Global Home Insurance Market By Coverage(Comprehensive Coverage, Dwelling Coverage, Content Coverage, Other Optional Coverage), By End User(Landlords, Tenants), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127774

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

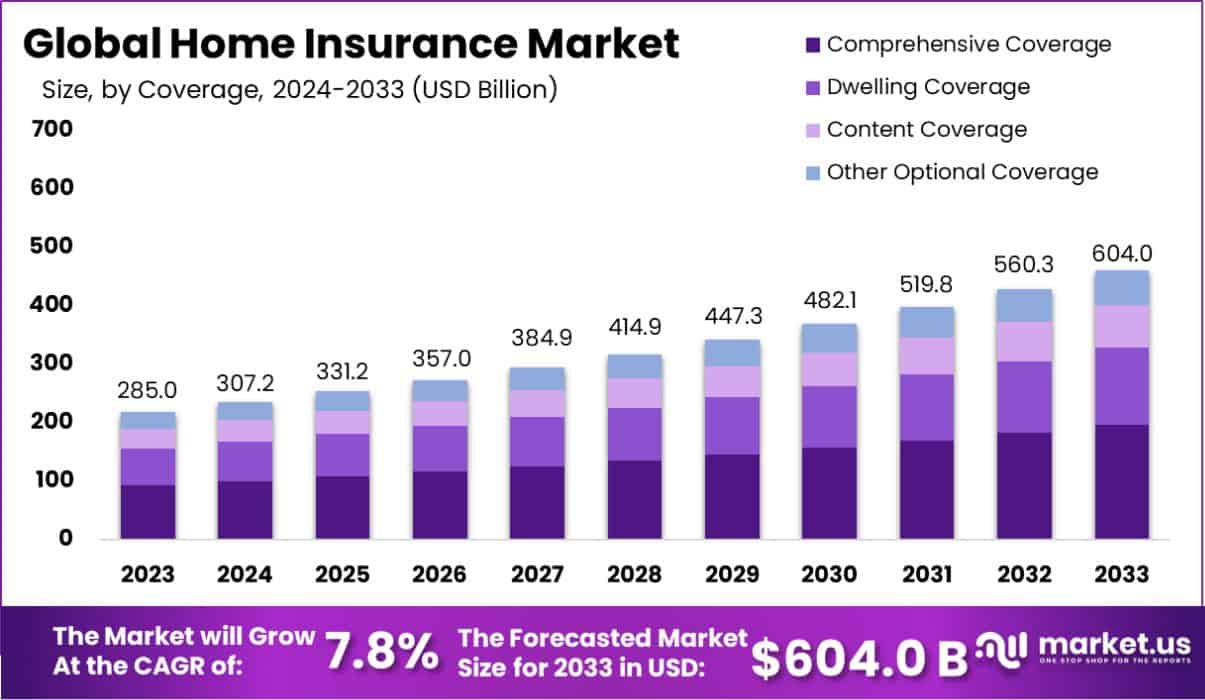

The Global Home Insurance Market size is expected to be worth around USD 604.0 Billion By 2033, from USD 285.0 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033. In 2023, North America held a dominant 38.5% market share in the home insurance market, generating USD 109.72 billion in revenue.

Home insurance, also known as homeowner’s insurance, provides financial protection against loss or damage to a person’s residence and contents. It typically covers risks such as fire, theft, and natural disasters. Additional coverage may include liability insurance, which protects against injuries that occur within the home.

The home insurance market is witnessing substantial growth, driven by increasing homeownership rates, rising property values, and heightened awareness of natural disasters’ financial impacts. Urbanization and governmental regulations mandating insurance in certain regions contribute significantly to market expansion.

Key growth factors in the home insurance market include technological risk assessment and management advancements. There is also a growing trend of bundled insurance products offering comprehensive coverage solutions. Top opportunities lie in integrating smart home technology with insurance services, which can attract a tech-savvy demographic while improving risk mitigation and reducing claims costs. This integration promises substantial growth potential by enhancing policyholder engagement and satisfaction.

The home insurance market is currently poised for a phase of steady growth, fueled by macroeconomic stability and an uptick in housing market activities. Factors such as increased awareness regarding asset protection, coupled with rising real estate values, are contributing to the expansion of this sector. Technological advancements like the integration of AI in risk assessment and customer service are also streamlining operations and enhancing customer satisfaction, thus driving adoption rates.

Supporting this optimistic outlook are broader economic indicators. The International Monetary Fund (IMF) has projected a 2.7% growth rate for the U.S. economy in 2024, underscoring a robust economic recovery and resilience. This growth is essential to the home insurance market as it directly influences homeownership rates and investment in residential properties, which are key drivers for insurance uptake.

Similarly, significant strides in achieving Sustainable Development Goals (SDGs) in India, with its SDG Index score ranging from 57 to 79 across states as reported in 2023-24, reflect an improving socio-economic landscape. This progress suggests a favorable environment for market expansion, as economic and social stability are crucial for the growth of insurance services.

Key Takeaways

- The Global Home Insurance Market size is expected to be worth around USD 604.0 Billion By 2033, from USD 285.0 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

- In 2023, Comprehensive Coverage held a dominant market position in the By Coverage segment of the Home Insurance Market, capturing more than a 32.5% share.

- In 2023, Landlords held a dominant market position in the By End User segment of the Home Insurance Market, capturing more than a 75.5% share.

- North America dominated a 38.5% market share in 2023 and held USD 109.72 Billion in revenue from the Home Insurance Market.

By Coverage Analysis

In 2023, Comprehensive Coverage held a dominant market position in the By Coverage segment of the Home Insurance Market, capturing more than a 32.5% share. This segment outperformed Dwelling Coverage, Content Coverage, and Other Optional Coverages, which garnered 24.3%, 21.2%, and 22.0% of the market respectively. The strong preference for Comprehensive Coverage can be attributed to its extensive protection against a wide range of risks, including but not limited to natural disasters, theft, and other liabilities. This preference is indicative of consumers’ increasing awareness and proactive management of potential household risks.

Dwelling Coverage, which provides financial protection specifically for the physical structure of the home, maintained a steady demand, reflective of ongoing construction and real estate investments. Content Coverage, offering insurance for personal belongings within the smart home, also saw significant uptake, driven by rising consumer expenditure on valuable personal goods.

Other Optional Coverages, encompassing additional benefits like flood or earthquake insurance, represented a specialized yet crucial market segment. This coverage’s relevance is particularly pronounced in geographically vulnerable regions.

Overall, the diverse preferences for these coverage types underscore the complexity and variability of consumer needs within the home insurance market. This segmentation facilitates targeted marketing strategies and product offerings, optimizing insurers’ reach and competitiveness in a dynamic financial landscape.

By End User Analysis

In 2023, Landlords held a dominant market position in the By End User segment of the Home Insurance Market, capturing more than a 75.5% share, in stark contrast to the 24.5% held by Tenants. This significant discrepancy underscores the heightened responsibility and financial investment landlords bear in property management, making comprehensive insurance coverage a critical component of their operational strategy. Landlords’ extensive adoption of insurance products is driven by the need to safeguard against property damage, liability claims, and potential loss of rental income, which are paramount to maintaining profitability and asset value.

Tenants, while occupying a smaller portion of the market, represent an important demographic. Insurance products tailored to tenants typically cover personal property and liability, reflecting the more limited scope of coverage necessary for renters. The lower uptake among tenants can be attributed to a lesser awareness of the benefits of tenant-specific insurance policies, or possibly the perception that such insurance is unnecessary given the landlord’s policies.

The stark disparity in market share between these two segments highlights the differing insurance needs and priorities between landlords and tenants, offering insurers opportunities to customize products and marketing strategies to more effectively target each group.

Key Market Segments

By Coverage

- Comprehensive Coverage

- Dwelling Coverage

- Content Coverage

- Other Optional Coverage

By End User

- Landlords

- Tenants

Drivers

Key Drivers in the Home Insurance Market

The growth of the home insurance market is primarily driven by increasing homeownership rates, heightened awareness of natural disasters, and technological advancements. As more individuals purchase smart homes, the demand for insurance policies that protect these investments escalates.

Recent years have seen a rise in the frequency and severity of natural disasters such as floods, wildfires, and hurricanes, prompting homeowners to seek comprehensive insurance solutions that offer financial protection against such events.

Additionally, the integration of technology in the insurance sector, through tools like online policy management and automated claims processing, enhances customer experience and operational efficiency. These factors collectively contribute to the robust expansion of the home insurance market.

Restraint

Challenges Facing Home Insurance Market

One significant restraint in the home insurance market is the rising cost of insurance premiums. As natural disasters become more frequent and severe due to climate change, insurance companies are compelled to raise premiums to cover the increased risk.

This price hike can deter potential customers from purchasing insurance, particularly in regions prone to such disasters. Additionally, the complexity and lack of transparency in insurance policies can confuse homeowners, leading to dissatisfaction and reluctance to invest in adequate coverage.

This scenario is exacerbated by the slow adoption of new technologies by some insurers, resulting in inefficient processes and customer service issues. These factors collectively hinder the growth of the home insurance market, as they challenge both affordability and customer satisfaction.

Opportunities

Expanding Opportunities in Home Insurance

The home insurance market presents several opportunities, particularly through the adoption of technology and tailored insurance products. Technological advancements such as artificial intelligence (AI) and big data analytics allow insurers to offer personalized insurance plans, improving customer satisfaction and retention.

These technologies also enhance risk assessment capabilities, leading to more accurate policy pricing. Moreover, there’s growing interest in supplemental coverages, like protection against cyber threats and home-sharing risks, driven by modern lifestyle changes and increasing internet use.

This shift provides a lucrative avenue for insurers to expand their product offerings. Additionally, educational initiatives that increase awareness about the benefits of home insurance can tap into previously underserved markets, significantly broadening the customer base. These strategic moves can lead to substantial growth in the home insurance sector.

Challenges

Navigating Challenges in Home Insurance

The home insurance market faces notable challenges, including regulatory compliance and competitive pressures. Insurers must constantly adapt to changing regulations that vary by region, which can complicate policy offerings and increase operational costs.

Additionally, the competitive landscape is intensifying, with new entrants using technology to disrupt traditional business models. This competition puts pressure on established companies to innovate while maintaining profitability. Another significant challenge is the public’s perception of the insurance process as complex and opaque, which can hinder customer engagement and trust.

Addressing these issues requires insurers to enhance transparency, simplify communication, and leverage technology to improve service delivery. By overcoming these challenges, insurers can strengthen their market position and build stronger relationships with their customers.

Growth Factors

Growth Factors in Home Insurance

The home insurance market is experiencing growth driven by several key factors. Increasing real estate investments and the rising value of home properties have led to a higher demand for insurance products to protect these assets.

Urbanization and the subsequent growth in housing development in both developed and emerging economies further fuel this demand. Additionally, technological innovations, such as IoT devices for home monitoring and automated claims processing, are improving the efficiency and appeal of home insurance offerings. These advancements not only enhance customer experience but also allow insurers to manage risks more effectively and reduce costs.

Furthermore, heightened awareness among homeowners regarding the potential financial impacts of natural disasters and other home-related incidents is pushing more individuals to seek comprehensive insurance solutions, bolstering market growth.

Emerging Trends

Emerging Trends in Home Insurance

Emerging trends in the home insurance market are reshaping how policies are sold and managed. One significant trend is the increasing use of digital platforms and mobile apps for policy management, which enhances accessibility and convenience for users.

This digital shift allows customers to purchase insurance, make claims, and manage their policies with just a few clicks, improving overall customer satisfaction. Another trend is the integration of smart home technology, which monitors home environments to prevent potential risks such as water leaks or fires.

Insurers are also offering discounts to homeowners who install such technologies, incentivizing safer home practices. Additionally, there’s a growing demand for policies that cover remote work-related incidents, a reflection of the increasing number of people working from home. These trends highlight a move towards more personalized, technology-driven solutions in the home insurance sector.

Regional Analysis

The global home insurance market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, each displaying distinct market dynamics and growth potentials.

North America stands as the dominant region in the home insurance market, accounting for 38.5% of the global share, with a market valuation of USD 109.72 billion. This dominance is primarily due to the high penetration of home insurance policies, driven by the regulatory environment and the high awareness among homeowners regarding the protection of their assets.

In Europe, the market is characterized by a robust regulatory framework and a high rate of home ownership, which contribute significantly to the demand for home insurance solutions. Western European countries, particularly the UK and Germany, show higher premiums due to increased claims related to natural disasters and property damages.

The Asia Pacific region is witnessing rapid growth in the home insurance sector, fueled by rising real estate investments and the escalating awareness of AI risk management among homeowners. Countries like China and India are experiencing substantial market expansions due to urbanization and increased financial literacy.

The Middle East & Africa region, although smaller in comparison, is seeing gradual growth. The market here is driven by the Gulf economies’ focus on economic diversification and the gradual adoption of Western financial products, including insurance.

Latin America, with its diverse economic landscapes, shows potential for growth amidst challenges such as political instability and economic volatility, which influence market penetration rates and risk assessment models.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Home Insurance Market for 2023, key players like Allstate Insurance Company, AXA, and PICC each bring distinct strengths and strategies to the table, positioning themselves uniquely within the industry.

Allstate Insurance Company continues to capitalize on its strong brand recognition and extensive network in the United States. It focuses on personalized home insurance solutions and a tech-driven approach, leveraging AI and data analytics to streamline claims processes and enhance customer experience. This strategy not only improves operational efficiency but also boosts customer satisfaction and retention.

AXA, with its vast global presence, stands out through its commitment to sustainable practices and innovative insurance products. In 2023, AXA has emphasized integrating climate resilience into its policies, appealing to a growing segment of environmentally conscious consumers. Furthermore, AXA’s investment in digital transformation and global partnerships has enhanced its agility in adapting to diverse market needs and regulatory environments, ensuring a competitive edge.

PICC, dominant in the Chinese market, benefits from scale and governmental support. Its extensive penetration in urban and rural areas of China provides a broad customer base. PICC’s focus on digital platforms and mobile solutions caters effectively to China’s tech-savvy population, facilitating seamless policy management and claims processing.

Top Key Players in the Market

- Allstate Insurance Company

- AXA

- PICC

- ADMIRAL

- ALLIANZ

- Liberty Mutual Insurance Company

- Chubb

- American International Group, Inc.

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Co. Limited

Recent Developments

- In July 2023, Liberty Mutual introduced an innovative home insurance scheme that includes automatic coverage adjustments based on real-time property value assessments, targeting a 20% increase in customer retention.

- In May 2023, Admiral launched a new home insurance product featuring simplified policy management directly through a mobile app, aiming to enhance user experience and accessibility.

- In March 2023, Allianz announced in March 2023 a strategic acquisition of a regional insurer, aiming to expand its footprint and customer base in Eastern Europe by 15%.

Report Scope

Report Features Description Market Value (2023) USD 285.0 Billion Forecast Revenue (2033) USD 604.0 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coverage(Comprehensive Coverage, Dwelling Coverage, Content Coverage, Other Optional Coverage), By End User(Landlords, Tenants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allstate Insurance Company, AXA, PICC, ADMIRAL, ALLIANZ, Liberty Mutual Insurance Company, Chubb, American International Group, Inc., State Farm Mutual Automobile Insurance Company, Zurich Insurance Co. Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Home Insurance?Home insurance, also known as homeowner’s insurance, provides financial protection against loss or damage to a person’s residence and contents. It typically covers risks such as fire, theft, and natural disasters. Additional coverage may include liability insurance, which protects against injuries that occur within the home.

How big is Home Insurance Market?The Global Home Insurance Market size is expected to be worth around USD 604.0 Billion By 2033, from USD 285.0 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Home Insurance Market?The home insurance market grows due to rising homeownership, increased natural disasters, and technological advances enhancing operational efficiency and customer experience, driving demand for comprehensive insurance solutions.

What are the emerging trends and advancements in the Home Insurance Market?Emerging trends in the home insurance market include the rise of digital platforms, integration of smart home technology, and policies covering remote work incidents, focusing on personalized, tech-driven solutions.

What are the major challenges and opportunities in the Home Insurance Market?Opportunities in home insurance include adopting AI and big data for personalized plans and risk assessment, and expanding coverages like cyber threats. Challenges involve regulatory compliance, competitive pressures, and enhancing transparency and customer trust.

Who are the leading players in the Home Insurance Market?Allstate Insurance Company, AXA, PICC, ADMIRAL, ALLIANZ, Liberty Mutual Insurance Company, Chubb, American International Group, Inc., State Farm Mutual Automobile Insurance Company, Zurich Insurance Co. Limited

-

-

- Allstate Insurance Company

- AXA

- PICC

- ADMIRAL

- ALLIANZ

- Liberty Mutual Insurance Company

- Chubb

- American International Group, Inc.

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Co. Limited