Global Hybrid UAV Market Size, Share, Industry Analysis Report By Type (Multicopter UAV, Lift + Cruise UAV, STOL UAV), By Propulsion (Hybrid Electric, Fuel Cell), By Endurance (Short Endurance, Medium Endurance, Long Endurance), By Power (Low Power, Medium Power, High Power, Very High Power), By End User (Government & Defense, Commercial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160430

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

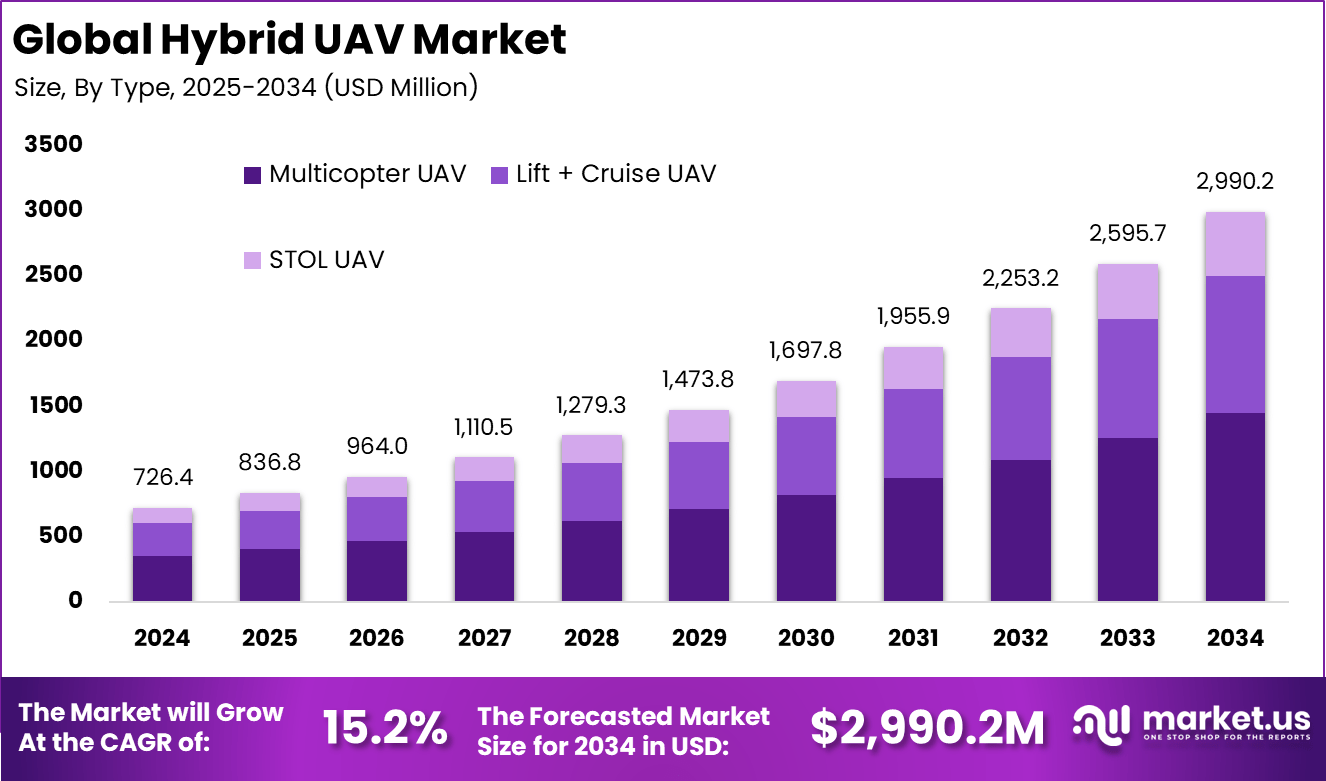

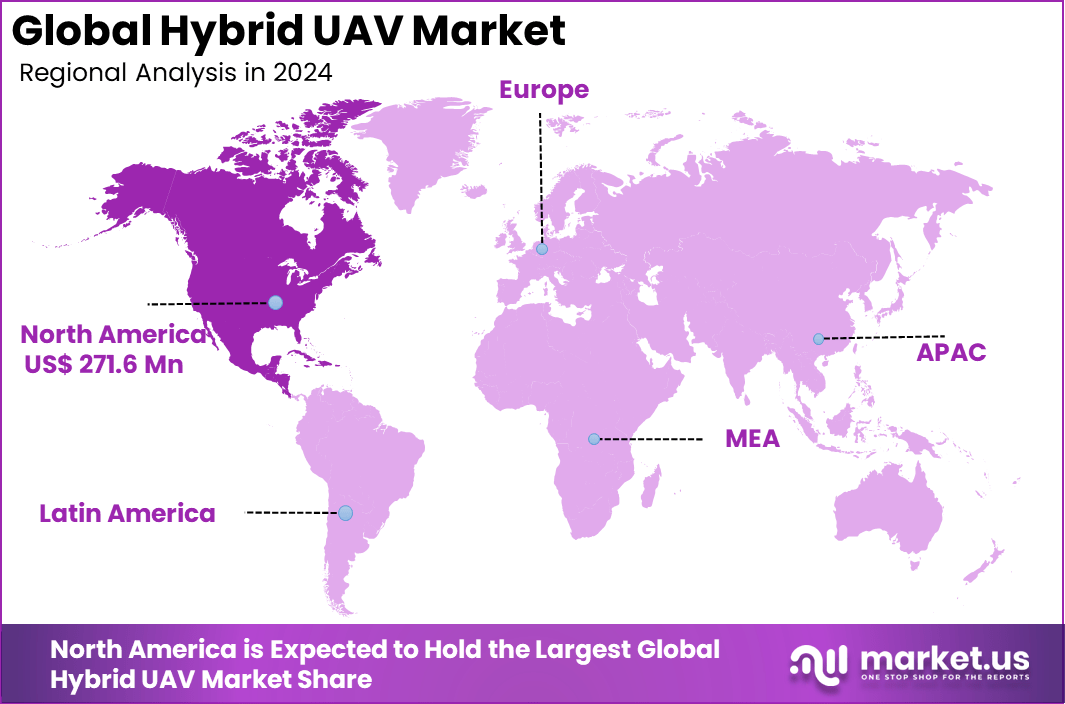

The Global Hybrid UAV Market size is expected to be worth around USD 2,990.2 million by 2034, from USD 726.4 million in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.4% share, holding USD 271.6 million in revenue.

The Hybrid UAV Market encompasses unmanned aerial vehicles that combine characteristics of vertical take-off and landing (VTOL) or multirotor systems with fixed-wing or other lift mechanisms. These hybrids aim to merge the flexibility of rotorcraft (hover, vertical takeoff/landing) with the efficiency and range of fixed-wing designs. In practice, hybrid UAVs are deployed in sectors such as surveillance, inspection, agriculture, logistics, and defense.

For instance, In May 2024, JOUAV presented its latest hybrid UAVs at the Drone World Congress in Shenzhen, featuring a dual electric and fuel-powered system for longer flight endurance and flexible operations. The new model targets practical uses such as power grid inspection, environmental monitoring, and agricultural surveillance.

Top driving factors in the hybrid UAV market include the demand for extended flight durations and enhanced mission capabilities. Various sectors, particularly military and commercial, require UAVs that can operate for hours over vast areas without frequent recharging. Innovations in hybrid propulsion, where combustion engines work alongside electric motors, optimize energy use and fuel efficiency.

Another key factor is energy efficiency and fuel savings. In missions where the UAV must hover, climb, or maneuver, the electric portion is efficient; during cruise phases, the internal combustion or hybrid system supports efficient forward flight, reducing overall energy consumption. This helps reduce operating cost and increases mission range.

For instance, Optiemus Unmanned Systems Private Limited, a subsidiary of Optiemus Infracom, has committed around USD 16.9 mn to deploy 5,000 drones by 2025, primarily for agriculture and mapping services. The rollout will follow a Drone-as-a-Service model, supported by the training of 6,000 drone pilots to manage operations efficiently. The company currently sources 65% of components locally, with a target to reach 75% indigenization by FY 2025.

Key Takeaway

- Multicopter UAVs lead with 48.6%, reflecting their versatility in surveillance, mapping, and short-range missions.

- Hybrid electric propulsion dominates with 82.7%, driven by efficiency, extended range, and reduced fuel costs.

- Medium endurance UAVs account for 42.1%, widely adopted for tactical and reconnaissance operations.

- High-power systems hold 39.4%, enabling advanced payload capacity and mission flexibility.

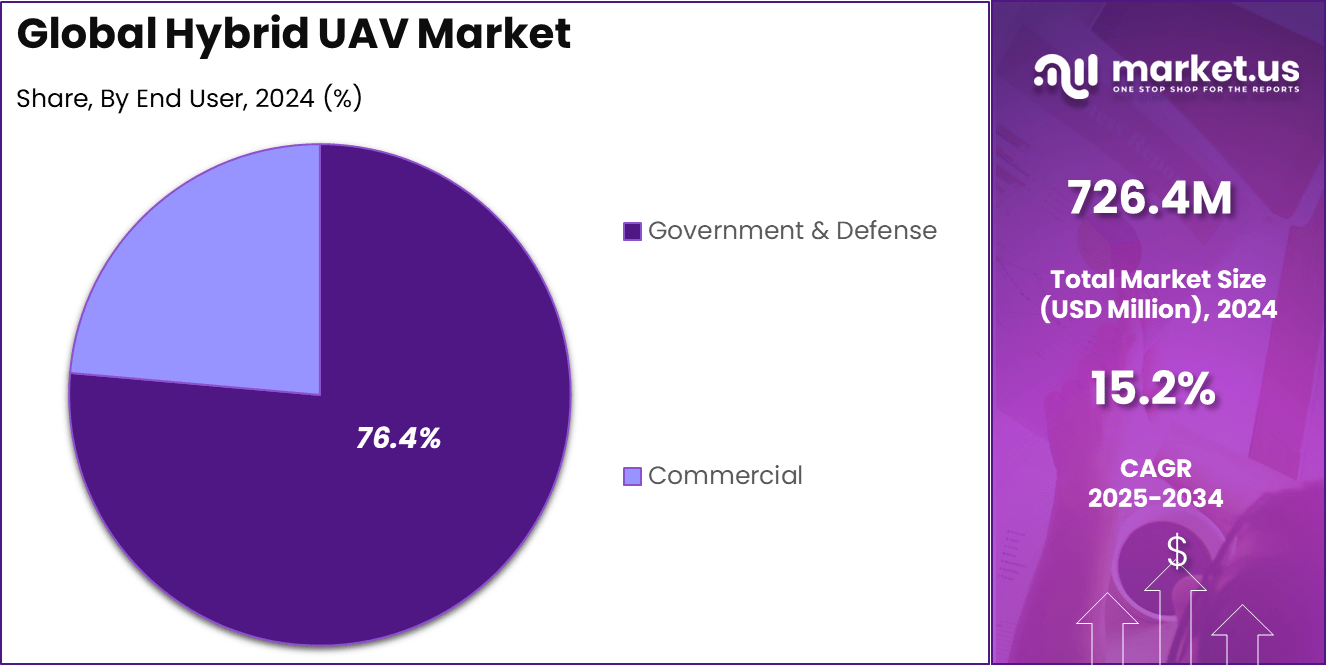

- Government and defense end users represent 76.4%, underscoring strong demand for security, intelligence, and military applications.

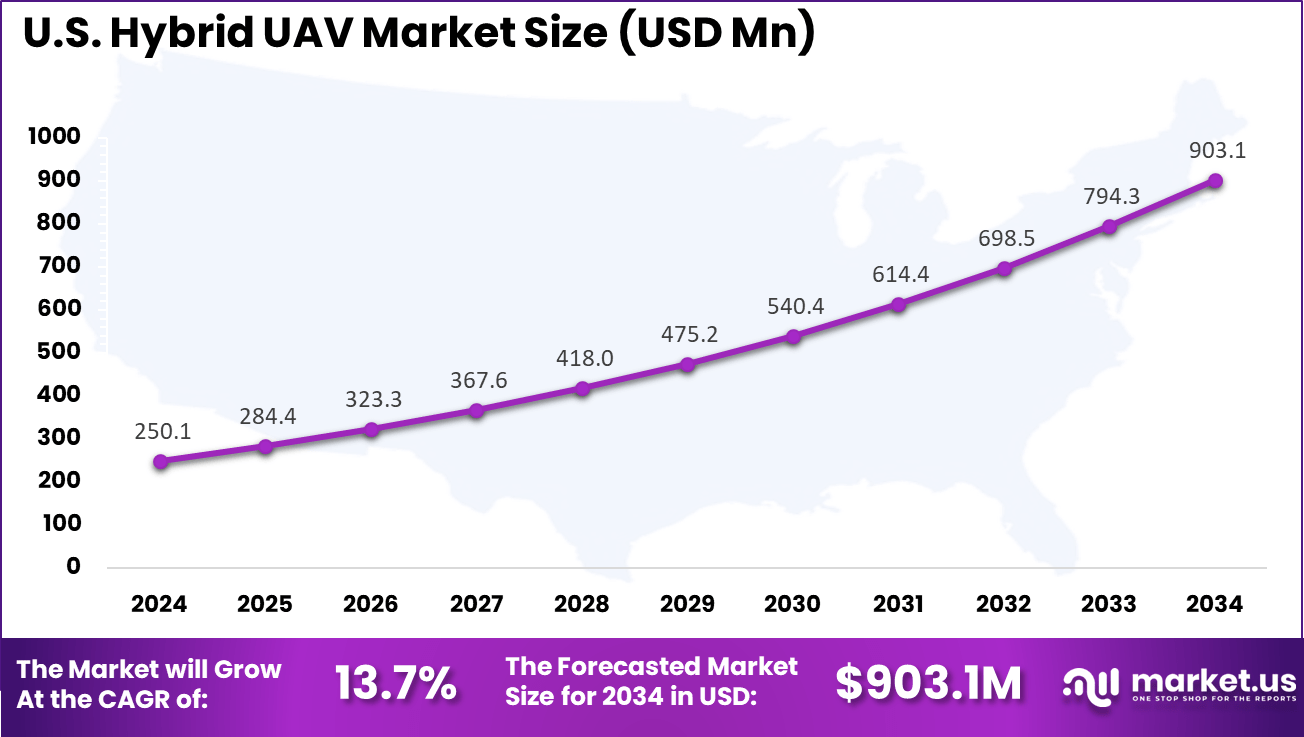

- The U.S. Hybrid UAV Market was valued at USD 250.1 Million in 2024, with a robust CAGR of 13.7%.

- In 2024, North America held a dominant market position in the Global Hybrid UAV Market, capturing more than a 37.4% share.

Investment and Business Benefits

Investment opportunities in the hybrid UAV market are strong due to ongoing technological innovation and expanding applications. Buyers include government defense and intelligence agencies investing in persistent ISR (intelligence, surveillance, reconnaissance) platforms, as well as commercial sectors like agriculture and logistics pursuing automation and data-driven management.

Investment is also flowing into developing regions like Asia-Pacific where local manufacturing and ecosystem development receive government support. Private and public funding targeting hybrid propulsion, AI integration, and regulatory compliance solutions offers multiple entry points for investors focused on aerospace and drone technology.

Business benefits from hybrid UAV adoption include improved operational efficiency due to longer flights and reduced downtime, flexibility in mission profiles, and enhanced data collection capabilities through persistent aerial presence. They enable companies and agencies to cover larger geographies and more complex environments without adding multiple drone platforms. Hybrid UAVs also provide environmental advantages through lower emissions compared to traditional fuel-only systems.

U.S. Hybrid UAV Market Size

The market for Hybrid UAV within the U.S. is growing tremendously and is currently valued at USD 250.1 million, the market has a projected CAGR of 13.7%. The market is growing tremendously due to increasing demand across various sectors like defense, agriculture, and logistics. Advancements in drone technology, combined with regulatory support for UAV integration into national airspace, are fueling this growth.

Additionally, the U.S. military’s push for modernized surveillance and reconnaissance systems drives the adoption of hybrid UAVs. The ability to cover vast areas and operate for extended periods also makes hybrid UAVs ideal for industries requiring reliable and efficient aerial solutions.

For instance, in September 2025, Elroy Air announced a partnership with Kratos Defense & Security Solutions to manufacture its Chaparral hybrid UAV in the U.S. This collaboration highlights the growing dominance of the U.S. in hybrid UAV technology, as it strengthens its position as a leader in the development and production of advanced aerial systems.

In 2024, North America held a dominant market position in the Global Hybrid UAV Market, capturing more than a 37.4% share, holding USD 271.6 million in revenue. This dominance is due to its advanced technological infrastructure and strong demand across both commercial and defense sectors, with leading companies like Northrop Grumman and L3Harris driving development.

The U.S., in particular, leads in military applications, driving adoption of hybrid UAVs for surveillance, reconnaissance, and logistics. Additionally, supportive regulations, government investments in UAV technology, and growing commercial applications in agriculture, infrastructure, and logistics contribute to North America’s market leadership.

For instance, In August 2025, Joby Aviation partnered with L3Harris Technologies to develop a hybrid VTOL aircraft for counter-UAS and electronic warfare missions, reinforcing North America’s leadership in hybrid UAV innovation for defense applications.

Type Analysis

In 2024, Multicopter UAVs dominate the hybrid UAV market segment with a strong 48.6% share. Their popularity stems from their versatility and ability to perform vertical takeoff and landing, making them highly suitable for complex mission profiles such as surveillance, inspection, and agricultural monitoring. Multicopters provide stable hovering and maneuverability, which are critical characteristics for precision tasks in various environments.

This type of UAV is particularly favored because it supports modular payloads and can quickly adapt to different operational needs. Their structure allows for easier maintenance and quicker deployment, boosting operational efficiency across government and commercial sectors where reliability is essential.

For Instance, in February 2023, UCAL Technologies unveiled its indigenous multicopter UAVs at Aero India. These UAVs are designed for a range of applications, including surveillance, reconnaissance, and industrial inspections. The multicopter UAVs are equipped with advanced features such as enhanced flight stability, longer endurance, and high payload capacity, making them ideal for both defense and commercial sectors.

Propulsion Analysis

In 2024, the hybrid electric propulsion segment overwhelmingly leads with an 82.7% share. This technology integrates electric motors with conventional fuel engines, combining the endurance and power of combustion engines with the efficiency and quiet operation of electric motors. This synergy extends flight times significantly compared to fully electric UAVs and helps to reduce overall emissions and operating costs.

Hybrid electric UAVs are becoming the go-to solution for applications requiring long-duration missions, such as border patrol and infrastructure monitoring. Their ability to switch between power sources optimizes energy consumption, enabling UAVs to cover more ground without frequent recharging or refueling, which is vital in remote or critical operations.

For instance, in May 2025, the Air Force Research Laboratory (AFRL) contracted General Atomics to develop the hybrid-electric Ghost UAV. This hybrid-electric drone aims to provide enhanced performance with longer flight durations and reduced emissions compared to traditional fuel-powered UAVs. The Ghost UAV will serve as a versatile, energy-efficient platform for various defense applications, including surveillance and reconnaissance.

Endurance Analysis

In 2024, UAVs with medium endurance capture 42.1% of the market. These UAVs strike a balance between compact design and flight duration, typically providing several hours of operational time, which suits a wide range of civil and defense applications. Medium-endurance UAVs are effective in missions that require persistent surveillance but do not call for ultra-long flight times.

The medium endurance class fits well within requirements for search and rescue, environmental monitoring, and tactical reconnaissance. Their endurance allows for repeat missions with faster turnaround, which supports operational readiness and cost-effectiveness in dynamic field conditions.

For Instance, in October 2024, TKEVER signed a Memorandum of Understanding (MOU) with Droneway to develop medium-endurance hybrid UAVs. This collaboration aims to enhance the operational capabilities of UAVs, offering extended flight times and versatility for both commercial and defense applications.

Power Analysis

In 2024, the high-power segment holds 39.4% market share, reflecting growing demand for UAVs capable of carrying heavier payloads and supporting complex mission equipment. High power UAVs enable longer distances and higher speeds, essential for rapid deployment and area coverage in demanding scenarios like military reconnaissance and disaster response.

Such power capabilities also support advanced sensor integration and communication technologies, which enhance UAV effectiveness in intelligence and data collection. The high power segment is critical for users needing robust UAVs capable of extended operational performance in harsh conditions.

For Instance, in January 2025, Pipistrel completed the first hover flight of its hybrid-electric VTOL-capable unmanned aircraft, the Nuuva V300. The test flight saw the aircraft hover untethered 30 feet in the air for about 30 seconds at Pipistrel’s facility in Italy. The Nuuva V300 is a long-range, large-capacity hybrid-electric VTOL unmanned aircraft designed for cargo transport.

End User Analysis

In 2024, the government and defense sector dominates demand with 76.4% share, underscoring the strategic importance of hybrid UAVs in national security and defense operations. These UAVs provide critical capabilities for surveillance, intelligence gathering, and tactical missions, where extended flight time, reliability, and operational flexibility are paramount.

Military applications benefit from hybrid UAVs’ longer endurance and payload versatility, which support complex battlefield scenarios including border security, maritime patrol, and electronic warfare. Their deployment helps reduce risks to personnel while enhancing situational awareness and rapid response capabilities.

For Instance, in February 2025, Circ and Coretronic collaborated to develop a hybrid UAV designed for government and military applications. This advanced drone integrates hybrid propulsion technology, providing extended flight times and improved endurance for critical missions such as surveillance, reconnaissance, and tactical operations.

Key Market Segments

By Type

- Multicopter UAV

- Lift + Cruise UAV

- STOL UAV

By Propulsion

- Hybrid Electric

- Fuel Cell

By Endurance

- Short Endurance

- Medium Endurance

- Long Endurance

By Power

- Low Power

- Medium Power

- High Power

- Very High Power

By End User

- Government & Defense

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Need for Longer Flight Time

Hybrid UAVs are gaining popularity mainly because of the demand for longer flight durations. These drones combine electric and fuel systems, allowing them to fly for more than 10 hours, unlike traditional drones that often need frequent recharging. This extended flight time makes them highly useful for long-range surveillance, environmental monitoring, and large-scale agricultural tasks.

As industries seek more efficient solutions for extensive operations, hybrid UAVs offer a balanced mix of endurance and payload capacity, meeting critical operational needs. The push for longer endurance is driven by sectors like border security, disaster response, and precision farming that require continuous data collection over large areas. Advances in hybrid propulsion technology have played a vital role, making these drones more reliable and capable of supporting complex missions.

Their ability to operate in remote or challenging environments without frequent refueling significantly boosts their appeal and market growth prospects. For instance, in June 2025, the Indian Army successfully conducted trials of the hybrid UAV Rudrastra in Pokharan, showcasing significant technological advancements. The drone demonstrated remarkable precision and a 170-kilometer range, highlighting its capabilities in surveillance and strike missions.

Restraint

High Initial Investment

One of the main restraints for the hybrid UAV market is their high upfront costs. The dual propulsion systems and advanced technologies involved make these drones more expensive than purely electric or internal combustion models. This higher cost can discourage small and medium-sized companies from adopting hybrid UAVs despite their longer endurance and higher payloads.

Additionally, the complex design and advanced energy management systems required for hybrid UAVs add to maintenance and operational costs. These financial barriers can slow down overall adoption, especially when companies are hesitant to invest heavily without clear short-term returns. As a result, high prices may restrict widespread use outside of large government or defense budgets.

For instance, in April 2025, Hydra Drones secured a significant investment from global defense company MBDA to advance its hybrid UAV technology. The funding will enable the development of high-performance drones with extended flight times and greater operational flexibility. This highlights the high initial investment required for cutting-edge hybrid UAV systems.

Opportunities

Expanding Commercial and Defense Uses

Opportunities in the hybrid UAV market are expanding as industries increasingly recognize their value for diverse applications. Hybrid drones are now seen as vital tools for military surveillance, border patrol, and disaster management due to their ability to stay airborne longer. Their versatility also benefits commercial sectors such as agriculture and logistics, where extended flight times improve operational efficiency and cost savings.

Furthermore, technological innovations, particularly in battery energy storage like solid-state batteries, are expected to further enhance hybrid UAV performance. These new energy sources can reduce weight and increase safety, opening doors for more innovative uses. As regulations become clearer and technology advances, the market for hybrid UAVs will likely see rapid growth with new opportunities emerging across sectors worldwide.

For instance, in June 2025, the Indian Army placed a ₹137 crore emergency order for IdeaForge hybrid mini UAVs as part of its ongoing military modernization efforts. These hybrid UAVs are expected to enhance the Army’s surveillance, reconnaissance, and tactical capabilities. With advanced features, such as longer endurance and high payload capacity, these UAVs will play a critical role in improving operational efficiency during critical missions.

Challenges

Regulatory and Payload Limitations

Hybrid UAVs face the challenge of regulatory hurdles, as there are no unified international standards for drone operations. Different countries have varying rules on air traffic management, which complicates the deployment of hybrid drones that often require more sophisticated control systems. This lack of standardization can slow market acceptance and operational expansion.

Aside from regulation, payload limitations continue to challenge hybrid UAVs. Despite their improved endurance, carrying heavy equipment or sensors remains a constraint for many models. Improving lightweight materials and energy storage technologies is necessary to boost payload capacity and unlock new high-demand applications. Overcoming these technical and regulatory barriers will be key for sustained market growth.

For instance, in February 2025, Alti Unmanned Systems entered the all-electric era with the unveiling of its new transition eVTOL (electric Vertical Takeoff and Landing) drone. This fully electric UAV is designed for a variety of commercial applications, offering reduced operational costs and a greener alternative to traditional fuel-powered drones.

Key Players Analysis

The Hybrid UAV Market is anchored by major aerospace and defense companies such as Northrop Grumman, Thales, and L3Harris Technologies, Inc. These firms develop long-endurance hybrid drones for intelligence, surveillance, and tactical operations. Their UAV platforms combine fuel-based propulsion with electric power systems to extend flight time, improve payload efficiency, and support multi-mission capabilities for military and homeland security applications.

Innovative aviation and drone manufacturers including JOUAV, Elroy Air, Pipistrel, Skyfront, and Harris Aerial focus on hybrid UAVs designed for logistics, mapping, and industrial inspection. These companies offer vertical takeoff and landing (VTOL) and fixed-wing hybrid aircraft that serve sectors such as agriculture, disaster response, and infrastructure monitoring. Their designs emphasize low emissions, autonomous navigation, and long-range connectivity.

Emerging players such as Natilus, Doosan Mobility Innovation, Moya Aero, WaveAerospace, Aeronautics, Xer Technologies, and Avartek contribute to niche applications including heavy cargo transport, maritime operations, and high-altitude surveillance. Many of these firms are integrating hydrogen fuel cells and hybrid-electric systems to enhance endurance and sustainability. A growing number of other manufacturers continue to expand the adoption of hybrid UAVs across commercial and defense markets worldwide.

Top Key Players in the Market

- Northrop Grumman

- Thale

- L3Harris Technologies, Inc.

- JOUAV

- Elroy Air

- Draganfly

- Pipistrel

- Harris Aerial

- Natilus

- Doosan Mobility Innovation

- Moya aero

- Waveaerospace

- Aeronautics

- Skyfront

- Xer Technologies

- Avartek

- Others

Recent Developments

- In June 2025, Thales announced a partnership with Skydweller Aero to offer a solar-powered drone designed for maritime patrols lasting weeks to months. This hybrid solution leverages AI-powered radar and over 17,000 solar cells, promising operations at a fraction (5 to 10 times lower) of costs compared to traditional platforms like the MQ-9 Reaper.

- In June 2025, the Indian Army successfully conducted trials of the hybrid UAV drone Rudrastra in Pokharan. The drone demonstrated exceptional precision and a range of 170 kilometers during the trials, showcasing its capabilities for both surveillance and strike missions.

- In January 2025, Pipistrel completed the first hover flight of its hybrid-electric VTOL-capable unmanned aircraft, the Nuuva V300. The test flight saw the aircraft hover untethered 30 feet in the air for about 30 seconds at Pipistrel’s facility in Italy. The Nuuva V300 is a long-range, large-capacity hybrid-electric VTOL unmanned aircraft designed for cargo transport.

Report Scope

Report Features Description Market Value (2024) USD 726.4 Mn Forecast Revenue (2034) USD 2,990.2 Mn CAGR(2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Multicopter UAV, Lift + Cruise UAV, STOL UAV), By Propulsion (Hybrid Electric, Fuel Cell), By Endurance (Short Endurance, Medium Endurance, Long Endurance), By Power (Low Power, Medium Power, High Power, Very High Power), By End User (Government & Defense, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Northrop Grumman, Thale, L3Harris Technologies, Inc., JOUAV, Elroy Air, Draganfly, Pipistrel, Harris Aerial, Natilus, Doosan Mobility Innovation, Moya aero, Waveaerospace, Aeronautics, Skyfront, Xer Technologies, Avartek, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Northrop Grumman

- Thale

- L3Harris Technologies, Inc.

- JOUAV

- Elroy Air

- Draganfly

- Pipistrel

- Harris Aerial

- Natilus

- Doosan Mobility Innovation

- Moya aero

- Waveaerospace

- Aeronautics

- Skyfront

- Xer Technologies

- Avartek

- Others