Global Hydrocyclone Market By Type (Solid-liquid, Liquid-liquid, Dense Media), By Separator Type (Pressure, Gravity), By Material (Steel, Ceramic, Polyurethane, Polypropylene), By End-User (Mining, Construction, Oil and Gas, Energy, Agriculture, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 14117

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

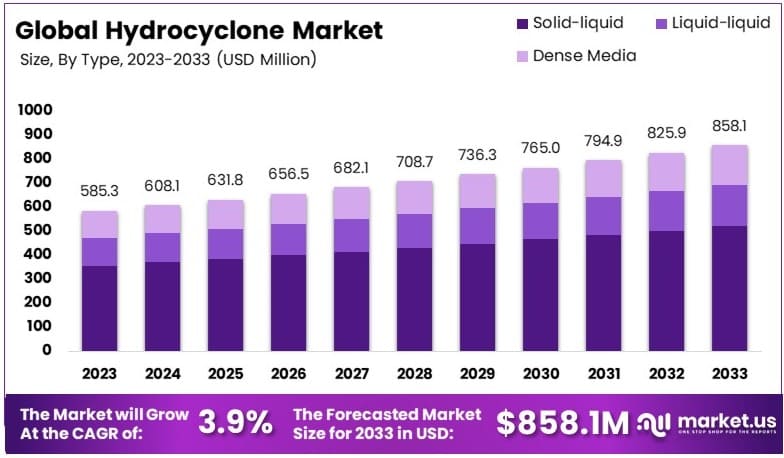

The Global Hydrocyclone Market size is expected to be worth around USD 858.1 Million by 2033, from USD 585.3 Million in 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

A hydrocyclone is a device engineered to separate particles in a liquid suspension by utilizing differences in their centripetal forces and fluid resistance. Widely used in industries such as mining, oil & gas, and wastewater treatment, this technology enhances particle separation efficiency, contributing to more sustainable and effective processes.

The hydrocyclone market encompasses the manufacturing and distribution of hydrocyclone devices, providing critical separation solutions to industries such as oil and gas, mining, and water treatment. The market is driven by the demand for high-efficiency solutions to separate, classify, and purify liquid suspensions, meeting stringent industry requirements.

Globally, oil fields produce around 250 million barrels of water per day, compared to roughly 80 million barrels of oil. This results in a 3:1 water-to-oil ratio, with approximately 70% water content. Over 60% of the water produced worldwide comes from oil fields, underscoring the need for advanced separation technologies like hydrocyclones. Consequently, the hydrocyclone market experiences growth as industries seek solutions to manage these large volumes of produced water effectively.

As investments in hydrocyclone technologies increase, their adoption is driven by the need to meet stringent environmental standards. For instance, in the North Sea oil sector, hydrocyclones are used to maintain effluent discharge levels below 40 ppm of oil content. These systems comply with regulatory requirements while also providing a compact, low-maintenance option suitable for challenging environments.

According to the World Bank, nearly 2 billion people globally lack access to safely managed drinking water, while 3.6 billion do not have safe sanitation services. This deficit encourages investment in hydrocyclone technology, as it can aid in addressing critical smart water management challenges, improve access to clean water, and enhance sanitation worldwide.

In line with global energy efficiency targets, the International Energy Agency (IEA) has noted increased investments, particularly in building technologies, appliances, and industrial automation systems. The goal is to double energy efficiency improvements by 2030.

Hydrocyclone technology supports these objectives, as its efficient design aids in conserving energy across multiple applications. Additionally, according to the World Economic Forum, nations like France have achieved a 12% reduction in energy intensity through targeted policies and technology upgrades, demonstrating the potential of efficient systems, including hydrocyclones, to further advance these improvements.

Key Takeaways

- The Hydrocyclone Market was valued at USD 585.3 million in 2023 and is expected to reach USD 858.1 million by 2033, with a CAGR of 3.9%.

- In 2023, Solid-Liquid Hydrocyclones dominated the type segment with 60.8%, primarily used in mineral and industrial processes.

- In 2023, Pressure-Type Separators led with 81.3%, offering high efficiency in various separation applications.

- In 2023, Steel was the dominant material with 47.9%, valued for its durability in harsh industrial environments.

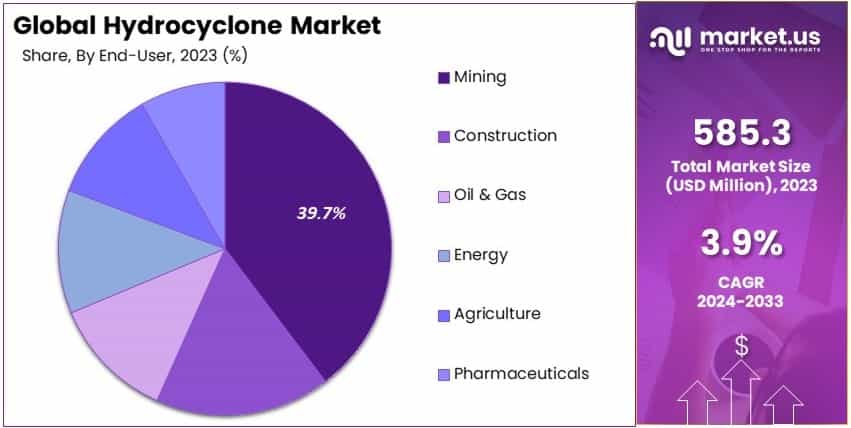

- In 2023, the Mining sector led the end-user segment with 39.7%, driven by increasing demand for ore processing solutions.

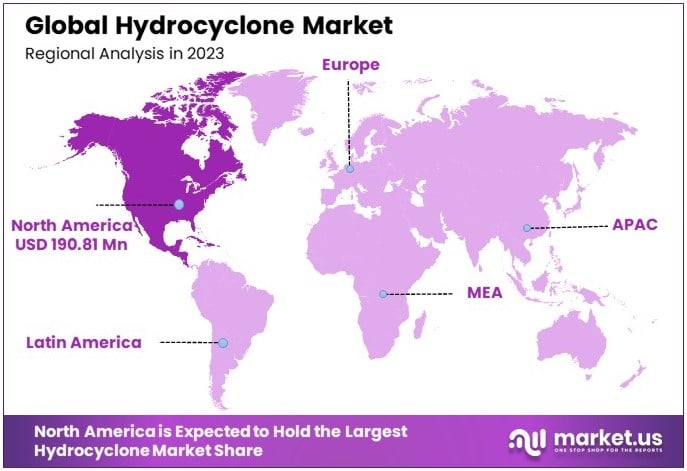

- In 2023, North America held 32.6% of the market, supported by the strong presence of mining and industrial activities.

Type Analysis

Solid-liquid hydrocyclones dominate the market with 60.8% due to their essential role in separating solid particles from liquids in various industrial processes.

The hydrocyclone market is segmented by type into solid-liquid, liquid-liquid, and dense media hydrocyclones. Solid-liquid hydrocyclones lead this segment because they are extensively used across a range of industries to separate solid contaminants from liquids.

These hydrocyclones are highly valued for their efficiency in clarifying wastewater, recovering solids, and in the processing of minerals and chemicals. Their ability to operate without moving parts or chemical additives also makes them a cost-effective and environmentally friendly option for many applications.

Liquid-liquid hydrocyclones are employed to separate oil from water or other liquids, which is crucial in industries such as oil and gas. This type of hydrocyclone helps to prevent water pollution and reclaim valuable hydrocarbons.

Dense media hydrocyclones are utilized in mineral processing to separate particles based on density, an essential function in the beneficiation of ores. This process is particularly important in the mining and recycling industries, where materials need to be separated with great precision.

Separator Type Analysis

Pressure-type separators lead with 81.3% as they efficiently utilize pressure to facilitate separation processes across various applications.

Separator types in hydrocyclones are categorized into pressure and gravity types. Pressure-type separators dominate the market due to their widespread use in industrial applications where high efficiency and precision are required.

These separators utilize centrifugal force generated by pressured fluid to separate substances of different densities. Their efficiency in processing large volumes of liquids makes them indispensable in sectors such as oil and gas, mining, and wastewater treatment.

Gravity separators, while useful in specific contexts, are generally slower and less efficient than pressure-type separators. They rely on gravitational forces to achieve oil and gas separation, making them suitable for applications where lower throughput and higher simplicity are beneficial.

Material Analysis

Steel hydrocyclones dominate the material segment with 47.9% because of their durability and effectiveness in handling abrasive solids and corrosive fluids.

Materials used in hydrocyclone construction include steel, ceramic, polyurethane, and polypropylene. Steel, being the most dominant material, is preferred for its robustness and longevity.

Steel hydrocyclones are capable of withstanding harsh operating conditions, including the handling of abrasive solids and corrosive fluids, which are common in mining and oil and gas industries.

Ceramic hydrocyclones are selected for their exceptional resistance to wear and corrosion, making them ideal for specialized applications that involve acidic or highly abrasive materials.

Polyurethane and polypropylene hydrocyclones offer lightweight and corrosion-resistant alternatives to metal and ceramic models. These materials are suitable for less severe conditions and are often used in applications such as water treatment and agricultural processes.

End-User Analysis

The mining sector dominates the end-user segment with 39.7%, relying heavily on hydrocyclones for mineral processing and waste management.

The end-user segment of the hydrocyclone market includes mining, construction, oil & gas, energy, agriculture, and pharmaceuticals. The mining sector holds the largest share, driven by the need for efficient mineral processing techniques. Hydrocyclones play a critical role in the mining industry by efficiently separating valuable minerals from waste rock and tailings, enhancing resource recovery and minimizing environmental impact.

Construction and oil & gas sectors also significantly utilize hydrocyclones. In construction, they are used for grading sand and aggregate materials, while in oil and gas, they are critical for separating oil from water in production fluids.

Energy, agriculture, and pharmaceutical industries use hydrocyclones for a variety of separation processes. In the energy sector, hydrocyclones help in the separation and recovery of solid byproducts. Agriculture uses these devices for irrigation and water treatment purposes, whereas pharmaceuticals deploy them to ensure the purity and quality of chemical compounds.

Key Market Segments

By Type

- Solid-liquid

- Liquid-liquid

- Dense Media

By Separator Type

- Pressure

- Gravity

By Material

- Steel

- Ceramic

- Polyurethane

- Polypropylene

By End-User

- Mining

- Construction

- Oil & Gas

- Energy

- Agriculture

- Pharmaceuticals

Drivers

Water Treatment and Mining Demand Drive Market Growth

The Hydrocyclone Market is driven by the rising demand for water treatment solutions across various industries. As global water scarcity issues increase, industries are turning to hydrocyclones for efficient water recycling and wastewater management. Hydrocyclones play a critical role in separating solids from liquids, making them essential for water treatment processes.

Additionally, increasing mining activities globally are fueling the demand for hydrocyclones. Mining operations rely heavily on hydrocyclones for separating valuable minerals from ores, particularly in regions where mining activities are on the rise. The oil and gas industry is another major driver, where hydrocyclones are used for separating oil from water, ensuring the efficiency of extraction processes.

Advancements in hydrocyclone design and materials have further supported market growth. Innovations in materials and construction techniques are enhancing the durability and performance of hydrocyclones, allowing for more efficient operation in demanding industrial environments.

Restraints

High Costs and Environmental Concerns Restraint Market Growth

High operational and maintenance costs are a significant challenge, especially for industries looking to reduce overall expenses. The need for frequent maintenance, combined with the cost of replacement parts, adds to the long-term operational costs of hydrocyclones.

Moreover, hydrocyclones often struggle with limited efficiency when handling fine particles, which can impact their overall performance in some applications. This limitation pushes industries to explore alternative separation technologies, creating competition within the market.

Environmental concerns also pose a restraint, particularly regarding waste disposal. The solids separated by hydrocyclones need to be properly managed, and in industries where waste disposal is heavily regulated, this can create additional challenges and costs for operators.

Opportunity

Energy-Efficient Systems and Emerging Markets Provide Opportunities

The Hydrocyclone Market presents numerous growth opportunities, particularly with the expansion into emerging markets. As industrial activities grow in regions such as Asia-Pacific and Latin America, the demand for efficient separation technologies like hydrocyclones is expected to rise.

Developing more energy-efficient hydrocyclones is another promising opportunity. With increasing pressure on industries to reduce energy consumption and lower their carbon footprint, hydrocyclone manufacturers that focus on energy-efficient designs can capture a larger share of the market.

The integration of automation and Internet of Things (IoT) technology into hydrocyclone operations is also creating new growth avenues. Smart hydrocyclone systems equipped with real-time monitoring capabilities can improve operational efficiency and reduce downtime, making them highly attractive to industries with large-scale operations.

In addition, growing demand from sectors such as agriculture and food processing is opening up new applications for hydrocyclones, where they are used to separate solid particles from liquids in food and beverage production.

Challenges

Technological Complexity and Regulatory Issues Challenge Market Growth

Many industries rely on older hydrocyclone systems, and integrating modern technology into these systems can be complex and costly. This technological complexity often requires specialized expertise, adding to the challenges for companies looking to modernize their operations.

Volatility in raw material prices is another challenge that affects the market. The fluctuating costs of the materials used to manufacture hydrocyclones can create unpredictability in pricing, which can impact profit margins for manufacturers and end-users alike.

Regulatory challenges also play a significant role, especially concerning environmental compliance. Industries that use hydrocyclones must meet stringent environmental regulations regarding waste management and water conservation, which can add to operational costs.

Scaling up hydrocyclone systems for large-scale industrial use is another hurdle. Ensuring that hydrocyclones perform effectively at larger capacities requires significant investment in design and engineering, making scalability a key challenge in the market.

Growth Factors

Wastewater Recycling and Mineral Processing Are Growth Factors

The Hydrocyclone Market is experiencing growth due to the increasing focus on wastewater recycling and reuse. As industries look to conserve water and meet stringent regulations, hydrocyclones are becoming an essential tool for recycling and purifying wastewater.

In mineral processing, hydrocyclones are widely used for separating valuable minerals from ores, making them indispensable in mining equipment and operations. With the mining sector expanding globally, the demand for efficient separation technologies continues to rise.

The oil and gas industry is also driving market growth. Hydrocyclones are used extensively in oil and gas exploration to separate oil from water, ensuring that extraction processes are as efficient as possible.

Lastly, rising government regulations on water conservation are contributing to the growth of the hydrocyclone market. As more industries are required to implement water-saving technologies, the demand for hydrocyclones is expected to increase, further supporting market expansion.

Emerging Trends

Compact, Modular Systems Are Latest Trending Factor

One of the key trends in the Hydrocyclone Market is the rising demand for compact and modular hydrocyclones. These smaller, more versatile systems allow for easier installation and maintenance, making them an attractive option for industries with space constraints or smaller-scale operations.

The growth of hybrid separation technologies is another trend shaping the market. Hybrid systems that combine hydrocyclones with other separation technologies are gaining popularity due to their improved efficiency and versatility.

Environmental sustainability is also a driving trend, with industries increasingly seeking green solutions. Hydrocyclones that minimize energy consumption and reduce waste generation are becoming more sought after as companies aim to meet environmental targets.

Advancements in smart hydrocyclone systems, featuring real-time monitoring and automated controls, are also trending. These systems enable more precise operation and maintenance, improving overall efficiency and reducing downtime in industrial applications.

Regional Analysis

North America Dominates with 32.6% Market Share

North America leads the Hydrocyclone Market with a 32.6% share, generating USD 190.81 million. This dominance is driven by high demand from industries such as mining, oil and gas, and wastewater management. The region’s strong industrial base, advanced technologies, and focus on efficiency in resource management contribute significantly to this market leadership.

North America benefits from extensive infrastructure in the mining and oil sectors, where hydrocyclones are essential for separation processes. The region also prioritizes environmental regulations, pushing industries to adopt efficient water treatment technologies, further driving demand for hydrocyclones. The presence of key manufacturers and a focus on innovation in industrial equipment play a crucial role in the region’s strong performance.

Regional Mentions:

- Europe: Europe has a significant hydrocyclone market presence, driven by strong regulations on environmental protection and water treatment. The region focuses on sustainable practices and efficient resource management.

- Asia Pacific: Asia Pacific is seeing rapid growth in the hydrocyclone market due to expanding mining and manufacturing activities. Countries like China and Australia are key contributors, with high demand for resource-efficient technologies.

- Middle East & Africa: The Middle East & Africa region is gradually adopting hydrocyclones, particularly in the oil and gas sectors. Growing investments in water treatment and industrial infrastructure are driving market demand.

- Latin America: Latin America shows steady growth in the hydrocyclone market, mainly due to the region’s focus on mining and agriculture. The need for efficient separation and resource management technologies is fueling demand.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Hydrocyclone Market is dominated by major players such as FLSmidth, Weir Minerals, and Schlumberger. These companies primarily serve industries like mining, oil and gas, and wastewater management, providing efficient separation and classification solutions.

Their product and service offerings include a wide range of hydrocyclone systems designed for solid-liquid separation, desanding, and material recovery. Companies like KSB and Metso focus on delivering high-performance hydrocyclones tailored to specific industrial applications, while others, like Multotec Pty Ltd, offer custom solutions for enhanced efficiency.

In terms of market strategies, these companies prioritize partnerships with mining and energy companies and aim to provide advanced, durable hydrocyclones to improve operational efficiency. They also focus on offering cost-effective and scalable solutions to meet varying industrial needs. Pricing strategies are typically based on the complexity and scale of the solutions, with premium pricing for advanced technologies.

Geographically, these companies have a global presence, with strong market penetration in North America, Europe, and emerging markets like Asia-Pacific.

Innovation is central to their market position, with continuous development in wear-resistant materials, automation, and energy-efficient designs.

Their competitive edge comes from their strong global reach, broad product portfolios, and continuous innovation in hydrocyclone technology, allowing them to maintain leadership in various industrial sectors.

Top Key Players in the Market

- FLSmidth

- Weir Minerals

- KSB

- Siemens

- Metso

- TechnipFMC

- Exterran

- Weihai Haiwang

- Netafim

- Schlumberger

- Multotec Pty, ltd

Recent Developments

- Metso: In September 2024, Metso launched the MHC™ CB Hydrocyclone, introducing a curved-bottom design that boosts classification efficiency and capacity. This innovation enhances particle separation, allows for greater throughput, and better manages coarser materials while reducing fines.

- FLSmidth: In September 2024, FLSmidth acquired Tipco Tudeshki Industrial Process Control GmbH, enhancing its pump, cyclone, and valve offerings. The integration of Tipco’s sensor technology into FLSmidth’s KREBS hydrocyclone portfolio aims to improve particle size measurement and support the company’s strategic focus on digital solutions and operational efficiency in mining.

Report Scope

Report Features Description Market Value (2023) USD 585.3 Million Forecast Revenue (2033) USD 858.1 Million CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Solid-liquid, Liquid-liquid, Dense Media), By Separator Type (Pressure, Gravity), By Material (Steel, Ceramic, Polyurethane, Polypropylene), By End-User (Mining, Construction, Oil and Gas, Energy, Agriculture, Pharmaceuticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FLSmidth, Weir Minerals, KSB, Siemens, Metso, TechnipFMC, Exterran, Weihai Haiwang, Netafim, Schlumberger, Multotec Pty, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- FLSmidth Weir Minerals

- KSB

- Siemens

- Metso

- TechnipFMC

- Exterran

- Weihai Haiwang

- Netafim

- Schlumberger

- Multotec Pty, ltd