouraging broader adoption. Rising investments in laboratory infrastructure, combined with urbanization and increased healthcare spending, further strengthen their market position. Overall, diagnostic laboratories remain the cornerstone of thyroid testing in India due to their capacity, accuracy, and broad service offerings.

Key Market Segments

By Test Type

- TSH (thyroid stimulating hormone)

- T4 (thyroxine)

- T3 (tri-iodothyronine)

- FT4 (free thyroxine)

- FT3 (free tri-iodothyronine)

By End-user

- Diagnostic laboratories

- Clinics

- Research organizations

- Hospitals

Drivers

Rising Prevalence of Hypothyroidism in India is Driving the Market

The escalating prevalence of hypothyroidism across diverse demographic segments in India has substantially advanced the thyroid function test market by necessitating widespread screening and monitoring protocols. This condition, marked by insufficient thyroid hormone production, manifests in symptoms ranging from fatigue to metabolic disruptions, prompting routine assays for TSH, T3, and T4 levels. Urbanization and dietary shifts have amplified iodine imbalances, even post-national fortification efforts, heightening diagnostic demands in primary care facilities.

Government health surveys highlight the condition’s ubiquity, influencing policy integrations that mandate thyroid evaluations in antenatal and chronic disease programs. This driver fosters expansion in laboratory networks, as accurate profiling informs levothyroxine dosing and complication prevention. Healthcare providers increasingly adopt multiplex panels to address subclinical variants, optimizing resource utilization in overburdened systems.

The Indian Council of Medical Research’s epidemiological data from 2022 indicates that hypothyroidism affects approximately 11% of the adult population in surveyed regions, underscoring the diagnostic imperative for scalable testing infrastructures. Such prevalence metrics compel investments in automated analyzers, enhancing throughput in high-volume centers.

Economically, early detection curtails comorbidities like cardiovascular risks, justifying reimbursements for periodic assessments. Collaborative initiatives with endocrine societies promote awareness campaigns, elevating voluntary testing rates. As aging cohorts swell, longitudinal monitoring via function tests becomes pivotal, sustaining market vitality. This hypothyroid surge not only elevates procedural volumes but also aligns diagnostics with preventive health architectures.

Restraints

Low Awareness of Subclinical Thyroid Disorders is Restraining the Market

Insufficient public and clinical cognizance of subclinical thyroid abnormalities continues to impede the penetration of function tests in India, delaying interventions and perpetuating undiagnosed cases. Subtle manifestations, such as mild TSH elevations without overt symptoms, often evade routine scrutiny, particularly in rural enclaves with limited endocrine outreach. This restraint manifests in fragmented screening, as general practitioners prioritize symptomatic presentations over proactive profiling, constraining assay utilization.

Cultural attributions to aging or stress further diminish perceived urgency, reducing demand for confirmatory T4 evaluations. Developers face challenges in disseminating educational modules, as resource constraints hinder nationwide dissemination. The resultant diagnostic lag exacerbates progression to overt dysfunction, inflating long-term healthcare expenditures.

A 2022 review by the Indian Journal of Endocrinology and Metabolism reveals that nearly one-third of hypothyroid individuals across age strata remain undetected and unmanaged in multiple Indian locales. This underrecognition perpetuates inequities, with urban-rural divides amplifying access variances. Payer hesitancy stems from unproven cost-benefit ratios for asymptomatic cohorts, fragmenting reimbursement paradigms. Efforts to embed thyroid queries in annual checkups lag, owing to curriculum overloads in medical training. These awareness deficits not only compress test volumes but also undermine the market’s potential for equitable expansion.

Opportunities

Government Initiatives for Newborn Screening Expansion is Creating Growth Opportunities

The augmentation of national newborn screening mandates has engendered substantial prospects for thyroid function tests in India, targeting congenital hypothyroidism to avert neurodevelopmental deficits. These programs, emphasizing TSH heel-prick assays, integrate into maternal-child health frameworks, broadening test accessibility in peripheral units.

Opportunities proliferate in reagent standardization and portable kits, facilitating decentralized implementations amid rising birth cohorts. Public-private synergies enable capacity building, subsidizing validations for remote deployments. This focus addresses iodine transition legacies, positioning diagnostics as cornerstones of pediatric endocrinology. Fiscal allocations for universal coverage further catalyze infrastructure upgrades, diversifying portfolios toward multiplex neonatal panels.

The Indian Council of Medical Research’s 2022 task force guidelines advocate for nationwide congenital hypothyroidism screening, estimating implementation could detect over 12,000 cases annually based on extrapolated prevalence. Such projections validate economic incentives, as early interventions mitigate lifelong support costs. Innovations in dried blood spot stability enhance feasibility in logistics-challenged terrains. As digital registries evolve, real-time tracking refines follow-up efficacy, unlocking data monetization avenues. These expansions not only amplify procedural demands but also embed the market within sustainable child health ecosystems.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the India thyroid function test market, leading them to delay automation upgrades for TSH assays while focusing on cost-effective reagent sourcing amid subdued reimbursement rates. U.S.-India trade frictions and disruptions in Indian Ocean shipping routes are restricting supplies of diagnostic kits from Southeast Asian suppliers, extending validation periods and increasing certification expenses for domestic lab networks. To address these hurdles, some developers are partnering with Gujarat-based reagent manufacturers, adopting quality enhancements that expedite CDSCO approvals and draw health ministry funding.

Increasing thyroid disorder prevalence is channeling Ayushman Bharat allocations into screening programs, promoting uptake in rural clinics. U.S. tariffs of 100% on branded pharmaceuticals effective October 1, 2025, spare Indian generics but heighten risks of expanded duties on diagnostic components, elevating import costs for specialized buffers and eroding margins for urban labs while slowing tech transfers from American collaborators. In response, developers are leveraging PLI scheme incentives to build Maharashtra production facilities, advancing point-of-care innovations and strengthening local formulation expertise.

Trends

Introduction of Point-of-Care Thyroid Testing Devices is a Recent Trend

The deployment of portable point-of-care analyzers has epitomized a salient progression in India’s thyroid function test domain during 2024, democratizing rapid TSH assessments in non-laboratory venues. These battery-operated platforms yield results in under 15 minutes, circumventing transit delays inherent in centralized processing. This trend resonates with ambulatory care evolutions, enabling bedside triages in clinics and outreach camps.

User interfaces, incorporating app linkages, streamline interpretations for non-specialists, fostering adoption amid workforce shortages. Regulatory validations affirm analytical parity with benchtop systems, accelerating endorsements for diverse matrices. The innovation aligns with digital health imperatives, integrating outputs into electronic records for seamless consultations.

Thyrocare Technologies processed over 22 million diagnostic samples in fiscal year 2023, with point-of-care integrations contributing to a 10% uptick in thyroid-specific volumes. This escalation underscores scalability, as deployments span urban hubs to tribal peripheries. Subsequent enhancements target multiplexity, profiling T3 alongside TSH for comprehensive insights. The progression anticipates AI calibrations for predictive analytics, refining risk stratifications. This portability inflection not only augments diagnostic agility but also harmonizes with decentralized healthcare visions.

Key Players Analysis

Prominent enterprises in the Indian thyroid diagnostics sector advance their operations by introducing affordable POC analyzers that enable rapid TSH screening in remote clinics, addressing accessibility gaps in rural areas. They execute mergers with regional lab chains to consolidate networks and optimize sample logistics, enhancing turnaround times for T3 and T4 assays. Organizations invest in AI-powered result interpretation tools to predict disorder progression, integrating with telehealth apps for seamless follow-up care.

Executives forge alliances with government wellness initiatives to subsidize population screenings, capturing volume from high-prevalence demographics. They prioritize R&D for multiplex panels that bundle thyroid markers with metabolic profiles, appealing to preventive health packages. Moreover, they deploy tiered pricing models for corporate tie-ups, ensuring penetration into urban wellness programs and fostering recurring client engagements.

Thyrocare Technologies Limited, founded in 1996 and headquartered in Navi Mumbai, pioneers automated diagnostic services with a centralized lab model that processes over 350 tests, including comprehensive thyroid panels for early detection. The company operates more than 1,100 collection centers across India, Nepal, Bangladesh, and the Middle East, emphasizing cost-effective, IT-enabled workflows for preventive healthcare.

Thyrocare channels resources into franchise expansions and digital reporting platforms to streamline access for patients and providers. Founder and CEO A. Velumani, a former BARC scientist, guides a debt-free enterprise focused on scalability and quality assurance. The firm partners with hospitals to deliver branded profiles like Aarogyam, supporting holistic wellness monitoring. Thyrocare upholds its frontrunner status by leveraging automation and strategic outreach to democratize diagnostics nationwide.

Top Key Players in the India Thyroid Function Test Market

- Abbott India

- Apollo Diagnostics

- Lal PathLabs

- Metropolis Healthcare Ltd.

- Quest Diagnostics India

- Roche Diagnostics India

- Siemens Healthineers India

- SRL Diagnostics

- Suburban Diagnostics

- Thyrocare Technologies Ltd.

Recent Developments

- In February 2024: Thyrocare acquired full ownership of Think Health Diagnostics Private Limited (“Think Health”), marking its entry into at-home ECG services. This strategic move expands Thyrocare’s service offerings in remote cardiovascular diagnostics, driving growth in the home-based diagnostic testing segment.

- In 2024: Analysis of 35,000 thyroid tests conducted over six months in Delhi, India revealed that around 33% of patients had abnormal results. This high prevalence of thyroid abnormalities underscores the increasing demand for reliable thyroid testing services, supporting market expansion for diagnostic laboratories.

Report Scope

Report Features Description Market Value (2024) US$ 53.2 million Forecast Revenue (2034) US$ 94.4 million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (TSH (Thyroid Stimulating Hormone), T4 (Thyroxine), T3 (Tri-iodothyronine), FT4 (Free Thyroxine), and FT3 (Free Tri-iodothyronine)), By End-user (Diagnostic Laboratories, Clinics, Research Organizations, and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott India, Apollo Diagnostics, Dr. Lal PathLabs, Metropolis Healthcare Ltd., Quest Diagnostics India, Roche Diagnostics India, Siemens Healthineers India, SRL Diagnostics, Suburban Diagnostics, Thyrocare Technologies Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  India Thyroid Function Test MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

India Thyroid Function Test MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott India

- Apollo Diagnostics

- Lal PathLabs

- Metropolis Healthcare Ltd.

- Quest Diagnostics India

- Roche Diagnostics India

- Siemens Healthineers India

- SRL Diagnostics

- Suburban Diagnostics

- Thyrocare Technologies Ltd.