Global Hybrid Cloud Market By Component (Solution, Services), By Service Model (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS)), By End-User (BFSI, IT & Telecommunications, Healthcare, Retail, Media & Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121633

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

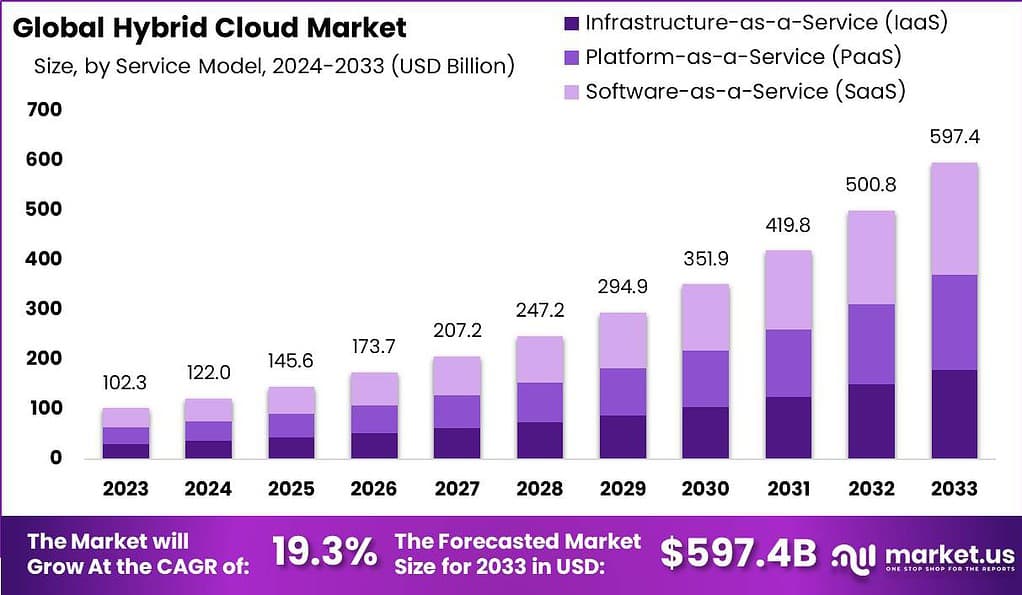

The Global Hybrid Cloud Market size is expected to be worth around USD 597.4 Billion By 2033, from USD 102.3 Billion in 2023, growing at a CAGR of 19.3% during the forecast period from 2024 to 2033.

A hybrid cloud refers to a computing environment that combines the use of both public and private clouds, allowing organizations to leverage the benefits of both platforms. In a hybrid cloud setup, certain applications and data are stored and processed in a private cloud, while others are hosted in a public cloud infrastructure. This approach offers businesses greater flexibility, scalability, and cost-efficiency, as they can optimize their workload placement based on specific requirements and priorities.

The hybrid cloud market has experienced significant growth in recent years, driven by the increasing adoption of cloud computing and the need for organizations to balance their on-premises infrastructure with the advantages of the public cloud. Businesses across various industries, including finance, healthcare, retail, and manufacturing, are embracing hybrid cloud solutions to address their unique operational needs.

One of the primary drivers of this growth is the increasing need for organizations to balance on-premises infrastructure with cloud resources, providing a seamless integration that supports dynamic business needs. Hybrid cloud environments enable businesses to optimize costs, improve operational efficiency, and enhance agility by allowing them to scale resources according to demand. The integration of public and private cloud services offers a versatile approach that can accommodate various workloads and data management requirements.

Another factor contributing to the growth of the hybrid cloud market is the increasing demand for hybrid IT architectures. Many organizations are adopting a multi-cloud strategy, utilizing multiple public cloud providers alongside their private cloud infrastructure. This approach allows businesses to avoid vendor lock-in and take advantage of the unique features and capabilities offered by different cloud providers.

Furthermore, the rise of edge computing has also fueled the adoption of hybrid cloud solutions. Edge computing involves processing data at or near the source of generation, reducing latency and enabling real-time decision-making. By combining edge computing with hybrid cloud architectures, organizations can distribute their workloads across various locations, ensuring efficient data processing and analysis.

According to recent research, 72% of firms have already combined or are in the process of incorporating a hybrid cloud into their IT infrastructure. This statistic highlights the growing popularity and acceptance of hybrid cloud solutions among businesses. Moreover, an overwhelming majority of 82% of enterprises have adopted a hybrid cloud strategy, indicating that organizations across various industries recognize the value and benefits that hybrid cloud environments offer.

One of the key advantages of hybrid cloud adoption is its positive impact on business uptime. A significant 60% of businesses believe that integrating hybrid cloud solutions improves their uptime, ensuring continuous availability and minimizing disruptions. This finding underscores the reliability and resilience that hybrid cloud architectures provide, enabling organizations to maintain smooth operations and deliver uninterrupted services to their customers.

Furthermore, the research reveals that hybrid cloud storage has a profound impact on productivity. An impressive 86% of users reported an increase in productivity after adopting hybrid cloud storage solutions. This result highlights the efficiency and accessibility that hybrid cloud storage offers, allowing users to seamlessly access and collaborate on data from various locations and devices. By enabling efficient data management and streamlined workflows, hybrid cloud storage empowers employees to work more effectively and achieve higher levels of productivity.

In addition to productivity gains, the study also highlights the cost-saving benefits of hybrid cloud storage. Approximately 63% of users identified cost-savings as the most significant advantage of utilizing hybrid cloud storage. With hybrid cloud environments, organizations can optimize their infrastructure costs by leveraging the scalability and cost-efficiency of public cloud services while retaining sensitive or critical data in private cloud environments.

Key Takeaways

- The Hybrid Cloud Market size is estimated to reach USD 597.4 billion in the year 2033 with a CAGR of 19.3 % during the forecast period and was valued at USD 102.3 billion in the year 2023.

- Based on the Component, the market is segmented into Solution and Services, where the Solution segment has dominated the market with a share of 54.6% in the year 2023.

- In 2023, the Software-as-a-Service (SaaS) segment held a dominant market position in the Hybrid Cloud market, capturing more than a 37.8% share.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Hybrid Cloud market, capturing more than a 21.0% share.

- In 2023, North America held a dominant market position in the Hybrid Cloud market, capturing more than a 36.4% share and generating revenue of USD 37.2 billion.

Component Analysis

In 2023, the Solution segment held a dominant market position in the Hybrid Cloud market, capturing more than a 54.6% share. This leadership is primarily driven by the increasing demand for scalable and cost-effective cloud computing solutions that can integrate seamlessly with existing on-premises infrastructures. Organizations across various industries are adopting hybrid cloud solutions to leverage the benefits of both private and public cloud environments, enabling enhanced flexibility, improved disaster recovery, and more robust data security.

The preeminence of the Solution segment can also be attributed to the continuous evolution and enhancement of cloud technologies. Hybrid cloud solutions offer the agility to run applications across private and public clouds, depending on their computing requirements and security needs. This flexibility allows businesses to optimize their operations and reduce costs significantly.

Furthermore, the adoption of artificial intelligence (AI) and machine learning (ML) within hybrid cloud solutions has made these platforms even more attractive, as they provide the tools necessary for businesses to gain actionable insights from their data. Moreover, the ongoing innovation in cloud solutions, such as containerization and microservices, is propelling the market forward.

These technologies enhance the deployment and scalability of applications, which is critical for businesses aiming to maintain competitiveness in a rapidly changing digital environment. Additionally, regulatory compliance and data sovereignty issues continue to drive enterprises towards hybrid cloud solutions, as these platforms can help meet stringent compliance requirements while still offering the benefits of cloud computing.

Service Model Analysis

In 2023, the Software-as-a-Service (SaaS) segment held a dominant market position in the Hybrid Cloud market, capturing more than a 37.8% share. This leading position is largely due to the widespread adoption of SaaS solutions by businesses seeking operational efficiency and scalability without significant upfront investment.

SaaS applications are particularly appealing as they offer quick deployment and are easily scalable, allowing businesses of all sizes to access sophisticated software and storage solutions over the internet. The popularity of the SaaS model in the hybrid cloud environment is also driven by its flexibility and cost-effectiveness. Companies can subscribe to services on a pay-as-you-go basis which enables them to better manage their expenses and reduce the costs associated with software maintenance and upgrades.

Furthermore, Service offerings across various business functions, such as customer relationship management (CRM), human resources management (HRM), and enterprise resource planning (ERP), have been pivotal in accelerating the adoption of SaaS. These applications are critical for enhancing operational efficiencies and improving decision-making processes.

Moreover, the SaaS segment benefits from the increasing integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) within these platforms, which can provide enhanced analytics and business intelligence capabilities. This integration helps businesses to gain a competitive edge by enabling more informed decision-making and personalized customer experiences.

Additionally, as data privacy concerns continue to grow, SaaS providers are increasingly focusing on enhancing security measures, which further increases their attractiveness to companies looking for reliable and secure cloud solutions.

End User Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Hybrid Cloud market, capturing more than a 21.0% share. This prominence is primarily attributed to the sector’s need for highly secure, flexible, and scalable IT infrastructure to handle vast amounts of sensitive financial data. Hybrid cloud solutions meet these demands effectively by combining the security of private clouds with the scalability and resource availability of public clouds.

The adoption of hybrid cloud in the BFSi sector is driven by the need for digital transformation and enhanced customer experience. Banks and financial institutions are leveraging hybrid cloud to deploy customer-centric solutions rapidly, improve operational efficiencies, and introduce new services that comply with stringent regulatory requirements. Furthermore, the hybrid cloud environment facilitates robust disaster recovery strategies and data redundancy, which are crucial for maintaining business continuity in the BFSI sector.

Additionally, the increasing integration of advanced technologies such as blockchain, artificial intelligence, and big data analytics in the BFSI industry boosts the demand for hybrid cloud solutions. These technologies require significant computational power and data storage capabilities, which hybrid clouds can provide. This enables financial institutions to innovate and stay competitive in a rapidly evolving market landscape.

Key Market Segments

By Component

- Solution

- Services

By Service Model

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

By End-User

- BFSI

- IT & Telecommunications

- Healthcare

- Retail

- Media & Entertainment

- Others

Drivers

Increasing demand for the agile, scalable and cost effective computing

The increasing demand for agile, scalable, and cost-effective computing is a significant driver for the growth of the hybrid cloud market. In today’s fast-paced digital environment, businesses require IT infrastructure that can quickly adapt to changing workloads and business needs. Hybrid cloud solutions provide the flexibility to scale resources up or down as needed, ensuring that companies can handle peak demands without over-provisioning resources, which leads to cost savings.

Hybrid cloud combines the best of both private and public cloud environments. This model allows organizations to keep critical, sensitive workloads on private cloud infrastructure for enhanced security and compliance while leveraging the public cloud for less sensitive applications and data, which offers cost advantages and scalability.

Furthermore, hybrid cloud enables businesses to innovate faster by providing a robust platform for developing and deploying new applications. Companies can quickly experiment with new technologies and services in the public cloud, and once validated, move them to the private cloud for production, ensuring agility and rapid time-to-market.

Restraints

Privacy and security concern

Privacy and security concerns are significant restraints on the hybrid cloud market, despite its rapid growth and numerous benefits. The hybrid cloud model, which combines public and private cloud services, presents unique challenges in safeguarding sensitive data and ensuring compliance with regulatory standards.

One major concern is the increased complexity and decreased visibility associated with managing hybrid environments. This complexity can lead to security vulnerabilities, as businesses may struggle to maintain consistent security protocols across different platforms. A study revealed that 33% of IT leaders experienced cyberattacks regardless of whether their data was hosted on-premises or in a hybrid cloud environment, underscoring the persistent security risks involved

Opportunities

Technological development

Technological advancements are a significant opportunity for the hybrid cloud market, driving its growth and evolution. The hybrid cloud model, which combines private and public cloud services, benefits greatly from innovations in several key areas. Advancements in cloud-native technologies such as containers and Kubernetes have simplified the deployment and management of applications.

This ease of management encourages businesses to adopt hybrid cloud strategies, as they can seamlessly integrate various cloud environments to enhance operational efficiency. Furthermore, the rise of server less computing eliminates the need for managing underlying infrastructure, allowing developers to focus solely on code development, thus accelerating application deployment and innovation.

Challenges

Higher cost

Higher costs present a significant challenge in the hybrid cloud market, particularly as businesses increasingly adopt hybrid cloud strategies to balance flexibility, scalability, and security. The financial burden associated with hybrid cloud environments stems from several factors.

The integration of public and private clouds necessitates advanced and often expensive cloud management tools. These tools are essential for ensuring smooth interoperability and workload portability, but they come at a high price. The complexity of managing diverse environments requires sophisticated software and skilled IT personnel, further driving up costs.

Hidden costs and unexpected charges are common in hybrid cloud deployments. Organizations frequently encounter unforeseen expenses related to data transfer fees, especially when moving large volumes of data between public and private clouds. Additionally, the need for continuous monitoring and optimization to prevent cost overruns can be resource-intensive and costly.

Growth Factors

- Flexibility and Scalability: Hybrid cloud environments offer the flexibility to scale computing resources up or down based on demand, helping businesses manage fluctuating workloads efficiently.

- Cost Efficiency: By leveraging both public and private clouds, organizations can optimize costs by using public clouds for less-sensitive workloads and private clouds for critical operations.

- Enhanced Security: Hybrid cloud models allow businesses to maintain control over sensitive data by keeping it in private clouds while utilizing public clouds for other applications, enhancing overall security compliance.

- Technological Advancements: Innovations in cloud technologies, such as containers and Kubernetes, facilitate easier deployment and management of applications across hybrid environments.

- Disaster Recovery and Business Continuity: Hybrid clouds provide robust disaster recovery solutions by replicating data across different environments, ensuring business continuity in case of failures.

Latest Trends

- Increased Adoption Across Industries: Sectors such as banking, healthcare, retail, and manufacturing are increasingly adopting hybrid cloud strategies to enhance agility, flexibility, and cost management.

- Advancements in Cloud Technology: The rise of containers, Kubernetes, and server less computing is simplifying the deployment and management of hybrid cloud environments, enabling more efficient operations.

- Integration of AI and Machine Learning: AI and ML are being integrated into hybrid cloud environments for better resource management, data analytics, and operational efficiency. This trend is making AI and ML technologies more accessible to businesses of all sizes.

- Growth in Edge Computing: The integration of edge computing with hybrid cloud architectures is accelerating. This combination allows for real-time data processing at the edge while leveraging the cloud for less time-sensitive tasks, optimizing overall performance and efficiency.

- Improved Security and Compliance Measures: Enhanced security protocols, identity and access management systems, and advanced threat detection tools are being developed to address the complexities of hybrid cloud environments. This ensures better compliance with regulatory standards.

Regional Analysis

In 2023, North America held a dominant market position in the Hybrid Cloud market, capturing more than a 36.4% share and generating revenue of USD 37.2 billion. This significant market share can be attributed to the region’s advanced technological infrastructure and the rapid adoption of cloud technologies by enterprises across various sectors, including technology, healthcare, and financial services.

North America’s robust digital ecosystem, supported by widespread internet connectivity and the presence of major cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud, has facilitated the swift integration of hybrid cloud solutions. The leadership of North America in the hybrid cloud market is also reinforced by the region’s strong focus on regulatory compliance and data privacy.

The stringent regulations governing data security in the U.S. and Canada push enterprises to adopt hybrid cloud solutions that offer enhanced control over sensitive data while benefiting from the scalability of public cloud resources. Furthermore, the growing trend of digital transformation across industries propels the demand for hybrid cloud systems, as they provide the agility and flexibility needed to adapt to changing business environments.

Moreover, the increasing investment in research and development activities related to cloud technologies in the region contributes to the evolution and enhancement of hybrid cloud solutions. These advancements further drive the adoption of hybrid cloud as businesses seek innovative solutions to optimize their operations and improve service delivery. North America’s proactive approach to adopting emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) further solidifies its position as a leader in the hybrid cloud market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the Hybrid Cloud market has witnessed substantial contributions from numerous key players, with IBM Corporation, Microsoft, and Amazon Web Services (AWS) standing out due to their innovative solutions and expansive market reach. IBM Corporation has been a frontrunner in providing robust hybrid cloud infrastructure and services, which are highly integrated with advanced AI capabilities and security features. This makes IBM a preferred choice for enterprises requiring complex data workflows and high regulatory compliance.

Microsoft continues to leverage its Azure platform to deliver seamless hybrid cloud experiences, focusing on ease of use, high scalability, and integrated management tools. Azure’s ability to interconnect with various Microsoft services enhances its appeal to businesses invested in the Microsoft ecosystem, looking for cohesive cloud solutions.

AWS, with its dominant position in the cloud market, excels in offering extensive and mature hybrid cloud functionalities through its vast service offerings and deep industry insights. AWS’s continual innovation in serverless computing and container services positions it as a leader in facilitating technology transformation and enabling businesses to scale efficiently.

Top Key Players in the Market

- IBM Corporation

- Microsoft

- Cisco

- Oracle Corporation

- AWS

- Alibaba

- Quest Software

- NetApp

- VMware, Inc.

- Rackspace Inc.

- Hewlett Packard Enterprise Company

- Other Key Players

Recent Developments

- In August 2023, Fujitsu, DIGITAL PROCESS LTD, and Information Services International-Dentsu, Ltd., collaborated to offer product life cycle management (hereinafter PLM) systems for customers in Japan.

- In August 2023, Dell and VMware partnered for providing on cyber resilient solutions for the inevitable attack.

- In April 2023, DXC Technology introduced the DXC Secure Network Fabric, a comprehensive platform tailored for hybrid cloud environments. Developed in collaboration with Hewlett Packard Enterprise and AMD, this system enhances data center networks by automating, modernizing, simplifying, and increasing security, all while lowering costs.

- In January 2023, Cloudian, a company that specializes in hybrid cloud data management and storage technology, successfully raised approximately USD 60 million. This funding round, which included investments from Intel Capital and other key players, increased Cloudian’s total investments to around USD 233 million.

Report Scope

Report Features Description Market Value (2023) USD 102.3 Bn Forecast Revenue (2033) USD 597.4 Bn CAGR (2024-2033) 19.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Service Model (Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS)), By End-User (BFSI, IT & Telecommunications, Healthcare, Retail, Media & Entertainment, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft, Cisco, Oracle Corporation, Google, AWS, Alibaba, Quest Software, NetApp, VMware Inc., Rackspace Inc., Hewlett Packard Enterprise Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a hybrid cloud?A hybrid cloud is a computing environment that combines the use of private cloud services and public cloud services with orchestration between the two platforms. It allows data and applications to be shared between them.

How big is Hybrid Cloud Market?The Global Hybrid Cloud Market size is expected to be worth around USD 597.4 Billion By 2033, from USD 102.3 Billion in 2023, growing at a CAGR of 19.3% during the forecast period from 2024 to 2033.

What factors are driving the growth of the hybrid cloud market?Factors such as increasing adoption of cloud computing, demand for hybrid IT solutions, data security concerns, and the need for seamless integration between on-premises and cloud environments are driving the growth of the hybrid cloud market.

What are the key challenges associated with implementing a hybrid cloud strategy?Key challenges include ensuring seamless integration between on-premises infrastructure and cloud services, managing data across hybrid environments, maintaining security and compliance standards, and addressing the complexity of hybrid cloud architectures.

Who are the leading players in the Hybrid Cloud Market?Leading players in the hybrid cloud market include IBM Corporation, Microsoft, Cisco, Oracle Corporation, Google, AWS, Alibaba, Quest Software, NetApp, VMware Inc., Rackspace Inc., Hewlett Packard Enterprise Company, Other Key Players

-

-

- IBM Corporation

- Microsoft

- Cisco

- Oracle Corporation

- AWS

- Alibaba

- Quest Software

- NetApp

- VMware, Inc.

- Rackspace Inc.

- Hewlett Packard Enterprise Company

- Other Key Players