Global Household Kitchen Appliances Market Size, Share, Growth Analysis By Product (Cooking Appliances, Dishwasher, Refrigerator, Range Hood, Others), , By Technology(Conventional, Smart Appliances), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153638

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

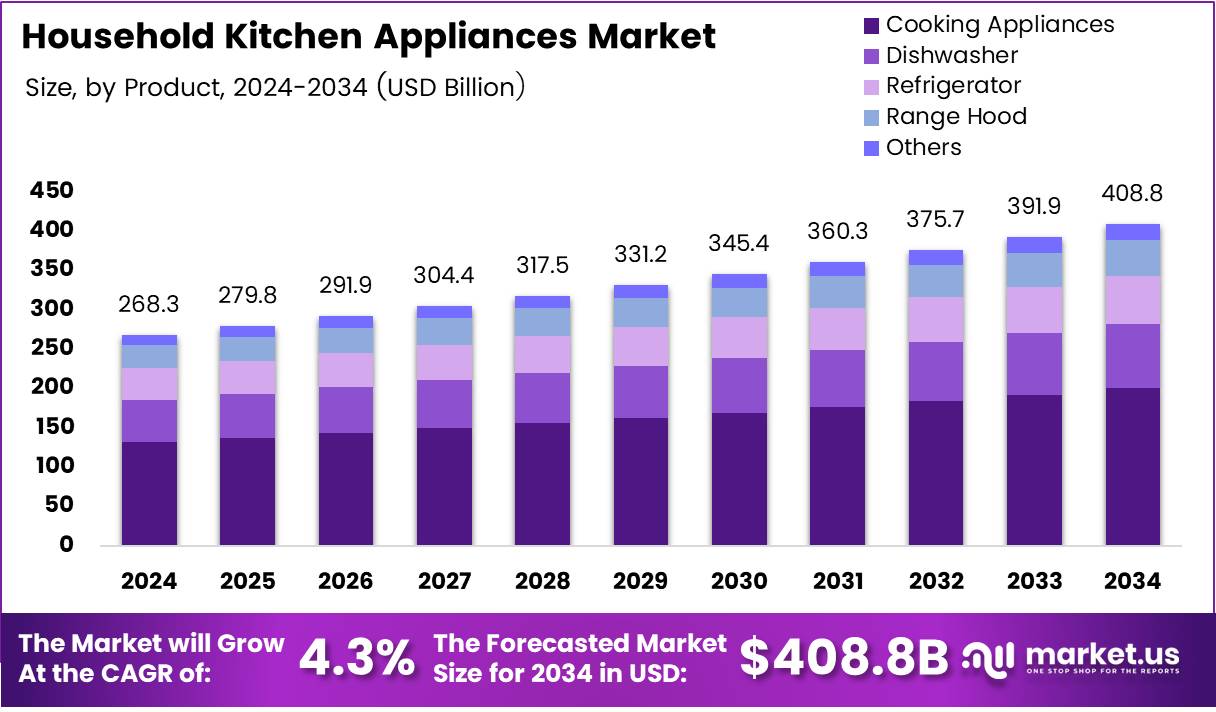

The Global Household Kitchen Appliances Market size is expected to be worth around USD 408.8 Billion by 2034, from USD 268.3 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The household kitchen appliances market encompasses a wide range of products used to aid in food preparation and other kitchen activities. These products include blenders, refrigerators, ovens, dishwashers, and coffee makers, among others. The market’s growth is driven by increasing consumer demand for convenience, efficiency, and smart features in kitchen devices.

With advancements in technology, there has been a noticeable shift towards smart appliances. These devices, equipped with Internet of Things (IoT) capabilities, enable consumers to remotely control functions such as temperature settings and cooking times. As a result, the demand for smart kitchen appliances has surged globally, contributing to market expansion.

Government investments in the home appliance sector, along with increasing consumer awareness about energy-efficient solutions, have positively impacted the market. Regulations aimed at reducing energy consumption are also pushing manufacturers to innovate, ensuring that products meet sustainability standards. Such regulations have spurred growth in the sector, particularly for energy-efficient refrigerators and dishwashers.

The U.S. market, for instance, has witnessed significant changes. According to ConsumerFed, 68% of U.S. consumers replaced at least one major appliance in the past five years. This trend is expected to continue as households look to upgrade to more efficient, advanced models. The longevity and performance of these appliances, particularly due to product failures, drive this replacement cycle.

Interestingly, the market also reveals disparities in appliance replacement trends among different income groups. 58% of low-income renters have not replaced a major appliance in the past five years, according to ConsumerFed. This indicates a gap in accessibility to newer, advanced appliances, highlighting a potential area for growth targeting budget-conscious consumers.

Key Takeaways

- The Global Household Kitchen Appliances Market is expected to reach USD 408.8 Billion by 2034, from USD 268.3 Billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034.

- Cooking Appliances dominated the market in 2024, accounting for 42.6% of the By Product Analysis segment.

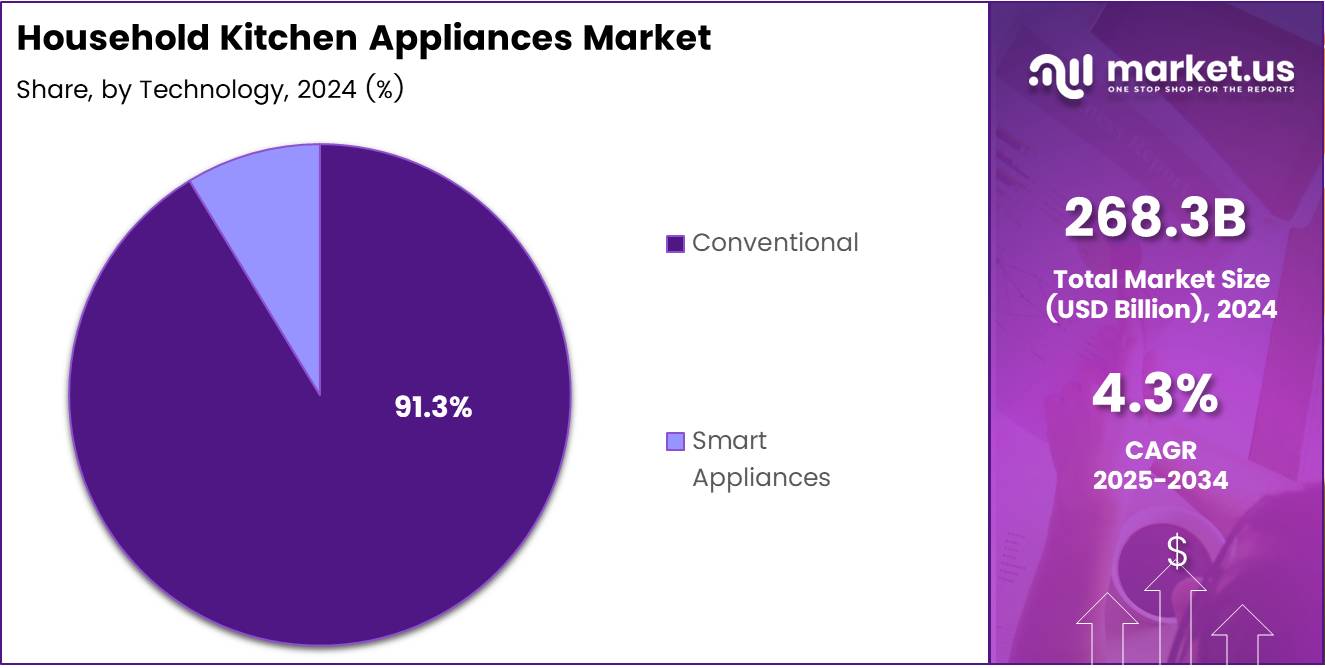

- Conventional technology led the By Technology Analysis segment in 2024, capturing 91.3% of the market share.

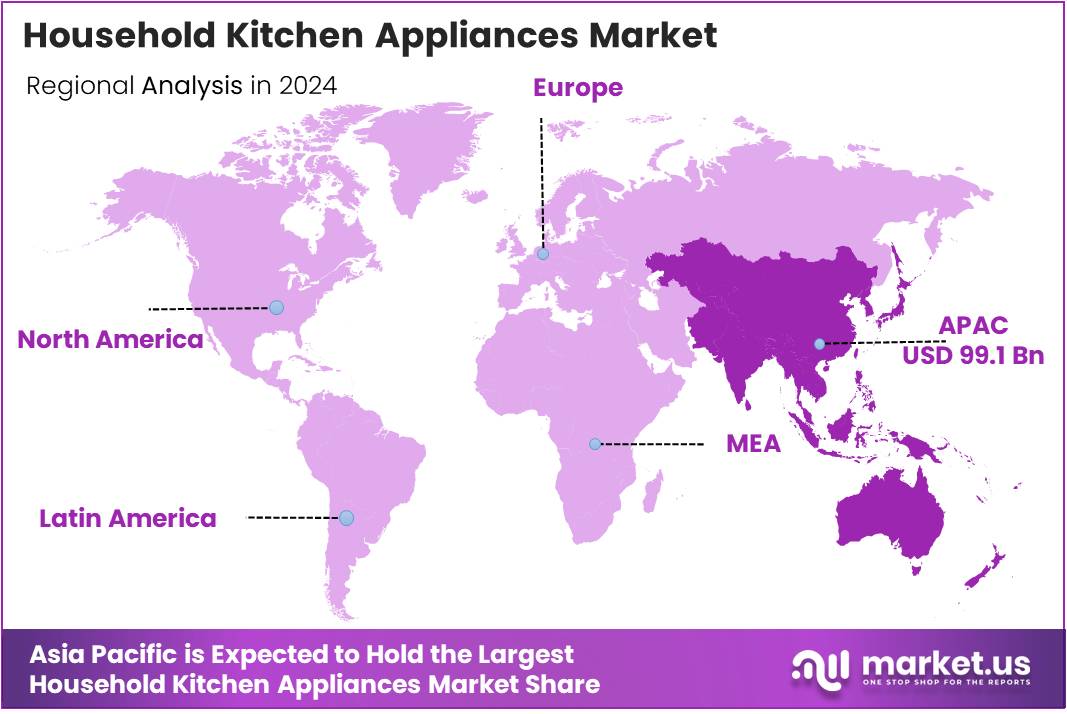

- The Asia Pacific region holds the largest market share, contributing 36.9%, valued at approximately USD 99.1 Billion in 2024.

Product Analysis

Cooking Appliances dominates with 42.6% share in the Household Kitchen Appliances Market in 2024.

In 2024, Cooking Appliances held a dominant market position in the By Product Analysis segment of the Household Kitchen Appliances Market, with a share of 42.6%. This segment is driven by the increasing demand for convenience and advanced cooking technology in households worldwide. Cooking appliances, such as ovens, stovetops, and microwaves, are essential for everyday meal preparation, contributing to their large market share.

Dishwashers, with their ability to save time and effort in cleaning, follow as an important segment. While the market share for dishwashers is substantial, it remains smaller compared to cooking appliances due to the differing consumer adoption rates.

Refrigerators continue to play a crucial role in preserving food, with growing emphasis on energy-efficient models. They make up a key portion of the market but hold a smaller share compared to cooking appliances.

Range hoods are gaining popularity for their ability to improve kitchen air quality, though they represent a smaller segment. The Others category includes other essential kitchen devices contributing to the overall market share but with comparatively limited dominance.

Technology Analysis

Conventional dominates with 91.3% share in the Household Kitchen Appliances Market in 2024.

In 2024, Conventional technology held a dominant market position in the By Technology Analysis segment of the Household Kitchen Appliances Market, capturing an impressive share of 91.3%. Conventional appliances, which include traditional cooking devices and refrigeration units, continue to lead due to their widespread availability, cost-effectiveness, and long-standing consumer familiarity.

The Smart Appliances segment, though growing steadily, held a smaller share in 2024. As consumers increasingly seek energy-efficient, connected solutions, smart appliances are expected to rise in prominence.

However, in 2024, they remain a niche category compared to conventional technology. Smart appliances offer features like remote control, energy monitoring, and connectivity with other home automation systems, driving their gradual growth.

Despite the trend toward smart technology, conventional appliances remain dominant, as many consumers prefer familiar and dependable products for everyday use. The balance between traditional and smart appliances is expected to evolve in the coming years, but conventional technology remains the prevailing choice in 2024.

Key Market Segments

By Product

- Cooking Appliances

- Cooktops & cooking range

- Ovens

- Others

- Dishwasher

- Refrigerator

- Range Hood

- Others

By Technology

- Conventional

- Smart Appliances

Drivers

Rising Demand for Energy-Efficient Appliances Drives Market Growth

The growing demand for energy-efficient appliances is one of the key drivers in the household kitchen appliances market. Consumers are becoming more aware of the long-term cost savings and environmental benefits that energy-efficient products offer. These appliances consume less energy, reducing electricity bills and contributing to sustainable living.

As a result, energy-efficient models are becoming increasingly popular, with consumers opting for products that align with their environmental concerns and budget preferences. This trend is expected to drive market growth, especially with the introduction of advanced technologies in energy-efficient kitchen appliances.

Restraints

High Initial Investment Cost of Advanced Appliances Restrains Market Growth

The high initial investment cost associated with advanced kitchen appliances is a major restraint in the market. Although energy-efficient and smart appliances provide long-term benefits, the upfront costs are often higher than traditional models. This can be a barrier for price-sensitive consumers, especially in emerging economies where affordability is a key consideration.

Limited awareness of the energy-saving benefits of these appliances further compounds the issue. As a result, despite the growing demand for advanced appliances, their adoption may be slower in price-conscious regions.

Growth Factors

Expansion in Emerging Economies with Rising Middle-Class Population Presents Growth Opportunities

The household kitchen appliances market has significant growth opportunities, particularly in emerging economies. As the middle-class population rises in countries like India and China, there is an increased demand for modern kitchen appliances.

Consumers in these regions are becoming more interested in upgrading their kitchens with energy-efficient and technologically advanced products. The growth of e-commerce platforms is also facilitating broader access to these products, making them more accessible to a larger segment of the population. This presents a promising growth opportunity for market players to expand their reach.

Emerging Trends

Increasing Popularity of Voice-Controlled and App-Enabled Appliances is a Key Trend

A notable trend in the household kitchen appliances market is the growing popularity of voice-controlled and app-enabled appliances. With the rise of smart home integration, consumers are increasingly looking for appliances that can be controlled remotely through mobile apps or voice assistants like Amazon Alexa or Google Assistant. This shift towards convenience is driving the demand for multifunctional and connected kitchen products.

Additionally, there is a growing focus on health-conscious cooking solutions, with appliances that assist in preparing nutritious meals gaining traction in the market. AI integration is further enhancing the personalization of cooking experiences, allowing users to customize meal preparations based on their preferences.

Regional Analysis

Asia Pacific Dominates the Household Kitchen Appliances Market with a Market Share of 36.9%, Valued at USD 99.1 Billion

The Asia Pacific region holds the largest share of the Household Kitchen Appliances market, contributing 36.9% of the total market value, which is approximately USD 99.1 Billion. This dominance is driven by rapid urbanization, increasing disposable income, and a growing middle-class population across emerging economies. Additionally, the demand for energy-efficient and smart appliances is boosting market growth, with consumers adopting advanced technologies to improve convenience and efficiency in their kitchens.

North America Household Kitchen Appliances Market Trends

North America holds a significant share in the market, fueled by a high rate of appliance replacements and advancements in appliance technology. The increasing focus on energy efficiency and smart home integration in the region contributes to steady market growth. With a mature market and increasing demand for high-end appliances, North America remains a key player in the global household kitchen appliances landscape.

Europe Household Kitchen Appliances Market Insights

Europe follows with a substantial presence in the Household Kitchen Appliances market, driven by robust demand for premium, energy-efficient products. Consumer awareness around sustainability and the push for energy-saving solutions plays a key role in shaping the market. The adoption of smart technologies in the region, combined with increasing consumer demand for convenience, positions Europe as a strong market player.

Middle East and Africa Household Kitchen Appliances Market Overview

The Middle East and Africa (MEA) region shows promising growth in the Household Kitchen Appliances market, primarily due to rapid urbanization and increasing income levels. Although the market is still in its nascent stages compared to other regions, the rise in modern living standards and expanding retail infrastructure is expected to drive steady demand for household appliances.

Latin America Household Kitchen Appliances Market Trends

Latin America, with its emerging economies, is witnessing a gradual shift in consumer preferences toward modern, energy-efficient household appliances. Rising disposable incomes, urbanization, and the growing influence of technology in daily life are contributing factors to the market’s expansion. However, price sensitivity remains a challenge in some areas, which may impact the growth of premium appliances in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Household Kitchen Appliances Company Insights

In 2024, AB Electrolux continues to hold a significant share in the global Household Kitchen Appliances Market due to its extensive product portfolio that caters to both premium and budget-conscious consumers. The company’s ongoing investments in energy-efficient solutions have helped strengthen its position in key markets globally.

SAMSUNG has been a major player in the sector, focusing on smart kitchen appliances. Its integration of Internet of Things (IoT) technologies in products like smart refrigerators and ovens has been a driving force in expanding its market presence. The brand’s commitment to innovation keeps it ahead of the curve in the highly competitive appliance market.

Haier Group has leveraged its robust distribution network and diversified product offerings to secure a leading position. The company’s strategy of acquiring local brands and enhancing product features, such as energy-saving modes, has allowed it to cater to both developed and emerging markets.

LG Electronics stands out for its advanced technology, particularly in the realm of energy efficiency and user-friendly designs. With the rise in demand for smart home devices, LG’s appliances, especially its AI-enabled refrigerators and dishwashers, have been key to its continued growth in the global market.

These companies are capitalizing on trends like smart home integration and energy efficiency, pushing the boundaries of innovation to secure their foothold in the ever-evolving household appliances landscape.

Top Key Players in the Market

- AB Electrolux

- SAMSUNG

- Haier Group

- LG Electronics

- Morphy Richards

- Panasonic Holdings Corporation

- Miele & Cie. KG

- Whirlpool Corporation

- Robert Bosch GmbH

- Smeg S.p.A

Recent Developments

- In Nov 2024, Beyond Appliances successfully raised $2 million in a funding round led by Fireside Ventures, aiming to enhance its product portfolio and expand market reach.

- In Jul 2025, Cookd, a promising home-cooking startup, secured ₹16 crore in its Pre-Series A funding round, with the aim of expanding its technology and culinary offerings.

- In Mar 2025, Nuuk, a direct-to-consumer (D2C) home appliance startup, raised $5 million in a funding round led by Vertex Ventures SEAI to drive product innovation and boost its market presence.

- In Apr 2025, Geek Technology raised ₹4 crore in funding from NativeLead, Navyug Global Ventures, and others, with plans to further develop its technology-driven products and services.

Report Scope

Report Features Description Market Value (2024) USD 268.3 Billion Forecast Revenue (2034) USD 408.8 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cooking Appliances, Dishwasher, Refrigerator, Range Hood, Others), , By Technology(Conventional, Smart Appliances) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AB Electrolux, SAMSUNG, Haier Group, LG Electronics, Morphy Richards, Panasonic Holdings Corporation, Miele & Cie. KG, Whirlpool Corporation, Robert Bosch GmbH, Smeg S.p.A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Household Kitchen Appliances MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Household Kitchen Appliances MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Electrolux

- SAMSUNG

- Haier Group

- LG Electronics

- Morphy Richards

- Panasonic Holdings Corporation

- Miele & Cie. KG

- Whirlpool Corporation

- Robert Bosch GmbH

- Smeg S.p.A