Global Hydraulic Fluids Market By Base Oil(Mineral Oil, Synthetic Oil, Bio-based Oil), By Point of Sale(OEM, Aftermarket), By Application(Mobile Equipment, Industrial Equipment), By End-use(Construction, Metal and Mining, Oil and Gas, Agriculture, Automotive, Aerospace and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126690

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

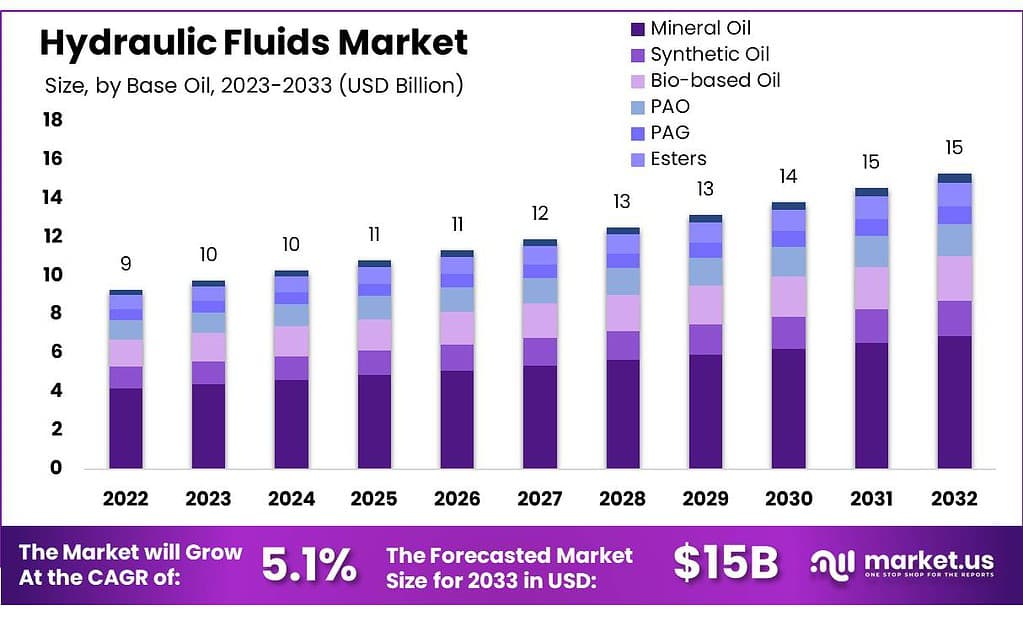

The global Hydraulic Fluids Market size is expected to be worth around USD 15 billion by 2033, from USD 9 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The hydraulic fluids market encompasses a global network involved in the manufacturing, distribution, and sales of hydraulic fluids. These fluids are vital for the operation of hydraulic systems utilized in various machinery sectors including industrial, automotive, and aerospace. The primary function of hydraulic fluids is to facilitate power transmission within these systems, while also offering lubrication, cooling, and corrosion prevention.

This market is propelled by robust demand from miscellaneous industries such as construction, manufacturing, mining, and agriculture, which heavily rely on hydraulic machinery. The essential attributes of hydraulic fluids, like viscosity and thermal stability, are crucial as they ensure the efficiency and durability of hydraulic systems. The market dynamics are also shaped by stringent environmental regulations that advocate for the development and adoption of eco-friendly hydraulic fluids to minimize environmental damage.

Notably, in 2020, the United States imported hydraulic fluids worth approximately $25.92 million, predominantly from Germany, the UK, and Switzerland. This figure rose significantly to $49.44 million by 2023, highlighting an increasing market demand and shifts in the global supply chain dynamics post-pandemic. The market is also characterized by continuous innovation, with a significant shift towards bio-based and synthetic hydraulic fluids. These developments are aimed at enhancing the performance and environmental sustainability of the fluids.

The global trade of hydraulic fluids involves substantial volumes, with major logistic hubs like Rotterdam and Tsingtao playing crucial roles in the distribution network. This underscores the market’s global nature and the complex logistics that support fluid distribution. The hydraulic fluids market is thus a critical component of the global industrial framework, continually adapting to technological advancements and regulatory standards to meet the evolving demands of its diverse consumer base.

Key Takeaways

- The hydraulic fluids market will grow from USD 9 billion in 2023 to approximately USD 15 billion by 2033, with a 5.1% CAGR.

- Mineral oil captured 45.6% of the hydraulic fluids market in 2023 due to its low cost and extensive use in construction and manufacturing.

- Mobile equipment accounted for 56.8% of the market in 2023, driven by hydraulic systems in construction, agriculture, and mining machinery.

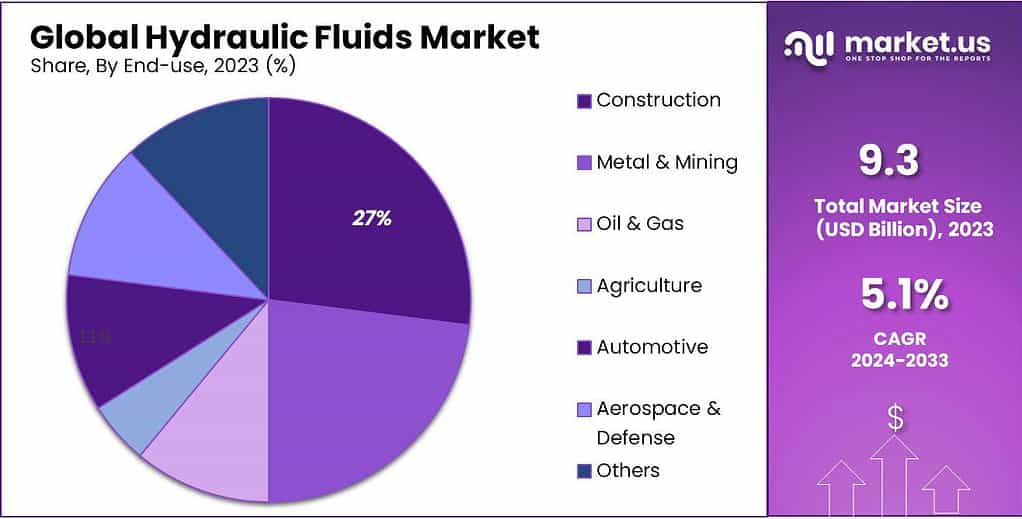

- The construction sector held 26.5% of the market in 2023, using hydraulic machinery like excavators and cranes in demanding environments.

- OEM (Original Equipment Manufacturer) held a dominant market position in the hydraulic fluids market, capturing more than a 68.7% share.

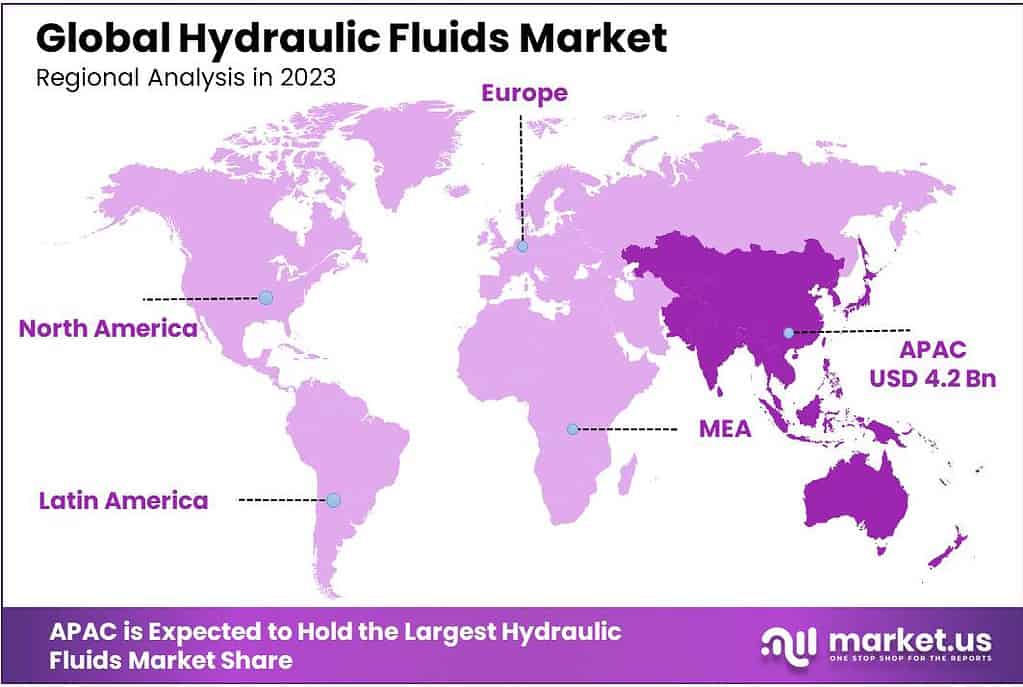

- Asia Pacific held 45.5% of the market in 2023, valued at USD 4.2 billion, driven by industrialization and construction in countries like China and India.

By Base Oil

In 2023, Mineral Oil held a dominant market position in the hydraulic fluids market, capturing more than a 45.6% share. Its wide availability and lower cost make it a popular choice across various industries, including construction and manufacturing. Mineral oils are known for their good lubrication properties, which help extend the life of hydraulic systems, making them a preferred option in cost-sensitive applications.

Synthetic Oil is the second-largest segment. It is valued for its superior performance in extreme temperatures and high-pressure environments. Synthetic oils offer better thermal stability and oxidation resistance, which enhances machinery efficiency and reduces maintenance costs. As industries seek more reliable and longer-lasting solutions, demand for synthetic oils is expected to grow steadily.

Bio-based Oil, while a smaller segment, is gaining traction due to its environmentally friendly properties. These oils are biodegradable and are increasingly used in industries focused on sustainability and reducing environmental impact. Though bio-based oils currently hold a smaller market share, the segment is expected to see faster growth as regulations and eco-friendly practices drive adoption.

By Point of Sale

In 2023, OEM (Original Equipment Manufacturer) held a dominant market position in the hydraulic fluids market, capturing more than a 68.7% share. This large share is due to the high demand for factory-fill hydraulic fluids in newly manufactured equipment across industries like construction, automotive, and agriculture. OEM fluids are specifically designed to meet the exact specifications of new machinery, ensuring optimal performance from the start.

The Aftermarket segment, though smaller, plays a crucial role in maintaining and servicing hydraulic systems. As equipment ages, the need for replacement fluids grows, driving steady demand in this segment. The aftermarket is expected to see continuous growth as businesses prioritize regular maintenance to extend the life of their machinery and avoid costly repairs.

By Application

In 2023, Mobile Equipment held a dominant market position in the hydraulic fluids market, capturing more than a 56.8% share. This dominance is driven by the widespread use of hydraulic systems in construction, agriculture, and mining machinery, where mobility and reliable fluid performance are essential. Mobile equipment requires hydraulic fluids that can operate efficiently under varied and extreme conditions, making it a key segment.

The Industrial Equipment segment, while smaller, is vital for sectors such as manufacturing and processing. Hydraulic systems in industrial equipment are crucial for operations in factories and plants, where precision and performance are needed. As industries continue to modernize and automate, the demand for hydraulic fluids in industrial applications is expected to grow steadily.

By End-use

In 2023, Construction held a dominant market position in the hydraulic fluids market, capturing more than a 26.5% share. The construction sector relies heavily on hydraulic machinery like excavators, loaders, and cranes, which require efficient hydraulic fluids to function smoothly in demanding environments.

The Metal & Mining segment follows closely. Mining equipment such as drills and haul trucks need hydraulic fluids to operate under extreme pressure and temperature, making it a crucial market for fluid demand.

The Oil & Gas industry also contributes significantly, using hydraulic systems in offshore rigs and drilling equipment. These systems need high-performance fluids to withstand harsh conditions, ensuring safety and reliability.

In Agriculture, hydraulic fluids are essential for tractors, harvesters, and other farm machinery. As farming becomes more mechanized, the demand for hydraulic fluids continues to rise.

The Automotive sector sees consistent demand due to the need for hydraulic fluids in braking systems and transmissions, particularly in heavy-duty vehicles.

In Aerospace & Defense, hydraulic fluids are vital for aircraft and military machinery, requiring precision and reliability in critical applications.

Key Маrkеt Ѕеgmеntѕ

By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Point of Sale

- OEM

- Aftermarket

By Application

- Mobile Equipment

- Industrial Equipment

By End-use

- Construction

- Metal & Mining

- Oil & Gas

- Agriculture

- Automotive

- Aerospace & Defense

- Others

Drivers

Increasing Research and Development Activities

One of the key drivers propelling the growth of the hydraulic fluids market is the increasing focus on research and development (R&D) activities by major market players. This trend is particularly evident in regions like China, which has established itself as a significant hub for the hydraulic fluids market due to its robust industrial activities in sectors such as automotive manufacturing, precision engineering, and heavy machinery manufacturing.

The commitment to R&D has led to the development of innovative hydraulic fluid formulations and additive packages, enhancing the performance and lifespan of hydraulic systems. This growth is underpinned by continuous innovations and the introduction of advanced products that cater to a growing demand for efficient and sustainable hydraulic solutions across various industries.

The intensive R&D efforts are not only focused on improving the quality and efficiency of hydraulic fluids but also on making them environmentally sustainable. This is in response to increasing environmental regulations globally, which demand lower emissions and reduced environmental impact from industrial operations. Companies are investing heavily in developing bio-based and synthetic hydraulic fluids that meet these regulatory requirements while maintaining or enhancing the performance characteristics needed in demanding applications.

For instance, China’s dedication to enhancing fluid performance through sophisticated maintenance measures like condition monitoring and fluid analysis has significantly influenced market dynamics, positioning it as a leader in the Asia Pacific region, which is one of the fastest-growing markets for hydraulic fluids.

The focus on sustainability and efficiency is further exemplified by the shift towards synthetic hydraulic fluids, known for their superior properties such as high thermal stability and excellent lubrication, which contribute to the extended lifespan of machinery and reduced operational costs. The aftermarket segment, which involves the sale of hydraulic fluids for maintenance and replacement, is also seeing considerable growth, reflecting the ongoing need for high-quality hydraulic solutions in existing systems.

Restraints

Environmental Impact and Regulatory Challenges

A significant restraining factor for the growth of the hydraulic fluids market is the environmental impact associated with the use of certain hydraulic fluids. This impact is primarily due to the toxicity and non-biodegradability of some traditional hydraulic fluids, which pose serious environmental risks, particularly in the event of leaks or spills.

The increasing stringency of environmental regulations globally is compounding this challenge. Regulations are tightening around the permissible types of hydraulic fluids, particularly those used in sensitive environments such as marine and forested areas. These regulations mandate the use of environmentally friendly fluids that are less harmful to ecosystems and are often bio-based or synthetic with enhanced biodegradability and lower toxicity levels.

For instance, the European Union and other regulatory bodies have implemented stringent guidelines that limit the use of certain types of hydraulic fluids based on their environmental and health hazards. This regulatory environment forces manufacturers to invest heavily in the research and development of cleaner and greener hydraulic fluids, which can be costly and technically challenging. The shift towards environmentally sustainable products, although beneficial for the ecosystem, puts additional pressure on the hydraulic fluids market by potentially limiting the use of traditional, often more economically priced, hydraulic fluids.

Moreover, the growing trend towards electrification and the use of hybrid vehicles, which require less or no hydraulic fluids, further restricts the growth of the market. As industries such as automotive and transportation increasingly adopt electric alternatives, the demand for hydraulic fluids is expected to decline, affecting market growth.

In summary, while the hydraulic fluids market continues to expand, driven by industrial growth and technological advancements, environmental concerns and regulatory frameworks represent significant challenges.

Companies in the sector are compelled to innovate and adapt, developing more sustainable and less environmentally damaging fluid solutions to comply with global standards and maintain market competitiveness. These environmental and regulatory pressures are reshaping the market landscape, steering it towards sustainability and innovation.

Opportunity

Expansion into Renewable Energy Sectors

The hydraulic fluids market is poised for significant growth, particularly through expansion into renewable energy sectors. This growth is driven by the increasing global shift towards sustainable energy practices and the integral role hydraulic systems play in renewable energy operations, especially in wind and hydropower applications.

Hydraulic systems are essential in wind turbines, particularly for blade pitch and brake control mechanisms. The demand for efficient and durable hydraulic fluids is rising as the wind energy sector expands. The global wind energy market’s continued growth, supported by government incentives and advancements in turbine technology, presents a substantial opportunity for hydraulic fluid manufacturers to innovate and supply products that meet the unique requirements of this industry.

Similarly, the hydropower sector, which remains the largest source of renewable electricity globally, relies heavily on hydraulic systems for turbine and gate control operations. Despite a slowdown in new projects in traditional markets like China and Europe, emerging markets in Asia-Pacific, Africa, and Latin America are experiencing rapid growth in hydropower capacity.

This expansion is largely driven by the need to increase electricity access and support economic growth, which in turn boosts the demand for specialized hydraulic fluids that can withstand the rigorous conditions of hydropower plants.

The market for hydraulic fluids in these renewable sectors is encouraged by not only the volume of upcoming projects but also by the evolving standards for environmental sustainability. There is an increasing demand for bio-based and environmentally friendly hydraulic fluids that reduce environmental impact without compromising performance.

Strategic partnerships and innovations focused on developing fluids with enhanced properties—such as biodegradability, lower toxicity, and improved fire resistance—are crucial. These developments align with global environmental regulations and sustainability goals, making them attractive to sectors that are particularly sensitive to ecological impacts.

Trends

Energy Efficiency and Performance Enhancements

A key trend shaping the hydraulic fluids market is the growing emphasis on energy efficiency and the development of high-performance hydraulic fluids. This trend is driven by technological advancements that enhance the operational efficiency of hydraulic systems used across various industries, including construction, manufacturing, and automotive sectors.

Energy-efficient hydraulic fluids are gaining traction because they help reduce operational costs and improve the environmental footprint of hydraulic systems. These fluids are designed to minimize power loss and maintain optimal performance even under severe operating conditions. For instance, they are formulated to work efficiently in cold weather and maintain their viscosity at higher temperatures, which is crucial for the consistent operation of hydraulic machinery.

The development of these fluids often involves the use of performance polymers and other additives that enhance the lubrication properties and thermal stability of the fluids. These additives help in reducing the wear and tear on hydraulic components, thereby extending the lifespan of the equipment and reducing maintenance costs.

Additionally, the market is seeing a shift towards the use of synthetic and bio-based oils, which are designed to offer better biodegradability and lower environmental impact compared to traditional mineral oils. This shift is largely driven by stringent environmental regulations and a growing industry focus on sustainability practices.

Manufacturers are also focusing on innovations that cater to specific industry needs, such as fire-resistant hydraulic fluids for use in high-risk environments like mining and certain manufacturing sectors. These specialized fluids are developed to ensure safety and compliance with industry-specific standards.

Regional Analysis

The global hydraulic fluids market demonstrates varying levels of growth across key regions, driven by industrial activity, automotive demand, and advancements in machinery. Asia Pacific (APAC) stands as the dominant region, accounting for 45.5% of the market share, translating to approximately USD 4.2 billion in 2023. This leadership is attributed to the region’s expanding construction, automotive, and industrial machinery sectors, particularly in China, India, and Southeast Asia. These nations are experiencing rapid urbanization and infrastructure developments, further propelling the demand for hydraulic fluids.

North America follows closely, supported by the robust manufacturing and automotive sectors in the United States and Canada. The region’s adoption of advanced hydraulic systems in industrial applications is expected to sustain market growth. Moreover, the presence of prominent manufacturers and increased investments in automation are further enhancing market dynamics.

In Europe, the market is driven by advancements in the automotive sector and stringent regulations related to sustainability. Countries like Germany, France, and the UK are focusing on the adoption of bio-based hydraulic fluids, aligning with environmental regulations. This shift is fostering moderate yet steady growth in the region.

The Middle East & Africa shows potential growth, spurred by increased infrastructure projects and industrial developments, particularly in countries like the UAE and Saudi Arabia. However, the market remains relatively nascent compared to APAC and North America.

Latin America is exhibiting gradual growth, primarily supported by the rising industrialization in Brazil and Mexico. Investments in agriculture and mining activities are key factors contributing to the demand for hydraulic fluids in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The hydraulic fluids market is highly competitive, with several prominent global players leading the industry. Shell plc, Exxon Mobil Corporation, Chevron Corporation, and BP p.l.c. are among the dominant companies, benefiting from their extensive distribution networks, strong brand recognition, and broad product portfolios. These companies have focused on research and development to innovate eco-friendly and high-performance hydraulic fluids, aligning with the global shift toward sustainability. TotalEnergies and PetroChina Company Limited also play significant roles, leveraging their strong presence in the oil and gas sector to capture substantial market share, particularly in Asia and Europe.

China Petrochemical Corporation (SINOPEC) and FUCHS have established themselves as key players in the Asian and global markets, respectively, with a focus on providing industrial lubricants, including hydraulic fluids. SINOPEC’s dominance is particularly pronounced in the Asia Pacific, where rapid industrialization and infrastructure development continue to drive demand. Valvoline, NYCO, and Idemitsu Kosan Co., Ltd. maintain strong market positions through a diverse range of offerings, catering to both the automotive and industrial sectors.

Dow, Eastman Chemical Company, LUKOIL, and Gazpromneft – Lubricants Ltd. are also key contributors to the hydraulic fluids market, focusing on advanced formulations and bio-based alternatives. These companies are capitalizing on increasing regulatory pressures for environmentally safe products, thus driving innovation in the industry. The competitive landscape is characterized by strategic partnerships, acquisitions, and expansions aimed at strengthening market positions and enhancing product portfolios.

Market Key Players

- Shell plc

- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- FUCHS

- Valvoline

- NYCO

- Idemitsu Kosan Co., Ltd.

- Dow

- Eastman Chemical Company

- LUKOIL

- Gazprommeft – Lubricants Ltd

Recent Development

In 2023 Exxon Mobil Corporation, the company focused on developing synthetic and bio-based hydraulic fluids, which cater to the growing demand for environmentally friendly products. This aligns with increasing regulations for reducing carbon emissions and improving sustainability across industries.

In 2023, Shell’s hydraulic fluids division focused on providing high-performance, eco-friendly solutions, particularly in synthetic and bio-based oils, to cater to the increasing global demand for sustainable products.

Report Scope

Report Features Description Market Value (2023) US$ 9 Bn Forecast Revenue (2033) US$ 15 Bn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Base Oil(Mineral Oil, Synthetic Oil, Bio-based Oil), By Point of Sale(OEM, Aftermarket), By Application(Mobile Equipment, Industrial Equipment), By End-use(Construction, Metal and Mining, Oil and Gas, Agriculture, Automotive, Aerospace and Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Shell plc, Exxon Mobil Corporation, Chevron Corporation, BP p.l.c., TotalEnergies, PetroChina Company Limited, China Petrochemical Corporation (SINOPEC), FUCHS, Valvoline, NYCO, Idemitsu Kosan Co., Ltd., Dow, Eastman Chemical Company, LUKOIL, Gazprommeft – Lubricants Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Hydraulic Fluids Market?Hydraulic Fluids Market size is expected to be worth around USD 15 billion by 2033, from USD 9 billion in 2023

What is the CAGR for the Hydraulic Fluids Market?The Hydraulic Fluids Market is expected to grow at a CAGR of 5.1% during 2023-2032.st the key industry players of the Global Hydraulic Fluids Market?Shell plc, Exxon Mobil Corporation, Chevron Corporation, BP p.l.c., TotalEnergies, PetroChina Company Limited, China Petrochemical Corporation (SINOPEC), FUCHS, Valvoline, NYCO, Idemitsu Kosan Co., Ltd., Dow, Eastman Chemical Company, LUKOIL, Gazprommeft - Lubricants Ltd

-

-

- Shell plc

- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- FUCHS

- Valvoline

- NYCO

- Idemitsu Kosan Co., Ltd.

- Dow

- Eastman Chemical Company

- LUKOIL

- Gazprommeft - Lubricants Ltd