Global Immunochemistry Products Market By Product Type (Antibodies, Consumables, Enzymes Reagents, Antigens, and Others), By Application (Infectious Disease Testing, Cardiology, Oncology, Endocrinology, and Others), By End-user (Hospitals & Clinics, Research Laboratories, Diagnostic Laboratories, Biopharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168405

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

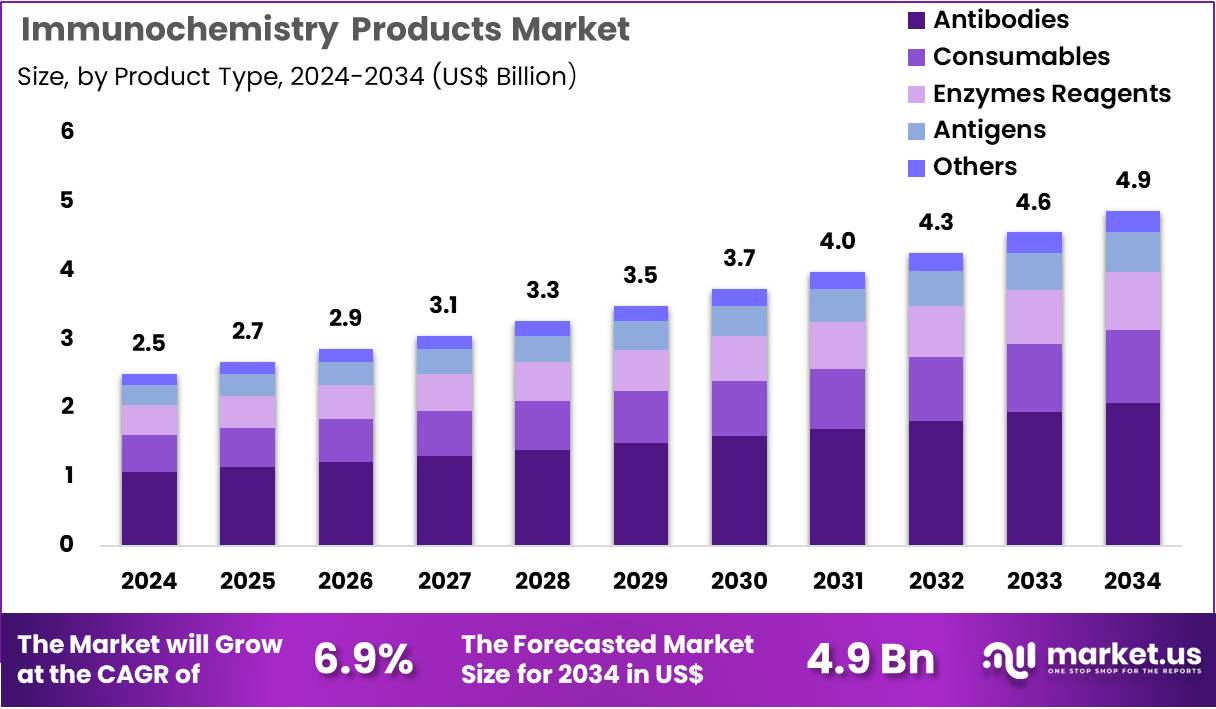

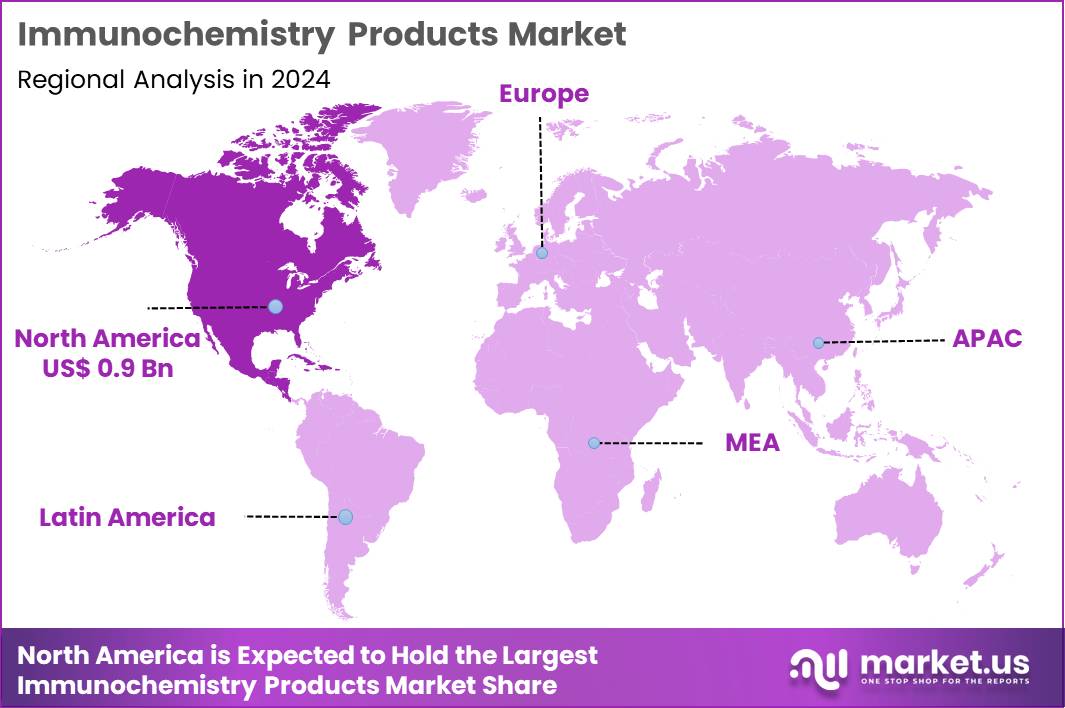

The Global Immunochemistry Products Market size is expected to be worth around US$ 4.9 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 0.9 Billion.

Increasing volume of immunohistochemistry workflows propels the Immunochemistry Products market, as pathology laboratories manage rising caseloads of tissue-based biomarker assessments for precision oncology and companion diagnostics.

Manufacturers deliver advanced staining instruments that automate deparaffinization, antigen retrieval, and antibody incubation steps with minimal hands-on time. These systems support HER2 quantification in breast cancer for trastuzumab eligibility, PD-L1 expression scoring in lung adenocarcinoma for immunotherapy selection, ALK rearrangement detection in non-small cell lung cancer, and mismatch repair protein evaluation for Lynch syndrome screening.

Enhanced automation creates opportunities for same-day turnaround and standardized staining across multi-site networks. Biocare Medical launched its intelliPATH+ Advanced Staining Instrument in December 2023, introducing flexible loading and accelerated processing that directly addresses high-throughput immunohistochemistry demands. This upgrade empowers laboratories to maintain quality while scaling diagnostic output efficiently.

Growing need for multiplex and co-expression analysis accelerates the Immunochemistry Products market, as oncologists require simultaneous visualization of multiple targets on single tissue sections to guide complex treatment algorithms. Reagent developers formulate chromogenic and fluorescent antibody cocktails that preserve spatial context and enable quantitative scoring.

Applications include immune checkpoint co-expression profiling on tumor-infiltrating lymphocytes, proliferation marker Ki-67 alongside therapeutic targets, hormone receptor status combined with proliferation indices in breast carcinoma, and phospho-protein mapping in signaling pathway studies. Multi-target panels open avenues for comprehensive tumor microenvironment characterization and novel biomarker validation. Pathology departments increasingly adopt these sophisticated immunochemistry products to meet evolving clinical expectations.

Rising integration of digital pathology and image analysis invigorates the Immunochemistry Products market, as laboratories pair high-quality stained slides with AI-assisted interpretation for objective, reproducible results. Companies optimize detection kits and counterstains that maintain compatibility with whole-slide scanning and algorithmic quantification.

These products facilitate automated tumor proportion scoring for PD-L1 assays, nuclear staining intensity measurement in estrogen receptor testing, membrane completeness assessment in HER2 evaluation, and hotspot identification in mutation-specific antibodies. Digital-ready reagents create opportunities for remote consultation, second-opinion networks, and large-scale retrospective studies. The convergence of robust immunochemistry staining with computational pathology establishes new standards in diagnostic accuracy and efficiency.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.5 Billion, with a CAGR of 6.9%, and is expected to reach US$ 4.9 Billion by the year 2034.

- The product type segment is divided into antibodies, consumables, enzymes reagents, antigens, and others, with antibodies taking the lead in 2024 with a market share of 42.7%.

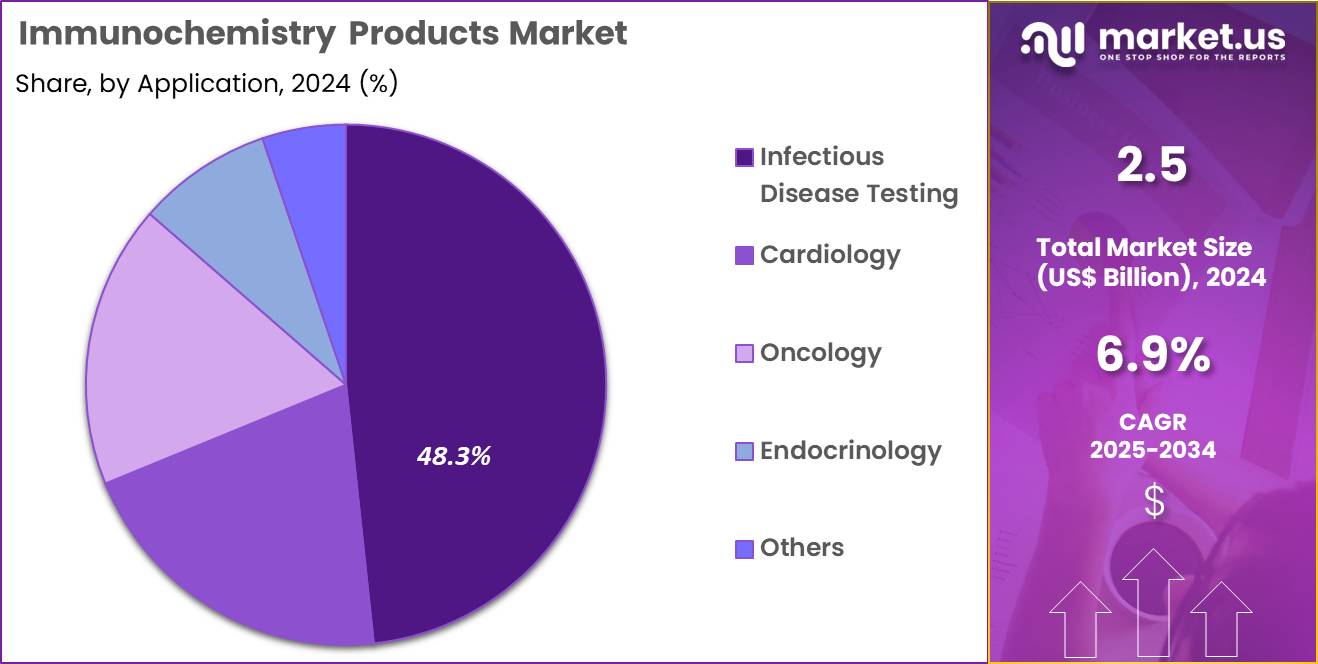

- Considering application, the market is divided into infectious disease testing, cardiology, oncology, endocrinology, and others. Among these, infectious disease testing held a significant share of 48.3%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, research laboratories, diagnostic laboratories, biopharmaceutical & biotechnology companies, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 46.1% in the market.

- North America led the market by securing a market share of 37.9% in 2024.

Product Type Analysis

Antibodies, holding 42.7%, are expected to dominate due to their essential role in immunoassays, targeted protein detection, and disease-biomarker identification. Diagnostic laboratories depend on high-affinity antibodies for reliable results across infectious disease, oncology, and metabolic disorder testing. Research laboratories increase usage as they explore immune pathways and validate therapeutic targets.

Biopharmaceutical companies integrate antibodies into vaccine development, immune-response profiling, and drug-efficacy analysis, strengthening demand. Continuous growth in monoclonal and recombinant antibody production enhances assay precision and consistency. Global investments in advanced immunochemistry platforms drive greater consumption of specialized antibodies.

Rising prevalence of chronic and infectious diseases increases test frequency, raising antibody utilization. Innovations in antibody engineering improve sensitivity and reduce background noise, attracting high-throughput labs. Expansion of personalized medicine further strengthens the need for highly specific antibody-based assays. These factors keep antibodies anticipated to remain the leading product type.

Application Analysis

Infectious disease testing, holding 48.3%, is projected to dominate due to increasing global attention toward early diagnosis, rapid screening, and outbreak management. Laboratories depend on immunochemistry products to detect viral, bacterial, and parasitic pathogens with high sensitivity. Rising prevalence of HIV, hepatitis, influenza, and emerging infectious threats increases routine testing volumes.

Hospitals integrate broader infectious-disease panels to support faster clinical decisions. Public-health programs expand surveillance initiatives, raising demand for reliable immunoassay reagents. Pharmaceutical companies use infectious-disease markers in vaccine development and immune-response studies, strengthening market growth. Advancements in assay design improve detection accuracy and shorten turnaround time.

Developing regions increase laboratory capacity, expanding testing adoption. Growing awareness of infectious risks in community and clinical settings further accelerates testing needs. These trends keep infectious disease testing anticipated to remain the dominant application segment.

End-User Analysis

Hospitals and clinics, holding 46.1%, are anticipated to remain dominant as they manage high patient volumes and increasingly rely on rapid, accurate immunochemistry-based diagnostics. Clinicians depend on immunoassays for diagnosing infectious diseases, hormonal disorders, cancers, and cardiac conditions, boosting product usage. Hospitals expand laboratory infrastructure to support faster testing workflows and higher throughput. Rising burden of chronic and acute diseases increases routine testing requirements.

Emergency departments integrate point-of-care immunochemistry analyzers for immediate clinical decisions. Hospitals also adopt advanced immunoassay platforms that streamline workflow automation and improve diagnostic precision. Growing emphasis on early disease detection strengthens utilization of immunochemistry kits and reagents.

Integrated care models promote testing efficiency, expanding demand across departments. Expansion of hospital networks in emerging regions increases procurement volumes. These factors keep hospitals and clinics projected to remain the most influential end-user segment in the immunochemistry products market.

Key Market Segments

By Product Type

- Antibodies

- Consumables

- Enzymes Reagents

- Antigens

- Others

By Application

- Infectious disease testing

- Cardiology

- Oncology

- Endocrinology

- Others

By End-user

- Hospitals & Clinics

- Research laboratories

- Diagnostic laboratories

- Biopharmaceutical & biotechnology companies

- Others

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The growing prevalence of chronic diseases worldwide is a primary driver for the immunochemistry products market, as these conditions require frequent biomarker testing for diagnosis and management. Immunochemistry products, including assays and reagents, facilitate the detection of specific antibodies and proteins associated with diseases like diabetes and cardiovascular disorders.

Healthcare facilities are increasingly adopting automated systems to process higher volumes of tests efficiently. This driver prompts manufacturers to innovate in high-sensitivity kits that support personalized treatment plans. Regulatory agencies emphasize the importance of reliable immunochemistry in public health surveillance programs. Collaborative initiatives between health organizations and suppliers ensure steady supply chains for essential products.

The economic impact of chronic diseases justifies expanded budgets for diagnostic tools in national health systems. Professional guidelines recommend routine immunochemistry screening to prevent complications. This momentum encourages research into multiplex formats for simultaneous analysis of multiple markers.

Educational efforts target clinicians to optimize product utilization in primary care settings. The Centers for Disease Control and Prevention reported that in 2023, 76.4% of U.S. adults, representing 194 million individuals, had at least one chronic condition. Consequently, the market benefits from sustained demand for comprehensive diagnostic solutions.

Restraints

High Initial Investment Costs are Restraining the Market

Elevated capital expenditures for immunochemistry products, particularly advanced analyzers, represent a significant restraint, limiting adoption in resource-limited laboratories. These costs encompass not only acquisition but also installation and ongoing maintenance, straining budgets in public health sectors. Smaller facilities often delay upgrades, relying on outdated equipment with lower throughput capacities. This financial barrier exacerbates disparities in diagnostic access across urban and rural areas.

Manufacturers face challenges in offering competitive pricing without compromising quality standards. Reimbursement policies vary, further complicating return-on-investment calculations for providers. The restraint contributes to prolonged turnaround times for test results in high-volume environments.

Policy interventions, such as subsidies, aim to alleviate pressures but implementation is inconsistent. Training requirements for new systems add to the overall financial burden on end-users. These factors collectively hinder market penetration in emerging economies.

Opportunities

Expansion of Point-of-Care Immunochemistry Applications is Creating Growth Opportunities

The shift toward point-of-care immunochemistry products is generating substantial growth opportunities, enabling rapid testing in non-traditional settings like clinics and homes. These portable solutions support immediate decision-making for infectious and inflammatory conditions. Developers are exploring integration with digital platforms for seamless data transmission to central records.

Regulatory approvals for user-friendly kits expand their utility in global health campaigns. Partnerships with telemedicine providers enhance remote monitoring capabilities. This opportunity aligns with efforts to decentralize diagnostics, reducing reliance on centralized labs. Economic models indicate potential savings from faster interventions and fewer hospital admissions.

International collaborations facilitate adaptations for diverse biofluid samples. The focus on miniaturization promises broader applicability in field epidemiology. Sustained investments in validation studies will solidify these products’ role in preventive care. The Centers for Disease Control and Prevention documented over 2.5 million cases of chlamydia, gonorrhea, and syphilis in the United States in 2022, underscoring the demand for accessible point-of-care diagnostics. Such prevalence drives innovation in rapid immunochemistry formats.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic drivers energize the Immunochemistry Products market, as escalating global healthcare investments and demand for rapid disease detection spur companies to innovate with high-performance reagents and assay kits. Providers integrate these tools to enhance clinical efficiency and support personalized treatment pathways. Inflationary pressures, however, erode profit margins for emerging suppliers and compel cost-cutting measures that delay market entry in resource-limited areas.

Geopolitical rivalries, especially intensifying US-China disputes, fracture supply chains for vital antibodies and substrates, forcing manufacturers to endure delays and heightened procurement risks. These tensions amplify regulatory hurdles across borders and disrupt cross-continental collaborations essential for product development.

Current US tariffs on imported diagnostic materials and equipment further burden the sector by inflating raw material prices, which firms pass on to customers and temporarily curb sales volumes in competitive hospital networks. Leaders counter these obstacles by relocating production to domestic hubs, securing federal grants for local innovation, and partnering with regional allies to streamline logistics.

In the end, the market builds enduring strength through adaptive strategies, positioning immunochemistry products as cornerstones of resilient, forward-thinking healthcare solutions.

Latest Trends

FDA Approval of MMR IHC Panel pharmDx is a Recent Trend

The U.S. Food and Drug Administration’s approval of advanced immunohistochemistry panels has emerged as a key trend in the immunochemistry products market in 2025, enhancing precision in cancer diagnostics. This development focuses on mismatch repair status assessment for guiding immunotherapy selections. Manufacturers are prioritizing compatible reagents for automated staining protocols.

The trend promotes standardization in pathology labs for consistent results across cases. Clinical workflows benefit from reduced manual steps, improving efficiency in tumor board discussions. This evolution supports companion diagnostic claims tied to specific therapeutic agents. Competitive responses include expansions to additional solid tumor indications.

Regulatory emphasis on validation data accelerates similar product pipelines. Broader adoption previews applications in hereditary syndrome screening. The integration with digital imaging tools refines interpretive accuracy. On August 15, 2025, the U.S. Food and Drug Administration approved the MMR IHC Panel pharmDx (Dako Omnis), a qualitative immunohistochemical assay for mismatch repair protein evaluation. This approval exemplifies the trend toward integrated, high-throughput immunochemistry solutions.

Regional Analysis

North America is leading the Immunochemistry Products Market

The percentage share of North America in the Immunochemistry Products market stands at 37.9%, driven by widespread adoption of high-sensitivity ELISA and chemiluminescence reagents in clinical laboratories throughout 2024. Growth accelerated due to expanded use of multiplex cytokine assays in autoimmune disease management and oncology biomarker panels.

Major hospitals upgraded to automated immunoassay systems to meet rising demand for rapid thyroid, fertility, and cardiac marker testing. The U.S. FDA cleared several novel antibody-based kits, while broadened Medicare reimbursement supported routine infectious disease serology. Academic and reference labs increased procurement of quality-control calibrators and conjugate stabilizers to ensure compliance with CLIA standards.

Supply chain recovery enabled consistent reagent availability, further boosting utilization. In support, the CDC awarded $225 million in 2023–2024 funding through the Immunology and Infectious Diseases Laboratory Strengthening Program to enhance diagnostic capacity across U.S. public health laboratories.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry leaders anticipate strong expansion of immunoassay reagents and consumables in Asia Pacific during the forecast period, propelled by large-scale national screening programs and laboratory modernization initiatives. Governments actively procure high-throughput antibody detection kits for hepatitis, HIV, and syphilis surveillance in high-burden countries. Hospitals and diagnostic chains invest in fully automated platforms to handle growing test volumes in urban tertiary centers.

Regulators streamline registration pathways for imported and locally manufactured conjugates, accelerating market entry. Local manufacturers scale production of cost-effective secondary antibodies and blocking buffers to capture price-sensitive segments. Research institutes integrate advanced bead-based multiplex systems into vaccine efficacy studies. Supporting this momentum, India’s Department of Biotechnology allocated ₹2,803 crore (approximately $335 million USD) in the 2024–2025 union budget for biotechnology research and infrastructure development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Dominant enterprises in the immunodiagnostics arena propel market expansion through disciplined portfolio acquisitions that immediately add high-margin, proprietary assay menus in fertility, cardiac, and infectious disease testing. They simultaneously allocate massive R&D budgets to next-generation chemiluminescence and microfluidic platforms that dramatically improve analytical sensitivity and cut reagent consumption per test.

Leadership teams secure exclusive technology licensing agreements with leading research institutes and biotech innovators, ensuring sustained first-to-market advantages in companion diagnostics and liquid biopsy applications. Companies aggressively build direct commercial presence in China, India, and Brazil through wholly-owned subsidiaries and local manufacturing joint ventures, capturing the fastest-growing volume segments while mitigating tariff and supply risks.

A standout performer, DiaSorin S.p.A., the Italian pure-play immunodiagnostics champion headquartered in Saluggia and listed on the Milan Stock Exchange since 2007, consistently delivers €1.1–1.3 billion in annual revenue almost entirely from its LIAISON® CLIA ecosystem and specialty vitamin D, hepatitis, and oncology panels. This focused, high-velocity execution allows frontrunners to command premium pricing and defend share in a consolidating industry increasingly driven by laboratory automation and reimbursement for high-medical-value tests.

Top Key Players

- PerkinElmer, Inc.

- Merck KGaA

- Illumina, Inc.

- Hoffmann‑La Roche Ltd.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- AstraZeneca

- Akoya Biosciences

- Agilent Technologies, Inc.

- Abbott Laboratories

Recent Developments

- In April 2025, Roche received Breakthrough Device status from the FDA for its VENTANA TROP2 RxDx Device. The system uses an IHC-based assessment supported by AI analysis to help clinicians better recognize which non-small cell lung cancer patients may be suitable for specific targeted therapies, improving confidence in treatment planning.

- In November 2024, the FDA granted approval to zanidatamab (Ziihera) for individuals with HER2-positive biliary tract cancer that cannot be surgically removed or has already spread and has been treated before. The decision highlights the role of immunohistochemistry, particularly strong HER2 staining, in identifying patients who may respond to this type of therapy.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 4.9 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antibodies, Consumables, Enzymes Reagents, Antigens, and Others), By Application (Infectious Disease Testing, Cardiology, Oncology, Endocrinology, and Others), By End-user (Hospitals & Clinics, Research Laboratories, Diagnostic Laboratories, Biopharmaceutical & Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PerkinElmer, Inc., Merck KGaA, Illumina, Inc., F. Hoffmann La Roche Ltd., Danaher Corporation, Bio Rad Laboratories, Inc., AstraZeneca, Akoya Biosciences, Agilent Technologies, Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Immunochemistry Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Immunochemistry Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PerkinElmer, Inc.

- Merck KGaA

- Illumina, Inc.

- Hoffmann‑La Roche Ltd.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- AstraZeneca

- Akoya Biosciences

- Agilent Technologies, Inc.

- Abbott Laboratories