Global Hostel Market Size, Share, Growth Analysis By Accommodation Type (Private Room, Twin Sharing, Family Room, Suite, Others), By Booking Channel (Online Booking, In-person Booking), By Tourist Type (Domestic, International), By Tour Type (Independent Traveler, Group Trip, Family Trip, Student Trip, Corporate Traveller), By Consumer Orientation (Men, Women, Children), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176105

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

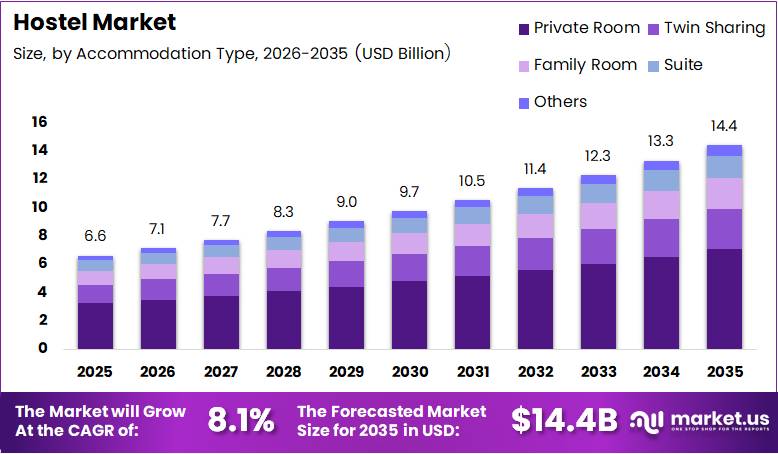

Global Hostel Market size is expected to be worth around USD 14.4 Billion by 2035 from USD 6.6 Billion in 2025, growing at a CAGR of 8.1% during the forecast period 2026 to 2035.

The hostel market represents budget-friendly accommodation facilities offering shared dormitories and private rooms for travelers worldwide. These establishments cater primarily to young tourists, backpackers, and cost-conscious travelers seeking affordable lodging options. Moreover, hostels provide communal spaces that encourage social interaction among guests.

The market experiences robust expansion driven by rising youth tourism and adventure travel preferences globally. Additionally, budget-conscious millennials and Gen Z travelers increasingly prefer hostels over traditional hotels. Consequently, the accommodation sector witnesses significant transformation toward experiential and community-focused lodging solutions.

Digital transformation reshapes booking patterns as online platforms dominate reservation channels. Therefore, hostel operators invest heavily in technology infrastructure to enhance guest experience. Furthermore, mobile applications streamline booking processes and improve operational efficiency across properties.

Sustainability initiatives gain momentum as environmental concerns influence traveler choices significantly. According to Bureau Veritas, hostels produce 82% fewer Scope 1 and Scope 2 carbon emissions per bed-night compared with typical hotels. This environmental advantage positions hostels favorably among eco-conscious consumers seeking responsible travel options.

Government support for tourism infrastructure development accelerates market growth across emerging economies. However, regulatory frameworks vary significantly across regions affecting operational standards. Additionally, safety regulations and licensing requirements shape market dynamics in different geographical markets.

According to Hostelworld Group, over 2,100 hostels completed sustainability assessment in 2024, reflecting industry-wide commitment to environmental responsibility. This growing focus on sustainability creates competitive differentiation opportunities for forward-thinking operators. Moreover, institutional investors recognize the sector’s potential as evidenced by major acquisitions.

In May 2025, Brookfield acquired Generator Hostels’ European assets for €776 million, demonstrating strong institutional confidence in the segment. This landmark transaction validates the hostel market’s maturity and investment attractiveness. Consequently, more private equity firms explore opportunities in budget accommodation segments worldwide.

Key Takeaways

- Global Hostel Market valued at USD 6.6 Billion in 2025, projected to reach USD 14.4 Billion by 2035

- Market grows at 8.1% CAGR during forecast period 2026-2035

- Private Room segment dominates Accommodation Type with 38.7% market share in 2025

- Online Booking channel leads with 78.2% share, reflecting digital transformation trends

- Domestic tourists represent 59.1% of market, indicating strong local travel demand

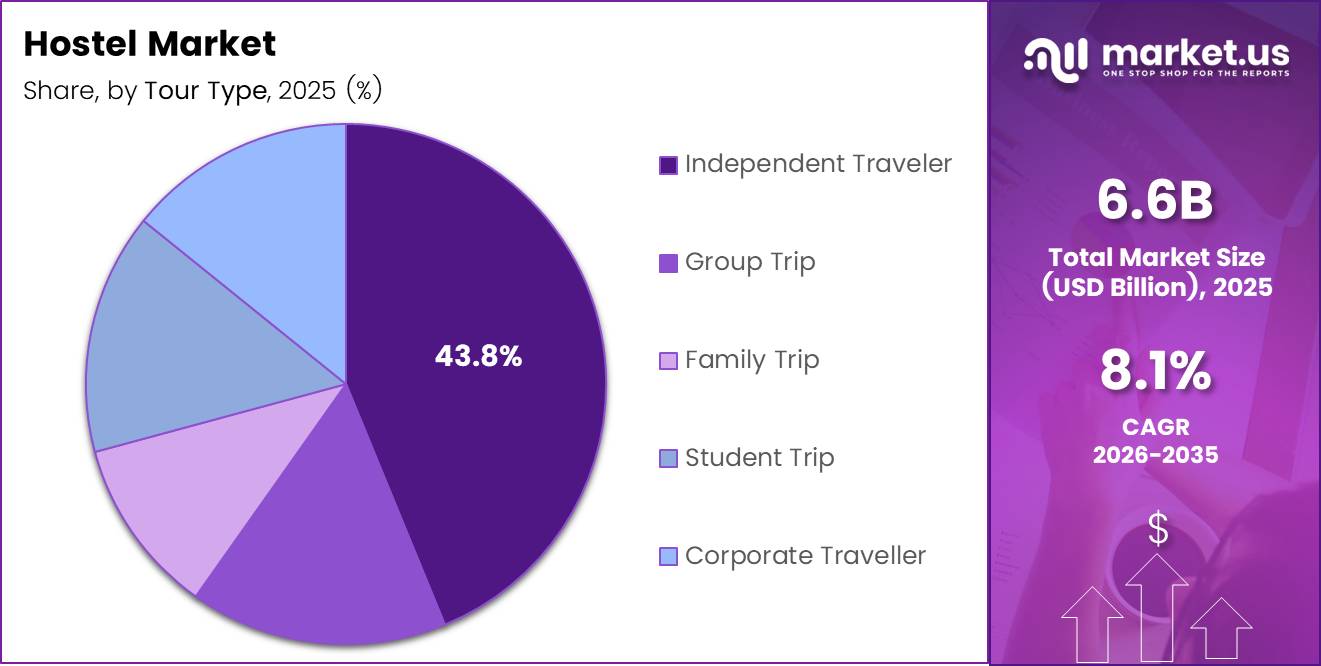

- Independent Traveler segment commands 43.8% share in Tour Type category

- Men constitute 49.2% of Consumer Orientation segment in 2025

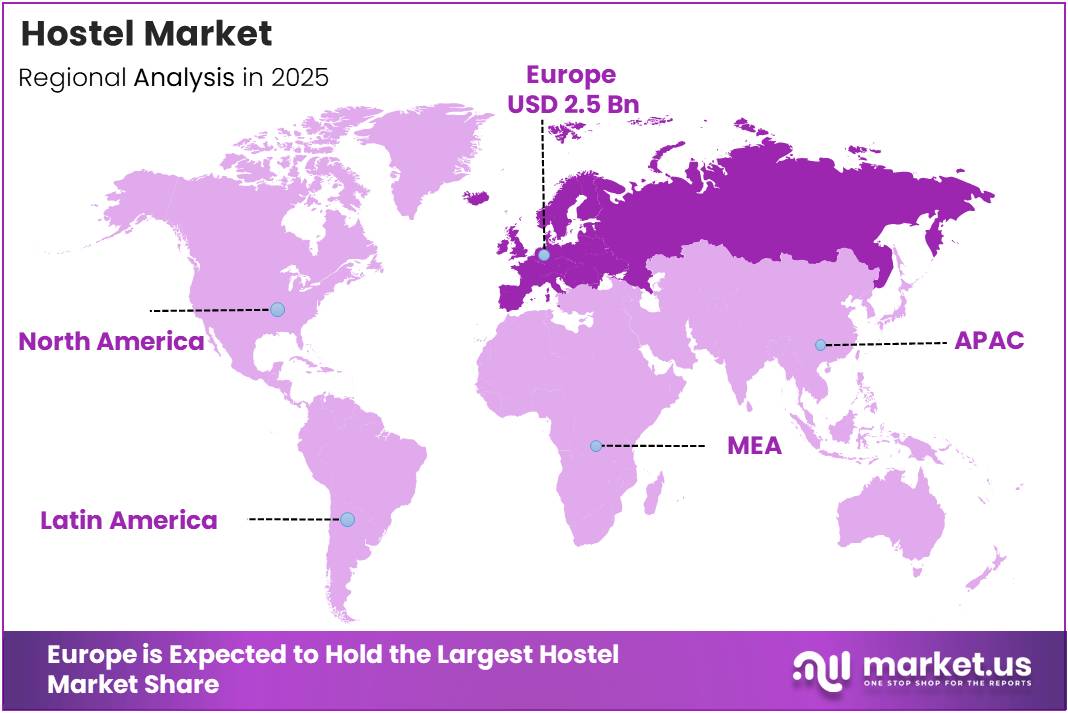

- Europe dominates regional market with 38.50% share, valued at USD 2.5 Billion

Accommodation Type Analysis

Private Room dominates with 38.7% due to increasing demand for personal space and privacy.

In 2025, Private Room held a dominant market position in the By Accommodation Type segment of Hostel Market, with a 38.7% share. Travelers increasingly seek privacy while maintaining budget-friendly options, driving this segment’s leadership. Moreover, private rooms offer flexibility for couples and small groups without compromising affordability advantages.

Twin Sharing accommodations attract travelers seeking cost-effective solutions with moderate privacy levels. This segment appeals particularly to friends traveling together and budget-conscious couples. Additionally, twin sharing provides social opportunities while maintaining comfortable personal space for guests.

Family Room options cater to growing multi-generational travel trends and family-oriented tourism patterns. These accommodations offer larger spaces suitable for parents traveling with children at competitive prices. Consequently, family rooms expand hostel market reach beyond traditional backpacker demographics.

Suite accommodations represent premium hostel offerings with enhanced amenities and additional living space. This segment targets travelers seeking upscale experiences at mid-range pricing points. Furthermore, suites enable hostels to diversify revenue streams and attract higher-spending customer segments.

Others category includes dormitories, mixed-gender rooms, and specialized accommodation formats serving niche traveler needs. These options maintain the traditional hostel concept of shared spaces and maximum affordability. Therefore, they remain essential for core backpacker and ultra-budget traveler segments.

Booking Channel Analysis

Online Booking dominates with 78.2% due to digital transformation and mobile-first consumer behavior.

In 2025, Online Booking held a dominant market position in the By Booking Channel segment of Hostel Market, with a 78.2% share. Digital platforms provide travelers instant access to property information, reviews, and competitive pricing comparisons. Moreover, online channels offer convenience and real-time availability updates essential for modern travelers.

In-person Booking channels serve spontaneous travelers and those preferring direct property interaction before commitment. This traditional method appeals to last-minute arrivals and travelers exploring unfamiliar destinations. Additionally, in-person bookings enable immediate room inspection and personal negotiation opportunities with property staff.

Tourist Type Analysis

Domestic tourists dominate with 59.1% due to rising local tourism and regional travel preferences.

In 2025, Domestic held a dominant market position in the By Tourist Type segment of Hostel Market, with a 59.1% share. Local travelers increasingly explore domestic destinations, driven by affordable transportation and familiar cultural environments. Moreover, weekend getaways and short-duration trips boost domestic hostel bookings significantly across regions.

International tourists represent globally mobile travelers seeking budget accommodations across foreign destinations. This segment includes backpackers, gap-year students, and adventure seekers exploring multiple countries. Additionally, international guests contribute higher average spending on ancillary services and extended stays.

Tour Type Analysis

Independent Traveler dominates with 43.8% due to personalized itinerary preferences and solo travel trends.

In 2025, Independent Traveler held a dominant market position in the By Tour Type segment of Hostel Market, with a 43.8% share. Solo travelers value flexibility in schedules and destination choices without group constraints. Moreover, independent travelers seek authentic local experiences and spontaneous activity decisions throughout their journeys.

Group Trip participants travel in organized parties sharing accommodation costs and social experiences collectively. This segment benefits from discounted group rates and coordinated booking processes through travel organizers. Additionally, group travelers create lively hostel atmospheres that enhance community-building objectives.

Family Trip travelers represent growing demographics seeking budget-friendly multi-generational vacation options together. Families appreciate cost savings compared to multiple hotel rooms while maintaining proximity. Furthermore, family-oriented hostels adapt facilities to accommodate children and provide age-appropriate amenities.

Student Trip participants include educational groups, study abroad programs, and university-organized excursions globally. Students prioritize affordability and social environments conducive to peer interaction and cultural exchange. Therefore, hostels remain preferred accommodation choices for academic travel programs worldwide.

Corporate Traveller segment encompasses business professionals seeking economical lodging during work-related trips. This emerging segment demonstrates hostels’ expanding appeal beyond traditional leisure tourism markets. Consequently, operators enhance business-friendly amenities like workspace and reliable connectivity for professionals.

Consumer Orientation Analysis

Men dominate with 49.2% due to higher solo travel rates and adventure tourism participation.

In 2025, Men held a dominant market position in the By Consumer Orientation segment of Hostel Market, with a 49.2% share. Male travelers demonstrate higher propensity for backpacking adventures and budget-conscious travel choices. Moreover, men frequently engage in extended travel periods requiring cost-effective accommodation solutions.

Women represent rapidly growing hostel consumer segment driven by rising female solo travel confidence. Safety-conscious female travelers increasingly select hostels offering women-only dormitories and secure environments. Additionally, women appreciate social aspects and community-building opportunities provided by hostel accommodations.

Children segment reflects family travel trends and multi-generational vacation patterns within budget accommodation sectors. Hostels adapt facilities to welcome younger guests through family rooms and child-friendly amenities. Furthermore, family-oriented properties create safe environments suitable for children while maintaining affordability advantages.

Drivers

Rising Youth Tourism and Budget Travel Preferences Drive Market Expansion

Millennials and Gen Z travelers prioritize experiential travel over luxury accommodations, fueling hostel demand globally. These demographics seek authentic cultural immersion and social connections during travels. Moreover, budget constraints among young professionals make hostels attractive alternatives to expensive hotels.

According to Hostelworld Group, the market witnessed a 16% increase in new hostels entering acquisition pipeline, reflecting strong growth momentum. This expansion demonstrates investor confidence and operator enthusiasm about future market potential. Additionally, new property development addresses growing demand across emerging destinations worldwide.

Digital platforms revolutionize booking experiences, making hostel reservations convenient and transparent for modern travelers. Mobile applications provide instant access to property information, real-time reviews, and competitive pricing comparisons. Consequently, technology-enabled distribution channels accelerate market penetration and customer acquisition rates significantly.

Restraints

Privacy Concerns and Shared Facility Limitations Restrict Market Adoption

Shared dormitory configurations deter privacy-conscious travelers preferring exclusive personal spaces during accommodations. Many potential customers perceive shared bathrooms and common areas as inconvenient compromises. Moreover, cultural preferences in certain regions favor private lodging options over communal living arrangements.

Safety concerns particularly affect female solo travelers considering dormitory-style accommodations in unfamiliar destinations. Negative experiences or security incidents damage brand reputation and customer confidence industry-wide. Additionally, inconsistent safety standards across properties create hesitation among first-time hostel users.

Quality inconsistencies across independent operators challenge market perception and customer satisfaction levels significantly. Variable cleanliness standards, outdated facilities, and poor maintenance affect overall guest experiences negatively. Furthermore, lack of standardization makes it difficult for travelers to predict accommodation quality accurately.

Growth Factors

Sustainability Advantages and Technological Innovation Accelerate Market Development

Environmental consciousness among travelers creates competitive advantages for eco-friendly hostel operations over traditional hotels. Hostels naturally consume fewer resources per guest through shared facilities and community-oriented designs. Moreover, sustainability certifications attract environmentally responsible travelers willing to support green accommodation options.

According to Investegate, strong sustainability focus emerges with adoption of Staircase to Sustainability framework by 2,500+ hostels in 2025. This standardized approach helps properties measure and improve environmental performance systematically. Additionally, sustainability credentials differentiate forward-thinking operators in increasingly competitive markets.

According to Travel Daily News, app bookings grew 11% year-on-year in H1 2025, demonstrating successful digital engagement strategies. Mobile-first booking experiences enhance customer convenience and streamline reservation processes significantly. Furthermore, technological investments improve operational efficiency and enable personalized guest services throughout customer journeys.

Emerging Trends

Digital Transformation and Experiential Offerings Reshape Competitive Landscape

Smart hostel concepts integrate IoT technology, keyless entry systems, and automated check-in processes seamlessly. Digital innovations reduce operational costs while enhancing guest convenience and property security simultaneously. Moreover, technology enables personalized experiences through data-driven insights into traveler preferences and behaviors.

Co-living and co-working spaces emerge within hostel properties targeting digital nomads and remote workers. These hybrid models combine accommodation with productive workspaces, high-speed internet, and networking opportunities. Additionally, extended-stay packages cater to location-independent professionals seeking community-oriented living arrangements.

Experiential programming including guided tours, cultural workshops, and social events differentiates premium hostel offerings. Properties curate unique local experiences that create memorable stays beyond basic accommodation services. Consequently, hostels evolve from simple lodging providers into comprehensive travel experience facilitators.

Regional Analysis

Europe Dominates the Hostel Market with a Market Share of 38.50%, Valued at USD 2.5 Billion

Europe maintains leadership position with 38.50% market share, valued at USD 2.5 Billion, driven by established backpacking culture and extensive rail networks. The region benefits from high youth mobility, inter-country travel ease, and strong hostel infrastructure across major cities. Moreover, cultural diversity and historical attractions make European hostels popular among international travelers.

North America Hostel Market Trends

North America experiences steady growth as budget travel awareness increases among younger American and Canadian travelers. Major cities develop hostel infrastructure catering to domestic backpackers and international tourists exploring the region. Additionally, rising accommodation costs in urban centers drive demand for affordable lodging alternatives.

Asia Pacific Hostel Market Trends

Asia Pacific region demonstrates fastest growth rates driven by expanding middle class and rising intra-regional tourism. Countries like Thailand, Vietnam, and Indonesia establish themselves as major backpacker destinations with thriving hostel ecosystems. Furthermore, affordable travel costs and exotic cultural experiences attract global youth travelers significantly.

Latin America Hostel Market Trends

Latin America maintains strong hostel culture supported by adventure tourism and rich cultural heritage across countries. Destinations like Peru, Colombia, and Argentina attract backpackers seeking authentic experiences at competitive prices. Moreover, social atmospheres in Latin American hostels create vibrant communities among international travelers.

Middle East & Africa Hostel Market Trends

Middle East and Africa represent emerging markets with developing hostel infrastructure in key tourist destinations. Countries invest in tourism development to diversify economies beyond traditional industries. Additionally, unique wildlife experiences and historical sites create opportunities for budget accommodation growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Hostelling International (HI) operates the world’s largest hostel network with properties across 60 countries serving budget-conscious travelers globally. The organization maintains strong brand recognition through consistent quality standards and member benefits programs. Moreover, HI promotes sustainable tourism practices and cultural exchange initiatives across its international network.

a&o Hotels and Hostels GmbH represents Europe’s leading hostel chain operating modern facilities across major cities with hybrid hotel-hostel concepts. The company successfully attracts diverse customer segments including families, groups, and individual travelers simultaneously. Additionally, a&o focuses on strategic expansion through acquisitions and new property development initiatives.

Generator Hostels pioneered design-led hostel concept combining contemporary aesthetics with social spaces and cultural programming. The brand targets millennial travelers seeking stylish accommodations without premium pricing through innovative property designs. Furthermore, Generator’s emphasis on location quality and experiential offerings differentiates it within competitive markets.

St Christopher’s Inns operates popular party hostels across European cities known for vibrant social atmospheres and nightlife integration. The brand appeals specifically to young travelers seeking social experiences and budget-friendly central locations. Moreover, St Christopher’s maintains loyal customer base through consistent brand identity and memorable guest experiences.

Key players

- Hostelling International (HI)

- a&o Hotels and Hostels GmbH

- Generator Hostels

- St Christopher’s Inns

- Meininger Hotels

- Selina Hostels

- Wombat’s Hostels

- CLINK Hostels

- Safestay Hotels & Hostels

- The Youth Hostels Association (YHA)

Recent Developments

- October 2025 – Hostel booking platform Hostelworld acquired B2B event discovery platform OccasionGenius for $12 million, expanding its service portfolio beyond traditional accommodation bookings. This strategic acquisition enables Hostelworld to offer comprehensive travel experience solutions including activities and events.

- December 2025 – a&o Hostels acquired Schulz Hotels as part of €500 million growth strategy, significantly expanding its European footprint and property portfolio. This major acquisition demonstrates strong consolidation trends within the budget accommodation sector and positions a&o for continued market leadership.

Report Scope

Report Features Description Market Value (2025) USD 6.6 Billion Forecast Revenue (2035) USD 14.4 Billion CAGR (2026-2035) 8.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Accommodation Type (Private Room, Twin Sharing, Family Room, Suite, Others), By Booking Channel (Online Booking, In-person Booking), By Tourist Type (Domestic, International), By Tour Type (Independent Traveler, Group Trip, Family Trip, Student Trip, Corporate Traveller), By Consumer Orientation (Men, Women, Children) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hostelling International (HI), a&o Hotels and Hostels GmbH, Generator Hostels, St Christopher’s Inns, Meininger Hotels, Selina Hostels, Wombat’s Hostels, CLINK Hostels, Safestay Hotels & Hostels, The Youth Hostels Association (YHA) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hostelling International (HI)

- a&o Hotels and Hostels GmbH

- Generator Hostels

- St Christopher's Inns

- Meininger Hotels

- Selina Hostels

- Wombat's Hostels

- CLINK Hostels

- Safestay Hotels & Hostels

- The Youth Hostels Association (YHA)