Global Independent Lodgings Market Size, Share, Growth Analysis By Consumer Orientation (Men, Women), By Type of Hotels (Budget, Boutique, Luxury, Hostel, Design Hotel), By Tourist Type (Domestic, International), By Age Group (15 to 25 Years, 26 to 35 Years, 36 to 45 Years, 46 to 55 Years, 66 to 75 Years), By Tour Type (Independent Traveller, Package Traveller, Tour Group), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155652

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

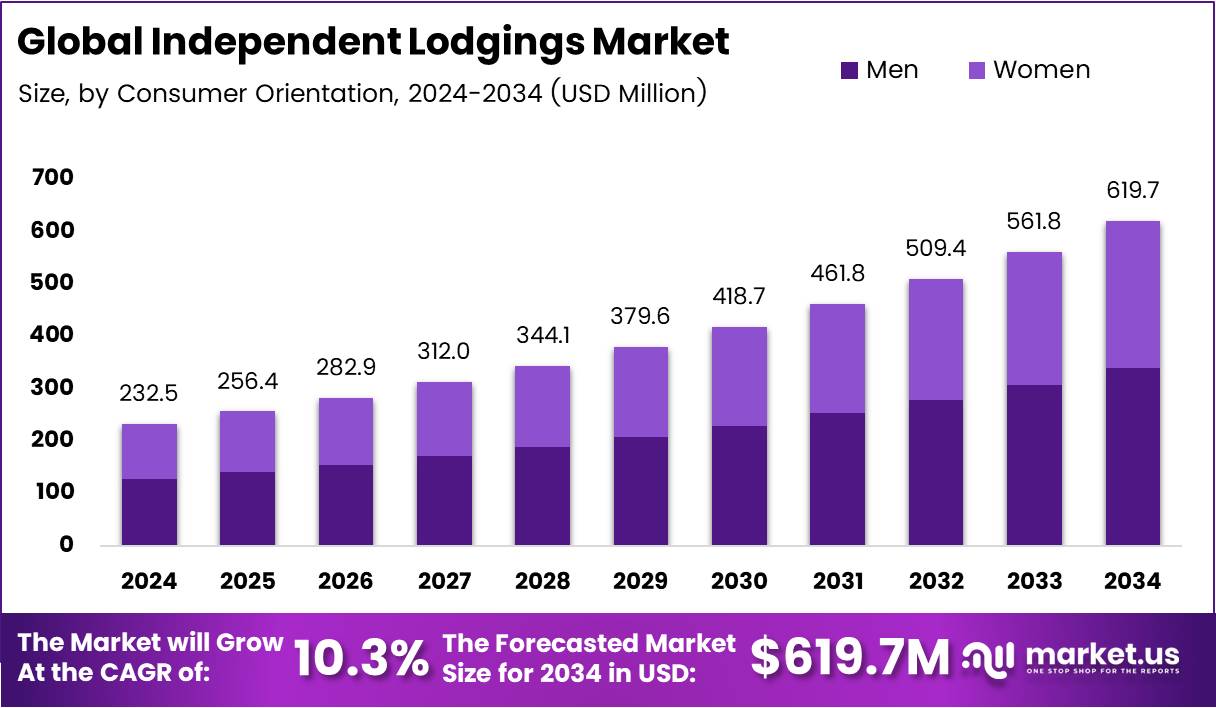

The Global Independent Lodgings Market size is expected to be worth around USD 619.7 Million by 2034, from USD 232.5 Million in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034.

The Independent Lodgings market refers to individually owned hotels, guesthouses, boutique stays, and alternative accommodations operating outside large chains. These properties emphasize personalized experiences, authentic destinations, and flexible offerings. Unlike standardized chain hotels, they attract travelers seeking unique stays and cultural immersion. Consequently, this segment continues to differentiate itself through service, location, and adaptability.

Independent Lodgings cater to rising demand from leisure and business travelers valuing customization. Owners have greater freedom to set pricing strategies, adopt digital solutions, and partner with online platforms. Furthermore, independent properties build strong local connections, supporting tourism and small economies. This ability to personalize services gives them an edge over standardized chain competitors.

The Independent Lodgings Market shows consistent growth, supported by expanding tourism and shifting traveler preferences. Guests increasingly choose boutique hotels, eco-lodges, and family-owned stays over branded chains. Additionally, digital platforms help small operators compete on global visibility. As travel confidence improves, this market is positioned to capture diversified customer segments and spending.

Opportunities are rising as travelers demand sustainable, experience-driven stays. Independent operators quickly adapt to green practices and wellness offerings. Moreover, niche segments like adventure travel, cultural tourism, and rural escapes expand market scope. Since travelers seek authenticity, independent lodgings provide a competitive advantage by combining affordability, exclusivity, and tailored guest experiences across destinations.

Governments worldwide are investing in tourism infrastructure, indirectly benefitting independent accommodations. Policies supporting heritage properties, rural tourism, and SME financing encourage expansion. At the same time, regulations on safety, sustainability, and digital compliance are increasing. While these rules raise operational costs, they also standardize quality, enabling independents to compete with established brands and chains.

According to surveys, 2024 arrivals reached ~99% of pre-pandemic levels, and Q1 2025 arrivals rose +5% YoY, ≈3% above 2019. This rebound signals strong recovery potential for independent players. Furthermore, Booking Holdings reported that 60%+ of room nights were booked on mobile, with app annualized gross bookings surpassing $150B in 2024.

According to SiteMinder, hotel websites in 2024 generated ~60% higher revenue per booking versus OTAs, averaging US$519 vs US$320 across 125M reservations. This trend highlights direct booking advantages for independent lodgings. By embracing digital channels and mobile platforms, independents can enhance profitability while reducing reliance on third-party intermediaries in the evolving travel ecosystem.

Key Takeaways

- The Global Independent Lodgings Market is expected to be worth around USD 619.7 Million by 2034, growing at a CAGR of 10.3% from 2025 to 2034.

- In 2024, Men held a dominant market position in the By Consumer Orientation Analysis segment with a 54.7% share.

- Budget hotels held a dominant market position in the By Type of Hotels Analysis segment with a 38.4% share in 2024.

- In 2024, Domestic tourism led the By Tourist Type Analysis segment with a 67.9% share.

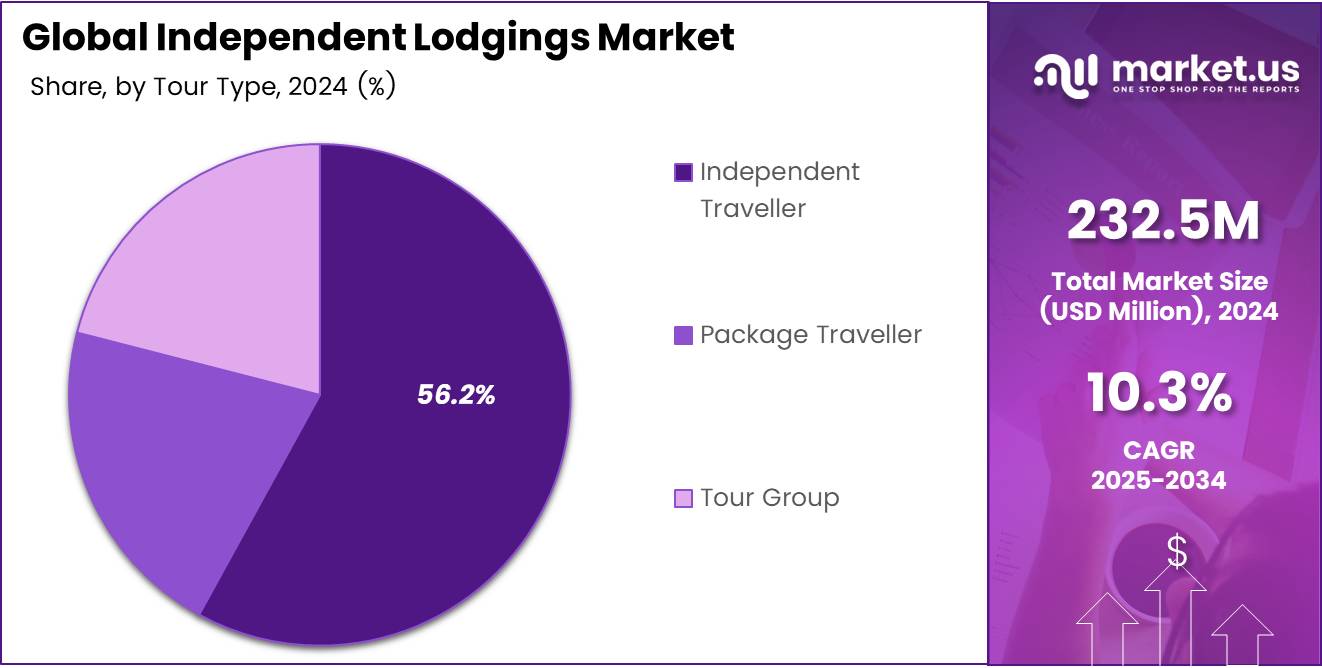

- Independent Traveller held a dominant market position in the By Tour Type Analysis segment with a 56.2% share in 2024.

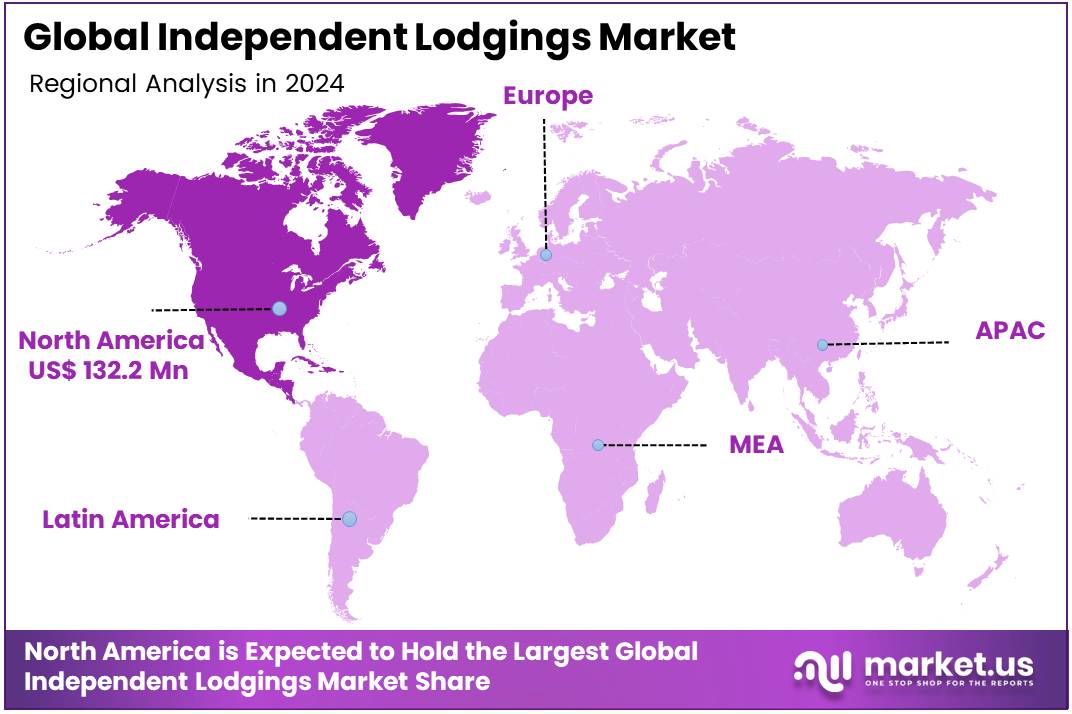

- In 2024, North America dominated the Independent Lodgings Market with a market share of 56.9%, valued at USD 132.2 Million.

Consumer Orientation Analysis

Men dominates with 54.7% due to higher business travel frequency and solo travel preferences.

In 2024, Men held a dominant market position in By Consumer Orientation Analysis segment of Independent Lodgings Market, with a 54.7% share. This significant market leadership reflects the continued prevalence of male business travelers who frequently utilize independent lodging options for corporate trips and professional engagements.

The male segment’s dominance stems from traditional business travel patterns where men constitute a larger portion of frequent travelers. Independent lodgings appeal to this demographic due to their flexibility, cost-effectiveness, and often more personalized service compared to large hotel chains.

Women showing substantial participation but trailing behind the male segment. The gap indicates opportunities for independent lodging providers to develop targeted marketing strategies and amenities that specifically cater to female travelers’ preferences and safety concerns.

The gender distribution in independent lodgings reflects broader travel industry trends, where business travel traditionally skews male. However, the growing participation of women in business and leisure travel suggests this gap may narrow in future years as travel patterns continue evolving.

Type of Hotels Analysis

Budget dominates with 38.4% due to its widespread availability and cost-effectiveness.

In 2024, Budget held a dominant market position in By Type of Hotels Analysis segment of Independent Lodgings Market, with a 38.4% share. This market leadership demonstrates the strong consumer preference for affordable accommodation options that deliver essential services without premium pricing.

Budget hotels capture the largest market segment by offering practical amenities at competitive rates, appealing to cost-conscious travelers across business and leisure segments. Their success stems from providing clean, comfortable accommodations with basic facilities that meet fundamental traveler needs.

Boutique hotels represent a significant secondary segment, leveraging unique design elements and personalized experiences to differentiate from standard offerings. Luxury properties command premium positioning through high-end amenities and exclusive services, while Hostels cater to budget-conscious younger demographics and backpackers.

Design Hotels occupy a niche market segment, focusing on architectural innovation and aesthetic appeal to attract discerning travelers seeking unique accommodation experiences. The diverse segmentation reflects the independent lodging market’s ability to serve varied consumer preferences and price points effectively.

Tourist Type Analysis

Domestic dominates with 67.9% due to increased local travel preferences and regional tourism growth.

In 2024, Domestic held a dominant market position in By Tourist Type Analysis segment of Independent Lodgings Market, with a 67.9% share. This overwhelming dominance reflects the significant shift toward domestic tourism driven by changing travel patterns and increased appreciation for local destinations.

The domestic segment’s commanding market position highlights how travelers increasingly explore destinations within their own countries. Independent lodgings particularly benefit from this trend as domestic travelers often seek authentic, locally-owned accommodations that provide genuine cultural experiences and support local communities.

International tourists representing a substantial but secondary segment. While international travel remains important for the independent lodging sector, the domestic segment’s dominance indicates the market’s resilience and ability to thrive on local demand.

This distribution pattern suggests independent lodging providers should prioritize domestic market strategies while maintaining international appeal. The strong domestic foundation provides stability, while international segments offer growth opportunities and market diversification for independent accommodation providers seeking expanded revenue streams.

Tour Type Analysis

Independent Traveller dominates with 56.2% due to growing preference for personalized and flexible travel experiences.

In 2024, Independent Traveller held a dominant market position in By Tour Type Analysis segment of Independent Lodgings Market, with a 56.2% share. This market leadership reflects the modern traveler’s preference for autonomy and customized experiences over structured group arrangements.

Independent travelers gravitate toward independent lodgings because these accommodations offer the flexibility and personalized service that align with their self-directed travel style. This segment values unique experiences, local insights, and the freedom to modify their itineraries spontaneously.

Package Travellers represent a notable secondary segment, utilizing pre-arranged accommodation bundles that include independent lodging options. Tour Groups comprise the smallest segment, as group travelers typically prefer standardized hotel chains for logistical convenience and bulk booking advantages.

The independent traveler dominance signals a fundamental shift in travel preferences toward experiential tourism. Independent lodging providers benefit significantly from this trend by offering authentic local experiences, personalized recommendations, and flexible check-in arrangements that cater to individual traveler needs and preferences effectively.

Key Market Segments

By Consumer Orientation

- Men

- Women

By Type of Hotels

- Budget

- Boutique

- Luxury

- Hostel

- Design Hotel

By Tourist Type

- Domestic

- International

By Age Group

- 15 to 25 Years

- 26 to 35 Years

- 36 to 45 Years

- 46 to 55 Years

- 66 to 75 Years

By Tour Type

- Independent Traveller

- Package Traveller

- Tour Group

Drivers

Increasing Popularity of Unique Lodging Options Drives Growth in Independent Lodgings Market

The Independent Lodgings Market has witnessed a surge in demand for short-term rentals and boutique stays, driven by travelers seeking unique and personalized experiences. These accommodations offer an alternative to conventional hotel stays, appealing to individuals who value authenticity and local immersion. This growing interest is reflected in the increasing number of platforms offering short-term rental options globally.

Digital booking platforms have played a pivotal role in the market’s expansion, enabling easier access to independent properties. The growth of platforms like Airbnb, Booking.com, and others has revolutionized how guests find and book accommodations, providing more options and fostering competition within the market.

Furthermore, younger generations, particularly Millennials and Gen Z, have contributed significantly to the rise of independent lodging options. These demographics are more inclined toward experiences over traditional luxury, often seeking off-the-beaten-path accommodations. Their preference for individuality and flexibility has fueled the demand for independent properties, further driving the market’s growth.

Restraints

Challenges Faced by the Independent Lodgings Market Amid Rising Competition

One of the significant challenges facing the Independent Lodgings Market is the inconsistency in service standards across various properties. Unlike branded hotels, independent lodgings often struggle with maintaining a uniform level of quality, which can lead to dissatisfaction and reduced repeat bookings. Ensuring a high-quality experience becomes essential for operators to retain customers.

Moreover, the market is facing intense competition from well-established branded hotel chains and large online travel platforms. These competitors possess extensive brand recognition, customer loyalty, and resources, making it challenging for independent properties to secure their market share. Independent lodgings need to find ways to differentiate themselves to stay relevant.

Growth Factors

Opportunities for Growth in the Independent Lodgings Market Through Technological Advancements

The integration of smart hospitality technologies presents a considerable growth opportunity for independent lodgings. By adopting smart solutions such as keyless entry, AI-powered concierge services, and room automation, independent properties can enhance guest experience and streamline operations. These technologies are becoming essential for staying competitive in the evolving hospitality industry.

Additionally, partnerships with travel agencies and experience providers can boost the visibility and appeal of independent lodgings. Collaborating with local tour operators, excursion companies, and travel platforms allows independent properties to offer exclusive packages, thereby attracting more guests. Such partnerships provide opportunities for expanding the customer base and driving growth.

Emerging Trends

Adoption of Contactless Check-In and Mobile-First Solutions Drives Growth in the Independent Lodgings Market

A significant trend in the Independent Lodgings Market is the adoption of contactless check-in and mobile-first solutions. These technologies enhance convenience and align with the growing preference for self-service, particularly in the post-pandemic world. Guests can now check in, access their rooms, and interact with staff through mobile apps, offering a seamless and safe experience.

Social media has also become an essential tool for direct guest engagement. Independent lodgings are increasingly using platforms like Instagram, Facebook, and Twitter to connect with potential guests, share user-generated content, and build a loyal customer base.

Additionally, the shift toward hybrid lodging models, which blend work and leisure, is gaining popularity. These accommodations cater to remote workers seeking extended stays while enjoying the benefits of leisure, thereby boosting demand.

Regional Analysis

North America Dominates the Independent Lodgings Market with a Market Share of 56.9%, Valued at USD 132.2 Million

In 2024, North America held a commanding position in the Independent Lodgings Market, with a market share of 56.9%, representing a value of USD 132.2 Million. The region’s dominance is driven by robust tourism infrastructure, high disposable income, and the growing preference for unique lodging experiences. Furthermore, the rise of digital booking platforms has facilitated easier access to independent lodging options, propelling market growth in the U.S. and Canada.

Europe Independent Lodgings Market Trends

Europe ranks as the second-largest region in the Independent Lodgings Market. The increasing preference for boutique stays and cultural travel has contributed to growth in countries such as the UK, France, and Germany. Strong government support for sustainable tourism and the growing appeal of eco-friendly lodging options further fuel market expansion. Europe’s diverse cultural offerings continue to make it a preferred destination for travelers seeking unique lodging experiences.

Asia Pacific Independent Lodgings Market Insights

Asia Pacific is witnessing significant growth in the Independent Lodgings Market, driven by the rising number of middle-class travelers and increasing disposable income in emerging markets like China and India. The region’s strong tourism industry, coupled with the demand for more personalized and local lodging experiences, is expected to drive future growth. Additionally, the growing popularity of mobile booking platforms has further streamlined access to independent properties across the region.

Middle East and Africa Independent Lodgings Market Dynamics

The Middle East and Africa region is experiencing steady growth in the Independent Lodgings Market, particularly in countries like the UAE, South Africa, and Morocco. A growing influx of international travelers, along with an increasing demand for luxury boutique stays and eco-friendly options, is shaping the market landscape. Government-led initiatives to promote tourism and diversify regional economies further support this trend.

Latin America Independent Lodgings Market Growth

Latin America is poised for moderate growth in the Independent Lodgings Market, with countries such as Brazil, Mexico, and Argentina becoming popular destinations for independent travelers. The demand for personalized lodging experiences, along with an expanding middle class, is expected to contribute to future market growth. While the region faces challenges related to infrastructure development, rising interest in local and sustainable travel options provides significant opportunities for independent lodging providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Independent Lodgings Company Insights

In 2024, Central-Hotel Kaiserhof remains a key player in the independent lodgings market, with its established reputation for luxury and impeccable service in the heart of Germany. This hotel appeals to both business and leisure travelers, leveraging its central location and high-end amenities to attract discerning guests.

Palace Hotel Tokyo, located in Japan’s capital, is another major player within the independent lodging sector. Known for its blend of traditional Japanese aesthetics and modern luxury, it continues to draw both international and domestic tourists. The hotel’s strong brand identity, coupled with exceptional service standards, ensures its place as a leader in the upscale independent lodging segment.

Sandy Lane Hotel in Barbados is renowned for offering a unique combination of private luxury and exclusive experiences. This hotel has successfully carved out a niche in the high-end market by providing exceptional personalized services, attracting elite clientele. Its beachfront location and world-class facilities further enhance its market position in the competitive global independent lodging space.

Hotel Hassler Roma, located in the heart of Rome, remains a significant player in the luxury independent lodging market. With its long history of providing bespoke services to elite guests, it is positioned as a symbol of Italian hospitality. The hotel’s luxurious offerings, along with its strategic location overlooking the Spanish Steps, keep it at the forefront of Rome’s high-end independent lodgings sector.

Top Key Players in the Market

- Central-Hotel Kaiserhof

- Palace Hotel Tokyo

- Sandy Lane Hotel

- Hotel Hassler Roma

Recent Developments

- In April 2025, DIAMO raised $4M to empower independent hotels with an AI-powered revenue management platform, aiming to optimize pricing and increase profitability for these properties.

- In July 2025, Journey secured $7.7 million in funding to expand its AI-driven loyalty platform, enhancing customer engagement and retention for independent hotel businesses.

- In November 2024, StayNow, a platform dedicated to supporting independent hotel owners, announced it had raised $2.2 million in seed funding to expand its operations and service offerings for the sector.

Report Scope

Report Features Description Market Value (2024) USD 232.5 Million Forecast Revenue (2034) USD 619.7 Million CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Consumer Orientation (Men, Women), By Type of Hotels (Budget, Boutique, Luxury, Hostel, Design Hotel), By Tourist Type (Domestic, International), By Age Group (15 to 25 Years, 26 to 35 Years, 36 to 45 Years, 46 to 55 Years, 66 to 75 Years), By Tour Type (Independent Traveller, Package Traveller, Tour Group) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Central-Hotel Kaiserhof, Palace Hotel Tokyo, Sandy Lane Hotel, Hotel Hassler Roma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Independent Lodgings MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Independent Lodgings MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Central-Hotel Kaiserhof

- Palace Hotel Tokyo

- Sandy Lane Hotel

- Hotel Hassler Roma