Global Hydrazine Hydrate Market By Concentration Level (100%, 60-85%, 40-55%, and 24-35%), By Application (Water Treatment, Polymerization & Blowing Agents, Agrochemicals, Pharmaceuticals, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 17152

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

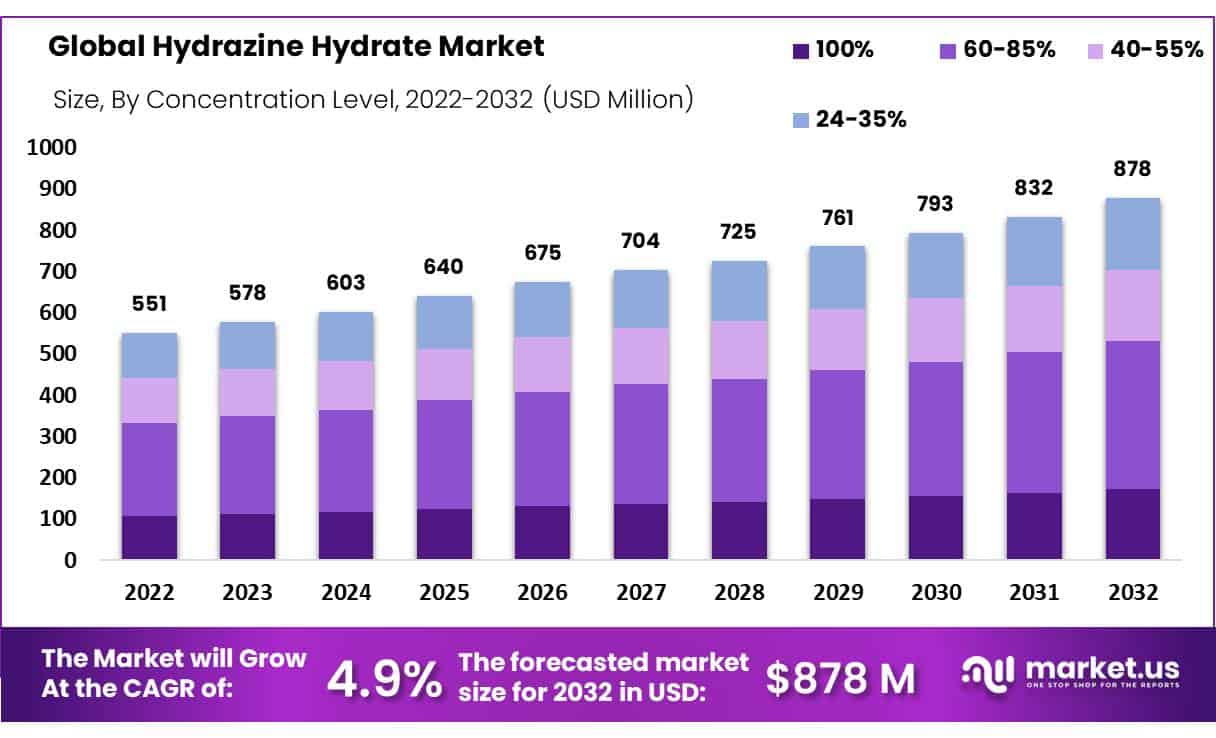

In 2022, the global Hydrazine Hydrate market size accounted for USD 551 Million and is expected to grow to around USD 878 Million in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 4.9%.

Hydrazine hydrate (N2H4·H2O) is well-known as a colorless liquid that consists of hydrazine (N2H4) molecules combined with water (H2O) molecules. It is highly soluble in water, highly reactive, versatile, and has a pungent odor. It exhibits both basic and acidic properties as well as acts as a reducing agent.

The global hydrazine hydrate market growth is fueled by rising water treatment activities to purify water for industrial and domestic use, increasing demand for hydrazine hydrate in the pharmaceutical sector for drug synthesis, and the growing demand for agrochemicals in the agriculture industry.

Key Takeaways

- Market Developments: The global hydrazine hydrate market is currently enjoying remarkable expansion with an expected Compound Annual Growth Rate (CAGR) of 4.9% from 2023-2032.

- Overview: Hydrazine hydrate is an indispensable chemical compound, used across numerous applications for its versatility and ability to scavenge oxygen from the atmosphere, such as acting as a reducing agent or oxygen scavenger or the creation of pharmaceutical and agrochemicals. As its applications span numerous industries, its demand is strong.

- Analyzing Concentration Level: The global hydrazine hydrate market can be divided into segments by concentration levels: 100%, 60-86%, 40-55%, and 24-35%. Of these segments, 60-85% concentration was the leader for revenue share as of 2022 and is projected to experience substantial expansion throughout its forecast period.

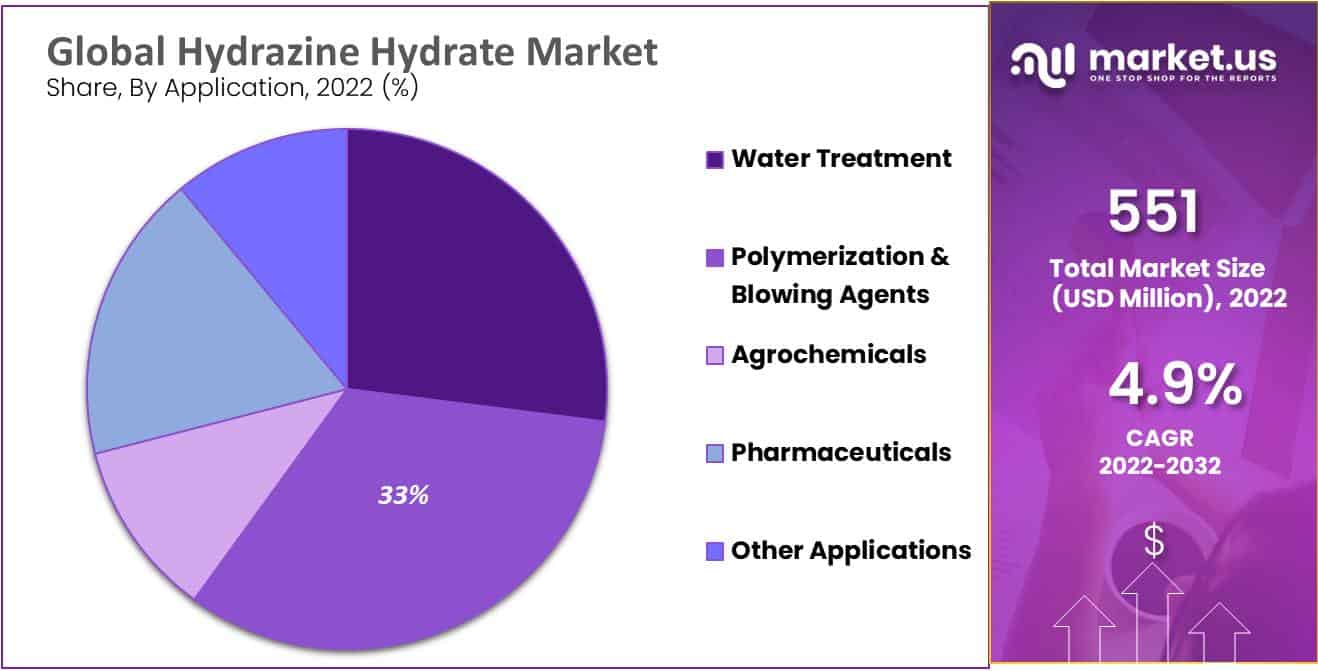

- Hydrazine Hydrate Market Analysis by Application Type: On the basis of application, the global hydrazine hydrate market can be divided into water treatment, polymerization & blowing agents, agrochemicals, pharmaceuticals, and other applications. Polymerization & blowing agent applications held the largest Hydrazine Hydrate market share globally as of 2022.

- Drivers: Hydrazine hydrate is one of the key drivers behind market expansion due to its vast use in water treatment processes and as an indispensable reducing agent in creating pharmaceutical and agrochemical compounds; additionally it’s widely applied in production processes as a blowing agent and has numerous industrial uses that fuel growth of this market segment.

- Restraints: Market challenges include regulatory restrictions due to safety concerns associated with hydrazine hydrate, price fluctuations in raw materials, and environmental and health considerations; competition and sustainability considerations also present barriers.

- Opportunity: Hydrazine hydrate market expansion opportunities lie in research and development efforts focused on increasing safety and efficacy applications of this material, including innovations to production processes or discovering alternative uses. Research findings could present considerable growth potential.

- Trends: In the hydrazine hydrate market, trends include technological innovations for production purposes and an emphasis on environmentally responsible synthesis methods as well as research for novel applications specifically within pharmaceutical and agrochemical markets. Furthermore, sustainable production practices also play a prominent role.

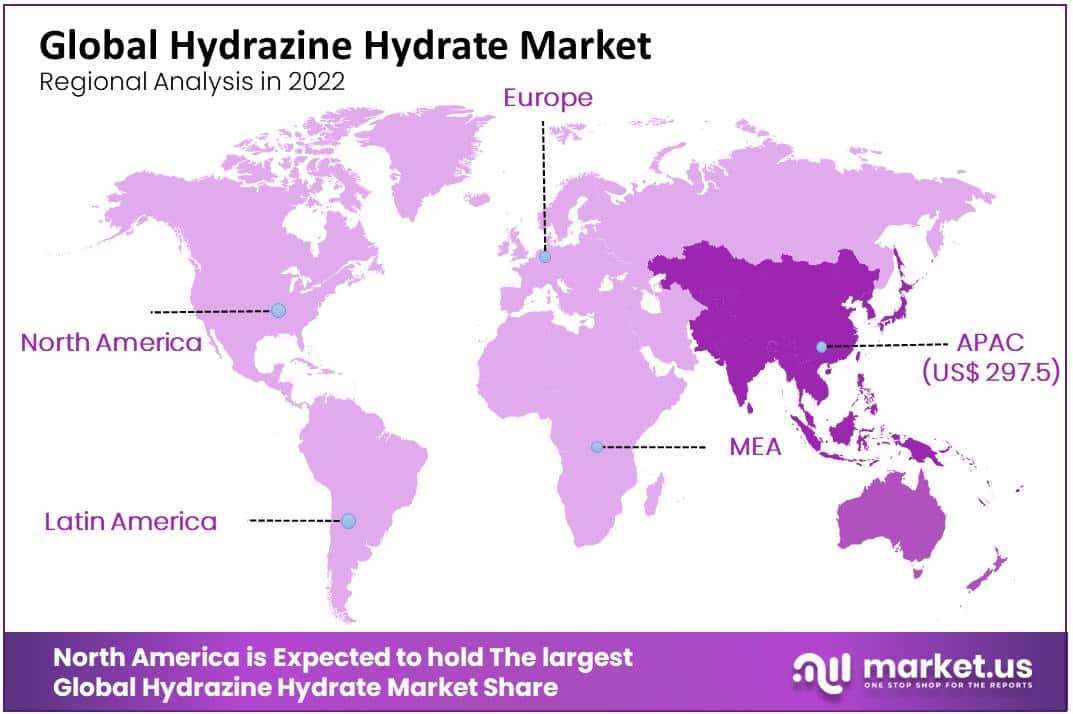

- Regional Analysis: Asia Pacific was the leader of the hydrazine hydrate market worldwide in 2022, holding 54% revenue share and dominating with its high revenue share of more than $54 Million USD.

- Key Players in Hydrazine Hydrate Market: Established Companies and Innovative Startups The market for hydrazine hydrate features both established companies as well as innovative startups specializing in its production and applications, along with key players that invest in research & development initiatives, sustainability measures, strategic alliances or joint ventures as a way of meeting market demands while remaining competitive and maintaining an edge over rival players.

Driving Factors

Rising demand for polymer foams boosts the market growth

The hydrazine hydrate manufacturers have scaled up their production capacities for the manufacturing of azodicarbonamide, used in the polymer industry. This is largely due to the increase in the use of hydrazine hydrate as well as its derivatives as foaming agents in the plastic industry.

Additionally, the expansion of several end-use industries such as automotive, furniture & bedding, packaging, building & construction industries is likely expected to boost the demand for polymer foams in the upcoming years, thereby increasing the requirement for hydrazine hydrate in the polymer industry.

The use of hydrazine hydrate in fuel cells surges the market growth

Hydrazine hydrate can be used as a fuel in fuel cells. Moreover, fuel cells are becoming increasingly popular as a cleaner and more efficient energy source. In addition, hydrazine hydrate offers high energy density and has the ability to generate electricity through chemical reactions in fuel cells. This is positively driving the demand for its utilization in this application.

Restraining Factors

Harmful properties of hydrazine restrict the market growth

Hydrazine hydrate is a highly reactive, unstable inorganic chemical compound and strong reducing agent. While kept in an unstable state, it becomes highly explosive. Moreover, hydrazine hydrate, if inhaled, can cause harmful effects on the lungs, spleen, liver, and thyroid. Furthermore, it has carcinogenic properties and toxic nature that can lead to serious risks. As a result, the market growth for hydrazine hydrate is expected to be hampered by its harmful properties.

By Concentration Level Analysis

60-85% segment accounted for the largest revenue share in 2022

Based on concentration level, the global hydrazine hydrate market is divided into 100%, 60-85%, 40-55%, and 24-35%. Among these, the 60-85% segment held the largest revenue share in 2022. It is also projected to expand more significantly over the forecast period.

This 60-85% concentration level is mostly preferred for the manufacturing of veterinary drugs, polymerization processes as a blowing agent or initiator, chemical synthesis, and as a propellant in emergency power units (EPU) in F16 aircraft and single-engine aircraft.

By Application Analysis

The polymerization and blowing agent segment dominated the global hydrazine hydrate market in 2022

Based on application, the global hydrazine hydrate market is divided into water treatment, polymerization & blowing agents, agrochemicals, pharmaceuticals, and other applications. Among these, the polymerization and blowing agent segment dominated the global market with the largest share in 2022.

This significant share can be highly attributed to the use of hydrazine hydrate as a foaming agent in polymer industries for manufacturing purposes. Likewise, the hydrazine hydrate derivatives are used as polymerization initiators and low-temperature blowing agents such as azobis isobutyronitrile and azodicarbonamide. As a result, this segment is expected to grow exponentially during the forecast period.

Key Market Segments

By Concentration Level

- 100%

- 60-85%

- 40-55%

- 24-35%

By Application

- Water Treatment

- Polymerization & Blowing Agents

- Agrochemicals

- Pharmaceuticals

- Other Applications

Growth Opportunity

Utilization of hydrazine hydrate in agricultural chemicals & as rocket propellants

Hydrazine Hydrate is being increasingly used in the production of agricultural chemicals such as herbicides and plant growth regulators. These chemicals aid in enhancing crop yield and protect against diseases and pests. As the population continues to rise worldwide, the demand for agricultural products is also anticipated to increase more potentially, propelling the demand for hydrazine hydrate in this sector.

Moreover, hydrazine hydrate is a vital component used in the formulation of rocket propellants, most particularly in bipropellants and monopropellants. In addition, the aerospace and defense industries are largely dependent on rocket propulsion systems. As satellite deployment and space exploration activities increase, the demand for hydrazine hydrate will also rise.

Latest Trends

Technological advancements in water treatment

As pollution and water scarcity remain major global challenges, there is an increase in demand for advanced water treatment technologies. The development of more efficient and innovative water treatment solutions can impact the hydrazine hydrate market, mainly in the context of oxygen scavenging applications. Thus, the manufacturers may face the need to adaption to emerging technologies or diversify their product offerings to remain in competition in this progressing landscape. Moreover, the focus on cost optimization and efficiency is expected to drive innovation in hydrazine hydrate production techniques and supply chain management.

Regional Analysis

Asia Pacific dominated the global hydrazine hydrate market with the highest revenue share of 54% in 2022

Based on region, the market is divided into North America, Europe, Asia Pacific, Latin America, And Middle East & Africa. Among these regions, Asia Pacific accounted for the highest revenue share in 2022. This regional growth can be highly attributed to the increasing demand in rapidly growing polymer and agrochemical sectors, especially in India and China. In addition, the favorable government policies in this region are also expected to surge the market growth. Moreover, the rapid urbanization that has led to the establishment of several industrial plants has fueled the demand for hydrazine hydrate in the Asia Pacific region.

North America accounted for the second-largest market for hydrazine hydrate

The market for hydrazine hydrate in North America is expanding due to the strong presence of key players involved in the distribution and production of hydrazine hydrate. Moreover, the high demand for hydrazine hydrate driven by several industries such as pharmaceuticals, agriculture, and water treatment is likely expected to surge the regional market growth during the forecast period.

Key Regions and Countries

- North America

-

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging market players are presently concentrating on implementing various growth strategies to increase their product reach. In addition, they are also involved in partnerships, collaborations, mergers & acquisitions, new product launches, and competitive pricing. They are highly focused on marketing their targeted products to capture a major market share. Also, they are focusing on geographic expansions to increase their presence in foreign markets. This forms the competitive landscape in the global market and significantly drives market growth.

Top Key Players

- Lonza Group Ltd

- LANXESS AG

- Arkema Group

- Otsuka-MGC Chemical Company

- Nippon Carbide Industries Co Inc.

- LCG Science Group Holdings Limited

- Japan Finechem Inc.

- Arrow Fine Chemicals

- Alfa Aesar

- Other key Players

Recent Development

- In April 2023, GACL, IICT, and CSIR-IICT developed a new process to make hydrazine hydrate that is better for the environment. This new process can reduce the environmental impact of production by up to 50%.

- In May 2023, Chemours expanded its hydrazine hydrate production in China. It will finish in 2024 and will increase their production by 50%.

- In June 2023, the International Maritime Organization (IMO) decided to stop using hydrazine hydrate as fuel in ships by 2025. This decision will increase the demand for hydrazine hydrate in other applications, like rocket fuel and polymerization initiator.

Report Scope

Report Features Description Market Value (2022) US$ 551 Mn Forecast Revenue (2032) US$ 878 Mn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Concentration Level – 100%, 60-85%, 40-55%, and 24-35%; By Application – Water Treatment, Polymerization & Blowing Agents, Agrochemicals, Pharmaceuticals, and Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Lonza Group Ltd, LANXESS AG, Arkema Group, Otsuka-MGC Chemical Company, Nippon Carbide Industries Co Inc., LCG Science Group Holdings Limited, Japan Finechem Inc., Arrow Fine Chemicals, Alfa Aesar, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the global hydrazine hydrate market?Hydrazine Hydrate market accounted for USD 551 Million in 2022 and is expected to grow to around USD 878 Million in 2032. Between 2023 and 2032.

What is the growth rate of Hydrazine Hydrate Market?The Hydrazine Hydrate Market is growing at a CAGR of 4.9% over the next 10 years.

Who are the key players in Hydrazine Hydrate Market?Lonza Group Ltd, LANXESS AG, Arkema Group, Otsuka-MGC Chemical Company, Nippon Carbide Industries Co Inc., LCG Science Group Holdings Limited, Japan Finechem Inc., Arrow Fine Chemicals, Alfa Aesar, Other key Players.

-

-

- Lonza Group Ltd

- LANXESS AG

- Arkema Group

- Otsuka-MGC Chemical Company

- Nippon Carbide Industries Co Inc.

- LCG Science Group Holdings Limited

- Japan Finechem Inc.

- Arrow Fine Chemicals

- Alfa Aesar

- Other key Players