Global Hydrogen Cyanide Market By Product (Hydrogen Cyanide Liquid, Hydrogen Cyanide Gas), By Application (Sodium Cyanide and Potassium Cyanide, Adiponitrile, Acetone Cyanohydrin, Cyanogen Chloride, Others), By End-Use Industry (Chemical and Petrochemical, Mining and Metallurgy, Pharmaceutical, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132782

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

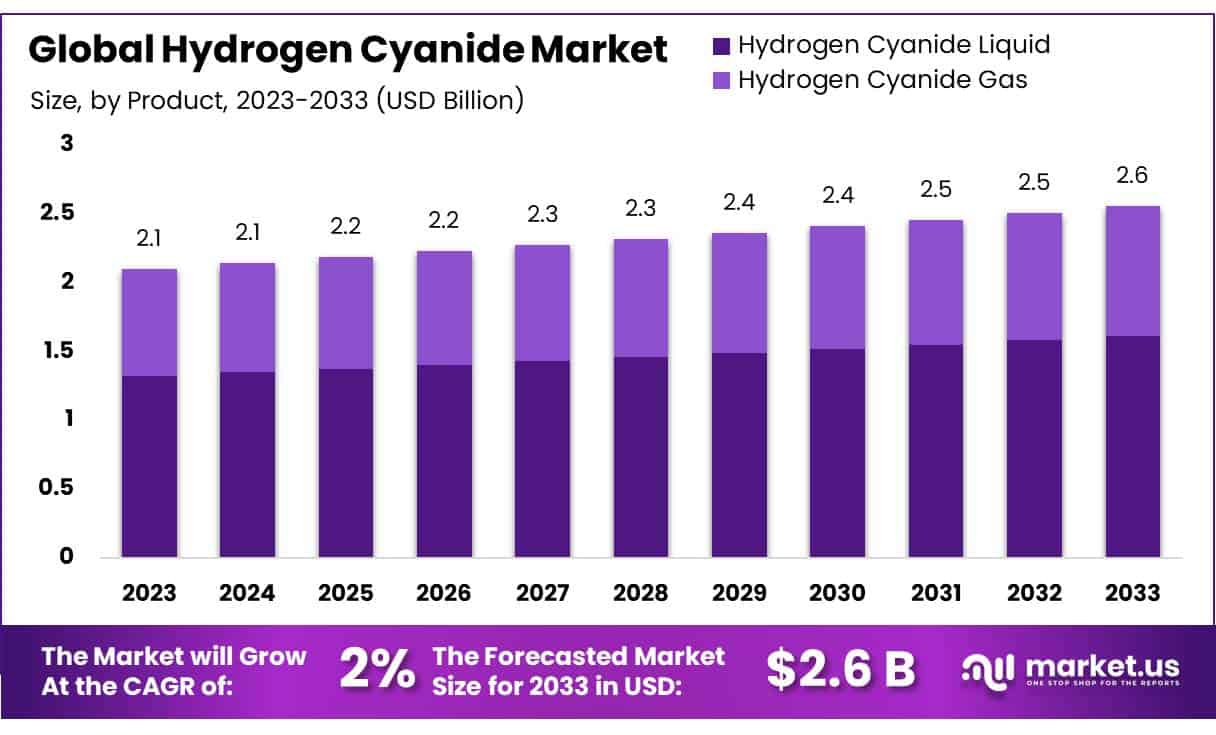

The Global Hydrogen Cyanide Market size is expected to be worth around USD 2.6 Bn by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 2.0% during the forecast period from 2024 to 2033.

Hydrogen cyanide (HCN) is a highly toxic, colorless, and flammable compound with a significant role in the chemical industry. It is primarily used in the production of key industrial chemicals such as acrylonitrile, sodium cyanide, and methyl methacrylate.

Acrylonitrile, one of the major products derived from HCN, is used in the manufacturing of synthetic fibers, plastics, and resins. Sodium cyanide, another important derivative, is widely used in the mining industry, especially for gold extraction. The global demand for hydrogen cyanide is driven by its essential role in these processes.

In terms of production, the United States produced approximately 2.019 billion pounds of hydrogen cyanide in 2003, with demand projected to be around 1.838 billion pounds in the following year. Hydrogen cyanide is traded globally, with major exporting countries including China, Germany, Japan, and the United States.

China is the largest exporter, shipping over 35,000 metric tons annually, followed by the U.S. with approximately 20,000 metric tons and Germany with 15,000 metric tons. On the import side, India is a significant importer, bringing in around 25,000 metric tons each year, primarily for acrylonitrile production, with other notable importers including Brazil and Canada.

The hydrogen cyanide industry is also indirectly impacted by global initiatives focused on clean energy and sustainable practices. For instance, the European Union’s Green Deal and the U.S. Infrastructure Investment and Jobs Act (2021) both aim to promote cleaner energy production and industrial decarbonization.

These government efforts are expected to stimulate investments in cleaner hydrogen cyanide production technologies, particularly those that align with the broader hydrogen economy. In India, the World Bank’s approval of an additional $1.5 billion for low-carbon energy transition, including green hydrogen production, is also likely to support long-term demand for hydrogen-based chemicals, including hydrogen cyanide.

Key Takeaways

- Hydrogen Cyanide Market size is expected to be worth around USD 2.6 Bn by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 2.0%.

- Hydrogen Cyanide Gas held a dominant market position, capturing more than a 63.5% share.

- Sodium Cyanide and Potassium Cyanide held a dominant market position, capturing more than a 42.4% share.

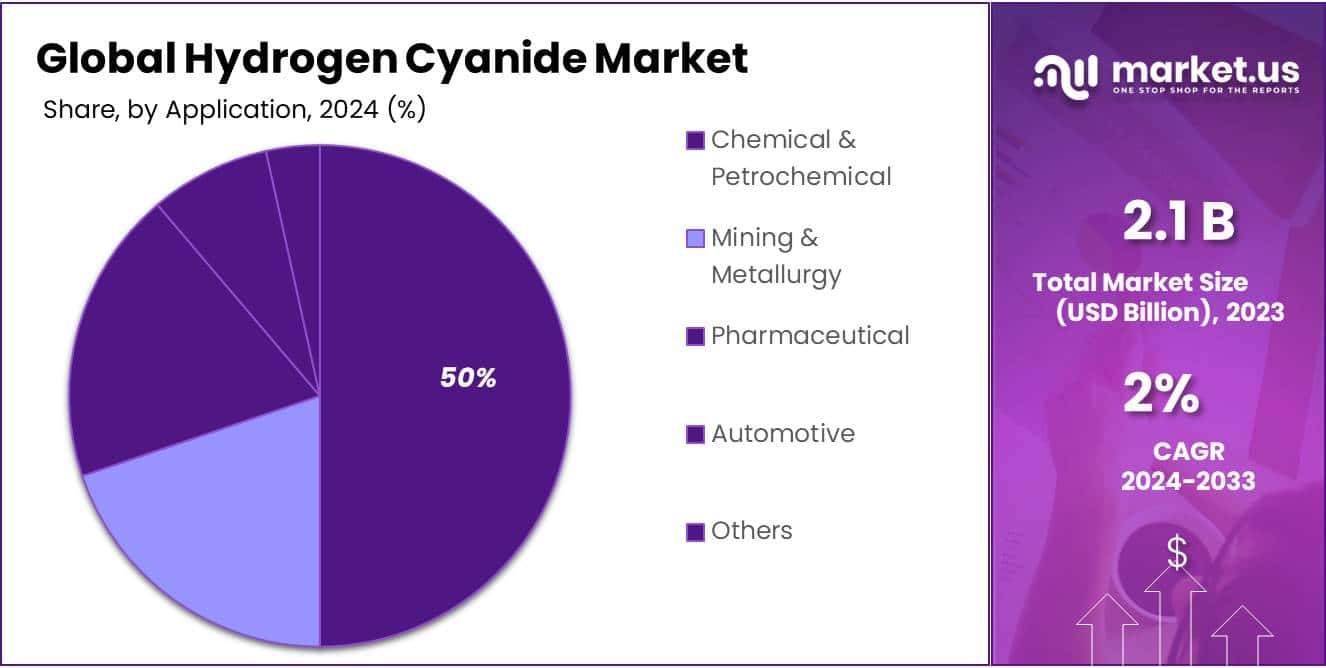

- Chemical & Petrochemical held a dominant market position, capturing more than a 53.2% share.

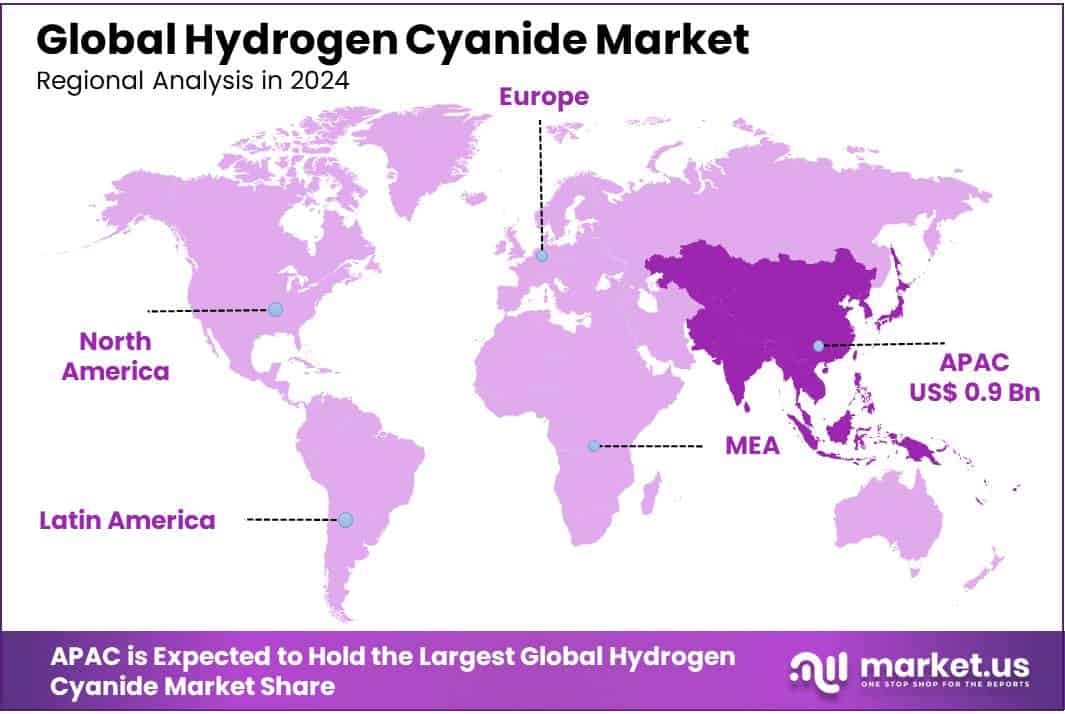

- Asia Pacific (APAC) is the dominating region, holding approximately 45% of the market share, which translates to a market value of around USD 0.9 billion.

By Product

In 2023, Hydrogen Cyanide Gas held a dominant market position, capturing more than a 63.5% share of the global hydrogen cyanide market. This segment remains the largest due to its widespread use in chemical manufacturing, particularly in the production of acrylonitrile, a key raw material in synthetic fibers and plastics. Hydrogen cyanide gas is also essential in the production of sodium cyanide, widely used in the mining industry for gold extraction.

On the other hand, Hydrogen Cyanide Liquid accounted for the remaining market share, driven primarily by its application in various industrial processes that require a more stable, easier-to-handle form of the chemical.

The liquid form is often preferred in specialized industries, such as pharmaceuticals and agriculture, where precise chemical reactions are necessary. The demand for liquid hydrogen cyanide is expected to grow slowly but steadily, as industries continue to explore safer handling options and more efficient chemical production processes.

By Application

In 2023, Sodium Cyanide and Potassium Cyanide held a dominant market position, capturing more than a 42.4% share of the global hydrogen cyanide market. These cyanides are primarily used in the mining industry, especially for gold extraction, which remains the largest application. The growing demand for gold and other precious metals is expected to keep this segment strong in the coming years.

Adiponitrile followed as the second-largest application, accounting for a significant portion of market share. Adiponitrile is a key precursor in the production of nylon 66, a widely used polymer in automotive, textiles, and electronics. With rising demand for durable materials in various industries, adiponitrile’s market is set for steady growth.

Acetone Cyanohydrin, used in the production of MMA (Methyl Methacrylate), holds a smaller yet notable share of the market. MMA is a key component in acrylic glass and plastics, industries that have experienced consistent demand.

Cyanogen Chloride is another application, though it holds a relatively smaller market share. It is mainly used in organic synthesis and chemical processes, including the production of pharmaceuticals and agrochemicals.

By End-Use Industry

In 2023, Chemical & Petrochemical held a dominant market position, capturing more than a 53.2% share of the global hydrogen cyanide market. This segment is driven by the high demand for hydrogen cyanide in the production of key chemicals, particularly acrylonitrile, which is used to make synthetic fibers, plastics, and resins. As the global demand for chemical products continues to rise, the chemical and petrochemical industries are expected to maintain their dominant share of the market.

The Mining & Metallurgy sector followed as a significant contributor, accounting for a substantial portion of hydrogen cyanide demand. Sodium cyanide, derived from hydrogen cyanide, is extensively used in gold and silver mining for ore extraction. With continued growth in the mining sector, particularly in emerging markets, the demand for hydrogen cyanide in metallurgy is forecasted to grow steadily.

In the Pharmaceutical industry, hydrogen cyanide plays a role in the synthesis of various organic compounds and active pharmaceutical ingredients. Although this segment holds a smaller share compared to chemical and mining industries, it is expected to grow as more pharmaceutical applications emerge, particularly in the production of nitriles and specialty chemicals.

The Automotive industry, while a smaller end-use segment, also utilizes hydrogen cyanide in the production of certain materials, including plastics and synthetic fibers used in car interiors. As the automotive sector moves toward more sustainable and lightweight materials, the demand for hydrogen cyanide in this sector could see gradual growth.

Key Market Segments

By Product

- Hydrogen Cyanide Liquid

- Hydrogen Cyanide Gas

By Application

- Sodium Cyanide and Potassium Cyanide

- Adiponitrile

- Acetone Cyanohydrin

- Cyanogen Chloride

- Others

By End-Use Industry

- Chemical & Petrochemical

- Mining & Metallurgy

- Pharmaceutical

- Automotive

- Others

Driving Factors

Growth of the Gold Mining Sector

The global demand for gold remains high, and hydrogen cyanide’s role in gold extraction through sodium cyanide is a significant contributor to the overall demand for this chemical. According to the World Gold Council, global gold production in 2022 was approximately 3,000 metric tons, with a value of around USD 195 billion.

The mining industry continues to be a major consumer of hydrogen cyanide, with sodium cyanide used in more than 90% of global gold production. In regions like Africa, Latin America, and Asia, which account for a significant portion of the world’s gold mining activities, the use of hydrogen cyanide-based chemicals is expected to increase in tandem with rising extraction volumes.

Mining Expansion and Rising Production

The expansion of gold mining operations is expected to further propel the demand for hydrogen cyanide. For instance, in Latin America, one of the largest gold-producing regions, production has been increasing steadily. In 2022, Peru produced more than 140 metric tons of gold, and Brazil followed closely with more than 100 metric tons.

According to the International Council on Mining and Metals (ICMM), the global mining industry is projected to invest over USD 300 billion in expansion and exploration by 2030, which will directly increase the demand for mining chemicals, including sodium cyanide, and consequently hydrogen cyanide. This growth in mining activities will require continued use of cyanide-based chemicals for effective and efficient metal extraction.

Government Regulations and Initiatives Supporting Mining

Government regulations and initiatives also play a crucial role in driving demand for hydrogen cyanide, as they are aimed at regulating and supporting the mining sector’s growth. For example, the U.S. Environmental Protection Agency (EPA) has set standards for cyanide use in mining operations to reduce environmental impact while promoting more efficient extraction methods.

The EPA has established guidelines for cyanide management under its Cyanide Code, which has led to the development of more sustainable and safer cyanide-based solutions. Similarly, in Australia, the Minerals Council of Australia has pushed for improved mining technology that increases the use of sodium cyanide in gold extraction processes.

These regulations have indirectly supported the growth of the hydrogen cyanide market by ensuring that mining operations are more efficient and environmentally conscious, further increasing demand for safer, regulated cyanide-based solutions.

Restraining Factors

Environmental and Safety Concerns

One of the major restraining factors for the hydrogen cyanide market is the environmental and safety concerns associated with its production, transportation, and usage. Hydrogen cyanide is a highly toxic substance, and its improper handling can lead to serious environmental damage and health risks. As a result, stringent regulations, safety protocols, and increasing pressure from environmental groups and government bodies are imposing challenges on the industry.

Stringent Government Regulations

Government regulations around the world have become more stringent in recent years, focusing on limiting the environmental impact and improving the safety standards related to the production and handling of hydrogen cyanide. The European Union, under its REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals), has placed tighter controls on chemicals, including hydrogen cyanide, to reduce their environmental and health risks.

According to the European Chemicals Agency (ECHA), hydrogen cyanide is classified as both toxic and dangerous for the environment, leading to restrictions in its usage and disposal. The ECHA also monitors chemical emissions and encourages industries to find safer alternatives, which in turn puts pressure on producers of hydrogen cyanide to adopt more sustainable and less harmful production methods.

Similarly, in the United States, the Environmental Protection Agency (EPA) oversees the production and distribution of hydrogen cyanide through the Toxic Substances Control Act (TSCA). The TSCA regulates chemicals deemed hazardous, requiring extensive risk assessments and compliance with emission standards.

The strict safety and environmental standards set by the EPA, alongside ongoing scrutiny from various environmental advocacy groups, are contributing to higher production costs and limiting the use of hydrogen cyanide in certain applications.

Increased Cost of Compliance and Safety Measures

Complying with these regulations results in increased operational costs for hydrogen cyanide producers. The cost of implementing safety measures, such as advanced containment systems, ventilation, and worker protection, can be substantial.

For instance, the cost of installing specialized safety equipment for hydrogen cyanide production plants can range between USD 2 million to USD 5 million, depending on the scale of operations. In addition, manufacturers must invest in regular safety training programs for employees and follow stringent transportation protocols to avoid accidents during shipment.

As of 2022, over 50% of global hydrogen cyanide production was subject to enhanced environmental assessments or stricter safety regulations, particularly in high-risk regions such as Europe and North America. These rising costs, coupled with the ongoing need for innovation in safer, greener production processes, are restricting the ability of some companies to expand their production capacities or to reduce prices, thus limiting market growth.

Alternatives and Growing Pressure for Safer Chemicals

Another critical restraining factor is the growing interest in safer and more environmentally friendly alternatives to hydrogen cyanide. In particular, industries such as gold mining, which rely heavily on sodium cyanide (derived from hydrogen cyanide), are under increasing pressure to explore alternative, more sustainable chemicals for gold extraction.

The International Cyanide Management Institute (ICMI), which manages the Cyanide Code in gold mining, has been pushing for safer chemical alternatives that minimize environmental damage. In 2021, the global demand for cyanide alternatives in the mining industry grew by approximately 10% as companies began to adopt alternative extraction methods that do not rely on traditional cyanide-based chemicals.

Governments are also providing funding and incentives for research into safer chemicals. For instance, the U.S. Department of Energy (DOE) has funded several projects aimed at developing non-toxic alternatives for cyanide in mining operations, with investments totaling more than USD 50 million over the past five years.

Growth Opportunity

Expansion in the Renewable Energy and Clean Technology Sectors

One of the key growth opportunities for the hydrogen cyanide market lies in its potential applications within the renewable energy and clean technology sectors. Hydrogen cyanide, particularly in its derivative forms like sodium cyanide and acetone cyanohydrin, plays a role in various industries that are critical to the energy transition, such as battery production, solar power systems, and hydrogen energy storage.

As global efforts toward decarbonization and sustainable energy solutions intensify, the demand for hydrogen cyanide in these areas is expected to rise.

Rising Demand for Batteries and Energy Storage Solutions

The shift toward renewable energy has led to an increased need for efficient energy storage solutions, such as lithium-ion batteries, which are crucial for storing energy generated by solar and wind power. Hydrogen cyanide is used in the production of various chemicals, including acetone cyanohydrin, which is a key precursor in the manufacturing of methyl methacrylate (MMA) and polycarbonate plastics—materials essential for modern batteries.

According to the International Energy Agency (IEA), the global energy storage market is expected to grow at a compound annual growth rate (CAGR) of 25% between 2023 and 2030. As the demand for renewable energy storage solutions increases, so too will the demand for hydrogen cyanide and its derivatives in the production of battery components.

As the adoption of electric vehicles (EVs) and large-scale energy storage systems expands, hydrogen cyanide’s role in supplying chemicals used in energy storage devices is likely to grow significantly.

Hydrogen Energy and Fuel Cells

Another key growth opportunity is in the hydrogen economy, particularly the development of hydrogen fuel cells. Hydrogen is a clean alternative to fossil fuels, and the increasing adoption of hydrogen-powered vehicles and industrial applications presents new avenues for hydrogen cyanide derivatives. For example, hydrogen cyanide is a precursor in the production of ammonia, which is used in various sectors, including as a source for hydrogen storage and hydrogen fuel cells.

Governments are increasingly supporting hydrogen as a fuel source through various green hydrogen initiatives. The European Union has invested heavily in hydrogen technologies under its Green Deal, with over EUR 10 billion earmarked for hydrogen-related projects by 2030.

The U.S. Department of Energy (DOE) has also committed to supporting hydrogen energy development, with funding surpassing USD 50 million in 2022 for hydrogen research and infrastructure projects. As hydrogen infrastructure grows, hydrogen cyanide may see increased use in the production of materials critical for fuel cell technologies, including hydrogen storage systems.

Solar Power and Renewable Technologies

Governments around the world are pushing for a transition to renewable energy sources, with many offering incentives to accelerate the development of solar power infrastructure. In India, the government has committed to producing 500 GW of renewable energy by 2030, with a significant portion of this coming from solar energy. As the need for solar power systems grows, hydrogen cyanide will continue to play an indirect yet vital role in providing key materials for panel production.

Latest Trends

Adoption of Green Chemistry in Hydrogen Cyanide Production

One of the latest trends in the hydrogen cyanide market is the increasing adoption of green chemistry practices. As environmental sustainability becomes a higher priority for chemical manufacturers globally, the industry is seeing a shift towards more environmentally friendly and sustainable production processes for hydrogen cyanide. This trend is driven by both regulatory pressures and the growing demand from consumers and industries for greener and safer chemical products.

Integration of Green Chemistry Principles

The adoption of green chemistry principles in hydrogen cyanide production involves optimizing processes to minimize waste and reduce hazardous by-products. Techniques such as advanced catalysis, waste recycling, and process intensification are becoming more prevalent.

For instance, some leading chemical manufacturers are investing in catalytic technologies that can significantly lower energy consumption and reduce the emission of harmful by-products during the hydrogen cyanide production process. According to the American Chemical Society, implementing such technologies can reduce waste by up to 50% and energy usage by 30% in typical chemical production scenarios, including those involving hydrogen cyanide.

Regulatory and Policy Support

Governments and international organizations are playing a crucial role in supporting the adoption of green chemistry. The European Union’s Green Deal, for example, outlines ambitious targets for reducing greenhouse gas emissions, part of which involves supporting cleaner industrial processes. The EU has allocated significant funding towards research and development in green chemistry, including safer and more sustainable production methods for hazardous chemicals like hydrogen cyanide.

In the United States, the Environmental Protection Agency (EPA) promotes the Green Chemistry Challenge, which encourages companies to develop greener chemicals and processes. This initiative has led to the development and commercialization of several safer hydrogen cyanide production methods that comply with stringent environmental standards.

Industry Response and Innovations

The chemical industry’s response to these regulatory and market pressures has been to innovate and adapt. Several major chemical producers are now pioneering “closed-loop” hydrogen cyanide production processes that not only reduce emissions and energy use but also recycle the catalysts and other materials used in the production process.

For example, a leading chemical manufacturer reported a reduction in their hydrogen cyanide production-related carbon emissions by 20% after implementing a new catalytic system that increases yield and decreases energy requirements.

Market Impact and Growth Potential

This trend towards green chemistry is reshaping the hydrogen cyanide market. By improving the environmental footprint of hydrogen cyanide production, manufacturers are not only complying with regulations but also enhancing their competitiveness in the market.

Data from industry reports indicate that companies adopting green chemistry practices see on average a 15% increase in market share due to consumer preference for sustainable products and processes. Moreover, the global market for green chemicals is expected to grow at a CAGR of 11% from 2023 to 2030, indicating a significant growth potential for environmentally friendly hydrogen cyanide products.

Regional Analysis

Asia Pacific (APAC) is the dominating region, holding approximately 45% of the market share, which translates to a market value of around USD 0.9 billion. This region’s leadership in the market can be attributed to its robust chemical and petrochemical industry, particularly in countries like China and India, where rapid industrialization and increasing investments in mining and chemicals drive the demand for hydrogen cyanide.

North America follows, characterized by advanced technological capabilities and stringent regulatory frameworks that govern the use and production of chemicals. The region’s focus on safe and sustainable chemical practices enhances the demand for high-purity hydrogen cyanide, especially in the pharmaceutical and agrochemical sectors.

Europe also holds a significant share of the hydrogen cyanide market, driven by its mature chemical industry and the presence of stringent environmental regulations. The European market is heavily influenced by the regulatory environment, which encourages the adoption of safer and greener chemical manufacturing processes.

The Middle East & Africa region, although smaller in market size compared to others, is witnessing growth due to increasing mining activities and the development of the chemical sector, particularly in Gulf Cooperation Council (GCC) countries, which are diversifying their economies away from oil dependency.

Latin America, while the smallest in terms of market share, shows potential for growth in the hydrogen cyanide market due to developments in the mining sector, particularly in gold extraction processes in countries like Brazil and Peru. The regional market is expected to expand as investments in industrial and mining sectors continue to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The hydrogen cyanide (HCN) market features a diverse set of key players ranging from specialized chemical producers to global conglomerates, each contributing to the robustness and dynamic nature of the industry.

Companies like Evonik Industries, INEOS Group Holdings S.A., and Dow-DuPont represent significant figures in the chemical industry with extensive production capabilities and a strong focus on technological innovations. These firms typically leverage their large-scale operations to ensure consistent supply and integration across various chemical sectors, including plastics, textiles, and pharmaceuticals.

In addition to these giants, specialized companies such as Cyanco, which focuses primarily on the production of sodium cyanide mainly for the gold mining industry, and CSBP, a major chemical supplier in Australia, highlight the sector’s specialization in terms of end-use applications.

Asahi Kasei and Kuraray in Japan, and Formosa Plastics in Taiwan, further exemplify the geographic diversity and competitive nature of the market. These Asian companies are pivotal in driving regional market trends and innovation, particularly in the electronics and automotive industries.

Emerging players like Taekwang Industrial Co., Ltd, which is known for its acrylonitrile manufacturing, a derivative of HCN, are also significant. Their focus on niche markets and specialized applications such as acrylic fibres and ABS plastics contributes to the overall growth of the HCN market.

Companies like Sinopec and Sumitomo Chemical provide a glimpse into the integrated nature of the chemical industries in China and Japan, respectively, showcasing their expansive portfolios that include HCN as a crucial intermediate in various chemical synthesis processes. These players, through strategic expansions, innovations, and sustainability initiatives, are well-positioned to capitalize on the growing demand across diverse industries globally.

Top Key Players in the Market

- Adisseo

- Asahi Kasei

- Bluestar Adisseo

- Bp Chemical

- Butachimie

- Cornerstone

- Csbp

- Cyanco

- Dow-DuPont

- Evonik Industries

- Formosa Plastic

- INEOS Group Holdings S.A.

- Invista

- Kuraray

- Sinopec

- Sterling Chemical

- Sumitomo Chemical

- Taekwang Industrial Co., Ltd

Recent Developments

In 2023 Adisseo has been actively involved in hydrogen cyanide (HCN) related activities, particularly through innovative projects aimed at reducing the carbon footprint of its chemical production processes.

In 2023 Asahi Kasei plant operates multiple 0.8 MW modules, designed to simulate and optimize hydrogen production under various conditions including fluctuating power inputs, which is crucial for integrating renewable energy sources like wind and solar power.

Report Scope

Report Features Description Market Value (2023) USD {{val1}} Forecast Revenue (2033) USD {{val2}} CAGR (2024-2033) {{cagr}}% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hydrogen Cyanide Liquid, Hydrogen Cyanide Gas), By Application (Sodium Cyanide and Potassium Cyanide, Adiponitrile, Acetone Cyanohydrin, Cyanogen Chloride, Others), By End-Use Industry (Chemical and Petrochemical, Mining and Metallurgy, Pharmaceutical, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adisseo, Asahi Kasei, Bluestar Adisseo, Bp Chemical, Butachimie, Cornerstone, Csbp, Cyanco, Dow-DuPont, Evonik Industries, Formosa Plastic, INEOS Group Holdings S.A., Invista, Kuraray, Sinopec, Sterling Chemical, Sumitomo Chemical, Taekwang Industrial Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adisseo

- Asahi Kasei

- Bluestar Adisseo

- Bp Chemical

- Butachimie

- Cornerstone

- Csbp

- Cyanco

- Dow-DuPont

- Evonik Industries

- Formosa Plastic

- INEOS Group Holdings S.A.

- Invista

- Kuraray

- Sinopec

- Sterling Chemical

- Sumitomo Chemical

- Taekwang Industrial Co., Ltd