Global Hotel Toiletries Market Size, Share, Growth Analysis By Product (Hand Soaps/Hand Wash, Hand Sanitizer, Shampoo & Conditioner, Soap & Body Wash, Facial Cleansers, Lotions & Moisturizers, Shaving Kits, Feminine Hygiene Products, Dental Care Products, Others), By Ingredients (Natural and Organic, Sulfate-Free, Paraben-Free, Vegan), By End User (Hotels (Economy Hotels, Upscale Hotels, Luxury Hotels), Resorts, Vacation Rentals, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177128

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

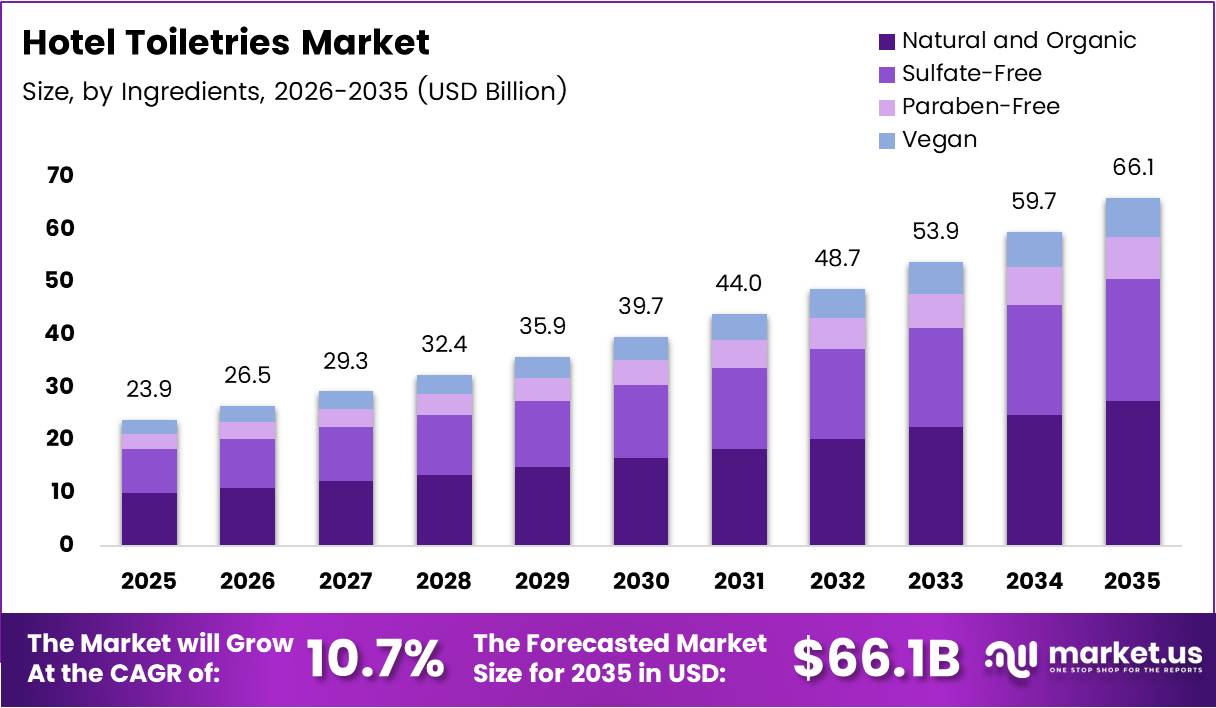

Global Hotel Toiletries Market size is expected to be worth around USD 66.1 Billion by 2035 from USD 23.9 Billion in 2025, growing at a CAGR of 10.7% during the forecast period 2026 to 2035.

Hotel toiletries represent essential personal care amenities provided to guests during their accommodation stays. These products include hand soaps, shampoos, conditioners, body washes, lotions, and dental care items. Hotels position these amenities as key touchpoints for enhancing guest experience and brand perception.

The market encompasses various product categories tailored to different hospitality segments. Economy hotels typically offer basic amenity packages, while luxury properties provide premium branded toiletries. Moreover, resorts and vacation rentals increasingly adopt customized amenity programs to differentiate their guest services and strengthen competitive positioning.

Hospitality establishments now prioritize guest wellness and sustainability in amenity procurement strategies. Hotels collaborate with cosmetic brands to offer high-quality products that align with traveler expectations. Consequently, the sector experiences rising demand for natural, organic, and eco-friendly personal care formulations.

Global tourism expansion drives continuous growth in hotel room inventory and occupancy rates. Asia-Pacific and Middle Eastern markets witness accelerating hospitality development projects. Therefore, demand for in-room amenities scales proportionally with increasing international and domestic travel volumes worldwide.

Regulatory frameworks increasingly mandate plastic reduction and sustainable packaging in hospitality operations. Hotels adopt refillable dispenser systems to comply with environmental standards and reduce operational waste. Additionally, guest preferences shift toward wellness-oriented and skin-sensitive toiletry formulations that support health-conscious travel experiences.

In August 2025, Forest Essentials partnered with Indian Hotels Company Limited to introduce refillable, biodegradable ceramic dispensers across all Taj properties, reducing plastic consumption by 61%. This development demonstrates industry commitment to circular economy principles and sustainable amenity innovation.

According to TrendLux, switching to refillable dispenser amenities reduces single-use packaging waste significantly and improves operational efficiency in hotel housekeeping supply chains. Furthermore, Hotel News Resource reports that bulk amenity systems can eliminate more than 1,000 individual amenity packages per hotel per year from landfill waste streams, demonstrating substantial environmental impact reduction.

Key Takeaways

- Global Hotel Toiletries Market projected to reach USD 66.1 Billion by 2035 from USD 23.9 Billion in 2025 at 10.7% CAGR

- Hand Soaps/Hand Wash segment dominates By Product category with 21.4% market share in 2025

- Natural and Organic ingredients segment holds 49.7% share in By Ingredients category during 2025

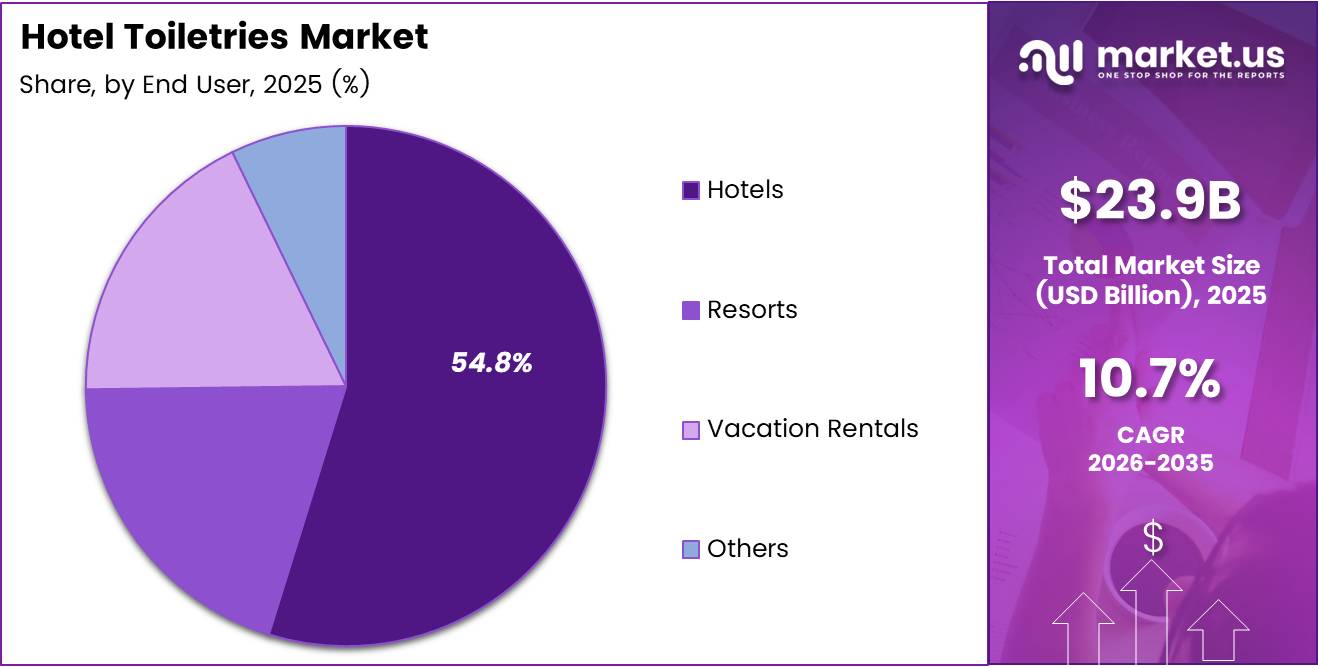

- Hotels segment commands 54.8% share in By End User category throughout 2025

- Offline distribution channel maintains 75.3% market dominance in 2025

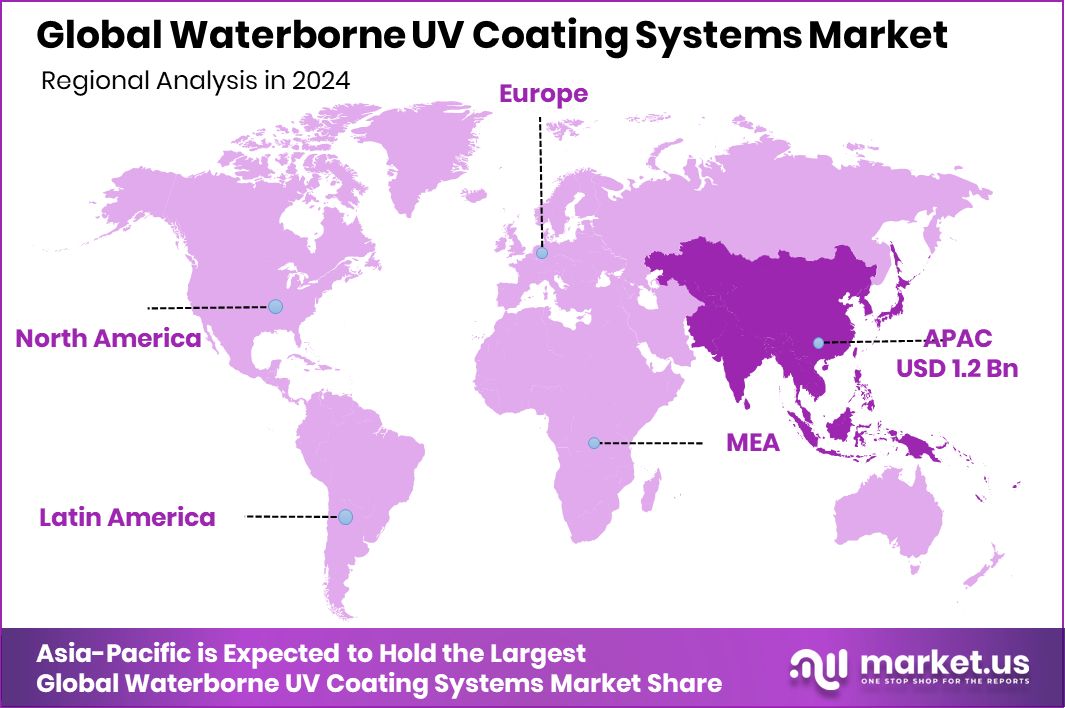

- Europe leads regional market with 45.80% share valued at USD 10.9 Billion in 2025

Product Analysis

Hand Soaps/Hand Wash dominates with 21.4% due to essential hygiene requirements and high usage frequency across all hospitality segments.

In 2025, Hand Soaps/Hand Wash held a dominant market position in the By Product segment of Hotel Toiletries Market, with a 21.4% share. Hotels prioritize hand hygiene amenities as fundamental guest safety provisions following post-pandemic sanitation standards. These products experience consistent replenishment demand across economy, upscale, and luxury properties globally.

Hand Sanitizer emerges as a critical amenity category driven by heightened health consciousness among travelers worldwide. Hotels now position sanitizers as standard in-room provisions alongside traditional soap offerings. Moreover, properties integrate wall-mounted dispensers in high-traffic areas to reinforce comprehensive hygiene protocols throughout guest facilities.

Shampoo & Conditioner represent core bathroom amenities with strong differentiation potential for hotel brand positioning strategies. Luxury properties leverage premium hair care formulations to enhance guest experience perception. Additionally, eco-conscious hotels transition to sulfate-free and vegan formulations that align with sustainability commitments and wellness-focused traveler preferences.

Soap & Body Wash products constitute essential daily-use amenities with significant procurement volumes across hospitality establishments. Hotels select these products based on skin-type compatibility, fragrance profiles, and ingredient transparency. Furthermore, boutique properties increasingly adopt locally-sourced and artisanal body care products to create distinctive regional guest experiences.

Facial Cleansers gain traction as upscale and luxury hotels expand comprehensive skincare amenity offerings beyond basic hygiene products. Travelers now expect specialized facial care provisions that match their home skincare routines. Consequently, hotels partner with dermatologist-approved brands to provide medical-grade cleansing formulations for discerning guests.

Lotions & Moisturizers serve as value-added amenities that hotels use to elevate perceived service quality and comfort levels. Properties operating in dry climates or business travel markets prioritize hydration-focused formulations. Therefore, demand increases for lightweight, fast-absorbing moisturizers suitable for various skin types and climate conditions.

Shaving Kits remain important convenience amenities particularly for business travelers and male guest demographics requiring grooming provisions. Hotels bundle razors with shaving cream or gel as complimentary guest services. Additionally, upscale properties offer premium multi-blade systems and aftershave products to enhance bathroom amenity completeness.

Feminine Hygiene Products emerge as essential inclusivity-focused amenities addressing comprehensive guest needs across diverse traveler demographics. Progressive hotels stock these items in bathrooms or provide on-request availability through housekeeping services. Moreover, sustainability-minded properties introduce organic and biodegradable feminine care options aligning with environmental commitments.

Dental Care Products constitute fundamental overnight stay amenities with universal appeal across all hospitality market segments worldwide. Hotels provide toothbrushes, toothpaste, and dental floss as standard guest room provisions. Furthermore, luxury establishments offer premium oral care brands and specialized products like mouthwash to complete comprehensive bathroom amenity suites.

Others category encompasses specialized amenities including cotton swabs, shower caps, combs, and sewing kits addressing diverse guest needs. Hotels customize this category based on target demographics and regional preferences. Additionally, wellness-focused properties include aromatherapy items and bath salts to enhance relaxation-oriented guest experiences.

Ingredients Analysis

Natural and Organic dominates with 49.7% due to rising consumer demand for clean-label formulations and sustainable hospitality practices.

In 2025, Natural and Organic ingredients held a dominant market position in the By Ingredients segment of Hotel Toiletries Market, with a 49.7% share. Travelers increasingly prioritize eco-friendly and chemical-free personal care products during accommodation stays. Hotels respond by procuring certified organic amenities that align with guest wellness expectations and environmental sustainability commitments.

Sulfate-Free formulations gain market traction as guests seek gentler cleansing alternatives that preserve skin and hair health. These products prevent excessive drying and irritation common with traditional sulfate-based formulations. Moreover, hotels targeting health-conscious and sensitive-skin demographics position sulfate-free amenities as premium wellness-oriented offerings.

Paraben-Free toiletries address growing consumer concerns regarding synthetic preservatives and potential endocrine disruption risks. Hotels adopt these formulations to demonstrate commitment to guest safety and clean ingredient transparency. Additionally, paraben-free products appeal to environmentally-aware travelers who scrutinize personal care ingredient lists during travel experiences.

Vegan amenities represent the fastest-growing ingredient category driven by ethical consumerism and plant-based lifestyle adoption trends. Hotels eliminate animal-derived ingredients and animal testing from amenity procurement specifications. Furthermore, properties promote vegan certifications as differentiating factors attracting conscious consumers who extend dietary values to personal care choices.

End User Analysis

Hotels dominates with 54.8% due to extensive global room inventory and consistent amenity procurement requirements across property types.

In 2025, Hotels held a dominant market position in the By End User segment of Hotel Toiletries Market, with a 54.8% share. This category spans economy, upscale, and luxury segments with varying amenity quality and procurement volumes. Hotels maintain consistent replenishment cycles and standardized amenity programs across their property portfolios globally.

Economy Hotels prioritize cost-effective basic amenity packages that meet essential guest hygiene needs without premium positioning. These establishments procure high-volume generic or private-label toiletries to control operational expenses. However, they increasingly adopt eco-friendly formulations to meet corporate sustainability targets while maintaining budget constraints.

Upscale Hotels balance quality and cost by offering mid-tier branded amenities that enhance guest perception beyond budget offerings. These properties select recognizable personal care brands that communicate value without luxury price points. Moreover, upscale segments experiment with natural ingredient formulations to attract health-conscious business and leisure travelers.

Luxury Hotels position premium and bespoke amenities as integral brand differentiation and guest experience elevation strategies. These establishments partner with high-end cosmetic houses to provide exclusive formulations and signature fragrances. Additionally, luxury properties customize amenity packaging with property branding to create memorable touchpoints and potential retail extensions.

Resorts emphasize wellness and relaxation-focused amenities including spa-grade products and aromatherapy formulations addressing vacation traveler preferences. These properties often source locally-inspired ingredients reflecting destination authenticity and regional cultural elements. Furthermore, resorts integrate sustainability narratives into amenity selection supporting eco-tourism positioning and environmental stewardship commitments.

Vacation Rentals represent the fastest-growing end-user segment driven by alternative accommodation platform expansion and changing traveler preferences. Owners differentiate properties through curated amenity selections that rival traditional hotel offerings. Consequently, demand increases for pre-packaged amenity kits and boutique toiletry brands suitable for short-term rental operations.

Others category includes extended-stay accommodations, serviced apartments, and hostel facilities with specialized amenity requirements. These establishments often provide bulk dispenser systems rather than individual bottles to support longer guest stays. Additionally, budget-conscious segments in this category prioritize functionality and cost-efficiency over premium brand positioning.

Distribution Channel Analysis

Offline dominates with 75.3% due to established B2B procurement relationships and bulk purchasing requirements in hospitality operations.

In 2025, Offline distribution held a dominant market position in the By Distribution Channel segment of Hotel Toiletries Market, with a 75.3% share. Hotels maintain long-term supplier relationships with specialized hospitality amenity distributors and manufacturers. These partnerships enable customized product specifications, volume pricing negotiations, and reliable delivery schedules critical for hospitality operations.

Online distribution channels gain momentum as digital procurement platforms streamline amenity sourcing for independent properties and small hotel chains. E-commerce enables access to diverse product ranges and competitive pricing transparency. Moreover, online channels support smaller-volume purchases suitable for boutique hotels and vacation rental operators lacking bulk procurement capabilities.

Key Market Segments

By Product

- Hand Soaps/Hand Wash

- Hand Sanitizer

- Shampoo & Conditioner

- Soap & Body Wash

- Facial Cleansers

- Lotions & Moisturizers

- Shaving Kits

- Feminine Hygiene Products

- Dental Care Products

- Others

By Ingredients

- Natural and Organic

- Sulfate-Free

- Paraben-Free

- Vegan

By End User

- Hotels

- Economy Hotels

- Upscale Hotels

- Luxury Hotels

- Resorts

- Vacation Rentals

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Global Tourism and Hospitality Industry Expansion Drives Market Growth

Global tourism recovery accelerates hotel room inventory expansion across emerging and established markets worldwide. International arrivals reach pre-pandemic levels driving accommodation demand across all hospitality segments. Consequently, hotels increase amenity procurement volumes to serve growing guest populations and maintain service quality standards.

According to Hotel News Resource, hotels using dispenser systems reduce disposal of partially used toiletry containers, a major operational waste source in housekeeping workflows. This efficiency improvement supports scalability as properties expand room counts and optimize operational costs. Moreover, standardized amenity programs enable hotel chains to maintain consistency across global portfolios.

Consumer preference shifts toward premium branded amenities reflect elevated guest expectations for in-room personal care quality. Travelers increasingly view toiletries as indicators of overall service standards and property positioning. Therefore, hotels invest in recognizable cosmetic brands and wellness-focused formulations to enhance guest satisfaction scores and positive review generation.

Restraints

High Procurement and Operational Costs of Premium Toiletries Limit Budget Hotel Adoption

Luxury and natural amenities command significantly higher unit costs compared to generic alternatives impacting profit margins. Budget and mid-range hotels face pressure to control operational expenses while meeting evolving guest expectations. Consequently, price-sensitive properties delay upgrades to premium toiletry programs despite competitive differentiation potential.

Stringent environmental regulations mandate plastic reduction and sustainable packaging increasing compliance costs for hospitality operators. Hotels must invest in refillable systems, biodegradable formulations, and certified suppliers to meet regulatory standards. Additionally, smaller independent properties lack economies of scale to absorb these transition costs efficiently.

Supply chain complexity increases as hotels source certified organic and specialized formulations from diverse suppliers globally. Quality control requirements and sustainability verification processes add administrative burden and procurement costs. Furthermore, price volatility in natural ingredient markets creates budget unpredictability for hospitality amenity programs.

Growth Factors

Expansion of Boutique and Luxury Hotels Drives Demand for Customized Amenity Programs

Boutique and experience-focused hotels differentiate through bespoke amenity programs reflecting unique brand identities and local cultural elements. These properties commission custom formulations and signature fragrances that create memorable guest touchpoints. Moreover, personalized amenity programs generate additional revenue through retail extensions and branded product sales.

According to Steiner, many hotels are replacing miniature amenity bottles with refillable systems to lower environmental impact and reduce resource consumption across supply chains. This transition enables luxury properties to maintain premium positioning while demonstrating environmental leadership. Additionally, refillable programs reduce procurement complexity and storage requirements in housekeeping operations.

Rapid tourism growth in Asia-Pacific, Latin America, and Middle Eastern markets drives hotel development and amenity procurement expansion. Emerging economies experience rising middle-class populations with increased domestic and international travel spending. Therefore, new hotel openings in these regions create substantial incremental demand for toiletry products across all quality segments.

Emerging Trends

Shift Toward Refillable Dispenser Systems Transforms Hotel Amenity Delivery Models

Hotels eliminate single-use plastic bottles by installing wall-mounted dispenser systems for shampoo, conditioner, and body wash. According to Steiner, refillable amenity adoption supports sustainability programs by lowering raw material usage and packaging production demand. This operational shift reduces housekeeping labor requirements while demonstrating environmental commitment to conscious travelers.

Natural and clean-label formulations dominate new amenity program launches across upscale and luxury hospitality segments worldwide. Hotels prioritize dermatologist-tested products free from harsh chemicals appealing to health-conscious and sensitive-skin guests. Moreover, transparency in ingredient sourcing and manufacturing processes becomes key differentiator in competitive markets.

In January 2025, BASF launched its Beyond Beauty concept introducing climate-adaptive personal care formulations specifically designed to protect skin and hair from environmental stressors. This innovation addresses traveler needs across diverse climate zones and pollution exposure levels. Furthermore, hotels leverage advanced formulation technologies to enhance perceived amenity value and guest wellness outcomes.

Regional Analysis

Europe Dominates the Hotel Toiletries Market with a Market Share of 45.80%, Valued at USD 10.9 Billion

Europe commands the largest market share driven by extensive hospitality infrastructure and stringent sustainability regulations mandating eco-friendly amenities. The region hosts established luxury hotel chains and boutique properties prioritizing premium toiletry programs. Moreover, European travelers demonstrate strong preferences for natural and organic personal care formulations, with the market share at 45.80% and valued at USD 10.9 Billion in 2025.

North America Hotel Toiletries Market Trends

North America maintains significant market presence supported by robust tourism industry and extensive branded hotel chain operations. Properties across United States and Canada adopt advanced sustainability practices including refillable dispensers and vegan formulations. Additionally, North American hotels lead innovation in personalized amenity programs and luxury cosmetic brand partnerships.

Asia Pacific Hotel Toiletries Market Trends

Asia Pacific represents the fastest-growing regional market driven by rapid tourism expansion and hospitality infrastructure development. Countries including China, India, and Southeast Asian nations experience accelerating hotel construction and international visitor arrivals. Furthermore, rising disposable incomes fuel demand for upscale accommodations with premium amenity offerings across the region.

Latin America Hotel Toiletries Market Trends

Latin America demonstrates steady growth potential supported by expanding tourism sectors in Brazil, Mexico, and Caribbean destinations. Hotels in this region increasingly adopt sustainability-focused amenity programs aligned with eco-tourism positioning strategies. Moreover, local ingredient sourcing and culturally-inspired formulations create differentiated guest experiences in competitive markets.

Middle East & Africa Hotel Toiletries Market Trends

Middle East and Africa witness significant hospitality investment particularly in Gulf Cooperation Council countries and South African markets. Luxury hotel development in Dubai, Saudi Arabia, and regional tourism hubs drives demand for premium toiletries. Additionally, Islamic hospitality principles influence amenity selection emphasizing halal-certified and alcohol-free personal care formulations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Kimirica Hunter positions itself as a premium provider of luxury hotel amenities with expertise in bespoke formulation development for hospitality clients. The company specializes in creating signature scent profiles and custom packaging solutions that enhance hotel brand identity and guest experience differentiation. Moreover, Kimirica Hunter maintains strong relationships with upscale and luxury properties seeking exclusive amenity programs that reflect their unique positioning in competitive markets.

Vanity Group Pty Ltd operates as a comprehensive hospitality amenity supplier offering extensive product ranges across multiple quality tiers and price points. The company serves diverse hotel segments from economy to luxury properties with scalable procurement solutions and reliable supply chain management. Additionally, Vanity Group emphasizes sustainability initiatives including biodegradable formulations and reduced packaging waste aligning with global hospitality environmental commitments.

Essential Amenities, Inc. focuses on natural and organic hotel toiletry formulations addressing growing consumer demand for clean-label personal care products. The company develops dermatologist-tested products free from harsh chemicals suitable for sensitive-skin guests and health-conscious travelers. Furthermore, Essential Amenities maintains certifications supporting hotel sustainability reporting requirements and environmental compliance standards across multiple international markets.

Unilever PLC leverages its global consumer goods portfolio to supply recognized personal care brands to hospitality establishments worldwide. The company offers established brands including Dove, Vaseline, and Lifebuoy providing hotels with familiar product recognition and quality assurance. Additionally, Unilever’s extensive distribution networks and production capabilities enable scalable amenity programs for large hotel chains operating across diverse geographic markets.

Key players

- Kimirica Hunter

- Vanity Group Pty Ltd

- Essential Amenities, Inc.

- Unilever PLC

- La Bottega S.P.A.

- Pineapple Hospitality

- Endeavor Czech s.r.o.

- HD Fragrances

- Molton Brown Limited

Recent Developments

- August 2024 – Hyatt announced acquisition of Standard International, the parent company of Standard Hotels and Bunkhouse Hotels, to expand its lifestyle hospitality portfolio and strengthen positioning in experience-focused accommodation segments across global markets.

- September 2024 – Oravel Stays, the parent company of OYO, agreed to acquire G6 Hospitality which operates the Motel 6 and Studio 6 brands, significantly expanding its footprint in the North American budget and economy hotel segments.

- July 2025 – Marriott International completed its acquisition of the citizenM lifestyle hotel brand for $355 million to strengthen its global, design-forward select-service portfolio and enhance competitive positioning in the boutique hotel market.

- November 2025 – Kimberly-Clark Corporation entered a definitive agreement to acquire Kenvue Inc. for $48.7 billion, creating a global hygiene and wellness powerhouse that consolidates major amenity brands including Aveeno, Neutrogena, and Kleenex for hospitality markets.

Report Scope

Report Features Description Market Value (2025) USD 23.9 Billion Forecast Revenue (2035) USD 66.1 Billion CAGR (2026-2035) 10.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hand Soaps/Hand Wash, Hand Sanitizer, Shampoo & Conditioner, Soap & Body Wash, Facial Cleansers, Lotions & Moisturizers, Shaving Kits, Feminine Hygiene Products, Dental Care Products, Others), By Ingredients (Natural and Organic, Sulfate-Free, Paraben-Free, Vegan), By End User (Hotels (Economy Hotels, Upscale Hotels, Luxury Hotels), Resorts, Vacation Rentals, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kimirica Hunter, Vanity Group Pty Ltd, Essential Amenities, Inc., Unilever PLC, La Bottega S.P.A., Pineapple Hospitality, Endeavor Czech s.r.o., HD Fragrances, Molton Brown Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kimirica Hunter

- Vanity Group Pty Ltd

- Essential Amenities, Inc.

- Unilever PLC

- La Bottega S.P.A.

- Pineapple Hospitality

- Endeavor Czech s.r.o.

- HD Fragrances

- Molton Brown Limited