Global Hybrid Train Market Size, Share, Growth Analysis By Propulsion Type (Electro-diesel, Battery Electric, Hydrogen Powered, Others), By Speed (100 - 200 Km/h, Below 100 Km/h, Above 200 Km/h), By Application (Passenger, Freight), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159898

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

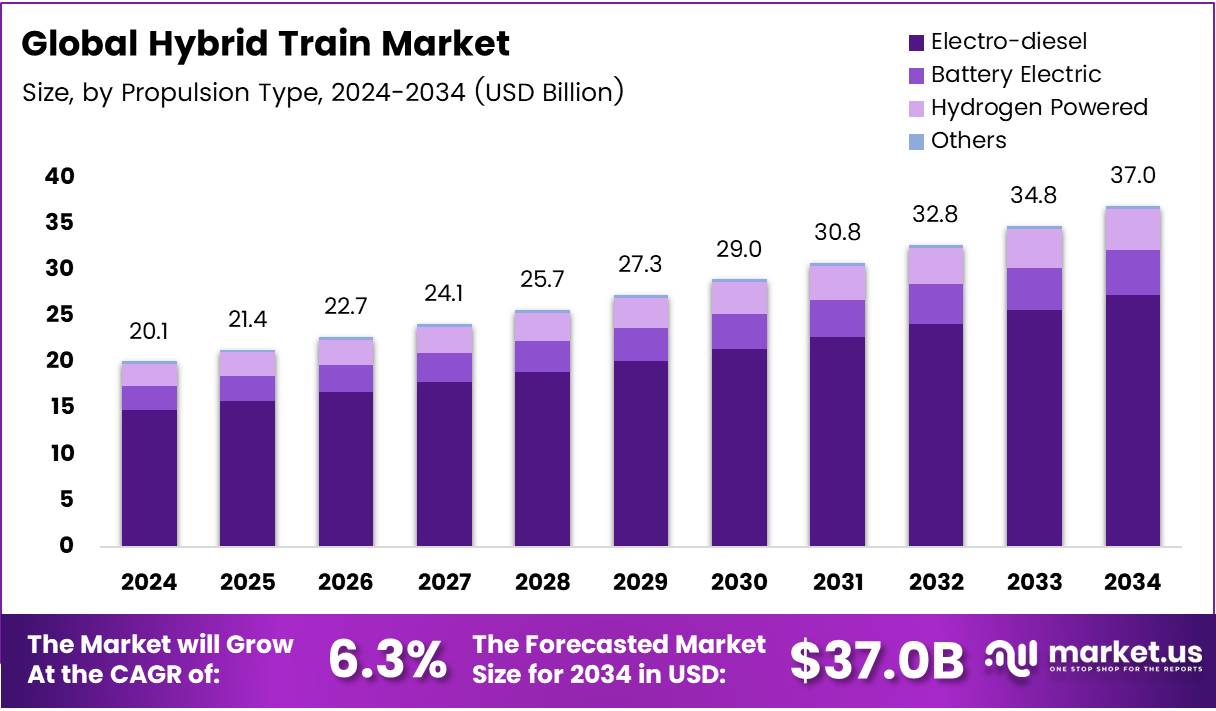

The Global Hybrid Train Market size is expected to be worth around USD 37.0 Billion by 2034, from USD 20.1 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Hybrid Train Market represents an evolving segment in rail transport, integrating diesel-electric, battery-electric, and hydrogen fuel cell technologies. These trains combine multiple power sources to enhance efficiency, lower emissions, and reduce operational costs. As sustainability becomes a priority, hybrid locomotives are increasingly preferred for both urban transit and intercity networks worldwide.

The rising global focus on carbon neutrality is driving rail operators to adopt hybrid propulsion systems. With stringent emission norms and decarbonization targets, hybrid trains offer a bridge between conventional diesel engines and full electrification. Their flexibility to operate in both electrified and non-electrified tracks supports broader rail network modernization initiatives.

Furthermore, technological advancements in energy storage, regenerative braking, and power management systems are boosting adoption. Rail manufacturers are integrating smart control units to optimize power usage and extend battery life. This innovation improves operational efficiency while addressing concerns over energy cost, maintenance, and long-term reliability across freight and passenger applications.

Government investments are also reshaping the market landscape. Many countries, including Japan, Germany, and India, are allocating infrastructure budgets for hybrid rail development. Public-private partnerships are fueling pilot projects and fleet upgrades. Additionally, regulatory incentives encouraging low-emission mobility are expected to accelerate commercialization through the next decade.

The market outlook remains optimistic, with opportunities emerging from urbanization, smart mobility, and renewable integration. Growing intercity connectivity and expansion of high-speed corridors are pushing hybrid train demand. Industry players are collaborating on scalable platforms, supporting retrofitting programs, and leveraging digital technologies to enhance safety, energy optimization, and predictive maintenance.

Key Takeaways

- The Global Hybrid Train Market is projected to reach USD 37.0 Billion by 2034, up from USD 20.1 Billion in 2024, growing at a CAGR of 6.3% during 2025–2034.

- In 2024, Electro-diesel propulsion dominated the market with a 73.9% share, enabling flexible operation on both electrified and non-electrified routes.

- The 100 – 200 Km/h speed segment led the market in 2024 with a 62.8% share, reflecting its suitability for intercity and regional services.

- The Passenger application segment accounted for a commanding 78.3% share in 2024, driven by increasing investments in sustainable public transport.

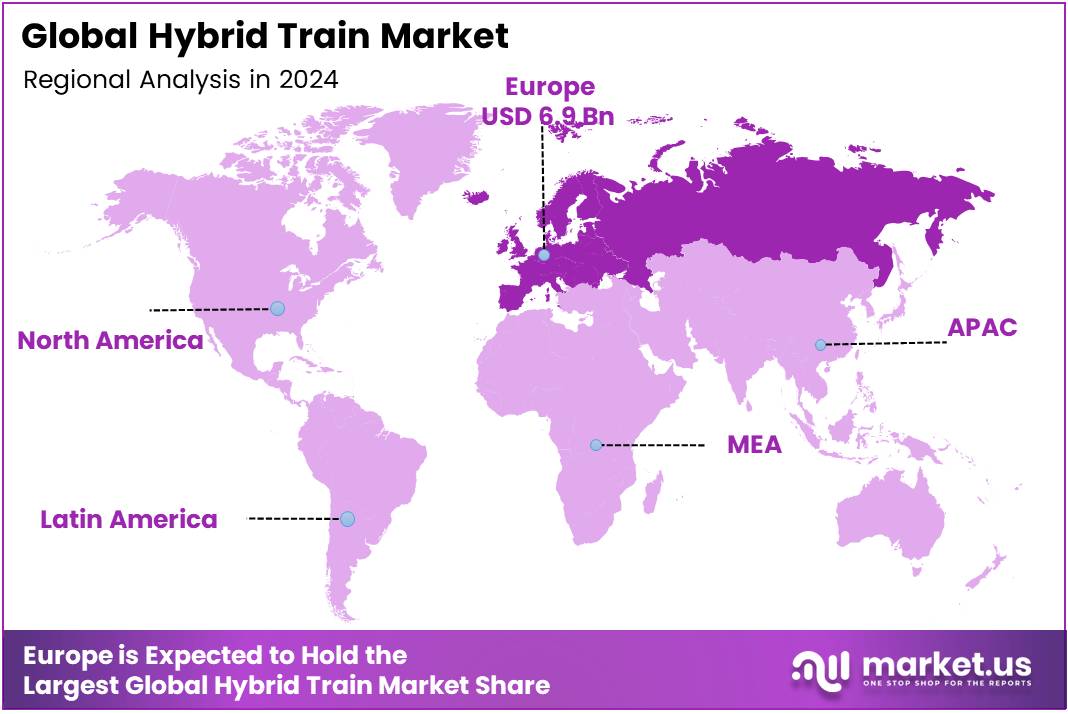

- Europe emerged as the leading regional market with a 34.61% share, valued at USD 6.9 Billion in 2024, supported by advanced rail networks and strict emission norms.

Propulsion Type Analysis

Electro-diesel dominates with 73.9% due to its operational flexibility and infrastructure compatibility.

In 2024, Electro-diesel held a dominant market position in the By Propulsion Type Analysis segment of Hybrid Train Market, with a 73.9% share. This propulsion system combines diesel engines with electric traction, enabling trains to operate seamlessly on both electrified and non-electrified routes.

The technology offers significant fuel savings compared to conventional diesel trains while maintaining operational flexibility across diverse rail networks. Railway operators prefer electro-diesel systems because they eliminate the need for complete infrastructure overhaul, making them cost-effective for transitioning toward greener transportation solutions.

Battery Electric trains represent an emerging segment focused on zero-emission operations. These trains utilize onboard battery packs to store electrical energy, allowing operation on non-electrified tracks without overhead catenary systems.

Battery electric technology appeals particularly to regional and suburban rail services seeking to reduce carbon footprints. However, current limitations in battery capacity and charging infrastructure restrict widespread adoption, positioning this segment as a growing alternative for shorter routes.

Hydrogen Powered trains leverage fuel cell technology to generate electricity through hydrogen oxidation. This propulsion type produces only water vapor as emission, making it environmentally superior.

Germany and other European nations have initiated hydrogen train deployments, demonstrating viability for long-distance non-electrified routes. Despite promising environmental benefits, high hydrogen production costs and limited refueling infrastructure currently constrain market penetration.

Others category encompasses experimental and hybrid propulsion technologies including solar-assisted systems and alternative fuel combinations. These innovative solutions remain in developmental or pilot phases, addressing specific regional requirements and niche applications within the hybrid train ecosystem.

Speed Analysis

100 – 200 Km/h dominates with 62.8% due to optimal balance between efficiency and infrastructure requirements.

In 2024, 100 – 200 Km/h held a dominant market position in the By Speed Analysis segment of Hybrid Train Market, with a 62.8% share. This speed range represents the sweet spot for intercity and regional rail services, offering reasonable travel times without requiring extensive infrastructure modifications.

Trains operating within this velocity band provide efficient connectivity between major cities while maintaining acceptable energy consumption levels. The moderate speed requirements align perfectly with hybrid propulsion capabilities, enabling cost-effective operations across electrified and non-electrified track sections.

Below 100 Km/h trains primarily serve suburban, commuter, and local transportation needs. This speed category emphasizes frequent stops and passenger accessibility rather than velocity.

Hybrid trains in this segment benefit urban and peri-urban networks where complete electrification remains economically challenging. The lower speed operations reduce energy demands, making battery electric and electro-diesel configurations particularly suitable. These trains contribute significantly to reducing urban pollution while maintaining operational flexibility.

Above 200 Km/h represents high-speed rail applications where hybrid technology adoption remains limited. Traditional high-speed trains predominantly rely on continuous overhead electrification for consistent power delivery at elevated velocities.

Hybrid propulsion systems face technical challenges in meeting the substantial energy requirements of high-speed operations. This segment remains niche, with hybrid technology primarily serving as backup propulsion or for depot movements rather than mainline high-speed services.

Application Analysis

Passenger dominates with 78.3% due to increasing demand for sustainable public transportation.

In 2024, Passenger held a dominant market position in the By Application Analysis segment of Hybrid Train Market, with a 78.3% share. Passenger rail services constitute the primary application for hybrid trains as governments worldwide prioritize sustainable public transportation solutions.

The growing urban population and environmental concerns drive investments in cleaner rail technologies for commuter and intercity passenger services. Hybrid trains offer passengers comfortable, eco-friendly travel experiences while helping transit authorities meet emission reduction targets. The passenger segment benefits from regulatory support, infrastructure development initiatives, and public acceptance of green transportation alternatives.

Freight applications represent a developing segment where hybrid train technology addresses sustainability challenges in cargo transportation. Railway freight operators increasingly explore hybrid propulsion to reduce diesel dependency and operational costs on non-electrified routes.

However, freight trains’ heavy loads and continuous operation requirements present distinct challenges compared to passenger services. The segment growth depends on demonstrating long-term reliability and economic viability for heavy-haul operations.

Despite current limitations, hybrid freight trains offer promising potential for reducing logistics sector emissions while maintaining cargo capacity and delivery efficiency across diverse rail networks.

Key Market Segments

By Propulsion Type

- Electro-diesel

- Battery Electric

- Hydrogen Powered

- Others

By Speed

- 100 – 200 Km/h

- Below 100 Km/h

- Above 200 Km/h

By Application

- Passenger

- Freight

Drivers

Increasing Demand for Fuel-Efficient and Low-Emission Transportation Solutions Drives Market Growth

Rising environmental concerns and stringent emission regulations are pushing governments and operators toward cleaner rail transport. Hybrid trains, which combine diesel and electric or battery propulsion, offer lower emissions and fuel consumption. This transition supports global climate goals and provides a reliable solution for sustainable mobility in both urban and regional routes.

Governments across major economies are investing heavily in sustainable railway infrastructure. These investments aim to modernize outdated fleets and promote hybrid propulsion technologies. Public-private partnerships, policy incentives, and funding programs are helping accelerate deployment, especially in regions focusing on carbon neutrality and renewable energy integration in rail networks.

Moreover, the rising need for fuel-efficient transport solutions is driving adoption among operators seeking operational cost savings. Hybrid trains reduce dependency on fossil fuels, enabling flexible operations across electrified and non-electrified routes. As energy efficiency becomes a competitive advantage, hybrid models emerge as the preferred choice for long-term sustainability.

Expanding urban transit networks in developing economies further enhance market demand. Rapid urbanization and growing passenger traffic are increasing the need for eco-friendly rail mobility. Hybrid trains provide a cost-effective transition model for cities lacking full electrification, supporting governments’ green transportation agendas and offering a balance between performance, efficiency, and affordability.

Restraints

Limited Charging and Refueling Infrastructure for Hybrid Rail Networks Restrains Market Growth

Despite growing demand, the Hybrid Train Market faces challenges due to inadequate charging and refueling infrastructure. Many rail networks lack proper facilities for hybrid or electric propulsion systems. This gap delays adoption in emerging markets and increases reliance on conventional diesel trains, limiting large-scale transition efforts.

The integration of hybrid systems within existing rail operations is another key restraint. Hybrid propulsion requires compatibility with current signaling, control, and maintenance frameworks. Adapting these legacy systems involves high technical complexity and extended project timelines. Operators often face challenges in harmonizing multiple power sources while maintaining operational efficiency and safety standards.

Concerns over long-term maintenance and lifecycle costs also slow adoption. Hybrid systems include advanced batteries, inverters, and control units requiring specialized maintenance. The cost of replacements and technical expertise adds financial burden to operators. Without adequate support from governments and manufacturers, small-scale operators struggle to justify upfront investments.

Overall, while hybrid trains promise sustainability and efficiency, the lack of supporting ecosystem, integration hurdles, and cost uncertainty continue to hinder market expansion. Addressing these issues through infrastructure upgrades, technical training, and public-private funding will be essential to unlock full market potential.

Growth Factors

Growing Adoption of Hybrid Trains in Freight Transport Creates New Growth Opportunities

The increasing use of hybrid trains in freight transport offers strong growth potential. Logistics operators are shifting to hybrid locomotives to reduce fuel consumption and emissions. This trend aligns with global decarbonization targets and helps industries lower carbon footprints while maintaining efficient goods movement across diverse terrains and long distances.

Regional and intercity connectivity development is another opportunity area. Governments are investing in hybrid models tailored for regional services that balance speed, efficiency, and cost. These trains serve as a bridge between fully electrified and non-electrified routes, providing flexibility and seamless travel options while enhancing connectivity across suburban and rural corridors.

Strategic collaborations between OEMs and energy storage providers further strengthen innovation. Battery and hydrogen storage advancements are enabling longer operational ranges and improved reliability. Partnerships ensure optimized powertrain integration and performance, fostering rapid commercialization of advanced hybrid technologies for multiple rail segments.

Additionally, government subsidies and incentives for green rail modernization boost investment. Policies promoting hybrid propulsion adoption through tax benefits and grants help offset initial costs. Such initiatives encourage railway operators to upgrade fleets, supporting industry transformation toward low-emission, energy-efficient mobility solutions across global markets.

Emerging Trends

Integration of Battery-Electric and Hydrogen Hybrid Propulsion Systems Shapes Emerging Market Trends

The integration of battery-electric and hydrogen hybrid propulsion systems is reshaping the Hybrid Train Market. These dual-power models offer enhanced flexibility, enabling operation on both electrified and non-electrified tracks. As hydrogen fuel cells and advanced batteries improve, operators gain longer range and reduced emissions, aligning with zero-carbon mobility goals.

Adoption of digital monitoring and predictive maintenance is becoming a major trend. Smart diagnostic systems help railway operators track performance, predict component failures, and reduce downtime. This technology-driven approach lowers maintenance costs, enhances safety, and ensures higher fleet availability, driving overall operational efficiency in hybrid train deployments.

The growing focus on autonomous and smart hybrid train technologies is another significant factor. AI-powered control systems, automated driving features, and real-time route optimization improve energy utilization and passenger experience. These innovations are helping operators modernize operations and adapt to future-ready, intelligent rail networks.

Lastly, the expansion of hybrid train pilot projects in Europe and Asia-Pacific reflects growing government support. Countries like Germany, Japan, and India are leading demonstrations to test hybrid feasibility under diverse conditions. These initiatives accelerate market learning, build confidence, and pave the way for commercial-scale adoption of hybrid propulsion systems.

Regional Analysis

Europe Dominates the Hybrid Train Market with a Market Share of 34.61%, Valued at USD 6.9 Billion

Europe leads the global Hybrid Train Market with a strong 34.61% share, valued at USD 6.9 billion, driven by its robust rail infrastructure and stringent emission regulations. Countries such as Germany, France, and the U.K. are investing heavily in sustainable mobility solutions. Moreover, the European Union’s Green Deal and decarbonization targets continue to fuel market adoption, fostering innovation in hybrid propulsion and advanced battery systems.

North America Hybrid Train Market Trends

In North America, the market is steadily growing due to rising investments in clean transportation and modernization of railway networks. The U.S. and Canada are introducing hybrid locomotives to reduce fuel dependency and carbon emissions. Additionally, government support for green energy transition and technological advancements in rail electrification are enhancing adoption across freight and passenger transport segments.

Asia Pacific Hybrid Train Market Trends

Asia Pacific exhibits notable potential owing to rapid urbanization and expansion of metro and intercity rail networks. Countries such as China, Japan, and India are focusing on hybrid rail technologies to manage growing commuter traffic and achieve sustainability goals. Increasing government initiatives and infrastructure funding are also driving demand for energy-efficient rail systems in this region.

Middle East and Africa Hybrid Train Market Trends

The Middle East and Africa region is gradually adopting hybrid train solutions as part of broader diversification and sustainability strategies. Infrastructure development in GCC nations and growing interest in green transport corridors are fostering demand. Moreover, partnerships with global rail technology providers are enabling countries to integrate hybrid systems into long-term transport plans.

Latin America Hybrid Train Market Trends

Latin America’s hybrid train market is emerging, supported by infrastructure upgrades and environmental policies. Nations such as Brazil and Mexico are emphasizing modernization of railway systems to improve efficiency and reduce operational costs. Growing urban populations and supportive government measures are expected to gradually boost regional market expansion over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hybrid Train Company Insights

In 2024, the global hybrid train market experienced steady advancements, supported by innovation and strategic investments from leading players. CRRC Corporation Limited continues to strengthen its leadership position by expanding hybrid rail solutions across Asia and Europe. The company’s focus on modular hybrid systems and cost-efficient propulsion technologies enhances its competitiveness in large-scale infrastructure projects.

Alstom SA remains a prominent player in the hybrid train market, leveraging its expertise in sustainable rail technologies. Through continuous development of battery-electric and hydrogen-hybrid models, the company actively supports global decarbonization goals. Its strong presence across Europe and strategic collaborations with transit authorities reinforce its commitment to low-emission mobility.

Siemens AG focuses on integrating advanced digital and energy-efficient solutions in its hybrid train offerings. The company’s emphasis on smart propulsion management and real-time diagnostics positions it as a technology-driven leader. Siemens’ hybrid models are gaining traction in urban and regional transport due to their operational efficiency and sustainability benefits.

Hitachi Rail STS demonstrates robust growth by deploying hybrid systems that combine fuel-efficient diesel engines with battery power. The company is expanding its market reach through partnerships that promote eco-friendly transportation. Its investments in intelligent rail control systems further align with the global shift toward greener, smarter mobility networks.

Top Key Players in the Market

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Hitachi Rail STS

- Wabtec Corporation

- Construcciones y Auxiliar de Ferrocarriles

- Hyundai Rotem Company

- Talgo

- The Kinki Sharyo Co., Ltd.

Recent Developments

- In February 2025, Sierra Northern Railway, a leading short-line freight operator in California, acquired RailPower LLC, a specialist in hybrid drive locomotives such as hybrid switchers and genset models. This acquisition strengthens Sierra’s push toward sustainable freight operations and aligns with California’s clean transportation goals.

- In April 2024, Canadian National (CN) announced its plan to purchase and test its first plug-in diesel–battery hybrid mainline locomotive from Progress Rail. This strategic move highlights CN’s commitment to reducing carbon emissions and exploring hybrid propulsion technologies for long-haul freight efficiency.

- In November 2024, Norfolk Southern revealed a collaborative project with Alstom to convert two existing locomotives to hybrid propulsion. The initiative aims to retrofit conventional units with modern hybrid systems, supporting emission reduction and energy efficiency across its operational network.

- In July 2025, Croatian operator HŽPP placed an order worth EUR 117.9 million with Končar Electric Vehicles for 13 hybrid + battery trains. This investment marks a significant step in Croatia’s transition toward greener regional mobility and modernization of its passenger fleet.

Report Scope

Report Features Description Market Value (2024) USD 20.1 Billion Forecast Revenue (2034) USD 37.0 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Electro-diesel, Battery Electric, Hydrogen Powered, Others), By Speed (100 – 200 Km/h, Below 100 Km/h, Above 200 Km/h), By Application (Passenger, Freight) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CRRC Corporation Limited, Alstom SA, Siemens AG, Hitachi Rail STS, Wabtec Corporation, Construcciones y Auxiliar de Ferrocarriles, Hyundai Rotem Company, Talgo, The Kinki Sharyo Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Hitachi Rail STS

- Wabtec Corporation

- Construcciones y Auxiliar de Ferrocarriles

- Hyundai Rotem Company

- Talgo

- The Kinki Sharyo Co., Ltd.