Global Home Care Services Market Size, Share, Growth Analysis By Service Type (Health Care Services, Non-Health Care Services), By End User (Children, Adults, Geriatric), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173390

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

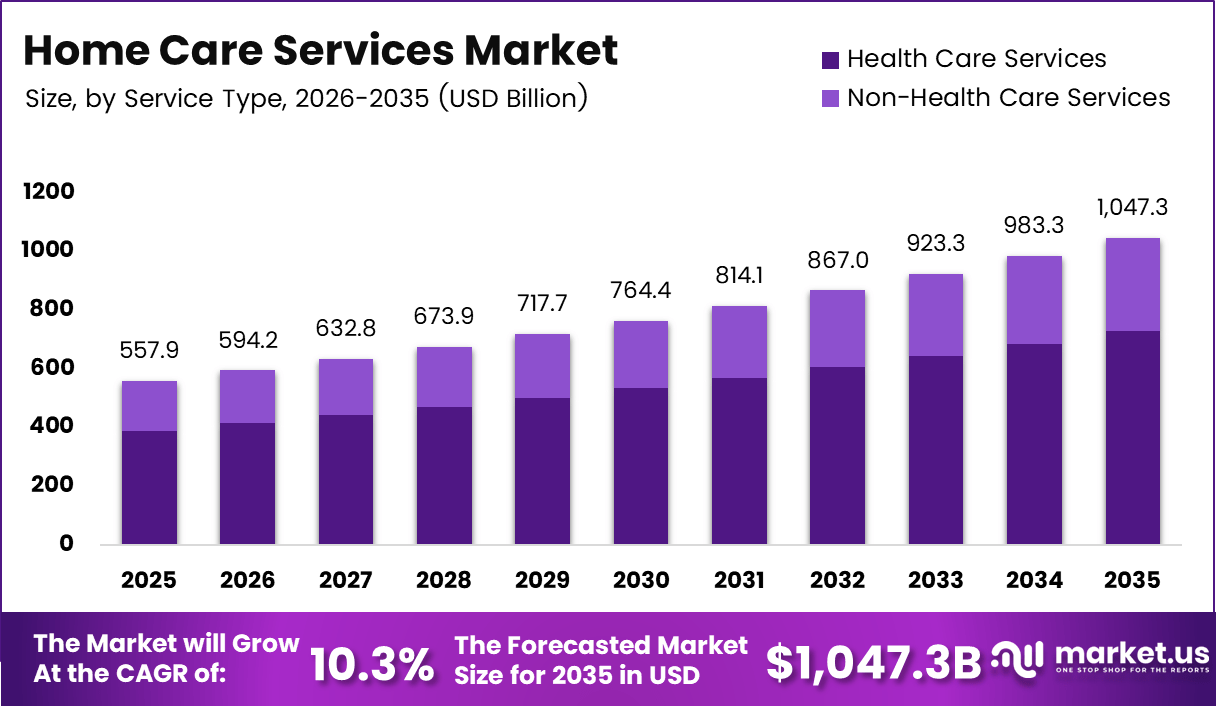

The Global Home Care Services Market size is expected to be worth around USD 1,047 billion by 2035, from USD 557.9 billion in 2025, growing at a CAGR of 10.3% during the forecast period from 2026 to 2035.

The Home Care Services Market refers to organized medical and non medical support delivered at a patient’s residence. It includes personal care, skilled nursing, therapy, and chronic pain treatment management. This market addresses aging populations, cost containment pressures, and preferences for aging in place across healthcare systems.

From a growth perspective, home care services increasingly align with value based care and population health Management. Providers emphasize continuity, reduced hospital readmissions, and patient centric delivery. Moreover, payers and families increasingly view in home care as a scalable alternative supporting long term services and supports while preserving patient independence.

From an opportunity standpoint, expanding chronic disease prevalence and post acute recovery needs strengthen long term demand. Governments increasingly recognize home care as a pressure release for institutional infrastructure. Consequently, policy backed expansion of home and community based services improves accessibility while supporting workforce development and technology enabled care coordination.

From a regulatory lens, government investment and reimbursement frameworks strongly shape market performance. Programs supporting home based care under Medicare and Medicaid encourage adoption. However, reimbursement volatility creates uncertainty for buyers and providers, influencing investment decisions and accelerating consolidation toward operational efficiency and diversified service portfolios.

From a study perspective, affordability remains a central market driver. According to long term services research, about 75% of older adults not on Medicaid could fund at least 2 years of paid home care only by liquidating all assets. Out of pocket costs can represent up to 70% of median older adult income, shaping demand elasticity.

Utilization gaps remain significant. According to Survey data 1998 to 2012, only 14% of community dwelling adults aged 65 and older with one or more ADL or IADL limitations received paid assistance. Among those with three or more ADL limitations, utilization reached just 39%, indicating structural access barriers.

Home care competes against institutional alternatives. According to 2013 national survey, daily nursing home care averaged $207, assisted living averaged $3,450 monthly, while home care offered flexible cost structures. In June, the Centers for Medicare and Medicaid Services proposed a 6.4% reimbursement cut, influencing near term buyer sentiment.

Industry operations demonstrate broad reach. Addus delivered personal care to approximately 34,000 consumers through 110 locations across 24 states, reflecting operational scalability. Overall, the Home Care Services Market remains positioned for sustained growth, driven by demographics, policy alignment, and cost efficiency imperatives.

Key Takeaways

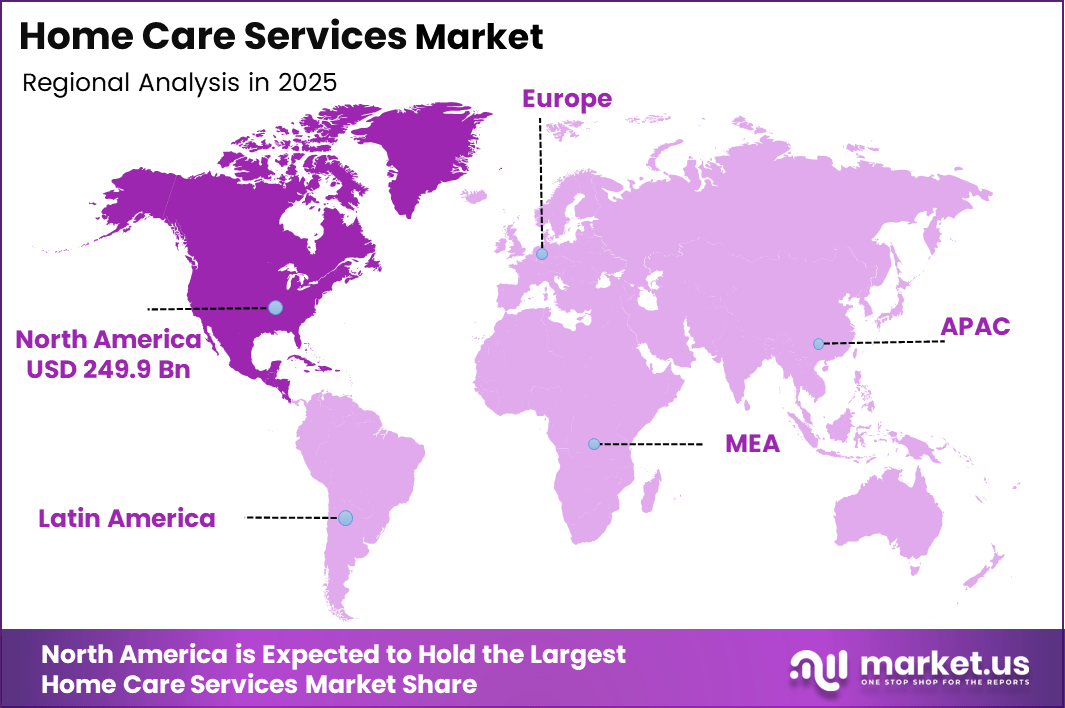

- The Home Care Services Market shows strong regional dominance in North America with a 44.8% share, valued at USD 249.9 billion.

- By service type, Health Care Services lead the market with a dominant share of 69.7%, reflecting higher demand for clinical home care.

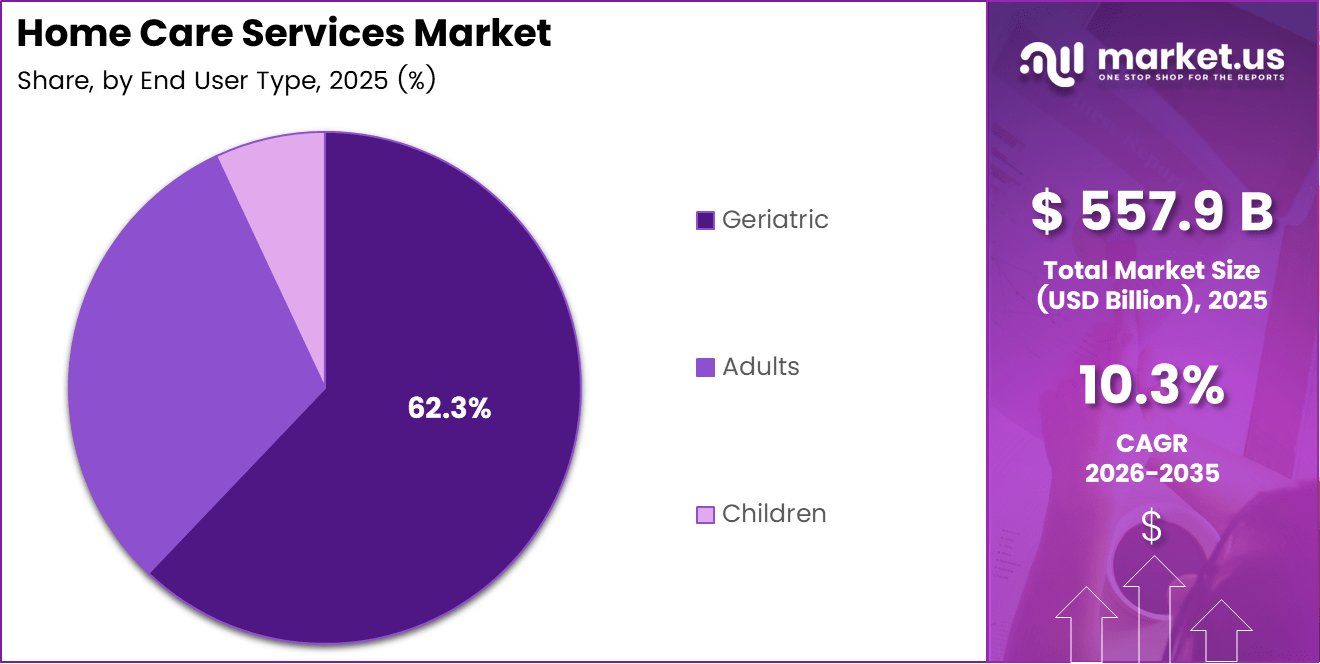

- By end user, the Geriatric segment accounts for the largest share at 62.3%, driven by aging population trends.

- Europe represents a mature regional segment with steady adoption of home and community based care models.

- Asia Pacific emerges as a high growth region supported by rapid demographic aging and expanding home care access.

By Service Type Analysis

Health Care Services dominates with 69.7% due to higher clinical dependency and regulated care requirements.

In 2025, Health Care Services held a dominant market position in the By Service Type Analysis segment of Home Care Services Market, with a 69.7% share. This dominance reflects rising demand for skilled nursing, therapy, and medical supervision at home. Moreover, hospitals increasingly shift post acute care into home settings to manage capacity.

Health Care Services benefit from stronger reimbursement alignment and physician referrals. Additionally, chronic disease management and recovery after surgery increasingly rely on professional home based clinical care. As a result, this segment continues to attract payer support, technology integration, and workforce investments supporting long term service scalability.

Non-Health Care Services represent an essential complementary segment supporting daily living activities. This segment focuses on companionship, mobility assistance, and household support. Consequently, it plays a critical role in improving quality of life and enabling aging in place, particularly for patients without continuous medical requirements.

Non-Health Care Services increasingly integrate with clinical care models to provide holistic support. Although lower in share, demand continues to grow through private pay arrangements and family driven care decisions. Therefore, this segment strengthens overall market resilience by addressing non clinical yet essential care needs.

By End User Analysis

Geriatric dominates with 62.3% due to aging population trends and higher long term care utilization.

In 2025, Geriatric held a dominant market position in the By End User Analysis segment of Home Care Services Market, with a 62.3% share. This leadership reflects increasing life expectancy and higher prevalence of mobility limitations. Consequently, older adults rely heavily on consistent home based support services.

The geriatric segment benefits from policy focus on aging in place and reduced institutionalization. Moreover, families increasingly prefer home care over facility based alternatives for elderly relatives. As a result, service providers prioritize specialized programs addressing dementia care, mobility assistance, and chronic condition monitoring.

Adults represent a significant end user group driven by temporary care needs. This segment includes post surgery recovery, injury rehabilitation, and chronic illness support. Therefore, demand fluctuates based on healthcare utilization patterns and employment related insurance coverage supporting short to medium term home care.

Children form a smaller yet critical end user segment requiring specialized pediatric home care. This segment focuses on developmental support, disability care, and medically complex conditions. Consequently, providers emphasize trained caregivers and family centered care models to ensure safety, continuity, and long term developmental outcomes.

Key Market Segments

By Service Type

- Health Care Services

- Non-Health Care Services

By End User

- Children

- Adults

- Geriatric

Drivers

Increasing Preference for Personalized Long Term Care Outside Institutional Settings Drives Market Growth

The Home Care Services Market benefits strongly from the rapid expansion of home based post acute care models. Hospitals increasingly face capacity constraints and cost pressures. Therefore, care delivery continues to shift toward home environments to support early discharge, faster recovery, and reduced inpatient burden while maintaining care quality.

Patient and family preferences further accelerate demand for home care services. Individuals increasingly seek personalized long term care outside institutional settings. As a result, home care improves comfort, emotional well being, and independence, making it a preferred alternative to nursing homes and assisted living facilities.

Value based reimbursement models also act as a strong growth driver. Payers prioritize cost efficient care outcomes over service volume. Consequently, home care services gain favor as they reduce hospital readmissions, improve care coordination, and support measurable health outcomes at lower overall system costs.

Additionally, the growing availability of trained home care professionals supports market expansion. Public and private initiatives increasingly invest in caregiver training and certification programs. Therefore, workforce development strengthens service reliability, expands provider capacity, and improves long term market sustainability.

Restraints

Persistent Shortage of Skilled Caregivers Limits Market Scalability

Despite strong demand, the Home Care Services Market faces structural workforce challenges. A persistent shortage of skilled caregivers restricts service expansion. Consequently, providers struggle to meet rising patient volumes, especially for complex medical and long term care needs requiring specialized skills.

Caregiver turnover further intensifies operational pressure. Home care roles often involve physical demands, emotional stress, and irregular schedules. As a result, retention remains difficult, increasing recruitment costs and disrupting care continuity for patients and families.

Regulatory complexity also restrains market growth. Licensing and compliance requirements vary significantly across regions. Therefore, providers must navigate multiple regulatory frameworks, increasing administrative burden and limiting cross regional scalability of standardized care models.

These combined challenges slow new market entry and delay service expansion. Smaller providers face greater difficulty meeting compliance and staffing demands. Consequently, market growth remains uneven across regions despite rising underlying demand.

Growth Factors

Expansion of Home Care Services into Underserved Regions Creates New Growth Opportunities

Significant growth opportunities emerge from expanding home care services into rural and underserved areas. These regions often lack sufficient institutional care infrastructure. Therefore, home care presents a practical solution to improve access, reduce travel burdens, and address unmet healthcare needs.

Integration of remote patient monitoring further enhances opportunity potential. Digital tools enable continuous health tracking and early intervention. As a result, providers improve clinical outcomes while extending care coverage without proportional increases in staffing intensity.

Strategic partnerships between home care providers and hospitals also unlock growth. Hospitals seek reliable post acute care partners to improve discharge planning. Consequently, collaboration strengthens referral pipelines, improves patient outcomes, and supports long term service integration.

Additionally, developing specialized programs for chronic and high acuity patients creates differentiation. Tailored care models address complex needs at home. Therefore, providers expand revenue streams while improving patient satisfaction and clinical effectiveness.

Emerging Trends

Increasing Adoption of Technology Enabled Care Coordination Platforms Shapes Market Trends

Technology adoption increasingly shapes the Home Care Services Market. Care coordination platforms improve communication between caregivers, clinicians, and families. As a result, providers enhance care transparency, reduce errors, and improve overall service efficiency.

Demand also rises for hybrid medical and non medical home care models. Patients seek integrated support covering both clinical and daily living needs. Therefore, providers expand service offerings to deliver comprehensive, patient centered care at home.

Data driven scheduling and workforce optimization tools gain traction across the market. These solutions improve caregiver utilization and reduce idle time. Consequently, providers lower operational costs while maintaining consistent service quality.

Finally, aging in place preferences continue to influence service design. Older adults prefer remaining at home as long as possible. Therefore, providers expand flexible care offerings aligned with long term independence and quality of life goals.

Regional Analysis

North America Dominates the Home Care Services Market with a Market Share of 44.8%, Valued at USD 249.9 Billion

North America leads the Home Care Services Market due to advanced healthcare infrastructure, high aging population, and strong preference for home based care. The region accounted for 44.8% of the market, valued at USD 249.9 billion, supported by favorable reimbursement frameworks and widespread adoption of post acute home care models.

Europe Home Care Services Market Trends

Europe represents a mature market characterized by strong public healthcare systems and growing emphasis on aging in place. Government backed home and community based care programs continue to expand, particularly across Western Europe. Additionally, cost containment policies encourage the shift from institutional care toward home care services.

Asia Pacific Home Care Services Market Trends

Asia Pacific shows strong growth momentum driven by rapid population aging, urbanization, and increasing healthcare awareness. Countries across the region experience rising demand for home care due to limited long term care infrastructure. Moreover, improving healthcare access and private sector participation support regional market expansion.

Middle East and Africa Home Care Services Market Trends

The Middle East and Africa market remains at a developing stage but demonstrates rising potential. Growth is supported by improving healthcare investments, increasing chronic disease prevalence, and expanding private home care services. Urban centers particularly drive demand as families seek alternatives to hospital based long term care.

Latin America Home Care Services Market Trends

Latin America experiences steady growth driven by demographic shifts and gradual healthcare system modernization. Home care adoption increases as governments and private providers focus on cost efficient care delivery. Additionally, rising middle class populations and growing awareness of home based care strengthen regional demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Home Care Services Company Insights

Brookdale Senior Living holds a strong strategic position in the Home Care Services Market through its integrated approach to senior focused care delivery. In 2025, the company continues to leverage its scale, care coordination capabilities, and long term aging expertise to address rising demand for home based senior support and aging in place solutions.

LHC Group remains a key participant in the global home care ecosystem by aligning clinical quality with operational efficiency. Its focus on post acute and long term home based services strengthens its relevance as healthcare systems increasingly prioritize cost effective care transitions and reduced hospital dependency across diverse patient populations.

Amedisys plays a critical role in shaping value driven home care delivery through its emphasis on clinical outcomes and patient centered care models. In 2025, the company’s strategic positioning reflects growing demand for skilled home health and hospice services aligned with chronic disease management and recovery focused care pathways.

Kindred Healthcare contributes to the market through its broad continuum of care approach, supporting patients across recovery and long term care stages. Its home care focus aligns with payer and provider strategies emphasizing coordinated care, improved patient experience, and optimized resource utilization within home based healthcare environments.

Top Key Players in the Market

- Brookdale Senior Living

- LHC Group

- Amedisys

- Kindred Healthcare

- Encompass Health

- Interim HealthCare

- AccentCare

- BAYADA Home Health Care

- AddusHomeCare

- Visiting Nurse Service of New York

Recent Developments

- In November 2025, Care Advantage, Inc. completed the acquisition of Attentive Angels, a leading in-home care provider based in Columbia, South Carolina, marking its strategic entry into South Carolina and strengthening its Mid-Atlantic and Southeastern regional footprint.

- In May 2025, Air Liquide expanded its healthcare presence in Germany through the acquisition of intensivLeben GmbH and AP-Sachsen GmbH, reinforcing its outpatient intensive care portfolio while supporting over 220,000 patients in Germany and 2.1 million patients globally under its Home Healthcare strategy.

Report Scope

Report Features Description Market Value (2025) USD 557.9 billion Forecast Revenue (2035) USD 1,047 billion CAGR (2026-2035) 10.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Health Care Services, Non-Health Care Services), By End User (Children, Adults, Geriatric) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Brookdale Senior Living, LHC Group, Amedisys, Kindred Healthcare, Encompass Health, Interim HealthCare, AccentCare, BAYADA Home Health Care, AddusHomeCare, Visiting Nurse Service of New York Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Brookdale Senior Living

- LHC Group

- Amedisys

- Kindred Healthcare

- Encompass Health

- Interim HealthCare

- AccentCare

- BAYADA Home Health Care

- AddusHomeCare

- Visiting Nurse Service of New York