Global In-Memory Computing Market Size, Share, Statistics Analysis Report By Component (Solutions, Services), By Enterprise Size (SMEs, Large Enterprises), By Industry Vertical (BFSI, IT & Telecom, Retail & E-Commerce, Healthcare, Government, Media & Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132967

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

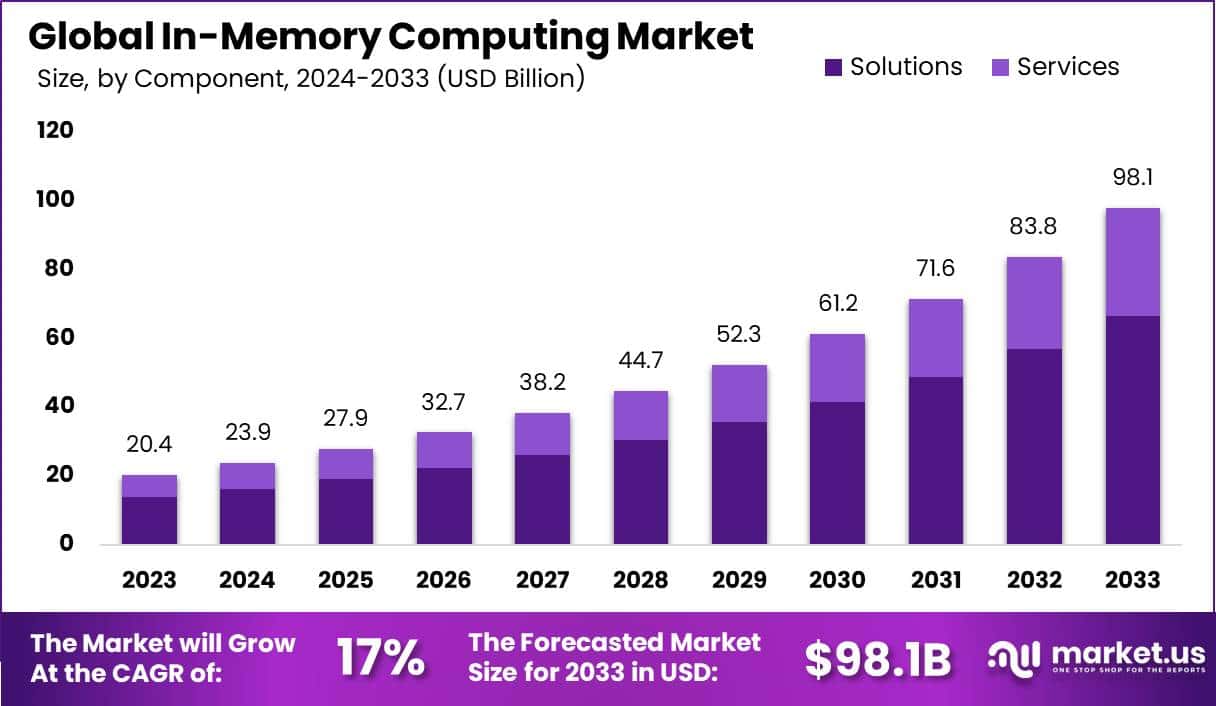

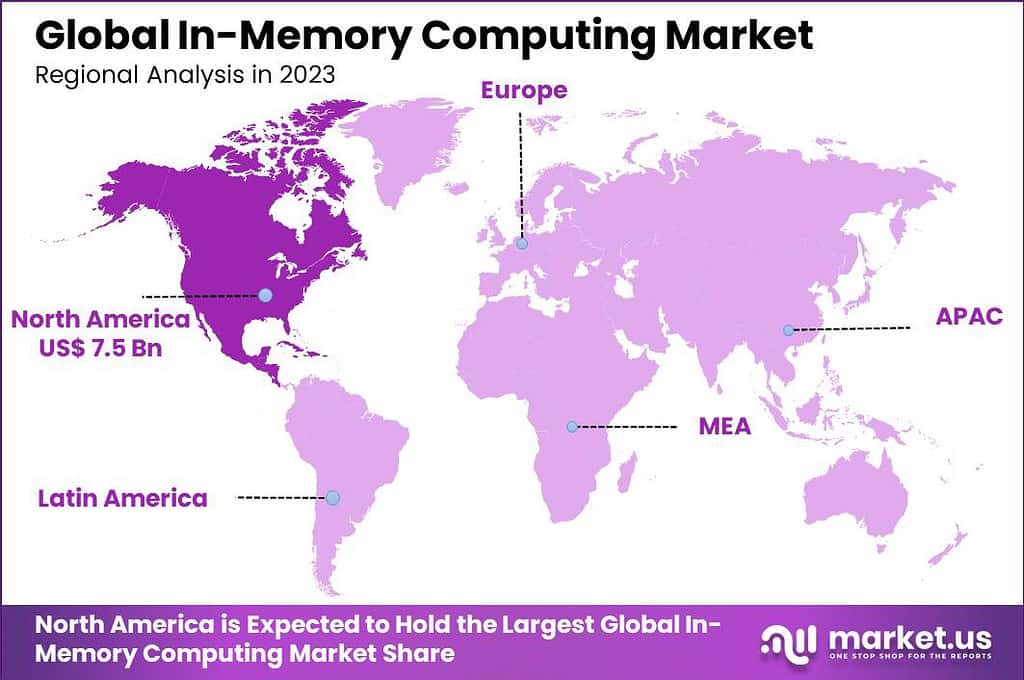

The Global In-Memory Computing Market size is expected to be worth around USD 98.1 Billion By 2033, from USD 20.4 Billion in 2023, growing at a CAGR of 17% during the forecast period from 2024 to 2033. In 2023, North America dominated the in-memory computing market, capturing over 37% of the market share, with revenues totaling USD 7.5 billion.

In-memory computing is a technology that boosts the speed and performance of applications by processing and storing data directly in the main RAM of the computer, rather than relying on slower disk-based storage. This approach enables much quicker data access and processing speeds, which is critical for applications requiring real-time operations and analytics.

The in-memory computing market is growing rapidly, driven by the increasing demand for faster processing capabilities and instant data analysis in fields such as finance, healthcare, and telecommunications. This market encompasses a range of products including in-memory data grids, in-memory databases, and in-memory analytics, all designed to provide high-speed, scalable, and efficient data processing solutions.

Several factors are propelling the in-memory computing market forward. The exponential growth in data volumes and complexity is a primary driver, as businesses require more sophisticated computing capabilities to process and analyze data quickly. Additionally, the need for real-time decision-making in areas like fraud detection, dynamic pricing, and on-the-spot analytics in industries such as e-commerce and financial services fuels the demand for IMC technologies.

The demand for in-memory computing is notably high in sectors that rely on real-time data processing. Financial services, telecommunications, and e-commerce are particularly keen on adopting these technologies to gain a competitive edge through faster data insights. Moreover, the shift towards cloud-based solutions offers significant opportunities for the in-memory computing market, as these environments are ideally suited to leverage the scalability and flexibility of IMC.

Technological advancements are continuously reshaping the in-memory computing landscape. Recent innovations include the development of next-generation memory chips that offer higher density and energy efficiency, along with enhanced compute capabilities directly on the chip. Researchers and developers are focusing on hybrid designs that combine traditional and neuromorphic computing elements, which mimic the human brain’s architecture to improve efficiency and computational power.

Key Takeaways

- The Global In-Memory Computing Market is projected to reach USD 98.1 billion by 2033, up from USD 20.4 billion in 2023, with a compound annual growth rate (CAGR) of 17% during the forecast period from 2024 to 2033.

- In 2023, the Solutions segment held a dominant market position, accounting for more than 68% of the total share in the in-memory computing market.

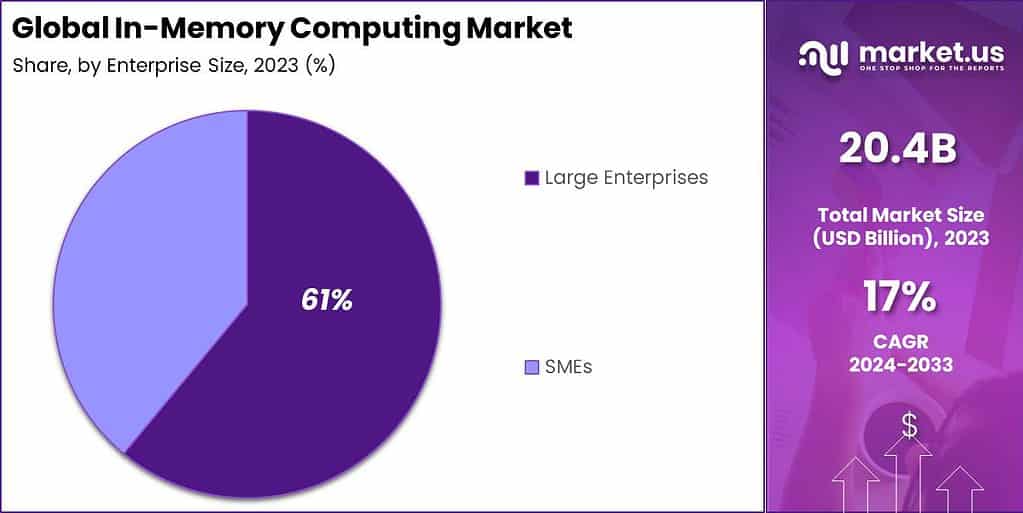

- The Large Enterprises segment dominated the in-memory computing market in 2023, holding over 61% of the market share.

- The BFSI sector emerged as a key player in the in-memory computing market in 2023, capturing more than 24% of the market share.

- North America led the global in-memory computing market in 2023, with the region holding over 37% of the market share, generating revenues of approximately USD 7.5 billion.

Component Analysis

In 2023, the Solutions segment of the In-Memory Computing market held a dominant position, capturing over 68% market share. This segment encompasses various technologies including in-memory databases (IMDB), data grids, and application platforms which are essential for businesses seeking real-time processing and analytics capabilities.

The demand for Solutions is primarily driven by the need to process and analyze large volumes of data at unprecedented speeds, which is crucial in sectors like finance, retail, and telecommunications where decision-making speed can significantly influence business outcomes. The substantial share held by the Solutions segment can be attributed to its ability to provide significant performance improvements over traditional disk-based systems.

In-memory solutions offer faster data retrieval and processing by storing data directly in RAM, thus eliminating the latency involved in accessing data from hard disk drives. This technological advantage is vital for applications requiring instant data access and analysis, such as real-time customer analytics, fraud detection, and dynamic pricing strategies.

Moreover, ongoing advancements in RAM technology, such as the development of non-volatile RAM (NVRAM) and enhancements in parallel processing capabilities, have further bolstered the appeal of in-memory solutions. These technological improvements have not only enhanced the performance and scalability of in-memory computing systems but have also made them more cost-effective and accessible to a broader range of businesses.

The Solutions segment is likely to maintain its dominance in the foreseeable future, driven by continuous innovation and the integration of AI and machine learning capabilities, which enhance the functionality and efficiency of in-memory computing platforms. As businesses increasingly prioritize digital transformation and data-driven strategies, the reliance on robust in-memory computing solutions will continue to grow, supporting faster decision-making and operational agility.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant position in the In-Memory Computing market, securing more than a 61% share. This predominance is largely due to the extensive resources that large enterprises have at their disposal, which allow them to invest in advanced technologies such as in-memory computing to enhance their data processing capabilities.

Large organizations typically handle vast amounts of data, necessitating robust systems that can accelerate data analytics and processing to support real-time decision-making and operational efficiency. Large enterprises are often at the forefront of adopting new technologies that can create a competitive advantage, and in-memory computing is no exception.

These firms are more likely to invest in in-memory solutions because they can significantly improve the performance of business-critical applications, from real-time analytics to complex ERP systems, thus supporting faster and more informed business decisions. Furthermore, the scalability of in-memory computing platforms is a crucial factor for large organizations that need to manage growth and system complexity without compromising on performance.

Additionally, large enterprises are increasingly focusing on digital transformation initiatives that integrate AI and machine learning with in-memory computing. This integration helps to automate and enhance various business processes, leading to increased productivity and reduced operational costs. The financial capability to experiment with and implement these advanced technologies continues to drive the high adoption rates within this segment.

Overall, the dominance of large enterprises in the in-memory computing market is expected to persist as these organizations continue to leverage the speed, efficiency, and scalability of in-memory technologies to maintain a strategic edge in a data-driven business environment.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) sector held a dominant market position in the In-Memory Computing market, capturing more than a 24% share. This prominence can be attributed to the sector’s critical need for real-time processing and analysis capabilities to handle complex financial transactions and risk management tasks efficiently.

Banks, financial institutions, and insurance companies deal with vast volumes of data that require high-speed processing to derive actionable insights quickly, which is essential for maintaining competitive advantage and compliance with regulatory requirements.

The BFSI sector relies heavily on in-memory computing to enhance the performance of applications involved in fraud detection, real-time analytics, customer relationship management, and risk management. These applications must process and analyze data in real-time to detect and prevent fraud, manage risks, and provide personalized services to customers, making in-memory computing an invaluable technology for these tasks.

Furthermore, the ongoing digital transformation in the BFSI sector, driven by the shift towards digital banking and increased consumer expectations for fast, on-demand financial services, continues to fuel the adoption of in-memory computing technologies. These technologies help financial institutions to not only improve their operational efficiencies but also to innovate by developing new financial products and services that meet the evolving needs of the market.

Overall, the demand within the BFSI segment for in-memory computing is expected to grow as institutions continue to leverage this technology to process, analyze, and manage financial data more effectively, ensuring faster response times and better service delivery in a highly regulated and competitive environment.

Key Market Segments

By Component

- Solutions

- Services

By Enterprise Size

- SMEs

- Large Enterprises

By Industry Vertical

- BFSI

- IT & Telecom

- Retail & E-Commerce

- Healthcare

- Government

- Media & Entertainment

- Others

Driver

The Rise of Real-Time Analytics

In-memory computing (IMC) has witnessed significant growth, driven primarily by the need for real-time analytics across industries. Today, enterprises demand faster access to data insights for critical decision-making, customer experience enhancement, fraud detection, and operational efficiency.

Traditional storage systems often fail to meet these performance needs due to inherent latency in data retrieval and processing from disk-based databases. IMC bridges this gap by storing data in the computer’s main memory (RAM), resulting in faster access and enabling near-instantaneous analytics capabilities.

Additionally, the explosion of data generated from Internet of Things (IoT) devices and digital transformation initiatives has underscored the need for faster processing power. Organizations can leverage IMC to analyze and act on data from multiple sources in real-time, a capability that is vital in modern, data-driven business landscapes.

Restraint

High Cost of Implementation

Despite its compelling advantages, the widespread adoption of in-memory computing is often restrained by the high cost of implementation. IMC requires large amounts of Random Access Memory (RAM), which can be significantly more expensive than traditional disk storage.

For many businesses, especially small and medium enterprises (SMEs), the financial burden associated with upgrading existing IT infrastructure to support IMC is a major deterrent. The transition to in-memory storage also involves substantial expenses related to software licensing, hardware acquisition, integration, and ongoing maintenance. Organizations must weigh the cost-benefit analysis carefully, considering whether the speed and agility provided by IMC justifies the high initial and operational costs.

Opportunity

Growing Demand for Advanced Analytics and AI

The rise of artificial intelligence (AI) and advanced analytics represents a massive opportunity for in-memory computing. AI-driven solutions and sophisticated analytics require high-speed processing and the ability to handle large, complex datasets.

IMC, with its capability to store and process data in main memory, offers a perfect fit for these high-performance requirements, providing a platform to build real-time, AI-driven applications and decision-making systems.

Moreover, the advent of edge computing in the IoT ecosystem provides another key opportunity. By combining IMC with AI capabilities at the edge, organizations can enable real-time data processing close to the source.

Challenge

Data Security and Compliance Concerns

One of the critical challenges faced by in-memory computing is addressing data security and compliance concerns. Storing vast amounts of sensitive data in-memory, often accessible at high speeds, introduces significant risks related to data breaches, unauthorized access, and data leaks. While IMC provides unmatched performance benefits, it also necessitates robust security measures to protect data from potential threats.

Unlike traditional disk storage, data in IMC solutions is continuously held in volatile memory, raising concerns about its safety in the event of power loss or hardware failure. Ensuring data persistence and integrity requires complex backup and failover mechanisms, which may not always be foolproof. This complexity adds a layer of difficulty to managing in-memory systems securely.

Emerging Trends

In-memory computing (IMC) is transforming how we process data by storing it directly in a computer’s main memory (RAM) rather than on traditional disk-based systems.

A notable trend in IMC is its application in artificial intelligence (AI) and machine learning (ML). Traditional computing architectures often struggle with the intensive data demands of AI and ML tasks. IMC offers a solution by allowing computations to occur where the data resides, minimizing data movement and enhancing processing efficiency.

Another development is the integration of IMC with emerging memory technologies like resistive random-access memory (ReRAM) and phase-change memory (PCM). These technologies enable computations within the memory hardware itself, further reducing data transfer times and energy consumption.

The rise of high-bandwidth memory (HBM) is also noteworthy. HBM stacks multiple memory chips vertically, increasing data transfer rates and reducing power consumption. This design is particularly advantageous for applications requiring high-speed data access, such as AI and graphics processing.

Business Benefits

In-memory computing offers several advantages for businesses aiming to enhance performance and efficiency. By storing data in RAM, IMC enables rapid data retrieval and processing, leading to faster decision-making and improved customer experiences. Companies can analyze large datasets in real-time, allowing for immediate insights and responses to market changes.

IMC also supports the integration of structured and unstructured data from various sources, facilitating comprehensive analytics. This capability is crucial for businesses dealing with diverse data types, such as social media content, customer feedback, and transactional records.

Additionally, IMC can lead to cost savings by reducing the need for extensive disk storage and associated maintenance. While the initial investment in in-memory technology may be higher, the long-term benefits of reduced hardware requirements and improved operational efficiency can offset these costs. Businesses can achieve a lower total cost of ownership while delivering faster services to their customers.

AI Impact on In-Memory Computing Market

Artificial Intelligence (AI) technology plays a transformative role in the In-Memory Computing (IMC) market, primarily by enhancing the capabilities of in-memory computing systems to process and analyze large datasets rapidly and with greater intelligence.

For instance, In October 2023, researchers at IBM in San Jose, California, unveiled the NorthPole processor chip, a groundbreaking advancement inspired by the human brain. This chip marks a significant leap in artificial intelligence technology, offering faster processing speeds while consuming notably less power compared to conventional chips.

Its innovative design minimizes the reliance on external memory, facilitating quicker execution of complex tasks like image recognition. The NorthPole chip is poised to enhance efficiency and performance in AI applications, potentially transforming the technological landscape. Here’s how AI impacts the field of in-memory computing:

- Enhanced Data Processing Speeds: AI algorithms are designed to optimize data processing tasks by learning from data patterns and making intelligent decisions. When combined with in-memory computing, which already reduces data access times by storing data in RAM, AI can further enhance processing speeds. This is crucial for applications requiring real-time analytics and decision-making, such as dynamic pricing and fraud detection.

- Improved Analytical Capabilities: AI enhances the analytical capabilities of in-memory computing systems by providing advanced analytics functionalities like predictive analytics, machine learning model training, and deep learning. These capabilities allow businesses to forecast future trends, personalize customer experiences, and make more informed strategic decisions.

- Automation of Complex Tasks: AI can automate complex data processing and analysis tasks within in-memory computing environments. This automation reduces the need for manual intervention, decreases the likelihood of human error, and increases efficiency, especially in processing real-time data streams from IoT devices or other real-time data sources.

- Scalability and Efficiency: AI can help optimize the allocation of in-memory resources, improving the scalability and efficiency of in-memory computing systems. By predicting workload patterns and automatically adjusting resources, AI ensures that the in-memory computing environment is not only fast but also cost-effective and energy-efficient.

- Cognitive Services Integration: AI enables the integration of cognitive computing capabilities into in-memory systems, allowing businesses to implement advanced features such as natural language processing, image recognition, and voice recognition. These features can significantly enhance user interactions and service offerings in various applications.

Regional Analysis

In 2023, North America held a dominant market position in the in-memory computing market, capturing more than a 37% share, with revenues reaching USD 7.5 billion. This leadership is largely due to the region’s strong technological infrastructure and the rapid adoption of advanced computing solutions.

North American companies are at the forefront of integrating in-memory computing to enhance real-time data processing and analytics capabilities, which are critical for driving business decisions and customer satisfaction. Also the country is home to several key players in the in-memory computing market.

These industry leaders not only contribute to regional market dominance through constant innovation and development of new technologies but also through strategic partnerships that expand their reach and solution capabilities. This has fostered a dynamic market environment where continuous improvement is necessary to maintain a competitive edge.

The region’s emphasis on data-driven technologies for achieving operational efficiencies and competitive advantages has also spurred the growth of the in-memory computing market. With the growing volume of data generated by digital interactions and transactions, North American businesses are increasingly reliant on real-time processing solutions to quickly analyze and act upon this information.

Initiatives aimed at enhancing digital infrastructure and promoting the use of big data analytics in industries like finance and healthcare are likely to continue driving the market’s expansion in the region. This ensures that North America not only maintains its market leadership but also sets the pace for the global advancement of in-memory computing technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the In-memory computing landscape, several key players are instrumental in shaping the industry, with their significant contributions and market presence.

SAP SE is a heavyweight in the in-memory computing market, primarily because of its pioneering product, SAP HANA. This technology has revolutionized how businesses handle and process data by allowing real-time analytics and applications to run simultaneously without the lag. SAP’s continuous innovation in enhancing the capabilities of SAP HANA, ensures its leadership position in the market.

Oracle Corporation follows closely with its impressive suite of in-memory computing solutions that cater to diverse industry needs. Oracle’s in-memory database technology is designed to deliver enhanced performance and accelerated processing speeds, which are critical for businesses dealing with large volumes of data.

Altibase Corporation holds a significant niche in the in-memory computing market with its open-source and hybrid database solutions. Altibase’s hybrid approach combines in-memory and on-disk databases in a single unified engine, providing flexibility and cost-efficiency that many businesses find attractive.

Top Key Players in the Market

- SAP SE

- Oracle Corporation

- Altibase Corporation

- GridGain Systems Inc.

- Software AG

- TIBCO Software Inc.

- Gigaspaces Technologies Inc.

- SAS Institute

- Hazelcast Inc.

- IBM Corporation

- Microsoft Corporation

- Mongodb

- Datastax Inc.

- Other Key Players

Recent Developments

- In June 2024, Synthara, a Swiss startup specializing in semiconductors, secured an ~$11.1 million investment aimed at advancing its in-memory computing technology for embedded AI. This funding round, led by Vsquared Ventures alongside other notable investors such as OTB Ventures, Hermann Hauser’s Onsight Ventures, and High-Tech Gründerfonds, marks a significant step in fostering innovative AI applications. The investment underscores a robust confidence in Synthara’s potential to impact the semiconductor industry significantly.

- Additionally, in December 2023, the Lyvia Group, a leading provider of B2B software services in Europe, announced a new partnership with GigaSpaces, a pioneer in in-memory computing. This collaboration aims to enhance Lyvia’s data-driven technology offerings, leveraging GigaSpaces’ expertise and its Smart DIH platform. The partnership is poised to drive technological advancement and improve operational efficiencies, showcasing a strong commitment to evolving enterprise solutions through strategic alliances.

Report Scope

Report Features Description Market Value (2023) USD 20.4 Bn Forecast Revenue (2033) USD 98.1 Bn CAGR (2024-2033) 17% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Enterprise Size (SMEs, Large Enterprises), By Industry Vertical (BFSI, IT & Telecom, Retail & E-Commerce, Healthcare, Government, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Oracle Corporation, Altibase Corporation, GridGain Systems Inc., Software AG, TIBCO Software Inc., Gigaspaces Technologies Inc., SAS Institute, Hazelcast Inc., IBM Corporation, Microsoft Corporation, Mongodb, Datastax Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In-Memory Computing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

In-Memory Computing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Oracle Corporation

- Altibase Corporation

- GridGain Systems Inc.

- Software AG

- TIBCO Software Inc.

- Gigaspaces Technologies Inc.

- SAS Institute

- Hazelcast Inc.

- IBM Corporation

- Microsoft Corporation

- Mongodb

- Datastax Inc.

- Other Key Players