Global In-flight Internet Market Size, Share, Industry Analysis Report By Aircraft Type (Commercial aircraft, Business jets, Military aircraft), By Service Type (Satellite-based connectivity, Ka-band, Ku-band, L-band, Air-to-ground connectivity, ATG, 5G ATG, Hybrid), By Technology (Wi-Fi, 4G/LTE, 5G (fastest), Satellite broadband), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161593

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

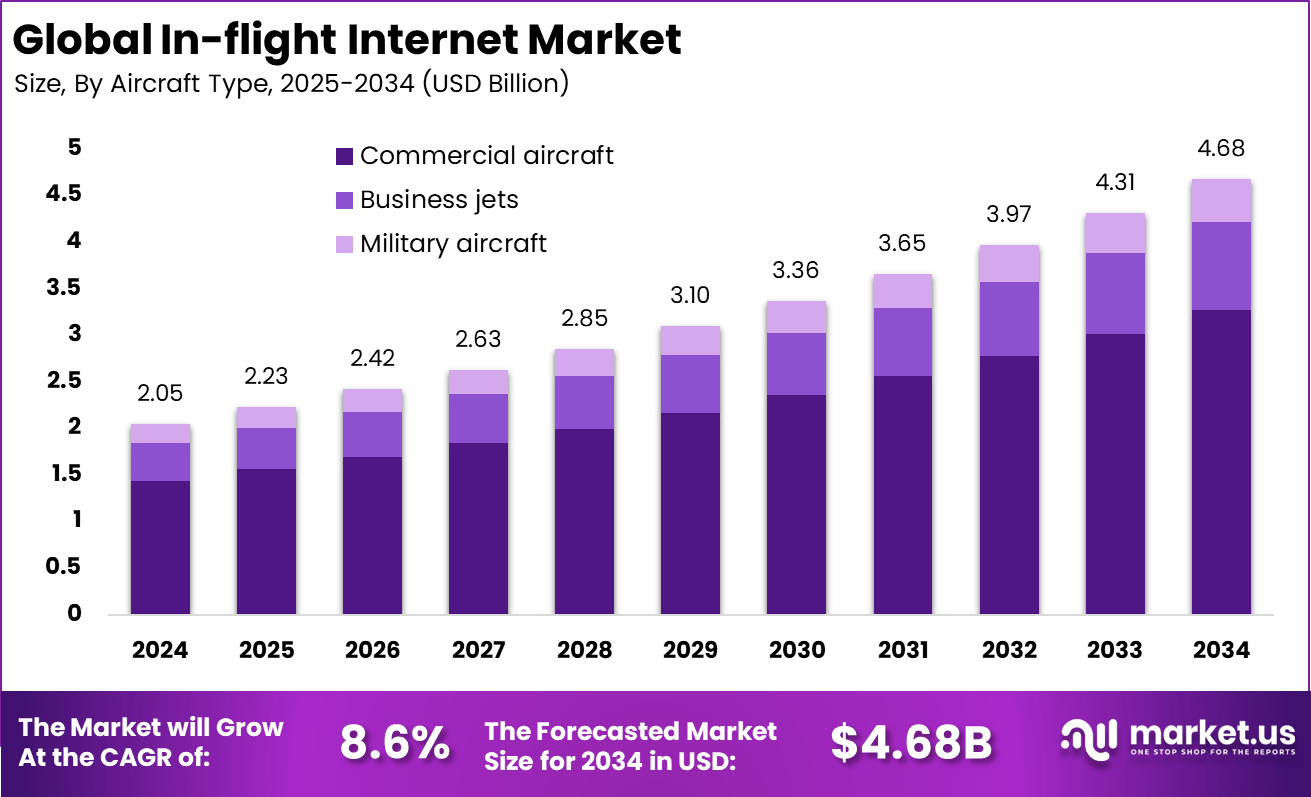

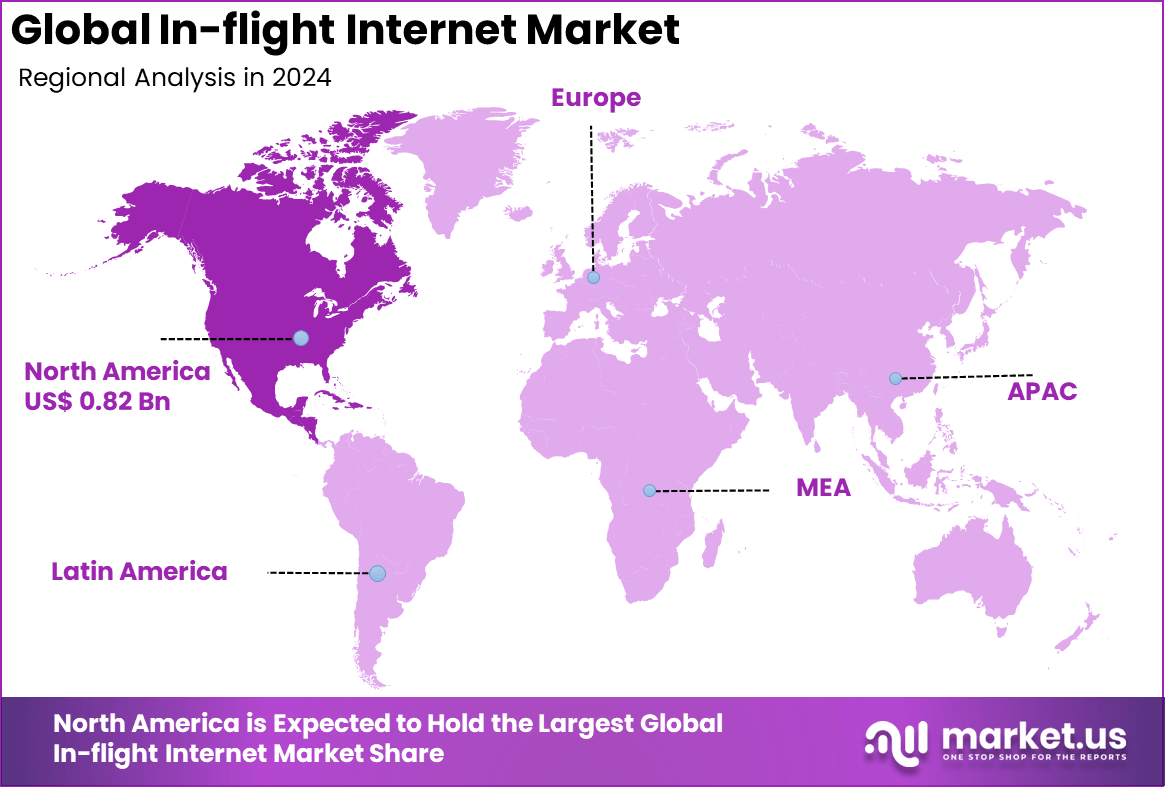

The Global In-flight Internet Market size is expected to be worth around USD 4.68 billion by 2034, from USD 2.05 billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 0.82 billion in revenue.

The in-flight internet market covers connectivity systems that allow passengers and crew to access online services during air travel. These solutions use satellite networks, air-to-ground links, onboard antennas, modems, and cabin distribution hardware to provide Wi-Fi, messaging, streaming, and operational data support. Both commercial airlines and private aviation operators deploy these systems to improve customer experience and enable digital operations.

Rising passenger expectations for continuous connectivity is the primary force behind adoption. Airlines are using in-cabin Wi-Fi to enhance loyalty, support entertainment platforms, and gather service feedback. Crew connectivity requirements for flight operations, logistics updates, and electronic flight bags further encourage installation. Growth in long-haul travel and fleet modernization increases the number of aircraft equipped with connectivity hardware.

Commercial airlines capture the largest share, with nearly half the market attributed to regional and low-cost carriers offering connectivity to boost passenger experience. Free and paid Wi-Fi models coexist, where paid services currently cover 59% of usage due to monetization strategies, while free Wi-Fi grows at over a 7% annual rate supported by ad-based and sponsorship models. Passengers use in-flight internet for streaming, messaging, and accessing real-time information, driving sustained growth in service adoption.

For instance, In October 2024, Textron announced that SpaceX’s Starlink service is now available on the Cessna Citation Longitude business jet, providing fast and reliable in-flight internet. The upgrade supports streaming, video calls, and other high-data activities at cruising altitudes, improving connectivity across more routes and expanding access to advanced satellite internet in business aviation.

Key Takeaway

- Commercial aircraft held nearly 70% of total adoption, showing that most in-flight connectivity demand comes from passenger airlines.

- Satellite-based connectivity accounted for about 65%, reflecting its reliability for long-haul and cross-border flights.

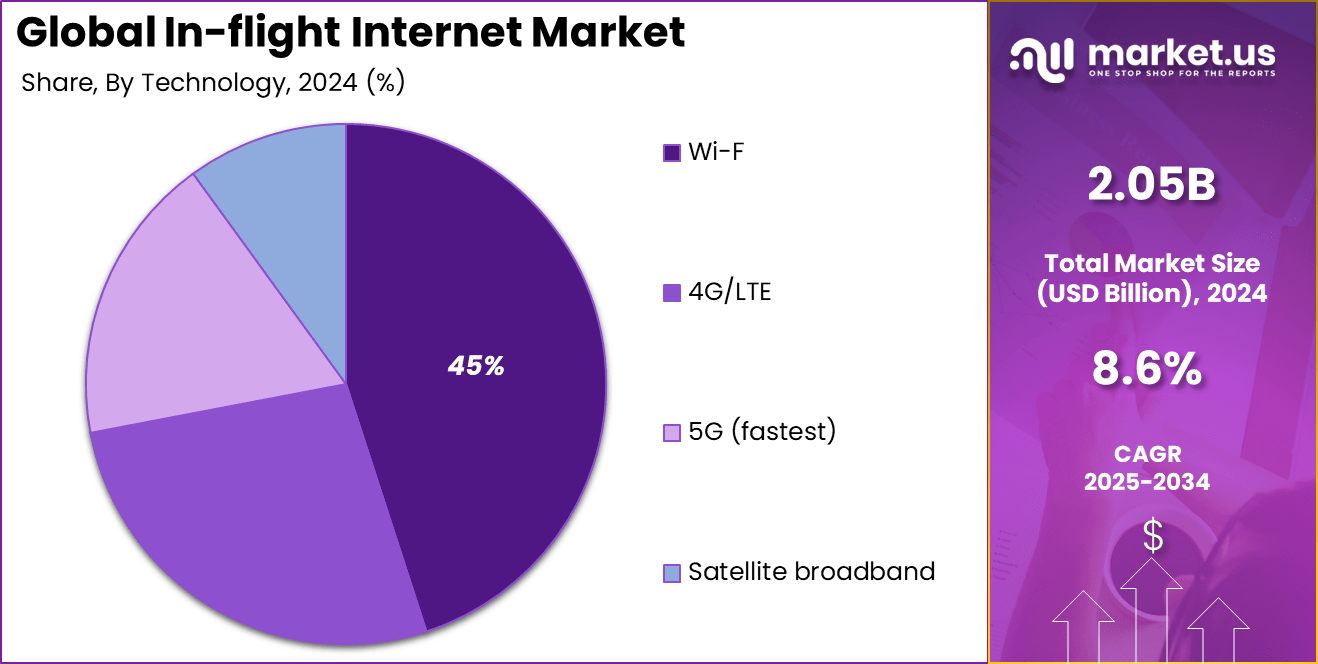

- Wi-Fi services made up around 45%, indicating strong passenger expectations for onboard internet access.

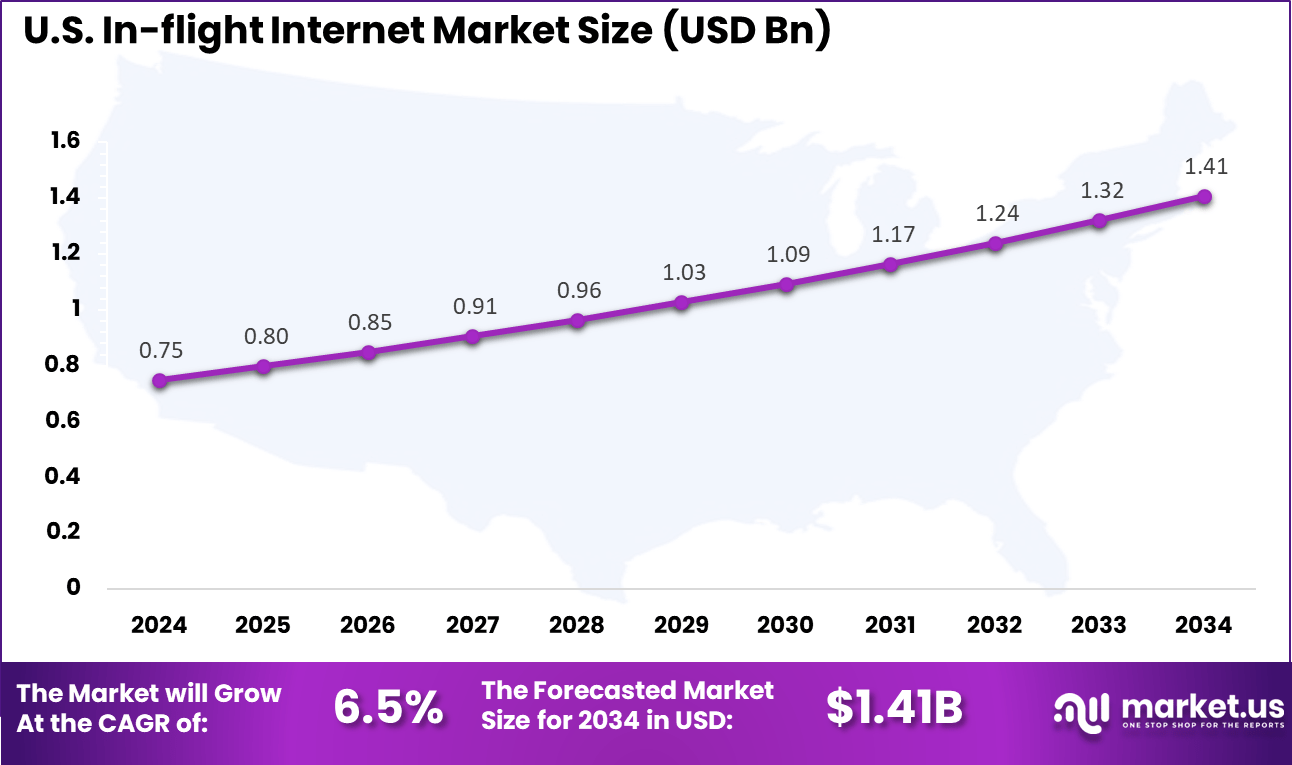

- The U.S. market showed steady growth, supported by rising passenger connectivity needs and service upgrades.

- North America captured over 40%, confirming its lead in infrastructure deployment and airline partnerships.

- Growth at roughly 6.5% CAGR signals consistent investment in high-speed in-flight connectivity solutions.

Analyst Viewpoint

Increasing adoption technologies include advanced satellite communications via hybrid Ku/Ka-band systems, 5G-enabled ground stations, and intelligent bandwidth allocation software. Electronically steerable antennas and smart onboard routers enable consistent service quality. The integration of next-gen satellite constellations with terrestrial networks delivers redundancy and reliability.

These technologies are adopted to meet rising passenger needs, optimize airline operational efficiency, and improve onboard experience. Key reasons for adopting in-flight internet services reflect passenger expectations for continuous digital access and airline efforts to differentiate through enhanced customer experience.

Business travelers seek connectivity to maintain workflow, while leisure passengers benefit from entertainment streaming and social connectivity. Airlines also recognize the ancillary revenue potential by providing tiered internet packages and premium content services, making investments attractive. Investment opportunities are growing in satellite network deployments, antenna system innovations, and onboard communication hardware.

The expanding commercial aviation sector’s push for connectivity presents scalable revenue streams in underserved markets and premium service models. Given the rapid launch of small satellites – rising from over 2400 units in 2022 to nearly 2900 in 2023 – investment in satellite infrastructure and service platforms remains a high-growth area.

Role of Generative AI

Generative AI is reshaping the in-flight internet experience by powering smarter operations and more personalized passenger services. It enhances flight routing by processing real-time weather and traffic data to recommend the most fuel-efficient paths, reducing emissions by thousands of tons annually. Airlines are also using AI to predict maintenance issues in advance, increasing aircraft availability and safety.

Additionally, generative AI improves passenger interactions by personalizing services such as entertainment options and loyalty programs, boosting traveler satisfaction and engagement. Around 60% of airlines now incorporate generative AI tools to optimize their operational workflows and customer experience during flights, marking a significant shift in aviation technology adoption.

This technology goes beyond flight operations; it helps airports plan smarter terminal layouts by simulating passenger flows and bottlenecks before construction begins. During disruptions, AI assists in quick rebooking and alternate travel suggestions, minimizing stress for travelers and protecting airline reputations. These innovations collectively signify an evolving digital ecosystem where generative AI plays a central role in making air travel more efficient, sustainable, and enjoyable for passengers

U.S. Market Size

The market for In-flight Internet within the U.S. is growing tremendously and is currently valued at USD 0.75 billion, the market has a projected CAGR of 6.5%. The market is growing tremendously due to increased air travel and strong passenger expectations for connectivity.

U.S. travelers frequently use mobile devices and expect consistent internet access for entertainment, communication, and work during flights. Airlines are responding by investing in advanced satellite and 5G technologies to provide faster, more reliable service. Additionally, competitive pressure is encouraging carriers to enhance onboard internet offerings, making connectivity an important factor in passenger satisfaction and loyalty.

For instance, In April 2025, American Airlines announced it will offer free high-speed in-flight Wi-Fi from January 2026 through a partnership with AT&T. The rollout will cover more than 500 regional aircraft and provide complimentary access to frequent-flyer members, reinforcing U.S. leadership in the in-flight internet market. The move follows successful trials and highlights the growing importance of connectivity in enhancing passenger experience and loyalty.

In 2024, North America held a dominant market position in the Global In-flight Internet Market, capturing more than a 40% share, holding USD 0.82 billion in revenue. This dominance is due to its advanced technological infrastructure and high adoption of in-flight connectivity services.

The region’s strong presence of major airlines committed to upgrading internet capabilities and the demand from business and leisure travelers for reliable onboard connectivity contributed significantly. Investments in satellite technology and supportive regulatory frameworks further facilitated market growth, positioning North America as a leader in offering advanced, high-speed in-flight internet solutions to passengers.

For instance, in April 2025, American Airlines announced it would join other major North American carriers such as United, Delta Air Lines, Air Canada, and Southwest in transforming the air travel experience by offering faster in-flight internet services. This collective push by leading airlines to upgrade connectivity infrastructure highlights North America’s continued dominance in the in-flight internet market.

Aircraft Type Analysis

In 2024, The Commercial Aircraft segment held a dominant market position, capturing a 70% share of the Global In-flight Internet Market. This dominance is largely because commercial airlines operate larger fleets and tend to prioritize passenger experience by offering internet services on board.

With growing passenger expectations for connectivity during flights, especially on long-haul and international routes, commercial aircraft remain the primary platform for in-flight internet deployment. Their extensive flight networks and higher passenger volumes justify sustained investments in advanced connectivity solutions.

Additionally, commercial aircraft are at the forefront of adopting innovative technologies like satellite-based systems, which can support thousands of passengers simultaneously. These investments enhance customer satisfaction and help airlines differentiate themselves in a competitive environment. Therefore, commercial aircraft’s scale and strategic focus on passenger comfort firmly establish their leadership in the market.

For Instance, In October 2025, United Airlines operated its first mainline commercial flight with Starlink satellite internet, marking a major step in in-flight connectivity. The Newark–Houston flight on a Boeing 737 offered passengers high-speed Wi-Fi on personal devices and in-flight entertainment systems, reflecting the airline industry’s push to adopt advanced internet technologies to improve passenger experience.

Service Type Analysis

In 2024, the Satellite-Based Connectivity segment held a dominant market position, capturing a 65% share of the Global In-flight Internet Market. This dominance reflects its ability to provide consistent internet service over long distances and in remote areas where ground-based coverage is unavailable.

Airlines prefer satellite connectivity because it offers global reach, covering transoceanic and polar flight routes effectively. The growing deployment of low-earth orbit satellites continues to increase bandwidth and reduce latency, making satellite-based internet the preferred choice for reliable onboard connectivity.

Moreover, satellite-based systems cater effectively to international airlines that need a dependable and continuous connection on flights crossing continents. This broad coverage, combined with improved bandwidth and lower latency, makes satellite-based connectivity the preferred choice for many airlines aiming to offer seamless internet onboard.

For instance, In May 2025, SITA introduced a satellite connectivity service for airlines and airports worldwide, using low-earth orbit satellites to deliver secure, high-bandwidth, and low-latency communication. The service is designed to maintain critical airport operations during natural disasters or network outages, underscoring the growing need for reliable, globally available aviation communications.

Technology Analysis

In 2024, The Wi-Fi segment held a dominant market position, capturing a 45% share of the Global In-flight Internet Market. Wi-Fi technology is widely adopted because it allows passengers to connect multiple devices easily, supporting the use of smartphones, tablets, and laptops during flights.

The familiarity and convenience of Wi-Fi make it the standard choice for passengers, who expect seamless browsing and streaming experiences. Furthermore, advances in Wi-Fi standards onboard aircraft have increased speeds and reliability, making it suitable for a range of passenger needs.

Airlines prioritize Wi-Fi as it enhances passenger satisfaction and engagement by enabling streaming, browsing, and communication. Wi-Fi networks also support operational uses, allowing crew members to access real-time information and coordinate more efficiently. This versatility and ease of use have made Wi-Fi the dominant technology choice for in-flight internet.

For instance, In January 2025, Air India became the first airline in the country to offer in-flight Wi-Fi on domestic routes. The service was introduced on select Airbus A350, Boeing B787-9, and Airbus A321neo aircraft with complimentary access in the initial phase. Passengers can stay connected above 10,000 feet using smartphones, tablets, and laptops throughout the flight.

Key Market Segments

By Aircraft Type

- Commercial aircraft

- Narrow-body aircraft

- Wide-body aircraft

- Regional jets

- Business jets

- Military aircraft

By Service Type

- Satellite-based connectivity

- Ka-band

- Ku-band

- L-band

- Air-to-ground connectivity

- ATG

- 5G ATG

- Hybrid

By Technology

- Wi-Fi

- 4G/LTE

- 5G (fastest)

- Satellite broadband

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging trends in in-flight internet reflect a strong push toward faster connectivity and seamless integration into the passenger journey. Low Earth Orbit (LEO) satellite constellations are a game-changer, offering significantly lower latency and higher bandwidth, with over 70% of new aircraft expected to be equipped for LEO-based internet by 2026.

Airlines are also blending 5G technology onboard to further enhance speed and reliability, meeting escalating passenger demand for uninterrupted streaming and real-time online interactions. At the same time, data security and privacy have become critical, with providers investing heavily in encryption and protective measures as more personal and payment data flow through in-flight networks.

Efforts to balance cost with quality service continue, as improved bandwidth and lower latency demand advanced satellite and antenna systems, which inflate operational expenses. Despite this, nearly 85% of travelers now expect high-speed internet availability as a standard service during flights, fueling ongoing technological advancements.

Growth Factors

Strong growth factors underpinning the in-flight internet sector include passengers’ rising expectation for constant connectivity regardless of flight duration or route. The global expansion in air travel volume by about 4% annually contributes to a larger user base hungry for reliable internet.

Airlines increasingly view Wi-Fi as crucial for competitive differentiation, integrating it alongside other digital services to enrich the flying experience. Satellite broadband innovations, particularly with next-gen technologies, enable more consistent coverage even on long-haul and oceanic flights, supporting this growth.

Another key factor is the integration of digital tools for personalized onboard services which improves ancillary revenue streams. Services like real-time shopping, entertainment, and customized upgrades driven by data analytics and AI now appeal to more than 50% of frequent flyers. Combined, these growth factors illustrate how evolving technology and customer expectations are propelling in-flight internet from a luxury to an essential amenity.

Drivers

Rising Passenger Demand for Connectivity

Air passengers today expect internet access during flights for entertainment, communication, and work purposes. The recovery of air travel post-pandemic has fueled a growing demand for seamless internet connectivity onboard.

Surveys suggest that a significant majority of passengers prefer airlines offering quality Wi-Fi service, with some choosing flights based solely on this feature. This trend is pushing airlines to adopt and upgrade in-flight internet solutions to meet evolving customer expectations and improve overall passenger satisfaction.

For instance, in October 2025, Etihad Airways reported a strong 21% increase in passenger numbers compared to the previous year, reflecting rising demand for air travel and enhanced connectivity. The airline operated 1.9 million passengers in September 2025, up from 1.6 million the year before, while expanding its fleet by 19% to 115 aircraft and increasing destinations to 82 worldwide.

Restraint

High Installation and Maintenance Costs

The cost of equipping aircraft with the hardware and infrastructure for in-flight internet remains a major barrier. Installation involves expensive satellite antennas, modems, and onboard network equipment requiring significant upfront investment. Beyond installation, airlines must bear ongoing maintenance costs and satellite bandwidth fees, which can be prohibitive for smaller or budget airlines.

Additionally, integrating new connectivity technology into existing aircraft presents operational complexities and expense. These financial and technical challenges slow down adoption and upgrades for some carriers, restraining faster market growth despite rising passenger demand.

For instance, In October 2025, British Airways reported significant delays in its A380 refurbishment due to poor performance by aftermarket providers. Around 93% of contractors failed to meet delivery schedules, leading airlines to retain engines longer and occasionally ground aircraft. The situation highlights how regulatory hurdles, long lead times, and limited spare parts continue to strain the aircraft aftermarket, slowing maintenance and increasing operational risk.

Opportunities

Advanced Satellite Technology and Expanding Coverage

Rapid advancements in satellite communication technologies are opening new growth possibilities. The deployment of low-earth orbit (LEO) satellite networks and improved broadband satellites enables faster speeds, lower latency, and wider coverage. These systems expand reliable internet access to flights over remote oceanic regions previously underserved.

This technology enhancement allows airlines to offer more robust, high-speed connectivity suited for activities like video streaming and remote work. It creates opportunities for new revenue models, including tiered service offerings and partnerships with tech providers. Improved satellite coverage positions in-flight internet as a competitive differentiator and essential passenger amenity for the future.

For instance, In August 2025, SpaceX’s Starlink advanced its position in the in-flight Wi-Fi market by engaging major luxury carriers like Emirates, Saudia, and FlyDubai. Its low Earth orbit network offers high-speed global connectivity suited for long-haul flights, while competitive pricing and faster installation are positioning it as a strong challenger to traditional satellite providers.

Challenges

Ensuring Consistent Connectivity Across Routes

Maintaining stable high-speed internet on all flight paths remains a technical challenge. Aircraft frequently travel over areas with weak satellite coverage or atmospheric disturbances that can interrupt service. Providing seamless access across vast, remote routes requires advanced satellites and network switching capabilities.

Passenger expectations, which often assume uninterrupted internet, can lead to dissatisfaction when speeds drop or connectivity fails briefly. Addressing this challenge involves balancing technological limits with customer satisfaction, all while managing operational costs and technical complexity. This ongoing issue slows the full realization of reliable in-flight internet everywhere.

For instance, in October 2025, the International Air Transport Association (IATA) highlighted that supply chain disruptions could cost airlines more than $11 billion this year. These challenges have slowed aircraft production, forcing airlines to keep older, less fuel-efficient planes flying longer and increasing maintenance and leasing costs.

Key Players Analysis

The In-flight Internet Market is led by major connectivity providers such as Gogo Inc., Viasat Inc., Inmarsat Plc, and Panasonic Avionics Corporation. These companies deliver satellite-based and air-to-ground (ATG) broadband solutions for commercial and business aviation. Their partnerships with airlines enable high-speed streaming, messaging services, and real-time data connectivity across regional and long-haul flights.

Aerospace and avionics manufacturers including Thales Group, Honeywell Aerospace, Collins Aerospace, and EchoStar Corporation (Hughes Network Systems) play a key role in integrating connectivity hardware, antennas, and onboard network systems. Their solutions support seamless cabin connectivity, cockpit communication, and aircraft operational data services across various aircraft platforms.

Additional contributors such as Global Eagle Entertainment, Deutsche Telekom AG, SITAONAIR, Airbus SE, Iridium Communications Inc., Rockwell Collins Inc., Kymeta Corporation, SmartSky Networks LLC, and other participants provide hybrid connectivity models, ground infrastructure, and antenna innovation. These companies enhance coverage, reduce latency, and expand service availability across global aviation networks.

Top Key Players in the Market

- Gogo Inc.

- Panasonic Avionics Corporation

- Viasat Inc.

- Inmarsat Plc

- Thales Group

- Honeywell Aerospace

- Global Eagle Entertainment

- Collins Aerospace

- Deutsche Telekom AG

- Airbus SE

- SITAONAIR

- EchoStar Corporation (Hughes Network Systems)

- Rockwell Collins Inc.

- Kymeta Corporation

- Iridium Communications Inc.

- SmartSky Networks LLC

- Other Key Players

Recent Developments

- In October 2025, Gogo Inc. reported significant progress in its satellite-based in-flight broadband business, receiving FAA approvals for cutting-edge full-duplex aviation antennas, supporting speeds up to 195 Mbps on business jets. This technology taps into the Eutelsat OneWeb low Earth orbit constellation, enabling seamless video conferencing and internet use for multiple onboard users.

- In August 2025, Panasonic Avionics Corporation launched its next-generation cloud-native Wi-Fi portal, giving airlines the ability to customize connectivity offerings without formal approval processes. This platform enhances passenger experience by allowing real-time updates on packages, pricing, and personalized content access.

- In April 2025, Viasat launched Amara, a next-generation in-flight connectivity platform built for high-capacity performance and seamless integration across GEO, HEO, and LEO satellite networks. It is compatible with the upcoming Viasat Aera electronically steered antenna and supports dual-beam connectivity using existing onboard systems. Amara also features digital services and ad-supported platforms to help airlines improve passenger experience and generate new revenue.

- In February 2025, Aeromexico partnered with Viasat to retrofit 17 Boeing 787 Dreamliners with Ka-band connectivity. The upgrade will enable passengers to stream, message, and browse at high speeds, supported by an ad-funded platform to boost engagement. This move strengthens Aeromexico’s long-haul service and deepens its partnership with Viasat.

- In January 2025, Air India became the first Indian airline to introduce complimentary in-flight Wi-Fi on domestic routes. The service, available on select A350, 787-9, and A321neo aircraft, allows passengers to stay connected above 10,000 feet and aligns the airline with global connectivity standards.

Report Scope

Report Features Description Market Value (2024) USD 2.05 Bn Forecast Revenue (2034) USD 4.68 Bn CAGR(2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Aircraft Type (Commercial aircraft, Business jets, Military aircraft), By Service Type (Satellite-based connectivity, Ka-band, Ku-band, L-band, Air-to-ground connectivity, ATG, 5G ATG, Hybrid), By Technology (Wi-F, 4G/LTE, 5G (fastest), Satellite broadband) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gogo Inc., Panasonic Avionics Corporation, Viasat Inc., Inmarsat Plc, Thales Group, Honeywell Aerospace, Global Eagle Entertainment, Collins Aerospace, Deutsche Telekom AG, Airbus SE, SITAONAIR, EchoStar Corporation (Hughes Network Systems), Rockwell Collins Inc., Kymeta Corporation, Iridium Communications Inc., SmartSky Networks LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gogo Inc.

- Panasonic Avionics Corporation

- Viasat Inc.

- Inmarsat Plc

- Thales Group

- Honeywell Aerospace

- Global Eagle Entertainment

- Collins Aerospace

- Deutsche Telekom AG

- Airbus SE

- SITAONAIR

- EchoStar Corporation (Hughes Network Systems)

- Rockwell Collins Inc.

- Kymeta Corporation

- Iridium Communications Inc.

- SmartSky Networks LLC

- Other Key Players