Global HVAC Linesets Market Size, Share, Growth Analysis By Material (Copper, Aluminum, and Others), By Category (Pre-Insulated Linesets and Non-Insulated Linesets), By Implementation (New Construction and Retrofit), By End-use (Residential, Commercial, and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168245

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

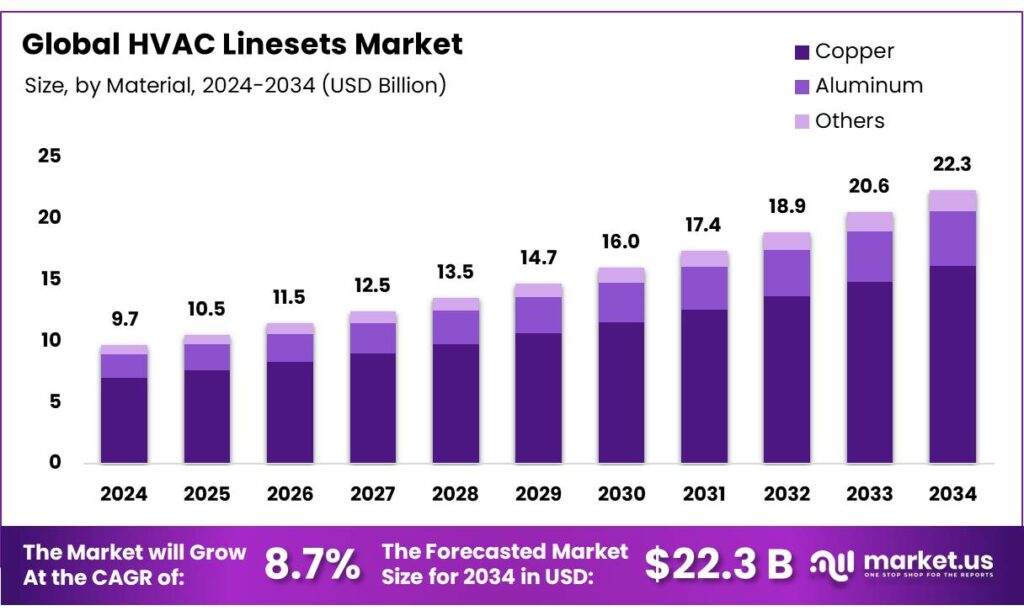

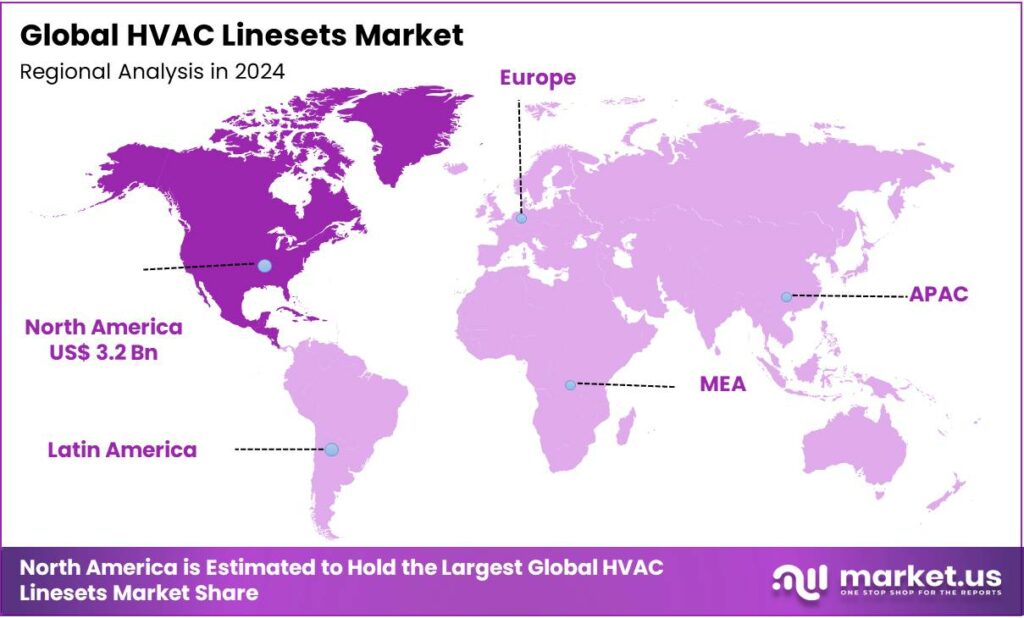

The Global HVAC Linesets Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 9.7 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 32.5% share, holding USD 3.2 Billion revenue.

HVAC line sets are a set of two semi-flexible copper tubes that connect the indoor and outdoor units of a split system air conditioner or heat pump. They transport refrigerant between the units to cool or heat a space. The line set includes a smaller liquid line, a larger insulated suction line, and wiring, all protected by insulation and sometimes a durable outer cover. The HVAC linesets market is being shaped by a combination of urbanization, construction growth, technological innovation, and evolving consumer preferences.

Rapid urban development in megacities has spurred demand for both residential and commercial HVAC systems, while the proliferation of data centers adds pressure for reliable, high-capacity refrigerant connections. Copper remains the dominant material due to its superior thermal conductivity, pressure resistance, and ease of brazing, while pre-insulated linesets are preferred for efficiency and condensation prevention.

Trends such as decorative covers, smart and connected systems, and energy-efficient designs reflect a shift toward aesthetics, convenience, and operational optimization. However, high production costs and geopolitical disruptions in metal supply chains pose challenges, prompting manufacturers to innovate, diversify materials, and optimize logistics.

Key Takeaways

- The global HVAC linesets market was valued at USD 9.7 billion in 2024.

- The global HVAC linesets market is projected to grow at a CAGR of 8.7% and is estimated to reach USD 22.3 billion by 2034.

- On the basis of material of HVAC linesets, copper dominated the market, constituting 72.4% of the total market share.

- Based on the category of HVAC linesets, pre-insulated linesets dominated the market, with a substantial market share of around 65.8%.

- Based on the implementation of HVAC linesets, new construction led the market, comprising 61.6% of the total market.

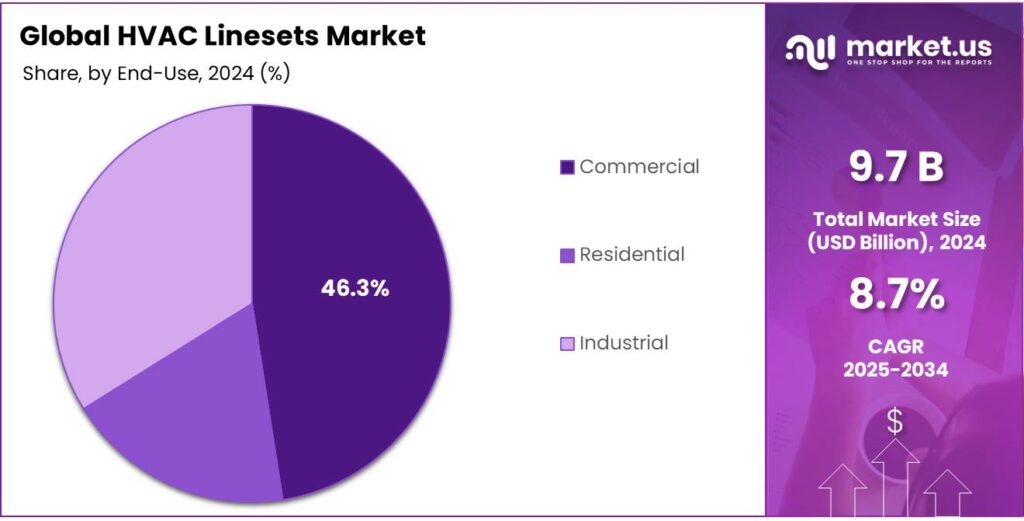

- Among the end-uses, commercial uses held a major share in the HVAC linesets market, 46.3% of the market share.

- In 2024, North America was the most dominant region in the HVAC linesets market, accounting for 32.5% of the total global consumption.

Material Analysis

Copper HVAC Linesets are a Prominent Segment in the Market.

The HVAC linesets market is segmented based on the material used into copper, aluminum, and others. The copper metal for HVAC linesets led the market, comprising 72.4% of the market share, due to its superior thermal conductivity, durability, and corrosion resistance, qualities that are essential for reliable refrigerant flow. In addition, copper has a thermal conductivity of about 400 W/m·K, nearly double that of aluminum at around 205 W/m·K, allowing refrigerant to move more efficiently through the system.

Similarly, it is far less prone to cracking under pressure as copper tubing can withstand internal pressures exceeding 800 psi, which is important as newer refrigerants often require higher operating pressures. Similarly, copper joints can be brazed easily, creating leak-resistant seals that have longer lives. For instance, residential split AC systems widely rely on copper lines as they maintain structural integrity even in extreme outdoor temperatures, ensuring long service life and fewer maintenance issues compared with aluminum alternatives.

Category Analysis

Pre-Insulated HVAC Linesets Dominated the Market.

On the basis of the category of the HVAC linesets, the market is segmented into pre-insulated linesets and non-insulated linesets. The pre-insulated HVAC linesets dominated the market, comprising 65.8% of the market share. Most HVAC linesets are pre-insulated, as insulation is essential for maintaining refrigerant temperature and preventing energy loss, moisture buildup, and system inefficiency. When the suction line is left uninsulated, warm surrounding air can cause condensation, which may drip onto walls or ceilings and lead to mold growth or structural damage.

Pre-insulated linesets eliminate the risk by providing a uniform insulation layer, typically made of elastomeric foam with thermal conductivity as low as 0.034 W/m·K, helping keep the refrigerant at the correct temperature as it moves between indoor and outdoor units. Additionally, pre-insulation prevents heat gain that can reduce cooling efficiency and increase compressor workload. For installers, pre-insulated linesets offer significant convenience as they cut installation time, ensure consistent insulation thickness, and reduce the chance of errors compared with manually wrapping insulation on-site.

Implementation Analysis

HVAC Linesets Are Mostly Utilized in New Constructions.

Based on the implementation of HVAC linesets, the market is divided into new constructions and retrofits. New constructions dominated the market, with a prominent market share of 61.6%, as installing them in new constructions is far more convenient when walls, ceilings, and mechanical pathways are still open and accessible. In new buildings, installers can route refrigerant lines through planned chases or ceilings without obstruction, ensuring proper bend radius, insulation integrity, and correct placement of the outdoor and indoor units.

However, in retrofit projects, accessing existing walls often requires cutting drywall, rerouting electrical lines, or working around structural elements, which increases labor time and costs. Additionally, older buildings may have limited space for new refrigerant piping or may not meet modern HVAC design requirements, making retrofitting more complex. For instance, adding linesets to a finished multi-story apartment building can require working through tight shafts or using surface-mounted covers, which can be visually intrusive.

End-Use Analysis

Commercial Uses Held a Major Share of the HVAC Linesets Market.

Among the end-uses, 46.3% of the total global consumption of HVAC linesets is utilized for commercial uses. HVAC linesets are utilized more in commercial applications as these buildings typically rely on large, distributed cooling systems, such as VRF/VRV setups, multi-split units, and rooftop systems, that require extensive refrigerant piping between multiple indoor and outdoor units. Commercial spaces such as offices, hospitals, hotels, and shopping centers often have multiple indoor units, each connected by linesets that span long distances across floors and mechanical rooms.

For instance, a hotel with 150 rooms may have individual indoor units on each floor connected through complex refrigerant networks, making linesets essential for efficient temperature control across the entire property. In contrast, residential systems usually involve a single split AC or heat pump with a short refrigerant run, requiring fewer or simpler linesets. While industrial facilities often use centralized chillers, cooling towers, or process-cooling systems that rely more on water-based piping rather than refrigerant linesets.

Key Market Segments

By Material

- Copper

- Aluminum

- Others

By Category

- Pre-Insulated Linesets

- Non-Insulated Linesets

By Implementation

- New Construction

- Retrofit

By End-use

- Residential

- Commercial

- Industrial

Drivers

Increased Urbanization and Construction Drive the HVAC Linesets Market.

Rapid urbanization and the resulting construction boom are significantly increasing demand for HVAC linesets as cities expand and modernize their infrastructure. According to United Nations data, more than 56% of the global population lived in urban areas in 2023, a figure expected to reach nearly 70% by 2050, driving large-scale residential and commercial building activity. The fastest level of urbanization is being registered in two of the most populous countries in the world, which account for 2.8 billion individuals: India and China.

- In addition, these two countries are showing impressive infrastructure development. For instance, according to the Government of India, the country’s total infrastructure spending has grown exponentially, with budget allocations rising to INR 10 lakh crore in 2023-24. Similarly, according to the National Bureau of Statistics of China, infrastructure investment reached approximately US$2.4 trillion in 2023, marking a 6% increase from 2022.

Growing megacities continue to expand with millions of new residents, resulting in high demand for apartments, offices, hospitals, and retail complexes, most of which require efficient cooling and heating systems. For instance, in the United States alone, construction spending on residential and non-residential buildings rose by over 7% in 2023, supported by ongoing urban redevelopment and new housing projects. As builders adopt energy-efficient HVAC systems to meet stricter building codes, linesets made of copper or advanced insulated materials become essential for connecting outdoor and indoor units. This surge in construction activity directly boosts the need for reliable HVAC linesets to support expanding urban living and working spaces.

Restraints

High Production Costs Might Pose a Challenge to the HVAC Linesets Market.

Rising production costs are becoming a major headwind for the HVAC linesets market, largely driven by volatile raw-material prices and tight supply chains. For instance, copper, an essential ingredient in many linesets, can account for more than 20-30% of the total manufacturing cost for HVAC tubing. Due to geopolitical instability across different regions, in November 2025, the copper prices have reached approximately US$10,649 to US$10,740 per ton, putting pressure on margins for tubing manufacturers.

This cost volatility forces producers to keep larger inventories, draining working capital, or to renegotiate contracts, both of which squeeze profitability. Moreover, due to these high costs, many HVAC component manufacturers are increasingly shifting to aluminum. About 40% of global HVAC units now use aluminum instead of copper to curb expenses. Smaller manufacturers, in particular, struggle to absorb these raw-material fluctuations and face added risk when competing with larger players who can hedge better or negotiate long-term supply deals.

Opportunity

Rising Number of Data Centers Creates Opportunities in the HVAC Linesets Market.

The rapid proliferation of data centers worldwide is fueling a surge in demand for HVAC linesets, as these high-density computing facilities generate tremendous heat that must be efficiently managed. There are over 12,000 operational data centers globally, with the United States alone accounting for more than 5,400 of them.

As of March 2025, the United States reportedly had 5,426 data centers and held the leading position in this field, while the UK was at number two with 523 data centers, and Germany, with 529 data centers, came third. As illustrated in the chart below, there is a consistent and sharp upward trend in the number of hyperscale data centers built globally from 2020 through 2023.

The number of these centers grew from 597 to nearly 992 in less than a decade, reflecting a compound annual growth rate well into double digits. This construction boom directly translates into insulation demand across building envelopes—walls, ceilings, ducting systems, pipe insulation, equipment enclosures, and raised floors.

As cloud providers and hyperscalers build larger campuses, some with gigawatt-scale power loads, cooling infrastructure is pushed to its limits. To maintain reliable operations, data centers rely on sophisticated HVAC systems connected by insulated copper or advanced synthetic-material linesets that transfer coolant between coolers and server rooms.

The energy demand for cooling can account for a significant portion of a facility’s electricity footprint, which in turn drives the need for high-quality, durable linesets. With edge data centers expanding in fast-growing markets such as India and Europe, and with AI workloads fueling more power density, the growing base of data centers directly opens up strong opportunities for HVAC lineset suppliers.

Trends

Adoption of Decorative HVAC Linesets Cover.

There’s a growing trend toward decorative HVAC lineset covers, as homeowners and designers increasingly demand both functionality and aesthetics. Rather than leaving copper or insulated pipes exposed, many customers are now using snap-on PVC or ABS covers that come in various colors and profiles to match or complement the building’s facade.

For instance, some decorative covers are engineered to follow tight bends without kinking and are built from UV-resistant materials that protect pipes while allowing them to be painted. Brands such as RectorSeal offer lineset covers in different colors, including black, for a clean, finished look that aligns with modern architectural trends. This design-led adoption is mirrored in product kits such as the Turbro Decorative PVC Line Cover Kit, which allow users to conceal unsightly lines while preserving functionality.

Additionally, there is a clear shift toward smart, connected HVAC systems, and this trend is reshaping lineset demand as thermostats, controllers, and chillers become network-enabled. The requirements for linesets also evolve to support more sophisticated refrigerant and sensor pathways. Globally, IoT devices have surged from about 10 billion in 2018 to more than 25 billion by 2025, with a significant share used in building automation and HVAC.

Geopolitical Impact Analysis

Increased Copper Prices Affecting HVAC Linesets Market Amid Geopolitical Tensions.

The current geopolitical tensions, particularly those tied to the Russia‑Ukraine conflict and escalating U.S.-China trade disputes, are creating headwinds for the HVAC linesets market by disrupting raw‑material supply chains. For instance, Russia, not being the largest copper producer, still contributes significantly to global metal exports. The sanctions placed by the U.S. and UK on Russia after its invasion of Ukraine have restricted its aluminum, nickel, and copper shipments, fueling price volatility.

These restrictions have tightened copper supply, a key component for refrigerant lines, increasing sourcing risk for manufacturers. Meanwhile, trade tensions with China, one of the world’s largest processors of copper, have introduced tariff barriers and uncertainty, pushing importers to diversify their sourcing strategies. Some metal producers, such as Norilsk Nickel, are relocating operations to shift copper smelting capacity to China to navigate Western sanctions.

Moreover, these geopolitical disruptions inflate logistics costs, complicate long-term contracts, and force HVAC‑lineset manufacturers to adjust to more fragmented, less predictable supply chains, making production more expensive and less stable.

Regional Analysis

North America Held the Largest Share of the Global HVAC Linesets Market.

In 2024, North America dominated the global HVAC linesets market, holding about 32.5% of the total global consumption. The region has held a dominant position in the global HVAC linesets market, largely due to its mature HVAC installation base and high appliance penetration. In the United States, almost 90% of households had some form of air conditioning by 2020, with about two-thirds using central systems. This widespread adoption drives a steady demand for replacement and new-build HVAC systems, requiring linesets to connect indoor and outdoor units.

The U.S. shipments of central air conditioners and heat pumps remain highly robust, with over 1.5 million such units shipped. Moreover, North America’s construction sector, both residential and commercial, is underpinned by strong regulation on energy efficiency, which encourages the use of advanced HVAC systems and therefore more sophisticated lineset infrastructure. The region continues to lead in terms of demand for high-quality HVAC connectivity components.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies in the HVAC linesets market focus heavily on product innovation, offering differentiated linesets such as pre‑insulated or paired lines, with liquid and suction, to reduce installation time and improve performance. For instance, Inaba Denko’s pre‑paired, pre‑insulated linesets simplify and speed up installer work. In addition, some firms are exploring more cost‑efficient materials.

For instance, Hydro is reengineering HVAC tubing to use aluminum micro‑channel structures, reducing weight and raw‑material cost. Several companies, such as RectorSeal, introduce decorative, snap‑on line cover systems to hide refrigerant lines while preventing moisture, air leakage, and pest intrusion. Furthermore, companies emphasize on improvement of logistics and customer reach by localizing manufacturing. For instance, Linesets, Inc. operates multiple production sites to shorten delivery times. Moreover, companies focus on after-sales support and close partnerships with contractors by building strong distributor‑installer relationships.

The Major Players in The Industry

- Norsk Hydro ASA

- Halcor

- Mueller Industries

- Cerro Flow Products LLC

- Linesets, Inc.

- DiversiTech Corporation

- PTubes, Inc.

- PDM Corporation

- Inaba Denko

- HMAX

- Great Lakes Copper Ltd.

- Gastite

- Airex Manufacturing Inc.

- Changzhou Dabund Pipe Co., Ltd.

- Other Key Players

Key Development

- In January 2023, RectorSeal, a leading manufacturer of quality HVAC/R and plumbing accessories and a wholly owned subsidiary of CSW Industrials, announced the launch of the Outset Seal, an adjustable lineset protection system for ducted and ductless HVAC installations.

- In March 2025, Cerro Flow Products LLC, a manufacturer of high-quality flow control products to the plumbing, heating, air conditioning, refrigeration, and industrial markets, unveiled its product line. The company offers over 1,000 different line set combinations based on length, diameter, end finish, and insulation thickness.

Report Scope

Report Features Description Market Value (2024) USD 9.7 Bn Forecast Revenue (2034) USD 22.3 Bn CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Copper, Aluminum, and Others), By Category (Pre-Insulated Linesets and Non-Insulated Linesets), By Implementation (New Construction and Retrofit), By End-use (Residential, Commercial, and Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Norsk Hydro ASA, Halcor, Mueller Industries, Cerro Flow Products LLC, Linesets, DiversiTech Corporation, PTubes, PDM Corporation, INABA DENKO, HMAX, Great Lakes Copper Ltd., Gastite, Airex Manufacturing, Changzhou Dabund Pipe Co., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Norsk Hydro ASA

- Halcor

- Mueller Industries

- Cerro Flow Products LLC

- Linesets, Inc.

- DiversiTech Corporation

- PTubes, Inc.

- PDM Corporation

- Inaba Denko

- HMAX

- Great Lakes Copper Ltd.

- Gastite

- Airex Manufacturing Inc.

- Changzhou Dabund Pipe Co., Ltd.

- Other Key Players