Global In Vitro Fertilization Market By Type (Conventional IVF, IVF with ICSI, IVF with Donor Eggs, and Other Types), By End-User (Fertility Clinics, Surgical Centers, Hospitals, Research Institutes, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 67275

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

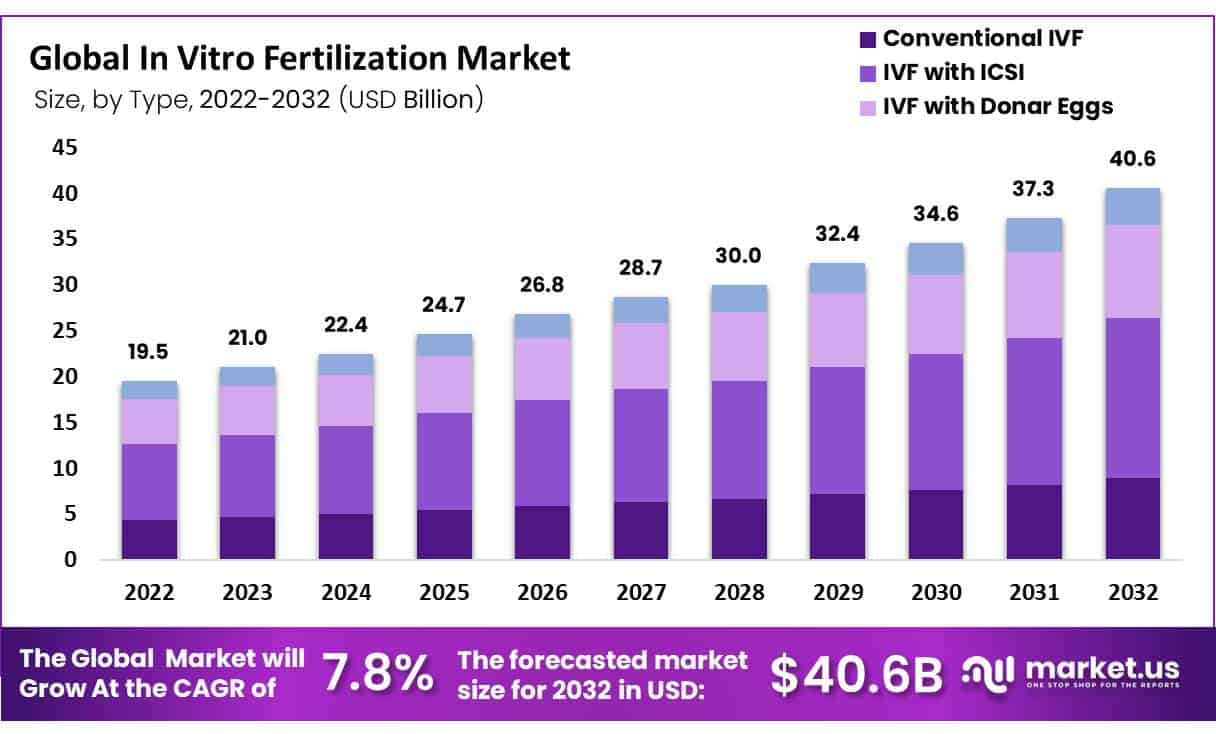

The Global In Vitro Fertilization Market size is expected to be worth around USD 40.6 Billion by 2032, from USD 19.5 Billion in 2022, growing at a CAGR of 7.8% during the forecast period from 2023 to 2032.

One of the most common forms of Assisted Reproductive Technology (ART), In Vitro Fertilization (IVF), involves drugs and surgical procedures. An infertile couple’s embryo development and implantation are aided by IVF treatment. In Vitro Fertilization (IVF) involves manually combining egg and sperm in a laboratory after extracting eggs and retrieving a sample of sperm. Around half a million babies are born annually using IVF, or other assisted reproductive methods because of the growing popularity.

Consequently, the adoption of in Vitro Fertilization (IVF) is anticipated to rise during the forecast period due to the growing popularity of IVF and ICSI treatments. Some of the main driving forces behind the global demand for IVF treatment are the rising success rates of IVF procedures, the rising prevalence of infertility, and the rising awareness of the condition. In addition, it is anticipated that Intracytoplasmic Sperm Injection (ICSI), an advanced and extended fertility treatment for IVF, will propel the market for in Vitro Fertilization (IVF) during the forecast period.

Key Takeaways

- Market Growth: In 2022, the global in vitro fertilization market reached $19.5 billion, with a projected CAGR of 7.8% from 2023 to 2032.

- IVF with ICSI Dominance: IVF with ICSI accounted for 43% of the market due to its effectiveness, notably for male infertility, making it a top choice.

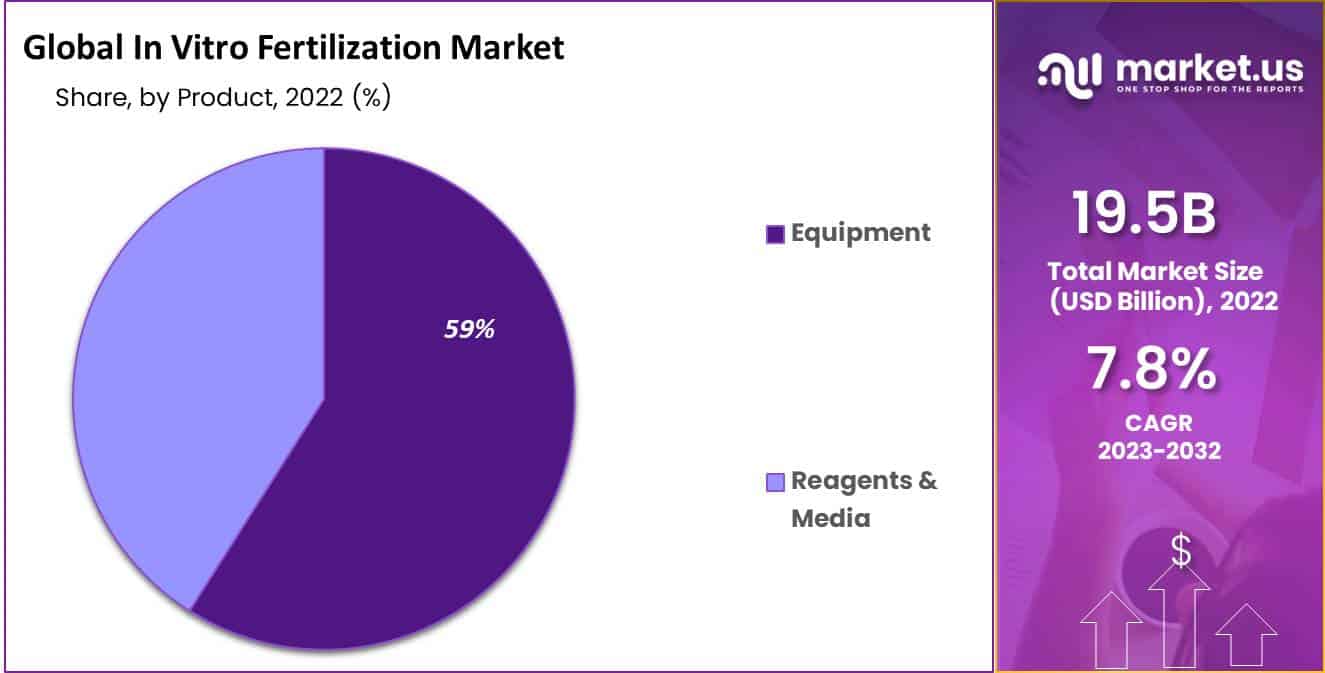

- Equipment Growth: The equipment segment is expected to hold 59% of the market share, driven by increased IVF procedures and advanced equipment.

- Fresh Non-Donor Success: Fresh non-donor IVF cycles are expected to grow at a high CAGR due to their high success rates, particularly with unfrozen eggs.

- Fertility Clinics Lead: Fertility clinics dominated the market with over 79% of the revenue share, supported by increased demand and accessibility.

- Delay in Pregnancy: Delayed pregnancies and infertility risk have driven IVF adoption globally, with infertility linked to delayed parenthood.

- Multiple Birth Risks: The transfer of multiple embryos in IVF poses risks like premature birth and low birth weight, impacting market growth.

- Medical Tourism Opportunities: Developing countries like India and Brazil offer affordable IVF treatments, boosting medical tourism opportunities in the industry.

Type Analysis

The IVF with ICSI Segment Dominated the Market

The IVF market is segmented into conventional IVF, IVF with ICSI, IVF with Donar Eggs, and others. Due to the rising number of IVF-ICSI procedures worldwide, the IVF with ICSI segment dominated the market by 43% of the revenue share. For instance, the Family Fertility Center estimates that Intracytoplasmic Sperm Injection (ICSI) was the most commonly used treatment for male infertility, accounting for approximately 75.0% of all IVF procedures in the United States.

As a result, the growth of this market is expected to be boosted during the forecast period by introducing cutting-edge methods like ICSI and the rising number of cases of male infertility. Similarly, the conventional IVF market is anticipated to expand significantly during the forecast period. This rise can be attributed to the growing number of infertile couples choosing standard IVF because it has a lower risk than ICSI.

Additionally, numerous studies demonstrate that the success rates of conventional IVF and IVF with ICSI are comparable in couples with a female partner experiencing infertility. As a result, such data is anticipated to accelerate this sector’s growth rate by the forecast period.

Product Analysis

The Equipment Segment Is Expected to Witness the Highest Growth Rate During the Forecast Period

The equipment industry is anticipated to experience the highest revenue share of 59% during the forecast period. The high growth rate can be attributed to the rising number of IVF procedures and established manufacturers’ introduction of cutting-edge IVF equipment.

Cycle Type Analysis

Fresh Non-Donor Segment to Hold a Largest Share

Fresh IVF cycles (Non-Donor), thawed IVF cycles (Non-Donor), and donor egg IVF cycles comprise the global market. Due to the high success rate of IVF procedures using fresh eggs or embryos and the rising prevalence of infertility, the fresh non-donor segment is anticipated to grow at a high CAGR over the forecast period. For instance, according to a study published in the Oxford Journal, if the egg used in the process had never been frozen, an estimated 19.0% of all fertility treatments performed in the United Kingdom would result in a live birth.

End-User Analysis

The Fertility Clinics Segment Dominated the Market for IVF

The market for IVF was dominated by the fertility clinics segment, which had the largest revenue share of over 79.0%. During the forecast period, the segment will likely experience the highest CAGR. The number of fertility clinics and ART centers is significantly rising as the demand for ART treatments rises. It is anticipated that the expansion of fertility clinics will be driven by factors such as the availability of specialists, cost-effectiveness, and low or no risks of hospital-acquired infections (HAIs). Hospitals are also used for IVF treatments.

IVF and other infertility treatments are available at several multispecialty hospitals. A higher preference for infertility treatments at hospitals can be attributed to increased accessibility and availability of potential treatments. In most cases, hospitals charge more for IVF treatments than fertility clinics do.

IVF treatments necessitate highly qualified medical professionals. As a result, employing dedicated IVF staff in hospitals is less preferable. Compensation, employment, and training are expensive in developed nations like the United States and the United Kingdom. The low market share of the hospital sector can be attributed to all of the abovementioned factors.

Key Market Segments

Based on Type

- Conventional IVF

- IVF with ICSI

- IVF with Donar Eggs

- Other Types

Based on Product

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Other Equipment

- Reagents & Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Other Reagents & Media

Based on Cycle Type

- Fresh IVF Cycles (Non-Donor)

- Thawed IVF Cycles (Non-Donor)

- Donor Egg IVF Cycles

Based on End-User

- Fertility Clinics

- Surgical Centers

- Hospitals

- Research Institutes

- Other End-Users

Drivers

Delay in Pregnancies is Increasing Demand for IVF Treatment

It has been observed that by the time a woman is 40, her chances of conceiving are half as low as when she was 32. There has been a significant rise in the median age of women who become pregnant for the first time in many countries. This increases the female partners’ infertility risk, causing several pregnancy-related complications.

Couples prioritizing their careers over family planning, late marriages, financial instability, and other factors are some of the primary causes of delay in pregnancy. As a result, the global adoption rate of IVF treatment is rising due to the growing trend toward delaying pregnancy. Infertility is the result of this trend. For instance, several studies have suggested that delayed pregnancies among women are primarily to blame for the global decline in fertility, estimated to be 2.5%.

Restraints

Multiple Births, Premature Delivery, Low Birth Weight, and Other Factors May Restraint the Market’s Growth.

If more than one embryo is transferred to your uterus during IVF, it increases the likelihood of multiple births. Compared to a pregnancy with just one fetus, a pregnancy with multiple fetuses carries a higher risk of early labor and low birth weight. Also, according to research, IVF raises the likelihood that the child will be born prematurely or with low birth weight. Other factors, such as egg-retrieval procedure complications, birth defects, social stigma, ethical issues, and legal issues, hindered the market growth.

Opportunities

Expanding Medical Tourism in Developing Countries

There are several reasons why the emerging countries’ medical tourism industry is doing well. Brazil has more than 20 medical facilities and 150 centers that treat infertility. Compared to Brazil, where an IVF cycle can be completed for US$ 4,000, the average cost in the United States is approximately US$ 12,000.

India is one of the most affordable places in the world to get in vitro fertilization (IVF) and other infertility treatments, with over 500 individual IVF centers. Compared to the United States, healthcare costs in India are up to 90% lower. The typical IVF cycle in the United States costs around US$ 12,000; in India, it can be completed for between US$ 2,000 and US$ 3,000.

Regional Analysis

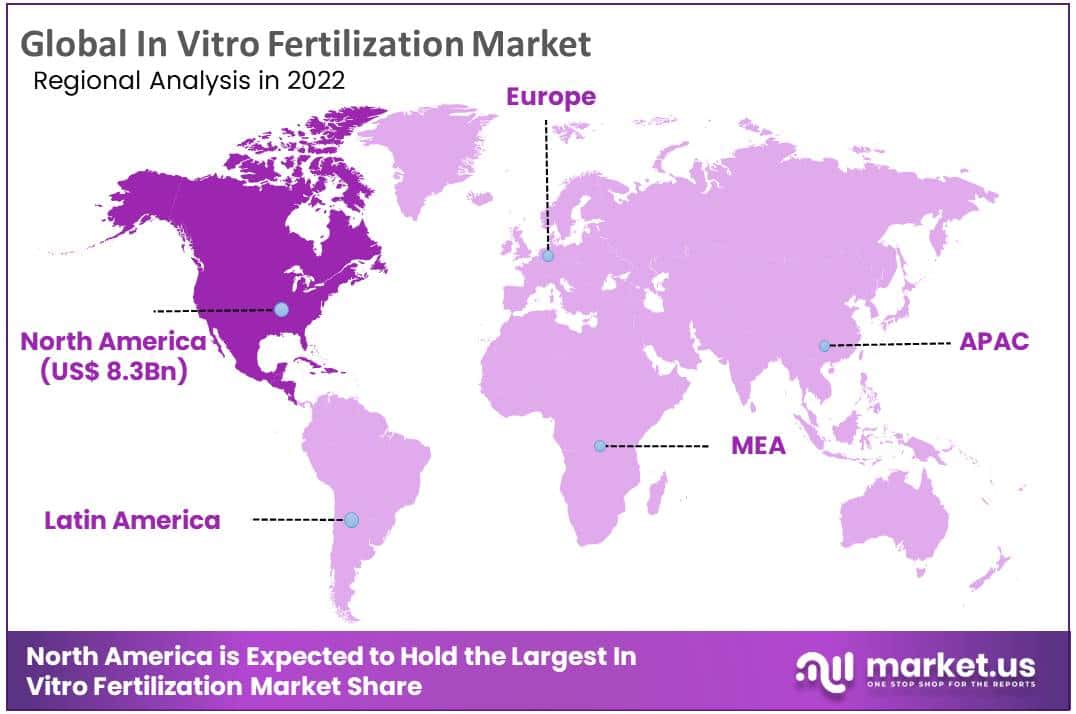

North America Dominates the Global In Vitro Fertilization Market During the Forecast Period

The North American market dominates with a market share of 43%. The reasons to drive IVF treatment procedures in NA are the regulatory reforms, the presence of various prominent players in this region, the increasing prevalence of associated conditions such as standardization of procedures, polycystic ovary syndrome (PCOS), a constant rise in the incidence of infertility in both sexes and government funding for sperm and egg storage.

Due to the rise in medical tourism in this region and the rising awareness of infertility, Asia Pacific is expected to experience a higher CAGR during the forecast period. Additionally, the region has seen an increase in registered fertility clinics, which is anticipated to increase IVF treatment adoption over the forecast period. For instance, the Fertility Society of Australia reports approximately 120 registered clinics in Australia, of which nearly 98.0% provide IVF services.

In addition, Latin America, the Middle East, and Africa are anticipated to hold substantial IVF market shares due to their expanding healthcare infrastructure, which is driving an increase in medical tourism for infertility treatment in these regions.

Key Regions- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Prime Tech and Vitrolife Entered a Partnership to Promote and Develop the Piezo Technique.

The market players use a variety of key strategies, including commercialization, mergers, product innovations, geographic expansions, and so on. For instance, Vitrolife and Prime Tech signed a collaboration agreement to market. They designed the Piezo technique for a more effective Intracytoplasmic Sperm Injection (ICSI) procedure for human IVF worldwide, except for Japan, Thailand, and Malaysia.

A few major players in the market are Kitazato Corporation, Esco Micro Pte., Hamilton Thorne Ltd., Cook Medical, Inc., Cooper Surgical Inc., EMD Serono Inc., Oxford Gene Technology, Nikon Corporation, Esco Micro Pte. Ltd., INVO Bioscience, Bayer AG, Rocket Medical PLC, EMD Sereno Inc., Ovascience Inc., others.

Below are some of the most prominent global in vitro fertilization market players.

Market Key Players

- OvaScience

- FUJIFILM Irvine Scientific

- EMD Serono, Inc.

- CooperSurgical, Inc.

- Genea Biomedx

- Thermo Fisher Scientific Inc.

- Progyny, Inc.

- Boston IVF

- Other Key Players

Recent Developments

- In June 2022– Oma Fertility emerged from stealth and launched a first-of-its-kind network of fertility clinics, providing families with AI-informed, cutting-edge fertility treatments and establishing a new benchmark for IVF success rates.

- In January 2022– One of the most reputable fertility clinics in the world, Boston IVF, entered into a partnership with the Delaware Institute for Reproductive Medicine (DIRM). Through cutting-edge procedures like preimplantation genetic testing, In Vitro fertilization (IVF), and other treatments for male infertility, the exclusive partnership aims to provide locally world-class fertility care and treatments.

Report Scope

Report Features Description Market Value (2022) US$ 19.5 Bn Forecast Revenue (2032) US$ 40.6 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Conventional IVF, IVF with ICSI, IVF with Donor Eggs, and Other Types; By Product- Equipment, Reagents & Media; By Cycle Type- Fresh IVF Cycles (Non-Donor), Thawed IVF Cycles (Non-Donor), and Donor Egg IVF Cycles; and By End-User- Fertility Clinics, Surgical Centers, Hospitals, Research Institutes, Other End-Users. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape OvaScience, FUJIFILM Irvine Scientific, EMD Serono, Inc., CooperSurgical, Inc., Genea Biomedx, Thermo Fisher Scientific Inc., Progyny, Inc., Boston IVF, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is in vitro fertilisation (IVF)?In vitro fertilisation (IVF) is one of the types of assisted reproduction technology (ART) that are used to treat infertility. In vitro fertilization involves fertilizing a sperm-egg mixture outside the body in a laboratory dish. The embryos are then transferred into the uterus where they can implant and grow to a pregnancy.

Who can benefit from IVF?Couples or individuals who are unable to get pregnant naturally or with other fertility treatments may be advised to try IVF. The procedure may be recommended in cases where both or one of the partners has a genetic disorder that could pass on to their children.

What are the main challenges that the IVF market faces?The high cost of IVF treatment, ethical concerns about the use of ART and regulatory hurdles are some of the challenges that the IVF market faces.

What are the main challenges that the IVF market faces?The high cost of IVF treatment, ethical concerns about the use of ART and regulatory hurdles are some of the challenges that the IVF market faces.

In Vitro Fertilization MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

In Vitro Fertilization MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- OvaScience

- FUJIFILM Irvine Scientific

- EMD Serono, Inc.

- CooperSurgical, Inc.

- Genea Biomedx

- Thermo Fisher Scientific Inc.

- Progyny, Inc.

- Boston IVF

- Other Key Players