Global Hydrogen Sulfide Scavengers Market Product Type(Regenerative Scavengers, Non-Regenerative Scavengers), By Formulation(Liquid Scavengers, Solid Scavengers, Powder Scavengers), Application(Oil & Gas Industry, Upstream (Exploration & Production), Midstream (Transportation & Storage), Downstream (Refining & Processing), Petrochemical Industry, Paper & Pulp Industry, Mining Industry, Water Treatment Industry, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast, 2024–2033

- Published date: Jan 2024

- Report ID: 14566

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

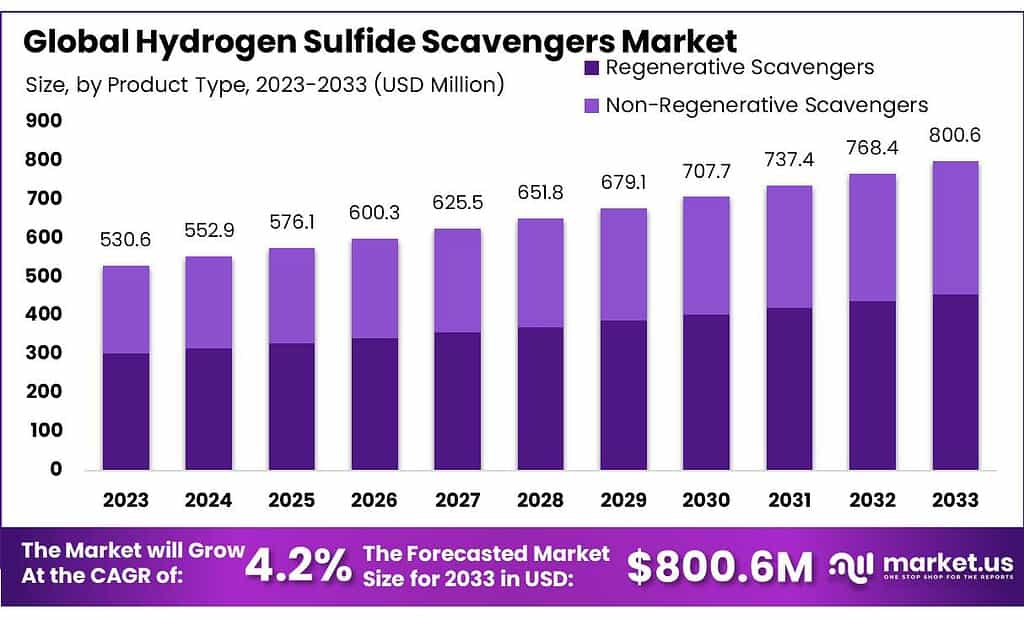

The Hydrogen Sulfide Scavengers Market size is expected to be worth around USD 800.6 Million by 2033, from USD 530.6 Million in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

Hydrogen sulfide scavengers refer to chemical substances or additives utilized in various industries to neutralize or eliminate hydrogen sulfide (H2S) gas. Hydrogen sulfide is a toxic and corrosive gas that can be present in natural gas, crude oil, and other hydrocarbon-containing fluids. The primary purpose of hydrogen sulfide scavengers is to mitigate the harmful effects of H2S by chemically reacting with it, converting it into non-toxic byproducts.

These scavengers play a crucial role in industries such as oil and gas, petrochemicals, and wastewater treatment, where the presence of hydrogen sulfide poses significant operational and safety challenges. The scavenging process helps prevent corrosion in pipelines and equipment, protects catalysts in chemical processes, and ensures compliance with safety and environmental regulations.

Hydrogen sulfide scavengers come in various formulations, including liquid and solid forms, and their selection depends on factors such as the specific application, concentration of H2S, and the desired method of application. The effective use of scavengers contributes to improved operational efficiency, safety, and environmental responsibility in industries dealing with H2S-containing substances.

Key Takeaways

- Market Growth: Projected to reach USD 800.6 Million by 2033, the Hydrogen Sulfide Scavengers Market exhibits a robust 4.2% CAGR from 2023.

- Regenerative Dominance: Regenerative Scavengers, holding a significant 54% market share, are favored for reusability, generating less waste in continuous operations.

- Formulation Preference: Liquid Scavengers, leading in 2023, are versatile and efficient, especially in the Oil & Gas, Petrochemicals, and Water Treatment industries.

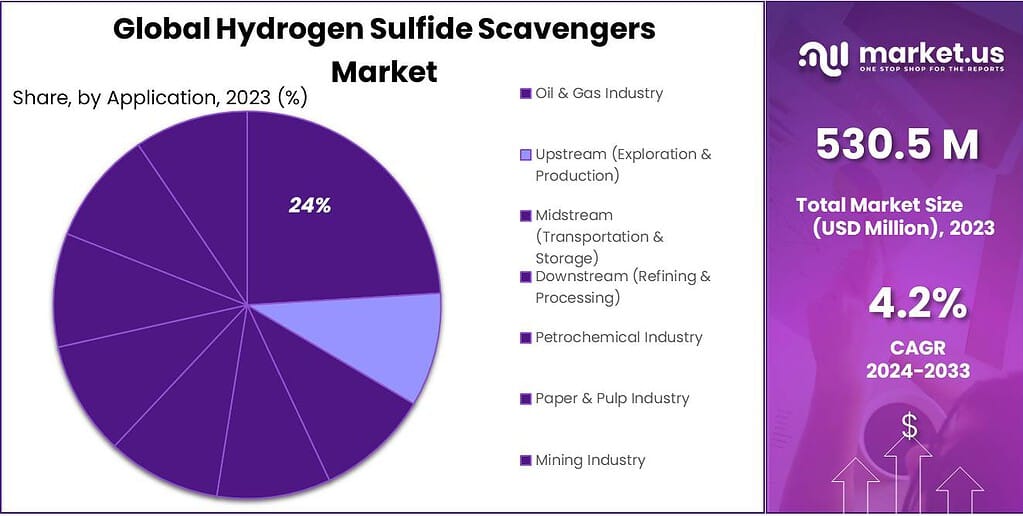

- Applications Across Industries: Oil and Gas, with over 43.5% market share, utilizes scavengers in exploration, transportation, refining, and processing for safety and compliance.

- Market Drivers: Stringent regulations, increased exploration activities, and environmental concerns drive demand for effective hydrogen sulfide removal solutions.

- Restraints: Implementation costs, technological challenges, and safety risks limit scavenger adoption, hindering market expansion to some extent.

- Innovation Opportunities: Advancements in scavenging technologies offer opportunities for more potent and versatile solutions, catering to diverse industrial requirements.

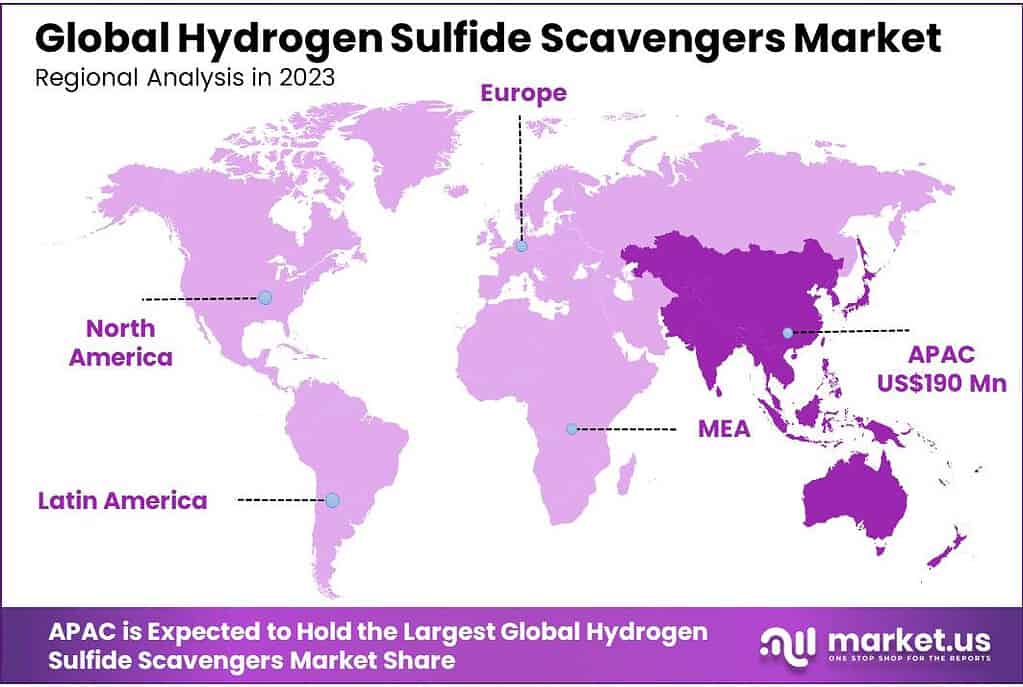

- Regional Dominance: Asia Pacific, with over 36.10% revenue share in 2023, focuses on innovative infrastructure solutions, while Europe anticipates growth through energy-efficient systems.

By Product Type

Regenerative Hydrogen Sulfide Scavengers have seen remarkable success since 2023, taking an overwhelming 54% market share and earning them the majority market share position in terms of market share. Regenerative Scavengers were chosen due to one key advantage – their reusability.

After the scavenging process is complete, these chemicals can be regenerated or reactivated for multiple usage cycles and generate less waste compared to single-use alternatives. Industries favor them for continuous hydrogen sulfide removal needs such as ongoing production or long-term operations where sustained usage is essential.

Non-regenerative scavengers, although effective in hydrogen sulfide removal, cannot be reused. These chemicals serve as one-time-use solutions, eliminating hydrogen sulfide during their process while being incapable of being regenerated or reused again afterward.

While effective and immediate applications might benefit, as their single-use nature makes them less cost-effective or sustainable in the long run; industries may opt for non-regenerative scavengers when one-off hydrogen sulfide removal solutions are necessary or constant regeneration isn’t essential.

The choice between regenerative and non-regenerative scavengers often depends on the industry’s requirements, the duration and frequency of hydrogen sulfide removal needs, cost considerations, and environmental sustainability goals.

Regenerative scavengers offer extended usage and reduced waste, ideal for continuous operations, while non-regenerative options suit scenarios where one-time application suffices, despite their lack of reusability.

By Formulation

In the Hydrogen Sulfide Scavengers market, the dominance of Liquid Scavengers was evident in 2023, capturing a considerable market share. These liquid formulations are preferred for their versatility and efficiency across multiple industries.

Industries such as Oil & Gas, Petrochemicals, and Water Treatment utilize liquid scavengers due to their ease of handling and effectiveness in removing hydrogen sulfide from various processes. Their adaptability to different industrial applications makes them a favored choice among users requiring consistent and reliable H2S removal.

Solid Scavengers also maintain a significant presence in the market. Available in pellet or granule forms, these formulations offer prolonged stability and a longer shelf life, making them suitable for applications requiring sustained hydrogen sulfide mitigation. Industries often rely on solid scavengers when a more extended-release or action period is necessary, such as in certain industrial cleaning operations.

Powder Scavengers, with their rapid reaction capabilities, hold relevance in scenarios demanding quick and immediate hydrogen sulfide removal. Industries like Mining, where swift action is crucial to mitigate H2S emissions, often prefer powder scavengers for their fast-acting properties and ease of application.

The variety in formulations caters to diverse industrial needs. Liquid scavengers provide adaptability, solid formulations ensure stability, while powders offer rapid response times, allowing industries to choose based on their specific hydrogen sulfide removal requirements and operational demands.

By Application

In 2023, the Oil and Gas industry led the Hydrogen Sulfide Scavengers market with over 43.5 % market share. They use these devices in various phases of their operations. The exploration & Production segment of the Oil & Gas industry stands out with its use of hydrogen sulfide scavengers during drilling and extraction phases to safely control and remove hydrogen sulfide emissions from wells, assuring safe extraction processes.

Hydrogen Sulfide Scavengers play an essential part of Midstream (Transportation & Storage). Their presence helps mitigate risks associated with hydrogen sulfide presence during transport and storage, thus protecting corrosion prevention efforts and infrastructure safety. Downstream (Refining & Processing) utilizes these chemicals during refining and processing activities, purifying crude oil and natural gas while eliminating hydrogen sulfide emissions to meet product quality standards and ensure operational safety.

Petrochemical Industries have become an important application area, as hydrogen sulfide scavengers play an integral part in product quality and safety by eliminating hydrogen sulfide contaminants from product processes. Hydrogen Sulfide Scavengers play a pivotal role in pulp bleaching processes, guaranteeing product quality while mitigating environmental impacts.

Mining industries rely heavily on hydrogen sulfide scavengers to control emissions during ore processing and refining operations, improving worker safety and environmental compliance while helping ensure worker wellbeing.

Hydrogen Sulfide Scavengers have long been utilized within the Water treatment industry as an effective means of controlling and removing hydrogen sulfide from sources, providing safe, clean water sources for various uses. Hydrogen sulfide scavengers have become ubiquitous across industries, attesting to their critical role in assuring operational safety, product quality and environmental compliance across numerous industrial processes.

Key Market Segments

Product Type

- Regenerative Scavengers

- Non-Regenerative Scavengers

By Formulation

- Liquid Scavengers

- Solid Scavengers

- Powder Scavengers

Application

- Oil & Gas Industry

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining & Processing)

- Petrochemical Industry

- Paper & Pulp Industry

- Mining Industry

- Water Treatment Industry

- Others

Drivers

Industry Safety and Regulatory Compliance: Stringent regulations mandating reduced hydrogen sulfide emissions have driven demand for hydrogen sulfide scavengers in industries, particularly oil & gas and petrochemical sectors, which use them to comply with environmental regulations while providing safe working environments.

Increased Oil & Gas Exploration Activities: With increasing oil and gas exploration activities, particularly those targeting unconventional resources, comes an increase in hydrogen sulfide scavenger needs. Scavengers play an essential role in mitigating risks associated with H2S presence during drilling and production activities by eliminating its presence during these activities.

Demand for Clean and Safe Processes: Industries prioritize cleaner operations to maximize process efficiency while safeguarding equipment from corrosion caused by hydrogen sulfide gas emissions, leading to widespread usage of scavengers in various sectors such as petrochemicals, refining, and water treatment to preserve process integrity and ensure process integrity is upheld.

Expansion in Industrial Applications: Scavenger use is expanding beyond traditional sectors like oil & gas. Mining, paper & pulp production, and wastewater treatment now use these products to manage hydrogen sulfide levels more effectively and fuel market expansion.

Environmental Awareness: Increased environmental concern drives demand for effective hydrogen sulfide removal methods. Scavengers help reduce emissions while aligning with corporate sustainability goals and driving adoption by multiple industries. These drivers contribute to the expansion and adoption of hydrogen sulfide scavengers, reflecting their vital role in maintaining operational safety, compliance, and environmental responsibility across various industrial sectors.

Restraints

Implementation Costs, Hydrogen Sulfide Scavenging Solutions Involve Considerations, Implementing hydrogen sulfide scavenging solutions can incur considerable expenses associated with procurement, installation and maintenance of these scavengers. Such costs may limit their widespread adoption among smaller industries or operations with limited budgets.

Technological Challenges, Although scavengers are capable of efficiently removing hydrogen sulfide from an environment, their application and effectiveness may depend on operational conditions and concentration levels of H2S present in different settings. As a result, developing universally efficient scavenging solutions compatible with diverse environments presents manufacturers with technical hurdles to consider when developing universal scavenger solutions.

Environmental Concerns. While scavengers help reduce hydrogen sulfide emissions, their use may generate by-products or waste materials which must be handled responsibly in an eco-friendly manner to comply with regulations and comply with environmental compliance issues. Safety and Handling Risks, Handling scavengers can pose potential hazards due to their chemical makeup. Therefore, proper safety protocols should be employed during storage, transportation, and use to limit any hazards from these chemical agents.

Limitations in Awareness and Education: Some industries may still not fully appreciate the significance or benefits of hydrogen sulfide scavengers. Due to a lack of understanding regarding their efficacy and potential benefits, adoption could be limited across multiple sectors. These restraints pose challenges to the hydrogen sulfide scavenger market, limiting their widespread implementation and consequently hindering market expansion to some degree. Addressing these obstacles is vital to increasing the acceptance and efficiency of these solutions in various industrial settings.

Opportunities

Innovation Technology, Advancements in scavenging technologies present an exciting opportunity. Research and development efforts geared at improving efficacy and efficiency can create more potent, versatile solutions; improved formulations and application methods could expand markets by more effectively meeting industrial requirements.

Expanded Energy Sector, With growing global energy needs comes an increased oil and gas industry expansion. Upstream operations present significant opportunities for hydrogen sulfide scavengers; their role is critical in providing safer exploration and production processes that meet industry requirements.

Environmental Regulations, The tightening of environmental and safety regulations globally provides hydrogen sulfide scavengers with opportunities. Industries strive to comply with these regulations, creating demand for effective H2S management solutions. Companies offering compliant scavenging products can capitalize on this growing need.

Diverse Industrial Applications, In addition to oil and gas industries, hydrogen sulfide scavengers have many other industrial uses across industries such as petrochemicals, mining, and water treatment. Their widespread adoption indicates an emerging market for customized scavenging solutions tailored specifically for each sector’s challenges.

Rise of Eco-Friendly Solutions, The rising interest in environmentally sustainable products is shaping the market, prompting innovation to create greener scavengers that match this growing preference for eco-friendly technologies. Manufacturers who invest in such sustainable technology stand to benefit.

Emerging Economies’ Industrial Development: With emerging economies expanding their industrial infrastructure, opportunities exist for hydrogen sulfide scavengers in emerging economies to penetrate and expand. When invested properly, effective scavenging solutions provide substantial prospects for market penetration and expansion.

These opportunities present industry players with an excellent opportunity to innovate, broaden their product lines, and cater to ever-evolving market requirements, ultimately driving the growth of the Hydrogen Sulfide Scavengers market.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 36.10% in 2023. This trend is expected to persist, with the region maintaining the largest market share throughout the forecast period. The Asia Pacific encompasses over 40 countries, many of which are classified by the United Nations as either developing or under-developed.

In the context of hydrogen sulfide scavengers, the region’s focus is on the need for innovative solutions for infrastructure development in high-end residential and commercial buildings, particularly in the developing countries of Asia. The surge in demand for aesthetically pleasing interior and exterior lighting is attributed to the rapid growth in India’s lifestyle, increasing disposable income, and the availability of cost-effective hydrogen sulfide scavengers in the architectural lighting market.

In Europe, the market for hydrogen sulfide scavengers is poised to experience a significant Compound Annual Growth Rate (CAGR) during the forecast period. This growth is fueled by the widespread adoption of energy-efficient scavenging systems and advanced control technologies across Europe. The increasing demand for modern hydrogen sulfide scavenging solutions, especially those featuring temperature control capabilities, is anticipated to drive market growth. Applications in homes, restaurants, theatres, museums, and hotels are contributing to the rising need for sophisticated architectural scavenging systems in the European market.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Key players play a crucial role in shaping the dynamics of the hydrogen sulfide scavengers market, contributing to its growth and competitiveness. Here’s an analysis of some prominent companies in the market

These key players contribute to the competitive landscape of the hydrogen sulfide scavengers market, driving innovation, research and development, and strategic partnerships to address the evolving needs of the industry. The market dynamics are influenced by the collective efforts and market presence of these leading companies.

Top Key Рlауеrѕ

- Suez SA

- Danaher Corporation

- Dorf-Ketal Chemicals India Private Limited

- Schlumberger Limited

- Halliburton Company

- Ecolab Inc.

- Arkema S.A.

Recent Developments

In August 2022, Baker Hughes, a leading Energy Technology Company, is growing its presence in Asia with the establishment of a new oilfield services chemicals production facility in Singapore, allowing for manufacturing optimization and speedier delivery of fit-for-purpose chemical solutions. The new plant expands on Baker Hughes’ previous strategy of sourcing and producing chemicals near key demand hubs, such as the recently announced chemicals joint venture firm with Dussur in Saudi Arabia.

Report Scope

Report Features Description Market Value (2023) USD 530.6 Mn Forecast Revenue (2033) USD 800.6 Mn CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type(Regenerative Scavengers, Non-Regenerative Scavengers), By Formulation(Liquid Scavengers, Solid Scavengers, Powder Scavengers), Application(Oil & Gas Industry, Upstream (Exploration & Production), Midstream (Transportation & Storage), Downstream (Refining & Processing), Petrochemical Industry, Paper & Pulp Industry, Mining Industry, Water Treatment Industry, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Suez SA, Danaher Corporation, Dorf-Ketal Chemicals India Private Limited, Schlumberger Limited, Halliburton Company, Ecolab Inc., Arkema S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Hydrogen Sulfide Scavengers Market?Hydrogen Sulfide Scavengers Market size is expected to be worth around USD 800.6 Million by 2033, from USD 530.6 Million in 2023.

What is the projected CAGR at which the Hydrogen Sulfide Scavengers Market is expected to grow at?Hydrogen Sulfide Scavengers Market is growing at CAGR of 4.2% during forecast periode 2024-2033List the key industry players of the Hydrogen Sulfide Scavengers Market?Suez SA, Danaher Corporation, Dorf-Ketal Chemicals India Private Limited, Schlumberger Limited, Halliburton Company, Ecolab Inc., Arkema S.A.

Hydrogen Sulfide Scavengers MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Hydrogen Sulfide Scavengers MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Suez SA

- Danaher Corporation

- Dorf-Ketal Chemicals India Private Limited

- Schlumberger Limited

- Halliburton Company

- Ecolab Inc.

- Arkema S.A.