Global Hypopituitarism Diagnostics Market By Test Type (Hormone Stimulation Tests, Insulin Tolerance Test, MRI or CT Scan, and Visual Field Check), By End-user (Hospitals, Specialty Clinics, Academic Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169130

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

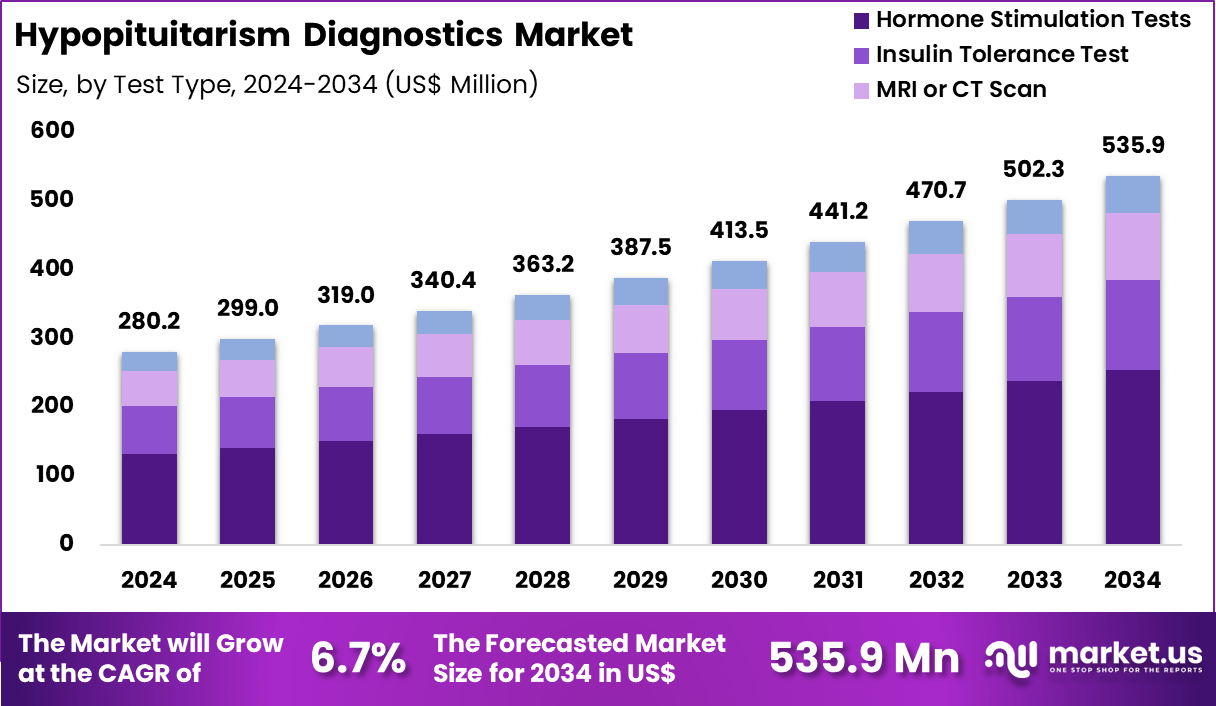

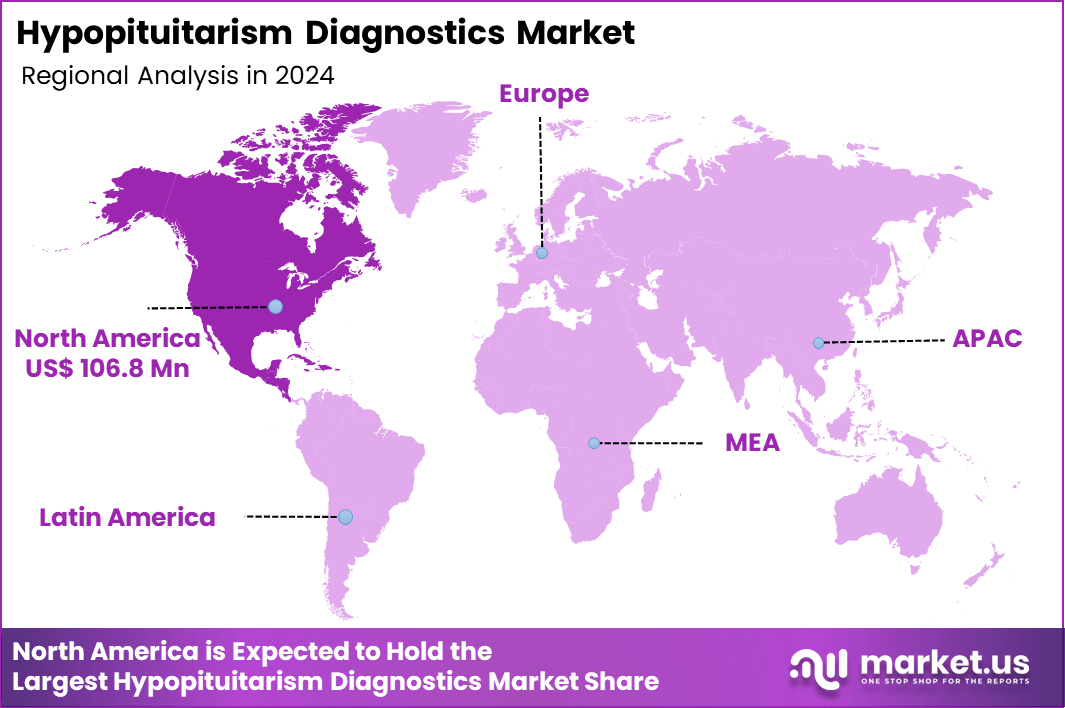

Global Hypopituitarism Diagnostics Market size is expected to be worth around US$ 535.9 Million by 2034 from US$ 280.2 Million in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 106.8 Million.

Increasing prevalence of pituitary adenomas and traumatic brain injuries drives the Hypopituitarism Diagnostics market, as endocrinologists seek sensitive assays to detect isolated or multiple hormone deficiencies early in at-risk populations. Diagnostic companies develop automated immunoassays that quantify baseline cortisol, thyroid-stimulating hormone, and insulin-like growth factor-1 levels from serum samples with rapid turnaround.

These tests enable adrenal insufficiency screening in post-surgical patients, thyroid axis evaluation in fatigue syndromes, gonadal function assessment for infertility workups, and growth hormone status confirmation in short stature cases. Clinical trials underscore the necessity of reliable diagnostics for patient selection and monitoring, creating opportunities for standardized protocols that integrate stimulation testing with baseline profiles.

Novo Nordisk A/S initiated a clinical study on December 5, 2023, comparing once-weekly Somapacitan with daily Norditropin FlexPro in children with Growth Hormone Deficiency, relying on consistent GH stimulation tests to verify eligibility and track hormonal responses. This trial highlights the pivotal role of diagnostic assays in therapeutic validation and expands demand for precise, reproducible testing frameworks.

Growing adoption of genetic screening panels accelerates the Hypopituitarism Diagnostics market, as geneticists incorporate next-generation sequencing to identify congenital mutations underlying septo-optic dysplasia and PROP1 deficiencies. Biotechnology firms launch multiplex kits that analyze pituitary transcription factors alongside hormonal immunoassays for comprehensive phenotyping.

Applications encompass familial isolated pituitary hormone deficiency diagnosis through HESX1 variant detection, Kallmann syndrome confirmation via ANOS1 gene analysis, craniopharyngioma risk stratification in pediatric cohorts, and adult-onset hypopituitarism evaluation post-radiotherapy. Non-invasive genetic tools open avenues for prenatal counseling and carrier screening in high-risk lineages. Pharmaceutical developers increasingly require these diagnostics for orphan drug trials targeting rare pituitary etiologies. This convergence of genomics and endocrinology fosters innovation in predictive modeling for hormone replacement initiation.

Rising integration of AI-enhanced imaging invigorates the Hypopituitarism Diagnostics market, as radiologists leverage machine learning algorithms to quantify pituitary stalk deviations and microadenoma volumes from MRI datasets. Technology providers embed diagnostic software that correlates volumetric data with dynamic contrast enhancement patterns for enhanced specificity. These platforms support sellar mass characterization in hyperprolactinemia cases, empty sella syndrome differentiation from true deficiencies, post-traumatic hypopituitarism detection via diffusion tensor imaging, and longitudinal surveillance in acromegaly remission monitoring.

AI-driven interpretations create opportunities for telemedicine-enabled second opinions and automated alert systems in electronic health records. Healthcare networks actively deploy these tools to reduce interpretive variability and expedite multidisciplinary consultations. This technological advancement positions advanced diagnostics as essential for timely intervention and optimized patient trajectories.

Key Takeaways

- In 2024, the market generated a revenue of US$ 280.2 million, with a CAGR of 6.7%, and is expected to reach US$ 535.9 Million by the year 2034.

- The test type segment is divided into hormone stimulation tests, insulin tolerance test, MRI or CT scan, and visual field check, with hormone stimulation tests taking the lead in 2024 with a market share of 47.3%.

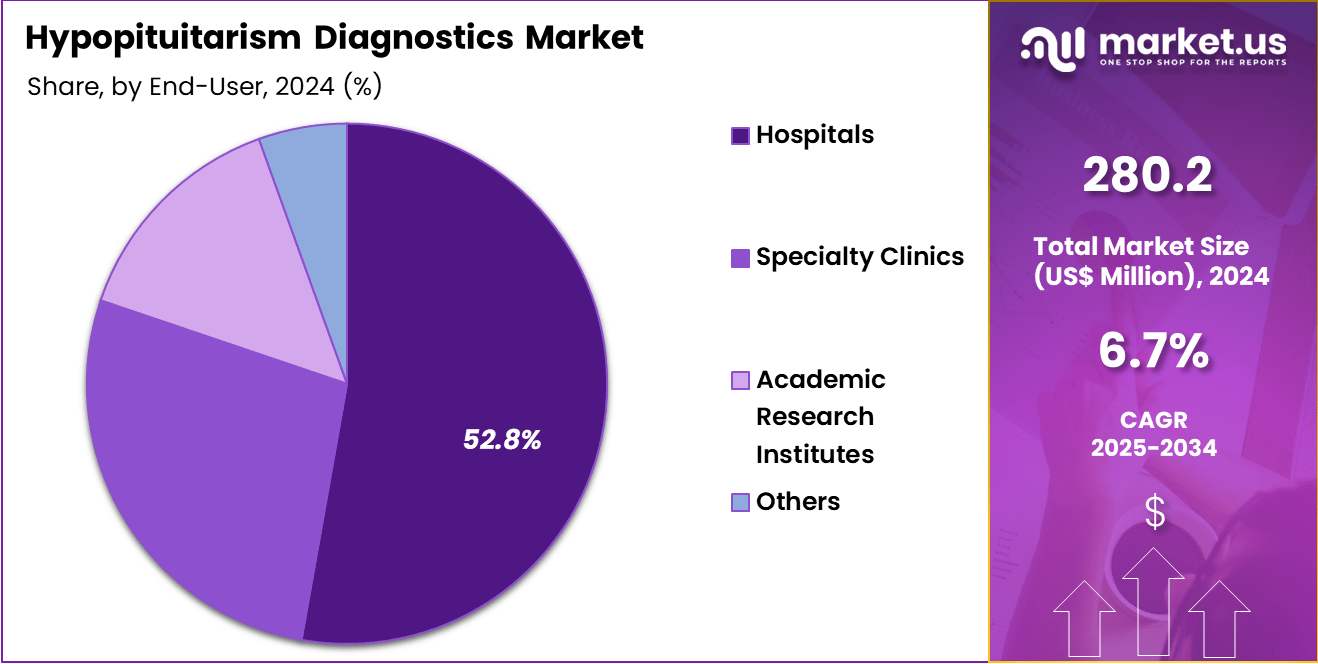

- Considering end-user, the market is divided into hospitals, specialty clinics, academic research institutes, and others. Among these, hospitals held a significant share of 52.8%.

- North America led the market by securing a market share of 38.1% in 2024.

Test Type Analysis

Hormone stimulation tests, holding 47.3%, are expected to dominate as they remain essential for evaluating pituitary hormone reserve and identifying deficiencies across ACTH, TSH, GH, and gonadotropins. Clinicians rely on stimulation protocols such as ACTH stimulation, TRH tests, and GnRH tests to confirm hypopituitarism accurately. Rising prevalence of pituitary adenomas, traumatic brain injuries, and postoperative pituitary dysfunction increases testing frequency.

Endocrinologists choose stimulation tests for their diagnostic precision compared to static hormone measurements. Hospitals expand endocrine units equipped to conduct controlled stimulation procedures. Advancements in assay sensitivity improve interpretation of stimulated hormone levels. Growing awareness of subtle hormonal disorders encourages earlier testing. Research groups investigate hormonal dynamics in rare pituitary conditions, increasing utilization. These factors keep hormone stimulation tests anticipated to remain the leading diagnostic method.

End-User Analysis

Hospitals, holding 52.8%, are anticipated to dominate the end-user segment due to their ability to perform comprehensive diagnostic evaluations involving hormonal, imaging, and functional assessments. Clinicians in hospital settings manage complex pituitary disorders, increasing reliance on multi-step diagnostic protocols. Hospitals maintain specialized endocrine departments capable of conducting stimulation tests, insulin tolerance testing, and advanced imaging. Rising admissions related to pituitary tumours, traumatic injuries, and postpartum pituitary dysfunction strengthen diagnostic volumes.

Integrated laboratory infrastructure ensures rapid hormone-level measurement and accurate interpretation. Multidisciplinary teams, including neurosurgeons and endocrinologists, collaborate on diagnosis and management. Hospitals participate in screening and treatment programs for hormonal deficiencies, raising routine testing demand. Access to emergency care supports urgent evaluation of adrenal crises linked to pituitary dysfunction. These drivers keep hospitals projected to remain the most influential end-user category in the hypopituitarism diagnostics market.

Key Market Segments

By Test Type

- Hormone Stimulation Tests

- Insulin Tolerance Test

- MRI or CT Scan

- Visual Field Check

By End-user

- Hospitals

- Specialty Clinics

- Academic Research Institutes

- Others

Drivers

Increasing Prevalence of Pituitary Tumors is Driving the Market

The growing prevalence of pituitary tumors has emerged as a primary driver for the hypopituitarism diagnostics market, as these neoplasms frequently lead to hormone deficiencies requiring comprehensive testing for early detection. This trend is fueled by improved imaging modalities that identify incidental adenomas, increasing the need for dynamic hormone assays to assess pituitary function. Healthcare providers are incorporating basal and stimulation tests into routine evaluations for patients with sellar masses, ensuring timely diagnosis of partial or complete hypopituitarism.

Diagnostic laboratories are expanding their capacity to handle elevated volumes of IGF-1 and ACTH stimulation tests, supported by automated immunoassay platforms. Regulatory bodies endorse standardized protocols for tumor-related hypopituitarism screening, aligning with endocrine society guidelines. Collaborative research initiatives between institutions facilitate biomarker validation, enhancing assay sensitivity for subtle deficiencies. The economic burden of undiagnosed hypopituitarism, including metabolic complications, justifies investments in accessible diagnostic tools.

Professional associations recommend MRI-guided testing for all pituitary incidentalomas, embedding diagnostics in multidisciplinary workflows. This driver accelerates innovation in non-invasive saliva-based hormone assays, reducing reliance on invasive procedures. Educational programs for endocrinologists emphasize the assays’ role in preventing life-threatening adrenal crises. The reported prevalence of pituitary tumors is approximately 10 per million with an average annual incidence of approximately 30 per million, as per the National Institutes of Health Endotext update.

Restraints

Lack of Specific Diagnosis Codes is Restraining the Market

The absence of dedicated diagnosis codes for conditions like adult growth hormone deficiency within hypopituitarism frameworks continues to restrain the diagnostics market, complicating accurate tracking and reimbursement in electronic health records. This coding gap leads to underreporting and inconsistent billing, hindering resource allocation for specialized testing in clinical practice. Healthcare systems struggle with data aggregation for epidemiological studies, limiting evidence generation for new assays.

The restraint disproportionately affects multidisciplinary clinics, where misclassification delays hormone replacement decisions. Regulatory efforts to refine ICD-10 codes progress slowly, exacerbating administrative burdens on providers. Manufacturers face challenges in demonstrating clinical utility without robust real-world data, prolonging market entry. These limitations perpetuate diagnostic delays, as patients with partial hypopituitarism evade systematic screening.

Policy advocacy for code expansions remains fragmented amid broader healthcare priorities. The issue undermines payer negotiations, confining coverage to severe cases rather than prophylactic testing. Mitigation requires integrated coding reforms to reflect hypopituitarism’s spectrum.

Opportunities

Advances in Genetic Testing for Congenital Hypopituitarism are Creating Growth Opportunities

The progression of genetic sequencing technologies for congenital hypopituitarism is unveiling substantial growth opportunities in the diagnostics market, enabling identification of mutations in genes like PROP1 and HESX1 for familial cases. These advances support carrier screening and prenatal counseling, expanding the scope beyond symptomatic presentations. Opportunities emerge in partnering with pediatric endocrinologists to develop targeted panels, integrating next-generation sequencing with traditional hormone assays.

Regulatory incentives for orphan diagnostics expedite approvals, fostering collaborations with rare disease networks. This innovation facilitates early intervention, reducing long-term morbidity from growth and thyroid deficiencies. Economic projections indicate savings from prevented complications, appealing to value-based reimbursement models.

Global consortia accelerate variant databases, validating tests across ethnic groups for equitable application. These developments diversify revenue through subscription-based genetic reporting services. Emerging applications in adult-onset forms broaden utility, tailoring tests to acquired etiologies. Sustained funding will drive miniaturization for point-of-care genetic screening. The National Institutes of Health funded a 2024 research proposal on neuropsychological effects of oxytocin deficiency in children with hypopituitarism, highlighting opportunities in biomarker-integrated diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare costs and fiscal constraints in public systems challenge endocrinologists to limit hypopituitarism diagnostic testing, delaying screenings for at-risk patients in underfunded clinics. Dedicated endocrine research grants and growing awareness of hormonal imbalances, however, inspire labs to adopt advanced hormone panels, expanding access through targeted wellness initiatives. Geopolitical strains in the Middle East and Eastern Europe interrupt shipments of specialized immunoassay reagents from affected suppliers, extending validation periods and raising fees for diagnostic developers.

These strains, in turn, encourage firms to forge resilient regional networks and invest in synthetic alternatives that enhance kit durability and precision. The current U.S. baseline 10% tariff on imported medical diagnostic devices, layered with up to 55% duties on Chinese-origin components under expanded 2025 measures, inflates procurement expenses for American providers and tightens budgets for routine pituitary evaluations.

Developers counter this effectively by scaling domestic reagent production and leveraging USMCA exemptions that preserve cost structures and supply flows. Broadly, these factors test adaptability yet refine strategic sourcing across the board. The hypopituitarism diagnostics market builds lasting momentum, channeling such dynamics into innovative pathways that ensure timely hormone assessments and better endocrine health outcomes worldwide.

Latest Trends

FDA Approval of Skytrofa for Adult GHD is a Recent Trend

The U.S. Food and Drug Administration’s approval of once-weekly growth hormone therapies for adult growth hormone deficiency has defined a salient trend in 2025, indirectly boosting demand for confirmatory diagnostic assays in hypopituitarism management. This regulatory milestone validates long-acting formulations like lonapegsomatropin, requiring precise IGF-1 monitoring to guide dosing in pituitary-deficient patients.

The trend emphasizes integration with digital platforms for home-based hormone tracking, aligning with remote endocrinology care models. Developers are refining assays for ultra-sensitive IGF-1 detection, supporting trend-driven therapeutic adjustments. Regulatory focus on post-approval surveillance accelerates similar approvals for combination diagnostics. Adoption in adult clinics surges, where the therapy addresses compliance issues in lifelong hypopituitarism treatment. This evolution intersects with AI analytics for predicting response based on baseline hormone profiles.

Competitive responses include expansions to multi-hormone panels for comprehensive pituitary evaluation. Broader implications encompass applications in post-traumatic hypopituitarism, adapting diagnostics for acquired deficiencies. The trend fosters international alignments, harmonizing guidelines for therapy eligibility. On July 28, 2025, the U.S. Food and Drug Administration approved Skytrofa (lonapegsomatropin-tcgd) for the replacement of endogenous growth hormone in adults with growth hormone deficiency.

Regional Analysis

North America is leading the Hypopituitarism Diagnostics Market

North America accounted for 38.1% of the overall market in 2024, and the region saw notable growth as endocrinologists expanded screening protocols for hormone deficiencies linked to pituitary adenomas, traumatic brain injuries, autoimmune inflammation, and post-surgical complications. Hospitals increased reliance on ACTH stimulation tests, GH stimulation tests, and high-resolution pituitary MRI to support earlier detection. Clinical networks emphasized timely evaluation of fatigue, metabolic slowdown, hyponatremia, and growth abnormalities, increasing referrals for endocrine testing.

Research centers advanced neuroendocrine biomarker studies, which raised the demand for standardized diagnostic assays. The National Cancer Institute recorded 12,060 new pituitary gland tumor cases in the United States in 2022 (NCI – SEER Cancer Stat Facts: Pituitary Tumors), and this clinical burden directly expanded diagnostic volumes for associated hormonal deficits. Diagnostic laboratories upgraded immunoassay analyzers to improve accuracy in TSH, LH, FSH, ACTH, and cortisol assessment. These factors collectively reinforced strong regional growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness steady expansion during the forecast period as hospitals strengthen endocrinology departments to address rising cases of congenital pituitary dysfunction, metabolic disorders, and post-trauma hormonal deficiencies. Clinics broaden access to dynamic hormone-testing protocols, enabling earlier identification of multi-hormonal deficits. Governments increase awareness campaigns around childhood growth delays and reproductive disorders, prompting earlier diagnostic intervention.

Diagnostic chains expand MRI and biochemical testing capacity across major urban centers. Medical universities intensify neuroendocrine research, raising demand for high-quality hormone-assay reagents. The Japan Ministry of Health, Labour and Welfare reported 5,424 treated cases of pituitary and hypothalamic disorders in 2022 (MHLW – Patient Survey 2022), reflecting a growing need for specialized diagnostic evaluation. Manufacturers improve reagent distribution across India, China, and Southeast Asia. These developments collectively position Asia Pacific for strong future market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms address growth in the hypopituitarism-diagnostics segment by broadening their test portfolios to include comprehensive hormone panels, dynamic stimulation assays and imaging-linked diagnostics, thereby covering both baseline and functional gland evaluations. They increase their appeal to clinics and reference labs by deploying automated immunoassay platforms and high-sensitivity hormone detection kits that boost throughput and improve diagnostic consistency.

They extend geographic presence through alliances with regional distributors and endocrine clinics in emerging markets, where rising awareness of pituitary disorders and better healthcare infrastructure create demand. They emphasise clinical validation, publishing studies and aligning assays with guideline-based diagnostic algorithms to foster trust among endocrinologists and hospital networks.

They invest in research and development to refine detection of subtle hormone deficiencies and streamline protocols, helping reduce misdiagnosis risk and lowering overall testing cost. One leading firm, Quest Diagnostics Incorporated, operates extensive laboratory networks across the Americas and offers an expansive endocrine-testing menu spanning pituitary, thyroid, adrenal and reproductive hormone assays, which positions it as a key partner for comprehensive pituitary-function evaluation worldwide.

Top Key Players

- Roche Diagnostics

- Thermo Fisher Scientific Inc.

- Beckman Coulter

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- QIAGEN N.V.

Recent Developments

- On June 15, 2024, The Lancet released an updated review on Hypopituitarism, noting that patients who show a strong likelihood of GHD and who already lack three or more pituitary hormones may not need biochemical confirmation through stimulation testing. This shift in clinical recommendations affects how often complex GH stimulation tests are performed.

- On May 1, 2025, major reference laboratories reiterated that evaluating suspected ACTH deficiency still depends on corticotropin stimulation testing. The rapid ACTH stimulation test remains the most reliable method for determining central adrenal insufficiency, underscoring its ongoing diagnostic relevance.

Report Scope

Report Features Description Market Value (2024) US$ 280.2 Million Forecast Revenue (2034) US$ 535.9 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Hormone Stimulation Tests, Insulin Tolerance Test, MRI or CT Scan, and Visual Field Check), By End-user (Hospitals, Specialty Clinics, Academic Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Thermo Fisher Scientific Inc., Beckman Coulter, Abbott Laboratories, Bio-Rad Laboratories, Inc., bioMérieux SA, Danaher Corporation, QIAGEN N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hypopituitarism Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hypopituitarism Diagnostics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roche Diagnostics

- Thermo Fisher Scientific Inc.

- Beckman Coulter

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- QIAGEN N.V.